Transcription

REV-588 (TR) 10-20STARTING a BUSINESSin PENNSYLVANIAA GUIDE to PENNSYLVANIA TAXESTom Wolf, GovernorC. Daniel Hassell, Secretary of Revenue

Dear Taxpayer,Welcome to Pennsylvania’s business community. We want to thank you for bringinggrowth and innovation to our local economy. Whether you are starting a brandnew business or you are a new business owner purchasing an existing business, youwill need to know some basic information about Pennsylvania state tax laws andregulations.The Department of Revenue has created this guide to help business ownersunderstand their filing obligations. The guide outlines the procedures to follow andthe forms to file with the Pennsylvania Department of Revenue. Your responsibilitiesas a new business owner will vary depending on the type of organization or entityyou operate. Certain types of businesses will need to immediately register for somebusiness taxes in Pennsylvania while others may only need to report Pennsylvaniaincome. Please review the information in this booklet to help determine which taxesapply to your business.This guide is not intended as a substitute for services of tax and legal professionalsnor is it intended to replace the Pennsylvania Business One-Stop Shop, located atwww.business.pa.gov. This helpful resource connects entrepreneurs with importantinformation on registering, operating, and growing a business. The website’s digitallibrary includes a link to the Entrepreneur’s Guide: Starting and Growing a Businessin Pennsylvania, which provides detailed information, instructions and personalizedbusiness checklists for entrepreneurs to help build a successful business.For more information, visit our website at www.revenue.pa.gov or call our CustomerExperience Center at 717-787-1064.The department wishes you success in your future endeavors.Sincerely,C. Daniel HassellSecretary of Revenue

revenue.pa.govTABLE OF CONTENTSIMPORTANT: This guide is published by the Pennsylvania Department of Revenueto provide information to business owners on how to register their business. Italso provides an understanding of various tax obligations, as well as commonmistakes to avoid. The guide is for informational purposes only and is notintended to constitute legal advice.This guide will cover three general areas that apply to many businesses:123Business Taxes in PennsylvaniaRegistering for Business Taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Employer Withholding . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Sales Tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Business Use Tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Exemption Certificate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .13578Reporting Pennsylvania IncomeBusiness Structure . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Sole Proprietorship . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Partnership . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Limited Liability Company . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Corporation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Expenses and Deductions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Business Start-up Costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Depreciation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Cost of Goods Sold . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Vehicle Expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Business Use of Your Home . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .1111111213151516171720Strategies for SuccessTake Advantage of Electronic Services . . . . . . . . . . . . . . . . . . . . . . . . . . . .Keep Good Records . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Open Accounts for Taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Update Your Address Regularly . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Obtain a Bulk Sales Clearance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Know Who to Contact . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .232325252626To receive email notifications containing links to newly posted tax information,including publications, important notices, and tax bulletins issued by thedepartment, visit www.revenue.pa.gov and click on the “PA Tax UpdateNewsletter” link to register to receive this information.

BEFORE REGISTERING YOUR BUSINESSWITH DEPARTMENT OF REVENUE1. Confirm requirements with your financialinstitution and insurance company.2. Check for special registrations, if applicable.3. Confirm your professional licensure is current.**Only applicable to Professional LLCs or Professional Corporations.All other business structures, skip to the next step.4. Check with the local municipality concerning taxes,zoning requirements, local licenses and permitsand any other regulations.**It is important to complete this step before proceedingwith your business registration.5. Register your business structure.**Make sure you have verified the business name you wish to use is available.6. Register your Fictitious Name.**Only required if operating under a name that is not theLegal Name of the business or sole proprietor.7. Apply for a Federal Employer Identification Number (FEIN).For a more personalized checklist,visit business.pa.gov/register.

SECTION 1BUSINESSTAXESin PENNSYLVANIA

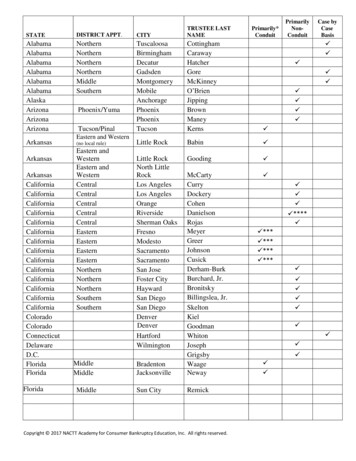

BUSINESS TAXES IN PENNSYLVANIARegistering for PA Tax AccountsDepending on your specific activities, your business may berequired to report items such as sales and use tax or employerwithholding. To register your business for state tax andemployer accounts in Pennsylvania, you will need to completethe PA Enterprise Registration Form called the PA-100. You maycomplete the form online by visiting www.pa100.state.pa.us.This form may also be used to add additional taxes or services,register a new entity that is acquiring all or part of an existingentity or request the Unemployment Compensation Experiencerecord and Reserve Account Balance of a Predecessor.The PA-100 enables taxpayers to establish multiple accounts,including: Employer Withholding Tax (as well as 1099 MiscellaneousWithholding) Promoter License Public Transportation Assistance Tax License Sales, Use, Hotel Occupancy Tax License Tobacco Product’s License Transient Vendor Certificate Unemployment Compensation Use Tax, Wholesaler Certificate Workers’ Compensation Coverage Vehicle Rental TaxNOTE: Corporations, LLCs and businesstrusts registered with the PennsylvaniaDepartment of State are not required toregister with the Department of Revenue forcorporation taxes. However, when a businessregisters with the Department of State, anEIN must be included so the Departmentof Revenue can establish a corporation taxaccount. Failure to include the EIN couldresult in the delay of processing corporatetax payments made to the Department ofRevenue.Tips to Complete the PA-100Before you begin the PA-100, you will need the following:1. EIN, Business Name, Business Address, Phone Number2. School District and Municipality3. NAICS Code4. Owner(s) Name(s), SSN / ITIN5. Date of First Operations (Inside and Outside of PA)6. Business Entity Trade Name7. Business Entity Fiscal Year End (MM/DD)8. Form of Organization9. For Profit or Non-Profit StatusNew registrants must complete every item in Sections 1 through10 and additional sections as indicated.Registered enterprises must complete every item in Sections 1through 6 and additional sections as indicated.You will receive your account number(s) within 24-48 hours viae-mail if you provide your e-mail address in Section 4. If you donot provide your e-mail address, do not have an e-mail address,or do not receive your e-mail notification, you may retrieveyour account number(s), simply by logging on to www.pa100.state.pa.us. In addition to specific tax account numbers, thedepartment also issues a 10-digit Revenue Identification Number(Revenue ID) to all businesses that have any tax filing obligationwith Pennsylvania. The Revenue ID number is referenced on allcorrespondence issued by the department.IMPORTANT: You cannot use the PA BusinessEntity Registration Online PA-100 to: Register your name with the Departmentof State, Bureau of Corporations andCharitable Organizations Apply for Sales Tax Exempt Status(REV-72) Register for Motor Carrier Road Tax/IFTA Register for Motor Fuels Tax PermitNOTE: To register, file and pay for all Motorand Alternative Fuel Taxes, please visitmypath.pa.gov1Starting a Business in Pennsylvania

revenue.pa.govHow to Avoid Delays in Processing Review the registration form and accompanying sections tobe sure that every item is complete.NOTE: It is your responsibility to notify thedepartment in writing within 30 days of anychange to the information provided on theregistration form.How to Check the StatusTo check the status of your application, return to www.pa100.state.pa.us, log in with your e-Signature username and passwordand select “View” to see the status of the application. If yourapplication has not yet moved to a “Successfully Processed” status,please allow up to 10 days before contacting the department.Once the status shows “Successfully Processed,” you will receivean email with information regarding how to report and remittaxes, your filing and payment frequencies, and the due dates ofyour filings. Your license and account information will be mailedshortly after receiving the email.PA-100 Application Status Descriptions: Incomplete - All sections, including payment information, ifapplicable, have NOT yet been completed. You may still editor delete your application. Submitted - All sections, including payment information, ifapplicable, have been completed and either submitted and/or confirmed. Your application has been forwarded to theappropriate department(s) and can no longer be edited. Under Review - Your application has been received andis under review for compliance will all laws, rules andregulations under the department’s jurisdiction. Pleaseallow at least 10 business days prior to contacting thedepartment for more information. Successfully Processed - Your application has beenprocessed by the Department of Revenue. The numbersprovided at the top of the application are for your referenceonly. Your license/account or certificate correspondence willbe mailed to you within 7-10 business days. If the issuingdepartment requires additional information, you will receivecorrespondence outlining what is needed to issue therequested license/account or certificate.2

BUSINESS TAXES IN PENNSYLVANIAEmployer WithholdingIf you employ one or more persons, your business needs toregister for an Employer Withholding Account (Section 9 of thePA-100). Pennsylvania law requires employers to withhold andremit PA personal income tax from employees’ compensation intwo common cases: When resident employees perform services within oroutside PA; and When nonresident employees (other than residents of NewJersey, Maryland, Virginia, West Virginia, Ohio and Indianafrom whose wages you withhold at the reciprocal state’s taxrate) perform services within PA.An employer is any individual, partnership, association,corporation, government body or other entity that employs oneor more persons and is required under the Internal Revenue Codeto withhold federal income tax from wages paid to an employee.Please review the Employer WithholdingInformation Guide (REV-415) for moreinformation on withholding PA personalincome tax.NOTE: Employers are also required to registerfor unemployment compensation insurancetax, imposed on employers and employeesto help support employees for loss of wagesshould they become unemployed throughno fault of their own. The rate is based onthe employment history of the company.This tax is administered through the PADepartment of Labor & Industry.Filing & Payment RequirementsEmployers should withhold taxes from each paycheck andremit to the department according to the Withholding PaymentSchedule as follows: Semi-Weekly – If total withholding is 5,000 or greaterper quarter ( 20,000 per year), the taxes are due on theWednesday following the pay dates for employers whosepaydays fall on a Wednesday, Thursday or Friday; and on theFriday following the pay dates for employers whose paydaysfall on Saturday, Sunday, Monday or Tuesday.3Starting a Business in Pennsylvania Semi-Monthly - If total withholding is 1,000 to 4,999.99per quarter, the taxes are due within 3 banking days of theclose of the semi-monthly period. Monthly – If total withholding is 300 to 999 per quarter,the taxes are due the 15th day of the following month. Quarterly – If total withholding is under 300 per quarter,the taxes are due the last day of April, July, October andJanuary.The Employer Withholding Return (W-3) is required to beelectronically filed every quarter even when no wages were paidduring that period. Each W-3 should reconcile the total amountof withholding remitted within each quarter.Employers are also required to electronically file annualreconciliation returns (REV-1667) by January 31 along with theW-2 forms for each employee. The REV-1667 should reconcilethe total amount of withholding remitted for the entire tax yearaccording to the W-3s filed.Non-Employee CompensationIf you make payments to a nonresident who is not your employeefor services in the course of your trade or business, you may berequired to withhold PA personal income tax.NOTE: Withholding is optional for paymentsless than 5,000 annually. However, if youare unsure of the total amount of paymentsthat will be made during the year, thedepartment encourages you to withhold andremit income tax from all payments made.Governmental payors, including the Pennsylvania State Systemof Higher Education and its institutions, are exempt from therequirement of withholding on non- employee compensationand business income.For more information on non-employee compensation, pleasevisit our website at www.revenue.pa.gov.

How to FileNOTE: Tax payments of 1,000 or moremust be remitted electronically throughelectronic funds transfer or by credit/debitcard, or they may be paid with certified orcashier’s checks.Employers can file and pay business taxes online using ourElectronic Tax Information and Data Exchange Service (e-TIDES)or TeleFile system.E-TIDES is an Internet-based filing option that allows taxpayers tofile returns and remit payments electronically without cost.TeleFile is a telephone filing system designed for taxpayers whodo not have computer access. Pre- registration is not necessaryto use TeleFile, however, you will need your Account ID, EINor SSN, 10 digit Revenue ID, and the period ending date of theperiod you wish to file for prior to calling. TeleFile is toll-free andcan be accessed 24 hours a day, 7 days a week by calling 1-800748-8299.To register for electronic funds transfer, visit the Revenuee-Services center at www.revenue.pa.gov and file anAuthorization Agreement for Electronic Tax ng at revenue.pa.gov, click theicon labeled “e-TIDES”You are now ready to enter e-TIDES toeither sign-in or create an account4

BUSINESS TAXES IN PENNSYLVANIASales TaxIf your business sells taxable items or performs taxable services,you are required to obtain a sales tax license. Taxable items aresubject to a 6% sales tax. Additionally, retailers in AlleghenyCounty are required to collect an additional 1% local sales taxand retailers in Philadelphia are required to collect an additional2% local sales tax. All three sales taxes are reported on the sametax return and under the same sales tax Account ID.To determine if your business is requiredto collect and remit sales tax, review theRetailer’s Information Guide (REV-717) or visitour website at www.revenue.pa.gov for moreinformation on sales tax.Filing & Payment RequirementsSales tax must be collected at the time of sale, unless the saleis on credit. Taxes due on credit sales must be remitted within30 days of the date of sale. A seller is liable for reporting andremitting taxes and fees with the tax return covering the periodin which either a taxable sale was made or the tax, or fee, shouldhave been collected.The filing frequency may vary. When you are a new sales tax filer,you are set up as a quarterly filer, meaning that your returns aredue in April, July, October and January. But your filing frequencycan change. Every year the department reviews each businessthat files returns to determine whether or not the filing frequencyshould be changed. If such a change is made by the department,the business is notified in writing.Payments and reports are required from sales tax licensees asfollows: Monthly returns with pre-payment obligations –Businesses that have an actual sales/use tax liability forthe third calendar quarter of the previous year totaling atleast 25,000 but less than 100,000 have two prepaymentcalculation options. They can either remit payment equal to50% of the actual tax liability from the same month of theprevious year or at least 50% of the actual tax liability for thecurrent period.Businesses remitting more than 100,000 for the thirdcalendar quarter of the previous year must remit 50% of theactual tax liability due from the same month of the previousyear. Prepayments are due by the 20th of the current monthand returns for the period are due on or by the 20th of thefollowing month.5Starting a Business in Pennsylvania Monthly returns – Licensees whose actual tax liability is lessthan 25,000, but greater than 600 per quarter, must filemonthly. Monthly returns are due the 20th day of the monththat follows the month in which the tax was collected. Quarterly returns – Licensees whose total tax liability is lessthan 600 in the third calendar quarter, but greater than 300 annually, must file quarterly.The report for January, February and March is due by April20; the report for April, May and June, is due by July 20; thereport for July, August and September is due by Oct. 20; andthe report for October, November and December is due byJan. 20. Semi-annual returns – Licensees whose total tax liability is 300 or less annually must file semi- annually. The report forJanuary through June is due on Aug. 20, and the report forJuly through December is due Feb. 20 of the following year.NOTE: It is important to know your filingand payment frequency. The Department ofRevenue offers a vendor discount for timelyfiled returns and payments. This discount islimited to a flat rate or 1% of tax collected,whichever is lesser. Monthly Filers: 25 or 1% of taxcollected Quarterly Filers: 75 or 1% of taxcollected Semi- Annual Filers: 150 or 1% of taxcollectedHow to FileThe department offers three electronic filing options: e-TIDES,TeleFile, and third party vendors. (See e-TIDES and TeleFileinformation under Employer Withholding Tax.)The department also has third party vendors who will providee-filing software for those taxpayers who do not wish touse the department’s e-filing options. A list of approvedsoftware vendors is available on the department’s website atwww.revenue.pa.gov.

revenue.pa.govDisplaying Sales Tax LicensesNOTE: Tax payments of 1,000 or moremust be remitted electronically throughelectronic funds transfer or by credit/debitcard, or they may be paid with certified orcashier’s checks.All businesses selling products and servicessubject to sales tax are required to prominentlydisplay the license at the business. Sales taxlicenses are issued free of charge and arerenewable every five years. The Departmentof Revenue is authorized to issue citations toanyone who operates a business without a validand current sales tax license. Convictions couldresult in fines of 300 to 1,500 per offenseand/or imprisonment. A sales tax license maybe suspended or revoked for failing to file taxreports or make payments.EXAMPLESALES TAX LICENSE6

BUSINESS TAXES IN PENNSYLVANIABusiness Use TaxIf your business purchases items subject to sales tax for whichthe seller does not charge and collect sales tax on the invoice orreceipt, your business is responsible for remitting the tax to theDepartment of Revenue. This is called use tax.Use tax exposure occurs most often when a business buys taxablegoods over the internet, through toll free numbers or throughthe mail and the vendor does not charge Pennsylvania sales tax.This is also true for purchases a business makes while out of statewhere no sales tax is charged. The items become taxable upondelivery into Pennsylvania.Many businesses believe they save money by making “taxfree” purchases from out-of-state vendors, unaware that thesetransactions are often assessed upon audit by the department.Since assessments include interest and penalty on top of tax,businesses actually increase operational costs by not voluntarilyaddressing use tax obligations. The department’s auditexperience shows that most businesses owe use tax but manydo not pay use tax. It is estimated that upon audit, 80% to 90% ofbusinesses are found to owe use tax.The use tax rate is the same as the sales tax rate: 6% state tax,plus an additional 1% local tax for items purchased in deliveredto or used in Allegheny County and 2% local tax for Philadelphia.Why is Use Tax Important?Uniform collection and enforcement of use taxprovides fairness. Pennsylvania businesses - thosewho employ our residents, pay state and local taxesand support our communities - are put at a 6%disadvantage against out of state businesses whensales or use tax is not paid on taxable items andservices.As internet and mail-order shopping becomes morepopular among Pennsylvania businesses, use taxcompliance helps to level the playing field amonge-commerce retailers and Pennsylvania’s brick andmortar stores.Use tax is an important source of revenue for thePennsylvania General Fund. Every dollar collected isa dollar available for government and public services.From an enforcement standpoint, when theDepartment of Revenue receives information onpurchases where use tax is owed but was not paid, itwill assess the purchaser for not only the tax but alsopenalty and interest for late payment.7Starting a Business in PennsylvaniaIs There a Credit for Tax Paid on an Itemin Another State?Yes. Pennsylvania grants a credit for sales tax paid to another state,provided the tax is legally due and paid, and that state offersreciprocal credit to PA. For example, if a PA business purchasesand takes delivery of a taxable item in another state and pays a5% sales tax there, the purchaser is responsible for reporting andremitting the 1% difference (use tax) due to PA upon the use ofthe property in PA. Credit against use tax is not granted for valueadded taxes or sales taxes paid to foreign countries. Also, taxespaid to the federal government, such as customs duties, cannotbe claimed as a credit against use tax.How do I Pay Use Tax?Any business that incurs use tax liabilities on a regular basis isencouraged to register for a sales/use tax account number bycompleting the PA-100 PA Enterprise Registration Form.If you are already registered for sales tax, then you can file anyuse tax due with your sales tax return. If the sales tax return isfiled timely, then the use tax is considered timely no matter thefiling frequency of your business.If you are not required to be registered for sales tax and you havea use tax liability that needs to be paid, you may still file the usetax return and pay electronically by completing the department’sOnline PA-1 Use Tax Return at www.etides.state.pa.us/UseTax.This return is due along with the payment of tax on or before the20th day of the month after the month in which the purchasewas made.IMPORTANT: A one-time registration for ane-Signature business tax account is requiredto log in. Visit www.pa100.state.pa.us.What if Use Tax is not Paid?The department identifies businesses that owe use taxthrough routine audits, self-assessment programs, complaints,investigations and lists of out-of-state purchases from vendorsand other states. The department can also identify businessesthat report minimal amounts of use tax. Underreporting of usetax can trigger an audit by the department. The Departmentof Revenue may issue an assessment for a use tax liability, onwhich both penalty and interest charges may be imposed. Theseadditional charges can exceed 30% of the tax amount.

Pennsylvania Exemption CertificatePurchaser InformationSome businesses may purchase an item with the intent to useit in a manner that has been deemed exempt from one of thefollowing taxes: State and Local Sales/ Use Tax State 6% and Local 1% Hotel Occupancy Tax Public Transportation Assistance Taxes (PTA) and Fees Vehicle Rental Tax (VRT) Additional Local, City, County Hotel TaxDepending on how you use the item or the type of business youconduct, you may not have to pay these taxes when making apurchase.In order to claim a tax exemption, you must complete the REV1220, Pennsylvania Exemption Certificate and give the completedform to the seller. A properly completed exemption certificatethat provides a valid reason for exemption and is accepted ingood faith will relieve the seller from the duty to collect tax.The seller has the right to deny the certificate at any time. Inthese situations, the purchaser would need to pay the sales taxand petition the Board of Appeals for a refund.Exemption ReasonsBusinesses can use the REV-1220 to claim an exemption oncertain property and services for the following reasons: The property or service is being directly and predominantlyused in manufacturing, mining, dairying, processing, farmingand/or shipbuilding. The purchaser is a government entity, instrumentality orpolitical subdivision; municipal authority; cooperativeAgricultural Association; electric cooperative or credit union. The property or service will be resold or rented in theordinary course of business. Business owners who buyan item with the intention of resale at a later time do notneed to pay sales tax. However, they will collect and remitthe sales tax from the ultimate consumer. In most cases,these businesses should have already obtained a Sales TaxLicense Number by completing the PA-100 Application. Formore information on wholesalers, please visit our website atwww.revenue.pa.gov. The purchaser is a religious organization, volunteer fireman’sorganization, non-profit educational institution, charitableorganization, or school district. Institutions of purely publiccharity obtain a sales tax exemption number (75 number) bycompleting the REV-72, Sales Tax Exemption Application. The purchaser is a direct pay permit holder, individual holdinga diplomatic identification card, or tourist promotion agency.These entities do not receive account numbers. Direct paypermit holders can obtain their numbers from the Revenuewebsite. Individuals with a diplomatic ID card can furnishtheir card as proof of eligibility for the exemption. Touristpromotion agencies must contact the department to receivea letter stating they are exempt. They will provide this letterto the seller when purchasing promotional materials fordistribution to the public. The property or service will be used directly andpredominately by purchaser performing a public utilityservice.The purchaser is located in Keystone Opportunity Zone orExpanded Zone (KOZ/KOEZ) and has been approved underthe KOZ regulations. These entities should include their KOZnumber which begins with 72, on Line 4.NOTE: Applications for a KOZ/KOEZ statusare made through the Department ofCommunity and Economic Development(DCED). The purchaser is providing goods and services under aconstruction contract with an exempt entity: a charitableorganization, government entity, or a firm in designated KOZ.NOTE: The REV-1220 cannot be used toclaim an exemption on the registration of avehicle.To claim an exemption from tax for a motorvehicle, trailer, semi-trailer or tractor with thePA Department of Transportation, Bureau ofMotor Vehicles and Licensing, use: Form MV-1, Application for Certificate ofTitle for “first time” registrations. Form MV-4ST, Vehicle Sales and Use TaxReturn/Application for Registration forall other registrations.8

BUSINESS TAXES IN PENNSYLVANIASeller InformationIf you are the seller and your customer provides you with aPennsylvania Exemption Certificate, you are responsible forensuring that the form is properly completed. An incompletecertificate may subject the seller to the tax. You have the rightto deny the certificate at any time. In these situations, thepurchaser would need to pay the sales tax and petition the Boardof Appeals for a refund.As the seller, you must be in possession of the certificate within60 days of the date of sale/lease. It is best practice to collect thecertificate at time of purchase.Although the REV-1220 does not expire, the seller is only requiredto retain an exemption certificate for four years from the dateof the exempt sale. However, the seller may periodically requestanother certificate.Please review the exemption reasons listed under “PurchaserInformation” and type of property or service to ensure it isconsistent with the type of business or organization that you areselling to.IMPORTANT: Certificates should not bereturn

Depending on your specific activities, your business may be required to report items such as sales and use tax or employer withholding. To register your business for state tax and employer accounts in Pennsylvania, you will need to complete the P