Transcription

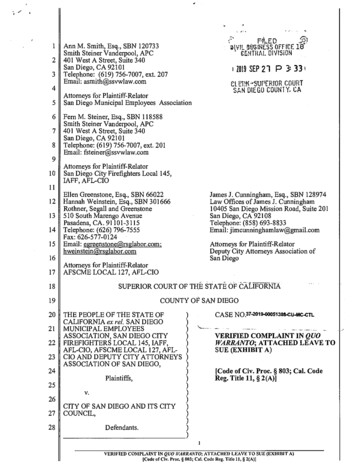

CASE NO. A156573IN THE COURT OF APPEAL OF THE STATE OF CALIFORNIAFIRST APPELLATE DISTRICT, DIVISION THREE-------------------------------Kathrine Rosas, Plaintiff and Appellant,v.AMG Services, Inc., Defendant and ----Appeal From an Order Granting AMG Services, Inc.’s Motion to DismissAlameda County Superior Court Case No. JCCP004688Honorable Winifred Y. Smith, Judge -------------------------------------------Service on the Attorney General and the District Attorney ofAlameda County as Required by Business & Professions Code ELLANT’S REPLY -----Harold M. Jaffe (Calif. State Bar #57397)Law Offices of Harold M. Jaffe11700 Dublin Blvd., Ste. 250Dublin, CA 94568Telephone: (510) 452-2610/Facsimile: (925) 587-1737email: hmjaffe@gmail.comBrian W. Newcomb (Calif. State Bar #55156)LAW OFFICES OF BRIAN W. NEWCOMB770 Menlo Avenue, Ste. 101Menlo Park, CA 94025Telephone: (650) 322-7780/Facsimile: (650) 322-7740email: brianwnewcomb@gmail.comAttorneys for Plaintiff and Appellant, Kathrine RosasPage 1

TABLE OF CONTENTSPAGE(S)TABLE OF CONTENTS. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2TABLE OF AUTHORITIES. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3-4INTRODUCTION. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5REPLY TO STATEMENT OF FACTS/PROCEDURAL HISTORY. . . . 6I.AMG's Formation. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6II.The Miami Tribe's Alleged Control Over AMG. . . . . . . . . . 7ARGUMENT. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8I.Sovereign Immunity is Not Jurisdictional and is Therefore NotSubject to Ongoing Inquiry by the Court Based on Present Factsand Circumstances. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8II.The Tribal Immunity Claim in This Case is Not Analogous toDiplomatic Immunity. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10III.AMG is Not Immune Under California's Arm of the Tribe Test. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17A.B.C.D.E.Method of Creation. . . .Tribal Intent. . . . . . . . .Purpose. . . . . . . . . . . . .Control. . . . . . . . . . . . .Financial Relationship.1718191920IV.Appellant's Claims are Not Moot and Have not Been VindicatedThrough Governmental Enforcement Actions. . . . . . . . . . . 21V.AMG Waived its Sovereign Immunity. . . . . . . . . . . . . . . . . 22VI.The Trial Court's Decision Was Not Within the Scope of theRemittitur. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24VII.Not Only the Law, but Public Policy Supports the Argumentthat Immunity Should Not be Evaluated at the Time the Motionis Made. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26CONCLUSION. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28CERTIFICATE OF COMPLIANCE. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 29CERTIFICATE OF SERVICE. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 30Page 2

TABLE OF AUTHORITIESCASESPAGE(S)Allen v. Gold Country Casino(9th Cir. 2006) 464 F.3d 1044. . . . . . . . . . . . . . . . . . . . . . . . . 15,16Ameriloan v. Superior Court (People)(2008) 169 Cal.App.4th 81. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16Amerind Risk Management Corp. v. Malaterre(8th Cir. 2011) 633 F.3d 680. . . . . . . . . . . . . . . . . . . . . . . . 11,12,13ASEDAC v. Panama Canal Com’n(11th Cir. 2006) 453 F.3d 1309. . . . . . . . . . . . . . . . . . . . . . . . . . . 13Eggomes v. ANGOP Angola Press Agency2012 WL 3637453 (E.D.N.Y). . . . . . . . . . . . . . . . . . . . . . . . . . . . 11Federal Trade Commission v. AMG Services, Inc., et al.(D. Nev. filed Apr. 2, 2012) No. 2:12-cv-00536. . . . . . . . . . . . . 7,16Hunter v. Redhawk Network Security, LLC2018 WL 4171612 (D. Oregon). . . . . . . . . . . . . . . . . . . . . . . . . . . 23Kiowa Tribe v. Manufacturing Techs, Inc.523 U.S. 751 (1998). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15,16Maysonet-Robles v. Cabrero(1st Cir. 2003) 323 F.3d 4352. . . . . . . . . . . . . . . . . . . . . . . . . . . . 11Michigan v. Bay Mills Indian Comty.134 S.Ct. 2024 (2014). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15,16Multimedia Games, Inc. v. WLGC Acquisition Corp.214 F. Supp. 2d 1131 (N.D. Okla. 2001). . . . . . . . . . . . . . . . . 22,23Oracle America, Inc. v. Oregon Health Insurance Exchange Corp.(D. Or. 2015) 145 F.Supp.3d 1018. . . . . . . . . . . . . . . . . . . . . . 13,14People ex rel. Owen v. Miami Nation Enterprises(2016) 2 Cal.5th 222. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . passimPolitis v. Gavriil2008 WL 4966914 (S.D. Tex.). . . . . . . . . . . . . . . . . . . . . . . . . . . . 11Port Auth. Trans-Hudson Corp v. Feeney495 U.S. 299 (1990). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13,14Rosas v. AMG ServicesA139147, 2017 WL 4296668. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25Surprenant v. Massachusetts Turnpike Auth.768 F.Supp.2d 312 (D. Mass. 2011). . . . . . . . . . . . . . . . . . . . . . . 14Page 3

U.S. v. Khobragade(S.D.N.Y. 2014) 15 F.Supp.3d 383. . . . . . . . . . . . . . . . . . . . . . . . 10STATUTES25 U.S.C. § 477. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1225 U.S.C. § 2701 et seq [Indian Gaming Regulatory Act]. . . . . . . . . . 15,1628 U.S.C. § 1605(a)(2) [Foreign Sovereign Immunities Act]. . . . . . . . . . . 9Kansas Statutes Annotated, Sections 17-7681(f). . . . . . . . . . . . . 9,12,14,23OTHER15 Fletcher Cyclopedia of the Law of Corporations, § 7121. . . . . . . . . . . 9Page 4

by virtue of Plaintiff’s need to obtain discovery from the TribalEntities, which are shielded from any such discovery efforts. Thus inthis and other cases, non-tribal parties now have a roadmap by whichthey may concoct schemes to defraud and exploit California residentsthrough the use (and abuse) of tribal entities as the vehicle forperpetrating their schemes and thereby avoid exposure to liability bymaintaining the evidence of their misconduct in the records of theimmune tribal entities for this “service.”A139147, AA vol. III, pp. 966-967REPLY TO STATEMENT OF FACTS/PROCEDURAL HISTORYI.AMG’s Formation.In the RB, AMG attempts to gloss over the undisputed fact that AMGwas formed by Tucker, not by the Tribe by arguing that Tucker’s offerthrough his business entities appeared to be a promising economic opportunityto help the tribe. (RB, p. 11, et seq.). What is ignored by AMG is whatTucker offered was to use AMG for the purposes of carrying on his illegalpayday lending and merge CLK Management, LLC (“CLK”) into AMG withAMG being the surviving entity so AMG could assert tribal sovereignimmunity as to any claims made by the class members in this case or stateregulatory authorities. For AMG to claim that the Miami Tribe had anythingto do with the creation of AMG is pure fantasy. 1 As will be discussed infra,AMG cannot credibly argue that at the time of the creation of AMG in2008/2010 that it had sovereign immunity. Nor can AMG deny that as a resultof the merger with CLK, with AMG as the surviving entity, that AMGassumed CLK’s obligations not only to appellant, but to all others similarlysituated. There is no evidence to support the inference that AMG did notknow what Tucker was doing, and in fact, AMG through its counsel, ConlySchulte and John Nyhan of Fredericks, Peebles & Morgan, LLP, continued torepresent AMG in A139147 until June 8, 2015, where AMG continued to1In fact, Tucker, a race car afficionado, even chose the name for AMGServices, Inc. AMG is a Mercedes model.Page 6

assert the same bogus arguments in this Court to support the claim ofsovereign immunity that it had asserted in the trial court at the May 3, 2013hearing, only to repudiate them eight months later in the Non-ProsecutionAgreement with the U.S. government, dated February 9, 2016 (AA vol. I, pp.267-272).II.The Miami Tribe’s Alleged Control Over AMG.As AMG admitted in the Non-Prosecution Agreement with the U.S.Government (AA vol. I, p. 272, ¶¶ 2-4), Tucker and entities controlled byTucker provided the capital to make loans, the tribe and its entities were notresponsible for any losses, the tribe, nor any entity it controlled established orpaid to acquire any part of Tucker’s payday lending business, Tucker ran thebusiness from Overland Park, Kansas, and Tucker -- not the tribe, managedoperations and created the loan approval criteria, with all essential stepsnecessary for the approval of loans being performed in Overland Park underthe direction of Tucker and individuals reporting to Tucker.Tucker controlled AMG, was signator on bank accounts of AMG, andit was only after the government through the FTC initiated an enforcementaction against AMG on April 2, 2012 (FTC v. AMG Services, Inc., et al.,United States District Court of Nevada, Case No. 2:12-cv-536) (“FTC v.AMG”), did AMG do anything to attempt to distance itself from Tucker andindividuals and entities affiliated with Tucker, a fact which AMG concedes(RB, p. 13). AMG now tries to make a virtue out of that necessity by sayingsomehow by terminating its relationship with Tucker, AMG has now beenabsolved of the illegal conduct in AMG’s day to day operations when AMGwas controlled by Tucker.AMG does not and cannot dispute, that allrevenues it obtained were as a result of AMG’s illegal conduct.In fact, in the Non-Prosecution Agreement, AMG stipulated that:“The Office and the Entities agree that the Forfeiture AmountPage 7

represents proceeds of the payday lending business described above.The Office further contends that the proceeds represented by theForfeiture Amount were derived from unlawful conduct relating to theoperation of that payday lending business and will file a CivilForfeiture Complaint against the Forfeiture Amount. The Entities donot contest that the Forfeiture Amount is subject to civil forfeiture tothe United States.”(AA vol. I, p. 268)ARGUMENTI.Sovereign Immunity is Not Jurisdictional and is ThereforeNot Subject to Ongoing Inquiry by the Court Based onPresent Facts and Circumstances.Affirming the trial court’s order (AA vol. III, pp. 757-763) is like“raising a red flag to a bull” and would do much to encourage successors toTucker to continue to rent Indian tribes to shield their illegal activities, andwhen law enforcement or regulators “raise their ugly heads” to jettisonthemselves from those supervising the illegal conduct and claim sovereignimmunity - in many cases years later, immunizing themselves from attemptsat recompense by those injured by the illegal and wrongful conduct, andactions by state regulators.Of the four different times mentioned by Judge Smith (AA vol. III, p.758) for evaluating AMG’s immunity claim, even AMG implicitly if notexplicitly admits that the only one that can successfully work for them is thefourth - at the time the court hears the motion, otherwise the motion would bedenied, because at the time of AMG’s formation, at the time of the wrongfulacts, and at the time both the original complaint was filed (July 1, 2009) andthe first amended complaint was filed (July 31, 2012), AMG was controlledby Tucker and his cohorts, and was engaged in the illegal conduct which ledto the Non-Prosecution Agreement above (AA vol. I, 267-272).From May 4, 2004 through July 6, 2004, CLK, a Tucker controlledentity, applied for and registered four trademarks (Request for Judicial NoticePage 8

filed December 4, 2019 [“RJN”], p. 12 and pp. 32-66), including the markUSFastCash. (RJN, p. 12 and pp. 50-57). At least two of appellant’s loanswere with the tradename USFastCash in 2005 (RJN, p. 14 and pp. 94-97).CLK undisputably was using the tradename USFastCash to conduct its illegalpayday lending activities to appellant and others similarly situated. Then CLKmerged into AMG, with AMG being the surviving entity and assuming all theliabilities of CLK, including those to appellants and those similarly situated.At least as to the named plaintiff and those similarly situated, the conduct byAMG to “cleanse themselves” from Tucker and his cohorts allegedly startingat the end of 2012, does not affect AMG’s liability to plaintiff and thosesimilarly situated whose liabilities were assumed by AMG in 2008, upon themerger with CLK.On December 7, 2018, when the motion to dismiss was heard by thetrial court, it is undisputed that Tucker was in jail, and the illegal paydaylending had ceased as a result of government enforcement actions. Althoughthe Foreign Sovereign Immunities Act (“FSIA”) may not pertain to claims ofsovereignty by Indian tribes and their alleged arms, it is analogous for thepurposes of this case in determining when the claim of immunity is evaluated.Like in the FSIA, there is no dispute that the conduct at issue was acommercial activity, in this case, an illegal commercial activity.As pointed out in the AOB, FSIA creates an exception for immunity forcommercial acts. 28 U.S.C. § 1605(a)(2).Other commonly invokedexceptions under the FSIA are waiver and commercial activity. In this case itis undisputed that AMG merged with CLK. As a result of AMG’s merger withCLK, AMG is responsible for the pre-merger liabilities of CLK. See K.S.A.§ 17-7681(f); see also 15 Fletcher Cyclopedia of the Law of Corporations, §7121.In its sovereign immunity argument, AMG omits the fact that in PeoplePage 9

ex rel. Owen v. Miami Nation Enterprises, (2016) 2 Cal.5th 222 (“Owen”), theSupreme Court discussed whether or not the tribal immunity was a matter ofsubject matter or personal jurisdiction. Id. at 243-244. After discussing bothsides of the issue, subject matter jurisdiction or personal jurisdiction theSupreme Court did not come down on either side but said, “Regardless of howwe characterize tribal immunity, it is undisputed that tribal immunity, like statesovereign immunity, can be affirmatively waived. In addition, trial courts donot have a sua sponte duty to raise the issue of tribal immunity. Thesefeatures indicate that tribal immunity, like Eleventh Amendment immunity, isnot ‘a true jurisdictional bar’ that automatically divests the court of the abilityto hear or decide the case.’(Citations omitted). Thus, ‘whatever itsjurisdictional attributes,’ tribal immunity ‘does not implicate . . . a court’ssubject matter jurisdiction in any ordinary sense.’” (citations omitted). Owen,Id. at 243-244.II.The Tribal Immunity Claim in This Case is Not Analogousto Diplomatic Immunity.At the bottom of Page 23 of the RB, AMG attempts to analogize itselfto reconstituted entities where it states, “Courts have found sovereignimmunity where an entity amenable to suit is dissolved during the pendencyof the case and replaced by an entity that asserts immunity.” In this case thereis no dispute that the structure of AMG has not changed since its formation in2008/2010. What AMG claims has changed is who controls AMG, i.e., it usedto be Tucker and his cohorts, and it is now the Miami Tribe.For the reasons set forth in the AOB, the trial court and AMG’s relianceon U.S. v. Khobragade (S.D.N.Y. 2014) 15 F.Supp.3d 383, 387-388, ismisplaced. Also, AMG ignores that diplomatic and consular immunities arebased on treaty law as applied to individual representatives of foreigngovernments (e.g., embassadors, embassy officials, consuls) who have beenPage 10

duly accredited to the Department of State. See Eggomes v. ANGOP AngolaPress Agency, 2012 WL 3637453 at *8-10 (E.D.N.Y) (diplomatic immunity);Politis v. Gavriil, 2008 WL 4966914 at *5-6 (S.D. Tex.) (consular immunity).AMG’s reliance on Maysonet-Robles v. Cabrero (1st Cir. 2003) 323F.3d 43 (“Maysonet”), and Amerind Risk Management Corp. v. Malaterre,(8th Cir. 2011) 633 F.3d 680, 682-683 (“Amerind”) (RB, pp. 23-24) aremisplaced.In Maysonet, the Puerto Rico Department of Housing was substitutedas a defendant for Antonio J. Cabrero, as Trustee for Urban Renewal andHousing Corporation (“URHC”), Accounts Liquidation Office of Puerto Rico,an entity created to liquidate the proceeds of extinct URHC. Subsequently, thePuerto Rico legislature passed Act 106 which dissolved the office andtransferred the assets of URHC to the Department of Housing of theCommonwealth of Puerto Rico (“Department”). Maysonet Id. at 46. Theoffice then said the Department was now the real party in interest, theDepartment was immune from suit under the Eleventh Amendment, and thatthe true successor was the Commonwealth of Puerto Rico itself who assertedEleventh Amendment immunity.In Maysonet, the court was concerned with the particular issue of suitagainst a state (commonwealth in this case) in federal court and the legal issueas to whether the Eleventh Amendment barred such a suit against theCommonwealth of Puerto Rico, and stated that unlike a private individual orcorporation, a state retains its sovereign immunity as a ‘personal privilege’whether it is the original defendant or is added as a party later, it cannot besued involuntarily. Maysonet Id. at 49. Maysonet has nothing to do with thefacts of this case, nor is it authority for the proposition that, irrespective of anybad and illegal acts that AMG had committed and which AMG acknowledgedit had committed at the hearing of the motion to dismiss on December 7, 2018,Page 11

only AMG’s conduct at the time of the hearing (December 7, 2018) should beconsidered in evaluating AMG’s claim of immunity.In Amerind, the issue was whether Amerind was immune to plaintiff’ssuit in Tribal Court, and the 8th Circuit stated:“We must first determine whether Amerind is entitled tosovereign immunity. While Amerind is not itself a tribe, ‘[i]t is . . .undisputed that a tribe's sovereign immunity may extend to tribalagencies.’ (Citation omitted) . . .Several courts have recentlyrecognized that § 477 corporations are entitled to tribal sovereignimmunity.”In Amerind, the United States Government issued a corporate charterincorporating Amerind under 25 U.S.C. § 477, pursuant to a petition of a tribe.No such act by the federal government has occurred in this case. Instead in thecase at bench, we have a Certificate of Merger of CLK and AMG pursuant tothe Kansas Revised Limited Liability Act which was filed in the Office of theClerk of the District Court of Wyandotte County Kansas, on July 29, 2010,which provides in pertinent part, “To the extent authorized by law, AMG maybe served with process in the State of Kansas in any action, suit, or proceedingfor the enforcement of any obligation of CLK and hereby irrevocably appointsthe Kansas Secretary of State as its agent to accept service of process in anysuch action . . .” (A139147, AA vol. III, p. 837), AOB, p. 44 and fn. 2therein, citing K.S.A. § 17-7681(f).Nowhere in the RB does AMG address these specific statutes underKansas Law, or address the specific language of the AMG/CLK Certificate ofMerger filed in the District Court of Wyandotte County, Kansas, but insteadcites inapposite authority in an attempt to avoid the fact that with the mergerof CLK and AMG, AMG succeeded to any existing liabilities of CLK,including those to the appellant/plaintiff and those similarly situated. Further,unlike for example, Amerind, even AMG concedes that at the time of themerger with CLK, it did not itself enjoy sovereign immunity. Therefore, inPage 12

merging with CLK, AMG knowingly agreed

1 In fact , Tuck er, a race car afficionado, even chos e the name f or AM G Services, Inc. AMG is a Mercedes model. Page 6 by virtu