Transcription

4 4 th E d i t i o n2004Mutual FundFact BookA g u i d e t o t r e nd sa n d s t a t i s t i c s i n th em u t u a l f u n d i n d u stryINVESTMENT COMPANY INSTITUTE 2004 Fact Book 1

Sign i fi c an t Ev e n t si n Mu t u a l F u n d Histo ry1924The first mutual funds are established in Boston.1933The Securities Act of 1933 regulates the registration and offering of newsecurities, including mutual fund shares, to the public.1934The Securities Exchange Act of 1934 authorizes the U.S. Securities andExchange Commission (SEC) to provide for fair and equitable securitiesmarkets.1936The Revenue Act of 1936 establishes the tax treatment of mutual fundsand their shareholders.1940The Investment Company Act of 1940 is signed into law, setting thestructure and regulatory framework for the modern mutual fund industry.The forerunner to the National Association of Investment Companies(NAIC) is formed. The NAIC will later become the Investment CompanyInstitute (ICI).1944The NAIC begins collecting investment company industry statistics.1951The total number of mutual funds surpasses 100, and the number ofshareholder accounts exceeds one million for the first time.1954Households’ net purchases of fund shares exceed those of corporatestock for the first time. NAIC initiates a nationwide public informationprogram emphasizing the role of investors in the U.S. economy andexplaining the concept of investment companies.1955The first U.S.-based international mutual fund is introduced.1961The first tax-free unit investment trust is offered. The NAIC changes itsname to the Investment Company Institute and welcomes fund advisersand underwriters as members.1962The Self-Employed Individuals Tax Retirement Act creates savingsopportunities (Keogh plans) for self-employed individuals.1971Money market mutual funds are introduced.1974The Employee Retirement Income Security Act (ERISA) creates the IndividualRetirement Account (IRA) for workers not covered by employer retirementplans.continued on inside back cover

4 4 th E d i t i o n2004Mutual FundFact BookA g u i d e t o t r e n dsa n d s t a t i s t i c s i n th em u t u a l f u n d i n d u stryINVESTMENT COMPANY INSTITUTE

Although information or data provided by independent sources is believed to be reliable, the InvestmentCompany Institute is not responsible for its accuracy, completeness, or timeliness. Opinions expressed byindependent sources are not necessarily those of the Institute. If you have questions or comments about thismaterial, please contact the source directly.Forty-Fourth EditionISBN 1-878731-36-XCopyright2004Bookby the Investment Company Institute4 2004 Fact

About ICIThe Investment Company Institute (ICI) is the national association of the U.S.investment company industry. Its mission is to advance the interests ofinvestment companies (mutual funds, closed-end funds, and unit investmenttrusts) and their shareholders, to promote public understanding of investmentcompanies, and to serve the public interest by encouraging adherence to highethical standards by all elements of the business. As the only association ofU.S. investment companies without regard to distribution method or affiliation,the Institute is dedicated to the interests of all investment companies and theirshareholders. The Institute represents members and their shareholders beforelegislative and regulatory bodies at both the federal and state levels, spearheadsinvestor awareness initiatives, disseminates industry information to the publicand the media, provides economic and other research, and seeks to maintainhigh industry standards.The association was originally formed by industry leaders who supportedthe enactment of the Investment Company Act of 1940, legislation thatprovided the strong regulatory structure that has been responsible for muchof the industry’s success. Established in New York in 1940 as the NationalCommittee of Investment Companies, the association was renamed theNational Association of Investment Companies in 1941 and the InvestmentCompany Institute in 1961. The Institute was relocated to Washington, DCin 1970.For more information on the Institute, its members, and how mutual fundsoperate, visit the Institute’s website at www.ici.org.2004 Fact Book i

Table of ContentsChapter 1What Is a Mutual Fund? . 1Mutual Fund Organization.2How a Fund Is Created .2Shareholders .6Boards of Directors.8Investment Advisers .8Administrators .10Principal Underwriters .10Custodians .11Transfer Agents.11Other Features of Mutual Funds .13Variety .13Liquidity and Fund Pricing .16Accessibility.18Shareholder Services .19Affordability.19Chapter 2Regulation and Taxation of Mutual Funds . 23The Foundation of Fund Regulation:The Investment Company Act of 1940.23Four Principal Securities Laws Govern Mutual Funds .24The System of Fund Regulation: The U.S. Securities and ExchangeCommission .25Other Regulatory Agencies and Entities .26The Internal Regulators: Mutual Fund Directors.27Taxation of Fund Earnings.28Other Tax-Advantaged Savings Vehicles .32Types of Distributions.33Share Sales and Exchanges .342004 Fact Book iii

Chapter 3How Is the Fund Industry Structured? . 35The Structure of the U.S. Mutual Fund Market.35A Wide Range of Choices for Investors .36The Rise of the Money Market Fund Era .36The Resurgence of Long-Term Funds .38Since 1990: Fund Competition, Specialization Increases.38Asset Concentration and Fund Formation Levels.40The Worldwide Market for Mutual Funds .42Chapter 4Where Investors Purchase Mutual Fund Shares. 45Buying and Selling Direct .45Buying Fund Shares Through Financial Advisers and Planners .45A Historical Look at How Funds Are Bought and Sold .48Retirement Plan Sponsors .49Fund Supermarkets.50How Rule 12b-1 Fees Pay for Broker Advice and Services .52More on Fund Distribution and Distribution Costs.54Chapter 5U.S. Mutual Fund and Economic Developments in 2003 . 55Financial Markets and Investor Demand for Mutual Funds .57Equity Funds.60Equity Fund Redemptions.63Equity Fund Portfolio Turnover .64Equity Fund Flows and Assets by Expense Ratios.64Bond and Hybrid Funds .67Taxable Bond Funds .68Tax-Exempt Bond Funds .68Long-Term Fund Assets and Flows by Share Class .70Money Market Funds.71Retail Money Market Funds.73Institutional Money Market Funds .76iv 2004 Fact Book

Chapter 6Mutual Fund Ownership and Shareholder Characteristics . 79Growth of U.S. Fund Ownership.80Characteristics of Household Owners of Mutual Funds .81For More Information on Fund Shareholders .83Chapter 7Retirement and Education Savings Markets . 85Retirement Accounts Hold About One-Third of Fund Assets.86Mutual Funds and the IRA Market .87Mutual Funds and the Employer-Sponsored Pension Market .91Mutual Funds and the Defined Contribution Market.92Types of Funds Used by Retirement Plan Investors .94Education Saving: Section 529 Plans and Coverdell EducationSavings Accounts.95Data SectionAbout ICI Data . 99Table of Contents .101Glossary and IndexGlossary of Mutual Fund Terms .163Index .1732004 Fact Book v

List of FiguresChapter 1What Is a Mutual Fund?Assets of Mutual Funds, 2003 .1The Structure of a Mutual Fund .7Number of Mutual Funds by Type of Fund, 1984 and 2003.13How a Mutual Fund Determines Its Share Price .16Chapter 2Regulation and Taxation of Mutual FundsDividend Distributions Paid by Mutual Funds, 1996–2003.28Capital Gain Distributions Paid by Mutual Funds, 1996–2003 .29Share of Mutual Fund Assets by Tax Status, 2003 .30Chapter 3How Is the Fund Industry Structured?Mutual Fund Complexes by Type of Intermediary, January 31, 2004.35Number of Mutual Funds by Type of Fund, Selected Years .37Assets of Mutual Funds by Type of Fund, Selected Years .37Average Size of Merged and Liquidated Funds by MedianFund Assets, 1996–2003 .40Share of Assets at Largest Mutual Fund Complexes,Selected Years .41Composition of Worldwide Mutual Fund Assets by Region, 2003 .432004 Fact Book vii

Chapter 4Where Investors Purchase Mutual Fund SharesPrincipal Features of Mutual Fund Distribution Channels.46Primary Mutual Fund Purchase Channel Used by Households, 2001.47Share of New Sales of Long-Term Funds by Distribution Channel,Selected Years .49Fund Use of 12b-1 Income, 1999 .52Chapter 5U.S. Mutual Fund and Economic Developments in 2003Assets of Mutual Funds, 1990–2003.55Net New Cash Flow to Mutual Funds, 1990–2003 .56Household Net Purchases of Mutual Fund Shares and All FinancialAssets, 1990–2003.58Share of Household Financial Assets Held in Mutual Funds,1990–2003 .59Mutual Fund Ownership of U.S. Corporate Equity,December 31, 2003.59Net New Cash Flow to Equity Funds, Wilshire 5000 Index,2000–2003 .61Net New Cash Flow to Domestic and Foreign Equity Funds,1995–2003 .62Redemption Rates of Equity Funds, 1985–2003 .63Annual Turnover Rate of Equity Funds, 1984–2003.65Equity Fund Assets by Turnover Rate, 2003.65Net New Cash Flow and Total Net Assets of Equity Funds by TotalExpense Ratio, 2003 .66Net New Cash Flow and Total Net Assets of S&P 500 Index Fundsby Total Expense Ratio, 2003 .66Net New Cash Flow to Bond and Hybrid Funds, 1990–2003 .67Bond Returns and Net New Cash Flow to Bond Funds, 1991–2003 .69Load and No-Load Fund Assets as a Share of Fund Assets,1984–2003 .70viii 2004 Fact Book

Net New Cash Flow to Long-Term Funds by Share Class, 2000–2003.71Net New Cash Flow to Money Market Funds, 1990–2003.72Interest Rate Spread and Net New Cash Flow to TaxableRetail Money Market Funds, 1990–2003 .74Fee Waivers and Assets of Taxable Retail Money MarketFunds by Share Class .75Share of U.S. Nonfinancial Business Short-Term AssetsHeld Through Money Market Funds, 1990–2003 .76Chapter 6Mutual Fund Ownership and Shareholder CharacteristicsMutual Fund Assets by Type of Owner, 1993 and 2003 .79U.S. Household Ownership of Mutual Funds, 1980–2003 .80U.S. Mutual Fund Shareholder Characteristics.82Chapter 7Retirement and Education Savings MarketsU.S. Retirement Market Assets, 2003.85Mutual Fund Retirement Assets, 1991–2003 .86Assets in the IRA Market, 1990–2003.87Types of IRAs and Their Owners .88Types of Assets Held in IRAs, 2003.89Mutual Fund Assets by Type of Retirement Plan, 1993 and 2003 .90Assets in 401(k) Plans, 1990–2003 .91Average Asset Allocation for All 401(k) Plan Balances, 2002 .92Average 401(k) Account Balance by Age and Tenure, 2002 .93Mutual Fund Retirement Assets by Type of Fund, 2003 .94Section 529 Savings Plan Assets, 1998–2003.95Investments Used to Save for College, 2003 .96Characteristics of Responding Households Saving for College byUse of Education-Targeted Savings Programs, 2003 .972004 Fact Book ix

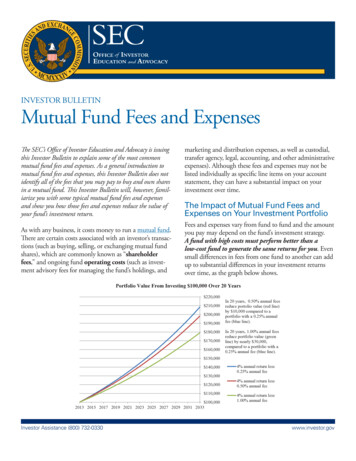

Chapter One: What Is a Mutual Fund?Chapter OneWhat Is a Mutual Fund?A mutual fund is a type of investment company that gathers assets frominvestors and collectively invests those assets in stocks, bonds, or money marketinstruments.Individuals and institutions invest in a mutual fund by purchasing sharesissued by the fund. It is through these sales of shares that a mutual fund raisesthe cash used to invest in its portfolio of stocks, bonds, and other securities.Through the collective investments of the mutual fund, each investor sharesin the returns from the fund’s portfolio while benefiting from professionalinvestment management, diversification, liquidity, and other benefits andservices.Assets of Mutual Funds, 2003Money Market Funds 2.052 trillionEquity Funds 3.685 trillionBond Funds 1.241 trillionHybrid Funds 437 billionTotal: 7.414 trillionNote: Components do not add to the total because of rounding.2004 Fact Book 1

Chapter One: What Is a Mutual Fund?Mutual Fund OrganizationA mutual fund is organized either as a corporation or a business trust that sellsits shares to investors. Mutual funds have officers and directors or trustees.In this way, mutual funds are like any other type of company, such as IBM orGeneral Motors.Unlike other companies, however, a mutual fund is typically externallymanaged: it is not an operating company with employees in the traditionalsense. Instead, a fund relies upon third parties or service providers, eitheraffiliated organizations or independent contractors, to invest fund assets andcarry out other business activities. The diagram on page 7 shows the types ofservice providers usually relied upon by a fund.How a Fund Is CreatedSetting up a mutual fund is a complicated process performed by the fund’ssponsor, typically the fund investment adviser, administrator, or principalunderwriter (also known as the distributor).The fund sponsor has a variety of responsibilities. For example, it mustassemble the group of third parties needed to launch the fund, including thepersonnel managing and operating the fund. The sponsor provides officersand affiliated directors to oversee the fund, and recruits unaffiliated persons toserve as independent directors. It must also register the fund under state law aseither a business trust or corporation. In addition, in order to sell its shares tothe public, the fund must first register those shares with the U.S. Securities andExchange Commission (SEC) by filing a federal registration statement pursuantto the Securities Act of 1933, and make filings with each state (except Florida)in which the fund’s shares will be offered.2 2004 Fact Book

Chapter One: What Is a Mutual Fund?Broker-dealers and their registered representatives who sell fund sharesto the public are also subject to regulation under the Securities Exchange Actof 1934, while investment advisers to funds generally must register under theInvestment Advisers Act of 1940.Preparing the federal registration statement, contracts, filings withindividual states, and corporate documents typically costs the fund sponsorseveral hundred thousand dollars. In addition, the Investment Company Act of1940 (1940 Act), a federal statute governing mutual fund operations, requiresthat each new fund have assets of at least 100,000 of “seed capital” beforedistributing its shares to the public; this capital is usually contributed by theadviser or other sponsor in the form of an initial investment.The ongoing operation of a mutual fund is also complicated and costly. Inaddition to management fees, funds regularly incur transfer agent, custodian,accounting, and other business expenses to continually meet federal and staterequirements and to service shareholder accounts.The 1940 Act requires that a mutual fund register with the SEC as a“registered investment company.” Status as a registered investment companyallows the fund to be treated as a “pass-through” investment vehicle for taxpurposes. In other words, the fund’s income flows through to shareholderswithout being taxed at the fund level.For more information on fund regulation and taxation, see Chapter 2 onpage 23.2004 Fact Book 3

Chapter One: What Is a Mutual Fund?The Origins of Mutual FundsThe mutual fund industry traces its roots to England in the mid-1800s. Theenactment of two British laws, the Joint Stock Companies Acts of 1862and 1867, permitted investors, for the first time, to share in the profitsof an investment enterprise, and limited investor liability to the amountof investment capital devoted to the enterprise. Shortly thereafter, in1868, the Foreign and Colonial Government Trust formed in London. Thistrust resembled a mutual fund in basic structure, providing “the investorof moderate means the same advantages as the large capitalists . byspreading the investment over a number of different stocks.”This concept of offering the investment potential of financial marketsto all individuals spawned additional “investment companies” in Britainand Scotland and, among other things, helped finance the developmentof the post-Civil War U.S. economy. Most of the early British investmentcompanies or trusts resembled today’s closed-end funds by issuing afixed number of shares to groups of investors whose “pooled” assetswere invested in various companies. The Scottish American InvestmentTrust, formed on February 1, 1873 by fund pioneer Robert Fleming,was significant because it invested in the economic potential of theUnited States, chiefly through American railroad bonds. Many othertrusts followed that not only targeted investment in America, but moreimportantly, led to the introduction of the investment fund concept on U.S.shores in the late 1800s and early 1900s.4 2004 Fact Book

Chapter One: What Is a Mutual Fund?The First “Mutual” FundThe first mutual, or “open-end,” fund—in which new shares are issuedas new money is invested—would not emerge until 1924 in Boston. TheMassachusetts Investors Trust, considered by most accounts to be the firstmutual fund, was introduced in March of that year. Formed as a commonlaw trust, this fund introduced important innovations to the investmentcompany concept by establishing a simplified capital structure, continuousoffering of shares, the ability to redeem shares rather than hold themuntil dissolution of the fund, and a set of clear investment restrictions andpolicies.While a handful of mutual funds were formed during the 1920s, fundsmanaged only 140 million by year-end 1929. The Stock Market Crash of1929 and the Great Depression that followed greatly hampered industrygrowth until a succession of landmark securities laws, beginning with theSecurities Act of 1933 and concluding with the Investment Company Actof 1940, re-invigorated investor confidence in funds. Renewed investorconfidence led to relatively steady growth in industry assets for theremainder of the century, and saw fund assets and shareholder accountsgrow, respectively, from 448 million and 296 thousand in 1940 to 7.4trillion and 261 million by year-end 2003.2004 Fact Book 5

Chapter One: What Is a Mutual Fund?ShareholdersAlthough a mutual fund is created from the seed money of the fund sponsor, itis managed for the benefit of all those investors who decide to buy shares oncethe fund is created and offered to the public.Investors are given comprehensive information about the fund to helpthem make informed decisions. A mutual fund’s prospectus describes thefund’s goals, fees and expenses, investment strategies and risks, and how tobuy and sell shares. The SEC requires a fund to provide a full prospectus eitherbefore an investment or together with the confirmation statement of an initialinvestment. In addition, periodic shareholder reports, provided to investors atleast every six months, discuss the fund’s recent performance and include otherimportant information, such as the fund’s financial statements. By examiningthese reports, an investor can learn if a fund has been effective in meeting thegoals and investment strategies described in the fund’s prospectus.Like shareholders of other companies, mutual fund shareholdershave specific voting rights. These include the right to elect directors atmeetings called for that purpose (subject to a limited exception for fillingvacancies). Shareholders must also approve material changes in the termsof a fund’s contract with its investment adviser, the entity that manages thefund’s assets. Furthermore, funds seeking to change investment objectivesor fundamental policies must obtain the approval of the holders of amajority of the fund’s outstanding voting securities. For example, a fund’smanagement fee can be increased only when a majority of shareholders voteto approve the increase.For more information on fund shareholders, see Chapter 6 on page 79 orvisit the Institute’s website at www.ici.org/shareholders/index.html.6 2004 Fact Book

Board of DirectorsShareholdersPrincipalUnderwriterSells fund shares,either directly tothe public orthrough otherfirms.InvestmentAdviserManages the fund’sportfolio accordingto the objectives andpolicies describedin the fund’sprospectus.Transfer AgentExecutes shareholdertransactions,maintains recordsof transactions andother shareholderaccount activity,and sends accountstatements andother documentsto shareholders.AdministratorOversees theperformance ofother companiesthat provideservices to thefund, and ensuresthat the fund’soperations complywith applicablefederalrequirements.Mutual FundHolds the fund’sassets, maintainingthem separatelyto protectshareholderinterests.CustodianOversees the fund’s activities, including approval of the contract withthe management company and certain other service providers.The Structure of a Mutual FundCertifies thefund’s pter One: What Is a Mutual Fund?2004 Fact Book 7

Chapter One: What Is a Mutual Fund?Boards of DirectorsA fund’s board of directors is elected by the fund’s shareholders to governthe fund, and its role is primarily one of oversight. The board of directorstypically is not involved in the day-to-day management affairs of the fundcompany. Instead, day-to-day management of the fund is handled by the fund’sinvestment adviser or administrator pursuant to a contract with the fund.Because mutual fund directors are looking out for shareholders’ interests,the law holds them to a very high standard. Directors must exercise the carethat a reasonably prudent person would take with his or her own business.They are expected to exercise sound business judgment, approve policies andprocedures to ensure the fund’s compliance with the federal securities laws, andundertake oversight and review of the performance of the fund’s operationsas well as the operations of the fund’s service providers (with respect to theservices they provide to the fund).As part of this fiduciary duty, a director is expected to obtain adequateinformation about issues that come before the board in order to exercise his orher “business judgment,” a legal concept that involves a good-faith effort bythe director.Independent Directors. Mutual funds are required by law to haveindependent directors on their boards: individuals who cannot have anysignificant relationship with the fund’s adviser or underwriter, in order to betterenable the board to provide an independent check on the fund’s operations.Under current law, a majority of most funds’ boards of directors must beindependent. A proposal pending in early 2004 would require that 75 percentof each fund’s board be composed of independent directors.For more information on fund directors, see page 27 of Chapter 2 or visitthe Institute’s website at www.ici.org/issues/dir/index.html.Investment AdvisersAs noted above, a fund’s investment adviser is often the fund’s initial sponsorand its initial shareholder through the “seed money” it invests to actually createthe fund. The investment adviser manages the fund’s assets in accordancewith the fund’s investment objectives and policies as stated in the registrationstatement it files with the SEC.8 2004 Fact Book

Chapter One: What Is a Mutual Fund?A fund’s board of directors must approve the fund’s contract with theinvestment adviser to manage its shareholders’ assets, including overseeing theinvestment adviser’s compliance with its advisory contract and fund prospectusdisclosure.As a professional money manager, the investment adviser provides a levelof money management expertise usually beyond the scope of the averageindividual investor. Indeed, an investment adviser’s service to a mutual fundprovides an economical, convenient way for the average investor to benefitfrom professional money management much like large institutions and wealthyinvestors receive.Professional Money Management. The investment adviser employed bya fund has its own employees who work on behalf of the fund’s shareholders.For example, the employees of the investment advisers who oversee “activelymanaged” fund portfolios—typically, a team of experienced investmentprofessionals headed by one or more portfolio managers—select securitiesbased on the fund’s investment objectives and extensive research of marketconditions. The investment adviser also considers the financial performance ofindividual companies and specific securities whose investment potential andcharacteristics are consistent with the fund’s investment objectives and risktolerance.As economic conditions change, the fund management team may adjustthe mix of its investments to a more aggressive or defensive footing to meet itsoverall investment object

A mutual fund is organized either as a corporation or a business trust that sells its shares to investors. Mutual funds have offi cers and directors or trustees. In this way, mutual funds are like any other type of company, such as IBM or General Motors. Unlike other companies, however, a mutual fund is typically externally managed