Transcription

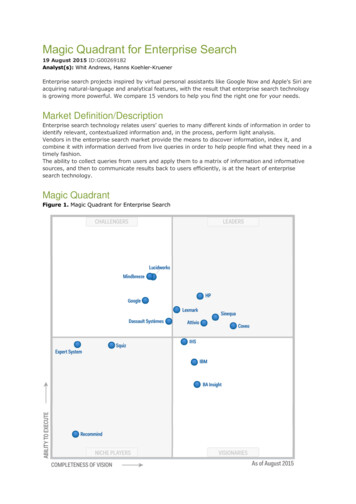

Magic Quadrant for Enterprise File Synchronization and Sharing1 of 15http://www.gartner.com/technology/reprints.do?id 1-1WLOUQV&ct .Magic Quadrant for Enterprise FileSynchronization and Sharing2 July 2014 ID:G00261766Analyst(s): Monica Basso, Jeffrey Mann, Charles SmuldersVIEW SUMMARYThe enterprise file synchronization and sharing market is maturing, which will benefit IT leaders, andmobile and collaboration planners. EFSS capabilities continue to standardize, forcing players todifferentiate mobile content and collaboration.Market Definition/DescriptionThis document was revised on 14 July 2014. The document you are viewing is the corrected version. Formore information, see the Corrections page on gartner.com.EFSS refers to a range of on-premises or cloud-based capabilities that enable individuals to synchronizeand share documents, photos, videos and files across multiple devices, such as smartphones, tablets andPCs. File sharing can be within the organization, as well as externally (e.g., with partners andcustomers) or on a mobile device as data sharing among apps. Security and collaboration support arecritical capabilities of EFSS to address enterprise priorities.Beyond file synchronization, sharing and access, EFSS offerings may include different levels of supportfor:Mobility, with native apps for a variety of mobile smartphones, tablets, notebooks and desktops,as well as Web browser support.Security, for protection of data on the device, in transit and in cloud services (or servers), such aspassword protection, remote wipe, data encryption, data loss prevention, digital rightsmanagement (DRM), access tracking and reporting. Mature products ensure that files leaving thesharing location are DRM-encrypted and only readable by those authorized to access the data.Audit and compliance support are also present in complete products.Administration and management, including integration with an Active Directory andLightweight Directory Access Protocol (LDAP) policy enforcement.Back-end server integration, e.g., with SharePoint and other corporate platforms. Integrationis achieved through connectors (e.g., based on the Content Management Interoperability Services[CMIS] standard and APIs).Content manipulation, such as file editing, PDF annotations and note taking.Collaboration, such as cooperative editing on a shared document using change tracking andcomments; and document-based workflow process support.Simplicity and usability, with optimized UIs and interactions, such as file drag and drop and fileopen in applications.Storage, i.e., cloud-based EFSS services often include cloud storage as part of the bundle toimplement the EFSS repository. Software EFSS products, instead, may integrate with repositorieson-premises or be implemented with a separate repository on-site.Typical architectures for EFSS offerings are:Cloud: Corporate files are accessed via mobile devices, or shared and are stored in the provider'scloud. Organizations that want to replace the personal cloud services adopted by employees withan enterprise-class alternative under IT control, while preserving the user experience andenhancing mobile collaboration, prefer the cloud method.On-premises: The remote access, synchronization and sharing component is deployedon-premises and integrates with corporate data repositories, without file replicas. This method ispreferred by organizations under strict regulations about data storage.Hybrid: The user and device authentication, security and search mechanisms are implemented inthe provider's cloud. Files and documents are kept in their original location, or can be in third-partyclouds. Organizations that want to simplify mobile users' access to corporate data through thecloud, without creating data replicas in someone else's cloud, prefer the hybrid method.There are two types of EFSS offerings:Destinations — Stand-alone products with file sync and share as a core capability, which representsa new purchase for an organization.Extensions — File sync and share capabilities added, and wrapped around established products orapplications — e.g., for collaboration, content management or storage. Organizations can useextensions as part of the broader platform (see "Destinations and Wraparounds Will Reshape theEnterprise File Synchronization and Sharing Market").Magic QuadrantFigure 1. Magic Quadrant for Enterprise File Synchronization and SharingSTRATEGIC PLANNING ASSUMPTIONSBy 2017, part of the enterprise file synchronization andsharing (EFSS) market will be absorbed into adjacentmarkets (e.g., collaboration and content management).By 2017, less than 10% of today's EFSS destinationvendors will offer stand-alone products, and the rest ofthe vendors will have been absorbed into adjacentmarkets, such as collaboration, enterprise contentmanagement (ECM), mobility and storage.NOTE 1RELATED MARKETSCOPEThis research expands the research presented in"MarketScope for Enterprise File Synchronization andSharing," published early in 2013. In addition to thevendors mentioned in that MarketScope, we includeAirWatch, Alfresco, Dropbox, Google, Huddle, IBM,Intralinks, Microsoft, Novell, ownCloud and Workshare inthis Magic Quadrant. Good Technology, Nomadesk andOxygenCloud included in the MarketScope did not qualifyfor inclusion in this new Magic Quadrant.EVALUATION CRITERIA DEFINITIONSAbility to ExecuteProduct/Service: Core goods and services offered bythe vendor for the defined market. This includes currentproduct/service capabilities, quality, feature sets, skillsand so on, whether offered natively or through OEMagreements/partnerships as defined in the marketdefinition and detailed in the subcriteria.Overall Viability: Viability includes an assessment ofthe overall organization's financial health, the financialand practical success of the business unit, and thelikelihood that the individual business unit will continueinvesting in the product, will continue offering theproduct and will advance the state of the art within theorganization's portfolio of products.Sales Execution/Pricing: The vendor's capabilities in allpresales activities and the structure that supports them.This includes deal management, pricing and negotiation,presales support, and the overall effectiveness of thesales channel.Market Responsiveness/Record: Ability to respond,change direction, be flexible and achieve competitivesuccess as opportunities develop, competitors act,customer needs evolve and market dynamics change.This criterion also considers the vendor's history ofresponsiveness.Marketing Execution: The clarity, quality, creativityand efficacy of programs designed to deliver theorganization's message to influence the market,promote the brand and business, increase awareness ofthe products, and establish a positive identification withthe product/brand and organization in the minds ofbuyers. This "mind share" can be driven by acombination of publicity, promotional initiatives, thoughtleadership, word of mouth and sales activities.Customer Experience: Relationships, products andservices/programs that enable clients to be successfulwith the products evaluated. Specifically, this includesthe ways customers receive technical support oraccount support. This can also include ancillary tools,customer support programs (and the quality thereof),availability of user groups, service-level agreements andso on.Operations: The ability of the organization to meet itsgoals and commitments. Factors include the quality ofthe organizational structure, including skills, experiences,programs, systems and other vehicles that enable theorganization to operate effectively and efficiently on anongoing basis.Completeness of VisionMarket Understanding: Ability of the vendor tounderstand buyers' wants and needs and to translatethose into products and services. Vendors that showthe highest degree of vision listen to and understand20.01.2015 17:29

Magic Quadrant for Enterprise File Synchronization and Sharing2 of 15http://www.gartner.com/technology/reprints.do?id 1-1WLOUQV&ct .buyers' wants and needs, and can shape or enhancethose with their added vision.Marketing Strategy: A clear, differentiated set ofmessages consistently communicated throughout theorganization and externalized through the website,advertising, customer programs and positioningstatements.Sales Strategy: The strategy for selling products thatuses the appropriate network of direct and indirectsales, marketing, service, and communication affiliatesthat extend the scope and depth of market reach, skills,expertise, technologies, services and the customerbase.Offering (Product) Strategy: The vendor's approachto product development and delivery that emphasizesdifferentiation, functionality, methodology and featuresets as they map to current and future requirements.Business Model: The soundness and logic of thevendor's underlying business proposition.Vertical/Industry Strategy: The vendor's strategy todirect resources, skills and offerings to meet the specificneeds of individual market segments, including verticalmarkets.Innovation: Direct, related, complementary andsynergistic layouts of resources, expertise or capital forinvestment, consolidation, defensive or pre-emptivepurposes.Geographic Strategy: The vendor's strategy to directresources, skills and offerings to meet the specific needsof geographies outside the "home" or native geography,either directly or through partners, channels andsubsidiaries as appropriate for that geography andmarket.Additional contributions to this research were providedby Chris Silva, Bryan Taylor, Guy Creese and Tom Eid.Source: Gartner (July 2014)Vendor Strengths and CautionsAccellionAccellion (www.accellion.com) is a private company based in Palo Alto, California. Founded in 1999, itoperates internationally, with offices in London and Singapore. The company originally served thetraditional file sharing and managed file transfer market. Since 2010, it has strongly refocused on mobilefile synchronization and sharing. Accellion has grown its visibility and track record, particularly formidsize to large regulated or security-conscious organizations. Accellion's kiteworks is a destinationEFSS product, including access to enterprise content servers, with security and management. Its latestrelease enhanced the user experience and architecture. The user experience has been built with themobile platform, rather than the PC, being the first design point. The architecture employs a three-levelmodel that separates the Web, application and data layers. The kiteworks solution can be deployed as aprivate cloud on-premises (virtual appliance on-premises), as a hosted cloud or hybrid cloud (mixingon-premises and hosted).Accellion is a good fit for organizations prioritizing their EFSS initiatives for mobile experiences, whileensuring data protection and compliance, particularly those operating in regulated markets, such asfinancial services, healthcare and government.StrengthsAccellion offers a modern mobile UI designed for touch-based interaction. It includes innovativefeatures, such as a touchscreen-based function to be visually dragged and dropped among folderson a mobile device (via the kiteworks Move Tray).Accellion offers a broad range of deployment options, including on-premises, private cloud, hostedprivate cloud (via Amazon Web Services), public cloud and hybrid. The hybrid model can combinethe on-premises component with public and private cloud services.Accellion has multiple compliance certifications in highly regulated markets, including certificationsfor compliance with the Health Insurance Portability and Accountability Act (HIPAA), the FederalInformation Security Management Act (FISMA) and the Sarbanes-Oxley Act.Accellion supports sharing unlimited size files, e.g., files larger than 1,000GB (1TB) — a criticalfeature for end users dealing with large media files, such as videos, source code or computer-aideddesign (CAD; e.g., engineering groups, graphics shops and video/audio production houses).CautionsAccellion's direct presence is limited outside the U.S., compared with some competitors; however,it has multiple distributors, such as Dimension Data and Compuware, and resells on a global level.Occasionally, references indicated issues with allocated storage space after the initial purchase —with the per-user storage space being reduced after signing the deal.Collaborative editing capabilities are not yet available within the kiteworks mobile application,although they are under development for future releases.Mobile management and policy enforcement capabilities in kiteworks are limited; however, theycan be enhanced through integration with enterprise mobility management (EMM) productvendors, such as Good Technology and MobileIron.AcronisAcronis (www.acronis.com), founded in 2003, is a private company based in Woburn, Massachusetts,20.01.2015 17:29

Magic Quadrant for Enterprise File Synchronization and Sharing3 of 15http://www.gartner.com/technology/reprints.do?id 1-1WLOUQV&ct .with operations in Europe, the Asia/Pacific region, North America and South America. Its core business isenterprise backup and recovery software (see "Magic Quadrant for Enterprise Backup/RecoverySoftware"). Its mobility business unit originates from its 2012 acquisition of GroupLogic, a provider of filesharing and managed file transfer technology. Acronis Access, the company's destination EFSS offering,combines the former GroupLogic's mobilEcho and activEcho into a single product. The product supportsaccess to enterprise content servers, with security and management. It is normally deployedon-premises, but also can be in private and public cloud models.Acronis is a viable option for organizations that are prioritizing mobile devices to raise employees'productivity, but have concerns about security and control. Acronis Access is a good choice forcompanies that are looking for a backup/recovery solution, as well as core capabilities for file sync andsharing, or already have investments in Acronis.StrengthsAcronis Access supports audit logs for control and compliance, and is certified for HIPAA and FISMAcompliance.Acronis has a strong base of global resellers and distributors to meet the needs of small or midsizebusiness (SMB) customers.Customer experience is very positive based on reference feedback, especially for ease of use andlevel of client service support.Acronis has demonstrated a strong presence in regulated industries, such as financial services,legal, energy and government, and the education sector.CautionsIntegration capabilities are limited — e.g., CMIS support for broad back-end integration and APIsfor integration with third-party client applications are not available. Social collaboration capabilitiesare limited.There is no native Windows Phone client available yet.No DRM capability is supported yet to protect shared documents once downloaded on anunmanaged device (e.g., to revoke permissions to open, view and edit a document).AirWatchAirWatch (www.air-watch.com) is headquartered in Atlanta, Georgia, and was founded in 2003. Thecompany has a worldwide presence with offices in all regions, and is a leading vendor in the EMM market(see "Magic Quadrant for Enterprise Mobility Management Suites"). VMware (with headquarters in PaloAlto, California, and founded in 1998) completed the acquisition of AirWatch in February 2014. VMware isa leading vendor in virtualization technology, expanding its end-user computing offerings with mobility.EFSS is a core element of VMware's vision of an end-user computing environment centered on mobility,collaboration and the cloud. AirWatch's Secure Content Locker (SCL) is an EFSS destination product withsecurity and management capabilities, available on-premises or in cloud instances. During the past 12months, it has been sold mostly as part of EMM deals.AirWatch is viable for organizations that are considering EFSS as part of an enterprise mobility initiative,and are making EMM decisions. It is also viable for organizations that have AirWatch's mobile devicemanagement (MDM) deployment in place and plan to add basic EFSS capabilities, or to provide a secureEFSS capability for employees on managed mobile devices.StrengthsAirWatch's operations are mature, and cloud services run in the company's data centers in Atlanta,Georgia.AirWatch's customer base is global. The company has a strong presence in markets outside theU.S., through local sales teams, channel partners and resellers. VMware's acquisition adds thepotential to scale up AirWatch's capabilities in sales, operations and local support.SCL integrates with AirWatch's EMM offering and adds the benefit of rich administration and usermanagement capabilities. SCL will become part of VMware Horizon deals, replacing the previousHorizon Files component.SCL supports dynamic content watermark management. IT administrators can set rules forapplying watermarks to specific documents before sharing or editing the content, based on users,groups or document types.CautionsSCL adoption so far has been limited mostly to initiatives to extend an MDM deployment with EFSScapabilities, focusing on mobility priorities. The uptake of SCL as a destination EFSS product forbroader use cases, including collaboration and back-end integration, is still immature.Some references indicated occasional issues with product maturity and performance, limited userfriendliness and intuitiveness in the UI, lack of central administration for the EFSS capability only,product delivery and support.The separate pricing of SCL and reallocation of features in the new product have prompted someMDM customers to question how original license agreements map to the new product. The new SCLpricing model with three packages brings more clarity.EMC's parent relationship with VMware might raise concerns about the overlap between AirWatch'sSCL and EMC's Syncplicity that could trigger product rationalization scenarios. VMware announcedit will incorporate SCL in its Horizon product line, and plans further product investments.AlfrescoFounded in 2005 and headquartered in Maidenhead, England, and San Mateo, California, Alfresco(www.alfresco.com) is an open-source ECM provider (see "Magic Quadrant for Enterprise ContentManagement"). Alfresco can be deployed on-premises, in a public or private cloud, or in a hybrid model.Alfresco considers file synchronization and sharing as basic features of a modern ECM system. Its EFSScapabilities are integrated features of the broader ECM platform that cannot be purchased separately;therefore, Gartner considers it an EFSS extension offering. Nonetheless, it can integrate with othercontent repositories (for example, SharePoint) through CMIS.Alfresco is a good fit for organizations that have deployed Alfresco as their ECM system, or are looking20.01.2015 17:29

Magic Quadrant for Enterprise File Synchronization and Sharing4 of 15http://www.gartner.com/technology/reprints.do?id 1-1WLOUQV&ct .to do so, and plan to add mobile access and EFSS capabilities to support extended use cases.StrengthsAlfresco provides server-to-server synchronization as a native capability.Alfresco integrates EFSS capabilities with the ECM repository (e.g., the ability to surf documentsthrough tasks) to support business process workflows, management and compliance.Its global presence has grown through an increased number of diverse partners for consulting andimplementation.The openness in its general approach provides more choices and opportunities for building othercapabilities on top of its platform.CautionsTo use these file sync and share capabilities, an organization needs to have Alfresco as the ECMplatform in place.Finding technical staff to support Alfresco was considered challenging by some references.There is no dedicated client for Windows Phone or Windows 8.BoxBox (www.box.com) is based in Los Altos, California. Founded in 2005, the company has internationalprese

Magic Quadrant Figure 1. Magic Quadrant for Enterprise File Synchronization and Sharing STRATEGIC PLANNING ASSUMPTIONS By 2017, part of the enterprise file synchronization and sharing (EFSS) market will be absorbed into adjacent markets (e.g., collaboration and content management). By 2017, less than 10% of today's EFSS destination