Transcription

Index RulebookBofAML European Style Indices NTRIndex SponsorMerrill Lynch InternationalDated as of 08 January 2016(as may be amended from time to time)Private and Confidential

BofAML European Style Indices1.INDEX OBJECTIVE .32.INDEX OVERVIEW AND MANAGEMENT .32.1Overview .32.2Index Valuation Day .42.3Eligible Universe .42.4Index-weighting scheme .42.4.1Fundamental Factor Risk Model .42.4.2Portfolio Optimization Tool .52.5Rebalancing schedule .62.6Index ESG Agent .72.7Index Sponsor .72.8Index Calculation Agent .82.9Index Rebalancing Agent .82.10Index Committee .82.11Index Publication .82.12Index Base Date and Value .93.INDEX CONSTRUCTION .93.13.24.Index Value .9Post Rebalancing Adjustment .13INDEX DISRUPTION EVENTS, AMENDMENT AND CANCELLATION .134.14.24.3Index Disruption Events .13Index Amendment .14Index Cancellation .145.DEFINED TERMS .156.RISK PROVISION .167.DISCLAIMER .18

BofAML European Style Indices1.INDEX OBJECTIVEThe BofAML European Style Indices NTR (each a “Style Index” and together the “Style Indices”) aremembers of a family of equity indices denominated in Euro that reflect the net total return of dynamicportfolios of shares.Each Style Index aims to provide exposure to specific Style Factor returns thanks to a rebalancing scheduleand an index-weighting scheme developed by Merrill Lynch International, as set out below in 2.4.The universe (the “Eligible Universe”) is comprised of (i) all the companies from a Benchmark Index (ii)that are not incompatible with “Environmental, Societal and Governance” considerations. Details on thedetermination of the constituent of the Eligible Universe can be found in Section 2.3.The Benchmark Index is the STOXX 600 Index sponsored by Stoxx Ltd (each constituent a “BenchmarkConstituent” and its weight in the Benchmark Index a “Benchmark Weight”).sStyle Index NameTicker1BofAML Europe Size Index NTRMLFPSSET IndexStyle FactorSize2BofAML Europe Growth Index NTRMLFPSGET IndexGrowth3BofAML Europe Momentum Index NTRMLFPSMET IndexMomentum4BofAML Europe Value Index NTRMLFPSVET IndexValue5BofAML Europe Volatility Index NTRMLFPSWET IndexVolatilityTable 1: List of Style IndicesUnless defined otherwise, terms used in this Index Rulebook shall have the meaning ascribed to them inSection 4 below.2.INDEX OVERVIEW AND MANAGEMENT2.1 OverviewThe Style Indices are based on the following premises: Stock returns are influenced by a finite set of style factor returns, which vary across time and regions.Index-weighting schemes based on quantitative models can be used to construct indices that offerexposure to certain style factor returns.Index-weighting schemes that do not allocate according to market capitalisation have demonstratedoutperformance over traditional market-cap weighting schemes1.Innovative, non-standard portfolio construction techniques can exploit behavioural marketinefficiencies and add further value, in addition to the above 2.1.2.Index Valuation Days are days where all the constituent of the Benchmark Index are scheduled to be open for their regulartrading session. Jason Hsu, “Value Investing: Smart Beta versus Style Indexes” - Journal of Index Investing, Summer2014, Vol5Bruce I. Jacobs ; Kenneth N. Levy, “Smart Beta versus Smart Alpha” – The Journal of Portfolio Management, Summer2014

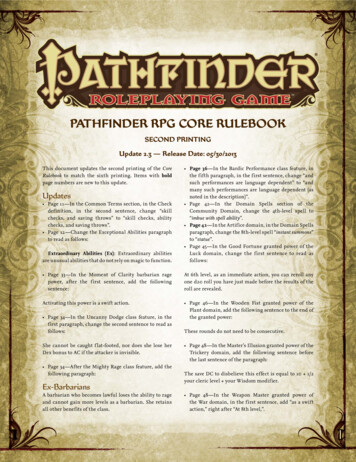

BofAML European Style Indices2.2 Index Valuation DayIndex Valuation Days are days where all the constituent of the Benchmark Index are scheduled to be openfor their regular trading session.2.3 Eligible UniverseThe Eligible Universe with respect to a Potential Rebalancing Date consists of all the shares as of theimmediately preceding Index Valuation Day that (each a “Potential Constituent”): Belonged to the Benchmark Index, provided that if an issuer has several share types within theBenchmark Index, then only the share type with the largest 20 days average traded volume shall bemade part of the Eligible Universe.Did not belong to the Active List of Non ESG Compliant List, list updated from time to time bythe Index ESG Agent with shares from the Benchmark Index.2.4 Index-weighting schemeOn each Potential Rebalancing Date and for each Style Index, the Rebalancing Agent will determine foreach Potential Constituent: A Style Weight, A Theoretical Style Weight whose function is to determine whether the Style Weight needs to beimplemented at the close on such day as further described in 2.5.To this purpose, the Rebalancing Agent will use a Fundamental Factor Risk Model described in section2.4.1 and a Portfolio Optimization Tool described in section 2.4.2.Eligible Universe on Potential Rebalancing DateCovariance MatrixFundamental FactorRisk ModelIndexweightingschemeScores for SizeStyle FactorPortfolio OptimizationToolScores forGrowth StyleFactorScores forMomentum StyleFactorScores forValue StyleFactorScores forVolatility StyleFactorBofAML EuropeValue Index NTRBofAML EuropeVolatility IndexNTRPortfolio Optimization ToolBofAML EuropeSize Index NTRBofAML EuropeGrowth Index NTRBofAML EuropeMomentum IndexNTRGraph 1. Index weighting scheme diagram2.4.1Fundamental Factor Risk ModelThe Fundamental Factor Risk Model employed is the Axioma Europe 2.1 Medium-Horizon FundamentalModel2. It contains Style Scores for each Potential Constituent. It also contains covariance values for each2Please see www.axioma.com for further details regarding the methodology behind these models.

BofAML European Style Indicespair of Potential Constituents (together a “Covariance Matrix”). Style Scores and Covariance Matrix areupdated on each Index Valuation Day by Axioma. The Rebalancing Agent always uses the FundamentalFactor Risk Model from the Index Valuation Day immediately preceding a Potential Rebalancing Date.The 5 Style Factors can be described as follows:Style ptionProvides an indication of a company’s historical rate of growth based on fundamentaldata such as return on equity, dividend payout rate, earnings growth rate. Companieswith larger historical rates of growth are assigned larger score. The BofAML EuropeGrowth Index NTR has a positive exposure to the Growth factorProvides an indication of a company’s annual price performance, excluding theprevious month’s performance. Companies with a larger annual price performance areassigned a larger score. The BofAML Europe Momentum Index NTR has a positiveexposure to the Momentum factor.Provides a measure of the market capitalisation of a company. Larger companies areassigned a larger score. The BofAML Europe Size Index NTR has a negative exposureto the Size factor.Provides a measure of how fairly a company’s share is priced based on fundamentaldata such as book-to-price and earning-to-price. Companies with a higher valuerelative to their share price are assigned larger scores. The BofAML Europe ValueIndex NTR has a positive exposure to the Value factor.Provides a measure of the volatility of the daily returns of a share relative to itsbenchmark. Companies with higher volatilities are assigned higher scores. TheBofAML Europe Volatility Index NTR has a negative exposure to the Volatilityfactor.Table 2: Style Factor definitionPortfolio Optimization ToolThe Portfolio Optimization Tool implements an algorithm that translates the Style Scores and theCovariance Matrix into Style Weights and Theoretical Style Weight for each Potential Constituent. It isbased on criteria for index construction designed by BofAML and implemented within the AxiomaPortfolio OptimizerTM version 6.9.3 for Windows7 64-bit, Matlab and the Java Running Environment.2.4.2.1 Construction Specification for the determination of Style WeightFor each Style Index, the optimization objective is set to minimise the risk of the index and theoptimization constraints are set to the following:ConstraintStyle WeightSum of StyleWeightTarget StyleExposureOther StyleExposuresSector LimitsDefinitionNo Style Weight can be negativeThe sum of all the Style Weights must be equal to 1For the Momentum, Value and Growth Style Factor, the Target Style Exposure mustbe equal to 50%, where the Target Style Exposure represents the weighted average ofthe Style Scores. For the Size and Volatility Style Factors, the Target Style Exposuremust be equal to -50%.should be within /-20%, where Other Style Exposure corresponds to the sum of theweighted average of all the Style Factor different to the targeted Factor StyleFor all Potential Constituents sharing the same Global Industry Classification Standard(GICS ) sector classification, the sum of their Style Weights must be within /-10% ofthe cumulative Benchmark Weights of that GICS sector

BofAML European Style IndicesCountry LimitsPosition LimitsLiquidityHolding LimitsLiquidity TradeLimitsTurnover LimitsConstraintHierarchyFor all the Potential Constituents sharing the same country (as defined in theFundamental Factor Risk Model), the sum of their Style Weight must be within /10% of the cumulative Benchmark Weights of that countryEach Style Weight is less than or equal to 3%Each Style Weight is capped at 20% x 20day average daily volume in Euro / Euro500mEach Style Weight is capped at 5% x 20day average daily volume in Euro / Euro500m for every name tradedThe sum of the absolute change of Style Weight is limited to 25%Axioma’s Portfolio Optimizer TM software allows constraints to be relaxed according toan order of prioritization in cases of infeasibility. The constraint priority are: Target Style Exposure: Priority 1 All other Style Exposure: Priority 2 Sector Limits: Priority 1 Country Limits: Priority 1 Position Limits: Priority 1 Liquidity Holding Limits: Priority 3 Turnover Limit: Priority 4 All other constraints are hard constraints (i.e., must be satisfied)Table 3: Constraints used in the Portfolio Optimisation ToolShould the Portfolio Optimization Model not provide a solution for a specific Style Index, then the StyleWeight with respect to such Style Index shall remain unchanged until the following Potential RebalancingDate.2.4.2.2 Construction Specification for the determination of Theoretical Constituent Style WeightA set of Theoretical Style Weights are calculated for each Potential Constituent using the sameoptimisation objectives and constraints defined in Section 2.4.2.1 with the exception of the “TurnoverLimits” and “Liquidity Holding Limits”, which are omitted. These Theoretical Style Weights are using topotentially trigger a Rebalancing, as described in Section 2.5.2.5 Rebalancing scheduleThe Potential Rebalancing Dates are the 5th, 10th, 15th Index Valuation Days immediately following the firstIndex Valuation Day of each calendar month and the last Index Valuation Day of the month. For example,for the beginning of 2014, the Potential Rebalancing Dates are 8 th, 15th, 22nd and 30th of January, 2014.On such day and for each Style Index, the Rebalancing Agent will Determine the Style Weight as well as the Theoretical Style Weight as described in 2.4.2 using theFundamental Factor Risk Model from the Index Valuation Day immediately preceding such PotentialRebalancing Date.Calculate a tracking error using the following formula:

BofAML European Style IndicesWhereTermi,jst-1MDefinitionRefers to the ith and jth shares that are both Potential Constituent as well as currentIndex Constituent for the Style IndexsRefers to the sth Style Index as described in Table 1Refers to the Index Valuation Dayt immediately preceding such Potential RebalancingDate.The number of shares that are both Potential Constituent and current IndexConstituentsStyle Weight as of the immediately preceding Index Valuation DayTheoretical Style Weight as of such Potential Rebalancing DateCovariance between the ith and jth share, according to the latest Fundamental FactorRisk Model as of the immediately preceding Index Valuation Day, as described in 2.4.Table 4: Definition of terms used in the calculation of the Tracking Error Determine for each Style Index whether a rebalancing should occur at the closing time on suchPotential Rebalancing Date. For this, the Rebalancing Agent will check that either condition (1), (2) or(3) below is met:1.2.3.There have been more than 11 Potential Rebalancing Dates since the last Rebalancing Date(i) The Tracking Errors,t is above 1.5%, (ii) the absolute value of Target Style Exposure (see2.4.2.1) is less than the minimum threshold of 40%, and (iii) there have been at least two (2)Potential Rebalancing Dates since the last rebalancing.(i) The Tracking Error is above 2%, and (ii) there have been at least two (2) PotentialRebalancing Dates since the last rebalancing.If the Rebalancing Agent determines that a rebalancing should occur for a Style Index, then the Style Indexwill rebalance with the calculated Style Weight at the close of such Index Valuation Day. Such day shallbecome a “Rebalancing Date” with respect to such Style Index and all the “Potential Constituent” shallbecome “Index Constituents” with respect to such Style Index and such Rebalancing Date.2.6 Index ESG AgentSustainalytics or any successor, in its capacity of Index ESG Agent, shall maintain a list of shares from theBenchmark Index that it deems highly controversial from an Environmental, Societal and Governance.Constituent of the Benchmark Index with a controversy level of 4 and 5 appear on this list. For moreinformation www.Sustainalytics.com2.7 Index SponsorMerrill Lynch International in its capacity as Index Sponsor is responsible for the day-to-day managementand maintenance of the Index, as well as the publication of the Index Value. Whilst the Index Sponsorcurrently employs the rules, procedures and methodology described in this Index Rulebook, no assurancecan be given that market, regulatory, judicial, fiscal or other circumstances will not arise that would, in theview of the Index Sponsor, necessitate a modification, adjustment and/or deletion of this Index Rulebook orany provision herein.The most recent Index Rulebook together with details of any modification, adjustment and/or deletion isavailable upon request to the Index Sponsor at the following email address:dg.Investable Indices EMEA@baml.com.

BofAML European Style Indices2.8 Index Calculation AgentMerrill Lynch International in its capacity as Index Calculation Agent will employ the methodologydescribed in this Index Rulebook, as may be modified and/or adjusted and/or subject to deletions from timeto time, in its calculation of the Index Value in respect of each Index Valuation Day.Subject to the terms of this Index Rulebook, any determination by the Index Calculation Agent will (i) bemade in its sole and absolute discretion by reference to such factors as it deems appropriate at such time,and (ii) will, in the absence of manifest error, be final, conclusive and binding.2.9 Index Rebalancing AgentEvalueServe, or any successor, in its capacity as Rebalancing Agent will employ the methodologydescribed in this Index Rulebook, as may be modified and/or adjusted and/or subject to deletions from timeto time, in its calculation of all the Style Weights in respect of each Index Valuation Day.2.10 Index CommitteeThe primary role of the Index Committee is to determine whether a proposed modification, adjustmentand/or deletion of this Index Rulebook or any provision herein (including, without limitation, themethodology) is necessary, in order to:(a)ensure continuity in the calculation and publication of the Index;(b )preserve or enhance performance of the Index; and/or(c)maintain the integrity of the Index,to the extent possible, given its stated objective.Modifications or adjustments which the Index Committee is authorised to make include, without limitation,amendments to the methodology, and substitution or removal of Underlying Indices from the notionalportfolio, which, in each case, may have a negative impact on the performance of the Index.The Index Committee will be periodically convened, and at any other time, at the request of the IndexSponsor, for the purposes of considering any event contemplated in Section 4 or any other issue or concernwhich in the determination of the Index Sponsor may have a material impact on the Index or the terms ofthis Index Rulebook.The Index Committee will not be required, at any time or in any manner, to have regard for the interests ofany particular investor or group of investors when considering any action to be taken in relation to theIndex or this Index Rulebook.2.11 Index PublicationSubject to Section 4 below, the Index Sponsor shall publish the Index Value in respect of each IndexValuation Day on the relevant Bloomberg page (see Table 1) or any successor financial information serviceas determined by the Index Sponsor in its sole and absolute discretion. The Index Sponsor shall publish theIndex Value in the Base Currency, as calculated by the Index Calculation Agent and rounded to the twonearest decimal places (0.005 being rounded up).Under normal market conditions the Index Value in respect of an Index Valuation Day will be calculatedand published no later than 5pm (London time) the date occurring two Index Valuation Days followingsuch Index Valuation Day.

2.4.1 Fundamental Factor Risk Model The Fundamental Factor Risk Model employed is the Axioma Europe 2.1 Medium-Horizon Fundamental Model2. It contains Style Scores for each Potential Constituent. It also contains covariance values for each 2 Please see www.axioma.com for furth