Transcription

Q1 2022 Debt investor presentationNordea Eiendomskreditt Covered Bonds

Table of contents1. In brief32. Cover pool key characteristics63. Asset quality104. Covered bond framework145. Macro166. Further information202

1. In brief3

Nordea covered bond operationsQ1 2022Nordea EiendomskredittNordea HypotekNordea KreditNordea Mortgage BankNorwegianSwedishDanishFinnishNorwegian residential mortgagesSwedish residential mortgages primarilyDanish residential & commercialmortgagesFinnish residential mortgages primarilyCover pool size*EUR 20.5bn (eq.)EUR 63.4bn (eq.)Balance principleEUR 23.8bnCovered bonds outstanding*EUR 10.8bn (eq.)EUR 34.4bn (eq.)EUR 61.1bn (eq.)EUR 20.7bnOC*120%84%7%*15%Main issuance currencyNOKSEKDKKEURRating (Moody’s / S&P)Aaa/ -Aaa / -- / AAAAaa / -YesYesYesYesYes (inaugural issue in 2021)-Yes (inaugural issue in 2019)-Four aligned coveredbond issuers withcomplementary rolesLegislationCover pool assetsIncluded in Nordea Green FrameworkIssued Green CB’s Covered bonds are an integral part of Nordea’s long term funding operations Issuance in Scandinavian and international currencies All Nordea covered bond issuance entities (MCI’s) are covered by Nordea’s updated 2021 green bond framework4 * The figures in Nordea Kredit only include capital centre 2 (SDRO). Nordea Kredit no longer reports for CC1 (RO), as this capital centre only accounts for a minor part ( 1%) of the outstanding volume ofloans and bondsOpen

Nordea Eiendomskreditt – overviewQ1 2022 A 100% owned subsidiary of Nordea Bank Abp The purpose of the Issuer is to acquire and provide residential mortgage loans and finance its activities mainlythrough issuance of covered bonds Issues also green covered bonds Loans are originated by Nordea Eiendomskreditt (NE) Collateral must be in the form of mortgages in residential real estate or holiday houses Cost-effective loan origination and service through Nordea Bank’s nationwide Norwegian branch network and internet Covered bonds rated Aaa by Moody’s5Open

2. Cover pool characteristics6

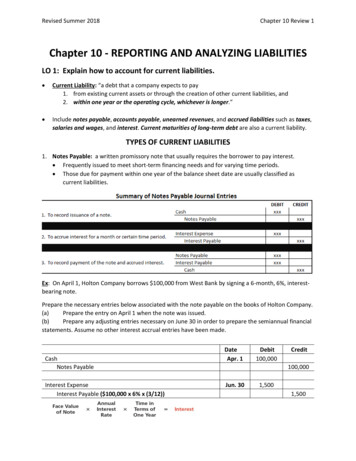

Cover pool key characteristicsQ1 2022Cover pool summaryPool notionalNOK 210.4bnOutstanding Covered BondsNOK 111.3bnCover pool contentMortgage loans secured by Norwegian residential collateralGeographic distributionThroughout Norway with concentration to urban areasAsset distribution100% residentialWeighted average LTV49.8% (indexed, calculated per property)Average loan sizeNOK 2.0mOver Collateralisation (OC)89%Rate typeFloating 97.6%, Fixed 2.4%AmortisationBullet/ interest only 38.4%, Amortizing 61.6%Pool typeDynamicLoans originated byNordea Eiendomskreditt7Open

Cover pool key characteristics (2)Q1 2022Cover pool balance by loan categoryCover pool balance by regionSummerhouses3%West 19%Tenant ownerunits27%South 5%North 5%Single familyhouses70%East 62%Mid 8%8Open

3. Asset quality9

Loan to Value (LTV)Each loan is reported in the highest bucketQ1 2022Weighted Average LTV - Indexed49.8%LTV buckets 0 - 40 % 40 - 50 % 50 - 60 % 60 - 70 % 70 - 80 %TotalNominal (NOKm)% Residential %100%

Loan structureQ1 2022Rate 21Q1Fixed rate21Q221Q32%21Q4Floating Q121Q221Q321Q4Bullet / interest only11OpenAmortising

Underwriting criteriaQ1 2022Regulation Mortgages are regulated in "Boliglånsforskriften" which sets requirements on borrowers' debt to income, rent sensitivity, instalmentsand loan to value.Affordability Customer's ability to service its commitment out of its cash flow/income is critical Repayment ability of borrowers is calculated using stressed scenarios. Customers must manage 5 percentage points increase oninterest rate on all debt Scoring of retail customersPayment history Credit bureau check is always conducted. Potential external payment remarks are revealedCollateral Information from Norwegian official property register in order to secure correct real estate ownership and priority Nordea accepts three sources of real estate valuations:a)Written statement from external authorized valuerb)Use of external evaluating system “Eiendomsverdi” (used by most banks and real estate agents in Norway)c)Written statement from (external) real estate agent12Open

4. Covered Bond framework13

Norwegian covered bond frameworkQ1 2022 Legal framework Financial Undertakings Act (Act. No. 17 of 10 April 2015, Norwegian: Finansforetaksloven)Registration and independent inspector A mortgage credit institution shall for each cover pool establish a register of loans, interest rate contracts and foreign exchangecontracts, substitute assets and covered bonds The institution shall put forward an independent inspector who shall be appointed by the FSA “Finanstilsynet”Limit on LTV ratio – based on the current value 75% for housing loans (residential property) 60% for holiday houses 2Matching cover requirements Liquidity requirements The value of the cover pool shall at all times exceed the value of covered bonds by 102% with a preferential claim over the pooland account shall be taken to the mortgage credit institution’s derivative contractsThe mortgage credit institution shall ensure that the payment flows from the cover pool enable the mortgage credit institution tohonour its payment obligations towards holders of covered bonds and counterparties to derivative contracts at any and all times14Open

5. Macroeconomy15

Resilient economies facing global uncertainty 16Open

Interest rates to rise throughout the Nordics 17Open

Households facing high inflation and rising interest rates 18Open

Rising interest rates might cool off hot Nordic housing markets 19Open

6. Further information20

Covered bonds – outstanding volumesQ1 2022Breakdown by ISINISINCurrencyAmount (NOKm)MaturityCoupon 6NO0010873334NO0010593064NOK2 5722022-06-151,08NOK9 3972022-06-15FRNNOK18 5502023-06-21FRNNOK18 9002024-06-19FRNNOK19 010981301NO0010852650NO0011151771 21986XS1837099339XS1451306036NOK12 5002025-09-16FRNNOK10 0002026-03-18FRNNOK6 0002026-05-222,17NOK7 0002026-09-17FRNNOK1 -172,20NOK3002048-05-042,60GBP3 6492023-06-18FRNEUR1 0272031-07-150,74Total111 76521Open

ContactsInvestor RelationsMaria CanemanDebt IR and ratingsMobile: 46 738 66 17 24Tel: 46 10 156 50 19maria.caneman@nordea.comGroup TreasuryOla BladholmMorten KeilChief Treasury ManagerTel: 46 101 56 1389Mobile: 46 702 69 6532ola.bladholm@nordea.comHead of Covered BondsTel: 45 3333 1875Mobile: 45 6177 3100morten.keil@nordea.com22Open

Rating (Moody's / S&P) Aaa/ - Aaa / - - / AAA Aaa / - Included in Nordea Green Framework Yes Yes Yes Yes Issued Green CB's Yes (inaugural issue in 2021) - Yes (inaugural issue in 2019) - . Credit bureau check is always conducted. Potential external payment remarks are revealed Collateral