Transcription

Presenting a live 90-minute webinar with interactive Q&AConcierge Medicine: Legal and Ethical ConsiderationsComplying With Medicare Regulations, Insurance Laws and the Anti-Kickback StatuteWEDNESDAY, MAY 22, 20131pm Eastern 12pm Central 11am Mountain 10am PacificToday’s faculty features:Robert M. Portman, Principal, Powers Pyles Sutter & Verville, Washington, D.C.Julie E. Kass, Principal, Ober Kaler, BaltimoreThe audio portion of the conference may be accessed via the telephone or by using your computer'sspeakers. Please refer to the instructions emailed to registrants for additional information. If youhave any questions, please contact Customer Service at 1-800-926-7926 ext. 10.

Sound QualityIf you are listening via your computer speakers, please note that the quality ofyour sound will vary depending on the speed and quality of your internetconnection.If the sound quality is not satisfactory and you are listening via your computerspeakers, you may listen via the phone: dial 1-866-258-2056 and enter your PINwhen prompted. Otherwise, please send us a chat or e-mailsound@straffordpub.com immediately so we can address the problem.If you dialed in and have any difficulties during the call, press *0 for assistance.Viewing QualityTo maximize your screen, press the F11 key on your keyboard. To exit full screen,press the F11 key again.

FOR LIVE EVENT ONLYFor CLE purposes, please let us know how many people are listening at yourlocation by completing each of the following steps: In the chat box, type (1) your company name and (2) the number ofattendees at your location Click the SEND button beside the box

If you have not printed the conference materials for this program, pleasecomplete the following steps: Click on the sign next to “Conference Materials” in the middle of the lefthand column on your screen. Click on the tab labeled “Handouts” that appears, and there you will see aPDF of the slides for today's program. Double click on the PDF and a separate page will open. Print the slides by clicking on the printer icon.

Concierge Medicine:Key Legal and Ethical ConsiderationsOverview and Practice ModelsRobert M. Portman, JD, MPProb.portman@ppsv.comPowers Pyles Sutter & Verville, PC

Road Map Overview of Concierge Medicine and Models Federal Legal Issues State Insurance and Other Laws Private Insurance Issues Contracting Issues Ethical Considerations Tips to Reduce Risk1501 M Street NW Seventh Floor Washington, DC 20002 202-466-65506

Concierge Care a/k/a “boutique” or “retainer” medicine Reasons for development lower reimbursement payment denials, delays rising malpractice premiums greater liability risk/regulatory burdens increasing overhead/paperwork higher patient loads1501 M Street NW Seventh Floor Washington, DC 20002 202-466-65507

Concierge Care Potential Risks Medicare, state insurance laws, private insurancecontracts Ethical dilemmas Contract issues Positive outcomes Personal care Professional satisfaction May make preventative care affordable and accessible1501 M Street NW Seventh Floor Washington, DC 20002 202-466-65508

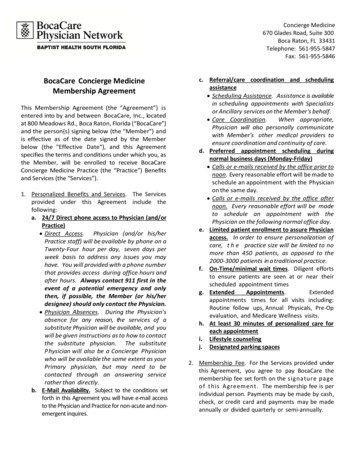

Concierge Care Common Characteristics Primary care Fixed monthly or annual fee Limited number of patients—300-800 Special services/attention Greater physician access Plan of care Amenities Must pay retainer to receive any services1501 M Street NW Seventh Floor Washington, DC 20002 202-466-65509

Services Provided Typical Services/Amenities priority/extended/Sat. appointments nicer, less crowded waiting rooms 24/7 pager/email/cell phone access house calls/visits to specialists preventive/wellness care telephone/email consultations Prescription/claims assistance1501 M Street NW Seventh Floor Washington, DC 20002 202-466-655010

Services Provided Premium Services Unlimited appointments Same day appointments All physician office services covered Transportation Spa-like amenities (bathrobes/slippers) “free” x-rays1501 M Street NW Seventh Floor Washington, DC 20002 202-466-655011

Practice Models Non-participation (no insurance)/all preventive andprimary care Participation (accepts insurance)/retainer only coversnon-covered services Participation/amenities only Fees for extra services1501 M Street NW Seventh Floor Washington, DC 20002 202-466-655012

Practice Models Variations Hybrid—concierge and non-concierge services withinsame practice Direct Care—retainer plus high deductible insurance Bifurcated corporate structure Franchise/Practice Management Direct non-physician ownership—only in states withweak corporate practice of medicine laws1501 M Street NW Seventh Floor Washington, DC 20002 202-466-655013

Practice Models Key Decisions Participation vs. Non-participation All concierge vs. hybrid What services included in the fee What fees to charge Size of patient panel Independent practice or affiliate with franchise ormanagement company1501 M Street NW Seventh Floor Washington, DC 20002 202-466-655014

The Numbers 750-2000 doctors 200,000 patients Retainer fees ranging from 600-30,000 100-500 patients Concierge practices in most states All but 11 states have concierge practices (per 2010MedPAC report)1501 M Street NW Seventh Floor Washington, DC 20002 202-466-655015

Concierge Care Examples MD2 – www.md2.com Seattle based/closed model started in 1996 Original concierge practice Now has offices in Portland, Chicago, and Dallas Mercedes medicine All the primary care you want for 13.5-20K/year Plus spa-like amenities, physician escort for specialist visits,prescription drug pickup/drop-off service Guaranteed same day appointments 50 families per physician1501 M Street NW Seventh Floor Washington, DC 20002 202-466-655016

Concierge Care Examples MD2 Does not accept insurance Will franchise for 75k plus 5% royalty Goal is to create international network of similarpractices1501 M Street NW Seventh Floor Washington, DC 20002 202-466-655017

Concierge Care Examples MDVIP—http://www.mdvip.com/ Boca Raton based closed model Starbucks approach—over 450 physician affiliates in 32states 1500-1800 annual fee 600 patients per physician Provides standard concierge services, but does not guarantee same day appointmentsdoes not provide unlimited office-based servicesdoes not provide spa amenities1501 M Street NW Seventh Floor Washington, DC 20002 202-466-655018

Concierge Care Examples MDVIP--http://www.mdvip.com/ Does accept insurance Will franchise turn-key operation for percentage offranchisee’s concierge fees. Franchisee keeps all insurance reimbursements1501 M Street NW Seventh Floor Washington, DC 20002 202-466-655019

Concierge Care Examples Personal Physician Health Care, LLC/PCwww.personalphysicians.net Boston based/closed model Dual corporate structure- LLC and PC PC accepts Medicare/private insurance LLC provides concierge services 5,000 per patient300 patients per physician1501 M Street NW Seventh Floor Washington, DC 20002 202-466-655020

Concierge Care Examples Health Access RI Network of independent medical practices Monthly membership fee of 25-30 per month Per visit fee of 5-10 Provides primary care services Does not accept insurance1501 M Street NW Seventh Floor Washington, DC 20002 202-466-655021

Concierge Care Examples Qliance Medical Management, Inc. Seattle-based “Direct Care”—retainer for conciergeservices backed up by high deductible insurance Funded by venture capital and other investors Shows growing interest of venture capital firms in directcare model Monthly fee of 39-79 for unlimited preventive andprimary care1501 M Street NW Seventh Floor Washington, DC 20002 202-466-655022

Concierge Care Examples Other Examples SignatureMD—Arizona, California, Georgia, Indiana,Missouri, Montana, New York, Oklahoma, Pennsylvaniaand Washington D.C Concierge Choice Physicians (National)-- 199 annual fee PartnerMD—Virginia, NC, SC, IL, CO, TX, WA Pinnacle Care—coordination of care only1501 M Street NW Seventh Floor Washington, DC 20002 202-466-655023

Concierge Medicine: Key Legal ConsiderationsBest Practices to Comply with Medicare RegulationsMay 22, 2013Julie Kass410-347-7314jekass@ober.comwww.ober.com

Concierge Medicine Under Medicare Secretary of HHS, 2002: Physicians participating in Medicare can chargepatients a special fee to provide services that arenot covered by Medicare25www.ober.com

Medicare Reimbursement Issues Participating physicians Medicare pays physicians 80% of fee scheduledirectly Physician bills patient co-payment of 20% 80% plus 20% is payment in full Non-participating physicians Patients pay physician Patients seek reimbursement from Medicare Limiting charge 115% of Medicare26www.ober.com

Medicare Reimbursement Issues Opting Out Physician has private agreement with Medicarebeneficiary and Medicare is not billed byphysician or patient for any services provided byphysician Review Medicare’s Opt-Out rules carefully Be certain to properly opt out before billing anypatients Failure to properly “opt-out” renders any contractsentered into with Medicare beneficiaries void andnullifies the physician’s decision to opt-out27www.ober.com

Medicare Reimbursement Issues Physicians who opt-out may not receive ANYremuneration from Medicare, including sharing inpractice income where other practice physicianshave not opted out for two years Other physicians in practice are not required toopt-out Recognize that opt-out is for two years28www.ober.com

Medicare Prohibition Physicians cannot charge patients for servicesalready covered by Medicare Applies to participating and non-participatingphysicians Violation of assignment agreement and carries civilmoney penalties Opt-out physicians are not subject to rule29www.ober.com

Medicare Coverage Issues What does practice bill patient for? Medicare prohibits billing patients for coveredservices beyond limiting charges Unclear distinction between “covered” and “notcovered”30www.ober.com

Covered Services Generally, routine photocopying, routine overhead(including malpractice insurance costs, heating,lighting, staff salaries, etc), supplies, rent, continuededucation or certification fees Malpractice fees31www.ober.com

Covered Service? Annual Wellness Physical Medicare covers annual wellness visit Is it the same as an annual physical? Many screening tests now covered But, covered under specific intervals Women’s health issues: screening pap tests, pelvicexams, and mammography Medicare enrolled physicians with retainer practices mustclearly be certain they are well aware of current Medicarecoverage guidelines32www.ober.com

Non-Covered Services Same day appointments Cell phone access Email consultations/texting Lectures to patients on wellness Claims facilitation Home visits Access that has been explicitly expanded in measurableways Is this enough?33www.ober.com

Non-Covered Services Additional or extra-ordinary services CDs, booklets, or pamphlets prepared by thephysician regarding the patient’s health, wellbeing, or a plan to achieve either Testing or treatment that is explicitly notcovered by Medicare Any other services which provide a genuinevalue and which are not part of a patient’scovered service34www.ober.com

Non-Covered Services and New Technology Providing test results faster and through differentmediums? Providing additional electronic aids to help patients Additional monitoring services35www.ober.com

Government Pronouncements 2002 - Congress sent letter to HHS and OIG Alleged that fees charged by MDVIP violatedMedicare limiting charge rules and false claimsact HHS response did not call practices illegal as longas charges were for non-covered services Cautioned that physicians entering arrangementsshould seek legal counsel36www.ober.com

Government Pronouncements 2004 - OIG Alert to physicians about addedcharges for covered services 2004 OIG settlement with physician for PersonalHealth Care Medical Care Contract with 600annual fee 2007 OIG settlement for over 100,000 withphysician in North Carolina allegedly violatingCivil Money Penalty Law for violating assignmentagreement37www.ober.com

OIG Roadmap for New Physicians:Avoiding Medicare Fraud and Abuse OIG education materials to teach physicians Issued in 2011 Specifically discusses “’boutique, concierge,retainer’” practices Explains that can’t get paid a second time for aMedicare covered service IMPORTANT – Explicitly states that it is legal tocharge for service not covered by Medicare Access fees or administrative fees are not allowedwhere they are to obtain Medicare covered services38www.ober.com

OIG Roadmap for New Physicians:Avoiding Medicare Fraud and Abuse Specifically notes CMP settlement Physician paid 107,000 to resolve allegations ofcharging patients annual fee for Medicarecovered services Fee covered Annual physical, same or next-dayappointments, dedicated support personnel,around the clock physician availability,prescription facilitation, expedited andcoordinated referrals, and other amenities atthe physician’s discretion39www.ober.com

OIG Roadmap for New Physicians:Avoiding Medicare Fraud and Abuse Alleged violation of assignment agreement becauseSOME of the services were already covered byMedicare Legality of agreement turns on what additional feescover40www.ober.com

Potential Fraud and Abuse Issues When dealing with Concierge PracticeManagement Companies be sensitive to: State Fee Splitting Prohibition: prevent aphysician from sharing any part of their feeswith a third-party without the third-partyperforming certain substantive services e.g., often payments are appropriate, butneed to be tied to the value of the services Potential kickback issues for marketing; seeAdvisory Opinion 10-23 (November 4, 2010)41www.ober.com

Concierge Medicine: Key LegalConsiderationsState LawsPrivate InsuranceContracting IssuesRobert M. Portman, JD, MPProb.portman@ppsv.comPowers Pyles Sutter & Verville, PC

State Insurance Law Unlicensed insurance companies? Practices that provide health care services for fixed,prepaid fee may be health plans under state insurancelaws (e.g., Knox-Keene Act in California) No other entity in chain of treatment/payment toaccept risk/subject to state regulation (e.g., reserverequirements) If practice goes under, patients left high & dry Ex.: Washington medical group offered their own insuranceplan that was put in state receivership1501 M Street NW Seventh Floor Washington, DC 20002 202-466-655043

State Insurance Law Potential State Insurance Requirements If a concierge practice is subject to state insurance regulations, itcould have to meet requirements such as Capital maintenance Reserve requirements Filings Certificate of authority In Florida in order to obtain a certificate of authority, an insurer mustmaintain a surplus of not less than five million dollars for a propertyand casualty insurer, or 2.5 million for any other insurer.In Washington in order to obtain a certificate of authority, theinsurer must maintain four to five million dollars in combinedcapital and surplus funds.1501 M Street NW Seventh Floor Washington, DC 20002 202-466-655044

State Insurance Laws Other Potential State Law Limitations State law might preclude physicians who have contractswith health insurers from collecting anything other thancopayments and deductibles from patients. Some states might also preclude or limit balance billing byout-of-network physicians who have no insurancecontracts. Other states might prevent HMOs and other insurers fromcontracting with providers whose services are not equallyavailable to all plan members within the same class.1501 M Street NW Seventh Floor Washington, DC 20002 202-466-655045

State Insurance Laws State of Washington In 2003, Washington considered requiring conciergepractices to obtain a certificate of registration as ahealthcare service contractor or HMO. Instead in 2007, Washington required by law thatconcierge practices (or “direct practices”) must Inform patients if the practice does not accept insurance, aswell as about the services they provide.Return any fees held in trust, if the physician/patientrelationship ends.Only raise fees once per year.Submit annual statements to the Insurance Commissioner.1501 M Street NW Seventh Floor Washington, DC 20002 202-466-655046

State Insurance Laws State of Maryland Maryland Insurance Administration 2008 report detailed certainindicators that a practice might be engaging in the unauthorizedbusiness of insurance: Annual retainer fee covers unlimited office visits or a limited number of servicesthat the physician cannot reasonably provide to each patient in his or her panel.No limitations on the number of patients accepted into the practice.Annual retainer fee does not represent the fair market value of the promisedservices.Physician has substantial financial risk for the cost of services rendered by otherproviders.The retainer agreement is non-terminable during the contract year and/or doesnot provide for pro-rated refunds.1501 M Street NW Seventh Floor Washington, DC 20002 202-466-655047

State Insurance Laws State Limitations on Concierge Medicine West Virginia – Determined that a physician providingcare for a flat fee was operating as an unlicensed insurer. New Jersey - Warned that NJ physicians serving on HMOor PPO panels could not require a concierge fee, because itdiscriminates against HMO and PPO patients. New York - Issued an informal warning against doublebilling for services already covered by private insurance. Reoccurring Issue: Which services are covered and which arenot?1501 M Street NW Seventh Floor Washington, DC 20002 202-466-655048

State Insurance Laws Positive State Trends WVA legislature has pilot program allowing physicians/healthclinics to charge prepaid fee for primary care and preventiveservices Florida – Found that MDVIP did not require an insurancelicense because the concierge fees were not consideredinsurance. Massachusetts – Found that Personal Physicians Healthcaredid not violate state insurance laws, and the state licensingboard for physicians also found that the concierge model waslegal.1501 M Street NW Seventh Floor Washington, DC 20002 202-466-655049

State Insurance Laws Analysis MD2 model may be most vulnerable provides unlimited service for prepaid feeaccepts risk Way to reduce risk Put fees in trust or escrow account?1501 M Street NW Seventh Floor Washington, DC 20002 202-466-655050

Other State laws Abandonment Concierge docs must be careful in how theydrop patients who do not become members Must provide adequate written notice andappropriate referrals Do not leave patients in unstable condition;provide transition care Check state law1501 M Street NW Seventh Floor Washington, DC 20002 202-466-655051

Other State laws Corporate Practice of Medicine For franchise/practice management models, physiciansmust control medical decision-making Anti-kickback (all payor)/Fee Splitting Will affect franchise or practice management fees Franchise Laws Check to see if state franchise laws apply iffranchise/practice management model is chosen1501 M Street NW Seventh Floor Washington, DC 20002 202-466-655052

Private Insurance Balance Billing and Nondiscrimination Most provider agreements and some state insurance lawspreclude balance billing of covered patients for covered services Key is to show these are not covered services However it is not always easy to distinguish what is a coveredservice and what is not. Examples: 24/7 doctor availability, physical examinations, andcoordination of care with specialists Notice to patients Nondiscrimination issue1501 M Street NW Seventh Floor Washington, DC 20002 202-466-655053

Private InsuranceNegative ReactionsPositive Reactions Premera Blue Cross in Regence Blue Shield inWashington and Blue Shield ofRochester: extra fees violatebalanced billing and nondiscrimination laws Harvard Pilgrim Health Care inMass: no longer contracts withphysician groups that chargeaccess fees Cigna and United Healthcare inFlorida and Texas: physicianconcierge care practices nolonger qualify for their networksWashington: extras fees okay aslong as for noncovered services BCBS of Mass: will contractwith concierge practices as longas they notify patients of natureof practice and fee structure1501 M Street NW Seventh Floor Washington, DC 20002 202-466-655054

Private Insurance Dr. Steven D. Knope of Arizona In 2008 Dr. Knope gave a high-profile interview about the benefitsof concierge medicine in eliminating the interference of third partypayers. A week later, Blue Cross Blue Shield called Dr. Knope to cancel his15 year contract stating that he had violated the contract bypracticing concierge medicine. Dr. Knope explained that he does not accept insurance from hisconcierge patients, but that he still saw 100 regular patients whowere covered by BCBS. BCBS still canceled his contract and his patients were forced to findanother doctor.1501 M Street NW Seventh Floor Washington, DC 20002 202-466-655055

Contracting Issues Business Entity-Practice Contracts If franchise/practice management modelchosen, business entity will need to enter intocontracts with participating medical practices Contract will specify whether business entity orpractice will collect retainer fees Practice receives license to use entity’s name andlogo1501 M Street NW Seventh Floor Washington, DC 20002 202-466-655056

Contracting Issues Business Entity-Practice Contracts Practice should retain control over physician’s services Specify that parties are independent contractors andcompany does not have control over medicalservices provided by practice to avoid CPM issuesPractice agrees to follow company’s standards andguidelinesFees in compliance with state AK/fee splitting laws1501 M Street NW Seventh Floor Washington, DC 20002 202-466-655057

Contracting Issues Sample practice contracts provisions: Liability insurance Mutual indemnification provisions Clearly defined services company will provide for practice (see next slide)Payment from practice to franchise companyPractice model/sizeServices practice will provideWhether practice will accept insuranceTerm and terminationNon-compete and other restrictive covenantsHIPAA BA agreement if entity touches PHI1501 M Street NW Seventh Floor Washington, DC 20002 202-466-655058

Contracting Issues Franchise/Practice Management Services Patient demographic analysis Initial and follow up mailings; other marketing Patient education seminars Processing membership enrollments Staff support Billing & Collections of membership fees Electronic medical records After hours call center Access to lower cost liability insurance and otherproducts/services1501 M Street NW Seventh Floor Washington, DC 20002 202-466-655059

Contracting Issues Patient Contracts- should contain: Services covered by the subscription fee What services/costs are not covered and any out-of-pocket costs Whether the physician accepts Medicare/private insurance When the retainer fee is payable/refundable When services covered by Medicare or private insurance will bebilled or collected How much practice will charge for services not covered byretainer fee1501 M Street NW Seventh Floor Washington, DC 20002 202-466-655060

Contracting Issues Patient Contracts Contract should specify duration of membership andwhether it automatically renews or patient mustaffirmatively renew Patient should be able to terminate without financialpenalties or excessive inconvenience Patient must be able to understand the contract andsign it voluntarily—practice staff assistance Contract should not make exaggerated claims about thequality of care1501 M Street NW Seventh Floor Washington, DC 20002 202-466-655061

Concierge Medicine: Key Legal ConsiderationsGuidelines and TipsMay 22, 2013Julie Kass410-347-7314jekass@ober.comwww.ober.com

Guidelines for Contracting With Patients AMA Ethical Guidelines AMA acknowledges that retainer contractsenhance patient choice and pluralism in thedelivery and financing of health care. However, AMA is concerned that a proliferation ofretainer practices might “threaten access to care” The AMA provides that retainer contracts: Be entered into without duress, with fulldisclosure (including any knowledge thephysician has regarding the patient’sinsurance coverage)63www.ober.com

Guidelines for Contracting With Patients AMA Ethical Guidelines The AMA provides that retainer contracts: Must be cancelable without financial penalty or “undueinconvenience” Cannot promise “more or better diagnostic andtherapeutic services”– a guideline which conflicts with the physician’s obligation to provide“more” in return for non-covered service fees In sum, AMA cautions against a physician’s use unfairpersuasion in the contracting process and emphasizesthe need to uphold quality of care standards for bothretainer and non-retainer patients alike64www.ober.com

Guidelines for Contracting With Patients Where a physician runs a “dual” practice (serving bothretainer and non-retainer patients) they must provide thesame level of diagnostic and therapeutic service to both Physician must facilitate transfer of patients to otherphysicians where necessary, or, if no other physicians areavailable, they must continue to treat them Contracts should clearly and specifically describe all “noncovered” services and physicians must always be honestin their insurance or other payor billings65www.ober.com

Tips to Reduce Risk Charge retainer fees only for noncovered medicalservices Take proper steps to transfer nonparticipating patientsto other competent physicians Fully inform patients which services are covered by theannual fee, which are covered by insurance, and whichwill require additional out-of-pocket payments by thepatient66www.ober.com

Tips to Reduce Risk Follow carefully rules for opting out of Medicare as wellas the termination provisions in agreements withmanaged care and other insurers For those who do not opt out of Medicare or privateinsurance, do not require insured patients to pay aretainer fee as a condition of receiving covered services To avoid bumping up against state insurance laws, donot offer all necessary medical services in exchange for afixed, prepaid fee; rather provide clearly defined servicesfor retainer fee67www.ober.com

www.ober.comPrincipal, Ober Kalerjekass@ober.com410.347.7314100 Light StreetBaltimore, MD 21202Julie E. Kass focuses her practice on the fraud andabuse aspects of Medicare and Medicaid, includingthe federal Stark and antikickback laws, OIGexclusion authorities and civil money penalties. Inaddition, Julie is a leader in the firm's ACO workinggroup, assisting various clients in navigating CMS'ACO rules and application procedures. Sherepresents a variety of health care entities, includinghospitals, large physician practices, physicaltherapy companies, and long-term care facilities.www.ober.com/attorneys/julie-kass

Robert M. PortmanRobert M. Portman is a principal in the law firm of Powers PylesSutter and Verville PC in Washington, DC. Mr. Portmanconcentrates his practice in health and association law, focusingon certification law, administrative law, antitrust law, litigation,transactions, election and lobbying law, and legislation andregulation in the health care field. He represents a wide range ofnon-profit health care organizations including a large number ofnational professional societies, trade associations, other healthcare associations, voluntary health organizations andcertification bodies, as well as numerous individual physicians,physician practice groups and other health care providers.Robert M. PortmanPrincipalPowers Pyles Sutter &Verville PC1501 M Street NWSeventh FloorWashington, DC 20005202-466-6550 Main202-872-6756 DirectRob.Portman@ppsv.com1501 M Street NW Seventh Floor Washington, DC 20002 202-466-6550

Concierge Care Examples MD2 - www.md2.com Seattle based/closed model started in 1996 Original concierge practice Now has offices in Portland, Chicago, and Dallas Mercedes medicine All the primary care you want for 13.5-20K/year Plus spa-like amenities, physician escort for specialist visits, prescription drug pickup/drop-off service