Transcription

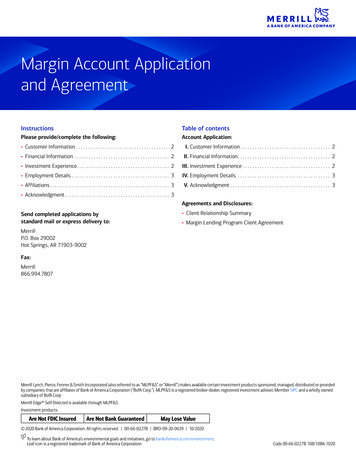

Margin Account Applicationand AgreementInstructionsTable of contentsPlease provide/complete the following:Account Application: Customer Information 2I. Customer Information 2 Financial Information 2II. Financial Information 2 Investment Experience 2III. Investment Experience 2 Employment Details 3IV. Employment Details 3 Affiliations 3V. Acknowledgment 3 Acknowledgment 3Agreements and Disclosures:Send completed applications bystandard mail or express delivery to: Client Relationship Summary Margin Lending Program Client AgreementMerrillP O Box 29002Hot Springs, AR 71903-9002Fax:Merrill866 994 7807Merrill Lynch, Pierce, Fenner & Smith Incorporated (also referred to as “MLPF&S” or “Merrill”) makes available certain investment products sponsored, managed, distributed or providedby companies that are affiliates of Bank of America Corporation (“BofA Corp.”). MLPF&S is a registered broker-dealer, registered investment adviser, Member SIPC and a wholly ownedsubsidiary of BofA Corp.Merrill Edge Self-Directed is available through MLPF&S.Investment products:Are Not FDIC InsuredAre Not Bank GuaranteedMay Lose Value 2020 Bank of America Corporation. All rights reserved. 00-66-0227B BRO-09-20-0639 10/2020To learn about Bank of America’s environmental goals and initiatives, go to bankofamerica.com/environment.Leaf icon is a registered trademark of Bank of America Corporation.Code 00-66-0227B 108/108A-1020

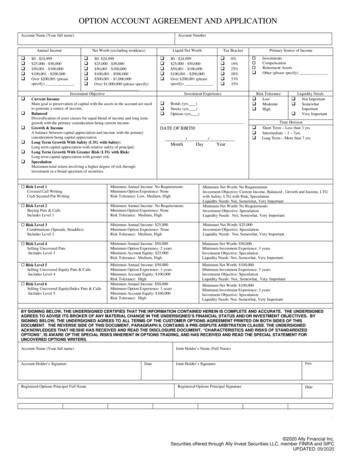

Margin Account ApplicationEnter your Merrill Edge Self-Directed account number:Definitions:Household: Households mayinclude spouse, domestic partnerand others who share financialresponsibility Annual Income: Gross annualincome, including salary and selfemployed income, rental incomeor investment income Investable Assets: Yourinvestable assets consists of yourhousehold's liquid assets (cashor cash equivalents), securities(stock, mutual funds, bonds,options, etc ), and retirement planassets (401k, 403b, pension, etc ) Net Worth: Total of investableassets and other assets (excludingauto and primary assets) such asreal estate, annuities, interest inbusiness ownership –I. Customer InformationPrimary Account HolderAdditional Account Holder(s)Name (First, Middle, Last)II. Financial InformationTotal Household Annual Income Total Household Investable Assets Total Household Net Worth III. Investment ExperiencePrior Trading Activity (Select only one )SeldomModerateActiveNonePrior Product ExperiencePlease indicate the number of years of experience for each product.Investment experience applies to the person(s) who are authorized to place trades on behalf of the account For trust accounts, investment experience applies to the designated trustee(s) OptionStocksMarginOtherPage 2 Merrill Edge Self-Directed Investing Margin Account ApplicationIndexesCommoditiesBondsCode 00-66-0227B 108/108A-1020

Margin Account ApplicationEnter your Merrill Edge Self-Directed account number:–IV. Employment DetailsEmployment Status (check one) Employed Not Employed RetiredCurrent or Former Employer/Name of BusinessPosition/TitleAffiliations: Are you affiliated with or employed by a stock exchange member or member firm of an exchange or the FINRA or municipal securities broker/dealer? Yes NoV. AcknowledgmentBY SIGNING, I OR WE HAVE READ, UNDERSTAND AND AGREE TO THE TERMS AND CONDITIONS IN THIS MARGINACCOUNT APPLICATION AND THE MARGIN LENDING PROGRAM CLIENT AGREEMENT (“MARGIN AGREEMENT”), WHICHMERRILL HAS ALSO PROVIDED. IN ADDITION, BY SIGNING, I OR WE UNDERSTAND, ACKNOWLEDGE AND AGREE:1. THAT PURSUANT TO PARAGRAPH 10 ON PAGE 2 OFTHE MARGIN AGREEMENT, CERTAIN OF MY/OURSECURITIES MAY BE LOANED TO MERRILL OR LOANEDOUT TO OTHERS; ANDFOR INTERNAL USE ONLY:Manager SignatureDate2. THAT IN ACCORDANCE WITH THE ARBITRATION CLAUSEFOUND AT PARAGRAPH 13 ON PAGE 2 OF THE MARGINAGREEMENT, I/WE AM/ARE AGREEING IN ADVANCE TOARBITRATE ANY CONTROVERSIES THAT MAY ARISE WITHMERRILL; AND3. THAT I/WE HAVE RECEIVED AND REVIEWED THE MARGIN LENDING PROGRAM CLIENT AGREEMENT; AND4. THAT I/WE HAVE RECEIVED AND REVIEWED THE CLIENT RELATIONSHIP SUMMARYNameTitle (for special accounts, e.g., Trustee)SignatureDateNameTitle (for special accounts, e.g., Trustee)Signature (Additional party if joint account; Co-Trustee)DateNameTitle (for special accounts, e.g., Trustee)Signature (Additional party if joint account; Co-Trustee)DateNameTitle (for special accounts, e.g., Trustee)Signature (Additional party if joint account; Co-Trustee)DateDATE THE MARGIN LENDING PROGRAM CLIENT AGREEMENT WAS PROVIDED TO CLIENT:Page 3 Merrill Edge Self-Directed Investing Margin Account ApplicationCode 00-66-0227B 108/108A-1020

The Margin Lending ProgramClient AgreementTable of contentsClient Relationship SummaryMargin Lending Program Client Agreement1–45–10I. Margin Lending Program5II. Margin Risks Disclosure Statement7III. Truth In Lending Disclosure Statement8IV. Alternative Credit Arrangements10

Client Relationship SummaryEffective June 30,2020Access supplemental materials by clicking on the links below or visiting ml.com/relationships and merrilledqe.com.Merrill Lynch, Pierce, Fenner & Smith Incorporated (referred to as Merrill or we) is registered with the Securities andExchange Commission (SEC) as both a broker-dealer and an investment adviser, and is a member of the Financial IndustryRegulatory Authority (FINRA) and the Securities Investor Protection Corporation (SIPC), which is described at www.sipc.org.Managed Account Advisors LLC (MAA), our subsidiary, is also an SEC-registered investment advisor. You can access free andsimple tools to research firms and financial professionals at investor.gov/CRS, which also provides educational materialsabout broker-dealers, investment advisers and investing.Brokerage and investment advisory services and fees differ and it is important for you to understand these differences. ThisForm CRS provides a summary of the types of services we provide and how you pay. At Merrill, we offer both brokerage andinvestment advisory services. You choose how you want to work with us:Work one-on-one with yourdedicated Merrill Financial Advisor(Advisor) and team who will give yourecommendations in a brokerageaccount relationship for a per tradecharge and/or in an investmentadvisory account relationship for anannual asset-based fee.Utilize the Merrill Edge selfdirected (MESD) investingplatform to handle your ownbrokerage trades for a per tradecharge, or invest in self-guidedportfolios managed by Merrillinvestment professionals for anannual asset-based fee.Obtain the advice of Merrill FinancialSolutions Advisors (FSAs) in the MerrillAdvisory Center program (MAC) via a callcenter or at a bank or wealth managementcenter to access certain brokerageinvestment solutions for a per trade chargeand/or through a selection of specificinvestment portfolios managed by Merrillinvestment professionals for an annualasset-based fee.The Summary of Programs and Services provides an overview of our primary programs. What investment services and advice can you provide me?BROKERAGE SERVICESIn a brokerage account (Account), you pay commissions andother sales fees on a per transaction basis. We mayrecommend investments for your Account, but you make thefinal decision to buy, sell or hold them.From time to time, we may voluntarily review the holdings inyour Account; however, for purposes of Regulation BestInterest, we do not provide an ongoing monitoring serviceor monitor your Account and Regulation Best Interest doesnot require us to do so. Our Best Interest DisclosureStatement provides material facts about a brokerage account,including material limitations on our offerings.The Cash Management Account (CMA) is our primary brokerageAccount for retail clients. Our brokerage services include: Providing you with investment information, makinginvestment recommendations, and responding to yourtrade instructions and other requests. Access to investment solutions, research, financial tools,investment guidance and market education. Trade execution for purchases and sales of securities,and custody of the assets in your Account. Margin lending (borrowing against the securities in yourAccount). Access to various account types. Cash management services (including direct deposit,check-writing, debit cards, electronic funds transfer) andaccess to our Cash Sweep Program where uninvestedcash in your Account is “swept” into interest-yielding bankdeposit accounts (affiliated with us) or, for certain accounttypes, into one or more money market mutual funds.The MAC program providing brokerage services through an FSAis only available to new clients for certain account types and forcertain investment products. Brokerage services without theassistance of an Advisor or an FSA are available through MESD.Merrill Lynch, Pierce, Fenner & Smith Incorporated (also referred to as “MLPF&S” or “Merrill”) makes available certain investment products sponsored, managed, distributed, or provided by companiesthat are affiliates of Bank of America Corporation (“BofA Corp.”). MLPF&S is a registered broker-dealer, registered investment adviser, Member SIPC and a wholly owned subsidiary of BofA Corp. MerrillLynch Life Agency Inc. (“MLLA”) is a licensed insurance agency and a wholly owned subsidiary of BofA Corp. Banking products are provided by Bank of America, N.A., Member FDIC and a wholly ownedsubsidiary of BofA Corp.Investment products offered through MLPF&S, and insurance and annuity products offered through MLLA:0857-0520Are Not FDIC InsuredAre Not Bank GuaranteedMay Lose ValueAre Not DepositsAre Not Insured By Any FederalGovernment AgencyAre Not a Condition toAny Banking Service or ActivityThe Margin Lending Program Client Agreement Page 1

What investment services and advice can you provide me? (continued)INVESTMENT ADVISORY SERVICES Merrill offers a variety of investment advisory programs (IAPrograms). When you enroll in one of our IA Programs, weact as your investment adviser and you receive the advisoryservices as stated in its client agreement and brochure foran asset based fee (and not on a per trade basis). You alsoreceive trade execution and custody services and accessto cash management services (including our Cash SweepProgram). Each IA Program is described in the relevantIA Program brochure, called an ADV brochure, available atour websites listed at the top of page 1 of this CRS.In certain of our IA Programs, you can make investmentdecisions yourself, or, alternatively, you can grant us or athird party the authority to make investment decisions foryour account on your behalf (discretion). Any discretionaryinvestment and trading authority is triggered when yougrant it to us and we keep this authority until you revoke it.In certain IA Programs, MAA provides discretionary servicesto you. MAA implements the investment strategies ofselected third-party managers and of Merrill, invests assets,processes contributions and withdrawals, and provides otherservices to your IA Program account.You pay the IA Program’s specified annual fee (which, inmost instances, is a fee calculated as a percentage of theassets in your account), payable on a monthly or quarterlybasis. We provide ongoing monitoring for an Accountenrolled in an IA Program as described in its IAProgram brochure.Our IA Programs summarized below have differing service andrelationship approaches and requirements. Certain of the samemanaged strategies are available in several of our IA Programs. You should evaluate which of our IA Programs areright for you considering: your investment objectives; yourpreferences on working with a personal Advisor whom youselect; accessing an FSA for advice or investing on a selfguided basis; the scope of the investment strategies; andsolutions available in the various IA Programs and the fees.Merrill Lynch Investment Advisory Program (IAP).Provides investment advice and guidance from yourdedicated personal Advisor and access to a wide rangeof investment solutions. You may choose to delegateinvestment discretion to your Advisor or to an investmentmanager (us or a third party). You may also choose toretain investment discretion. The strategies include thirdparty and Merrill-managed strategies as well as individualfunds, equities and fixed income securities.Strategic Portfolio Advisor Service (SPA). Providesinvestment advice and access to certain investmentstrategies offered by a third-party investment managerunder a separate agreement with that manager.Managed Account Service (MAS). Allows for the selectionby you, without a recommendation from us, of a third partyinvestment manager not currently available in one of ourother IA Programs.Merrill Guided Investing with Advisor (MGI with Advisor).Offers access to a defined list of investment strategiesmanaged by us provided through an online, guided interactivewebsite with advice and guidance from a MAC-based FSA.Merrill Edge Advisory Account (MEAA). Offers access to adefined list of investment strategies managed by us, withadvice and guidance from a MAC-based FSA.Merrill Guided Investing (MGI). Provides access to a set ofinvestment strategies managed by us through an online,self-guided interactive website.Advice Access. Provides a self-guided, web-based serviceto participant-directed defined contribution plans usingMerrill for recordkeeping. Services include providinginvestor profile-based asset allocation recommendationsand certain specific investments to consider.Institutional Investment Consulting (IIC). Providesspecified investment portfolio services to investmentportfolios of IIC-eligible clients.BOTH INVESTMENT ADVISORY AND BROKERAGESERVICESWe offer a wide variety of investment products but limitthem based on factors such as account limitations, clienteligibility and our product approval process. We generally donot offer investment products unless the product providerhas entered into agreements with us and, in certainsituations, agree to make payments to us for compensation,revenue sharing and sub-accounting services. Thesematerial limitations are further described in theBest Interest Disclosure Statement.Merrill utilizes its own broker-dealer capabilities as well as thoseof its Affiliates, including BofA Securities, Inc. (BofAS),to provide you with certain investments and services, includingtrade execution and access to leading research.The investment options we make available for brokerageclients and IA Program-enrolled clients include productssponsored by third parties. There are a limited number ofproducts in which we or our affiliates have an interest.For a CMA Account (excluding an MESD account), there is aminimum funding of 20,000 in cash and/or securities (witha 2,000 minimum for a sub-account). Certain programsand products are subject to minimum investment amountsdetailed in offering materials.Not all account type options provide the services describedin this Form CRS.Questions you can ask us about our services: Given my financial situation, should I choose an investment advisory service? Should I choose a brokerage service or bothtypes of services? Why or why not? How will you choose investments to recommend? What is your relevant experience, including your licenses, education and other qualifications and what do they mean?0857-0520The Margin Lending Program Client Agreement Page 2

What fees will I pay?BROKERAGE FEESYou will pay a fee for each transaction (commission, markup/markdown or sales charge). It can be a direct paymentfrom you or a payment made to us by a product sponsorout of the value of your investment.These per transaction fees vary from product to product.Additional fees, such as brokerage charges, custodian feesand account maintenance fees, will apply. For MESDAccounts, certain commissions and account maintenancefees are waived or do not apply.An overview of brokerage commissions and other chargesis included in the Best Interest Disclosure Statement;Explanation of Fees; Schedule of Miscellaneous Accountand Service Fees; and at merrilledge.com/pricing. Inaddition, trade confirmations and prospectuses forcertain investment products provide information aboutthe fees and costs of those products.The more trades that you make in your brokerageaccount, the more we and your Advisor get paid,giving us a financial incentive to encouragetransactions in your account.INVESTMENT ADVISORY PROGRAM FEESYou pay us an IA Program fee (payable monthlyor quarterlydepending on the IA Program) based on the value of the assetsin your account at the annualized fee rates listed below: IAP – Advisor-based advice on, and access to, a full listof investments and managed strategies for a customizedrate (max 2.00%). SPA – Advisor-based advice on, and access to, dual contractmanaged strategies for a customized rate (max 1.50%). MAS – Access, on an exception basis, to third-partymanaged strategies not offered at Merrill for a customizedrate (max 1.80%). MGI with Advisor and MEAA – FSA-based advice on,and access to, a list of managed strategies for 0.85%. MGI – Access to a limited list of managed strategieson a self-guided basis for 0.45%. Advice Access – No separate fee charged. IIC – Access to IIC services for negotiated rate ( max 0.45%).The IA Program fee includes payments for investmentadvisory services, trade execution and custody at Merrill.Advisors are paid compensation out of the IA Programfee and other charges. If you select a third-partymanaged strategy, a separate manager strategy fee willapply. Certain Merrill-managed strategies have a separatemanager fee. There are no additional transaction feesexcept as stated in the relevant IA Program brochure.The more assets there are in your IA Program-enrolledaccount, the more you will pay in fees, giving us afinancial incentive to encourage you to increase theassets in your account.ADDITIONAL FEE INFORMATION FOR BOTHCertain transaction fees and charges may be discounted byus or your Advisor based on your circumstances, any waiveror discount requirements and the applicability of certainreward and other rebate programs.In addition to the fees you pay to Merrill and third-partyfirms and managers, certain products have built-in fees andexpenses described in their product offering material.You will pay fees and costs whether you make or losemoney on your investments. Fees and costs willreduce any amount of money you make on yourinvestments over time. Please make sure you understandwhat fees and costs you’re paying.What are your legal obligations to me whenproviding recommendations as my broker-dealer orwhen acting as my investment adviser? How elsedoes your firm make money and what conflicts ofinterest do you have?STANDARD OF CONDUCT AND CONFLICTS OFINTERESTWhen we provide you with a recommendation as yourbroker-dealer or act as your investment adviser, wehave to act in your best interest and not put our interestahead of yours. At the same time , the way we and ouraffiliates make money creates some conflicts with yourinterests. You should understand and ask us about theseconflicts because they can affect the

Merrill Lynch, Pierce, Fenner & Smith Incorporated (also referred to as “MLPF&S” or “Merrill”) makes available certain investment products sponsored, managed, distributed or provided by companies that are affiliates of Bank of America Corporation (“BofA Corp.”). MLPF&S is a registered broker-dealer, registered investment adviser, MemberFile Size: 770KB