Transcription

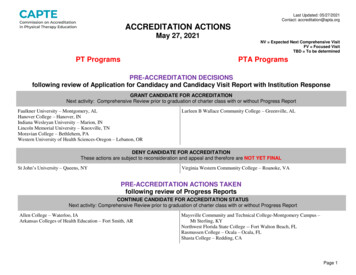

Last Updated04/01/20Enter Company Name HereEnter Company Phone HereTRADITIONAL FIXEDAnnuity Product Reference Guide2020AprilOPEN HERE!Your potential annuitysales await!ils!sll FOR 5 YEARS!Contact us Today!Enter Company Name Here* EFFECTIVE APRIL 1, 2020Your Complete Address* 2-YEAR OR 5-YEAR TERMS* PRINCIPAL PROTECTIONPO BOX 2460, SALT LAKE CITY, UTAH 84110-2460888-352-5178 FAX: 888-352-5126WWW.EQUILIFE.COM* COMPETITIVE COMP* MIN. PREMIUM OF 10,000 (QUAL OR NON-QUAL)Interest rates as of April 1, 2020 and are subject to change without notice. EQUITABLE SECURE SAVINGS IS A PRODUCT OF THE INSURANCE INDUSTRY AND NOTGUARANTEED BY ANY BANK NOR INSURED BY FDIC OR NCUA/NCUSIF. NOT A DEPOSIT. NOT INSURED BY A FEDERAL GOVERNMENT AGENCY. RESTRICTIONSAPPLY. SURRENDER CHARGES AND MARKET VALUE ADJUSTMENT MAY APPLY TO WITHDRAWALS MADE DURING THE GUARANTEE PERIOD. POLICY MUST BESURRENDERED WITHIN 30 DAYS FOLLOWING THE GUARANTEE PERIOD OR POLICY WILL AUTOMATICALLY RENEW. MAY ONLY BE OFFERED BY A LICENSEDINSURANCE AGENT. Available in all states except: CA, MN, NJ, and NY.Enter Company Web Address Herephonefax:Any Contacts and phone extensions(For Agent Use Only)Not intended for soliciting annuity sales from the public.Rates and Commissions subject to change.Check for current state approvals.

Table of Contents - Company Overviews3MULTI-YEAR GUARANTEES4AMERICAN EQUITY INVESTMENT LIFE INSURANCE COMPANYA.M. Best Rating A- (excellent) (888) 221-12344AMERICAN GENERAL LIFE COMPANIES*Policies issued by American General Life and United States Life (NY only)A.M. Best Rating* A (excellent) (888) 438-69335AMERICAN NATIONAL INSURANCE COMPANYA.M. Best Rating A (excellent) (800) 835-53206ATHENE ANNUITY & LIFE ASSURANCE COMPANYA.M. Best Rating A (excellent) (855) 428-4363, option 17THE CAPITOL LIFE INSURANCE COMPANYA.M. Best Rating B (good) (800) 274-48258EQUITABLE LIFE & CASUALTY INSURANCE COMPANYA.M. Best Rating B (good) (800) 352-51219EQUITRUST LIFE INSURANCE COMPANYA.M. Best Rating B (good) (866) 598-36949GLOBAL ATLANTIC FINANCIAL GROUPA.M. Best Rating A (excellent) (866) 645-244910GREAT AMERICAN LIFE INSURANCE COMPANYA.M. Best Rating A (excellent) (800) 438-3398 x1719711GUGGENHEIM LIFE & ANNUITY COMPANYA.M. Best Rating B (good) (800) 767-774912LIBERTY BANKERS LIFE INSURANCE COMPANYA.M. Best Rating B (good) (800) 274-482913LINCOLN FINANCIAL GROUPA.M. Best Rating A (superior) (800) 238-625213MUTUAL OF OMAHAA.M. Best Rating A (superior) (800) 775-7898 x416814NASSAU RE COMPANYA.M. Best Rating B (good) 888-794-444714NORTH AMERICAN COMPANY FOR LIFE AND HEALTHA.M. Best Rating A (superior) (877) 586-0242 x3567615OXFORD LIFE INSURANCE COMPANYA.M. Best Rating A- (excellent) (800) 308-231816SAGICOR LIFE INSURANCE COMPANYA.M. Best Rating A- (excellent) (888) 724-4267 x6180(For Agent Use Only)Not intended for soliciting annuity sales from the public.Rates and Commissions subject to change.Check for current state approvals.*The most prominent independent ratings agencies continue to recognize American General LifeInsurance Company in terms of insurer financial strength. For current insurer financial strength ratings,please consult our Internet Web page, www.americangeneral.com/ratings. See Advertising Disclosuresfor additional information.2

Multi-Year GuaranteesCompanyEquitable Life HOTAthene AnnuitySagicor (100k )AM BestRatingSurrenderChargesB AA-2 years3 years3 yearsMaxRate - 33 years5 years5 years5 yearsMulti-Select MYG - 3Preserve MYG - 5Multi-Select MYG - 5Guarantee Choice - 5Product NameSecure Savings ELITEMilestone MYG - 3(Low Band Rates Shown)GUARANTEE PERIOD1st YearRate ThereafterRate2.30%1.15%2.50%AverageAnnual Yield2.30% yrs. 1-21.15% yrs 2-32.50% yrs 2-32.30%1.15%2.50%GuggenheimB 3 yearsPreserve MYG - 32.15%2.15% yrs 2-3Equitable Life HOTB 5 yearsSecure Savings ELITE3.10%3.10% yrs. 2-5A-5 yearsMilestone MYG - 53.00%3.00% yrs. 2-73.00%Liberty Bankers LifeB 5 yearsBankers Elite - 52.75%2.75% yrs. 2-52.75%GuggenheimEquiTrust LifeB B 6 years6 yearsPreserve MYG - 62.60%3.50%2.60% yrs. 2-6Min. 2.00% yrs 2-6 GREAT2.60%VariesNassau RENassau REB B 7 years7 years2.60%2.40%2.60% yrs. 2-72.40% yrs. 2-72.60%2.40%Equi-Trust LifeB 8 yearsCertainty Select – 82.20%2.20% yrs. 2-8GuggenheimB 9 yearsPreserve MYG - 92.80%2.80% yrs. 2-9GuggenheimB 10 yearsPreserve MYG - 102.90%2.90% yrs. 2-10Oxford LifeGuggenheimOxford LifeNorth AmericanNassau RENassau RESagicor (100k )Liberty Bankers LifeAmerican NationalAmerican EquityOxford LifeSagicor ( 100k )Liberty Bankers LifeAmerican NationalLiberty Bankers LifeOxford LifeGuggenheimAmerican NationalOxford LifeEquiTrust LifeNorth AmericanAB AA B B B AAAAB AB A B AA-B A 5 years5 years5 years6 years6 years6 years7 years7 years7 years7 years8 years8 years9 years10 years10 years10 yearsMYAnnuity5XMYAnnuity5X (10% Free Withdrawal)Premier Plus - 5Palladium MYG - 6Choice Four: MVA & Liquidity OptionGuarantee - 6Multi-Select MYG - 6Milestone - 7Bankers Premier - 7Palladium MYG - 7MYAnnuity7XMYAnnuity7X(10% Free Withdrawal)Bankers - 7Multi Select MYG - 8Preserve MYG - 8Palladium MYG - 9Multi-Select MYG - 10Certainty Select - 10Guarantee Choice - 0%1.75% yrs 2-32.50% yrs. 2-52.15% yrs 2-51.70% yrs. 2-52.15%GREAT2.50% yrs. 2-52.30% yrs. 2-5Varies2.75% yrs. 2-61.85% yrs. 2-52.55% yrs. 2-63.05% yrs 2-72.75% yrs. 2-72.60% yrs. 2-72.50% yrs. 70%2.20%2.72%2.80%2.60% yrs. 2-102.30% yrs. 2-101.50% yrs. 2-103.10%2.50%2.30%2.35% yrs. 2-52.45% yrs 2-72.70% yrs. 2-82.70% yrs. or Agents Use Only . Call for state approvals. Rates and commissions subject to change. Check individual commission schedules for guaranteed accuracy and descriptions.

AMERICAN EQUITY INVESTMENT LIFE INSURANCE COMPANY (AEI)FIXEDPRODUCTSCurrentInterestGuarantee 5GuaranteedInterestGuarantee 51.80%Guarantee 6MGIR:Currently 1.75%Guarantee 71.90%IssueAgesMVAY YesN NoStates NotAvailable18-85 Q and NQYNYSurrender Charges5 years(9, 8, 7, 6, 5, 0%)Minimum: 10,000Guarantee 61.85%Guarantee 7WithdrawalProvisionsMinimumPremiumRates effective as of 10-10-2019Maximum:18-69: 1,500,00070-74: 1,000,00075-80: 750,00081-85: 500,000Annually, Penalty-free withdrawal of interestcredited that contract year. Systematic Withdrawal &RMD immediately6 years(9, 8, 7, 6, 5, 4, 0%)7 years(9, 8, 7, 6, 5, 4, 3, 0%)AMERICAN GENERAL LIFE COMPANIES (AGLC)FIXEDPRODUCTSCurrentInterestAmerican PathwaySMFixed 5 AnnuityGuaranteedInterestMinimumPremiumWith Guarantee ROP:1.85%(MVA) 2.00% 100,000Year 51.65%(MVA) 1.80%1.50%Without Guarantee ROP: 5,000 NQ 2,000 Q 100,000Year 51.85%Year 51.65%American PathwayFixed 7 Annuity(MVA) 1.80%With Guarantee ROP:1.85%(MVA) 2.00% 100,000Year 71.65%(MVA) 1.80%1.50%Without Guarantee ROP: 5,000 NQ 2,000 Q 100,000Year 71.85%Year 71.65%VisionMYG(MVA) 1.80%Low BandHigh Band4 Year1.55%1.85%5 Year1.60%1.90%6 Year1.60%1.90%7 Year1.60%1.90%10 Year1.60%1.90%(For Agent Use Only)Not intended for soliciting annuity sales from the public.Rates and Commissions subject to change.Check for current state approvals.5 years(9,8,7,6,5)0-90(0-85 inNY)Q&NQ7 years(9,8,7,6,5,4,2)0-90(0-85 inNY)Q&NQY0-85Q&NQYStates NotAvailableTerminal Illness Waiver: Early withdrawal charge fees will be waived on one full or partialwithdrawal upon the diagnosis of a terminal illness that will result in the death of a contract owner within one year. Written documentation from a qualified physician is required.Death Benefits: If the spouse is the sole beneficiary of a deceased owner, he/she mayelect to become the new “owner” or receive a disttibutionYAvailable in allstates, somevarations(MVA is notavailable in NY)Terminal Illness Waiver: Early withdrawal charge fees will be waived on one full or partialwithdrawal upon the diagnosis of a terminal illness that will result in the death of a contract owner within one year. Written documentation from a qualified physician is required.Death Benefits: If the spouse is the sole beneficiary of a deceased owner, he/she mayelect to become the new “owner” or receive a disttibutionAvailable in allstates, somevarations(MVA is notavailable in NY)Optional Return of Premium Guarantee: The annuity may be returned at anytime for anamount equal to the single premium paid, less prior withdrawals, or the withdrawal value,whichever is greater. Adding this feature will result in a slightly lower initial interest ratethan a contract without the feature would receive.(MVA) 2.00% 100,000American PathwaySMIssueAgesPenalty-Free Withdrawal Privilege: After 30 days from contract dateExtended Care Waiver: After 1st contract year, early withdrawal charge fees will bewaived if the owner is confined to a qualifying insitution or extended care facility for 90consecutive days or longer. 100,000Year 7MVAY YesN NoSurrenderChargesOptional Return of Premium Guarantee: The annuity may be returned at anytime for anamount equal to the single premium paid, less prior withdrawals, or the withdrawal value,whichever is greater. Adding this feature will result in a slightly lower initial interest ratethan a contract without the feature would receive.(MVA) 2.00% 100,000SMWithdrawalProvisionsPenalty-Free Withdrawal Privilege: After 30 days from contract dateExtended Care Waiver: After 1st contract year, early withdrawal charge fees will bewaived if the owner is confined to a qualifying insitution or extended care facility for 90consecutive days or longer. 100,000Year 5Rates effective as of 03-09-2020Penalty-Free Withdrawal Privilege: After Year 1, 15% free withdrawals. After 30 daysfrom contract date1.50% 10,000 Q&NQDeath Benefits: If the spouse is the sole beneficiary of a deceased owner, he/she mayelect to become the new “owner” or receive a disttibutionEarly Withdrawal Charge Waiver: After the first contract year, withdrawal charge fees willbe waived if the owner cannot perform two or more of the six defined activities of dailyliving (bathing, continence, dressing, eating, toileting, and transferring) for at least 90consecutive days. Written certification by a licensed healthcare practitioner is required.10 years(8,8,8,7,6,5,4,3,2,1)In New York7 Years(7,6,5,4,3,2,1)Available in allstates, somevarations.Policies issued by American General Life Insurance Company, 2727-A Allen Parkway, Houston, TX 77019 The underwriting risks, financial and contractual obligations and support functions associated with products issued by American General Life InsuranceCompany (AGL) are its responsibility. AGL does not solicit business in the state of New York. Policies (or annuities) and riders not available in all states.These contracts are not insured by the FDIC, the Federal Reserve Board or any similar agency. The contract is nota deposit or other obligation of, nor is it guaranteed or endorsed by, any bank or depository institution.4

AMERICAN NATIONAL INSURANCE COMPANY (ANL)FIXEDPRODUCTSPalladium MYGHigh Band Shown.Under 100,000,subtract 10 basis pointsCentury PlusNEWCurrentInterest5 Year6 Year7 Year8 Year9 Year10 Year1st Year2.60%2.85%3.70%2.75%4.60%3.75%Base stYield2.80%2.85%2.84%2.75%2.82%2.85% 100,000Yr. 1 - 7.00%, Base Rate - 2.00%Fixed Rate - 7.20%Accumulated Period - 10 YearsRider Premium Enhancement - N/ARider Premium Charge - 1.00%(2 year rate)DiamondCitadel - 7(2 year rate)NAIC States1.75% 5,000Q&NQ 100,000Yr. 1 - 7.10%, Base Rate - 2.10%Lifetime Income RiderDiamondCitadel - 51.00%MinimumPremium1st Year Base Rate 100,000 2.85%1.85% 100,000 2.75%1.75%1st Year Base Rate 100,000 4.10%2.10% 100,000 4.00%2.00%1.00%NAIC States1.75%1.00%NAIC States1.75%1.00%NAIC States1.75% 5,000Q&NQMax 1,000,000WithdrawalProvisionsMonthly interest option. 10% free beginning yr 2. Transplant surgery waiver.Confinement Waiver. Available thru issue ages. Full account value paid atdeath.Starting in the first contract year, you can withdraw up to 10% of your annuityvalue as of the beginning of your annuity’s contract year, without any surrender charges.You can request an amount to be withdrawn from Century Plus on a regularbasis. They systematic withdrawal can be for either the earned interest onlyor for a specific fixed amount. Please keep in mind that when the sum of anysystematic withdrawal payments and partial surrenders exceeds 10% of thecontract’s beginning year annuity value, a surrender charge and market valueadjustment or excess interest deduction, if applicable, will be charged.Rates effective as of 3-1-2020Surrender Charges5-yr 8,8,8,7,66-yr (8,8,8,7,6,5)7-yr (8,8,8,7,6,5,4)8-yr(8,8,8,7,6,5,4,3)9yr 8,8,8,7,6,5,4,3,210yr 8,8,8,7,6,5,4,3,2,1(30 day bail out after guaranteed period)10 IssueAgesMVAY YesN No0-85YUT0-80YAvailable in all statesStatesStatesNotNotAvailableAvailable 5,000-Q&NQ(Initial depositsover 100,000receive .10 additional basis points)10% Penalty Free beginning year 1. Mo. interest option. Full account value paid at death. Principal Guarantee: Minimum surrender value is a return of premiums paid, less any cumulativewithdrawals. The policy will now be owner driven. The death benefit will be paid only upondeath of owner, not the annuitant. Please note this will affect chargebacks. In the event of adeath or full surrender in the first year, and owner is over 80, there will be a 100% chargeback.Now being marketed as only Confinement and Disability. The definition of Confinement ischanging from 60 days to 30 days. If the contract owner is confined for will be imposed on anysurrender or withdrawal. Please note Terminal Illness is included in the disability waiver.5 years(7,7,7,6,5)0-85NQ & QNAvailable in all states 2,000Q 5,000NQ(Initial dep. over 100K receive .10add. basis points.)Add. Prem 1,000random or 100/mo. bank draft.10% Penalty Free beginning year 1. Mo. interest option. Full account value paid at death. Principal Guarantee: Minimum surrender value is a return of premiums paid, less any cumulativewithdrawals. The policy will now be owner driven. The death benefit will be paid only upondeath of owner, not the annuitant. Please note this will affect chargebacks. In the event of adeath or full surrender in the first year, and owner is over 80, there will be a 100% chargeback.Now being marketed as only Confinement and Disability. The definition of Confinement ischanging from 60 days to 30 days. If the contract owner is confined for will be imposed on anysurrender or withdrawal. Please note Terminal Illness is included in the disability waiver.7 years(7,7,7,6,5,4,2)0-85NQ & QNAvailable in all statesRates and Commissions subject to change.(For Agent Use Only)Check for current state approvals.Not intended for soliciting annuity sales from the public.2) Two year charge back - 100% year 1 & 50% year 25

ATHENE ANNUITY & LIFE ASSURANCE COMPANY (ALA)FIXEDPRODUCTSCurrentInterest3 yearMaxRate:Multi-Year Fixed StrategyHigh Band 100,0001.30%Low BandUp to 100,001.15%5 e Withdrawal - Equal to the Multi-Year Fixed Strategy ratemultiplied by the accumulated Value (as of the most recentContract Anniversary) beginning in the first contract year.7 year2.15%1.00%1.90%MinimumPremium2.00% 10,000Q&NQAdditionalPremium 1,000per paymentRequired Minimum Distribution (RMDs) - Considered part ofyour annual Free Withdrawal, even if they exceed your FreeWithdrawal amount.Flexible Premium!Terminal Illness Waiver and Confinement Waiver built-in (notavailable in all states)3 yearMaxRate:1-Year Fixed (additionalpremium)5 yearFree Withdrawal - Equal to the Multi-Year Fixed Strategy ratemultiplied by the accumulated Value (as of the most recentContract Anniversary) beginning in the first contract year.7 yearHigh Band 100,0001.30%2.05%2.15%Low BandUp to 100,001.15%1.90%2.00%1.00% 10,000Q&NQAdditionalPremium 1,000per paymentRequired Minimum Distribution (RMDs) - Considered part ofyour annual Free Withdrawal, even if they exceed your FreeWithdrawal amount.Flexible Premium!Terminal Illness Waiver and Confinement Waiver built-in (notavailable in all states)MaxRate:Multi-Year Fixed StrategyMaxRate:1-Year Fixed (additionalpremium)3 year5 year7 yearHigh Band 100,0001.30%2.00%2.10%Low BandUp to 100,001.15%1.85%1.95%Free Withdrawal - Equal to the Multi-Year Fixed Strategy ratemultiplied by the accumulated Value (as of the most recentContract Anniversary) beginning in the first contract year.1.00% 10,000Q&NQAdditionalPremium 1,000per paymentRequired Minimum Distribution (RMDs) - Considered part ofyour annual Free Withdrawal, even if they exceed your FreeWithdrawal amount.Flexible Premium!Terminal Illness Waiver and Confinement Waiver built-in (notavailable in all states)3 year5 year7 yearHigh Band 100,0001.30%2.00%2.10%Low BandUp to 100,001.15%Free Withdrawal - Equal to the Multi-Year Fixed Strategy ratemultiplied by the accumulated Value (as of the most recentContract Anniversary) beginning in the first contract year.1.00%1.85%1.95% 10,000Q&NQAdditionalPremium 1,000per paymentRequired Minimum Distribution (RMDs) - Considered part ofyour annual Free Withdrawal, even if they exceed your FreeWithdrawal amount.Flexible Premium!Terminal Illness Waiver and Confinement Waiver built-in (notavailable in all states)(For Agent Use Only)Not intended for soliciting annuity sales from the public.Rates and Commissions subject to change.Check for current state approvals.Rates Effective as of 11-22-2019SurrenderChargesIssueAges3 year(10,10,10)0-85(3 year)5 year(10,10,10,10,10)0-83(5 year)7 year(10,10,10,10,10,10,10)0-83(7 year)3 year(10,10,10)0-85(3 year)5 year(10,10,10,10,10)0-83(5 year)7 year(10,10,10,10,10,10,10)0-83(7 year)3 year(10,10,10)0-85(3 year)5 year(10,10,10,10,10)0-83(5 year)7 year(10,10,10,10,10,10,10)0-83(7 year)3 year(10,10,10)5 year(10,10,10,10,10)7 year(10,10,10,10,10,10,10)MVAY YesN NoStates ONLYAvailable inYAL, AZ, AR, CO, DC, FL,GA, ID, IL, IN, IA, KS, KY,LA, ME, MD, MA, MI,MS, MT, NE, NH, NC,ND, RI, SD, TN, VT, VA,WV, WI & WYNAL, AZ, AR, CO, DC, FL,GA, ID, IL, IN, IA, KS, KY,LA, ME, MD, MA, MI,MS, MT, NE, NH, NC,ND, RI, SD, TN, VT, VA,WV, WI & WYYAK, CA, CT, DE, HI, MN,MO, NV, NJ, OH, OK,OR, PA, SC, TX, UT, WAYAK, CA, CT, DE, HI, MN,MO, NV, NJ, OH, OK,OR, PA, SC, TX, UT, WA0-85(3 year)0-83(5 year)0-83(7 year)6

THE CAPITAL LIFE INSURANCE COMPANY tMinimumPremiumWithdrawalProvisionsSurrender ChargesIssueAgesMVAY YesN NoIn these statesONLY2.30% for 3 Years1.00% 10,000Q&NQAccumulated interest twice per yr or monthly if interest is over 100.00. Death benefit is full accumulation value. Nursing home benefit and disability available after yr 1 on NQ money and you canwithdraw 50% of your accumulated value if you are confined or disabled for 90 consecutive days.Available thru issue ages.3 years(8,7,6)0-90Q & NQ0-85 inOKYAL, MN, MO, NY2.50% for 5 Years1.00% 10,000Q & NQAccumulated interest twice per yr or monthly if interest is over 100.00. Death benefit is full accumulation value. Nursing home benefit and disability available after yr 1 on NQ money and you canwithdraw 50% of your accumulated value if you are confined or disabled for 90 consecutive days.Available thru issue ages.5 years(8,7,6,5,4)0-90Q & NQ0-85 inOKYAL, AK, MN, MO, NH, NY3.60% year 12.60% years 2-51.00% 10,000Q & NQAccumulated interest twice per yr or monthly if interest is over 100.00. Death benefit is full accumulation value. Nursing home benefit and disability available after yr 1 on NQ money and you canwithdraw 50% of your accumulated value if you are confined or disabled for 90 consecutive days.Available thru issue ages.5 years(8.1,7.3,6.4,5.5,4.5)0-90Q & NQ0-85 inOKYAL, AK, DE, MN, NY2.80%For 5 years1.00% 10,000Accumulated interest twice per yr or monthl

9 EQUITRUST LIFE INSURANCE COMPANY A.M. Best Rating B (good) (866) 598-3694 9 GLOBAL ATLANTIC FINANCIAL GROUP A.M. Best Rating A (excellent) (866) 645-2449 10 GREAT AMERICAN LIFE INSURANCE COMPANY A.M. Best Rating A (excellent) (800) 438-3398 x17197 11 GUGGENHEIM LIFE & ANNUITY COMPANY A.M.