Transcription

Mastercard Rules7 December 2021BM

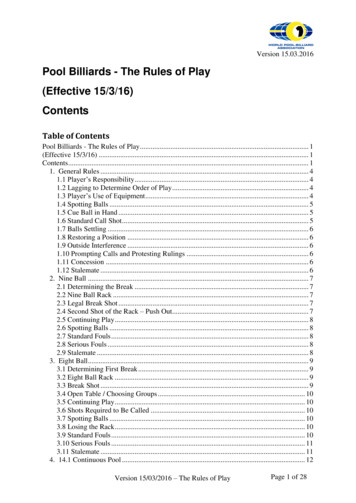

ContentsContentsSummary of Changes, 7 December 2021.22Mastercard Standards. 24Applicability of Rules in this Manual. 25Chapter 1: The License and Participation. 271.1 Eligibility to be a Customer.291.1.1 Principal or Affiliate. 291.1.2 Association.291.1.3 Digital Activity Customer. 301.1.4 Payment Transfer Activity Customer. 301.2 Mastercard Anti-Money Laundering and Sanctions Requirements. 311.2.1 Anti-Money Laundering Requirements. 311.2.2 Sanction Requirements. 321.3 Satisfaction of Minimum Financial Requirements. 331.4 Special Conditions of Participation, License or Activity. 331.5 Interim Participation.341.6 The License.351.6.1 SEPA Licensing Program—Europe Region Only. 351.7 Area of Use of the License.351.7.1 Extending the Area of Use.361.7.2 Extension of Area of Use Programs. 361.7.3 Central Acquiring—Europe Region Only.381.7.4 Transfer of Cards to India Residents is Prohibited without a License. 381.8 The Digital Activity Agreement. 381.9 Participation in Activity(ies) and Digital Activity. 391.9.1 Changing Customer Status. 391.9.2 Participation and License, Digital Activity Agreement or PTAAgreement Not Transferable. 391.9.3 Right to Sponsor Affiliates.401.9.4 Change in Sponsorship of an Affiliate.401.9.5 Customer Name Change. 401.9.6 The Sponsored Digital Activity Entity.401.10 Participation in Competing Networks. 401.10.1 Protection of the Corporation.411.10.2 Participation Restrictions.411.10.3 Exceptions to the Participation Restrictions.411969–2021 Mastercard. Proprietary. All rights reserved.Mastercard Rules 7 December 2021 2

Contents1.11 Portfolio Sale, Transfer, or Withdrawal.431.12 Change of Control of Customer or Portfolio. 441.13 Termination.451.13.1 Voluntary Termination.451.13.2 Termination by the Corporation. 451.13.3 Termination for Provision of Inaccurate Information.471.13.4 Rights, Liabilities, and Obligations of a Terminated Customer.48Chapter 2: Standards and Conduct of Activity and DigitalActivity. 512.1 Standards.522.1.1 Variances. 522.1.2 Failure to Comply with a Standard. 522.1.3 Noncompliance Categories. 532.1.4 Noncompliance Assessments.542.1.5 Certification.562.1.6 Review Process. 572.1.7 Resolution of Review Request.572.1.8 Rules Applicable to Intracountry Transactions. 572.2 Conduct of Activity and Digital Activity.572.2.1 Customer Responsibilities. 582.2.2 Obligations of a Sponsor. 592.2.3 Affiliates. 592.2.4 Financial Soundness.602.2.5 Mastercard Acquirers. 602.2.6 Compliance. 602.2.7 Information Security Program.612.3 Indemnity and Limitation of Liability.612.4 Choice of Laws.632.5 Examination and Audit.63Chapter 3: Customer Obligations.653.1 Obligation to Issue Mastercard Cards. 663.2 Responsibility for Transactions.663.3 Transaction Requirements.673.4 Authorization Service.683.5 Non-discrimination—POS Transactions.693.6 Non-discrimination—ATM and Bank Branch Terminal Transactions. 693.7 Integrity of Brand and Network. 693.8 Fees, Assessments, and Other Payment Obligations.703.8.1 Taxes and Other Charges. 701969–2021 Mastercard. Proprietary. All rights reserved.Mastercard Rules 7 December 2021 3

Contents3.8.2 Maestro and Cirrus Card Fees and Reporting Procedures.713.9 Obligation of Customer to Provide Information. 713.10 Confidential Information of Customers.723.11 Use of Corporation Information by a Customer. 733.12 Confidential Information of Mastercard.743.12.1 Customer Evaluation of Mastercard Technology.743.13 Privacy and Data Protection.753.13.1 Processing of Personal Data for Purposes of Activity and DigitalActivity.753.13.2 Data Subject Notice and Consent.763.13.3 Data Subject Rights.763.13.4 Personal Data Accuracy and Data Minimization.763.13.5 Data Transfers. 773.13.6 Sub-Processing. 773.13.7 Returning or Destroying Personal Data. 773.13.8 Regional Variances and Additions. 773.14 Quarterly Mastercard Report (QMR).773.14.1 Report Not Received.773.14.2 Erroneous or Incomplete Report.783.14.3 Overpayment Claim.783.15 Cooperation.793.16 Issuer Reporting Requirement—EEA, Serbia, Gibraltar and UnitedKingdom. 793.17 BINs. 793.18 Recognized Currencies. 803.18.1 Prior Consent of the Corporation.803.18.2 Communications and Marketing Materials.80Chapter 4: Use of the Marks. 814.1 Right to Use the Marks.824.1.1 Protection and Registration of the Marks. 824.1.1.1 Registration of a Card Design. 834.1.2 Misuse of a Mark.834.2 Requirements for Use of a Mark. 834.3 Review of Solicitations. 844.4 Signage System. 844.4.1 Signage at a Merchant Location.854.4.2 ATM Terminal Signage.854.5 Use of the Interlocking Circles Device. 864.5.1 Use or Registration of Similar Logos, Designs, and Names.864.6 Use of Multiple Marks. 864.7 Particular Uses of a Mark. 871969–2021 Mastercard. Proprietary. All rights reserved.Mastercard Rules 7 December 2021 4

Contents4.7.1 Generic Use. 874.7.2 Use of Modifiers.874.7.3 Use on Stationery.874.7.4 Use on Non-Licensed Products or Services.874.7.5 Use or Registration of “Master,” “Maestro,” and “Cirrus” Terminology. 874.7.6 Use of a Word Mark in a Corporate, Business or Domain Name.884.7.7 Use of a Word Mark in Text. 884.7.8 Program Names.884.7.9 Use on Cards.884.8 Use of Marks on Maestro and Cirrus Cards.894.9 Use of Marks on Mastercard Cards.894.10 Use of a Card Design in Merchant Advertising and Signage.904.11 Use of a Card Design in Issuer Advertising and Marketing Material. 904.12 Use of the Mastercard Card Design in Cardholder StatementEnclosures. 914.13 Use of the Brand Marks on Other Cards.91 4.14 Use of EMVCo Trademarks. 91Chapter 5: Acquiring Activity. 935.1 The Merchant and ATM Owner Agreements. 955.1.1 Verify Bona Fide Business Operation; Government ControlledMerchants. 955.1.2 Required Merchant Agreement Terms. 965.1.2.1 Gambling Merchants. 965.1.3 Required ATM Owner Agreement Terms. 975.1.4 Maintaining Information.985.1.4.1 Location Administration Tool (LAT) Updates. 995.2 Merchant and Submerchant Compliance with the Standards. 995.2.1 Noncompliance Assessments.995.3 Deferred Delivery Merchant.100Regular Monitoring of DDMs.100Information and Consent. 100Conditional Consent.100Request for DDM Information. 1015.4 Acquirer Obligations to Merchants. 1015.4.1 Payment for Transactions. 1015.4.2 Supplying Materials. 1025.4.3 Provide Information. 1025.4.4 Merchant Deposit Account—Canada Region Only.1025.5 Merchant Location.1025.5.1 Disclosure of Merchant Name and Location.1035.5.2 Merchant Location Compliance and Certification . 1031969–2021 Mastercard. Proprietary. All rights reserved.Mastercard Rules 7 December 2021 5

Contents5.6 Submerchant Location.1045.6.1 Disclosure of Submerchant Name and Location. 1045.6.2 Submerchant Location Compliance and Certification. 1055.7 Responsibility for Transactions. 1055.8 Transaction Message Data. 1055.8.1 Card Acceptor Business Code (MCC) Information.1065.8.2 Card Acceptor Address Information. 1065.8.3 Submerchant Name Information. 1065.8.4 ATM Terminal Information. 1065.8.5 Transactions at Terminals with No Fixed Location.1075.9 Transaction Currency Information. 1075.10 Use of the Marks. 1075.10.1 Display of the Acceptance Marks.1085.10.1.1 Location of Display.1085.10.1.2 Display with Other Marks. 1105.11 Merchant Obligations for Acceptance. 1105.11.1 Honor All Cards. 1105.11.2 Merchant Acceptance of Mastercard Cards.1115.11.3 Obtain an Authorization.1115.11.4 Additional Cardholder Identification. 1115.11.5 Discounts or Other Benefits at the Point of Interaction .1115.11.6 Merchant Business Logos.1115.12 Prohibited Practices.1125.12.1 Discrimination.1125.12.2 Charges to Cardholders. 1125.12.3 Minimum/Maximum Transaction Amount Prohibited.1125.12.4 Scrip-dispensing Terminals. 1135.12.5 Existing Mastercard Cardholder Obligations. 1135.12.6 Cardholder Right of Dispute.1135.12.7 Illegal or Brand-damaging Transactions.1135.12.8 Disparagement.1145.12.9 Mastercard Tokens.1145.13 Valid Transactions.1155.14 Sale or Exchange of Information.1155.15 Payment Account Reference (PAR) Data. 115Chapter 6: Issuing Activity.1176.1 Card Issuance—General Requirements.119Mastercard Safety Net. 119Transaction Alerts Service.120Mastercard Decision Intelligence.120Mastercard Acquirer Fraud Dashboard. 1201969–2021 Mastercard. Proprietary. All rights reserved.Mastercard Rules 7 December 2021 6

Contents6.1.1 Mastercard Card Issuance. 1216.1.1.1 Linked Mastercard Card Program Solicitations.1216.1.2 Maestro Card Issuance. 1216.1.2.1 Eligible Accounts—Maestro.1226.1.2.2 Ineligible Accounts—Maestro.1226.1.3 Cirrus Card Issuance.1226.1.3.1 Eligible Cards—Cirrus. 1236.1.3.2 Eligible Accounts—Cirrus. 1246.1.3.3 Ineligible Cards—Cirrus. 1246.1.3.4 Ineligible Accounts—Cirrus. 1256.1.3.5 Transferred Cirrus Portfolios. 1256.1.4 Tokenization of Accounts.1256.1.4.1 Maestro Accounts. 1266.1.5 Cardholder Communications.1266.2 Issuer Responsibilities to Cardholders. 1276.2.1 Cardholder Communications.1276.3 Limitation of Liability of Cardholders for Unauthorized Use.1286.4 Selective Authorization.1286.5 Affinity and Co-Brand Card Programs.1296.5.1 Ownership and Control of the Program. 1296.5.2 Use of the Acceptance Marks.1306.6 Brand Value Transactions and Proprietary Accounts.1306.6.1 Proprietary Account Access. 1306.6.2 Use of BVT and Proprietary Accounts on a Mastercard Card. 1316.6.3 Fees and Reporting Requirements. 1326.7 Virtual Accounts.1326.8 Secured Card Programs.1336.8.1 Refund of Fees. 1336.8.2 Solicitation and Disclosure Requirements. 1336.9 Youth Card Programs.1346.9.1 Solicitation and Disclosure Requirements. 1346.10 Prepaid Card Programs. 1346.10.1 Prior Consent of the Corporation. 1356.10.2 Reservation of Rights.1356.10.3 Responsibility for the Prepaid Card Program.1356.10.4 Categories of Prepaid Card Program.136Consumer Prepaid Card Programs. 136Commercial Prepaid Card Programs.136Government Prepaid Card Programs. 1366.10.5 Return of Unspent Value. 137Consumer Prepaid Card Programs. 137Commercial Prepaid Card Programs.137Government Prepaid Card Programs. 1371969–2021 Mastercard. Proprietary. All rights reserved.Mastercard Rules 7 December 2021 7

Contents6.10.6 Value Loading. 1386.10.7 Automatic Value Loads from Payment Cards.1386.10.8 Communication and Marketing Materials. 1396.10.9 Anonymous Prepaid Card Programs. 1406.10.10 BINs.1406.10.11 Simplified Due Diligence Guidelines. 1406.10.12 Debit Mastercard Meal/Food Voucher Card Program .1406.11 Maestro Chip-only Card Programs—Europe Region Only.1406.12 Debit Card Programs Issued by Electronic Money Institutions andPayment Institutions.1406.13 Decoupled Payment Card Programs. 140Chapter 7: Service Providers and Network EnablementPartners. 1417.1 Service Provider Categories and Descriptions.1437.2 The Program Service and Performance of Program Service.1537.2.1 Customer Responsibility and Control.1547.2.2 Notification to the Corporation of Change of Name or Transfer ofOwnership or Control.1547.2.3 Program Service Agreement.1547.2.4 Disclosure of Standards.1557.2.5 Customer Point of Contact. 1557.2.6 Use of the Marks. 1567.2.7 Service Provider Identification on a Card. 1567.2.8 Program Materials. 1567.2.9 Notification of Settlement Failure Obligation.1567.2.10 Data Security.1577.3 Access to Merchant Account.1577.4 Transfer of Rights Prohibited.1577.5 Use of Corporation’s Systems and Confidential Information. 1577.6 Acquiring Programs.1587.6.1 Merchant Agreement.

1.2.1 Anti-Money Laundering Requirements.45 1.2.2 Sanction Requirements.46 1.3 Satisfaction of Minimum Financial Requirements .47 1.4 Spe