Transcription

An Acuris CompanyThe comprehensive review of mergersand acquisitions in the Americas region2017 Half-year editionDeal DriversAmericasMergermarket.com

Kick back this summer,Kickback thissummer,let Merrillsecurethe deal.let Merrill secure the deal.MERRILL DATASITEMERRILLDATASITEOur award-winningVirtual Data Room is used by thousandsof leading organizations, worldwide.Our award-winning Virtual Data Room is used by thousandsTheseorganizationstrustworldwide.our team of highly qualified expertsof leadingorganizations,to handle their most confidential transactions.These organizations trust our team of highly qualified expertsSimple.Safe.Secure.Merrill’s technologysolutions will taketo handletheirmost confidentialtransactions.the stress out of your next deal.Simple. Safe. Secure. Merrill’s technology solutions will takeTocan helpthelearnstresshowoutweof yournextyou,deal.contact us now:888.311.4100To learn how we can help you, contact us p.cominfo@merrillcorp.comwww.merrillcorp.com Merrill Communications LLC. All rights reserved.All trademarks are property of their respective owners.1,000,000,000 1,000,000,000 PAGES UPLOADEDPAGES UPLOADED46,000 46,000 VIRTUAL DATA ROOMPROJECTS SECUREDSINCE 2003VIRTUAL DATA ROOMPROJECTS SECUREDSINCE 200340,000 40,000 M&A TRANSACTIONSSINCE 2003M&A TRANSACTIONSSINCE 20032222TECHNOLOGY AWARDSWON IN THE LAST DECADETECHNOLOGY AWARDSWON IN THE LAST DECADE Merrill Communications LLC. All rights reserved.All trademarks are property of their respective owners.F I N A N C I A L T R A N S A C T I O N S & R E P O R T I N G M A R K E T I N G & C O M M U N I C AT I O N S F O R R E G U L AT E D I N D U S T R Y C U S T O M E R C O N T E N T & C O L L A B O R AT I O N S O L U T I O N S

MergermarketDeal Drivers AmericasContents3ContentsForeword4Canada54Americas Heat Chart5West61All Sectors6Midwest68Financial Services18South75Industrials, Manufacturing & Engineering24Mid-Atlantic82Energy, Mining, Oil & Gas30New England89Consumer36Latin America96Technology, Media & Telecom42About Merrill Corporation104Life Sciences & Healthcare48Merrill Corporation Contacts104Mergermarket.com

MergermarketDeal Drivers AmericasForeword4ForewordWelcome to the half-year edition of DealDrivers Americas, published by Mergermarketin association with Merrill Corporation. Thisreport provides an extensive review of M&Aactivity and trends across North America andLatin America.Dealmaking in the Americas has experienced aslow start, falling short of the lofty expectationsdealmakers had set as we entered 2017.However, there is still optimism that rumoredmegadeals and negotiations already in thepipeline could turn around this early slump.While the number of transactions dropped,North American M&A activity did experiencean increase in value, with 2,793 deals worthUS 658.5bn in the first half, versus therecorded 2,999 deals worth US 621.1bnin 1H16, according to Mergermarket data.Dealmakers had expected that momentumfrom Q4 2016 (when close to US 500bnworth of deals were announced) would carryinto 2017. This optimistic outlook was drivenby continued stock market growth and theelection of President Donald Trump, who hadlaid out plans to cut personal and corporatetax rates, reduce the taxation of overseas cashpiles repatriated to the US, invest US 1tn ininfrastructure and roll back regulation.Slow but sureThe number of megadeals slowed in the firstsix months of the year, with the uncertaintyover tax reform serving as a large culprit forMergermarket.comthis. However, with some big deals in thepipeline, this could turn around in 2H17. Furtherregulatory uncertainty hangs over inboundcross-border M&A, especially from China, witha number of ongoing deals awaiting nationalsecurity clearance from the Committee onForeign Investment in the United States. Chinaset inbound M&A records in 2016, but fell in1H17. Dealmakers are confident that we couldsee a return to this kind of activity later in theyear, when there is an expected looseningof the Chinese government’s capital controlmeasures that currently make it difficult forcompanies to get money out of the countryto finance overseas.Looking at sectors, financial services M&Ais expected to remain healthy for the remainderof 2017, especially in areas such as assetmanagement and financial technology (fintech).Energy, mining, oil & gas recorded the highesttotal deal value in 1H17 with US 156.6bn,followed by consumer at US 143.7bn. Thetechnology, media and telecom (TMT) sectorshould also see a busy 2H17, while an increasecould also be seen in healthcare M&A.One of the more positive stories to come outof the first half is the level of private equityactivity. PE transactions soared in the first half,which saw buyouts worth roughly US 111bn,as compared to US 173.3bn for all of 2016. PEactivity will remain a key driver in 2H17 as PEinvestors have record levels of dry powder andare under pressure to invest.In Latin America, after initial optimism inthe political stability of the region and signsof recovery earlier this year, the region islikely to experience a slight decrease in dealactivity in 2H17. In Brazil, in particular, politicalinstability paired with uncertainties related tothe government’s ability to carry out reformsof its pension and labor law systems areforcing sellers and buyers to delay closings.Looking forwardDealmakers have their sights on increasedactivity in 2H17, undeterred by this slower-thanexpected start. The US economy is expectedto steadily grow, with the World Bankforecasting growth of 2.1% in 2017 and 2.2%in 2018. This is higher than forecasted for theEurozone and compares favorably to emergingmarkets. Debt markets are open, and withinterest rates at 1% financing is accessible,indicating ripe conditions for activity to flourish.Sincerely,Doug CullenSenior Vice President,Global Head of Solution SalesDoug CullenSenior Vice President,Global Head of SolutionSales, Merrill Corporation

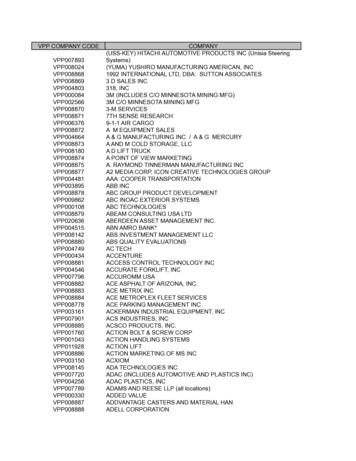

MergermarketDeal Drivers AmericasHeat Chart5Americas Heat ChartThe powerhouse sector of technology, media& telecoms (TMT) and the West region of theUS are set to retain their dominant positionsin the M&A tables this year, according to ourforward-looking Heat Chart of “companiesfor sale” stories on Mergermarket.A total of 2,968 stories about companies forsale were written by Mergermarket’s proprietaryintelligence service in the first half of 2017. Thisrepresents an 8.6% increase over the secondhalf of 2016, indicating that the Americas couldbe due for an increase in M&A dealmaking.Breaking down the chart by sector, theconsumer and life sciences& healthcareindustries both made gains over the last half.There were 401 stories related to consumercompanies for sale and 399 related tohealthcare targets, compared to 340 and328, respectively, in H2 2016. In the consumerindustry, there are indications that upheavalwill spur a wave of consolidation and distress,while the boom in healthcare continues acrossNorth America.The industrials, manufacturing & engineeringand energy, mining, oil & gas sectors hadthe fourth- and fifth-most number of stories,respectively. Many of these deals wereconcentrated in the heartland regions of theSouth and Midwest, as well as in Latin Americaand the West.The areas with the most stories followingthe West region were the South, Mid-Atlanticand Midwest. According to the Mergermarketclassification, the South includes states withmajor business centers such as Florida andTexas, where business services and financialservices deal activity is strong.Canada had fewer “companies for sale” storiesthis half, with just 128, compared to 195 in H22016. Interestingly, the sector with the moststories was TMT with 34, which is 11 morethan the traditionally active energy sector.Heat Chart based on potential companies for 115401Life Sciences ing &Engineering569349105403016389Energy, Mining, Oil& Gas88773623591323319Business Services7267403438211273Financial 319Real 7128Criteria of heat chart:Mergermarket’s sector heat chart is based on companies tagged as potential targets in the last three months.Mergermarket.comTotal2968

MergermarketDeal Drivers AmericasPart of the Acuris Reporton Global M&A ActivityAll SectorsMergermarket.comAll Sectors6

MergermarketDeal Drivers AmericasAll Sectors7All SectorsOverviewDespite a small uptick in total value, NorthAmerican M&A activity in the first half did notquite live up to the great expectations thatushered in 2017, dealmakers said.In total, there were 2,793 deals worthUS 658.5bn in North America in the first half,compared to 2,999 deals worth US 621.1bn forthe same period a year earlier, according toMergermarket data.While a number of megadeals were announcedin 1H17, there were fewer than anticipated atthe outset of the year when a combinationof factors such as abundant corporate cashpiles and the prospect of a looser regulatoryframework in Washington DC had beenexpected to drive rampant deal activity. Leadingthe way in 1H17 was British American Tobacco’s[LON:BATS] acquisition of the 57.8% stake inReynolds American [NYSE:RAI] it did not alreadyown for US 60.6bn, including net debt.Nonetheless, lofty expectations for 2017 couldstill play out in the second half, according todealmakers. “There are very specific reasonswhy deals that didn’t happen [in 1H17] eithergot delayed or fell apart,” said Scott Falk ofKirkland & Ellis. “A lot of the rumored big dealscould still happen, and there are many dealsin the pipeline being negotiated.”Seller’s marketUnderlying market conditions that led toexpectations for even greater activity earlierin the year remain, pointing to the potentialMergermarket.comfor a strong M&A market in 2H17. “It remains asellers’ market,” Falk said. “If you have a healthyasset, auctions are robust.”Private equity activity soared in the first half,which saw buyouts worth roughly US 111bn,as compared to US 173.3bn for all of 2016. PEactivity will remain a key driver in 2H17 as PEinvestors have record levels of dry powder and areunder pressure to invest, the dealmakers noted.Energy, mining and utilities recorded the highesttotal deal value in 1H17 with US 156.6bn,followed by consumer, which talliedUS 143.7bn.The technology, media and telecom (TMT)sector should also see a busy 2H17, whilefinancial services and healthcare M&A couldalso see a pick-up, the dealmakers mentioned.On the heels of Amazon.com’s [NASDAQ:AMZN]US 13.5bn bid for Whole Foods Market[NASDAQ:WFM] in June, technology-enableddisruption is one theme set to drive continuedM&A across all sectors. “Across sectors businessmodels are being challenged,” said Bill Casey,Americas vice chair of EY Transaction AdvisoryServices, who noted the automotive andsemiconductor industries as likely focal pointsfor more tech-driven M&A activity.Dealmakers also expect an uptick in NorthAmerican companies divesting assets in 2H17.After a high-water mark last year, which saw 82divestitures in 1H16, activity slowed somewhatin 1H17, with 52 divestitures worth a totalUS 31.2bn, Mergermarket data shows.Casey said oil and gas is one area wherecompanies will remain in selling mode. Accordingto the data, the energy, mining and utilities sectoraccounted for 30.8% of all divestiture activity in1H17, up from 23.2% a year earlier.Healthcare is another sector expected to seea pick-up of corporate carve-outs. “A lot of bigcompanies that made biotech acquisitions nowfind that some of these assets are non-core,”Falk said.RoadblocksDespite the strong fundamentals, some largecompanies remain in wait-and-see mode untilfurther clarity emerges in Washington DC,including on the Trump administration’s plansfor tax reform.Expectations for a more business-friendlyantitrust process that would emboldencompanies to pursue more daring combinationshave also not yet played out. “A deal thatdeserved to be scrutinized under Obama is notgoing to escape scrutiny under Trump,” Falk said.Further regulatory uncertainty hangs over inboundcross-border M&A, especially from China. After arecord 2016, inbound US M&A from China plungedin 1H17, but could see a return later in the year,when the Chinese government’s capital controlmeasures that make it hard for companies to getmoney out of the country are expected to ease.Further informationGet in touchTom Cane

MergermarketDeal Drivers AmericasAll Sectors8Top dealsTop 20 Announced Deals for Half Year Ending 30 June 2017 (any North American Involvement)AnnouncedDateStatusBidder CompanyTarget CompanySectorVendor CompanyDeal Value(US m)17-Jan-17CBritish American Tobacco PlcReynolds American Inc (57.83% stake)Consumer60,56723-Apr-17PBecton, Dickinson and CompanyC.R. Bard IncLife Sciences & Healthcare23,60910-Feb-17CReckitt Benckiser Group PlcMead Johnson & CompanyConsumer1-Feb-17CONEOK IncONEOK Partners LP (60% stake)Energy, Mining, Oil & Gas16-Jun-17PAmazon.com IncWhole Foods Market IncConsumer29-Mar-17CCenovus Energy IncConocoPhillips (Canadian conventional natural gasassets); and Foster Creek Christina Lake Oil SandsPartnership (50% stake)Energy, Mining, Oil & Gas9-Jan-17CWilliams Companies IncWilliams Partners LP (32.24% stake)Energy, Mining, Oil & Gas17,83517,11813,464ConocoPhillips Company13,24011,35822-May-17PClariant AGHuntsman CorporationIndustrials, Chemicals & Engineering26-Apr-17CAbu Dhabi Investment Authority; and GIC PrivateLimitedPharmaceutical Product Development LLCLife Sciences & Healthcare10,3559-Jan-17PMars IncorporatedVCA IncLife Sciences & Healthcare9-Mar-17CCanadian Natural Resources LimitedThe Athabasca Oil Sands Project (60% stake); andRoyal Dutch Shell plc (Peace River Complex in-situassets, including Carmon Creek, and a number ofundeveloped oil sands leases in Alberta)Energy, Mining, Oil & Gas19-Jun-17PEQT CorporationRice Energy IncEnergy, Mining, Oil & Gas7,6895-Apr-17CJAB Holdings BVPanera Bread CompanyConsumer7,404The Carlyle Group; and Hellman & Friedman LLC9,050Royal Dutch Shell Plc8,5008,79225-Jan-17PAltaGas LtdWGL Holdings IncEnergy, Mining, Oil & Gas6,68528-Jun-17PSycamore PartnersStaples IncorporatedConsumer6,65717-Jan-17CExxon Mobil CorporationBOPCO LP; and The Bass Family (Permian Basinoil companies)Energy, Mining, Oil & GasThe Bass Family6,6208-May-17PSinclair Broadcast Group IncTribune Media CompanyTechnology, Media & TelecomOaktree Capital Management LP; and Angelo,Gordon & Co6,5975-May-17PAvantor Performance Materials IncVWR International LLCBusiness ServicesMadison Dearborn Partners LLC6,41818-Apr-17CCardinal Health IncMedtronic Inc (Patient Care, Deep Vein Thrombosisand Nutritional Insufficiency businesses)Life Sciences & HealthcareMedtronic Inc6,10029-Jun-17CMetLife Inc (Shareholders)Brighthouse Financial IncFinancial ServicesMetLife Inc6,073C Completed; P Pending; L LapsedMergermarket.com

MergermarketDeal Drivers AmericasAll Sectors9Mix of deals by geographic regionValueMix of deals by geographic regionDeal CountBased on announced deals, excluding those that lapsedor were withdrawn. Geographic region is determined withreference to the dominant location of the target.Based on announced deals, excluding those that lapsedor were withdrawn. Geographic region is determined withreference to the dominant location of the target.4.6%7.2%17.4%21.2%2.0%33.9%1.9%29.3%Please use corresponding AIT filePlease use corresponding AIT rn EuropeValueUSAValueNorthern EuropeValueCentralValue & Eastern EuropeSouthern EuropeValueAsia-Pacific %CanadaValueWestern EuropeValueNorthernEuropeValueCentralValue & Eastern EuropeSouthern EuropeValueValueAsia-PacificRoWValue

MergermarketDeal Drivers AmericasAll Sectors10Mix of deals by industry sectorValueMix of deals by industry sectorDeal CountBased on announced deals, excluding those that lapsed orwere withdrawn, where the dominant location of the target isin North America. Industry sector is based on the dominantindustry of the target.Based on announced deals, excluding those that lapsed orwere withdrawn, where the dominant location of the target isin North America. Industry sector is based on the dominantindustry of the target.70016014060012050080PleaseUS US 156.6 correspondinguseNumber of dealsValue (US bn)100AIT file143.7400Please use corresponding AIT file60430060462US DefenseReal ss ServicesValue2450Life Sciences & HealthcareValueEnergy, Mining, Oil & GasValueFinancial Services0Leisure77US 0.4AgricultureUS 0DefenseUS 21.8Real EstateUS 8.9ConstructionLeisureTMTConsumerBusiness ServicesFinancial ServicesUS 10.3Industrials, Manufacturing & EngineeringValueEnergy, Mining, Oil & GasValueIndustrials, Manufacturing & EngineeringUS 8.50273269100US 36.4Life Sciences & Healthcare20256243US 41.8TransportationUS 54.1399200US 76.140

MergermarketDeal Drivers AmericasAll Sectors11BuyoutsExitsBased on announced deals, excluding those that lapsedor were withdrawn, where the dominant location of thetarget is in North America [USA and Canada].Based on announced deals, excluding those that lapsedor were withdrawn, where the dominant location of thetarget is in North America [USA and 00200,000800160,000100,00060,000US 114,804US 127,558US 142,064600US 173,261US 155,589US 110,976400150,000600US 292,501US 250,011US 240,987100,000400US 159,495US 176,583US 161,065US rket.com2012Deal Count20132014201520160H1 201702011Value2012Deal Count2013201420152016H1 2017VolumeUS 170,99280,000Number of dealsValue (US m)120,000Value (US m)140,000

MergermarketDeal Drivers AmericasAll Sectors12Transatlantic dealsValueTransatlantic dealsDeal CountBased on dominant location of targetand bidder and excludes all buyouts.Based on dominant location of targetand bidder and excludes all buyouts.350150,000300120,000250US xxxUS xxxValue (US m)Value (US m)90,000200US xxxUS xxx60,000US xxxUS xxx150US xxxUS xxxUS xxxUS xxx30,000US xxx100US xxx0Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q22011201220132014201520162017US xxxUS xxx50Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q22011201220132014201520162017European bidder acquiring a North American targetEuropean bidder acquiring a North American targetNorth American bidder acquiring a European targetNorth American bidder acquiring a European targetTotal North American/European dealsTotal North American/European dealsMergermarket.com

MergermarketAll SectorsDeal Drivers Americas13M&A split by deal sizeValueM&A split by deal sizeDeal 79276962681,5005,000US 644.61,000Please use corresponding AIT fileUS 315.2US 341.2500US 394.9US 207.8US 192.2US 237.5US 81.5US 111.7US 73US 113.3201120122013 5m - 250m 251m - 500m 2,001m - 5,000m 5,001mMergermarket.comValueUS 246.3US 305.3US 275.4US 270.4US 148.4US 152.2US 86US 129.5US 98US 116.5US 152.6201420152016H1 2017US 309US 84.1US 114.9ValueUS 265.7ValueUS 0Please 1,858use corresponding AIT file1,84421159 501m - 2,000m8482,000US 258.3US 158.4US 268.7US 191.90US 777.3Number of dealsValue (US bn)US 1US 43.4US 55.80201120122013201420152016Value not disclosed 5m - 250m 251m - 500m 501m - 2,000m 2,001m - 5,000m 5,001mValueValueValueH1 201747117

MergermarketDeal Drivers AmericasAll Sectors14Quarterly M&A activit

Our award-winning Virtual Data Room is used by thousands of leading organizations, worldwide. These organizations trust our team of highly quali ed experts to handle their most con dential transactions. Simple. Safe. Secure. Merrill s technology solutions will take the stress out of your next deal. To learn how we can help you, contact us now:

![Shareholders’ Agreement of [Company name] company. 1 .](/img/1/startup-founders-sha-sample.jpg)