Transcription

Equipment Leasing and Finance 101Alfrado Donelson, Baker Donelsonadonelson@bakerdonelson.comKen Weinberg, Baker Donelsonkweinberg@bakerdonelson.com

The Equipment Leasing and Finance Industry Equipment leasing and finance is one of the most popular means offinancing the acquisition of business equipment in the United States. In 2014, American businesses, nonprofits and government agenciesinvested more than 1.4 trillion in capital goods and software(excluding real estate). Approximately 65% (or 900 billion) wasfinanced through loans, leases and other financial instruments.www.bakerdonelson.com 2016 Baker, Donelson, Bearman, Caldwell & Berkowitz, PC2

The Equipment Leasing and Finance Industry Equipment leasing and finance is one of the most popular means offinancing the acquisition of business equipment in the United States. In 2014, American businesses, nonprofits and government agenciesinvested more than 1.4 trillion in capital goods and software(excluding real estate). Approximately 65% (or 900 billion) wasfinanced through loans, leases and other financial instruments. Morethan 1 trillion projected for each of 2015, 2016 and 2017.www.bakerdonelson.com 2016 Baker, Donelson, Bearman, Caldwell & Berkowitz, PC3

The Equipment Leasing and Finance Industry Equipment leasing and finance is one of the most popular means offinancing the acquisition of business equipment in the United States. In 2014, American businesses, nonprofits and government agenciesinvested more than 1.4 trillion in capital goods and software(excluding real estate). Approximately 65% (or 900 billion) wasfinanced through loans, leases and other financial instruments. Morethan 1 trillion projected for each of 2015, 2016 and 2017. A historical/industry perspective is important and it is not enough toonly understand the various discrete legal, documentation and otherconcepts applicable to equipment leasing and finance www.bakerdonelson.com 2016 Baker, Donelson, Bearman, Caldwell & Berkowitz, PC4

Specialized Area With Deep, Historic Rootswww.bakerdonelson.com 2016 Baker, Donelson, Bearman, Caldwell & Berkowitz, PC5

Not Traditional Bank Financing Even the most experienced equipment leasing and financeprofessional should remind themselves from time to time about theunique nature of this industry. The industry approaches issues and documentation differentlybecause of its history and origins, viewing transactions through itsown special lens www.bakerdonelson.com 2016 Baker, Donelson, Bearman, Caldwell & Berkowitz, PC6

Not Traditional Bank Financingwww.bakerdonelson.com 2016 Baker, Donelson, Bearman, Caldwell & Berkowitz, PC7

The 1800s The first significant recorded equipment leasing transactions relatedto transportation needs in the 1870s with the leasing of barges,railroad cars and locomotives using equipment trust certificates. Trusts continue to be used in more structured transactions likeleveraged leases and in titling trusts (facilitating motor vehiclesyndications).www.bakerdonelson.com 2016 Baker, Donelson, Bearman, Caldwell & Berkowitz, PC8

Leveraged Lease and Titling TrustLease/Finance Co.Beneficial Interest HolderEquity Investor/Owner ParticipantTitling Trust/LessorDebt/IndentureTrusteeOwner Trust/LessorLesseeLesseeLease/Finance Co.AssigneeBeneficial InterestSubtrustwww.bakerdonelson.com 2016 Baker, Donelson, Bearman, Caldwell & Berkowitz, PC9

1950s and Tax Benefits Truly modern equipment leasing began to hit its stride in the 1950swith the introduction of the depreciation system to the U.S. InternalRevenue Code. This system allows owners to recover the cost ofpurchased assets over time by way of periodic deductions or offsetsto income. If a customer doesn’t have sufficient “tax appetite” to benefit fromthese deductions, a financial institution or other tax equity investorcan purchase the equipment, owning it for tax purposes, and lease itto the customer, as lessee (passing on some of the benefits throughpricing).www.bakerdonelson.com 2016 Baker, Donelson, Bearman, Caldwell & Berkowitz, PC10

Definition and Return on Investment (ROI) In general, a "lease" is an arrangement where one person, thelessor, owns an asset and provides possession and use of theasset to another person, the lessee, for a fixed term. See UCC§1-203 for more complex issues of lease versus security interest. In return, the lessor receives compensation, known as rent. Usually,at the end of that term, the lessee either: (a) returns the asset to thelessor or (b) purchases it from the lessor. A component of thelessor’s return is therefore derived from the value of the equipmentat the end of the term, whether purchased by lessee or someoneelse (often referred to as the “residual”). The owner also receivestax benefits such as depreciation deductions.www.bakerdonelson.com 2016 Baker, Donelson, Bearman, Caldwell & Berkowitz, PC11

Definition and Return on Investment (ROI) In general, a "lease" is an arrangement where one person, thelessor, owns an asset and provides possession and use of theasset to another person, the lessee, for a fixed term. See UCC§1-203 for more complex issues of lease versus security interest. In return, the lessor receives compensation, known as rent. Usually,at the end of that term, the lessee either: (a) returns the asset to thelessor or (b) purchases it from the lessor. A component of thelessor’s return is therefore derived from the value of the equipmentat the end of the term, whether purchased by lessee or someoneelse (often referred to as the “residual”). The owner also receivestax benefits such as depreciation deductions.www.bakerdonelson.com 2016 Baker, Donelson, Bearman, Caldwell & Berkowitz, PC12

Evolution to Reduce Risks Lessors want the contemplated return on their investment (throughtax benefits, rent and the residual) but with minimal risk. Lessee is responsible for:- taxes- insurance- maintenance- risk of loss or casualtywww.bakerdonelson.com 2016 Baker, Donelson, Bearman, Caldwell & Berkowitz, PC13

Pushing the Envelope Lessors work to minimize the residual risk through special optionssuch as:- First amendment option (purchase or renew – not return)- Dollar purchase “option”- Difficult return conditions- Evergreen leasewww.bakerdonelson.com 2016 Baker, Donelson, Bearman, Caldwell & Berkowitz, PC14

Pushing the Envelope Lessors work to minimize the residual risk through special optionssuch as:- First amendment option (purchase or renew – not return)- Dollar purchase “option”- Difficult return conditions- Evergreen leasewww.bakerdonelson.com 2016 Baker, Donelson, Bearman, Caldwell & Berkowitz, PC15

Evolution of the Law If the lessor buys from the vendor solely to lease to the lessee, thelessee has possession from day one, and the lessee willundoubtedly end up owning the equipment, then is it really alease?- Dollar-out leases- Non-tax leases- Capital leases- Dirty leases- Disguised security interests- Financing leases- Leases intended as security- ALIAS’swww.bakerdonelson.com 2016 Baker, Donelson, Bearman, Caldwell & Berkowitz, PC16

Evolution of the Law If the lessor buys from the vendor solely to lease to the lessee, thelessee has possession from day one, and the lessee willundoubtedly end up owning the equipment then, is it really alease?- Dollar-out leases- Non-tax leases or non-true leases- Capital leases (accounting term)- Dirty leases (sounds well dirty)- Disguised security interests (feels sneaky)- Financing leases (not Article 2A finance lease)- Leases intended as security (intent not relevant)- ALIAS’s (intent not relevant)www.bakerdonelson.com 2016 Baker, Donelson, Bearman, Caldwell & Berkowitz, PC17

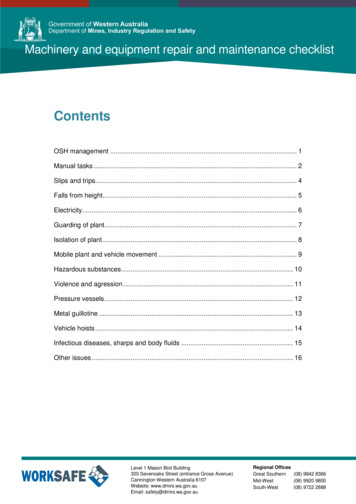

Evolution of the Law In fact, the majority of “leases” are actually merely secured loans. The legal and accounting professions eventually adjusted but thereare different tests for accounting, tax and commercial law LCOMMERCIAL LAWGuidance riddled with Facts and Circumstance AnalysisTAX LAWBlend of the Abovewww.bakerdonelson.com 2016 Baker, Donelson, Bearman, Caldwell & Berkowitz, PC18

Evolution of the Law In fact, the majority of “leases” are actually merely secured loans. The legal and accounting professions eventually adjusted but thereare different tests for accounting, tax and commercial law LCOMMERCIAL LAWGuidance riddled with Facts and Circumstance AnalysisTAX LAWBlend of the Above Not always the same (e.g. a synthetic lease).www.bakerdonelson.com 2016 Baker, Donelson, Bearman, Caldwell & Berkowitz, PC19

Equipment Finance Agreements Master Loan andSecurity Agreements Due to confusion caused by leases that are merely secured loans(e.g. lessor liability, state and local taxes) the dollar-out lease isslowly being replaced with loan documentation derived from itsleasing roots. Examples include equipment finance agreements (EFAs) andvariety of “master agreements” which may or may not involveseparate promissory notes.www.bakerdonelson.com 2016 Baker, Donelson, Bearman, Caldwell & Berkowitz, PC20

Why Customers Use Equipment Leasing and FinanceTrue Leases Monetize tax benefits- Customers with net operating losses (NOLs)- Expensive equipment- Extra tax incentives such as bonus depreciation, investmenttax credits (ITCs) and production tax credits (PTCs) Balance sheet effect (landscape is changing) Asset management/conveniencewww.bakerdonelson.com 2016 Baker, Donelson, Bearman, Caldwell & Berkowitz, PC21

Why Customers Use Equipment Leasing and FinanceEquipment Financings & Leases 100 percent financing without loan to value (LTV) requirements Efficient, quick and inexpensive compared to traditional bankfinancing- Form driven- Reliance on purchase money priority- Understanding equipment as collateral- Use of “master” agreements to facilitate growth- Robust syndication market with well-defined lawwww.bakerdonelson.com 2016 Baker, Donelson, Bearman, Caldwell & Berkowitz, PC22

Why Customers Use Equipment Leasing and FinanceEquipment Financings & Leases Customer’s internal approval structures Free up other credit lines Restrictions in senior credit facilities Less likely to impose financial covenants/restrictionswww.bakerdonelson.com 2016 Baker, Donelson, Bearman, Caldwell & Berkowitz, PC23

UCC, Financing Structure and Purchase Options Determining whether the financing is a lease or loan is critical. Ingeneral Uniform Commercial Code Article 9 will govern the collateralrights of the parties in a lending structure and UCC Article 2A willgovern the rights of the parties in a “true lease” structure. A number of factors may be considered in determining lease v. loan.Purchase options are an important factor.www.bakerdonelson.com 2016 Baker, Donelson, Bearman, Caldwell & Berkowitz, PC24

Purchase Options As stated earlier, if the structure is deemed a loan, then Article 9 willgovern the rights of the parties vis a vis third parties that might havecompeting interests in the equipment. If it is a true lease, thenArticle 2A is the relevant UCC provision. The following slides address different types of purchase options andhow they affect the characterization of the financing.www.bakerdonelson.com 2016 Baker, Donelson, Bearman, Caldwell & Berkowitz, PC25

“True Lease Purchase Options” FMV Purchase Option. Here the lessee has the right to either returnthe equipment at the end of the lease or purchase it at its thencurrent fair market value. Fixed Price Purchase Option. So long as the fixed price is a pricethat at the inception of the lease is a reasonable estimate of the fairmarket value of the equipment at the end of the lease term – whenthe FPO will be exercised.www.bakerdonelson.com 2016 Baker, Donelson, Bearman, Caldwell & Berkowitz, PC26

“True Lease Purchase Options” (cont’d) FMV Purchase Option with a Floor. Here the purchase option is thegreater of FMV determined at the end of the term or a fixed pricedetermined at lease inception.www.bakerdonelson.com 2016 Baker, Donelson, Bearman, Caldwell & Berkowitz, PC27

Purchase Options Resulting in Loan Treatment Nominal (Dollar Out) Purchase Option. In these cases, the purchaseoption offered to the lessee is an amount significantly below areasonable estimate, determined at the inception of the lease, of thefair market value at the end of the lease term. A “dollar out” leasewill most certainly result in the lease being characterized as a loan.Keep in mind that even if 1 is the reasonable estimate of the FMVat the end of the lease, then this will still be a loan because in almostany instance the lessee will have used up the useful economic life ofthe equipment involved.www.bakerdonelson.com 2016 Baker, Donelson, Bearman, Caldwell & Berkowitz, PC28

Purchase Options Resulting in Loan Treatment (cont’d)Mandatory (Put) Purchase Option. Here, the lessee must purchasethe equipment at the end of the term for an amount specified at thebeginning of the lease.In all the above cases, the question is who receives the financialbenefit of the residual value of the equipment? If it’s the lessee,either through the ability to purchase the equipment at a bargainafter the lease term or by its being able to use the equipment for itsuseful financial life, then it’s a loan. If the lessor retains thefinancial benefits of the value of the equipment at the end of theterm, and the equipment still retains its relative economic usefullife, then it’s a lease.www.bakerdonelson.com 2016 Baker, Donelson, Bearman, Caldwell & Berkowitz, PC29

Walking on the Edge How about around the edges? Many financing parties have becomecomfortable with the notion that if the equipment is believed tocontain at least 20 – 25 percent of its remaining useful life and20 – 25 percent of its initial fair market value at the end of the leaseterm, then a purchase price of at lea

In general, a "lease" is an arrangement where one person, the lessor, owns an asset and provides possession and use of the asset to another person, the lessee, for a fixed term. See UCC §1-203 for more complex issues of lease versus security interest. In return, the lessor receives compensation, known as rent. Usually, at the end of that term, the lessee either: (a) returns the asset .File Size: 557KBPage Count: 64