Transcription

Northern Ohio AFP 2019Optimizing Your North American TreasuryStructureDoing Business in CanadaSeptember 16, 2019This presentation is delivered by PNC Bank, N.A. on the condition that it be kept confidential and not be shown to,or discussed with, any third party, including any financial institution (other than on a confidential or need-to-knowbasis with the recipient’s directors, officers, employees, counsel and other advisors, or as required by law), or usedother than for the purpose of evaluating the services in this presentation, without PNC Bank’s prior written approval.

Doing Business in CanadaPanel SpeakersJaney SiladiTreasury Director, CTPTradesmen InternationalJoseph MigliacciVice President, InternationalTreasury Advisory (Canada),PNC1

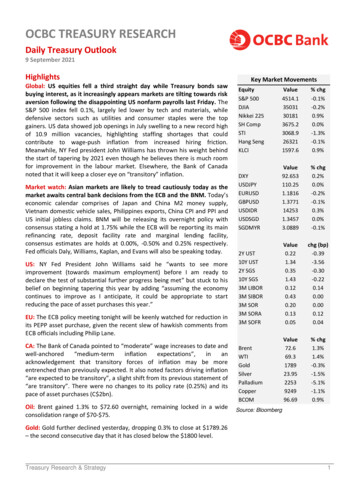

Canadian EconomyCompared to the U.S. EconomyU.S. and Canada Trade Environment 345.0US ,BillionsShare oftotal exports 342.5GDP Relative to U.S. Total100%CA75% 340.050%14.5%TX8.7%NY8.3%8.1%CanadaFL 337.525% 335.05.1%IL4.2%PA3.9%0%US Exports US Imports Share of US Share ofto ces: US Department of Commerce, Statistics Canada, Bureau of Economic Analysis, PNC Economics Calculations2

The US and Canadian economies have similarstructures and closely linked economic cyclesU.S. and Canada Economic Cycles3.0%PNC Forecasts2.5%2.0%US Federal Funds Rate1.5%1.0%Financial Market ExpectationsCanadian Policy Interest Rate0.5%0.0%Mar 14Mar 15Mar 16Mar 17Mar 18Mar 19Mar 20 Consumer Economies Dynamic manufacturing and energy industries Better population growth than other developed countries due toopenness to immigration Floating exchange ratesSources: Bloomberg, Bank of Canada, Federal Reserve, PNC Economics3

U.S. & Canada - Ideal Trading PartnersSimilarities and AdvantagesCanadian / U.S Commercial Working Relationship Favorable Exchange Rateo Strong USD creates buying/ investing opportunity in CanadaEase of Doing Businesso Cultural Elements (Labor and Employment Issues)o Geographically close to the U.S.Trade Tariff Complicationso USMCA and Section 232 – Steel and Aluminum TariffsFuture Outlooks Canada represents a stable economy in which to conduct businessSteady growth projections in the near term futureMarket Considerations Interest rate environmentNew USMCA implications, and impacts to corporationsCross border paymentso Impact of exchange rate fluctuationsTreasury centralization with consolidated reporting and visibility4

Canadian Banking EnvironmentDifferent not DifficultBanking System 82 banks in Canada vs. 6,000 in the U.S.oNationwide banking with top 5 banks (RBC, BMO, BNS, CIBC, TD)oForeign Banks include U.S., Asian and European Banks looking to service theirdomestic clients in Canada. Dual Currency Clearing Systems (CAD/ USD) Payments Canada sets payment standards (e.g NACHA) and also runs the paymentnetwork for CAD and USD Cheques, ACH and Wire Payments Modernization market initiative underway5

Canadian Banking EnvironmentDifferent not DifficultElectronic Payments ACH / EFT Payment information Same Day Clearing within Canada Canadian Same Day Transaction Limits USD Same Day ACH Cross Border Payments into Canada Same-Day ACH / EFT introduction ISO 20022 File Standardization Emergence of card for corporate paymentsCheques and Receivables Growing lockbox usage by U.S. companies to provide Canadian mailing address for cheques Remote Deposit relatively new Image Cheque Clearing in infancyCard Emergence of card for corporate payments6

Tradesmen InternationalCompany BackgroundWho We Are Founded in 1992, TradesmenInternational is North America’spremier staffing resource forproven skilled craftsmen. In2018, we sustained anoperational employee workforceof more than 11,000 monthly.These are proven craftprofessionals – covering alltrades, at all skill levels – whoserve the constructionindustry’s leading contractorsemphasizing Safety,Productivity and Craftsmanship.What We Do Workforce Optimization,servicing the followingindustries. Commercial &ResidentialConstruction Manufacturing Power (RenewableEnergy & Solar)Where We Are Headquartered in Macedonia,OH Nearly 200 locations acrossNorth America Offices located in Vancouver,BC and looking to expand Heavy Industrial Marine Skilled TradesSource: https://www.ansys.com/about-ansys7

Canadian Banking EnvironmentCurrent State Tradesmen InternationalNorth American TreasuryProcessCentralized treasurystructure – local team is mostcomfortable with themReceivablesPayables Emphasis on ElectronicReceivables In the process of convertingchecks to electronic payments Added a Canadian Lock Box Scoping Commercial Cardrequirements as it relates tooverall payment strategy. Remittance on SiteAcceptance of CardPaymentsWholesale PaymentIntegration Moving from a Tier III Merchantprocessor to First Data Canada,with an expected improvementin Working Capital. Intent is to achieve a NorthAmerican Treasury offering froma functionality and reportingperspective. Looking to use Vancouver as aTreasury proving ground forfuture office expansion.8

Key Area’s of ConsiderationDifferent not DifficultConsolidation of Treasury Management Providers Location and Needs within each country Importance of Reporting and Real Time Functionality as it relates to cash flow management Working Capital improvements Qualitative and Quantitative Benefits of Treasury ProvidersStrategic Partners from a North American Perspective Evaluation of Advantages of Single vs Group of Banking providers specific to Treasury Overall Banking Group can play a strategic role in considering banking partners Product Capability and Integration with cost consideration9

Key Area’s of ConsiderationDifferent not DifficultCard Programs Ease of Integration within a North American landscape Growth from Travel & Entertainment Program to a Procurement Program. Reporting Capabilities for Accounting as well as volume perspective Control RebateF/X Shared Services Model supporting U.S & Canada Royalties paid from Canada to the U.S, subject to exchange rate risk. Certainty of the Rate is of importance Understanding the best way to understand and manage the F/X risk10

Payments CanadaOrganizational BackgroundWho We AreWhat We Do Payments Canada is the replacement for the formerCanadian Payments Association (CPA) Headquartered in Ottawa and employee 230 fulltime staff Through formalized processes and regularinteractions, we work with financial institutions, thefederal government, the Bank of Canada, ournational stakeholders and international counterparts Payments Canada is responsible for the clearingand settlement infrastructure, processes and rulesessential to billions of dollars of exchanges eachyear in Canada The value of payments cleared by PaymentsCanada’s systems in 2018 was approximately 53trillion or 209 billion every business day Work with approximately 110 financialinstitutions, representing thousands of branches,that participate in one or more of our systemsPayments ModernizationPayments Canada is developing a modern payments system that will provide new opportunities to simplify andenhance Canadians’ daily payment interactions and help secure and strengthen Canada’s competitive positionas a global leader in financial servicesSource: https://www.payments.ca/about-us/what-we-do11

Payments ModernizationOur PerspectiveWhile there are many great benefits associated with Payments Canada’s ongoing PaymentsModernization Initiative, there are two important features that we are particularly excited about:The expansion of ACH Addenda Information will enable an easierreconciliation process for companies compared to the current-state whereACH Payments the necessary addenda information for simple reconciliation.The addition of a new Real Time Payments rail will facilitate the delivery oflow-value payments in a matter of seconds – supporting last-minute paymentneeds and providing certainty of receipt.12

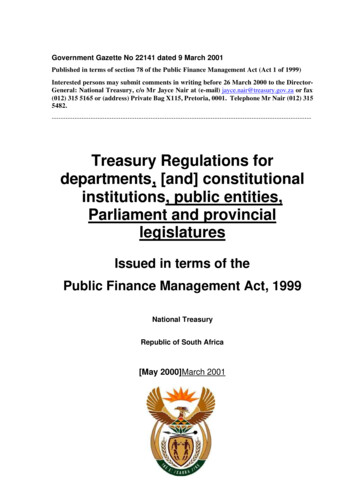

Payments Canada: Our Roadmap forFuture DevelopmentFUTURE STATECURRENT STATELarge Value TransferSystem (i.e. wires)ACSS Processes large value, timecritical payments in real-timewith settlement finality—replacesLVTSRTRReal-TimePayment SystemRETAILPayments &Enhanced AFTLYNXHigh-ValuePayment SystemLVTS Supports clearing of lower value,less time-sensitive electronic andpaper-based payments—replacesACSS Adds new capability for real-timelower value payments, withimmediate fund availability for thepayment recipientAutomated Clearingand Settlement Systemfor batch retail payments Standardized and data-rich messaging (ISO 20022) Updated policy and rules framework Enhanced risk models and oversight13

ISO 20022Worldwide InitiativesISO 20022 Global AdoptionLiveLiveLiveDKUSCMPG,RUSEPA, EULiveUKIPFALiveFIPC, CALiveLiveCHT2, ASCORESource: https://www.iso20022.org/adoption.page - As of 7.31.1814

International DiagnosticBest Practices Account Structure: Determine your optimal account structure Account Management and Visibility: Rationalize accounts Liquidity and Working Capital: Manage excess balances proactively Payments Strategy: Optimize your cross-border payments Forecasting: Guidance on implementing and managing cash-flow forecasting Intercompany Management: Advise on intercompany lending and netting15

International Market KnowledgeAdditional Resources AFP Country Profile Reportso Updated Quarterlyo Over 30 country profiles16

Questions?17

Standard DisclaimerThe web seminar and/or materials were prepared for general information purposes only and are not intended as legal, tax,accounting or financial advice, or recommendations to buy or sell securities or currencies or to engage in any specifictransactions, and do not purport to be comprehensive. Under no circumstances should any information contained in the webseminar and/or materials be used or considered as an offer or a solicitation of an offer to participate in any particulartransaction or strategy. Any reliance upon any such information is solely and exclusively at your own risk. Please consult yourown counsel, accountant or other advisor regarding your specific situation. Any views expressed in the web seminar and/ormaterials are subject to change without notice due to market conditions and other factors.In Canada, PNC Bank Canada Branch, the Canadian branch of PNC Bank, provides bank deposit, treasury management,lending (including asset-based lending) and leasing products and services. Deposits with PNC Bank Canada Branch are notinsured by the Canada Deposit Insurance Corporation or by the United States Federal Deposit Insurance Corporation.PNC is a registered service mark of The PNC Financial Services Group, Inc. (“PNC”). Bank deposit, treasury management,and lending products and services are provided by PNC Bank, National Association (“PNC Bank”), Member FDIC and awholly-owned subsidiary of PNC. Foreign Exchange and derivative products are obligations of PNC Bank, are not bankdeposits and are not FDIC insured, nor are they insured or guaranteed by PNC Bank or any of its subsidiaries or affiliates. 2019 The PNC Financial Services Group, Inc. All rights reserved.18

In Canada, PNC Bank Canada Branch, the Canadian branch of PNC Bank, provides bank deposit, treasury management, lending (including asset-based lending) and leasing products and services. Deposits with PNC Bank Canada Branch are not insured by the Canada Deposit Insurance Corporation or by the United States Federal Deposit Insurance Corporation.