Transcription

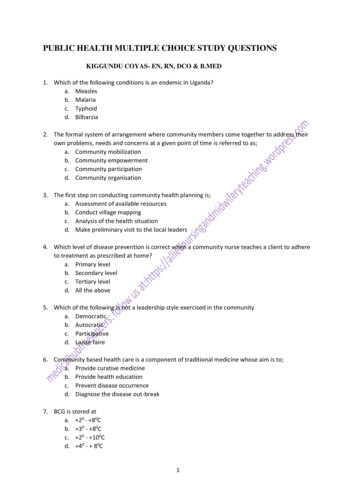

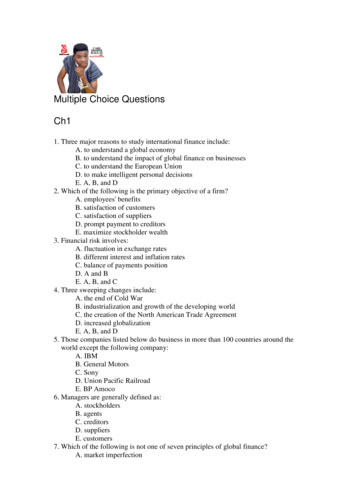

Multiple Choice QuestionsCh11. Three major reasons to study international finance include:A. to understand a global economyB. to understand the impact of global finance on businessesC. to understand the European UnionD. to make intelligent personal decisionsE. A, B, and D2. Which of the following is the primary objective of a firm?A. employees' benefitsB. satisfaction of customersC. satisfaction of suppliersD. prompt payment to creditorsE. maximize stockholder wealth3. Financial risk involves:A. fluctuation in exchange ratesB. different interest and inflation ratesC. balance of payments positionD. A and BE. A, B, and C4. Three sweeping changes include:A. the end of Cold WarB. industrialization and growth of the developing worldC. the creation of the North American Trade AgreementD. increased globalizationE. A, B, and D5. Those companies listed below do business in more than 100 countries around theworld except the following company:A. IBMB. General MotorsC. SonyD. Union Pacific RailroadE. BP Amoco6. Managers are generally defined as:A. stockholdersB. agentsC. creditorsD. suppliersE. customers7. Which of the following is not one of seven principles of global finance?A. market imperfection

B. risk-return tradeoffC. portfolio effectD. comparative advantageE. company advantage8. Incentives for multinational company managers does not include the following:A. stock optionsB. bonusesC. perquisitesD. salary increasesE. vacation9. Environmental factors affecting international operations are as follows except:A. foreign customsB. foreign economic factorsC. foreign political situationsD. foreign legal aspectE. international distance10 Three major risks in international business are:A. political, financial and weatherB. economic, political and peopleC. political, financial and regulatoryD. accounting, management and informationE. marketing, ethics and political11. Conflicts of interest for multinational corporations do not include:A. the interests of sovereign governments may be differentB. the goals of multinationals are divergent from host countriesC. some conflicts may exist within multinational subsidiariesD. multinational companies may conflict with local lawsE. multinational managers live in different time zones12. To maximize shareholder value, US companies have increased:A. profit margin on sales and asset turnoverB. Asset dispositionsC. dividends and share purchasesD. the utilization rate of assetsE. mergers and acquisitions13. The conflict between owners, employees, suppliers, and customers of a companyis known as:A. regulatory riskB. problem of agencyC. conflict of multiple environmentsD. conflict of interestsE. none of the above14. The main differences between domestic and international companies from afinancial manager's point of view are largely due to differences in:A. risksB. national lawsC. economic factorsD. political factors

E. all of the above15 A global company is an organization that attempt to :A. has a worldwide presence in its marketB. Integrate its operations worldwideC. standardize operations in one or more of the company's functional areas.D. A and BE. A, B, and C16. Corporate governance is often narrowly defined as the prudent exercise ofownership rights toward the goal of increased:A. shareholder valueB. profitC. profit margin on salesD. asset turnoverE. sales volume17. The most common form of shareholder activism includes:A. a shareholder proposal for proxy fightB. direct negotiation with managementC. public targeting of a corporationD. A, B, and CE. A and C only18. The OECD Principles of Corporate Governance covers:A. the rights of shareholdersB. the equitable treatment of shareholdersC. the responsibilities of the boardD. disclosure and transparencyE. the rights of suppliersCH 2Multiple Choice Questions1. Which of the following is not true about the theory of comparative advantage?A. some countries can produce some goods more efficiently than othercountries.B. all countries are better off if each specializes in its area of strength.C. factors of production are equally distributed among nations.D. efficient production requires combinations of different resources andtechnologies.E. distribution of resources and technology can change over time.2. Specialization and trade provide benefits for a country that produces more inboth products than another country with a given amount of investment.A. noB. negativeC. positiveD. none of the aboveE. all of the above3. According to the theory, a country must specialize in any good that uses itslarge amount of production factors.A. product life cycleB. factor endowment

C. comparative advantageD. competitive advantageE. free trade4. The more abundant the supply of any factor, the lower will be the cost of the factor.This statement is the essence of the theory of .A. product life cycleB. factor endowmentC. comparative advantageD. competitive advantageE. free trade5. The concept that the whole is worth more than the mere sum of its parts is knownas.A. comparative advantageB. competitive advantageC. economies of scopeD. economies of scaleE. factor endowment6. Which of the following is a valid argument for protectionism?A. national securityB. unfair competitionC. domestic employmentD. diversificationE. all of the above7. Which of the following is not true about protective tariffs?A. eliminate import of foreign productsB. place foreign sellers at a comparative disadvantageC. consumers have to pay more for foreign goodsD. reduce consumption of imported goodsE. none of the above8. In the maturity or saturation stage of a product life cycle, some companies shifttheir manufacturing methods to developing countries because .A. standard production methods require only unskilled workersB. developing countries have a lot of unskilled laborC. labor costs are low in developing countriesD. all of the aboveE. none of the above9. Benefits of open trade do not include .A. reduced foreign direct investmentB. allocation efficiencyC. increased competitionD. increased productivityE. expanded menu of goods10. Economic integration creates opportunities for economies of scale, which areusually known as .A. monopoly effectsB. oligopoly effectsC. ripple productionD. synergistic effectsE. A and B

11. The Levy-Sarnat model in portfolio theory assumes that domestic investmentprojects tend to be .A. less correlated with each other than foreign investment projectsB. less correlated with foreign investment projects than other domesticprojects.C. totally uncorrelatedD. correlated with respect to domestic investment projectsE. none of the above12. The main functions of the World Trade Organization (WTO) do not include .A. administrating its trade agreementsB. forum for trade negotiationsC. technical assistance and training for developing countriesD. monitoring national trade policiesE. the establishment of trade centers around the world13. In the oligopoly model, a horizontal investment may .A. reduce the number of competitorsB. eliminate duplicate facilitiesC. expand a firm's operation in an existing product lineD. B and CE. A, B and C14. The following factors are essential to develop new products.A. highly advanced technologiesB. highly educated labor resourcesC. abundant capitalD. A and CE. A, B and C15. The portfolio theory, as a rationale for foreign investment, rests on .A. labor costsB. risk and returnC. standard production methodsD. the supply of unskilled laborE. all of the above16. The control of input sources in an oligopolistic industry may make it possible forcompanies to .A. raise barriers to the entry of new competitorsB. protect their oligopolistic positionC. impose quotasD. A and BE. A, B and C17. Horizontal investments for foreign production of the same goods as made in ahome market are made to produce .A. market integrationB. changes in the location of productionC. coordinated economic cyclesD. operational economies of scaleE. none of the above19. Two loose trading blocs in Asia are:A. ASEAN and NAFTAB. ASEAN and EUC. ASEAN and APEC

D. NAFTA and EUE. APEC and NAFTA20. Nehrt and Hogue suggested that companies invest abroad for .A. new marketsB. raw materialsC. production efficiencyD. new knowledgeE. all of the above21. Aharoni studied the process for foreign investment decisions and found thatforeign investment takes place because of .A. outside proposals such as those from foreign governmentsB. fear of losing a marketC. the bandwagon effectD. strong competition from abroad in the home marketE. all of the above22. The bandwagon effect means that .A. successful foreign operations reported by a company induce competitors toGo abroadB. multinational companies tend to possess knowledge that is superior to localcompanies'C. local companies tend to possess knowledge that is superior to multinationalcompanies'D. some companies prefer to obtain news of technical developments in foreigncountries through foreign investmentE. companies that find it difficult or costly to obtain raw materials at homeInvest their money abroad to obtain them23. Nehrt and Hogue suggested that companies do not invest abroad for :A. new marketsB. raw materialsC. transportation systemD. product efficiencyE. new knowledge24. Corporate responses to trading blocs include .A. invest in various trading blocsB. forge various strategic alliances across various trading blocsC. forge various joint ventures across trading blocsD. A, B, and CE. none of the above25. The theory makes it possible to synthesize foreign trade and investmenttheories into a single theory of international economic involvement.A. product life cycleB. portfolioC. eclecticD. oligopolyE. none of the above26. Which of the following is not an example of trading bloc?A. African UnionB. North American Free Trade AgreementC. MercosurD. the Central American Common Market

E. the Asian Pacific Economic Cooperation27. A large number of studies conclude that NAFTA will .A. decrease U.S. jobsB. decrease Mexican jobsC. decrease Canadian jobsD. increase U.S. jobsE. increase Japanese jobs28. John Dunning argues that a company is willing to invest abroad when it has:A. ownership-specific advantagesB. benefit-specific advantagesC. internationalization advantagesD. location-specific advantagesE. A, C, and DCH 31. Credit transactions in the balance of payments include .A. exports of goods and servicesB. investments and interest paid to foreign residentsC. investment and interest earningsD. transfer receipts from foreign residentsE. investments and loans from foreign residents2. The financial account in the balance of payments does not include .A. foreign direct investmentsB. foreign portfolio investmentsC. exports of goods and servicesD. other investmentsE. A, B, and D3. A country's balance of payments is commonly defined as the .A. yearly average of all transactions conducted between its residents and foreignresidentsB. record of transactions over a specified period of time between its residents andforeign residentsC. sum of all transactions conducted by foreign nationals in the host countryD. sum of all transactions conducted by its residents in foreign countriesE. C and D4. Surpluses and deficits in the balance of payments are not used to .A. predict pressures on foreign exchange ratesB. anticipate government policy actionsC. assess a country's credit and political risksD. predict a country's political stabilityE. evaluate a country's economic health5. A country's balance of payments affects the .A. value of its currencyB. ability to obtain currencies of other countriesC. policy towards foreign investmentD. A, and BE. A, B, and C6. The balance of payments is .A. sources and uses of funds statementB. similar to an income statementC. the same as a balance sheet

D. both an income statement and a balance sheetE. none of the above7. Transactions that earn foreign exchange are often called transactions.A. foreignB. debitC. creditD. internationalE. domestic8. Which of the following transactions does not represent a credit transaction?A. exports of goods and servicesB. investment and interest earningsC. unilateral transfers received from foreign residentsD. investments and loans from foreign residentsE. none of the above9. Transactions that expend foreign exchange are sometimes called transactions.A. foreignB. debitC. creditD. internationalE. domestic10. Which of the following transactions does not represent a debit transaction?A. exports of goods and servicesB. dividends and interest paid to foreign residentsC. transfer payments abroadD. investtments and loans to foreignersE. imports of goods and services11. In a freely floating exchange rate system, a current account deficit should producea financial account .A. surplusB. deficitC. balanceD. both A and BE. all of the above12. During the 1990s, the United States had a in its current account.A. surplusB. deficitC. reasonable balanceD. both A and BE. none of the above13. Interest and dividend incomes show up on the .A. merchandise accountB. reserves and related itemsC. capital accountD. current accountE. financial account14. In theory, the balance of payments .A. should always balanceB. never balanceC. must balanceD. has nothing to do with debits and creditsE. has nothing to do with debits

15. Official reserve assets are composed of .A. goldB. convertible foreign exchangeC. special drawing rightsD. all of the aboveE. A and B16 World output has grown than world trade during the 1990s.A. fasterB. slowerC. ten times fasterD. all of the aboveE. none of the above17. The J-curve effect holds that a country's currency depreciation causes its tradebalance to .A. deteriorate for a short timeB. flatten out after an initial deteriorationC. a significant improvement in the long runD. A, B, and CE. A and B only18. To reduce its trade deficit, a country should .A. deflate the economyB. devalue the currencyC. adopt foreign exchange controlsD. institute trade controlsE. all of the above19. As the real value of the yen rises, the balance on Japan's current account is likely to.A. stay the sameB. improveC. deteriorateD. cannot tellE. none of the above20. The growing economic interdependence of the United States and other countries isreflected in .A. expanding international tradeB. expanding foreign direct investmentC. expanding portfolio investmentD. A, B, and CE. increasing isolationism21. The phrase "adversarial trade is used to mean .A. preferential tradingB. the best trading partnerC. only selling but not buyingD. only buying but not sellingE. none of the aboveCH 41. Which of the following is not one of advantages for a flexible exchange ratesystem?A. countries can maintain independent monetary policy

B. exchange rates under a flexible system are unstableC. countries can maintain independent fiscal policyD. flexible exchange rates permit a smooth adjustmentE. Central banks do not need to maintain large reserves2. Under the purely fluctuating exchange rate system, the balance of paymentsimbalances are automatically corrected by the following mechanism .A. speculationB. government interventionC. interest rate changesD. supply and demand in exchange marketsE. none of the above3. Which of the following is not directly related to the Bretton Woods system?A. 1944B. the fixed exchange rate systemC. the bank of EnglandD. the International Monetary FundE. the World Bank4. Which of the following is not directly attributable to the collapse of the fixedexchange rate system?A. U.S. balance of payments deficitsB. the decrease in the U.S. dollar valueC. the decline of international reservesD. Japan's trade surplusE. none of the above5. The Group of Ten got together at the Smithsonian Institution to agree on a widerband system so that exchange rates can fluctuate .A. 5% above and below the central rateB. 2.25% above and below the central rateC. 2% above and below the central rateD. 4% above and below the central rateE. 10% above and below the central rate6. The Jamaican Agreement was held to amend the Bretton Woods Agreement of thefixed exchange rate system in .A. 1973B. 1975C. 1976D. 1978E. 19797. Factors that cause demand and supply schedules for foreign exchange to shiftinclude:A. relative inflation ratesB. relative interest ratesC. different welfare systemsD. relative income levelsE. government intervention8. The July 1993 currency crisis in Europe caused the European Monetary System towiden the bands within which member currencies could fluctuate against othermember currencies, to of a central value.A. 14%B. 15%

C. 16%D. 17%E. 18%9. Which of the following countries is not a member of the G-7 Group?A. the United StatesB. ItalyC. the United KingdomD. SwitzerlandE. Japan10. The objectives of the International Monetary Fund (IMF) are .A. to promote international monetary cooperationB. to promote exchange stabilityC. to create standby reservesD. all of the aboveE. none of the above11. Since 1976, each member of the International Monetary Fund (IMF) has beenrequired to contribute % of its quota in its own currency and % in SpecialDrawing Rights or convertible currencies.A. 25; 75B. 50; 50C. 75; 25D. 90; 10E. 95; 512. The reserve tranche of the International Monetary Fund (IMF) means that byexchanging their own currencies for convertible currencies, a member countrymay draw % of its quota.A. 25B. 50C. 75D. 80E. 10013. Which of the following is not a SDR component currency?A. U.S. dollarB. euroC. Swiss francD. Japanese yenE. British pound14. Special drawing rights are used to settle payments by the following organizationsexceptA. IMF member countriesB. prescribed organizationsC. central banksD. multinational corporationsE. A, B, and C15. SDR interest rates are the weighted average interest rate of .A. given short-term ratesB. SDR countriesC. Treasury Bill ratesD. certificate of deposits (CD) ratesE. IMF member countries

16. The euro began public circulation in .A. 1999B. 2000C. 2001D. 2003E. 200217. The managed floating exchange system was established in .A. 1969B. 1973C. 1976D. 1979E. 198018. The decline of the U.S. dollar value in the late 1980s was mainly attributable tothe following agreement .A. Louvre AccordB. Plaza AccordC. Smithsonian AgreementD. Jamaica AgreementE. None of the above19. The Asian currency crisis in 1997 started in .A. KoreaB. ThailandC. IndonesiaD. Hong KongE. Philippines20. The total Gross Domestic Products (GDP) of the United States is than thatof the 11-euro zone countries as of December 1998.A. largerB. neither larger nor smallerC. two times largerD. smallerE. two times smaller21. The September 1992 currency crisis in Europe was mainly attributable to .A. the British currency actionB. the increase in German interest rateC. the Danish electionD. the French currency policyE. all of the above22. The proposal under which a par value of a currency is adjusted intermittently isreferred to as a .A. wide bandB. narrow bandC. crawling pegD. crawling bandE. gliding band23. The quota allotted to a member country of the IMF, which it can borrow at will, isknown as tranche.A. goldB. basicC. member

D. creditE. reserve24. Economists regard the creation of the Euro as a new European currency in theinternational monetary system as the most important development since .A. 1953B. 1963C. 1973D. 1983E. 199325. A country may link its exchange rate to the value of a major currency, usually theU.S. dollar or the French franc. This is called .A. a currency parB. a currency pegC. a currency compositeD. a currency basketE. none of the above26. If and when the value of the Japanese yen against the U.S. dollar goes up 15%, itaffects the following items .A. the price of imported Japanese carsB. the price of Japanese camerasC. the price of Japanese pearls sold in Troy, OhioD. the price of a Sharp copier in DetroitE. all of the above

Multiple Choice Questions Ch1 1. Three major reasons to study international finance include: A. to understand a global economy B. to understand the impact of global finance on businesses C. to understand the European Union D. to make intelligent personal decisions E. A, B, and D 2. W