Transcription

Quality health plans & benefitsHealthier livingFinancial well-beingIntelligent solutionsWashington CascadeEmployer’s Health InsuranceTrust (CEHIT) plan guideThe health of business,well planned.Plans effective August 1, 2012For businesses with 5–50 eligible employeeswww.aetna.com64.10.300.1-WA (3/13)

Team with Aetna for thehealth of your businessProducts and services designedspecifically for companies with5 to 50 eligible employees.You can count on us to provide health plansthat help simplify decision making andplan administration so you can focus on thehealth of your business.4Small-business commitment5Medical overview7Managing health care expenses9Medical plan options18Dental overview20Dental plan options26Life overview28Life plan options29Underwriting guidelines44Limitations and exclusions64.43.300.1-WA (3/13)We are committed to helping employers build healthy businesses.In today’s rapidly changing economy, we recognize the need forless expensive, less complex health plan choices. Now, we offer avariety of newly streamlined medical and dental insurance plansto provide more affordable options and to help simplify planselection and administration.In this guide:Health/dental benefits and health/dental insurance plans, life insurance plans are offered, underwritten and/oradministered by Aetna Life Insurance Company (Aetna).

64.44.300.1-WA (3/13)Women’s preventive health benefitsNew changes effective August 1, 2012As you may know, the Affordable Care Act(ACA, or Health Care Reform law) includes changesthat are being phased in over a number of years.The latest set of changes includes additional benefitsfor certain Women’s Preventive Health Services.When plans renew or are effective on or after August 1, 2012,all of the following women’s health services will be consideredpreventive (some were already covered). These services generallywill be covered at no cost share, when provided in network: Well-woman visits (annually and now including prenatal visits) Screening for gestational diabetes Human papillomavirus (HPV) DNA testing Counseling for sexually transmitted infections Counseling and screening for human immunodeficiencyvirus (HIV) Screening and counseling for interpersonal anddomestic violence Breastfeeding support, supplies and counseling Generic formulary contraceptives are covered without membercost-share (for example, no copayment). Certain religiousorganizations or religious employers may be exempt fromoffering contraceptive services3

Aetna is dedicated to thehealth of your businessYou and your employees can benefit from Confidence Affordable plan options Online self-service tools and capabilities Enhanced services for consumer-directed health plans 24-hour access to Employee Assistance Program services Preventive care covered 100% Aetna disease management and wellness programsWe work hard to provide health plan solutions you can trust.Our account executives, underwriters and customer servicerepresentatives are committed to providing you and youremployees with service and care they can trust.With Aetna, we know it’s about greateremployee choice Track medical claims and take advantage of online serviceswith your Aetna Navigator secure member website. It featuresautomated enrollment, personal health records and printabletemporary member ID cards. Get real cost and health information to help make the rightcare decision with an online Cost of Care Estimator. Manage health records online with the Personal Health Record. Use of the Aetna Health Connections SM disease managementprogram, which provides personal support to members to helpthem manage their conditions. Leverage 24/7 access to a nurse to help with personalhealth-related questions. Help members work toward health goals with wellnessinitiatives, such as the Simple Steps To A Healthier Life online program. Take advantage of discount programs for vision, dental andgeneral health care that encourage use of plan offerings.OptionsYou can offer any 5 of the 14 available plan options.* We providea variety of health plan options to help meet your employees’needs, including medical, dental and life insurance.And, with access to a wide network of health care providers,you can be sure that employees have options in how they accesstheir health care.Medical plans Consumer-directed health plans (CDHP) Value plans Saver plans Traditional plansDental plans PPO PPO Max Freedom-of-Choice PreventiveLife plansEmployee Assistance Program (EAP)**Our Employee Assistance Program is a confidential programthat gives employees and members of their household access touseful services and support to help them manage the everydaychallenges of work and home. The EAP is available at no chargeto members and their family members and includes: Basic term life insuranceChoice — They’ll find a range of resources to help them balancetheir personal and professional lives.SimplicityEasy access — EAP representatives can be reached anytime tollfree at 1-866-672-5417 or on the web at www.aetnaeap.com.We know that the health of your business is your top priority.Our streamlined plans and variety of services make it easier foryou to focus on your business by simplifying administrationand management.We make it easy to manage health insurance benefits withsimplified enrollment, billing and claims processing so you canfocus on what matters most.4Aetna resources are designed to fortify the healthof your businessManagement and human resource assistance — You getunlimited phone consultations with workplace-trained clinicianswho can proved help in dealing with complex employee issuesthat may arise.* One person must enroll and remain enrolled in each plan for it to be active.**Discounts are not insurance and are not underwritten by Aetna.

Aetna Medical OverviewAt Aetna, we are committedto putting the employee atthe center of everything we do.You can count on us to providehealth plans that help simplifydecision making and planadministration so youcan focus on the health ofyour business.5

MedicalOverviewWashington network*Washington has more than 33,500 providers and 102 hospitals**AdamsAsotinBentonChelanClallamClark ays HarborIslandJeffersonKingKitsapKittitasKlickitat LewisLincolnMasonOkanoganPacificPend OreillePierceSan JuanSkagitSkamania SnohomishSpokaneStevensThurstonWahkiakum Walla WallaWhatcomWhitmanYakimaWhat is Pick-A-Plan 5?Pick-A-Plan 5*** is our suite of plans designed specificallywith small businesses in mind. These plans provide choice,flexibility and simplicity.Pick-A-Plan 5 offers the following advantages:Freedom and choiceWe offer 14 plan choices that range in price and benefitsto help meet each individual employee’s needs. This allows youto offer something for everyone.Greater employee choiceEasy administrationYou can offer any 5 of the 14 available plan designs. Setting up this program is simple:Flexibility and affordabilityCreate a customized benefits package from any of our plantypes and plan designs. We offer a variety of plans at differentprice points. You may designate a level of contribution thatmeets your budget.1. Y ou choose up to 5 plans to offer on the Employer Application2. Y ou choose how much to contribute3. Each employee chooses the plan that’s right for him or herPick-A-Plan 5Target audienceEvery small business with 5 enrolled employeesPlan choicesUp to 5 of the 14 available plansMinimum participation5 or more enrolled employees6Up to 5 of the 14 available plansEmployer contribution75% of employee coverage to a minimum of 50% when there is also 50% or morecontribution for dependentsRating options5–9 employees — tabular10–50 employees — composite*Network subject to change.**According to the Aetna Enterprise Provider Database as of January 31, 2012. Network subject to change.***Available with 5 or more enrolled employees. Counties maintained through Oregon Network. One person must enroll and remain enrolled in each plan for it to be active.

Aetna PPO planAetna Indemnity planThe Aetna PPO insurance plan offers members the freedomto go directly to any recognized provider for covered expenses,including specialists. No referrals are required.This insurance plan is for employees who live outside the plan’snetwork service area. Emergency care coverage — anywhere, anytime,24 hours a day Large provider network No claim forms in-network If members choose a provider from our network ofparticipating physicians and hospitals, out-of-pocketcosts will be lower If members choose a physician or hospital outside of thenetwork, out-of-pocket costs will be higher, except foremergency treatment Deductibles and coinsurance applyConsumer-directed health plansConsumer-directed health plans are high-deductible healthplans (HDHP) designed to give individuals greater flexibilityand control when purchasing care. Aetna HDHP’s are pairedwith account-based funds that include health savings accounts(HSAs), health reimbursement accounts (HRAs) and flexiblespending accounts (FSAs).HDHP’s increase the flexibility and control employers andemployees have by putting them in the center of their healthcare. In more traditional scenarios, employees may havea higher premium associated with a low-deductible plan,and never use it. With an Aetna HDHP, employees can lowertheir monthly premiums, and create a fund to pay for theservices when needed. In an HSA or HRA fund, the moniescan roll over from year to year and can be used towardfuture medical expenses.When a HDHP is paired with an HSA, your qualifiedemployees have a tax-advantaged solution that allowsthem to manage their qualified medical and dentalexpenses. You use tax-deductible dollars to reimburseemployees for predetermined types of medical expenses.While FSAs allow individuals to use pretax salary dollarsto help pay for health care and dependent care expenses.Aetna high deductible PPO plan (HSA compatible)The Aetna PPO insurance options that are compatible with ahealth savings account (HSA) provide employers and theirqualified employees with an affordable tax-advantaged solutionthat allows them to better manage their qualified medical anddental expenses. Employees can build a savings fund to assist in coveringtheir future medical and dental expenses. HSA accounts canbe funded by the employer or employee and are portable. Fund contributions may be tax-deductible (limits apply). When funds are used to cover qualified out-of-pocket medicaland dental expenses, they are not taxed. Individual coordinates his or her own health care No PCP required No referral required Members can access any recognized physician or hospital forcovered servicesFor specific plan information, please see your plan contract.We offer two ways to meet your family deductiblefor high-deductible plansEmbedded aggregateTrue integratedfamily aggregateEach covered family memberonly needs to satisfy his orher individual deductible, notthe entire family deductible.The entire family deductiblemust be met beforecoinsurance applies for anyindividual or family member.Health Savings Account (HSA)The Aetna HSA, when coupled with a HSA-compatiblehigh-deductible health benefits and health insurance plan,is a tax-advantaged savings account. Once enrolled, you andyour employees can make contributions. The HSA can beused to pay for qualified expenses tax free.Member’s HSA plan Members own the HSA Contribute tax free Member chooses how and when to use dollars Roll it over each year and let it grow Earns interest, tax freeToday Use for qualified expenses with tax-free dollarsFuture Plan for future and retiree health-related costsHigh-deductible health plan Eligible in-network preventive care services will not besubject to the deductible Pay 100% until deductible is met, then only pay ashare of the cost Meet in-network out-of-pocket maximum, then plan pays 100% We provide a no-cost health savings account throughpreferred vendors7

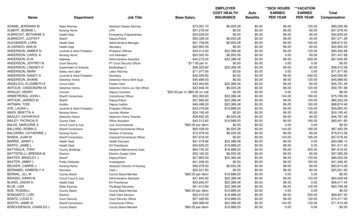

Health Reimbursement Arrangement (HRA)The Aetna HRA combines the protection of a deductible-basedhealth plan with a health fund that pays for eligible healthcare services. The member cannot contribute to the HRA,and you have control over HRA plan designs and fund rollover.The fund is available to an employee for qualified expenseson the plan’s effective date.The HRA and the HSA provide members with financialsupport for higher out-of-pocket health care expenses.Our consumer-directed health products and services givemembers the information and resources they need tohelp make informed health care decisions for themselvesand their families while helping lower employers’ costs.COBRA administrationAetna COBRA administration offers a full range of notification,documentation and record-keeping processes that can help youmanage the complex billing and notification processes that arerequired for COBRA compliance, while also helping to save youtime and money.Section 125 Cafeteria Plans and Section 132 TransitReimbursement AccountsEmployees can reduce their taxable income, and employers canpay less in payroll taxes. There are three ways to save:Premium Only Plans (POP)Employees can pay for their portion of the group healthinsurance expenses on a pretax basis. First-year POP feeswaived with the purchase of medical and 20,000 in lifeinsurance per employee.Flexible Savings Account (FSA)FSAs give employees a chance to save for health expenseswith pretax money. Health Care Spending Accounts allowemployees to set aside pretax dollars to pay for out-of-pocketexpenses as defined by the IRS. Dependent Care SpendingAccounts allow participants to use pretax dollars to pay childor elder care expenses.Administrative FeesFee descriptionFeePremium Only Plan (POP)Initial set-up* 190Renewal 125Health Reimbursement Arrangement (HRA)and Flexible Spending Account (FSA)**Initial set-upRenewal fee5–25 Employees 360 23526–50 Employees 460 285Monthly fees† 5.45 per participantAdditional set-up feefor “stacked” plans(those electing an Aetna HRAand FSA simultaneously) 150Participation feefor “stacked” participants 10.45 per participantMinimum fees5–25 Employees 25 per month minimum26–50 Employees 50 per month minimumCOBRA ServicesAnnual fee20–50 Employees 165Per employee per month20–50 Employees 0.95Initial notice fee 3.00 per notice(includes notices at time ofimplementation and duringongoing administration)Minimum fees20–50 Employees 25 per month minimumTransit Reimbursement Account (TRA)Annual fee 350Transit monthly fees 4.25 per participantParking monthly fees 3.15 per participantTransit Reimbursement Account (TRA)TRAs allow participants to use pretax dollars to paytransportation and parking expenses for the purpose ofcommuting to and from work.8* Non-discrimination testing provided annually after open enrollment for POP and FSA only. Additional off-cycle testing availableat employer request for 100 fee. Non-discrimination testing only available for FSA and POP products.**Aetna FSA pricing is inclusive for POP. Debit cards are available for FSA only. Contact Aetna for further information.† For HRA, if the employer opts out of Streamline, the fee is increased 1.50 per participant. For FSA, the debit card is available foran additional 1 per participant per month. Mailing reimbursement checks direct to employee homes is an additional 1 perparticipant per month.Aetna HRAs are subject to employer-defined use and forfeiture rules. Health information programs provide general healthinformation and are not a substitute for diagnosis or treatment by a physician or other health care professional. Information subjectto change.Aetna reserves the right to change any of the above fees and to impose additional fees upon prior written notice.

Traditional PlansPlan NamePPO 250 90/60 20PCP/Referrals RequiredNoN/ANoN/AMember BenefitsIn networkOut of network1In networkOut of network1Plan Coinsurance90%60%80%60%Calendar-Year Deductible(In network and out of network accumulate separately) 250 per member 500 per member 250 per member 500 per memberCalendar-Year Coinsurance Maximum(Deductible and certain payments do not apply) 2,000 per member 4,000 per member 2,500 per member 5,000 per memberDeductible and Coinsurance Maximum AccumulationPPO 250 80/60 25Three-member maximumThree-member maximumUnlimitedUnlimitedLifetime Maximum BenefitPrimary Physician 20 copay; ded waived60% 25 copay; ded waived60%Specialist Office Visit 20 copay; ded waived60% 25 copay; ded waived60%Outpatient Lab & X-ray 20 copay; ded waived60% 25 copay; ded waived60%Outpatient Complex Imaging90%(CAT, MRI, MRA/MRS and PET Scan; precertification required)60%80%60%Chiropractic Services(Limited to 12 visits per member per calendar year;IN and OON combined) 20 copay; ded waived60% 25 copay; ded waived60%Acupuncture Services(Limited to 12 visits per member per calendar year;IN and OON combined) 20 copay; ded waived60% 25 copay; ded waived60%Outpatient Physical, Occupational & Massage Therapy 90%(Limited to 30 visits per calendar year; IN and OON combined)60%80%60%Speech Therapy(Limited to 20 visits per member per calendar year;IN and OON combined)90%60%80%60%Physical Exams – Adults(Age and frequency schedules apply) 0 copay; ded waived60% 0 copay; ded waived60%Well-Child Exams(Age and frequency schedules apply) 0 copay; ded waived60% 0 copay; ded waived60%Routine Gynecology(Frequency schedules apply) 0 copay; ded waived60% 0 copay; ded waived60%Mammography(Age and frequency schedules apply) 0 copay; ded waived60% 0 copay; ded waived60%Inpatient Hospital90%60%80%60%Outpatient Surgery90%60%80%60%Transplants90%Not covered80%Not coveredEmergency Services(Copay waived if admitted)90%Paid as in-network80%Paid as in-networkUrgent Care 50 copay; ded waived 50 copay; ded waived 50 copay; ded waived 50 copay; ded waived 10 / 30 / 60Not covered 10 / 30 / 60Not coveredDrugs2PrescriptionRetail: up to a 30-day supplyMail Order: Up to a 90-day supply; two-times retail copay90-Day Rx Transition of Coverage (TOC) forPrecertification3See page 17 for footnotes.IncludedIncluded9

Traditional PlansPlan NamePPO 500 80/50 25*PPO 750 80/50 25PCP/Referrals RequiredNoN/ANoN/AMember BenefitsIn networkOut of network1In networkOut of network1Plan Coinsurance80%50%80%50%Calendar-Year Deductible(In network and out of network accumulate separately) 500 per member 1,000 per member 750 per member 1,500 per memberCalendar-Year Coinsurance Maximum(Deductible and certain payments do not apply) 3,000 per member 6,000 per member 3,500 per member 7,000 per memberDeductible and Coinsurance Maximum AccumulationThree-member maximumThree-member maximumUnlimitedUnlimitedLifetime Maximum BenefitPrimary Physician 25 copay; ded waived50% 25 copay; ded waived50%Specialist Office Visit 25 copay; ded waived50% 25 copay; ded waived50%Outpatient Lab & X-ray 25 copay; ded waived50% 25 copay; ded waived50%Outpatient Complex Imaging80%(CAT, MRI, MRA/MRS and PET Scan; precertification required)50%80%50%Chiropractic Services(Limited to 12 visits per member per calendar year;IN and OON combined) 25 copay; ded waived50% 25 copay; ded waived50%Acupuncture Services(Limited to 12 visits per member per calendar year;IN and OON combined) 25 copay; ded waived50% 25 copay; ded waived50%Outpatient Physical, Occupational & Massage Therapy 80%(Limited to 30 visits per calendar year; IN and OON combined)50%80%50%Speech Therapy(Limited to 20 visits per member per calendar year;IN and OON combined)80%50%80%50%Physical Exams – Adults(Age and frequency schedules apply) 0 copay; ded waived50% 0 copay; ded waived50%Well-Child Exams(Age and frequency schedules apply) 0 copay; ded waived50% 0 copay; ded waived50%Routine Gynecology(Frequency schedules apply) 0 copay; ded waived50% 0 copay; ded waived50%Mammography(Age and frequency schedules apply) 0 copay; ded waived50% 0 copay; ded waived50%Inpatient Hospital80%50%80%50%Outpatient Surgery80%50%80%50%Transplants80%Not covered80%Not coveredEme

Employer’s Health Insurance Trust (CEHIT) plan guide Plans effective August 1, 2012 For businesses with 5–50 eligible employees www.aetna.com. Health/dental benefits and health/dental insurance plans, life