Transcription

PurchaseYour NextHomeWITH A REVERSEMORTGAGE LOANUpsize or Downsizeinto Your Dream Home

What is aREVERSEMORTGAGELOAN?If you’re 62 or better, you can use a reverse mortgage loan to purchasea new home or turn your current home’s equity into cash. A reversemortgage loan gives you the opportunity to potentially increase yourpurchase power or cash flow while eliminating monthly mortgagepayments as long as you pay taxes and insurance, and maintain thehome.Most, but not all, reverse mortgages today are federally insured through the Federal Housing Administration’sHome Equity Conversion Mortgage (HECM) Program. This advertisement talks about HECM loans only.BENEFITS of BUYINGIT’S TIME TO DO WHAT YOU WANT TO DOHere are a few things a reverse mortgage loan could help you with: Purchase in a 55 plus community Increase your purchasing power and flexibility No monthly mortgage payments (taxes, insurance, and maintenance required) Move closer to family, better weather, or a more appropriate home Purchase a home for 30-70% down* Close in as little as 17 days***The down payment required is determined on a number of factors, including borrower(s)’ age (and non-borrowing spouse’s age, ifapplicable); current interest rates; and the lesser of the home’s appraised value or purchase price.**17 day close is based on receiving an appraisal within 10 days of ordering it with no contingencies.SO YOU’RE LOOKING FOR A NEW HOUSE.

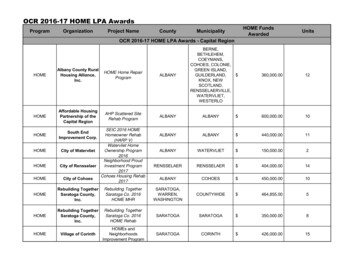

PURCHASEPowerPurchasePrice-Estimated ReverseMortgage AvailableFunds Estimated FundsRequired from theBorrower at Closing*ESTIMATED CASH FROM BORROWER* 123,491 119,491 112,491 107,291 99,091 183,091 177,091 166,591 158,791 146,491 242,691 234,691 220,691 210,291 193,891 302,291 292,291 274,791 261,791 241,291Age of YoungestBorrowerPurchase Price62 Years Old65 Years Old70 Years Old75 Years Old80 Years Old 200,000Purchase PriceFaded portion of barrepresents the estimatedreverse mortgage funds 300,000Purchase Price 400,000Purchase Price 500,000 361,891 349,891 328,891 313,291 288,691This graph shows the estimated funds available from utilizing an FHA-insured reverse mortgage topurchase a home. This information is provided as a guideline and does not reflect the final outcome forany particular homebuyer or property. *The actual reverse mortgage available funds are based on currentinterest rates, current charges associated with the loan, borrower’s date of birth, the property sales priceand standard closing costs. Interest rates and loan fees are subject to change without notice. Followingthe closing of the home purchase, no further principal or interest payments will be required as long asone borrower occupies the home as their primary residence and adheres to all HUD guidelines of loan.Borrower must remain current on property taxes, homeowner’s insurance and maintenance. The costof any reverse mortgage loan depends upon how long the loan is kept and how much the propertyappreciates in value. Generally, the effective cost decreases across the life of the loan.Purchase Price 600,000

PURCHASING OPTIONS& COMPARISONSCASH OUTLAY OVER 30 YEARS20%DOWNPAYMENT 120,000Required 360payments cash flow 2,577 \ MONTH5% Interest Rate,5.0885% APR 1,047,628CASHPURCHASEREVERSEMORTGAGE LOAN 600,000Down Payment 369,00062 year old 231,000* Loan*Negative Amortization couldcause the total amount due atthe end of the loan to increaseif optional** reverse mortgagepayments are not made.Deborah is looking to purchase a home for 600,000 and islooking into several loan options. The graph above shows thetotal amount Deborah would pay over the 30 year life of the loan.The payments on the graph do not include taxes, insurance, andmaintenance costs.**Housing expenses must continue to be paid, such as property taxes and insurance (and homeownerassociation fees, if applicable), and home must be maintained.

UPSIZINGJames and Mary, who are 62 and 59, want tomove to a newly constructed home to retire. They want tokeep the same size home they currently have, but home valuesare more than double in the new community compared towhere they live currently. A Realtor recommended to themthat with a reverse mortgage for home purchase, they couldbuy a house similar to the one that they currently live in.NOTE: One spouse must be 62 years or older to be eligible for a reverse mortgage.In Texas both spouses must be 62 years or older.– OR – 391,400 600,000James and Mary could continue to livein this 391,400 home.They could move to a 600,000 home for 391,400down with no monthly mortgage payments, exceptfor taxes, insurance, and maintenance.CLIENTS COULD SELL THEIR HOUSE FOR 391,400 AND PURCHASE A NEWLYCONSTRUCTED HOME FOR 600,000.DOWNSIZINGCindy, who is 62, is selling her current home that is ownedfree and clear to move closer to her grandchildren. She would liketo downsize when she moves and be able to set up an annuity forher grandchildren to help pay for college*. The community shewould like to move to is more expensive than her current one. Areverse mortgage can allow her to purchase a home in the newcommunity and be able to have money left over from the sale ofher current house.*The information in this advertisement does not constitute financial planning advice.Please consult a financial planner regarding purchasing an annuity and your specificretirement plan.– OR – 400,000Cindy could live in her current 400,000 homefurther away from her grandchildren. 375,000She could downsize to a 375,000 home for 230,000 down that is closer to her grandchildren.CLIENT COULD DOWNSIZE HER 400,000 HOME, PURCHASE A 375,000 HOUSE AND HAVE 170,000 TO SPEND ON AN ANNUITY.The houses and stories are used for illustration purposes only. Houses may not be available for purchase. This information is provided as a guideline; the actual reverse mortgageavailable funds are based on current interest rates, current charges associated with loan, borrower date of birth, the property sales price and standard closing cost. Interest rates andloan fees are subject to change without notice.

Questions AboutREVERSEMORTGAGEFOR PURCHASEWhen you purchase a home with a reverse mortgage, will the loan be held on your existinghome or your newly purchased home?The reverse mortgage will be held on the newly purchased home as your primary residence. The down paymentyou will need to bring to closing is usually between 30-70%.How will the lender determine how much money you will need at closing?The required down payment on your new home is determined on a number of factors, including your age oreligible non-borrowing spouse’s age, if applicable; current interest rates; and the lesser of the home’s appraisedvalue or purchase price.What sources of funds (money) are allowed when you purchase a home with a reverse mortgage?The money must come from your liquid assets (bank accounts, CDs, retirement accounts, etc.) or from thedocumented sale of other assets you may have (your present home for example).Why is my down payment higher with a reverse mortgage?Your down payment is higher initially because you will not be required to make a mortgage payment (except fortaxes and insurance, and the home must be maintained). With a traditional mortgage, you would potentially losemore in cash flow over the years because of the consistently required payments.Remember the reverse mortgage for purchase also can allow you to purchase a more expensive home than whatyou would otherwise be willing to commit to in payments for the next 20-30 years.Eligibility: One spouse must be 62 years or older to beeligible for a reverse mortgage. In Texas bothspouses must be 62 years or older Home must be a primary residence(live there 6 months per year) The property must be a single-family home, a2 to a 4-unit dwelling or FHA-approved condo Must meet minimal credit andproperty requirements Must receive reverse mortgage counselingfrom a HUD approved counseling agency Must not be delinquent on any federal debt

THE NEXT STEPS.WE'RE DEDICATED TOPROVIDING YOU AN AMAZINGEXPERIENCE EVERY DAY.Why work with FairwayReverse Mortgage Planners?1. Professional team approach2. Specialized training for Fairway's ReverseMortgage Planners3. Trusted advisors know options & tools4. National in-person appointmentsFairway at a GlanceAt Fairway Independent Mortgage Corporation,customer service is a way of life. We are dedicated tofinding great rates and loan options for our customerswhile offering some of the fastest turn times inthe industry. Our goal is to act as a trusted advisor,providing highly personalized service and helpingyou through every step of the loan process – fromapplication to closing and beyond. It’s all designed toexceed expectations, provide satisfaction and earntrust. Since opening our doors more than 20 yearsago, our team has helped thousands of Americansachieve their dream of homeownership. Ranked asone of the top 10 mortgage companies in America byMortgage Executive Magazine, we have funded morethan 26.7 billion in 2018 alone.

Gabe BodnerProducing Branch Manager, NMLS# 235374Direct: 720-600-4870Cell: 650-218-0976eFax: 77 29th Street, Suite 102 Boulder, CO 80303Download the FairwayNOW pyright 2020 Fairway Independent Mortgage Corporation (“Fairway”) NMLS#2289. 4750 S. Biltmore Lane, Madison, WI 53718, 1-866-912-4800. All rights reserved. Fairwayis not affiliated with any government agencies. These materials are not from HUD or FHA and were not approved by HUD or a government agency. Reverse mortgage borrowersare required to obtain an eligibility certificate by receiving counseling sessions with a HUD-approved agency. The youngest borrower must be at least 62 years old. Monthlyreverse mortgage advances may affect eligibility for some other programs. This is not an offer to enter into an agreement. Not all customers will qualify. Information, rates andprograms are subject to change without notice. All products are subject to credit and property approval. Other restrictions and limitations may apply. Equal Housing Lender.Fairway AZ License #BK-0904162. Licensed by the Department of Business Oversight under the California Residential Mortgage Lending Act, License No 41DBO-78367.Licensed by the Department of Business Oversight under the California Financing Law, NMLS #2289. Loans made or arranged pursuant to a California Residential MortgageLending Act License CA-DBO235374.4 19 420 5

free and clear to move closer to her grandchildren. She would like to downsize when she moves and be able to set up an annuity for her grandchildren to help pay for college*. The community she would like to move to is more expensive than her current one. A reverse mortgage can allow her to purchase a home in the new