Transcription

SEC Comment Letters — IncludingIndustry InsightsNovember 2017

This publication contains general information only and Deloitte is not, by means of this publication, rendering accounting,business, financial, investment, legal, tax, or other professional advice or services. This publication is not a substitute for suchprofessional advice or services, nor should it be used as a basis for any decision or action that may affect your business. Beforemaking any decision or taking any action that may affect your business, you should consult a qualified professional advisor.Deloitte shall not be responsible for any loss sustained by any person who relies on this publication.As used in this document, “Deloitte“ means Deloitte & Touche LLP, a subsidiary of Deloitte LLP. Please see www.deloitte.com/us/about for a detailed description our legal structure. Certain services may not be available to attest clients under the rules andregulations of public accounting.Copyright 2017 Deloitte Development LLC. All rights reserved.ii

ContentsForeword viiiAcknowledgments ixContacts xBefore the Details — Trends and Priorities xiTop 10 Topics in Reviews xiiPercentage of Public Companies Reviewed Increased Slightly xvReviews With Comment Letters and Number of Comment Letters Trending Downward xvComment Letters per Review and Days to Complete a Review Continue to Trend Downward xviiObservations About Reviews by Filing Status and Revenue xixFinancial Statement Accounting and Disclosure Topics 1Business Combinations 2Determining the Accounting Acquirer 2Purchase Price Allocation 2Contingent Consideration 3Bargain Purchases 3Disclosures 4Consolidation 5Determining Whether an Entity Is a VIE and Whether the Reporting Entity Is a VIE’sPrimary Beneficiary 5Required Disclosures for VIEs 6Contingencies 6Loss Contingencies 7Litigation Contingencies 8Asset Retirement Obligations 8Debt 8Restrictions 8Financial Covenant Disclosures 9Classification as Debt or Equity 10Discontinued Operations, Assets Held for Sale, and Restructuring Charges 11Discontinued Operations and Assets Held for Sale 11Restructuring Charges 12iii

ContentsEarnings per Share 12Two-Class Method 12Fair Value 13Valuation Techniques and Inputs 13Use of Third-Party Pricing Services 14Financial Instruments 14Embedded Derivatives in Hybrid Instruments 15Classification of Financial Instruments 15Financial Statement Classification, Including Other Comprehensive Income 16Balance Sheet Classification 16Income Statement Classification 17Cash Flow Statement Classification 19Comprehensive Income — Disclosure 19Foreign Currency 20Quantification of Foreign Currency Adjustments 20Impairments of Goodwill and Other Long-Lived Assets 21Goodwill 21Other Long-Lived Assets 23Income Taxes 24Repatriation of Foreign Earnings and Liquidity Ramifications 24Valuation Allowances 26Income Tax Rate (Including Rate Reconciliation and Effective Tax Rate) 27Transaction-Specific Disclosures 29Noncompliance With Disclosure Requirements 29Leases 30Lease Classification 30Sale-and-Leaseback Transactions 31Materiality 32Noncontrolling Interests 34Pensions and Other Postretirement Benefits 35Critical Accounting Estimates 35Alternatives to Applying Discount Rates for Defined Benefit Plans 36Liquidity and Capital Resources 38Fair Value of Plan Assets 39Immediate Recognition of Gains and Losses 39Disclosures Related to Non-U.S. Plans 39Revenue Recognition 40Revenue Recognition Disclosures 40Multiple-Element Arrangements 41Principal-Versus-Agent Considerations 42Revenue Recognition for Long-Term Construction-Type and Production-Type Contracts 43Milestone Method 44iv

ContentsSAB Topic 11.M (SAB 74) — Disclosures About the Impact of Recently IssuedAccounting Pronouncements 45Segment Reporting 46Identification of Operating Segments 47Aggregation of Operating Segments 48Changes in Reportable Segments 49Entity-Wide Disclosures 49Share-Based Payments 50Disclosures 50Share-Based Payment Awards Issued by Privately Held Companies 51Significant Assumptions 52Financial Statement Presentation 53SEC Disclosure Topics 55Management’s Discussion and Analysis 56Results of Operations 56Liquidity and Capital Resources 57Critical Accounting Estimates 58Tabular Disclosure of Contractual Obligations 59Early-Warning Disclosures 60Disclosures Related to Income Taxes 60SEC Reporting 60Private-Company Accounting Alternatives 61Significant Business Acquisitions (Rule 3-05) 61Investments in Equity Method Investees (Rules 4-08(g) and 3-09) 63Restrictions on Dividends (Rules 4-08(e), 5-04, and 12-04) 64Guarantors of Registered Securities (Rule 3-10) 64Pro Forma Financial Information (Article 11) 67Disclosures About Risk 68Risk Factors 68Cybersecurity 69Non-GAAP Financial Measures and Key Metrics 70Undue Prominence 72Disclosures About Purpose and Use 73Clear Labeling 73Liquidity Versus Performance Measures 74Reconciliation 75Nature of Adjustments 76Income Tax Effects 77Certain Financial or Operating Metrics 77Disclosure Controls and Procedures 78Inappropriate Conclusion About DC&P 78Incomplete, Inconsistent, or Inaccurate Information in Disclosure About DC&P 79v

ContentsConclusion That DC&P Were Effective If a Restatement Is Required, a Material Weakness Exists, orReports Were Not Filed in a Timely Manner 79A Change in the Conclusion That DC&P Were Effective If No Changes to ICFR Were Disclosed 80Internal Control Over Financial Reporting 80Evaluation of Severity of Control Deficiencies 81Evaluation of Control Deficiencies Related to Immaterial Misstatements 82Evaluation of Deficiencies Identified in the Other COSO Components 83Disclosure of Material Changes in ICFR 84Disclosures About the Impact and Remediation of Material Weaknesses 85Conclusion That ICFR Remains Effective After a Restatement 86Disclosure of the Framework Used to Evaluate ICFR 86Incomplete or Missing ICFR Evaluation 87Executive Compensation and Other Proxy Disclosures 88Determining Compensation — Assessment of Performance 89Executive Compensation Tables 90Emerging Growth Companies 91EGC Status and Elections 92Other Considerations 93Other SEC Reporting Matters 94Certifications 94Use of Experts and Consents 95Material Contracts 96Backlog Disclosures 97Disclosures Regarding State Sponsors of Terrorism 98Interactive Data — eXtensible Business Reporting Language (XBRL) 99Audit Report Requirements 101Selected Quarterly Financial Data 102Disclosure Topics in Initial Public Offerings 103Initial Public Offerings 104Registrant Financial Statements 105Public-Entity Disclosures and Transition Provisions 108Distributions to Owners 110Changes in Capitalization 110Dilution Disclosure 112Foreign Private Issuers 113Foreign Private Issuers Using IFRSs 114Presentation of Financial Statements 114Impairment 115Non-GAAP/Non-IFRS Measures 116vi

ContentsIndustry-Specific Topics 117Consumer and Industrial Products 118Retail and Distribution 118Travel, Hospitality, and Leisure 120Energy and Resources 121Oil and Gas 121Power and Utilities 126Financial Services 128Banking and Securities 128Insurance 129Investment Management 129Real Estate 131Health Sciences 134Life Sciences 134Technology, Media, and Telecommunications 140Technology 140Media and Entertainment 143Telecommunications 145Appendixes 147Appendix A — SEC Staff Review Process 148Appendix B — Best Practices for Working With the SEC Staff 150Appendix C — Tips for Searching the SEC’s Database for Comment Letters 154Appendix D — Glossary of Standards and Other Literature 158Appendix E — Abbreviations 165vii

ForewordTo our clients, colleagues, and other friends:We are frequently asked to provide our perspective on the topics the SEC staff focuses on in its commentletters to registrants. The 2017 edition of SEC Comment Letters — Including Industry Insights offers suchperspective. In addition to extracts of letters and links to relevant related resources, it contains analysisof staff comments to help registrants understand trends and improve their financial statements anddisclosures. You will also find an update on some of the SEC’s strategic priorities as well as a summaryof comment letter trends related to the top 10 topics of frequent comment and other various commentletter statistics. The 2017 edition also includes the following appendixes: (1) Appendix A, which gives aglimpse into the SEC staff’s review and comment letter process; (2) Appendix B, which discusses bestpractices for working with the SEC staff; (3) Appendix C, which provides helpful tips on searching theSEC’s EDGAR database for comment letters; (4) Appendix D, which lists the titles of standards and otherliterature referred to in this publication; and (5) Appendix E, which defines the abbreviations we used.The 2017 edition captures developments on relevant financial reporting topics through the date ofpublication. The SEC and its staff will continue to provide registrants with information that is pertinentto their filings by means of rulemaking and written interpretive guidance as well as speeches deliveredat various forums, of which the AICPA Conference is a prime example. Deloitte’s US GAAP Plus Website is a resource you can use to keep current on the SEC’s latest activities related to financial reportingmatters — including the SEC staff’s participation at the next AICPA Conference, which is scheduled forDecember 4–6, 2017, and will be discussed in an upcoming issue of our Heads Up newsletter.We hope you find the 2017 edition — and other publications on US GAAP Plus and the DeloitteAccounting Research Tool — useful resources as you prepare your annual reports and plan for theupcoming year.In line with the SEC’s disclosure effectiveness initiative, we encourage you to consider materiality,relevance, and redundancy as you assess whether to provide additional disclosures or enhance existingones.As always, we encourage you to contact us for additional information and assistance, and we welcomeyour feedback.Sincerely,Deloitte & Touche LLPviii

AcknowledgmentsLisa Mitrovich and Courtney Sachtleben oversaw the development of this publication. The 2017 editionof SEC Comment Letters — Including Industry Insights would not have been possible without the significantcontributions of the Accounting Services, Audit & Assurance Services, and SEC Services departments andthe industry specialists at Deloitte & Touche LLP.We also could not have completed this publication without the assistance of Jeff Naumann andDeloitte’s Disclosure Analytics team. Deloitte, specifically the Disclosure Analytics team in relation to thispublication, continues to focus on innovation and technology to transform the audit; and the statisticsdeveloped in this publication are an example of the results of that initiative, for which we are extremelyappreciative.In addition, we are grateful to Morgan Miles for his contributions and efforts in managing thedevelopment of this publication. We would also like to thank Teri Asarito, Geri Driscoll, David Eisenberg,Michael Lorenzo, Peter McLaughlin, and Lora Spickler-Alot for delivering the first-class editorial andproduction effort that brings all of Deloitte’s financial reporting publications to life.ix

ContactsIf you have questions about the information in this publication, please contact any of the followingDeloitte professionals:Christine DavinePartnerDeloitte & Touche LLP 1 202 879 4905cdavine@deloitte.comLisa MitrovichPartnerDeloitte & Touche LLP 1 202 220 2815lmitrovich@deloitte.comMark MiskinisPartnerDeloitte & Touche LLP 1 203 761 3451mmiskinis@deloitte.comChristine MazorPartnerDeloitte & Touche LLP 1 212 436 6462cmazor@deloitte.comDiana CravottaManaging DirectorDeloitte & Touche LLP 1 412 338 7371dcravotta@deloitte.comx

Before the Details — Trends and PrioritiesIn May 2017, the SEC underwent a leadership change when Jay Clayton was appointed as its 32ndchairman. As has been the case since early 2016, the SEC has only three commissioners, includingChairman Clayton; nominees to fill the two vacant commissioner seats have not yet been confirmed bythe U.S. Senate. Nonetheless, the SEC continues to focus on the following priorities that may be helpfulfor registrants to consider as we start the 2017 annual reporting cycle: Enhancing and facilitating capital formation — Increasing the attractiveness of the publiccapital markets is a top priority and includes exploring ways for the SEC to make IPOs moreattractive while continuing to protect investors. In accordance with this priority, the SEC recentlyannounced a nonpublic review process available for IPO draft registration statements for allcompanies, with a goal of encouraging more companies to consider going public. Investor protection — The SEC’s mission to protect investors remains a top priority, with acontinued focus on combating financial fraud and protecting retail investors. In addition,the SEC continues to prioritize cybersecurity and (1) recently created a Cyber Unit to targetcyber-related misconduct and address growing cyber-based threats and (2) emphasizes theimportance of public company disclosures about cyber risks and cyber events. Disclosure effectiveness initiative — The Commission continues to work on its broad-based staffreview of the disclosure requirements in its rules as well as the presentation and delivery ofthose disclosures. In October 2017, the SEC issued a proposed rule1 to modernize and simplifyRegulation S-K, and Mr. Clayton further indicated that the Commission has several initiativesunder way to improve disclosures available to investors. New accounting standards — The adoption of new accounting standards, including the newrevenue, lease, and credit loss accounting standards, is critical to the financial reporting systemgiven the pervasiveness of the expected changes. Therefore, the Commission continues tofocus on the successful implementation of new accounting standards, including the accounting,disclosures, and related ICFR. Non-GAAP measures — During the past year, there was significant SEC staff scrutiny of non-GAAPmeasures, and many registrants have improved their disclosures to comply with the SEC’sinterpretive guidance. While we have started to see fewer comments in this area, the SEC staff isexpected to continue to monitor registrants’ use of non-GAAP measures.The Division of Corporation Finance (the “Division“) continues to help the SEC meet its responsibilitiesunder the Sarbanes-Oxley Act via its filing review process, in which it selectively reviews filings madeunder the Securities Act and Exchange Act. Under the filing review process, the Division performs somelevel of review of each registrant at least once every three years (referred to as a “filing review“). Manyregistrants are reviewed more frequently, and they may or may not receive a comment letter.1SEC Proposed Rule Release No. 33-10425, FAST Act Modernization and Simplification of Regulation S-K.xi

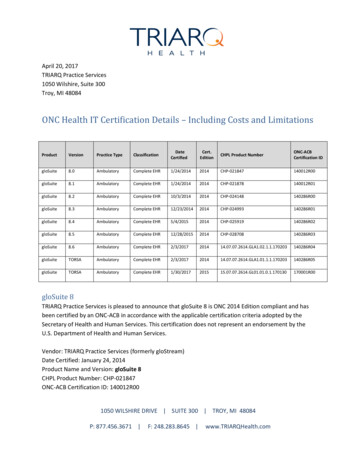

Before the Details — Trends and PrioritiesThe comment letter trends and statistics discussed in this edition2 are generated from an analysis ofthe comment letters issued by the Division in connection with its filing reviews of Forms 10-K and 10-Q(and any amendments to those respective forms). Filing reviews that resulted in one or more commentletters are referred to herein as “reviews with comment letters“ or simply “reviews.“Top 10 Topics in ReviewsThe following table summarizes comment letter trends by topic in the 12-month periods ended July 31,2017 (“review year 2017“ or the “current year“), and July 31, 2016 (“review year 2016“ or the “prior year“):3Review Year 2017TopicNon-GAAP measuresNumber ofReviewsWith aCommenton Topic474Percentageof AllReviews43%MD&A:Results of operations24RankChangein RankFromPriorYearNumber ofReviewsWith aCommenton Topic1133521Percentageof AllReviewsRank27%2119818%30025%Critical accountingpolicies alobligations182%292%Fair value15714%3—23920%Segment reporting13813%4—16614%4Revenue recognition11711%5—16513%5–TIntangible assets andgoodwill1049%6115212%7Income taxes1029%7216513%5–TState sponsors of terrorism878%88756%16Signatures, exhibits, andagreements797%91059%9Acquisitions, mergers,and businesscombinations727%101169%8—23Unless noted otherwise, comment letter trend information in this publication:Was derived from data provided by Audit Analytics.Is related to reviews of Forms 10-K, 10-K/A, 10-Q, and 10-Q/A (which are referred to generally as “filings“).Is based on SEC uploads (i.e., comment letters that the SEC issued to registrants) and does not include registrant responses.Does not include the SEC’s “closing letter“ communicating that its review is complete.Includes only information related to reviews that have been closed and subsequently posted to EDGAR. Accordingly, the statistics presented inthe tables and charts below may be affected by reviews that are still ongoing or have recently been closed. Pertains to 12-month periods ended July 31 (“review years“). May be different upon comparisons with the Supplement to the Ninth Edition (October 2016) as a result of the facts that (1) additional 2016reviews have been closed and posted to EDGAR and (2) refinements have been made to the methods used.Reviews that generated more than one comment letter are counted only once in the statistics below and only in the year in which the initialcomment letter was issued.Additional 2016 reviews have been closed and posted to EDGAR since the Supplement to the Ninth Edition of our comment letter publication wasissued. Further, the method we used to develop the top 10 rankings in the 2017 edition is a refinement of the method used in the Supplement tothe Ninth Edition. 3Review Year 20164xii

Before the Details — Trends and PrioritiesWhile the topics that constitute the top 10 list were generally the same as those in the prior year, wedid see some movement in the rankings, with non-GAAP measures surpassing MD&A for the first spot.There was also a noticeable shift in comment letter volume toward non-GAAP measures, which is notsurprising given their extensive use by registrants and the SEC’s increased focus on this topic over thepast year. In addition, we saw an increase in comments related to state sponsors of terrorism, whichmoved into the top 10 list for the first time.The top 10 topics in reviews with comment letters issued in review year 2017 are ranked as follows:1. Non-GAAP measures — Beginning in late 2015, SEC officials began discussing non-GAAPmeasures as a result of several factors, including (1) the increased use and prominence of suchmeasures, (2) the nature of the adjustments to arrive at such measures, and (3) the increasinglylarge difference between the amounts reported for GAAP and non-GAAP measures. In responseto increasing concerns about the use of such measures, in May 2016, the Division updatedits C&DIs on non-GAAP measures to provide additional guidance on what it expects fromregistrants when using these measures. Therefore, it is no surprise that they have taken overthe number one spot in the top 10 list. That said, in response to the C&DIs and public remarksby various SEC staff members, many registrants took the initiative to modify their disclosuresto comply with the C&DIs. While there was significant SEC scrutiny of these disclosures thispast year, the volume of comments in this area is beginning to lessen. Nevertheless, registrantsshould continue to be mindful of the key focus areas, which include (1) whether there is undueprominence of non-GAAP measures, (2) enhancing the disclosure related to the purposeand use of such measures, (3) clear labeling of non-GAAP measures, (4) whether measuresare appropriately characterized as liquidity or performance measures, (5) reconciliationrequirements, (6) whether the nature of certain adjustments may be potentially misleading, and(7) the presentation of the tax impact of non-GAAP adjustments.2. MD&A — As the table above indicates, MD&A was replaced

SAB Topic 11.M (SAB 74) — Disclosures About the Impact of Recently Issued Accounting Pronouncements 45 Segment Reporting 46 Identification of Operating Segments 47 Aggregation of Operating Segments 48 Changes in Reportable Segments 49 Entity-W