Transcription

Financial Stability InstituteFSI Award2010 Winning PaperRegulatory use of system-wideestimations of PD, LGD andEADJesus Alan Elizondo FloresTania Lemus BasualdoAna Regina Quintana SordoComisión Nacional Bancaria y de Valores,MexicoSeptember 2010JEL classification: G21, G28

The views expressed in this paper are those of their authorsand not necessarily the views of the Financial Stability Instituteor the Bank for International Settlements.Copies of publications are available from:Financial Stability InstituteBank for International SettlementsCH-4002 Basel, SwitzerlandE-mail: fsi@bis.orgTel: 41 61 280 9989Fax: 41 61 280 9100 and 41 61 280 8100This publication is available on the BIS website (www.bis.org). Financial Stability Institute 2010. Bank for InternationalSettlements. All rights reserved. Brief excerpts may bereproduced or translated provided the source is cited.ISSN 1684-7180

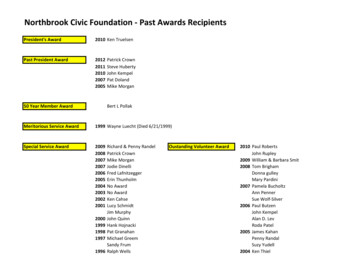

ForewordThe Financial Stability Institute is pleased to present thewinning FSI Award paper for 2010. This award, given everytwo years at the time of the International Conference ofBanking Supervisors, was established to encourage thoughtand research on issues relevant to banking supervisorsglobally. In 2010, nine papers were received from centralbanks and supervisory authorities in eight countries.A jury of highly qualified individuals read all of the papers andchose the winner. The group was chaired by Mr JaimeCaruana, General Manager of the Bank for InternationalSettlements. It also included Mrs Ruth de Krivoy, formerPresident of the Central Bank of Venezuela; Mr Nick LePan,former Superintendent of Financial Institutions, Canada;Mr Charles Freeland, former Deputy Secretary General of theBasel Committee on Banking Supervision; and Mr StefanWalter, Secretary General of the Basel Committee on BankingSupervision.The jury members and the FSI are pleased to announce thatthe paper authored by Mr Jesus Alan Elizondo Flores,Ms Tania Lemus Basualdo and Ms Ana Regina QuintanaSordo of the Mexican Comisión Nacional Bancaria y deValores has been chosen as the winner of the 2010FSI Award. In the paper, the authors set out an example ofhow to use a prudential tool typically aimed at coping with thesolvency of individual banks to deal with the measurement ofsystemic risk.Congratulations to our three winners, as well as to the authorsof the other papers submitted for consideration. Their interestin analysing and potentially improving supervisory methodsprovides a true service to the supervisory community.Josef TošovskýChairmanFinancial Stability InstituteSeptember 2010FSI Award – 2010 Winning Paperi

ContentsForeword . i1.Introduction . 12.System-wide PD, LGD and EAD. 23.System-wide information and PD, LGD and EADmodels. 64.Empirical results. 105.Model applications . 156.5.1Credit card portfolio reserves. 155.2System-wide PD dependency on idiosyncraticand cyclical factors. 205.3Bank IRB model comparison to system-widemodel estimates. 295.4Risk return analysis of the credit card portfolio. 325.5Differences in point-in-time (PIT) models andthrough-the-cycle (TTC) estimations . 38Conclusions. 42Annex 1: Explanatory variables. 44Annex 2: Reserve requirement rule . 66Bibliography. 69FSI Award – 2010 Winning Paperiii

1.IntroductionThe objective of prudential regulation has for a long time beenthe solvency of individual entities and hence a vast range ofprudential tools were developed to address this priority. Mostrecently, due to the period of financial stress and the failure ofseemingly solvent institutions, the international supervisorycommunity has expanded the relevance of prudential tools inpromoting the stability of the financial system as a whole inaddition to individual institutions.In this sense the Basel Committee has concluded that theissue of systemic risk is probably the most important and mostdifficult one confronted by the international regulatorycommunity and that progress requires, among other things, acombination of better regulation and the inclusion of a macro1perspective into prudential tools. With this in mind, the aim ofthis paper is to extend the use of a prudential tool typicallyused to cope with the solvency of individual institutions inorder to estimate risk parameters that measure systemic risk.This objective is achieved by estimating system-wideProbability of Default (PD), Loss Given Default (LGD), andExposure at Default (EAD) parameters for a retail portfolio withinformation that is representative of the system, bothcross-sectionally and for a relevant part of the economic cycle.This paper intends to generate a prudential tool that(i) encompasses both micro and macro prudential supervisionconcerns and (ii) sheds light on the adequacy of banks’individual reserves and their sufficiency to cover systemicexpected losses. The tool also seeks to disentangle the natureof exposure of the system to risk, in terms of its dependencyon systemic factors, as opposed to idiosyncratic ones.1Caruana (2010).FSI Award – 2010 Winning Paper1

The paper draws strongly from the recommendations toenhance the resilience of the financial system issued by theBasel Committee in December 2009.2Particularly, on the loan loss provisioning principles highlightedby the document, in which, among others, it is proposed to:(i) use robust and sound methodologies that reflect expectedcredit losses in the banks’ existing loan portfolio over the life ofthe portfolio and (ii) the incorporation of a broader range ofavailable credit information than the one presently included inthe incurred loss model to achieve early identification andrecognition of losses.In this paper, the second section defines what is understoodby system-wide PD, LGD, and EAD and examines therelevance of its use as a regulatory tool. The third sectionexplains the models used to estimate system-wide parametersand the information used in them. The fourth section providesempirical results. The final section provides practicalapplications of the regulatory tool for both micro andmacroprudential dimensions.2.System-wide PD, LGD and EADIn June 2006, the Basel Committee issued the RevisedFramework on International Convergence of CapitalMeasurement and Capital Standards (Basel II),3 which tookinto account new developments in the measurement andmanagement of banking risks for those institutions that optedto use the “internal ratings-based” (IRB) approach. In thisapproach, institutions are allowed to use their own internalmeasures for key drivers of credit risk as primary inputs to the2Basel (2009).3Basel (2006).2FSI Award – 2010 Winning Paper

capital calculation. These measures require the estimation ofthe following parameters4 that describe the exposure of theportfolio:5(i)probability of default (PD), which gives the averagepercentage of obligors that default in a rating grade inthe course of one year;(ii)exposure at default (EAD), which gives an estimate ofthe outstanding amount (drawn amounts plus likelyfuture draw-downs of yet unused lines) in case theborrower defaults; and(iii)loss given default (LGD), which gives the percentage ofexposure the bank might lose if the borrower defaults.These risk measures are converted into risk weights andregulatory capital requirements by means of risk weightformulas specified by the Basel Committee.The parameters mentioned above are aimed at describing theexposure of the bank to its own credit risk. However, theestimation of these parameters can be escalated to considersystem-wide information. The interpretation of theseparameters gains a broader dimension since explanatory riskfactors reflect the potential exposure of the system to acommon risk and can be analyzed in two complementarydimensions that offer valuable insight into systemicvulnerabilities (ie cross-sectional and through time).On the cross-sectional dimension it is acknowledged that ashock hitting one institution can spread to other institutionsthat are interconnected; thus, such shock can become asystemic threat. This financial shock may be originated from acommon exposure across the system.4Retail exposures.5Basel (2005).FSI Award – 2010 Winning Paper3

While the use of system-wide estimations of PD, LGD, andEAD may not shed light on the inter-linkages amonginstitutions, it appears to be a useful diagnostic tool fordetecting a common exposure to a risk factor across thesystem.6 The line of investigation that is proposed separatesthe analysis of system-wide PD into two different branches.On the one hand, we analyze variables associated withindividual borrower behaviour; thus such variables are notinfluenced or under direct control of financial institutions.Examples of these variables are payment behaviour or creditlimit use. On the other hand, the variables associated withidiosyncratic factors (individual institution) such as collectionand origination practices followed by specific institutions. Thehypothesis is that, if system-wide PDs are explained byvariables related to the behaviour of individual borrowers andno significant impact is borne by idiosyncratic factors, not onlyis the system exposed to a common risk exposure but, as longas explanatory factors are dependent on the economic cycle, itis also exposed to cycle dynamics.In this sense, the procyclical dimension of systemic risk relatesto how aggregate risk evolves over time and its dependencyon the economic cycle. In order to test if the system isexposed to the time dimension variant of systemic risk,system-wide PDs are correlated to aggregate variables relatedto the economic cycle and its significance is statistically tested.Further applications of system-wide PD, LGD, and EAD as aregulatory tool are presented. As mentioned before, theRevised Framework on International Convergence of CapitalMeasurement and Capital Standards proposes the estimationof capital assuming that expected losses are constituted and64However once these parameters are estimated, they can be further usedin subsequent research to explore inter-linkages among institutions usinga framework to assess systemic financial stability as defined bySegoviano and Goodhart (2009).FSI Award – 2010 Winning Paper

estimated with PD, LGD, and EAD parameters calibrated withthe same characteristics (eg 12 months of losses) as thoseproposed in the Revised Framework. For the case of thecountry analyzed, it is shown that reserves built by the systemat the time of analysis accounted for approximately half of theestimated expected losses under these criteria and were lessrisk-sensitive. To address this issue a specific reserverequirement based on system-wide estimates of PD, LGD, andEAD was introduced.It is also shown that the use of system-wide parametersrepresents a useful benchmarking tool for the validation ofIRB models. IRB model estimations of PD calculated by abank seeking model approval are compared to system-wideestimations of PD. A detailed set of conclusions is drawn onthe IRB model proposal and its capacity to considersystem-wide explanatory variables of PD.An additional application is to measure the relevance of usingeither point-in-time (PIT) model estimates as opposed tothrough-the-cycle (TTC) models. The analysis of the structureof the model through time indicates the dependency of theaggregate risk of the system to a common set of explanatoryvariables and provides valuable insight in terms of systemvulnerabilities. By using both types of models, it is also shownhow system-wide PIT estimations of PD consistentlyunderestimate and overestimate the observed default rateswhen PIT models are estimated in respectively lower andhigher risk segments of the economic cycle.Finally, a set of conclusions is drawn from individual bank riskpricing practices, as interest rate charging policies canindividually be compared to expected loss estimations; thusallowing for risk-return analyses both across banks and withinbank portfolios. For the case of the credit card portfolio of thecountry analyzed, it is concluded that there exists clear pricedifferentiation across banks, generally associated with the riskprofile of the population, while it is not the case that pricingpractices of all institutions differentiate risk across their ownclientele.FSI Award – 2010 Winning Paper5

3.System-wide information and PD, LGD andEAD modelsModels of PD, LGD, and EAD are estimated by banks withinformation that reflects payment experience within the bank.These parameters tend to describe individual bank experienceand often show different explanatory factors when comparedto other banks’ models.In order to convey a system-wide dimension to parametersand identify if there exists common risk factors across banks,three sources of information were collected:1.Individual credit card statements that describe loan-leveldata information related to outstanding balance, interestrate, actual payments, minimum required payment, anddate of payment. This information is designed todescribe the payment behaviour of borrowers, identifyrecovery in subsequent periods after default and allowthe identification of the exposure at the time of default.2.Credit bureau information that consists of individualcredit records, including information such as the numberof loans the borrower had with other banks in theanalyzed period, its performance and the time elapsedsince the borrower first received a loan in the system.3.Social housing institute information which collectspayroll deductions from workers and describesborrowers’ employment history and current incomelevel.The ten largest institutions, accounting for 97% of total creditcards in the system, were selected to participate in theexercise. A random panel data sample of the system wasdesigned considering two dimensions:(i)Point-in-time dimensionThe information was structured to span a 25-month intervaldivided into two 12-month intervals and a reference point. Thefirst 12-month interval (historical period) gives information6FSI Award – 2010 Winning Paper

about the borrower’s behaviour, based on the three sources ofinformation mentioned above, for the twelve months precedingthe reference point. The twelve months after the referencepoint (performance period) are designed to identify individualdefault rates. This structure allows the association of borrowercharacteristics and default.(ii)Time series dimensionTo gain insight into the stability of the model through arelevant part of the cycle, 12 windows of 25 months ofinformation were extracted. The 12 reference points selectedfor each window were April 2006 to March 2007 spanning athree year period of time starting in April 2005 and ending inMarch 2008.Random samples were taken from the universe of loansavailable in the system as registered in the credit bureau foreach of the 12 reference points and the size of the samplewas determined to allow an estimation error of a PDparameter of 40 basis points with a 99% confidence.7Default is defined based on the definition of Basel II whichstates that a loan has defaulted if either one or both of thefollowing events have taken place: (1) the bank considers thatthe obligor is unlikely to pay its credit obligations to thebanking group in full, without recourse by the bank to actionssuch as realizing security (if held); and (2) the obligor is pastdue more than 90 days on any material credit obligation to thebanking group.7The formula used to determine the simple size of the credit card portfoliois: n N z 2 / 2 P (1 P )(N 1)e 2 z 2 / 2P (1 P )FSI Award – 2010 Winning Paper.7

PD modelCategorical data techniques such as logistic regression haveincreasingly been used in models of prediction of default andthis approach is proposed for the estimation of the model ofsystem-wide PD.8Let x i' be a vector of p independent variables, yi denotes thevalue of a dichotomous outcome variable, and i 1,2,3, ,N.Furthermore, assume that the outcome variable has beencoded as 0 or 1, representing the absence or the presence ofdefault, respectively. To fit the logistic regression modelrequires the estimation of the vector ' ( 0 , 1, . , p ) .Let the conditional probability that the outcome is present bedenoted by P (Y 1 X ' ) ( x ' ) . The logit of the multiplelogistic regression model is given by the equationg ( x ' ) 0 1x1 2 x 2 . p x p , in which case the logistic'regression model is ( x ) eg(x )''1 eg(x ). LGD modelLGD is the credit loss incurred if an obligor defaults and isdependent on the characteristics of the loan. Losses areinfluenced by the presence of collateral and when no collateralexists the cash flows that the borrower pays after defaultdetermine the LGD of the loan.The model proposed to estimate LGD for the credit cardportfolio analyzed is to account for the cash flows that occurthree months after default and compare them to the maximumoutstanding balance of the loan after the moment of default.88Hosmer and Lemeshow (1995).FSI Award – 2010 Winning Paper

The maximum outstanding balance is used in order toconsider the revolving nature of credit card loans, and hencethe possibility of balance increases due to line dispositions inthe period of default. Following this definition, LGD can beexpressed as:t3 Borrower PaymentsiLGD 1 i t defaultMAX Bal t default , Bal t default 1 , Bal t default 2 , Bal t default 3 Where Bal i is the outstanding balance of the credit card attime “i” and tdefault is the time of default of the loan.EAD modelEAD estimates the percentage of exposure the bank mightlose if the borrower defaults. The estimation of EAD becomeshighly relevant in revolving instruments such as credit cardsand hence it is necessary to include an estimation of the valueof the exposure that the borrower will have at the time ofdefault in order to obtain an appropriate estimate of theexpected loss. Commonly used methods of estimation for thisparameter9 are focused in metrics that associate theincrements in the balance between a specific date of referenceand the time of default. The model proposed in this documentconsists of estimating an exposure at default factor thatreflects the multiple of the outstanding balance at the momentof default to the outstanding balance at the reference point(EAD factor).Considering that the credit limit use at the reference point dateis a candidate to explain significant differences in the EADfactor, a simple statistical association between both variablesis proposed as follows:9Engelmann and Rauhmeier (2006).FSI Award – 2010 Winning Paper9

EAD factor f (balance at reference point date / credit limit atreference point date)Where,EAD factor balance at default / balance at reference pointdate.4.Empirical resultsPD modelThe independent variables used to build the PD model wereconstructed from the data set mentioned before and wereselected according to their explanatory power. For anexhaustive list of variables analyzed see Annex 1.The PD model contains the following five variables:1.X1: number of consecutive periods, up to the referencepoint, in which the cardholder has not paid its minimumcontractual payment obligation;2.X2: number of periods in which the cardholder has notcovered the minimum payment in the last 6 months.3.X3: payments made by the cardholder as a proportionof the outstanding balance of the credit card at thereference point;4.X4: total outstanding balance as a proportion of thecredit limit at the reference point; and5.X5: number of months elapsed since the issuance of thecredit card by the bank.10FSI Award – 2010 Winning Paper

Table 1System-wide PD explanatory variablesExplanatory variablesInterceptCoefficient–2.970***X1Current non-payment0.673***X2Historical non-payment0.469***X3Percentage of payment–1.022***X4Credit limit use–1.151***X5Maturity–0.007***Note: Significance level *** 0.001, ** 0.01, * 0.05 (performed with standardWald test).It is important to note that all relevant variables are associatedwith the characteristics of the borrower behaviour and creditcard use.LGD modelThe estimation of LGD considered all the credit cards thatdefaulted in the performance period and the reference point.Table 2 shows the average amount recovered by the banks inthe three-month period after default.FSI Award – 2010 Winning Paper11

Table 2Cash flow recovery of outstanding balance 3 monthsafter default as percentage of maximum outstandingbalance after default% of 1%0.7%80%–89%1%0.4%90%–99%1%0.5% 100%9%9.2%LGD81%The final LGD estimate for the systemic credit card portfoliois 81%.EAD modelThe association between the EAD factor and credit limit use isapparent, as illustrated in Graph 1.12FSI Award – 2010 Winning Paper

Graph 1EAD factor and credit limit use30Factor lanceT0/CreditLineEAD is therefore a function of the credit limit use of individualborrowers where low credit limit use is associated to high EADfactors. The resulting function is: Outstandin g Balance at reference point EAD factor Credit limit at reference point 0.5784Once the function is defined, adjustment factors are estimatedand summarized.FSI Award – 2010 Winning Paper13

Table 3EAD factors as a function of credit limit use% USECredit limituseFitted %–100%95%103%100%100% 100%1Mid–pointbThe curve was fitted by OLS by transforming the equation: y cx . Thesignificance level of the b parameter (t-test) is .0001.14FSI Award – 2010 Winning Paper

5.Model applications5.1Credit card portfolio reservesInternational accounting standard principles have for a longtime indicated that credit losses are to be recognized only ifthere is objective evidence of impairment as a result of a lossevent.10The applicable rule for the country analyzed in this documentestimates reserves as a function of the number of past duepayments owed by the borrower at the time of analysis.Table 4Credit card reserve requirement10Number of periods past due% Reserves00.5%110%245%365%475%580%685%790%895%9 or more100%IASB (2009).FSI Award – 2010 Winning Paper15

While the reserve methodology is easy to implement andreflects more reserves when there is more evidence of loandeterioration, as a prudential requirement, it shows thefollowing limitations:1.reserves are not calibrated to cover expected losses of12 months;2.all relevant available credit information is not consideredto differentiate risk among individual borrowers;3.loss estimations are not based on prospective analysis;4.the amount of reserves does not consider exposure atdefault adjustments.Total loan loss reserves were estimated using the requirementdescribed in Table 4 and contrasted to actual credit cardportfolio write-offs for the 12-month period following theestimation.16FSI Award – 2010 Winning Paper

Table 5Reserve requirement sufficiency measured in months12-month1write-offsReservesat start of12-month1period%Write-offs /ReservesMonths ofcoverageBank 12,5771,045246.51%4.9Bank 211,3975,198219.26%5.5Bank 36,6504,624143.83%8.3Bank 4629212296.69%4.0Bank 5397212187.36%6.4Bank 62,2061,401157.44%7.6Bank 74,0011,070373.86%3.2Bank 8534475112.39%10.7Bank 81.12%6.6Bank 10Credit CardSystemNote: In what follows Bank 1, 2, .,10 represent the same institution.1In millions.Table 5 shows that reserves were on average sufficient tocover 6.6 months of actual write-offs. The results also illustratethe heterogeneity that the regime generates across banks interms of the number of months that the allowance covers. Thislast fact may lead the regulator to consider banks that complywith the regime as equally equipped to cover losses even ifthere was significant variance among them.FSI Award – 2010 Winning Paper17

In order to test the exposure of the system, the loan lossdistribution of the analyzed portfolio was estimated by usingsystem-wide PD, LGD, and EAD and the IRB capital formulasset in the Revised Framework (Basel II).Graph 2Loan loss distribution and capitaland reserve requirementReserves9.31%FREQUEN CYExpected Loss18.42%Capital Requirement Reserves(Standard Approach)17.31%Capital Requirement Reserves(IRB approach)36.54%% Assets8% risk weigthed Assets18.12 % risk weigthed AssetsGraph 2 makes evident that the regime of reserves along withthe Basel I capital standard for the credit card loan portfolioanalyzed were insufficient to cover losses measured under theBasel II approach.System-wide models of PD, LGD, and EAD can be furtherused to estimate individual banks’ expected losses by feedingcorresponding client information on PD and EAD equations.This procedure results in estimates of individual banks’expected losses and capital estimations illustrated in Table 6.18FSI Award – 2010 Winning Paper

Table 6Individual banks’ capital and reserve m(Systemwide modelwide modelapproach inapproach)IRBformulas)%Reserves(Table k 18.45%8%17.63%17.65%Bank 212.17%8%17.57%17.82%Bank 315.84%8%30.21%23.90%Bank 421.95%8%75.48%10.52%Bank 58.58%8%23.87%19.06%Bank 69.66%8%19.11%19.08%Bank 78.73%8%14.52%16.85%Bank 810.06%8%16.62%17.93%Bank 98.10%8%13.70%13.79%Bank 1019.98%8%60.19%16.21%9.31%8%18.42%18.12%Credit CardSystemThe comparison of both regimes shows that the formerreserve and capital regime were also insufficient to coverexpected losses for each institution in the system.System-wide models of PD, LGD, and EAD were introduced inthe analyzed country as a minimum reserve requirement(Annex 2) to address these issues and set a homogeneoustime frame for loss coverage. These requirements allowed theFSI Award – 2010 Winning Paper19

regulator to equip the system with a homogeneous regime ofreserves fitted to sustain 12 months of expected losses andpromoted incentives for banks to develop their own IRBmodels and to actively manage the risk of their portfolios dueto the fact that the regulatory cost of individual loans is morerisk sensitive.5.2System-wide PD dependency on idiosyncratic andcyclical factorsThe credit card portfolio risk exposure of the analyzed countryappears to be subject to systemic risk. In order to test thehypothesis of the

winning FSI Award paper for 2010. This award, given every two years at the time of the International Conference of Banking Supervisors, was established to encourage thought and research on issues relevant to banking supervisors globally. In 2010, nine papers were received from central banks and supervisory authorities in eight countries.