Transcription

U. A. PLUMBERS LOCAL UNION NO. 68GROUP PROTECTION PLANandMechanical Contractors Association of Houston, Inc.as ofJuly 1, 2011

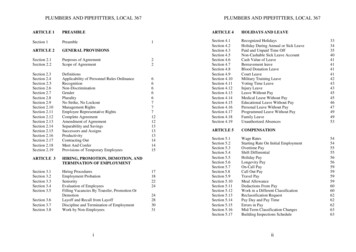

U. A. PLUMBERS LOCAL UNION NO. 68GROUP PROTECTION PLANTABLE OF CONTENTSPageNINE WAYS TO CONTROL YOUR HEALTH CARE BILLS. 8HOW TO FILE A CLAIM. 10SCHEDULE OF BENEFITS – REGULAR PLAN . 11SCHEDULE OF BENEFITS – MEDICARE SUPPLEMENT PLAN . 21ELIGIBILITY RULES . 23CONTINUATION OF ELIGIBILITY DURING ACTIVE DUTY SERVICE (USERRA) . 26FAMILY AND MEDICAL LEAVE ACT OF 1993 (FMLA) . 27COBRA CONTINUATION OF COVERAGE . 28CERTIFICATE OF CREDITABLE COVERAGE . 30COORDINATION OF BENEFITS (COB) . 31SUBROGATION . 32CLAIMS AND APPEALS PROCEDURES . 33PRIVACY NOTICE . 43AMENDED AND RESTATED RULES AND REGULATIONS OF THE PLAN . 52ARTICLE I – ELIGIBILITY, EFFECTIVE DATE AND TERMINATION DATE . 52Section 1.01. Eligibility for Employees . 52Section 1.02. Initial Eligibility . 52Section 1.03. Continuation of Eligibility . 53Section 1.04. Hour Bank Account . 53Section 1.05. Reinstatement . 54Section 1.06. Disability Credits . 54Section 1.07. Active Duty Service . 55Section 1.08. Reciprocity . 56Section 1.09. Effective Date of Employee’s Coverage . 56Section 1.10. Termination of Employee’s Coverage . 56Section 1.11. Eligibility for Dependent’s Coverage . 57Section 1.12. Effective Date of Dependent’s Coverage . 571

Section 1.13. Termination of Covered Dependent’s Coverage . 58Section 1.14. Special Eligibility Rules . 59Section 1.15. Retirees. 60Section 1.16. Family and Medical Leave Act (FMLA) of 1993 . 60Section 1.17. Certificate of Creditable Coverage . 61Section 1.18. Claim Provisions . 62ARTICLE II – DISABILITY BENEFITS FOR EMPLOYEES . 74Section 2.01. Benefits . 74Section 2.02. Successive Disabilities . 74Section 2.03. Limitations . 74Section 2.04. Extension of Benefits Due to a Disabling Condition . 75ARTICLE III – HOSPITAL AND EXTENDED CARE FACILITY EXPENSE BENEFITSFOR EMPLOYEES AND ELIGIBLE DEPENDENTS . 76ARTICLE IV – MEDICAL, MENTAL AND/OR NERVOUS DISORDER EXPENSEBENEFITS FOR EMPLOYEES AND ELIGIBLE DEPENDENTS . 81ARTICLE V - DEDUCTIBLE AMOUNTS, PLAN MAXIMUMS AND ANNUALREINSTATEMENT. 90Section 5.01. Deductible Amounts . 90Section 5.02. Common Accident . 90Section 5.03. Annual Maximums. 91Section 5.04. Lifetime Maximums . 91Section 5.05. Reinstatement . 92Section 5.06. Out-of-Pocket Maximums. 92Section 5.07. General Limitations . 93Section 5.08. Trustees’ Authority . 95ARTICLE VI - COORDINATION OF BENEFITS . 96Section 6.01. Application . 96Section 6.02. Order of Benefit Determination . 97Section 6.03. Coverage by Medicare . 98Section 6.04. Coverage by a Preferred Provider Organization (PPO), HealthMaintenance Organization (HMO) or a Dental Maintenance Organization(DMO) . 98Section 6.05. Co-Payment and Non-Scheduled Prescription Drug Providers . 98Section 6.06. Release of Information . 992

Section 6.07. Payment to Insurance Carriers . 99Section 6.08. Recovery . 99ARTICLE VII – DENTAL EXPENSE BENEFITS PAYABLE FOR EMPLOYEES ANDELIGIBLE DEPENDENTS . 100Section 7.01. Dental Benefits . 100Section 7.02. Deductible Amount Requirements. 100Section 7.03. Co-Insurance Percentage . 100Section 7.04. Eligible Dental Expenses . 100Section 7.05. Maximum Dental Benefits . 100Section 7.06. General Information . 101ARTICLE VIII – VISION EXPENSE BENEFITS PAYABLE FOR EMPLOYEES ANDELIGIBLE DEPENDENTS . 102Section 8.01. Vision Benefits . 102Section 8.02. Deductible Amount . 102Section 8.03. Vision Benefit Percentage . 102Section 8.04. 3-Calendar Year Benefit Period . 102ARTICLE IX – HOSPITAL CONFINEMENT BENEFITS . 103Section 9.01. Hospital Confinement Benefits . 103Section 9.02. Deductible Amount . 104Section 9.03. Co-Insurance . 104Section 9.04. Calendar Year Maximum . 104Section 9.05. General Limitations, Continuation of Benefits, Coordination ofBenefits and Subrogation . 104ARTICLE X – MEDICARE SUPPLEMENT BENEFIT PLAN FOR RETIREES ANDSPOUSES OVER THE AGE OF 65 YEARS . 105Section 10.01. Eligibility . 105Section 10.02. Benefits . 105ARTICLE XI – SUBROGATION AGREEMENT AND AUTHORIZATION FORREIMBURSEMENT . 106Section 11.01. Subrogation . 106ARTICLE XII – CONSOLIDATED OMNIBUS BUDGET RECONCILIATION ACT of 1985(COBRA) . 108Section 12.01. Continuation of Coverage . 108Section 12.02. Notification Requirements . 1093

Section 12.03. Individuals Whose Eligibility is Affected by Multiple QualifyingEvents . 110Section 12.04. Payment of Self-Payment Premium for Employees andEligible Dependents. 110ARTICLE XIII – DEFINITIONS . 111ARTICLE XIV – INTERPRETATION, AMENDMENT, TERMINATION AND MAXIMUMLIABILITY . 123Section 14.01. Interpretation . 123Section 14.02. Amendment and Termination . 123Section 14.03. Maximum Liability of the Plan . 123ARTICLE XV – USE AND DISCLOSURE OF PROTECTED HEALTH INFORMATION124Section 15.01. Use and Disclosure of Protected Health Information (PHI) forHealth Care Treatment, Payment for Health Care, and Health CareOperations . 124Section 15.02. Use and Disclosure by Authorization . 126Section 15.03. Use of PHI by the Plan Sponsor . 126Section 15.04. Separation between the Plan and the Plan Sponsor . 127Section 15.05. Compliance with HITECH Act . 127ARTICLE XVI – INFORMATION REQUIRED UNDER THE EMPLOYEE RETIREMENTINCOME SECURITY ACT OF 1974 (ERISA) . 129ADDENDUM TO U. A. PLUMBERS LOCAL UNION NO. 68 GROUP PROTECTIONPLAN . 1364

DISCLOSURE OF STATUS AS A GRANDFATHERED HEALTH PLANThis group health plan believes this plan is a “grandfathered health plan” under thePatient Protection and Affordable Care Act (the Affordable Care Act). As permitted bythe Affordable Care Act, a grandfathered health plan can preserve certain basic healthcoverage that was already in effect when that law was enacted. Being a grandfatheredhealth plan means that your plan may not include certain consumer protections of theAffordable Care Act that apply to other plans, for example, the requirement for theprovision of preventive health services without any cost sharing. However,grandfathered health plans must comply with certain other consumer protections in theAffordable Care Act, for example, the elimination of lifetime limits on benefits.Questions regarding which protections apply and which protections do not apply to agrandfathered health plan and what might cause a plan to change from grandfatheredhealth plan status can be directed to the plan administrator at:468 Link RoadPost Office Box 8726Houston, Texas 77249-8726(713) 869-2592 or (800) 833-2980.You may also contact the Employee Benefits Security Administration, U.S. Departmentof Labor at 1-866-444-3272 or www.dol.gov/ebsa/healthreform. This website has atable summarizing which protections do and do not apply to grandfathered health plans.5

ALL ELIGIBLE EMPLOYEES ARE REMINDED THAT THEY MUST NOTIFY THEFUND OFFICE WHEN:1.Upon initial coverage, Eligible Employees are required to furnish the Fund Officewith a certified copy of their marriage licenses, divorce decrees and/or birthcertificates and/or legal documentation for each Dependent.2.There is a change of address.3.New Dependents are to be covered. (Provide birth certificates and/or legaldocumentation.)4.There is a divorce/legal separation (date). (Provide court certified divorcepapers.)5.There is a marriage. (Provide certified copy of marriage license or court-issuedstatement of informal marriage.)6.There is a death. (Provide a certified copy of death certificate.)7.A Dependent ceases to be a Dependent as defined by the Plan.6

U. A. PLUMBERS LOCAL UNION NO. 68GROUP PROTECTION PLANTO ALL PARTICIPANTS:We are pleased to present you with this new Booklet which describes the benefitsprovided by the Fund and which has been updated to include the July 1, 2011 Planchanges.Disability, Medical, Dental and Vision benefits are paid for directly from the assets of theFund. The Life Insurance is insured by the ULLICO.We urge you to read this new Booklet carefully so you will better understand thebenefits that you and your family may be entitled to receive. While it is hoped thateveryone will enjoy good health at all times, we believe that you will feel, as we do, thatthe Fund benefits provide financial security in times of need.In order to have your claims paid on a timely basis, be sure to read and comply with therequirements outlined on the inside front cover of this Booklet.If you have any questions regarding your benefits, eligibility or how to file claims, pleasecontact the Fund Office at (713) 869-2592.Please remember that, in order to be official, any information concerning your rightsunder the Plan must be communicated to you in writing by the Fund Office.This document and other important information can be found at the PlumbersLocal Union No. 68 website: www.plu68.com.Sincerely,BOARD OF TRUSTEES7

NINE WAYS TO CONTROL YOUR HEALTH CARE BILLSYou can control your health care expenses. Start now. Although you may already be aconscientious user of the health care system, by practicing all nine ways to control yourhealth care expenses, you will positively affect your pocketbook and your health.1.Treat yourself right. Many Illnesses and Injuries can be prevented. MajorIllnesses such as heart disease are often connected with lifestyle. Smoking,excessive drinking of alcoholic beverages, improper diet and stress are a few ofthe factors that can cause heart disease. By eating right, getting enough sleepand exercising regularly, you can be on the road to preventing Illness, both majorand minor. Remember to wear your seatbelts when driving and take the time tobe careful around your home to avoid unnecessary household accidents.2.Ask “dumb” questions. Actually, the only dumb questions are the ones youdon’t ask. Ask about charges on your Hospital bill if you don’t understand them.All Hospitals have people who can help answer your billing questions.Patients who are informed about what to expect during their Hospitalconfinement usually recover faster and have fewer complications than patientswho are uninformed. Many Hospitals have patient information programs to helpyou. Use them!Inquire about the costs of medications. Generic drugs often cost less than namebrands and your Physician will prescribe them if you ask.If you have any doubts or questions about a treatment or procedure yourPhysician has recommended for you, get a second opinion from anotherPhysician or health care professional.3.Don’t be in when you can be out. Ask your Physician about the use ofoutpatient services in your Hospital or Physician’s office for tests, treatments andmany types of minor surgery. Outpatient care is always less expensive than aHospital confinement and can often accomplish the same objective.4.Use the emergency room for “emergencies.” Your Hospital’s emergencyroom is an expensive place to treat minor aches and ailments. When possible,contact your Physician before deciding to use the emergency room.5.Understand your coverage before you have to use it. Make sure youunderstand your health coverage. Read this Booklet. It describes how thebenefits will work and what is and what is not covered.6.The shorter your Hospital confinement, the less you pay. When it’s practical,have tests performed before you enter the Hospital. Except in emergencies,avoid being admitted to the Hospital at night or on the weekend because you8

may spend unnecessary time waiting for surgery or special treatment. Also, it isimportant to leave the Hospital as soon as your Physician tells you that you areready.Remember - your benefits may be reduced if it is determined your Hospitalconfinement was unnecessary, begins on a weekend or holiday when admissionat that time is not medically necessary or you remain in the Hospital for moredays than have been certified as necessary for your condition.7.Don’t expect a “free” lunch. Be a cost-conscious consumer. Even though ourFund or the government may pay for most of your health care needs, theservices and treatment you receive are never free. If you make an effort tocontrol how you use health care services, everyone will benefit especially you.8.Watch for early warnings! Learn the early warning signs of Illnesses such asheart disease and cancer. Early detection of Illnesses could save your life andmay save you money.9.Use PPO providers whenever possible. When you and your eligibleDependents use PPO providers, you and the Fund save money.These nine steps may lead you to better health and lower medical expenses!9

HOW TO FILE A CLAIMIf you or your Dependents become sick or injured and you believe you may be entitledto benefits under the Plan:1.You should immediately telephone the Fund Office at (713) 869-2592.2.The Fund Office will tell you if you are eligible for benefits under the Plan.3.The Fund Office will furnish you with a claim form.4.A new claim form must be completed and submitted to the Fund Office for eachfamily member each year. In some situations, the Fund Office may require anadditional claim form.5.Complete your portion (Claimant’s Statement) of the form.6.If your claim is related to a disability, give the form to your Physician who mustcomplete his part of the form (Attending Physician’s Statement).7.Mail the form and all bills pertaining to the claim to the Fund Office at:Plumbers Local Union No. 68 Group Protection PlanP. O. Box 8726Houston, Texas 77249-872610

SCHEDULE OF BENEFITS – REGULAR PLANBENEFITS FOR EMPLOYEES ONLYLife Insurance and AD&D Benefits:The life insur

U. A. PLUMBERS LOCAL UNION NO. 68 GROUP PROTECTION PLAN TO ALL PARTICIPANTS: We are pleased to present you with this new Booklet which describes the benefits provided by the Fund and which has been updated to include the July 1, 2011 Plan changes.