Transcription

Retirement Hybrid PlanEffective Date:The effective date of the new Hybrid pension plan is July 1, 2014. Employees hired on or after July 1, 2014 will be enrolled into the new planCurrent employees or retirees are not affected by the changesCurrent plan will be referenced as the ‘Legacy Plan’ going forwardBreaks in Service:Options returning TCRS and ORP members will have available to them: Vested in old plan with break in service – may return to old plan upon reemployment with state agency.Not vested in old plan and return to service in less than 7 years – may return to old plan.Not vested in old plan and return to service after 7 years – must enroll in new hybrid plan.Summary of Plan:The new TCRS pension plan has two components, a defined benefit plan and a defined contribution plan, andaccordingly is referred to as the Hybrid Plan. The defined contribution component will be administered through theState of Tennessee’s 401(k) plan with record keeping by Empower Retirement.The charts pictured on the following page assist in visualizing the various components and elements of the plan. Forinstance, in the TCRS Hybrid Plan the Defined Benefit component has two elements, one is the employercontributions and the other is the employee contributions. The Defined Contribution is another component, whichwill always have the 5% employer contribution element and may or may not have the 2% employee contributionelement – depending on whether the employee opted‐out of the auto‐enroll.In addition to the TCRS Hybrid Plan, an ORP option is available to eligible Higher Education employees. The ORPoption is pictured in the second chart.

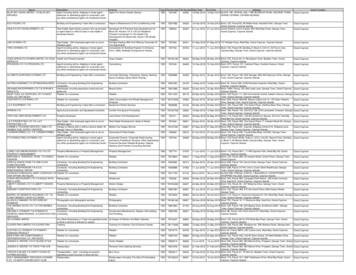

Contributions:Contribution Levels – TCRS HybridTCRS Hybrid Plan ParticipantDefined BenefitDefined ContributionTotal3.87%5%8.87%Employee Contributions: Required5%0%5%Employee Contributions: Auto Enrolln/a2%2%8.87%7%15.87%Employer ContributionsTotalContribution Levels – ORPOptional Retirement Plan (ORP) Plan ParticipantORPDefined ContributionTotalEmployer Contributions9%0%9%Employee Contributions: Required5%0%5%Employee Contributions: Auto Enrolln/a2%2%14%2%16%TotalVesting:Contributions to the plan(s) are subject to the established vesting rights. The TCRS Defined Benefit Plan requires five(5) years of service for vesting. All other contribution types are immediately vested, including the employercontribution under the Defined Contribution Plan – which is administered through Empower Retirement.Note: While loans are permitted under the hybrid plan, they are allowed on the employee contributions only ‐ theyare not allowed on the employer contributions.The chart on the following page outlines the vesting rights of each plan and contribution types within those plans.

Vesting RightsContribution RateVesting RightsTCRS Defined Benefit PlanBenefit Accrualn/a5 years of service for a monthly annuity onlyEmployee Contributions: Required5%Immediate – including credited interest byTCRS5%Immediate – including earningsDefined Contribution PlanEmployer Contributions(loans excluded)Employee Contributions: Required0%Immediate – including earningsEmployee Contributions: Auto‐enrolled2%Immediate – including earningsEmployer Contributions9%Immediate – including earningsEmployee Contributions: Required5%Immediate – including earningsORP PlanMatchAs long as an employee does not ‘opt‐out’ completely, the match of up to 50 per month will continue. AgencyBenefit Coordinator’s will need to communicate this effectively to new employees hired on or after July 1st.If the employee opts‐out completely he/she will also be opting out of receiving the match.Should a situation occur in which an employee does not opt‐out and wishes to contribute less than the 2% the auto‐enroll requires, he/she can change that percentage to a lower amount and receive the match up to 50 per month.

MatchHybrid Plan ParticipantDBDCTotal3.87%5%8.87%Employee Contributions: Required5%0%5%Employee Contributions: Auto‐enrolled (1)na2%2%Employee Contributions: Voluntary (2)naFed LimitFed LimitEmployer Contributions: 401k (3)na 50 match 50 match8.87%7%15.87%Employer ContributionsTotal (excluding 50 match)Optional Retirement Plan (ORP) ParticipantORPDCTotalEmployer Contributions9%0%9%Employee Contributions: Required5%0%5%Employee Contributions: Auto‐enrolled (1)na2%2%Employee Contributions: Voluntary (2)naFed LimitFed LimitEmployer Contributions: 401k (3)na 50 match 50 match14%2%16%Total (excluding 50 match)Notes:(1) Employees may opt out of the auto‐enrolled contributions.(2) Employees may make additional voluntary contributions to the 401k,457, and 403b plan up to limits set by Federal law.(3) Employer match up to 50 per month for employees contributing to401k.

Implementation:Remember the effective date: The effective date of the new Hybrid pension plan is July 1, 2014. Employees hired on or after July 1, 2014will be enrolled into the new plan.Remember who is not affected: Current employees (hired before July 1, 2014) and retireesRemember eligibility: Exempt and Non‐TCAT employees will continue to have an option to select TCRS or ORP.Non‐Exempt and TCAT employees may only select TCRS.Auto‐Enroll Feature:The auto‐enroll feature is mandated by the legislation and applies to both TCRS and ORP. 30 day window to opt‐out:o The employee will receive a letter and instructed on how to opt out of the enrollment 90‐day permissible withdrawal from date of first payroll received at EMPOWER RETIREMENT:o In the event the employee fails to opt‐out and an employee contribution is directed into a EmpowerRetirement account, the employee can request to withdraw the funds. As long as the contribution hasnot been in the employee’s account at Empower Retirement for 90 days or more, he/she can withdrawit without any penalty. The employee receives the funds directly from Empower Retirement. At thispoint the employee will complete the opt‐out process with Empower Retirement and payroll will benotified on the weekly file.Enrollment TCRS Hybrid:TCRS Hybrid – Part ITCRS Concord (Defined Benefit) Exempt and Non‐TCAT employees will complete the following form:oNotice of Election to Participate in the Optional Retirement Program or the Tennessee ConsolidatedRetirement System (Notarization Required) Non‐Exempt and TCAT employees will not complete a form. Set‐up the employer TCRS Hybrid deduction in the employee’s payroll record.

TCRS Hybrid – Part IIEmpower Retirement (Defined Contribution)Employer Contribution (5% Required): Mandatory – the employer will immediately upon hire set‐up the eligible employee with a 5% employercontribution and remit funds with the next scheduled payroll remittance.Auto‐Enroll (2% With Opt‐Out Feature): Eligibility – the Banner Job Record for each newly hired employee will be captured on the data file andtransmitted to Empower Retirement at the end of each payroll cycle. Upon receipt, Empower Retirementcreates an account for the participant. Participant Notification – Empower Retirement will send a letter to the employee with a PIN and instructionsfor Opting Out, Changing the Contribution Amount, or Changing the Investment Selection. 30 Day Window Action – participant is auto‐enrolled at 2% of the salary if no action was taken during the 30 day window. Ifaction was taken during the 30 day window, Empower Retirement administers the requested changes. Confirmation – the employee will receive a letter from Empower Retirement regarding the completed auto‐enrollment or if applicable, any changes made to the deferral amount or opt‐out verification. Payroll File – Empower Retirement will send a deferral feed file to the employer, which will indicate anyaction the employer is required to take.Active member welcome packet:The employee will be enrolled in TCRS Hybrid through the file upload process performed in the Concord system.TCRS will send the employee an active member welcome packet which will instruct him/her to go online to MemberSelf‐Service (MSS) and elect a beneficiary. TCRS will also enclose a beneficiary election form the employee can fill inand mail directly to TCRS should he/she prefer to utilize that method instead.Enrollment ORP:ORP – Part IORP Continue current process Exempt and Non‐TCAT employees will complete the following forms:oNotice of Election to Participate in the Optional Retirement Program or the TennesseeConsolidated Retirement System (Notarization Required)

May still split among 3 vendorsoProvide each selected vendor enrollment application Set‐up the employer ORP deduction in the employee’s payroll record.ORP – Part IIEmpower Retirement (Defined Contribution)Auto‐Enroll (2% With Opt‐Out Feature): Eligibility File – the Banner Job Record for each newly hired employee will be captured on a bi‐weekly fileand transmitted to Empower Retirement. Upon receipt, Empower Retirement creates an account for theparticipant. Participant Notification – Empower Retirement will send a letter to the employee with a PIN and instructionsfor Opting Out, Changing the Contribution Amount, or Changing the Investment Selection. 30 Day Window Action – participant is auto‐enrolled at 2% of the salary if no action was taken during the 30 day window. Ifaction was taken during the 30 day window, Empower Retirement administers the requested changes. Confirmation – the employee will receive a letter from Empower Retirement regarding the completed auto‐enrollment or if applicable, any changes made to the deferral amount or opt‐out verification. Payroll File – Empower Retirement will send a deferral feed file to the employer, which will indicate anyaction the employer is required to take.File Format:Record‐keeper (Payroll Data Interchange)oThe type of file used satisfies Empower Retirement’s relationship as Record Keeper. Data istransferred using a file rather than maintenance performed on a web‐based system. For example,instead of updating an employee’s address in an online system, the information just comes over onan electronic file.Specifications will be achieved using a derivative of the Concord fileoTBR programmers will use a derivative of the file created for the new Concord process and roll outto the campuses for testing and future use.

Payroll Deductions:TCRS HybridBenefit Definition# of CodesType of CodeDefined Benefit – ER & EE1RDeferred Comp – ER1DDeferred Comp – EE Auto‐enroll1D (will use same code for ORP)ORPBenefit Definition# of CodesType of CodeORP : TIAA CREF ‐ ER & EE3RORP : VALIC ‐ ER & EE3RORP : VOYA ‐ ER & EE3RORP : TIAA CREF ‐ ER & EE3XORP : VALIC ‐ ER & EE3XORP : VOYA ‐ ER & EE3XDeferred Comp – EE Auto‐enroll1D (will use same code for TCRS)Remittance:Same website, access, and process in place currently.oTBR previously implemented the EFT process with Empower Retirement in 2012, therefore, all TBRinstitutions are already set‐up to remit via the website.Timing requirements will be enforced – must be submitted on the payroll date.oDue to IRS requirements surrounding the new hybrid institutions MUST submit the file and EFT onthe payroll date. Please share this information with the appropriate person at your campus.

Contributions: Contribution Levels - TCRS Hybrid TCRS Hybrid Plan Participant Defined Benefit Defined Contribution Total Employer Contributions 3.87% 5% 8.87% Employee Contributions: Required 5% 0% 5% Employee Contributions: Auto Enroll n/a 2% 2% Total 8.87% 7% 15.87% Contribution Levels - ORP