Transcription

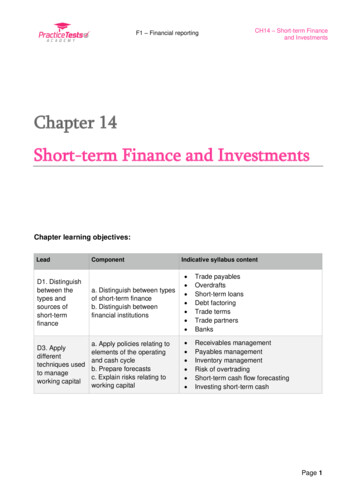

F1 – Financial reportingCH14 – Short-term Financeand InvestmentsChapter 14Short-term Finance and InvestmentsChapter learning objectives:LeadD1. Distinguishbetween thetypes andsources ofshort-termfinanceD3. Applydifferenttechniques usedto manageworking capitalComponentIndicative syllabus contenta. Distinguish between typesof short-term financeb. Distinguish betweenfinancial institutions Trade payablesOverdraftsShort-term loansDebt factoringTrade termsTrade partnersBanksa. Apply policies relating toelements of the operatingand cash cycleb. Prepare forecastsc. Explain risks relating toworking capital Receivables managementPayables managementInventory managementRisk of overtradingShort-term cash flow forecastingInvesting short-term cashPage 1

F1 – Financial reportingCH14 – Short-term Financeand Investments1. Short-term finance and financial institutions Current liabilities should not be allowed to increase to a level where the cash positionand liquidity of the company are at risk. Requires careful management of short-term finance.Financial institutions2. Types of short term financingTrade payables Used as a source of short-term finance by delaying payments to suppliers. By paying on credit, the entity is able to finance its purchase of material through itssuppliers. To maximize this benefit, the entity should aim to pay as late as possible withoutdamaging its trading relationship with its suppliers. If a cash discount is offered, the entity must weigh the saving from the discountagainst the additional cost of borrowing the funds needed to make the early payment.The entity must also consider whether the funds are available to take up thediscount.Page 2

F1 – Financial reportingCH14 – Short-term Financeand InvestmentsTrade receivablesFactoring Factoring is outsourcing the credit control department via a third party. The factor charges a fee for collecting debts. The factor offers 3 services:1. Debt collection (outsourcing of the credit control dept)2. Financing (factor advances the debt before it is collected)3. Credit insurance (the factor takes the responsibility for irrecoverable debt "without recourse").Page 3

F1 – Financial reportingCH14 – Short-term Financeand InvestmentsInvoice Discounting Service is also provided by factoring entities. Selected invoices are used as security against the entity’s borrowing of funds. This is a temporary source of finance and repayable when the debt is cleared.Bank overdraftShort-term cash requirements can also be funded by borrowing from the bank.There are two main sources of bank lending: Bank overdraft - short term, flexible financing, linked to company bank accounts indeficit. Bank loans - a contractual agreement for a specific sum, loaned for a fixed period atan agreed rate of interest. Bank loans are less flexible and more expensive thanoverdrafts but provide greater security.Financing exportsDocumentary credits (irrevocable letters of credit) A letter of credit is a document issued by a bank on behalf of its customer (theimporter), authorising another entity or person (the exporter) to withdraw a specifiedamount of money from its branches, when conditions set out in the document havebeen met.Page 4

F1 – Financial reportingCH14 – Short-term Financeand Investments It is a guarantee that the exporter will get paid by the overseas customer, providedthat the exporter complies with certain requirements of the sale. As the payment is via the bank of the importer rather than the importer directly, thecredit risk is removed.A bill of exchange (acceptance credit) A bill of exchange is used primarily in international trade and binds one party to pay afixed sum of money to another party on demand or at a predetermined date. They are similar to post-dated cheques. For example, a supplier of goods (the drawer) can draw a bill of exchange on acustomer (the drawee). By signing the bill of exchange, the customer acknowledges the debt exists andcommits to paying it.There are two types of bills of exchange: A sight draft/bill – which is payable immediately. A time draft/bill – which is payable at a predetermined future date (can be describedas term bills).Characteristics of bill of exchange: The drawee is given a period of credit before having to pay a term bill, but The drawer or payee can obtain payment earlier than the bill’s maturity date, bymeans of discounting the bill.Export factoring Export factoring is similar to ordinaryfactoring, with the exception that thefactoring organisation agrees to factorthe client’s overseas trade receivables. In view of the problems that can arisewith collecting payments fromcustomers in other countries, theexpertise of an export factor can bevery helpful, particularly for small andmedium-sized businesses with littleexperience in collecting foreignpayments.Page 5

F1 – Financial reportingCH14 – Short-term Financeand InvestmentsForfaiting Forfaiting is the same as export factoring, except that the seller (exporter) will receive100% of the receivable as a lump sum from the forfaiter in return for a bill ofexchange. The exporter will draw a bill of exchange from an importer (the buyer). This bill ofexchange is purchased by a forfaiting company (typically banks) without recourse tothe exporter. The exporter receives the total amount owed, the forfaiter chases the debt and theimporter settles direct to the forfaiter. The exporter has obtained payment for the goods without any risk of having to returnthe money if the importer fails to meet its payment obligations.3. Short-term investmentsCash surpluses can be investedin a range of short-term interestearning investments: Interest-bearing bankaccounts Negotiable instruments Short-dated governmentbonds Other short-terminvestmentsPage 6

CH14 – Short-term Financeand InvestmentsF1 – Financial reportingTypes of short-term investmentsInterest bearing bank accountsThese can fall into two categories: bank deposit accounts – instant access accounts paying low returns but maximumflexibility of access to the funds. money market deposits – deposits through a bank into the financial markets forshort-term borrowing and lending. Returns are higher but deposits must remain in theaccount until the maturity date (ranging from 1 day to months), so therefore lessflexible.Interest earned: If you are required to calculate the amount of interest earned on a deposit or savingsaccount within a particular period of time, the calculation is simply:𝑨𝒎𝒐𝒖𝒏𝒕 𝒅𝒆𝒑𝒐𝒔𝒊𝒕𝒆𝒅 𝑨𝒏𝒏𝒖𝒂𝒍𝒊𝒔𝒆𝒅 𝒊𝒏𝒕𝒆𝒓𝒆𝒔𝒕 𝒓𝒂𝒕𝒆 𝑵𝒖𝒎𝒃𝒆𝒓 𝒐𝒇 𝒅𝒂𝒚𝒔 𝒊𝒏𝒕𝒆𝒓𝒆𝒔𝒕 𝒆𝒂𝒓𝒏𝒆𝒅𝑨𝒏𝒏𝒖𝒂𝒍 𝒅𝒂𝒚 𝒄𝒐𝒖𝒏𝒕Keep in mind that interest on the US dollar in the money markets is calculated on theassumption of 360 days in the year.Test your understanding 1: Interest earnedOn 1 June 20X0, an entity placed 25 million on deposit at an interest rate of 18%. The deposit had a maturitydate of 31 August 20X0 (92 days later).Calculate the interest earned and the amount of cash that the entity will receive on maturity of thedeposit. There are 360 days in a year (for interest purposes).Page 7

F1 – Financial reportingCH14 – Short-term Financeand InvestmentsNegotiable instruments: Negotiable instruments are financial instruments that may be obtained asinvestments. A key feature of a negotiable instrument is that the title passes when the instrumentis handed from one person to another. They can be easily be sold to and from individuals and entities. Examples: Bank notes Bearer bonds Certificates of deposit Bills of exchange Treasury billsShort-dated government bonds: An investment in government bonds enables an entity to: receive interest on the due payment dates. liquidate their investment at any time by selling the bonds in the secondary market. hold the bonds to maturity and have them redeemed at par (for short-dated bonds). If interest rates change in the market, the market value of bonds will rise or fall. Thiscreates a price risk for the investor. Bond prices rise when interest rates fall, but prices fall when interest rates go up. Themovement in price is greater for longer-dated bonds.Other short-term investments There are other short-term investments such as: corporate bonds, and commercial paper (CP). These are more likely to be purchased by investment institutions rather than entitieswith short-term cash surplus.Page 8

F1 – Financial reportingCH14 – Short-term Financeand Investments4. Solutions to Test Your UnderstandingTest your understanding 1: Interest earnedThe interest on the deposit will be 25 million x 18% x 92/360 1,150,000.The interest will be added to the face value of the deposit on maturity.At maturity, the deposit will be 25 million 1,150,000 26,150,0005. Chapter summaryPage 9

and Investments Page 1 Chapter 14 Short-term Finance and Investments Chapter learning objectives: Lead Component Indicative syllabus content D1. Distinguish between the types and sources of short-term finance a. Distinguish between types of short-term finance b. Distinguish between financial institutions Trade payables Overdrafts