Transcription

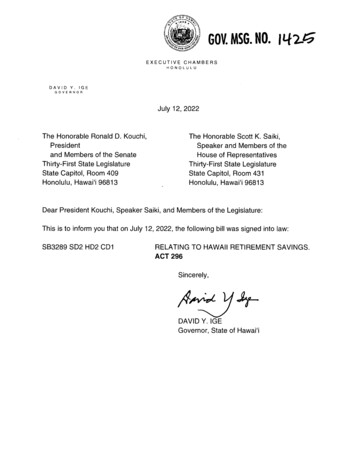

I 7 \\,.\Gov. MSG. N0.425EXECUTIVE CHAMBERSHONOLULUDAVID Y. IGEGOVERNORJuly 12, 2022The Honorable Ronald D. Kouchi,Presidentand Members of the SenateThirty-First State LegislatureState Capitol, Room 409Honolulu, Hawai‘i 96813The Honorable Scott K. Saiki,Speaker and Members of theHouse of RepresentativesThirty-First State LegislatureState Capitol, Room 431Honolulu, Hawai‘i 96813Dear President Kouchi, Speaker Saiki, and Members of the Legislature:This is to inform you that on July 12, 2022, the following bill was signed into law:883289 SD2 HD2 CD1RELATING TO HAWAII RETIREMENT SAVINGS.ACT 296Sincerely,DAVID Y. IGEGovernor, State of Hawai‘i

Approved by the GovernorJULOH‘1 2 2022ACT 2 9 6S B. NO. S.D.2.'THE SENATETHIRTY-FIRST LEGISLATURE.2022STATE OF HAWAII3289H.D. 2C.D. 1A BILL FOR AN ACTRELATING TO HAWAII RETIREMENT SAVINGS.BE IT ENACTED BY THE LEGISLATURE OF THE STATE OF HAWAII:lSECTIONl.The purposeof this Act is to establisha2state—facilitated payroll—deduction retirement savings plan for3private sector4employeesin Hawaiiwho donot have access toii‘e‘mployer-sponsored retirement plans.The Hawaii RevisedSECTION 2.56adding7asa newStatutes ischapter to be appropriately designated and to readfollows:8"CHAPTER9HAWAII RETIREMENT SAVINGSl01112131415§beamended bycited§-1Shorttitle.This chapter shall be known andas the Hawaii Retirement Savings-2Definitions.As usedAct.in this chapter, unless thecontext otherwise requires:"Board" means the Hawaii retirement savings boardestablished under section-3.l6"Covered employee" means anl7(1)Is18(2)Is eighteen years ofaindividualresident of the State;2022-3237 SB3289CD1 SMA.dOClfl“WWWmmmmmflmagemayor older;who:

Page2M m (OSB. NO.Olmwg’pFDANN(3)Is in the employ of(4)Receives wages or other remunerations from a coveredemployerincomeacovered employer; andfor services rendered thattaxto sectionas compensationare subject topaid in the State pursuant235—34."Covered employee" does not include anindividual covered underthe federal Railway Labor Act (45 United Statesoron whosebehalf the employermakesCodechaptercontributions toa8)Taft-Hartley multiemployer pension trust fund.10"Covered employer" means any person whois in business inllthe State and has one or more individuals in employment.12"Covered employer" does not include:l3(l)TheUnited States;l4(2)TheState or any of15(3)Aits politicalsubdivisions; orperson that has been maintainingfor allemployeesretirement plan thatl6during the preceding two yearsl7is tax-qualified under or is described inl8satisfies the ;equirements of section 401(a), 401(k),l9403(a), 403(b), 408(k), or 408(p) of the Internal20Revenue Code.2022-3237 SB3289CD1 SMA.dOCaand

3.3. No.2%:H112CI11"Department" means the department of labor andindustrialrelations."Director"meansthedirector of laborandindustrialrelations."Individual retirement account" or "IRA"traditional orRothmeans aindividual retirement account or individualretirement annuity under section 408(a), 408(b), orInternal11Revenue Code" means the1986, as amended(title"Participant"26IRA under the program13program.InternalRevenue Codeindividualwhois contributing toor has an IRA account balance under the"Person" means anyindividual, firm, association,15organization, sole proprietorship, partnership,16corporation, joint venture, trust, or any other form ofl7business, legal entity, or group of individuals.18l9ofof the United States Code).means an12l4of theRevenue Code."Internal10408Acompany,"Program" means the Hawaii retirement savings programestablished pursuant to this chapter.2022—3237 SB3289 CD1 SMA.dOCan

3.3. No.2%:HI12CI11"Roth IRA" means a Roth individual retirement account orindividual retirement annuity under section408Aof the InternalRevenue Code.“Special fund"meansthe Hawaii retirement savings specialfund established in section-8."Total fees and expenses"expenses, including but notmeansallfees, costs, andlimited to administrativeexpenses,investment expenses, investment advice expenses, accountingcosts, actuarial costs, legal costs, marketing expenses,l0education expenses, trading costs, insurance annuitizationllcosts, and other miscellaneous costs."Traditional12IRA" means atraditional individual retirementtraditional individual retirement annuity13account orl4section 408(a) or15"Wages" hasl6§-3(b)theof the Internalsame meaning asunderRevenue Code.in section388—1.Hawaii retirement savings board; establishment;is established within the department forl7purpose.18administrative purposes only,a Hawaiil9tostate—facilitated payroll—20deduction retirement savings program for private—sector(a)Thereimplement and administer a2022-3237 SB3289CD1 SMA.dOCretirement savings board

Page5S.B. NO.333.920.1953—ANemployees who do not have access to employer-sponsoredretirement plans.shall consist of nineboard(b)The(1)Two exofficio, votingmembers asmembers whofollows:shall serveas theco-chairs of the board, consisting of:(A)Thedirector or the director's designee;(B)Thedirector of finance or the director'sanddesignee;(2)l0Two ex(A)officio,A membernonvoting members, consisting of:of the house of representativesllappointed by the speaker of the house of12representatives; and(B)13of the senate appointed by the presidentof the senate; andl415A member(3)Five voting memberswhoshall holdnoother public16office, tol7the board in accordance with section 26-34, consistingl8of:19(A)be appointed by the governor and serve onOne memberwith professional knowledge20experiencein establishing retirement21plans and retirement investment products;2022-3237 SB3289CD1 SMA.dOCllflHWmmmmmmmfllmmandsavings

SB; No. 3.92F); 9F?(B)(C)6NOne memberrepresenting the interests of smallbusinessesin Hawaii;One memberwith professional knowledgeandexperience in representing the interests ofemployers(D)One memberwith professional knowledgeexperiencein representing the interests ofemployees(E)in terms of retirement savings;andin terms of retirement savings;One member whoisaretireeandresides inwhoHawaii,-representing retirees in Hawaii.10llThe terms(c)of boardinitialmembersshallbefour years;for staggered12provided that the13terms, as determined by the governor; provided further that ex-l4officio15appointing authority.l6appointments shall beboard members shall serve at the pleasure of the(d)Asimple majority of voting members of the board shall17constitute18shalll9present.20authority of the remaining21the board.quorumtodo business.be approved by a simple2022-3237 SB3289membersCD1 SMA.dOCaction taken by the boardmajority of the votingAny vacancy on the boardAll decisions ofAnymembersshall not impair theto exerciseallthe powers ofthe board shall be reduced into

3.3. No.2.23.92HI120111writingandshall state separately the board's findings of factand conclusions.(e)The membersof the board shall serve withoutcompensation but shall be reimbursedfor their actualandnecessary expenses, including travel expenses, incurred incarrying out their duties.(f)board,board, orThemay employ anand 89, and other10s-4(a)12law to:co—chairs with the approval of theexecutive director exempt from chaptersstaff necessary to perform its duties.shallhave powers andduties in accordance with13(1)Establish, implement, and maintain the program;l4(2)Causethe program and arrangements and accounts15established under the program to16established, and operated:l7(A)be designed,In accordance with best practices for retirementsavings vehicles;l81976Hawaii retirement savings board; powers; duties.The board11its(B)To encourageparticipation, saving,sound20investment practices, and appropriate selection21of default investments;2022-3237 SB3289CD1 SMA.dOC

Page85.3. No.(C)To maximizesimplicity 3.9;HI12CI11of administrationand easefor employers;(D)minimize costs, including by collectiveToinvestment and other measures to achieveof scaleeconomiesandother efficiencies inprogram design and administration;(E)To promote(F)Toportability of benefits;andavoid preemption of the program by federallaw;10(3)ll12(4)Determine theeligibilityofan employer, employee,(5)Ensure the program's compliancelaws and(6)withEstablish procedures for the timelyresolution of participant18to accounts or program operation;(7)Develop and implement:2022-3237 SB3289allapplicableregulations;l719pooled investmentother individual to participate in the program;1516common, andof assets of the program;l3l4for collective,ArrangeCD1SMA.docandandfairother disputes relatedor

Page9S.B. NO.33.92HI12CLX1(A)Aninvestment policy that defines the program'sis consistent withinvestment objectives and thatthe objectives of the program; and(B)Otherpoliciesand proceduresconsistent withthose investment objectives;(8)incurred toCause expensesinitiate,implement,maintain, and administer the program to be paid fromthe program and other available sources;(9)andcollect application, account,andadministrative fees;1011Establish(10)Accept grants,gifts,donations, legislative12appropriations, loans, and other13State, any unit of federal, state, or locall4government, or any other person to defray the costs of15administering and operating the program;l6(11)moneys from theEnter into contracts pursuant to chapterl7services that the boardl8the purposes of19(A)deems103Dnecessary to carry outthis chapter, including:Services of private and public financial20institutions, depositories, consultants,21actuaries, counsel, auditors, investment2022-3237 SB3289CD1 SMA.dOCfor

SB. No. 8.92HI12CI11advisors, investment administrators, investmentmanagementfirms, other investment firms, third-party administrators, other professionalsandservice providers;(B)Research,and(C)other services; andServices of other state agencies to assist thein the exercise of itsboard(12)technical, financial, administrative,Develop and implement an outreach planand disseminatellretirement savings in general;(13)toto gain inputbeandheld and invested and reinvestedunder the program;l314Cause moneysduties;information regarding the program1012powers and(14)Ensurethatallcontributions to individual retirement15accounts under the program may be used only to:16(A)Paybenefits to participants under the program;17(B)Paythe cost of administering the program; andl8(C)Makeinvestmentsfor the benefit of theprogram;19provided that no assets of the program shall20transferred to the general fund of the State or21to any other fund of the State or otherwise2022—3237 SB3289 CD1 SMA.d0C‘be10

Page11SB. NO.encumbered or usedthose specified(15)Providefor thefor333.92HI12CI11any purpose other thanin this paragraph;paymentof costs of administration andoperation of the program;(16)forEvaluate the needand,ifthe boarddeemsnecessary, procure:(A)Insurance against any andallloss in connectionwith the property, assets, or activities of theprogram; and10ll(B)(17)Pooledprivate insurance;Indemnify, including procurement of insurancefor this12as needed13personal loss or14action or inaction15(l8)ifandpurpose, each board member fromliabilityresulting from themember'sas a board member;Collaborate with and evaluate the role of financiall6advisers or other financial professionals, including17in assisting18employees; andl920(l9)andproviding guidance for coveredReimburse, when appropriate, the general fund of theState of Hawaii for the2022-3237 SB3289CD1 SMA.dOCinitialexpensesincurred for11

3.3. No. 3.92F); F’pinitiating,—sn implementing, maintaining, andadministering the program; and(20)(b)other action the boardTake anydeemsreasonablynecessary to carry out the purpose ofthis chapter.The board may develop and disseminateinformationdesigned to educate covered employees about the impacts ofopting in to the program on take-home pay, savings strategies,and thebenefits of planningll1213level participation(c)for retirement to helpin deciding whether to participatecovered employeesl0and savingmay beandapprOpriate.Board members, the executivedirector,and other(1)Have anyinterest, directly or indirectly, in themaking of any investment under the program or15or profits accruing from any investment;(2)any program—related funds or deposits18for20(3)in gainsBorrow any program-related funds or deposits, or use17l9staffof the board shall not:1416at whatany manner,themselves or as an agent'or partner of others; orBecome anmadeinendorser, surety, or obligor on investmentsunder the program.2022-3237 SB3289CD1 SMA.dOCWWWMEIIMIMMWIW12

3.3. No.,2.23.92HD.2CL11§Hawaii retirement savings program; due diligence;-5establishment; payroll deduction upon election to contribute.(a)Thereis established within theadministrative purposes only,program.The programshallbeHawaii retirement savingsaadministered by the board, inconsultation with the departmentandfinance.The board mayfordepartment,of budgetand the departmentfordetermine the time framedevelopment and implementation of the program; provided thatprior to implementation of the10llprogram, the boardshallmeet therequirements of subsections (b) and (c).(b)Prior to implementation of the program, the board12conduct a detailed implementation and evaluation study and13perform other due diligence tasks to determine thel4of the program parameters established by this chapter15resources and time needed to implement the program.16completion of the study, the board shall reportl7recommendations, including any proposed18requirements, to the legislature.l9(c)Uponsubmittal ofits reportfeasibilityand theUponits findingslegislationandand fundingto the legislatureprior to implementation of the20pursuant to subsection (b) and21program, the board may determine the2022—3237 SB3289 CD1 SMA.dOCmaylevel of staffing necessaryl3

N m (O3.3. No.to implement the program, developtimetable,and conduct outreachan implementation01 “FJFJDANNstrategyefforts to potentialandcoveredemployers and covered employees.(d)Any covered employee mayof the employee's salary orwageselect to contributetoanaportionindividual retirementaccount provided by the program through payroll deduction.(e)Beginning on a date to be determined by the boardpursuant to subsection (a), a covered employer shall:(1)Allowa covered employeeto enroll into the program10after providing thellnotice of the employee's right to opt in; and12(2)For any covered employee who has optedl3program:l4(A)(B)writtenin to theWithheld the covered employee's contributionamount from the employee's15l6covered employee with asalary or wages;andTransmit the covered employee's payroll deductionearliestl7contribution to the program18the amount withheld can reasonably be segregatedl9from the covered employer's assets, but no20than the2022-3237 SB3289fifteenthCD1 SMA.dOCIWWWMMWHM“WWII!on thedatelaterday of the calendar month14

Page153289S.B. NO.8.0.2HI12C111following thein which the coveredmonthemployee's contribution amounts are withheld.(f)shall establish forThe programa Roth IRA,traditional(g)TheIRAin addition tocontributions toThecontributed toto contributea Roth IRA.and earnings on the amountsan employee's IRA under the programthe employee.anboard may add anall participants to affirmatively electoption foraenrolled employeeinto which the contributions deducted fromemployee's payroll shall be deposited.toeachshallState and employers shall havel0owned by11proprietary interest in the contributions or earnings in12employee's IRA.l3l4(h)Covered employersshall notmakenoancontributions,whether matching or not, to the program.(i)15The board maytol7first18for twelve consecutive 500authorize matching contributions of50,000 covered employees who§upper participant account from the special fund for thel6l9Thebe-6monthsparticipate in theprogramafter initial enrollment.Hawaii retirement savings program; contributionrates.default contribution20amount;21the payroll of a covered employee2022-3237 SB3289TheCD1 SMA.dOCWWWHMWMIMWIWwho hasamount deducted fromelected to contribute15

Page”SB. NO.3 N m (O2S.H.bEJU 2Cto the program shallbe equal1to five per cent of the coveredemployee's salary or wages; provided that an employee may electto contributehigher or lower percentage of compensation asalong as the amount does not exceed the applicable contributiondollar limitsThe program(a)shallbe aexperience10boardin(b)11Hawaii retirement savings program; program manager.-7sunder the Internal Revenue Code.shallbe managed by a4program managerfinancial institution with professionalinmanagingpayroll deductionthatknowledge andIRAs, contracted by thecompliance with chapter 103D.total feesand expensespracticable; provided that the total feesand expensesThe program managershallkeep12as low asl3of the programl4points of the total assets of the program; provided further that15this limit shall not apply during the initiall6following the establishment of the program.l7(c)each yearshall notThe program managerall participantsreportexceed seventy—five basisshall prepareto19account at least once every calendar year.2022-3237 SB3289CD1 SMA.dOCon theand makeavailablestatus of each participant'sl8athree—year period16

Page17S.B. NO.-8Hawaii retirement savings special fund.is established withinthe state treasurya333-9(a)ThereHawaii retirementsavings special fund, into which shall be deposited:(l)Moneysappropriated to the fund by the legislature;(2)Moneystransferred to the fund from the federalgovernment, other states, andtheir politicalsubdivisions;(3)Feescollected by the board in relation to n of the program;and donations madeto the board fordeposit into the fund;(5)l3Moneys(A)collected for the fund from:Contributions to, or investment returns or assetsof, the program; orl4(B)15Other moneys collected by orfor theprogram orl6pursuant to arrangements established under the17program,to the extent permitted under federal18l9(6)state law;on moneys depositedin thefund; and2021Interest earned or accruedand(7)Penalties collected pursuant to section2022-3237 SB3289CD1 SMA.dOC-l4.17

3.3. No.(b)Allmoneys33.92HI12CI11in the special fund are appropriated forthe purposes of and shall be expended by the department to paythe administrative costs and expenses of the program, programcontributions to participant accounts,manager, matchingadministrative costsperformance ofitsand expensesand thethat the board incurs in theduties under this chapter, and to reimbursethe general fund of the State of Hawaii for theinitialincurred for initiafiing, implementing, maintaining,expensesandadministering the program.10s-9Protection fromliability;employers.llcovered employer or other employer,shall be12responsibility for:13(l)(2)liable for orbeardecision to opt in or not participate inInvestment decisionsmade bythe participants and theboard;l617Nothe program;1415An employee's(a)(3)Théadministration, investment, investment returns, or18investment performance of the program, including anyl9interest rate or other rate of return earned20contribution or account balance; provided that the21employer played no role2022-3237 SB3289CD1 SMA.dOCon anyin the investment;18

Page 193.3. No.23?(4)design or the benefits paid toThe programparticipants;(5)Individuals'awareness of or compliancewith theconditions and other provisions of the tax laws thatdetermine:(A)individuals are eligible toWhichmaketax-favored contributions to IRAs;(B)Thepermissible amount of contributions;(C)Thetime frame and manner within whichcontributions are to10ll(6)Anyandbe made;loss, failure to realize any gain, or any other12adverse consequences, including any adverse tax13consequences or lossl4public assistance, or other benefits, incurred15person as al6Anyl7to the action or inaction of the program manager.(b)18Noresult ofof favorable tax treatment,programloss, deficiency, orparticipation; ordamages caused bycovered employer or other employerto be,shallshall20program or any other arrangement under the program.2022-3237 SB3289CD1aSMA.docIMWIWIWIHWlfllmmmllflor relatedbe, orfiduciary in relation to thel9be consideredby any19

Page 20§22392S B NO-10liability;Protection fromdepartment of labor andState.industrial relations,The(a)State,Hawaii retirementsavings board, Hawaii retirement savings program, and otherdepartments, agencies, boards, commissions, and programs of theState and any officers or employees thereof:(1)Shall not be responsible for compliance by coveredemployers or otherindividuals with the conditionsother provisions of the Internal RevenueCodeandthatdetermine:(A)10Which covered employees or otherlleligible to12IRAS;makeindividuals aretax-favored contributions to13(B)Thepermissible amount of contributions; andl4(C)Thetime frame and manner within whichcontributions are to15l6(2)be made;Shall have no duty, responsibility, orliabilitytoparty for the payment of any benefits under the17any18program, regardless of whetherl9available under the program to pay those benefits;2022-3237 SB3289CD1 SMA.dOCIEHflWIHHIWEIIIWMMWHsufficientfunds are20

3.3. No.2%:H112CI11(3)Shall not guarantee any interest rate or other rate ofreturnonor investment performance of anycontribution or account balance;(4)Shall notbeandliable or responsible forany loss,deficiency, failure to realize any gain, or any otheradverse consequences, including any adverse taxconsequences or loss of favorable tax treatment,public assistance, or other benefits, incurred bycovered employees or other person as aparticipating in the10ll(b)Theresult ofprogram.debts, contracts, and obligations of the programobligations of12or the board are not the debts, contracts,l3the State, and neither thel4of the State is pledged15the debts, contracts, and obligations of the program or the16board.l7S 11anyandfaith and credit nor the taxing powerdirectly or indirectly to the payment ofConfidentiality of participantand accountIndividual account information relating to18information.l9accounts under the program and relating to individual20participants, including but not limited to21telephone numbers, email addresses, personal2022—3237 SB3289 CD1 SMA.dOCnames, addresses,identification21

3.3. No. 8.92H112CI11information, investments, contributions,confidential(1)andshallbeand earnings,ismaintained as confidential:Except to the extent necessary to administer theprogramina mannerconsistent with this chapter, thetax laws of the State, and the InternalRevenue Code;or(2)Unless theisparticipantwhoprovides the information orthe subject of the information expressly agrees inwriting to the disclosure of the information.-12Collaborationandcooperation; intergovernmental;10§llinterstate.12agreement or memorandum of understanding with the State or anyl3agencyl4enforcement and compliance services, or15dissemination of information pertinent to the program, subjectl6tol7and other agencies of the State.18a(a)The board mayenter intoanintergovernmentalof the State to receive outreach, technical assistance,confidentiality(b)Thecollection oragreement deemed appropriate by the boardState and any department, board, commission, orthat enter intoorofl9agency20understanding pursuant to this section shall collaborate to21provide the outreach, assistance, information, and compliance oran agreement2022—3237 SB3289 CD1 SMA.dOCmemorandum22

SB. No.other services or assistance to the board.Memorandaunderstanding executed pursuant to this sectionmay*8?ofcover thesharing of costs incurred in gathering and disseminatinginformationand the reimbursementof costs for any enforcementactivities or assistance.(c)The board maymemorandumenter intoacontract, agreement,of understanding, or other arrangement tocollaborate, cooperate, coordinate, contract, orcombineresources, investments, or administrative functions with otherentities, including other states orany oftheir10governmental11agencies or instrumentalities that maintain or are establishing12retirement savings programs compatible with the program,l3including collective,14funds of other states' programs with which the assets of the15program andl6invested, to the extent necessary or desirable for the effective17and18program consistent with the purposes setl9including the purpose of achieving economies of scale20efficiencies designed to minimize costs for the21participants.common,or pooled investments with othertrust are permittedefficientby law to becollectivelydesign, administration, and implementation of the2022-3237 SB3289CD1 SMA.docforth in this chapter,and otherprogram andits23

3.3. No.-13sCivil actions.filecivilaHD.2CI11Any covered employee deniedenrollment into the program in violation of sectionmay 3.92-5(e)(l)action against the covered employer to requirethe covered employer to enroll the covered employee into theprogram and recover costs, including reasonable attorneys' fees,incurred in the-14§enrollllaction.Penalties.a covered employee(a)Any covered employer whointo theprograminfails toaccordance with-5(e)(l) without equitable justification shallsection10civilbeliable:(1)Tothe covered employee, in an amount equal to the12contributionl3employeel4six per cent per year15beginning from the date the contribution would havel6been madel7the contribution amount and interest thereto shall be18transmitted by the covered employer to the program to19be20(2)Aamountinto thethat wouldprogram andon thehave been made by theinterest atcontributionarate ofamount,into the account; provided that thesumofpaid into the covered employee's IRA; andpenalty of:2022-3237 SB3289CD1 SMA.dOCIllMMWIMMWMWWHMW24

3.3. No.(A)for 25for 50tobeHI12CI11each month the covered employee was notenrolled in the program;(B) 3.92andeach month the covered employee continuesunenrolled in the program after the date onwhich a penalty has been assessed with respect tothe covered employee who had elected toparticipate in the(b)program.Any covered employer whofails to timely transmitacovered employee's payroll deduction contribution to the program-5(e)(2) shall10pursuant to section11sanctions imposed on an employer for misappropriation of12employee wage withholdings and thel3388.l4(c)Noimposed on a covered employer16establish by17employer:(1)2021a preponderance(2)samepenalties pursuant to chapterif'the(b)shallbecovered employer canof the evidence that the coveredExercised reasonable diligence to meet therequirements of section19subject to thepenaity under subsections (a)(2) and1518be-5(e);Did not know or reasonably should not have known thatthefailure existed;2022-3237 SB3289CD1 SMA.dOCWWWMWWMMmmand25

SB. No.failure within ninetyCures the(3)28.92HI12CI11days of the day thecovered employer was given actual notice of thefailure or shouldtothat the failure existed,is earlier.whichever(d)have knownAny covered employer who otherwisecomply with anyprovision of this chapter or rules adoptedliable forpursuant to this chapter shall beless than 500violates or failsforapenalty ofnoviolation or failure; provided that theeachpenalties shall not exceed 5,000 per calendar year.10All or part of(e)the penalties imposed under subsectionsll(a)(2) and12the penalties wouldl3relative to the violation or failure involved; provided that thel4covered employer can establish, by a preponderance of the15evidence, the existence of equitablel6violation or failure.l718l9‘2021(f)(b) may be waivedTheto the extent that the payment ofbe excessiveor otherwise inequitablejustification forpenalties under this section shallthebe depositedinto the special fund.§-15Rulemaking.(a)with the department of budgetpursuant to chapter2022-3237 SB328991Theanddepartment,finance,mayin consultationadopt rulesto govern the actions of the board.CD1 SMA.dOC26

Page”S.B.NO.3289 0.2HIlZCI11The board,(b)in consultation with the departmentanddepartment of budget and finance, may adopt rules pursuant tochapter91to carry out the purposes of this chapter.Therulesadopted by the board may include but not be limited to rules andprocedures governing:(1)Enrollment and contributions to an IRA'under theprogram, including withholding by covered employers ofemployeepayroll, rights of coveredemployees, andobligations of covered employers;10(2)Withdrawals, rollovers, and direct transfers from anllIRA under the program12portability13(3)Phasingin the interest of facilitatingand maximizationof benefits;in the enrollment of eligiblecoveredl4employees by the size or type of covered employer,15beginning with thel6specified in this chapter;l7(4)initial applicabilitydateOutreach to covered employees, covered employers,18other stakeholders, and the public regarding thel9program;20(5)Actions of the program manager;21(6)Distribution of funds from the2022—3237 SB3289 CD1 SMA.dOCprogram;

8.3. No. 3.92H 12C111Portability of benefits, including the ability to(7)tax-free rollovers or transfers fromprogram to other IRAs or tomakeIRAs under thetax-qualified plans thataccept rollovers; andPrescribed forms to be used by covered employers and(8)covered employees. 16§Audits and annual reports.cause an accurate account ofreceipts,and expenditures(a)all activities,The boardshalloperations,to,be maintained in relation to theafter the first full fiscal10program and the board.11year following program implementation,12and accounts of the boardl3operations, receipts and expenditures, personnel, services, or14facilities15certified publié16limited to the review of directl7to the18any other persons who are not state employeesl9administration of the program.20auditors shall have access to the properties and records of the21program and board and may prescribe methods of accounting anduseEach year,afullaudit of thebookspertaining to the activities,of the program and the board shallaccountant.Thebe conducted by aaudit shall include but notandbeindirect costs attributableof outside consultants, independent contractors, and2022-3237 SB3289CD1SMA.doclflfllfllmmmmmmWWII!for theFor purposes of the audit, the28

3.3. No.2.23.92HI12CI11the rendering of periodic reports in relation to projectsundertaken by the program.(b)Nolater than twentydays before the conveningregular session, the board shall preparegovernor and the legislature, andan annual report(l)Themakeof eachto theand submitavailable to the public,that sh

10 ll 12 l3 l4 15 l6 l7 l8 l9 20 Page2 (3) (4) SB. NO. M m (O Olmw g'pFD ANN Is in the employ of a covered employer; and Receives wages or other remunerations from a covered employer for services rendered that are subject to income tax as compensation paid in the State pursuant to section 235—34. "Covered employee" does not include an individual covered under