Transcription

Reeve Warren Duchac10eJames M. ReeveProfessor Emeritus of AccountingUniversity of Tennessee, KnoxvilleCarl S. WarrenProfessor Emeritus of AccountingUniversity of Georgia, AthensJonathan E. DuchacProfessor of AccountingWake Forest UniversitySOUTH-WESTERNCENGAGE Learning*A u s t r a l i a B r a z i l C a n a d a M e x i c o S i n g a p o r e - S p a i n U n i t e d K i n g d o m U n i t e d S t a t e s

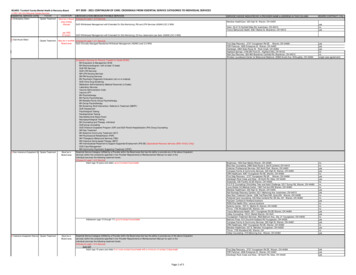

CHAPTER1Prepaid Expenses 107Unearned Revenues 109Accrued Revenues 110Accrued Expenses 111Depreciation Expense 113Introduction to Accounting andBusinessNature of Business and Accounting 2Types of Businesses 2The Role of Accounting in Business 3Role of Ethics in Accounting and Business 4Opportunities for Accountants 6Summary of Adjustment Process 115Business Connection: Microsoft Corporation i 18Adjusted Trial Balance 120Generally Accepted Accounting Principles 7Business Entity Concept 8The Cost Concept 8 .Financial Analysis and Interpretation 122The Accounting Equation 9CHAPTER 4Business Transactions and the AccountingEquation 10Completing theAccounting Cycle145Flow of Accounting Information 146Business Connection: The Accounting Equation 10Financial Statements 148Income Statement 148Retained Earnings Statement 150Balance Sheet 151Business Connection: International Differences 152Financial Statements 16Income Statement 17Retained Earnings Statement 19Balance Sheet 20Statement of Cash Flows 20,/Interrelationships Among Financial Statements 22Financial Analysis and Interpretation 23Closing Entries 152Journalizing and Posting Closing Entries 154Post-Closing Trial Balance 157Accounting Cycle 158CHAPTER 2Analyzing Transactions.51Using Accounts to Record Transactions 52Chart of Accounts 54Business Connection: The Hijacking Receivable 54Double-Entry Accounting System 55Balance Sheet Accounts 55Income Statement Accounts 56Dividends 56Normal Balances 56Journalizing 57Posting Journal Entries to Accounts 61Trial Balance 70Errors Affecting the Trial Balance 70Errors Not Affecting the Trial Balance 72Financial Analysis and Interpretation 73CHAPTER3The Adjusting ProcessNature of the Adjusting Process 102The Adjusting Process 103Types of Accounts Requiring Adjustment 104Recording Adjusting Entries 106Illustration of the Accounting Cycle 159Step 1. Analyzing and Recording Transactions in theJournal 160Step 2. Posting Transactions to the Ledger 161Step 3. Preparing an Unadjusted Trial Balance 162Step 4. Assembling and Analyzing Adjustment Data 162Step 5. Preparing an Optional End-of-Period Spreadsheet(Work Sheet) 163Step 6. Journalizing and Posting Adjusting Entries 163Step 7. Preparing an Adjusted Trial Balance 165Step 8. Preparing the Financial Statements 165Step 9. Journalizing and Posting Closing Entries 167Step 10. Preparing a Post-Closing Trial Balance 167Fiscal Year 170Financial Analysis and Interpretation 171.101Appendix: End-of-Period Spreadsheet (Work Sheet) 171Step 1. Enter the Title 171Step 2. Enter the Unadjusted Trial Balance 172Step 3. Enter the Adjustments 172Step 4. Enter the Adjusted Trial Balance 174Step 5. Extend the Accounts to the Income Statement andBalance Sheet Columns 175XXV

Step 6. Total the Income Statement and Balance SheetColumns, Compute the Net Income or Net Loss, andComplete the Spreadsheet 175Preparing the Financial Statements from the Spreadsheet 176Comprehensive Problem 1 204CHAPTER5Accounting for MerchandisingBusinesses208Nature of Merchandising Businesses 209Comparing Inventory Costing Methods 275Reporting Merchandise Inventory in the FinancialStatements 276Valuation at Lower of Cost or Market 277Valuation at Net Realizable Value 278Merchandise Inventory on the Balance Sheet 278Effect of Inventory Errors on the Financial Statement 279Business Connection: Rapid Inventory at Costco 282Financial Analysis and Interpretation 282Appendix: Estimating Inventory Cost 283Retail Method of Inventory Costing 283Gross Profit Method of Inventory Costing 284Financial Statements for a Merchandising Business 210Multiple-Sep Income Statement 211Single-Step Income Statement 215Retained Earnings Statement 215Balance Sheet 215CHAPTERBusiness Connection: H&R Block Versus the Home Depot 217Merchandising Transactions 217Chart of Accounts for a Merchandising Business 217Sales Transactions 217Purchase Transactions 223Freight, Sales Taxes, and Trade Discounts 226Dual Nature of Merchandise Transactions 2297Sarbanes-Oxley, InternalControl, and Cash304Sarbanes-Oxley Act of 2002 305Internal Control 307Objectives of Internal Control 307Elements of Internal Control 307Control Environment 308Risk Assessment 309Control Procedures 309Monitoring 311Information and Communication 312Limitations of Internal Control 312The Adjusting and Closing Process 230Adjusting Entry for Inventory Shrinkage 230Closing Entries 231Financial Analysis and Interpretation 232Appendix: The Periodic Inventory System 233Cost of Merchandise Sold Using the Periodic InventorySystem 233Chart of Accounts Under the Periodic Inventory System 234Recording Merchandise Transactions Under the PeriodicInventory System 234Adjusting Process Under the Periodic Inventory System 235Financial Statements Under the Periodic Inventory System 235Closing Entries Under the Periodic Inventory System 236Cash Controls Over Receipts and Payments 312Control of Cash Receipts 313Control of Cash Payments 315Comprehensive Problem 2 259Financial Statement Reporting of Cash 324Bank Accounts 316Bank Statement 316Using the Bank Statement as a Control Over Cash 318Bank Reconciliation 319Special-Purpose Cash Funds 323Financial Analysis and Interpretation 325CHAPTER6InventoriesControl of Inventory 264Safeguarding Inventory 264Reporting Inventory 265Inventory Cost Flow Assumptions 265Inventory Costing Methods Under a Perpetual InventorySystem 268First-ln, First-Out Method 268Last-In, First-Out Method 270Average Cost Method 271Computerized Perpetual Inventory Systems 271Inventory Costing Methods Under a Periodic InventorySystem 272First-ln, First-Out Method 272Last-In, First-Out Method 273Average Cost Method 274XXVI263Business Connection: Microsoft Corporation 326CHAPTER8Receivables349Classification of Receivables 350Accounts Receivable 350Notes Receivable 350Other Receivables 351Uncollectible Receivables 351Direct Write-Off Method for Uncollectible Accounts 352Allowance Method for Uncollectible Accounts 353Write-Offs to the Allowance Account 354Estimating Uncollectibles 355Comparing Direct Write-Off and Allowance Methods 360Notes Receivable 362

Characteristics of Notes Receivable 362Accounting for Notes Receivable 363Accounting Systems for Payroll and Payroll Taxes 445Payroll Register 446Employee's Earnings Record 449Payroll Checks 449Payroll System Diagram 450Internal Controls for Payroll Systems 451Reporting Receivables on the Balance Sheet 365Financial Analysis and Interpretation 366Business Connection: Delta Air Lines 367Appendix: Discounting Notes Receivable 367CHAPTER9Fixed Assets and Intangible.392AssetsContingent Liabilities 456Probable and Estimable 456Probable and Not Estimable 457Reasonably Possible 457Remote 457Financial Analysis and Interpretation 459Nature of Fixed Assets 393Classifying Costs 394The Cost of Fixed Assets 395Capital and Revenue Expenditures 396Leasing Fixed Assets 397Accounting for Depreciation 398Factors in Computing Depreciation Expense 399Straight-Line Method 400Units-of-Production Method 401Double-Declining Balance Method 402Comparing Depreciation Methods 403Depreciation for Federal Income Tax 404Revising Depreciation Estimates 404Disposal of Fixed Assets 406Discarding Fixed Assets 406Selling Fixed Assets 407Employees' Fringe Benefits 453Vacation Pay 453Pensions 454Postretirement Benefits Other than Pensions 455Current Liabilities on the Balance Sheet 456Comprehensive Problem 3 478CHAPTER 1 1Corporations: Organization, StockTransactions, and Dividends483Nature of a Corporation 484Characteristics of a Corporation 484Forming a Corporation 485Paid-in Capital from Issuing Stock 487Characteristics of Stock 487Classes of Stock 487Issuing Stock 489Premium on Stock 490No-Par Stock 490Business Connection: Cisco Systems, Inc. 491:Natural Resources 408Intangible Assets 409Patents 409Copyrights and Trademarks 410Goodwill 411Accounting for Dividends 492Cash Dividends 492Stock Dividends 494Financial Reporting for Fixed Assets and IntangibleAssets 412Business Connection: Hub-and-Spoke or Point-to-Point? 413Financial Analysis and Interpretation 414Treasury Stock Transactions 495Reporting Stockholders' Equity 497Stockholders' Equity in the Balance Sheet 497Reporting Retained Earnings 499Statement of Stockholders' Equity 500Reporting Stockholders' Equity for Mornin' Joe 501Appendix: Sum-of-the-Years-Digits Depreciation 414Appendix: Exchanging Similar Fixed Assets 415Gain on Exchange 416Loss on Exchange 416Stock Splits 502CHAPTER1 O Current Liabilities and Payroll436Financial Analysis and Interpretation 503Current Liabilities 437Accounts Payable 437Current Portion of Long-Term Debt 438Short-Term Notes Payable 438Payroll and Payroll Taxes 441Liability for Employee Earnings 441Deductions from Employee Earnings 441Computing Employee Net Pay 444Liability for Employer's Payroll Taxes 444Business Connection: The Most You Will Ever Pay 445CHAPTER 1 2Long-Term Liabilities: Bonds andNotes524Financing Corporations 525Nature of Bonds Payable 528Bond Characteristics and Terminology 528Proceeds from Issuing Bonds 528Accounting for Bonds Payable 529Bonds Issued at Face Amount 529XXVII

Bonds Issued at a Discount 530Comprehensive Problem 4 610Amortizing a Bond Discount 531Financial Statements for Mornin Joe 614Bonds Issued at a Premium 532Amortizing a Bond Premium 533Business Connection: Ch-Ch-Ch-Changes in Bond Trends 534CHAPTER 1 4 Statement of Cash FlowsBond Redemption 534Reporting Cash Flows 618Installment Notes 536Issuing an Installment Note 536Annual Payments 536Cash Flows from Operating Activities 619Cash Flows from Investing Activities 621Cash Flows from Financing Activities 621Noncash Investing and Financing Activities 621Business Connection: Too Much Cash! 621No Cash Flow per Share 622Reporting Long-Term Liabilities 538Financial Analysis and Interpretation 539Appendix 1: Present Value Concepts and Pricing BondsPayable 539Present Value Concepts 540Pricing Bonds 542Statement of Cash Flows—The Indirect Method 622Retained Earnings 624Adjustments to Net Income 624Dividends 629Common Stock 629Bonds Payable 630Building 630Land 631Preparing the Statement of Cash Flows 631Appendix 2: Effective Interest Rate Method ofAmortization 544Amortization of Discount by the Interest Method 544Amortization of Premium by the Interest Method 545CHAPTER 1 3Investments and Fair ValueAccounting.-.Why Companies Invest 565Investing Cash in Current Operations 565Investing Cash in Temporary Investments 566Investing Cash in Long-Term Investments 566Accounting for Debt Investments 567Purchase of Bonds 567Interest Revenue 567Sale of Bonds 568Accounting for Equity Investments 569Less Than 20% Ownership 569Between 20% and 50% Ownership 571More Than 50% Ownership 573564Statement of Cash Flows—The Direct Method 632Cash Received from Customers 633Cash Payments for Merchandise 634Cash Payments for Operating Expenses 635Gain on Sale of Land 635Interest Expense 635Cash Payments for Income Taxes 636Reporting Cash Flows from Operating Activities—DirectMethod 636Financial Analysis and Interpretation 637Appendix: Spreadsheet (Work Sheet) for Statement of CashFlows—The Indirect Method 638Analyzing Accounts 638Retained Earnings 638Other Accounts 640Preparing the Statement of Cash Flows 640Valuing and Reporting Investments 574Trading Securities 574Held-To-Maturity Securities 577CHAPTER 1 5 Financial Statement AnalysisAvailable-for-Sale Securities 578Summary 581Basic Analytical Methods 672Business Connection: Warren Buffett: The Sage of Omaha 583Horizontal Analysis 673Fair Value Accounting 583Trend to Fair Value Accounting 583Effect of Fair Value Accounting on the FinancialStatements 584Future of Fair Value Accounting 585Financial Analysis and Interpretation 585Appendix 1: Accounting for Held-to-MaturityInvestments 585Purchase of Bonds 585Amortization of Premium or Discount 586Receipt of Maturity Value of Bond 587Appendix 2: Comprehensive Income 588XXVIII617Vertical Analysis 675Common-Sized Statements 676Other Analytical Measures 678Solvency Analysis 678Current Position Analysis 679Accounts Receivable Analysis 681Inventory Analysis 682Ratio of Fixed Assets to Long-Term Liabilities 684Ratio of Liabilities to Stockholders' Equity 684Number of Times Interest Charges Earned 685Profitability Analysis 686Ratio of Net Sales to Assets 686.671

Rate Earned on Total Assets 687Rate Earned on Stockholders' Equity 688Rate Earned on Common Stockholders' Equity 689Earned Per Share on Common Stock 690Price-Earnings Ratio 691Dividends Per Share 692Dividend Yield 692Summary of Analytical Measures 692Cash Receipts Journal C-6Accounts Receivable Control Account and SubsidiaryLedger C-8Purchases Journal C-8Cash Payments Journal C-10Accounts Payable Control Account and Subsidiary Ledger C-13APPENDIX DCorporate Annual Reports 694Management Discussion and Analysis 694Report on Internal Control 694Report on Fairness of Financial Statements 695Business Connection: Investing Strategies 695Temporary Differences D-1Reporting Deferred Taxes D-3Permanent Differences D-3APPENDIX EAccounting for Deferred IncomeTaxesE-1Temporary Differences E-1Reporting Deferred Taxes E-3Permanent Differences E-3Appendix: Unusual Items on the Income Statement 696Unusual Items Affecting the Current Period's IncomeStatement 696Unusual Items Affecting the Prior Period's IncomeStatement 698Nike, Inc., Problem 724APPENDIX AInterest TablesA-2APPENDIX BReversing EntriesB-1APPENDIX CEnd-of-Period Spreadsheet (WorkSheet) for a MerchandisingBusinessD-1Special Journals and SubsidiaryLedgersC-1Subsidiary Ledgers C-1Special Journals C-1Revenue Journal C-3APPENDIX FForm 10-K Nike IncAPPENDIX GInternational FinancialReporting StandardsGlossarySubject IndexCompany IndexF-1G-1GL-11-11-12

CHAPTER 7 Sarbanes-Oxley, Internal Control, and Cash 304 Sarbanes-Oxley Act of 2002 305 Internal Control 307 Objectives of Internal Control 307 Elements of Internal Control 307 Control Environment 308 Risk Assessment 309 Control Procedures 309 Monitoring 311 Information and Communication 312