Transcription

MORTGAGE CLEARING CORPORATIONMCC CorrespondentUser Guide5/20/2022MCC Correspondent General Guidelines and Procedures

Table of ContentsEligible Mortgage Loans . 5Loan Registration and Lock Policies . 6Loan Registration and Purchase Procedures. 8Loan Delivery and Purchase Procedures . 10Post Purchase Procedures . 13Product Descriptions . 15Conforming Fixed Rate . 16FHA Fixed Rate. 20HUD Section 184. 23USDA Rural Development. 26Veterans Administration . 29MCC Required File Stacking Order . 33File Stacking Order--Conventional. 34File Stacking Order-- FHA 203b & HUD 184. 35File Stacking Order--VA. 36File Stacking Order--Rural Development . 37MCC Correspondent Client Guide, rev. 05-20-22Page 2 of 37

Doing Business with MCC Correspondent LendingGeneralThis Guide provides you general information you will need in order totransact business with Mortgage Clearing’s Correspondent Division. Pleasedirect questions to the Correspondent Division associates at their directnumbers and addresses shown below.MCC BusinessHours andHolidayScheduleCorrespondent business hours are between 8:30 a.m. and 5:00 p.m. (CT),Monday through Friday. MCC is closed on the following holidays:New Year’s DayMemorial DayIndependence DayLabor DayThanksgiving DayThe Friday after ThanksgivingChristmas DayCorrespondent Mark W. FranksDivisionVice-PresidentManager918-749-2274 Ext. 234markfranks@mortgageclearing.comCorrespondent Ben OvertonOperationsLead Underwriter918-749-2274 Ext. 238boverton@mortgageclearing.comBarbara WilsonCorrespondent Liaison918-749-2274 Ext. 230bwilson@mortgageclearing.comJohn Nolte918-749-2274 Ext.242Funding & Acquisition Manager jnolte@mortgageclearing.comLock DeskAnd LoanRegistrationlocks@mortgageclearing.comLoan Servicing Faith CrenshawServicing Portfolio ManagerMCC Correspondent Client Guide, rev. 05-20-228:30 a.m. – 6:00 p.m. CST918-749-2274 Ext. 212faithc@mortgageclearing.comPage 3 of 37

Doing Business with MCC Correspondent LendingWire TransferSend Wire To:Routing Number/ABA:For Credit Of:Account Number:The Bankers Bank1030 0361 6Triad Bank, National Association90304For Further Credit:Account Number:Attention:Mortgage Clearing Corporation100-6940Chris JonesMortgageeClauseMortgage Clearing CorporationISAOA5612 South Lewis Ave.Tulsa, OK 74105FHA ID3931809996VA ID86501100007USDA ID12345678910Fannie Mae12230-000-5UCDPAggregator ID KPF351MailingAddressMortgage Clearing Corporation5612 South Lewis AvenueTulsa, OK 74105MCC Correspondent Client Guide, rev. 05-20-22Page 4 of 37

Eligible Mortgage LoansEligiblePropertyStatusAll loans must be secured by a first lien mortgage on a one-to-two familyresidential dwelling located in the following states: ArizonaArkansasColoradoKansas MissouriNevadaNew MexicoOklahoma TexasUtahClients are responsible for adhering to all federal, state, and local lawsand/or regulatory lending guidelines and licensing requirements.EligibilityRestrictionsProperty Types Not Eligible: : Conventional Condos Cooperatives Manufactured Homes 3-4 Unit Properties Unique PropertiesLoan Types Not Eligible: High Cost Loans *Sec.32* Temporary Interest Ratebuy-downs Loans with non-MCCapproved DPA programsBorrowerRestrictions non-conforming with Fannie Mae, FHA,VA, HUD 184, & USDA Properties with appraisal condition andQuality ratings exceeding C4 and Q5 Collateral Underwriter risk assessmentrating of 999 without MCC approval. Properties that are encumbered with aprivate transfer fee. non-conforming with Fannie Mae, FHA,VA, HUD 184, & USDA guidelinesSeasoned Loans: Loans rejected by or repurchased from another investor non-conforming with Fannie Mae, FHA, VA, HUD 184, & USDABorrower Types Not Eligible: Borrowers without Social Security Numbers Non-Permanent Resident Aliens Trusts-Purchase TransactionsMCC Correspondent Client Guide, rev. 05-20-22Page 5 of 37

Loan Registration and Lock PoliciesDaily RatesRate sheets are published and distributed daily via email at approximately8:30 Central Time. Rates and prices are valid until 6:00 p.m. Central Timewithout overnight protection. Rates are subject to change without notice.Registrationand LockProceduresLock Desk Email address: locks@mortgageclearing.comAll loan registrations and/or locks must be completed online atwww.mcc-correspondent.com.Lock confirmations are validated upon submission. An assigned loannumber will be emailed back to the sender.All loans must have a registered lock no later than one (1) day prior todelivery.Lock Policies“Best efforts” delivery is expected on all locked loans. If a loan is locked andsubsequently closed, it must be delivered to MCC for purchase. Violationswill be subject to pair off fees and termination of the correspondentrelationship.Lock periods are available for 15, 30, 45, 60, 75, and 90 day terms.Lock confirmations are tied to the property address.Locks with expiration dates that fall on a weekend or federal holiday willexpire on the first business day following the stated expiration date.Loan amount changes by more than 10% of the original principle balancewill be subject to the worse of current market or original lock date priceapplied to the difference between the final loan amount and the loan amounton the original lock.Loans must be closed, disbursed, and delivered within the lock period toavoid a price adjustment.MCC Correspondent Client Guide, rev. 05-20-22Page 6 of 37

Loan Registration and Lock PoliciesLock PoliciesLock extensions must be completed prior to expiration. A loan may beextended up to 3 times for a maximum of 30 days after which worst casepricing will apply.Extension Fees 5 day 12.5 bps 10 day 25.0 bps 15 day 37.5 bps 30 day 62.5 bpsRe-locks and expired rate locks are reviewed on a case-by-case basis.Lock renegotiations are evaluated on a case-by-case basis.Loan fallouts are to be reported to the Lock Desk within 1 business day.MCC Correspondent Client Guide, rev. 05-20-22Page 7 of 37

Loan Registration and Purchase ProceduresGeneralAll closed loans are required to be delivered by 3:00 pm CST on or prior tothe lock expiration date. Loans not received by the expiration date must beextended or relocked in accordance with the Lock Policies.DocumentsAll documents must conform to Fannie Mae, Ginnie Mae, FHA, VA, USDA,and ONAP 184, Insurer, Guarantor, Agency, and document custodialrequirements, as applicable for the loan product and terms.All documentation obtained in originating, processing, underwriting, andclosing the loan must be delivered to Mortgage Clearing Corporation.Borrower names and property addresses must be identical on the Note,Security Instrument, Title Commitment, Flood Certificate, Appraisal, HazardInsurance Policy, and AUS findings.For amortizing payments Mortgage Clearing Corporation calculates interestusing a 30/360 calendar year. Interest per diem is calculated using a 365calendar year.InterestCalculationLoans closed more than 60 days prior to delivery to Mortgage ClearingCorporation are not eligible for delivery.Age of LoanLoan packages must be delivered to Mortgage Clearing Corporation’sServicing Center utilizing our File Transfer Protocol or by mail to:DeliveringLoan PackagesMortgage Clearing CorporationCorrespondent Lending5612 S. Lewis Ave.Tulsa, OK 74105-7107MCC Correspondent Client Guide, rev. 05-20-22Page 8 of 37

Loan Registration and Purchase ProceduresDocumentTransfer EngineMCC Correspondent Lending provides a transport mechanism for yourorganization to electronically transfer your loan documents (preferably in aPDF format) to our secure Web site using off-the-shelf FTP software. Yourdocuments are transferred to a secure, password protected folderdesigned specifically for your organization.MCC Correspondent Lending will assign a person in your organization witha security user id and password which automatically points their server orPC to a private and secure transport folder on the MCC CorrespondentLending website. Only your organization and MCC CorrespondentLending can “see” this folder.The only requirement is for your organization to arrange the loan file in theMCC Correspondent Lending preferred stacking order before transmission.This enables our purchasing manager to quickly find and verify thecontents of the loan file.When we receive the mortgage note via overnight mail, we will “accept” thefile and transfer it to our on-site digital mortgage server. It is then deletedfrom our website.We strongly recommend FileZilla which can be easily downloaded to yourlocal PC pe clientDocuments can be sent 24 hours a day, 7 days a week.There are several ways to package and send these loan documents. Oneloan at a time or, several loans at a time. Assigning a loan number andlast name as the file name is the preferred nomenclature.MCC Correspondent Lending will provide more detailed informationincluding the secure user id and password when you are ready toproceed.MCC Correspondent Client Guide, rev. 05-20-22Page 9 of 37

Loan Delivery and Purchase ProceduresOn-Time DeliveryLoans must be closed, dispersed, and delivered within the lock period toavoid a price adjustment.Late DeliveryA loan delivered after the lock expiration is considered a late delivery. Latedelivery loans will be re-priced to the “worse of” extended original price orcurrent market price.PurchaseEvaluationProcessMCC will perform a thorough review of every closed loan file prior topurchase to ensure quality and marketability. Every file will be reviewed for,but not limited to, the following: Underwriting & Program GuidelinesRequired Credit & Compliance documentationCollateral/PropertyRequired Closing documents & formsSecondary Marketing requirementsSuspended LoansMCC will notify via e-mail if any documentation is missing or needscorrection. The Correspondent shall have five (5) business days, includingthe date of notification, to correct deficiencies for any loan that had "ontime" delivery as noted above. (Note: To avoid extension fees, MCC mustpurchase the loan on or before the fifth 5th business day.)Fees to beNet-FundedFees and escrow impounds shall be deducted from each wire uponpurchase of the loan.WiringInstructionsAs noted on the Closed Loan Checklist, please include a copy of the wiringinstructions with each file to expedite funding.Purchase/FundingCertificate(Funding BreakDown Sheet)MCC will provide a funding schedule via fax or e-mail for each loan on thedate of purchase. The summary will itemize the principal balance, purchaseprice, fees, interest, etc.MCC Correspondent Client Guide, rev. 05-20-22Page 10 of 37

Loan Delivery and Purchase ProceduresSeasoning/Amortizingthe Principal LoanBalanceLoans with less than 15 days between MCC's purchase/funding dateand the borrowers "first" and/or "next" payment due date will requireMCC to "season" (reduce) the loan balance prior to purchase based onCorrespondents payment letter including escrow funds. If additionalprincipal or escrow impounds are received the Correspondent mustforward them immediately. (Note: MCC will require a pay history on allloans that have had a payment made by the borrower to theCorrespondent).Flood InsuranceCertificates and FloodInsurance:Flood Certifications - MCC requires a FEMA Standard Flood ZoneDetermination Certificate with Life of Loan Monitoring on all mortgageloans.Flood Insurance - Flood insurance is required if the certificationindicates that the property is located within a flood zone. The minimumcoverage required would be equal to the loan amount or the maximuminsurance available under the National Flood Insurance Programwhichever is less. The maximum deductible is the higher of 1,000 or1% of the face value of the policy on all loans submitted.Note EndorsementThe Note must have a complete endorsement chain ending withMortgage Clearing Corporation.The Correspondent name on the front of the Note and in theendorsement language must match exactly.Only officers authorized on the most recent Corporate Resolution mayexecute the endorsement.The endorsements to the Note should indicate the following:Pay to the order of Mortgage Clearing Corporation without recourse(Lender printed name)By: (Signature of Authorized Officer)Name: (Printed)Title: (Printed)MCC Correspondent Client Guide, rev. 05-20-22Page 11 of 37

Loan Delivery and Purchase ProceduresAlonge to the NoteThe Alonge must indicate the following information and be fullyexecuted by an authorized agent:(a) Borrower(s) Name(b) Subject Property Address(c) MCC Assigned Loan Number(d) Note Date(e) Loan Amount(f) Investor # (if applicable)Interest CreditClosingMCC will purchase loans utilizing interest credits when the loandisbursed between the 1st and the 15th of the month subject to loanprogram restrictions.Escrow ImpoundsMCC requires a 2-month cushion for escrow impounds on all loans.Escrow WaiverA minimum FICO Indicator Score of 680 is required for anEscrow Waiver.Escrow Waiver LetterIf the loan does not have escrows collected on the HUD-1, an EscrowWaiver Letter should be in the file and contain the following borroweracknowledgements: Borrower(s) are responsible to pay the taxes/insurance on thesubject property. Borrower(s) will provide MCC with proof of payment annually. Borrower(s) are aware that if they fail to pay the taxes/insurance,MCC has the right to revoke the Escrow Waiver and force placeinsurance, and pay the taxes and charge the borrower(s)accordingly.InsuranceMortgagee ClauseMortgage Clearing Corporation, its successors and/or assigns,5612 South Lewis, Tulsa, OK 74105.Mortgage InsuranceRequirementsStandard MI insurance is required. MCC will permit the minimumrequired MI percentage of coverage allowable per the DU Findings.Reduced MI is not accepted.MCC Correspondent Client Guide, rev. 05-20-22Page 12 of 37

Post Purchase ProceduresGeneralThe following steps are required to ensure a seamless transfer ofservicing responsibilities.Goodbye Letter toBorrowerCorrespondents are required to notify the borrower(s) upon transfer ofservicing. A copy of the “Goodbye Letter” shall be provided in the loansubmission file to MCC. (Note: This letter should not be provided to theBorrowers at closing OR sent out prior to MCC's purchase of the loanfile).Transfer of ServicingLetterThe Correspondent is responsible for preparing a notification of loansale and/or change of servicer form, which must be sent to all applicableparties. (Note: These letters are required to be sent to all applicableparties, only AFTER the loan has been purchased by MCC. Pleaseindicate MCC's servicing address and phone #, etc. on all out-goingletters).FHA Servicer/HolderTransferServicer/Holder transfer must be processed within 30 days of purchasevia The FHA Connection.Escrow Paymentsand Disbursements toMI Co., Tax Offices,and Insurance Co.Monthly Mortgage Insurance Premiums. If the Borrowers monthly MIpremium is due prior to MCC's purchase of the loan, the Correspondentwill be responsible for forwarding all monthly MI disbursements to the MICompany in order to keep the MI policy active and the Borrowerpayments up to date and current.Tax Payments due at closing or prior to MCC's purchase. TheCorrespondent will be responsible for collecting and disbursing allsubsequent tax payments due at closing or due 45 days after closing.Taxes are to be paid on the "due" date NOT the delinquency date.Hazard Insurance Payments. On a purchase transaction, theCorrespondent is responsible for ensuring that the annual hazardinsurance policy premium is paid in full at closing. On a refinancetransaction the Correspondent will be responsible for the next "annual"payment due if the current policy expires 30 days after closing.MCC Correspondent Client Guide, rev. 05-20-22Page 13 of 37

Post Purchase ProceduresFinal DocumentsFinal documents (recorded Mortgage/Deed of Trust, recordedAssignment, MICs, LGCs, Final Title, etc.) should be forwarded to MCC.Final documents must be received within 60 days of purchase.Payment ProcessingAfter MCC's purchase of the loan, Borrowers should send monthlypayments to the following address:Mortgage Clearing CorporationP.O. Box 702100Tulsa, OK 74170Year End InterestReportingMCC will report, to the IRS, interest paid by the borrower starting withthe "first" payment received by MCC after the purchase of the loan. TheCorrespondent is responsible for reporting to the IRS any discountpoints and interest paid by the borrower to them, in full. (Note: Interestmay include, any interest paid by the borrower where a Correspondentmay have had to collect one or more Mortgage payments from theborrower prior to MCC's purchase).MCC Correspondent Client Guide, rev. 05-20-22Page 14 of 37

Product DescriptionsConventional ProductsFannie Mae Fixed RateFHA ProductsFHA Fixed RateHUD ProductsSection 184 Fixed RateUSDA ProductsUSDA Rural Development Fixed RateVA ProductsVA Fixed RatePlease note:To access any website link supplied in the sections below, pleasecopy and paste the complete address into your browser.MCC Correspondent Client Guide, rev. 05-20-22Page 15 of 37

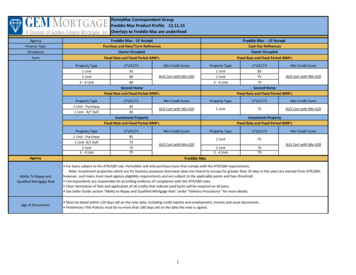

FANNIE MAE FIXED RATEDESCRIPTION First lien, fully amortizing, Fannie Mae Fixed Rate 30, 25, 20, 15or 10 year termProduct codes: C30, C25, C20, C15, C10ELIGIBLE STATES Arizona, Arkansas, Colorado, Kansas, Missouri,Nevada, Oklahoma, Texas, UtahMAXIMUMLTV/CLTV/HCLTV Follow Fannie Mae Eligibility y information/eligibility-matrix.pdfMINIMUM LOANAMOUNT 50,000.MAXIMUM LOANAMOUNT 1-2 Unit - 647,200 High balance loans: Eligible areas in Colorado and Utah imits Loans must have been closed no more than 60 days prior todelivery.Loans previously rejected by or repurchased from MCC areineligible.Loans rejected by or repurchased from another investor areineligible.AGE OF LOAN /PRIOR REJECTS ASSUMPTIONS Not allowedBOND PROGRAMS Not allowedBUYDOWNS Not allowedCOMMUNITYSECONDS Not AllowedPURCHASETRANSACTIONS TOTRUSTS Not AllowedMCC Correspondent Client Guide, rev. 05-20-22Page 16 of 37

FANNIE MAE FIXED RATE Lenders must request credit scores for each borrower from eachof the three credit repositories with a three in-file merged creditreport. See LLPA matrix on rate sheet for FICO minimums. Borrowers with no score Non-traditional credit are allowed subjectto Fannie Mae guidelines with AUS approval.DEBT TO INCOMERATIO Max 50.00% with 700 FICOMax 45.00% with 700 FICOUNIFORMAPPRAISALDATASET Minimum Condition Rating accepted-C4Minimum Quality Rating accepted-Q5ESCROWHOLDBACKS Escrow Holdbacks must be completed prior to loan purchase, asevidenced by satisfactory final inspectionESCROW WAIVERS Not allowed on LTV’s greater than 80%.A minimum FICO Indicator Score of 680 required.If the subject property is located in a special flood hazard zonerequiring flood insurance, escrow of the flood insurance premiumis required.An escrow waiver fee is applicable for any escrow waiver. Tribal LandLeaseholdCooperativesCondominiumsManufactured Housing & Mobile HomesUnique propertiesProperties that are encumbered with a private transfer fee.CREDIT SCOREINELIGIBLEPROPERTY TYPEMCC Correspondent Client Guide, rev. 05-20-22Page 17 of 37

FANNIE MAE FIXED RATEINTEREST CREDITAT CLOSING NATURAL DISASTERPOLICY MORTGAGEINSURANCE NON-ARM’S LENGTHTRANSACTIONSUNDERWRITINGCannot exceed 7 calendar days and must be used to reduceclosing costs. Cannot result in cash back to the borrower atclosing.Correspondent represents and warrants the existence andcondition of the subject property at time of purchase.A Property Condition Certification is required for appraisalscompleted within 90 days of the disaster declaration.Eligible Mortgage Insurers are Essent Guaranty, Genworth,MGIC, Radian, and United Guaranty.Single premium financed MI permitted.LPMI permitted per Fannie Mae Guidelines.Reduced MI is not accepted For the purchase of newly constructed properties, if the borrowerhas a relationship or business affiliation (any ownership interest,or employment) with the builder, developer, or seller of theproperty, MCC will only purchase mortgage loans secured by aprincipal residence. MCC will not purchase mortgage loans on newly constructedhomes secured by a second home or investment property if theborrower has a relationship or business affiliation with the builder,developer, or seller of the property. DU Approve/Eligible required with findings finalized and releasedto MCC.Third-party contract underwriting not accepted by MCC unlessapprovedUnderwriters must be employees of the Correspondent. MCC Correspondent Client Guide, rev. 05-20-22Page 18 of 37

FANNIE MAE FIXED RATETo access the following web site addresses please copy and paste the address intoyour browser.Each loan must comply with all Fannie Mae Guide requirements. Fannie MaeGuidelines may be accessed from Fannie Mae’s website www.efanniemae.com or onAllRegs.Fannie Mae Seller eringFannie Mae Eligibility ty information/eligibility-matrix.pdfFannie Mae DU QuickSteps index.jspMCC Correspondent Client Guide, rev. 05-20-22Page 19 of 37

FHA FIXED RATEDESCRIPTION First lien, fully amortizing FHA Fixed RateFHA Section 203(b) & 234(c)30, 25, 20, & 15 year termsProduct codes: F30, F25, F20, F15ELIGIBLE STATES Arizona, Arkansas, Colorado, Kansas, Missouri,New Mexico, Nevada, Oklahoma, Texas, UtahMIN/MAX LOANAMOUNT Follow FHA guidelines for the applicable county/MSA, FHAprogram section, and loan purpose.Minimum loan amount 100,000. AGE OF LOAN /PRIOR REJECTS Loans must have been closed no more than 60 days prior todelivery.Loans previously rejected by or repurchased from MCC, FHA orGNMA are ineligible.Loans previously rejected by or repurchased from a privateinvestor, unless such prior rejection / repurchase is fully andspecifically disclosed to MCC in the loan file and MCC determinesthe loan is eligible for purchase regardless of the prior investor’sdetermination.CREDIT SCORE Each borrower must have a minimum of two credit scores.Minimum 660 FICO indicator score.DEBT TO INCOMERATIO Max 50.00% with 700 FICOASSUMPTIONS Owner occupied full qualifying only.BOND PROGRAMS MCC must be the Master Servicer.BUYDOWNS Not allowed.Max 45.00% with 700 FICOMCC Correspondent Client Guide, rev. 05-20-22Page 20 of 37

FHA FIXED RATECREDIT REJECT Loans with a Credit Reject on FHA Connection not allowed.DOWN PAYMENTASSISTANCE All down payment assistance programs must be approved byMCC. Government entity approved DPA programs only.ESCROWHOLDBACKS Escrow Holdbacks must be completed prior to loan purchase, asevidenced by satisfactory FHA final inspection.ESCROW WAIVERS Not allowed.INELIGIBLEPROPERTY TYPE LeaseholdCooperativesSecond HomesManufactured Housing & Mobile HomesUnique propertiesInvestmentINTEREST CREDITAT CLOSING Cannot exceed 7 calendar days and must be used to reduceclosing costs (e.g., cannot result in cash back to the borrower atclosing).NATURAL DISASTERPOLICY Correspondent represents and warrants the existence andcondition of the subject property at time of purchase.A Property Condition Certification is required for appraisalscompleted within 90 days of the disaster declaration. MCC Correspondent Client Guide, rev. 05-20-22Page 21 of 37

FHA FIXED RATENON-ARM’S LENGTHAND CONFLICT OFINTEREST Not allowed if new construction and the borrower is the builder oraffiliated with the builder/developer.OCCUPANCY Primary only.PRINCIPALCURTAILMENTAT CLOSING May not exceed lesser of 2% of loan amount or 500.Must be reflected as a Principal Curtailment on the HUD-1.STREAMLINEREFINANCE Streamline refinances must have a 660 minimum FICO IndicatorScore.Manual underwrite only.No late mortgage payments in the last 12 months.Documentation required: Tri-merge credit report, Verification of sufficient assets to close Income verification:A. Salaried i.most recent paystubii.written VOEiii.employment and income completedon 1003B. Self-employedi.Executed 4506ii.employment and income completedon 1003 UNDERWRITING DU Approve/Eligible through FHA TOTAL Scorecard required.Clear CAIVRS, LDP and GSA search required.Each loan must comply with all FHA requirements. FHA Guidelines are available atwww.hud.gov or on All Regs.MCC Correspondent Client Guide, rev. 05-20-22Page 22 of 37

HUD SECTION 184DESCRIPTION HUD Section 184, Indian Home Loan Guarantee ProgramFirst lien, fully amortizing Fixed Rate30 year termPrimary Residences onlyOne Unit dwellings onlyFee simple ownership onlyProduct Code HUD184ELIGIBLE STATES Arizona, Arkansas, Colorado, Kansas, Missouri,New Mexico, Nevada, Oklahoma, Texas, UtahMIN/MAX LOANAMOUNT Follow HUD 184 guidelines for the applicable HUD 184 loanpurpose.Minimum loan amount 100,000. AGE OF LOAN /PRIOR REJECTS Loans must have been closed no more than 60 days prior todelivery.Loans previously rejected by or repurchased from MCC, FHA orGNMA are ineligible.Loans previously rejected by or repurchased from anotherinvestor are ineligibleASSUMPTIONS Not allowedBUYDOWNS Not allowedCREDIT SCORE Each borrower must have a minimum of two credit scores.Minimum 660 FICO score indicator.MCC Correspondent Client Guide, rev. 05-20-22Page 23 of 37

HUD SECTION 184DOWN PAYMENTASSISTANCE All down payment assistance programs must be approved byMCC. Government entity approved DPA programs only.DEBT TO INCOMERATIO DTI 41% requires prior approval by ONAP.Max 43% DTI allowed.ESCROWHOLDBACKS Escrow Holdbacks must be completed prior to loan purchase,and evidenced by satisfactory final inspection.ESCROW WAIVERS Not allowedINELIGIBLEPROPERTY TYPE Tribal LandLeaseholdInvestmentCooperativesSecond HomesCondominiumsManufactured Housing & Mobile HomesUnique propertiesNATURAL DISASTERPOLICY Correspondent represents and warrants the existence andcondition of the subject property at time of purchase.A Property Condition Certification is required for appraisalscompleted within 90 days of the disaster declaration. MCC Correspondent Client Guide, rev. 05-20-22Page 24 of 37

HUD SECTION 184NON-ARM’S LENGTHAND CONFLICT OFINTEREST Not allowed if new construction and the borrower is the builder oraffiliated with the builder/developer.OCCUPANCY Primary only.PRINCIPALCURTAILMENTAT CLOSING May not exceed lesser of 2% of loan amount or 500.Must be reflected as a Principal Curtailment on the HUD-1.UNDERWRITING Must be manually underwritten by Correspondent ONAPapproved Direct Underwriter Approval (DUA) Underwriter, or priorapproved by ONAP.Clear CAIVRS, LDP and GSA search required. Each loan must comply with all ONAP Section 184 Indian Home Loan Guarantee Programhttps://www.hud.gov/program offices/public indian housing/ih/homeownership/184MCC Correspondent Client Guide, rev. 05-20-22Page 25 of 37

USDA RURAL DEVELOPMENTDESCRIPTION USDA Rural Development Guaranteed Fixed RateFirst lien, fully amortizing Fixed Rate30 year termPrimary Residences onlyProduct code RD30ELIGIBLE STATES OklahomaPROPERTYELIGIBILITY Property Eligibility must be verified at the following link,and retained in the ty/welcomeAction.do?pageAction sfp&NavKey property@11MIN/MAX LOANAMOUNT Follow USDA RD Guaranteed Loan Program Guidelines for maximumloan amounts, property location, income limits, and loan purpose.Minimum loan amount 100,000. AGE OF LOAN /PRIOR REJECTS Loans must have been closed no more than 60 days prior to delivery.Loans previously rejected by or repurchased from MCC, FHA orGNMA are ineligible.Loans previously rejected by or repurchased from another investorare ineligible.ASSUMPTIONS Not allowedBOND PROGRAMS Not allowedBUYDOWNS Not allowedCREDIT SCORE Each borrower must have a minimum of two credit scores.Minimum 660 FICO score indicator.M

For Further Credit: Mortgage Clearing Corporation Account Number: 100-6940 Attention: Chris Jones Mortgage Clearing Corporation ISAOA 5612 South Lewis Ave. Tulsa, OK 74105 3931809996 86501100007 12345678910 12230-000-5 Aggregator ID KPF351 Mailing Address Mortgage Clearing Corporation