Transcription

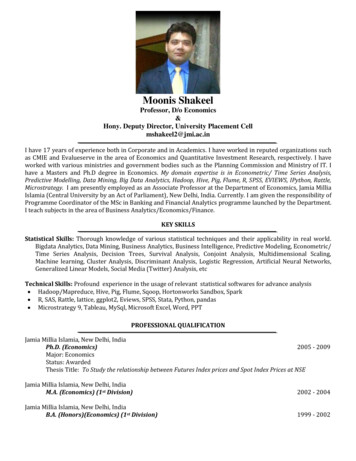

Moonis ShakeelProfessor, D/o Economics&Hony. Deputy Director, University Placement Cellmshakeel2@jmi.ac.inI have 17 years of experience both in Corporate and in Academics. I have worked in reputed organizations suchas CMIE and Evalueserve in the area of Economics and Quantitative Investment Research, respectively. I haveworked with various ministries and government bodies such as the Planning Commission and Ministry of IT. Ihave a Masters and Ph.D degree in Economics. My domain expertise is in Econometric/ Time Series Analysis,Predictive Modelling, Data Mining, Big Data Analytics, Hadoop, Hive, Pig, Flume, R, SPSS, EVIEWS, IPython, Rattle,Microstrategy. I am presently employed as an Associate Professor at the Department of Economics, Jamia MilliaIslamia (Central University by an Act of Parliament), New Delhi, India. Currently. I am given the responsibility ofProgramme Coordinator of the MSc in Banking and Financial Analytics programme launched by the Department.I teach subjects in the area of Business Analytics/Economics/Finance.KEY SKILLSStatistical Skills: Thorough knowledge of various statistical techniques and their applicability in real world.Bigdata Analytics, Data Mining, Business Analytics, Business Intelligence, Predictive Modeling, Econometric/Time Series Analysis, Decision Trees, Survival Analysis, Conjoint Analysis, Multidimensional Scaling,Machine learning, Cluster Analysis, Discriminant Analysis, Logistic Regression, Artificial Neural Networks,Generalized Linear Models, Social Media (Twitter) Analysis, etcTechnical Skills: Profound experience in the usage of relevant statistical softwares for advance analysis Hadoop/Mapreduce, Hive, Pig, Flume, Sqoop, Hortonworks Sandbox, Spark R, SAS, Rattle, lattice, ggplot2, Eviews, SPSS, Stata, Python, pandas Microstrategy 9, Tableau, MySql, Microsoft Excel, Word, PPTPROFESSIONAL QUALIFICATIONJamia Millia Islamia, New Delhi, IndiaPh.D. (Economics)2005 - 2009Major: EconomicsStatus: AwardedThesis Title: To Study the relationship between Futures Index prices and Spot Index Prices at NSEJamia Millia Islamia, New Delhi, IndiaM.A. (Economics) (1st Division)2002 - 2004Jamia Millia Islamia, New Delhi, IndiaB.A. (Honors)(Economics) (1st Division)1999 - 2002

CERTIFICATIONS Developing Data Products, Johns Hopkins University, Coursera 2015Bigdata Analytics and Hadoop 2014Financial Modelling using Excel and VBA, 2012.Introduction to Computational Finance and Financial Econometrics, University of Washington, 2013.Certified Stock Market Technical Analyst from BLB Institute of Financial Markets, 2007.“Essential Econometrics for Research in Finance” at National Institute of Securities Market, 2011.RESEARCH20211. Moonis Shakeel, Himani Arya (2021). Modelling and Forecasting Intraday Volatility with RangeBased GARCH Models for Indian Stock Market. International Journal of Economics and BusinessResearch, DOI: 10.1504/IJEBR.2023.10044578. (UGC List)(Scopus Indexed)20202. Shakeel, M., & Srivastava, B. (2020). Determinants of intraday market liquidity: an empiricalanalysis of Indian futures market using high frequency data. International Journal of ManagementPractice, 13(2), 178-199. (UGC List)(Scopus Indexed)3. Shakeel, M., Barsaiyan, S., & Sijoria, C. (2020), “Twitter As A Customer Service ManagementPlatform: A Study On Indian Banks”, Journal Of Content, Community & Communication Volume 11,pp 84-104. (ISSN: 2395-7514)(In UGC List/ICI)(Scopus Indexed)20184. Shakeel, Moonis., and Srivastava, Bhavana (2018), “Analysis Of Intraday Volatility Using Highfreqency Data: An Empirical Investigation Of Indian Futures Market”, Al-Barkaat Journal of Finance& Management, (Al-Barkaat Institute of Management Studies) Volume 9, Number 2, pp 29-45. (ISSN:0974-7281)(In UGC List/ICI)5. Shakeel, Moonis., and Srivastava, Bhavana (2018), “Stylised facts of High Frequency Financial TimeSeries Data”, Global Business Review, Sage Publishing. (ISSN:09721509)(In UGC List/ICI) (ScopusIndexed) (ABDC C category)6. Shakeel, Moonis., and Srivastava, Bhavana (2018), “Volatility Analysis in Different Intraday TimeFrequencies: An Empirical Investigation”, International Journal of Management Studies,(ISSN:2249-0302), Vol-V, No – 3(2), pp 45-52. )(In UGC List)20177. Moonis Shakeel, Anshu Banwari, Deepak Verma (2017), “Does Preference For Negotiation StyleDepends On Religious Orientation?”,International Journal of Applied Business and EconomicResearch, Vol.15, No. 23, pp. 79-95 (ISSN : 0972-7302) (Scopus Indexed)(In UGC List)8. Shakeel, Moonis , and Mehra, Shashank. “Store Format Choice Behaviour for Organised andUnorganised stores of NCR in India-A Discriminant Analysis”, International Journal of BusinessInnovation and Research, Vol 14, No. 3, pp.345 – 363.(Scopus Indexed) (ABDC C category) (InUGC List) (ISSN: 1751-0252)9. Anshu Banwari, Moonis Shakeel, Deepak Verma (2017), “ Clout of Professional Education andReligion on Conflict Resolution Style”, International Journal of Emerging Research in Management&Technology, Vol 6, Issue 8, pp. 138-140. ( ISSN: 2278-9359)(In UGC List)10. Anshu Banwari, Moonis Shakeel, Deepak Verma (2017), “Assessing Preference Of CommunicationStyle In Indian Society”, Man in India, Vol. 97, No. 23, pp, 39-49(ISSN :0025-1569) (ScopusIndexed)(In UGC List)11. Ahuja, V., Shakeel, M., “Twitter Presence of Jet Airways-Deriving Customer Insights UsingNetnography and Wordclouds”, International Conference on Information Technology andQuantitative Management, Procedia Computer Science, Volume 122, pp. 17-24. ( ISSN: 18770509)(Elsevier-ScienceDirect)(Scopus Indexed).

201612. Shakeel M., Karwal V.,”Lexicon-based Sentiment Analysis of Indian Union Budget 2016-17”, 2016International Conference on Signal Processing and Communication (ICSC-2016), (Scopus), IEEEIndexed.13. Wahi, Ashok., Misra, K. Rajnish and Shakeel, Moonis (2016), “Why Should Indian BusinessesTransition To Enterprise 2.0?”, Info-The journal of policy, regulation and strategy fortelecommunications, information and media, Vol 18 No 1, Emerald. (Scopus)( ABDC B) ( ISSN:1463-6697) (In UGC List)14. Mehra, Shashank., and Shakeel, Moonis, “Determining Store Attribute Salience on Store ChoiceBehaviour in an Emerging Market- The case of Indian Grocery Market”, International Journal ofIndian Culture and Business Management, Vol 12, No. 4 pp. 489 – 507. (Google Scholar) (PrintISSN: 1753-0806) (ABDC C category)(In UGC List)(ESCI-WoS)201515. Shakeel, Moonis., and Chaudhry, Shivani (2015), “Attribute-based perceptual mapping of mutualfund schemes: a study from an emerging market”, International Journal of Economics and BusinessResearch, Vol. 10, No. 1, pp. 81 – 103. (Scopus Indexed) (Print ISSN: 17569850) (ABDC Ccategory) (In UGC List)16. Sharma, Vinky., and Shakeel,Moonis (2015),“Illusion versus Reality: An Empirical Study ofOverconfidence and Self Attribution Bias in Business Management Students”, Journal of Educationfor Business, (Routledge), Vol 90, No. 4, Pp. 199-207. (WoS/SCI Indexed) Print ISSN: 0883-2323)(ABDC C category)201417. Shakeel, Moonis., and Purankar, Shriram (2014),“Price Discovery Mechanism of Spot and FuturesMarket in India: A Case of Selected Agri-Commodities “,International Research Journal Of BusinessAnd Management, (Global Wisdom Research Publications) Volume-VII, Issue-8, pp 50-61. (ISSN:2322-083X) (SJIF Impact Factor: 5.172)(In UGC List)18. Mehra, Shashank., and Shakeel, Moonis (2014), “Comparative Study Of Unorganised And OrganisedRetail: The Case Of Indian Grocery Market At Ncr.”, International Journal Of Research In Commerce,Economics & Management, Volume 4, Issue No. 10, pp 78-84. (Google Scholar) (ISSN: 2231-4245(E))19. Shakeel, Moonis., and Srivastava, Bhavana (2014),"Modeling Intraday Volatility Behavior: AnEmpirical Investigation Of Indian Futures Market", International Journal of Research &Development in Technology and Management Science , (Modern Rohini Education Society) Vol. 21,Issue 1, pp 79-98. (ISBN: 978-1-63102-445-0)20. Chaudhry, Shivani., and Shakeel, Moonis (2014),“Performance Evaluation Of Top Performing MutualFund Managers: An Analytical study From India”, International Journal Of Research In Commerce,Economics & Management, (Licensed under Creative Common) Volume-4, Issue-9, pp 71-76. (ISSN2231-4245) (Google Scholar)21. Shakeel, Moonis., and Sharma, Vinky (2014), “Right to Marital Property Act and Economics ofMarriage”, International Research Journal of Business and Management, (Global Wisdom ResearchPublications) Vol.8, Issue 3, Pp. 58-62. (ISSN: 2322-083X) (Impact Factor: 1.47)(In UGC List)201322. Shakeel, Moonis., and Chaudhry, Shivani (2013), "Attribute Based Preference & Predictability OfMutual Funds For Investment By Investment Professionals: A Study From Emerging Market" ,European Journal of Innovative Business Management,(Whites Science) Vol 1, pp 17-26. (ISSN2056-9904) (ProQuest and EBSCOhost)201223. Sharma, Vinky., and Shakeel, Moonis. (2012), “An Empirical Analysis to Identify effectiveRecruitment Source Mix Using Conjoint Analysis”, Asian Journal of Managerial Science, (IntegratedPublishing Association) Vol.1, No.2, pp 50-60. (ISSN: 2249 - 6300)(In UGC List)24. Shakeel Moonis & Ashraf Shahid (2012) “Empirical Relationship Between Index Futures Prices,Volume and Open Interest: Evidence from Indian Futures Market” Icfai Journal of Applied Finance,(Hyderabad ICFAI University Press.) Vol. 18, No. 2 3, pp 48-66. (ISSN: 0972-5105) (Cabell’sDirectory) (In UGC List)

25. Shyam Shanker Hari, Shakeel Moonis, Mehra Shashank (2012), “Retail SERVQUAL of Food RetailChain: A Study of Inter Category Competition in NCR Region”, International Journal of Trends inRetail Management, (Academic Journals) Volume 1 issue 6 ( ISSN: 0976-9803).201126. Shakeel Moonis (2011) “An empirical study on volatility spillover between Nifty futures index andNifty spot index at National Stock Exchange: A GARCH-VAR Approach”, International Journal ofBusiness & Engineering Research,( Sobhasaria Group of Institutes) Volume 4, pp 104-116. (ISSN:0975-0479)200927. Shakeel Moonis (2009), “An Empirical Study on the Relationship between Nifty Futures Index Pricesand Nifty Spot Prices at National Stock Exchange”, Al-Barkaat Journal of Finance & Management,(Al-Barkaat Institute of Management Studies) Volume 1, Number 2, pp 23-34. (ISSN: 0974-7281)(InUGC List/ICI)PHD GUIDANCES. No12345Student DetailsTopicStatusAnand Kumar (11409520)AnshuBanwari(12409701)Bhavana Srivastava(12409509)A Comparative Analysis of the Financial Performance ofMicrofinance Institutions of India and BangladeshBehavior, Perception & Performance of InvestmentProfessionals in Mutual Fund IndustryConsumer’s Store Choice Criteria In Organised AndUnorganised Grocery Stores-A Study At Ncr-Region.Communication and Negotiation Styles: An EmpiricalAnalysisEmpirical Essays on Futures Market 16)Awarded(2019)Awarded(2021)ACADEMIC EXPERIENCEData Science/Analytics Courses Taught: Business Forecasting and Predictive Techniques Data Management, Visualization and Analysis Econometrics Data Visualization Querying Databases using SQLPapers Taught to MA (Economics)/MBA/PhD students: Business Research Methods Business Statistics using Excel Quantitative Techniques and Software Applications Macroeconomics Microeconomics Behavioral Finance General Equilibrium Theory Game Theory Mathematical EconomicsAcademic Responsibilities Programme Coordinator – MSc Banking and Financial Analytics Programme Director – PhD Programme Director – MBA

FDPs/MDPs ConductedS.No.Title / Academic Sessionwith dateLecture/ ResourcePerson/ Paperpresentation/ fullpaper in ConferenceProceedingsAgencyWhether International(Abroad) / International(within country)/National/State/University levelResearch Methodology: Statistical Tests ofSignificance: Parametric and Non-ParametricTests using SPSS1-5 April 2021Research Methodology: Data Collection andAnalysis: Basic Statistical Analysis using SPSS1-5 April 2021Resource PersonDeshbandhu College,University of DelhiNationalResource PersonDeshbandhu College,University of DelhiNational2-Week Refresher Course in Commerce andManagement Studies: How to write a researchpaper?, 29/01/2021Faculty Development Programme on DataScience in the Digital Era : Explorative andztVisual data Mining 9-14 July 2018Resource PersonUGC-Human ResourceDevelopment Centre, JMINationalResource PersonJaypee Institute ofInformation Technology,NoidaNational5Workshop[ on Research Data ManagementTools and Techniques: Research DataManagement Tools and Techniques17-18 Jan 2019Resource PersonTERI, Lodhi Road, NewDelhiNational6R Programming training for CompetitionCommission of India officials, GOI, 24/03/17 to12/05/17Application of R Software in Big DataAnalytics: International Conference on DigitalLibraries, 13-16 Dec 2016Application of Data Analytics in SmartLibraries, 11 August 2016Data Visualization: ICT for Teacher Educators,Feb, 28 17 to Mar 2, 17Resource PersonCompetition Commissionof IndiaNationalResource PersonTERI, Lodhi Road, NewDelhiInternational (within country)Resource PersonNational10Sensitization on Demonetization, 23 Dec, 2016Resource PersonTERI, Lodhi Road, NewDelhiDepartment for TeacherTraining and Non-FormalEducation, Jamia MilliaIslamiaDepartment for TeacherTraining and Non-FormalEducation, Jamia MilliaIslamia11Modelling Volatility-Econometrics Techniques: Resource PersonTheory andApplications, 20 Feb - 04 Mar, 2017Doctoral Workshop on Research Methodology Resource PersonUsing SPSS & R Analytics, 4-5-6 February2016Doctoral Workshop on Research Methodology Resource PersonUsing SPSS & R Analytics, 14-16 July 2016Department of Economics,Jamia Millia IslamiaNationalAIMA, New DelhiNationalAIMA, New DelhiNational14Data Analytics and Research Methodology, 13June 2016 to 18 June 2016Resource PersonABES Engineering College NationalGhaziabad15Business Research and Analytics, Sept 14-19,2015Business Research and Analytics, June 20-25,2016Resource PersonJaypee Business School,NoidaJaypee Business School,NoidaNationalJaypee Business School,NoidaNational123478912131617Business Research and Analytics, June 19-24,2017Resource PersonProgrammeCoordinator/ ResourcePersonProgrammeCoordinator/ ResourcePersonNationalUniversityNational

1819202122232425Advance Research Methodology, June 18-23,2018ProgrammeCoordinator/ ResourcePersonResearch Methodology and Data Analysis, June Programme17-22, 2019Coordinator/ ResourcePersonR for business analytics, 13-April-2016Resource PersonResearch Methodology and Application ofContemporary Techniques for Management,One weekManagerial Economics 2014Managerial Economics 2015Managerial Economics 2016Lexicon-based Sentiment Analysis of IndianUnion Budget 2016-17, InternationalConference on Signal Processing andCommunication (ICSC-2016), IEEE IndexedResource PersonResource PersonResource PersonResource PersonPaper presentationJaypee Business School,NoidaNationalJaypee Business School,NoidaNationalJaipuria Institute ofManagement, NoidaNIILM, Centre forManament Studies, GreaterNoidaCMS, JMICMS, JMICMS, JMIJaypee Institute ofInformation iversityInternational within country26Peace be upon All of Us, National conference on Paper presentationPeace education: Strategies for buildingcivilization of peaceRamanujan College ofEducationNational27Logistic Regression using SPSS/R: FacultyDevelopment Programme on Mathematical andStatistical Methods, 13 July 2018D/o Mathematics, JIITUniversityNationalResource PersonCORPORATE EXPERIENCEWorked with the Government of India (GOI) Ministries such as the Planning Commission and Ministry ofInformation Technology (Economic Policy and Planning Division) and also other related agencies andassociations as Research and Information Officer. At these government organizations, the work involved: Analyzing data released by various government agencies and authentic private bodies. Tracking leading macroeconomic indicators and interpret the same to forecast the likely direction andperformance of the Indian economy using high-end regression analysis in R. Tracking the IT/ITeS sector in India Prepared proprietary industry/economic reports for Centre for Monitoring Indian Economy (CMIE)Worked as part of the Quantitative Investment Research team at Evalueserve (for a leading Germaninvestment bank). Highlights of the work involved: Preparing daily market report covering various sectors, economic news, days biggest gainers and losersfor various major world indices. The daily report is prepared for a leading Investment Bank based in UK. Conducting advance econometric analysis including forecasting using Arima/Garch model in R. Done a project on predicting the direction and magnitude of commodity prices based on raw materialcosts. Analyze the relation between VIX (Volatility Index) and Returns using time series in R. Analysis of Analyst RecommendationsAWARDS AND ACHIEVMENTS Batch Topper in B.A. Honors (Economics) in the Class of 2002 Awarded three merit scholarships at college level Awarded certificate for Recognition in Team WorkMEMBERSHIPS Analytics Society of India The Indian Econometric Society

Predictive Modelling, Data Mining, Big Data Analytics, Hadoop, Hive, Pig, Flume, R, SPSS, EVIEWS, IPython, Rattle, Microstrategy. I am presently employed as an Associate Professor at the Department of Economics, Jamia Millia Islamia (Central University by an Act of Parliament), New Delhi, India. Currently. I am given the responsibility of