Transcription

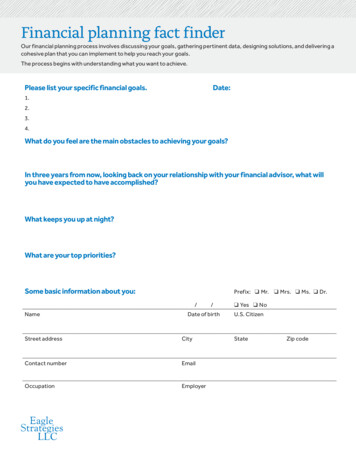

2021 Financial Fact BookWalmart Inc. (NYSE: WMT)Fact Book – Fiscal 2021April 22, 20211

Corporate Home OfficeQuick factsCompany descriptionWalmart Inc. (NYSE: WMT) helps people around the world save money and livebetter - anytime and anywhere – in retail stores, online, and through their mobiledevices. Each week, approximately 220 million customers and members visitapproximately 10,500 stores and clubs under 48 banners in 24 countries andeCommerce websites. With fiscal year 2021 revenue of 559 billion, Walmartemploys over 2.2 million associates worldwide. Walmart continues to be a leader insustainability, corporate philanthropy and employment opportunity.Walmart Inc.702 SW 8th StreetBentonville, AR 72716Tel: 479-273-4000Fax: 479-277-1830http://corporate.walmart.com/Walmart U.S. Home OfficeWalmart U.S.702 SW 8th StreetBentonville, AR 72716Sam’s Club Home OfficeAdditional information about Walmart can be found by visitinghttp://corporate.walmart.com, on Facebook at http://facebook.com/walmart and onTwitter at http://twitter.com/walmart.Investor ContactMichael Brigance479-204-5646Media ContactRandy Hargrove479-277-0547Sam’s Club2101 S.E. Simple Savings Dr.Bentonville, AR 72716Walmart International Home OfficeWalmart International Support Center702 SW 8th StreetBentonville, AR 72716Walmart eCommerce Home OfficeThe amounts shown in this Fact Book are based on the most recentpublically disclosed documents for fiscal year 2021.2Walmart eCommerce850 Cherry AvenueSan Bruno, CA 94066

StrategyFinancial frameworkCulture and valuesService toRespect forthe customer the individualStrive forexcellenceAct withintegrityStrong, efficientgrowthStrategic objectives1.Make every day easier for busy families2.Sharpen culture and become more digital3.Operate with discipline4.Trust as a competitive advantageStrategic capitalallocationDelivering shared ing disciplineCommunities ShareholdersPlanetFramework forsustainable earningsgrowth and strongreturns

Consolidated financial overview(Amounts in Millions)Operating resultsTotal revenuesPercentage change from previous fiscal yearNet salesPercentage change from previous fiscal yearGross profit rateOperating, selling, general and administrative expenses,as a percentage of net salesOperating incomeConsolidated net income attributable to WalmartNet income per common share:Diluted income per common share from1continuing operations attributable to WalmartDividends declared per common share1The4FY21As of and for the Fiscal Years Ended January 31,FY20FY19FY18FY17 559,1516.7% 523,9641.9% 514,4052.8% 500,3433.0% 485,8730.8% 555,233 519,926 510,329 495,761 9%20.9%20.9%21.0%21.5%21.2% 22,548 13,510 20,568 14,881 21,957 6,670 20,437 9,862 22,764 13,643 4.75 2.16 5.19 2.12 2.26 2.08 3.28 2.04 4.38 2.00company’s adjusted EPS for FY17 – FY21 was 4.32, 4.42, 4.91, 4.93 and 5.48, respectively.

Strong, efficient growth: 4-5-4 comparable store sales1,2Walmart U.S. & Sam’s Club comp store sales continue to grow Walmart U.S.13.3%Sam's 2%3.4% 3.2%3.3% des2 Sam’s2Q203Q200.8%4Q2031Q21fuel.Club comp excluding fuel was negatively affected by reduced tobacco sales by 410 bps in 1Q21, 390 bps in 2Q21, 420 bps in 3Q21 and 410 bps in 4Q213Calculated51Q200.6%on a 4-5-5 basis as the retail sales calendar included 14 weeks2Q213Q214Q21

Strong, efficient growth: 4-5-4 comparable store sales1,2 .and maintained high levels on a two-year stackWalmart U.S.Sam's Club14.5%13.4%12.3% 12.1%11.7%11.6%10.5%9.6%6.3%6.2%5.4%6.1% 6.0%6.8%5.7%1Excludes2 21fuelclub comp excluding fuel was negatively affected by reduced tobacco sales by 410 bps in 1Q21, 390 bps in 2Q21, 420 bps in 3Q21 and 410 bps in 4Q213Calculated66.2% 6.6%5.5%4.1%3.5%1Q197.3%on a 4-5-5 basis as the retail sales calendar included 14 weeks2Q213Q214Q21

Financial overview: 4-5-4 comparable store sales1FY21FY20Comp store salesWalmart U.S.1TransactionsAverage ticketeCommerce3Sam's Club1TransactionsAverage 1.5%WMT .5%FY21 .6%5.7%-5.1%1.9%FY21 Q44.2%0.9%3.3%2.4%3.3%6.4%-3.1%1.1%FY21 Average Q424.5%16.6%26.7%28.0%fuel.on a 4-5-5 basis as the retail sales calendar included 14 weeks.in FY21, we revised our definition of eCommerce net sales to include certain pharmacy transactions. Accordingly, we revised prior period amounts for Walmart U.S. and Sam’s Club to beconsistent with the current year’s presentation.2Calculated3Beginning7

Segment overviewNet sales by segment – FY2122%Walmart U.S. merchandise category,% of segment net sales1%1%1%33%32%32%Sam's Club merchandise category,% of segment net %58%60%FY19FY20FY21FY19FY2011%67%Walmart U.S.Sam's ClubInternationalGrocery1Health and wellnessHealth and wellnessGeneral MerchandiseOther categoriesTechnology, office and entertainmentHome and apparelFuel, tobacco and other categories1WalmartU.S. grocery consists of a full line of grocery items, including meat, produce, natural & organics, deli & bakery, dairy, frozen foods,alcoholic and nonalcoholic beverages, floral and dry grocery, as well as consumables such as health and beauty aids, baby products, householdchemicals, paper goods and pet supplies8Grocery and consumables66%FY21

Consistent operating disciplineCommitted to leveraging expensesImproving inventory levels at Walmart U.S.Walmart U.S. quarterly comp store sales1, & Y/Y % change incomp store 1.9%1.2%8.6%1.1%In FY21, focused on operating efficiency: Maintained expense leverage across the company EDLC culture reinforcedSG&A affected by strategic investments in: Special associate bonuses (COVID-19) Associates (wages, benefits, training) Technology eCommerce Customers (experience)Walmart consolidated SG&A % of total net 3Q2121.0%4Q2120.9%20.9%FY20FY21Walmart U.S. Y/Y change in comp store inventoryWalmart U.S. comp store sales1Excludesfuel.on a 4-5-5 basis as the retail sales calendar included 14 weeks.2Calculated9FY17FY18FY19

Strategic capital allocationAllocation of capital expenditures by typeAllocation of capital expenditures by segment( in billions)( in billions) 10.3 10.7 10.3 10.3 10.7 10.3FY19FY20FY21FY19FY20FY21U.S. New stores and clubs, including expansions and relocationsU.S. RemodelsU.S. eCommerce, technology, supply chain and otherWalmart InternationalWalmart U.S.Walmart InternationalSam's ClubCorporate & Support Allocating more capital to eCommerce, technology, supply chain and remodels Allocating less capital to new store and club opening Bringing together stores and eCommerce in a more digitally-connected way that makes shopping easier10

Strategic capital allocationTotal cash return to shareholders1Operating cash flow( in billions)(in billions of dollars) 36.1 13.5 11.8 27.8 25.3 7.4 5.7 8.7 2.6FY19FY20FY21 6.1 6.0 6.1FY19FY20FY21Dividends1Dollars11may not sum due to rounding.Share Repurchases

Cash returns for shareholdersFY22FY21HighN/A 152.79 121.28 105.56 109.98 75.19 88.00 90.97 81.37 77.60 62.00 57.90LowN/A 104.05 93.86 82.40 66.04 62.35 56.30 72.27 68.13 57.18 48.31 47.77 2.20 2.16 2.12 2.08 2.04 2.00 1.96 1.92 1.88 1.59 1.46 .5%-19.8%16.6%9.4%16.8%12.5%7.4%Stock endDeclared1YieldPrice to earnings 2Return on equity3Total Shareholder returnWMT annual dividendWMT Total return to shareholders70% 2.0060%50% 1.50 2.20 2.16 2.12 2.08 2.04 2.00 1.96 1.92 1.88 1.46 1.00 1.5940%30%24.8%20%10%0% 0.5010-year CAGR: 4.2%-10%-20% 0.00-30%FY12 FY13 FY14 FY15 FY16 FY17 FY18 FY19 FY20 FY21 FY221Calculatedby dividing the declared dividend by the close price at the end of the fiscal yearof close of the last trading day in each fiscal year3Return on equity is defined as net income attributable to Walmart divided by average total equity2As12FY12 FY13 FY14 FY15 FY16 FY17 FY18 FY19 FY20 FY21

2021 Financial Fact Book Walmart Inc. (NYSE: WMT) Fact Book –Fiscal 2021 April 22, 2021. 2 Quick facts Walmart Inc. (NYSE: WMT) helps people around the world save money and live better - anytime and anywhere –in retail stores, online, and through their mobile devices. Each we