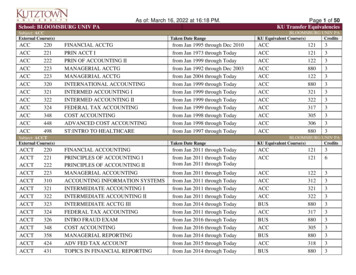

Transcription

Course DescriptionsAccounting (ACC)ACC 1150Fundamentals of Business Math3* Prerequisite(s): MAT 0950 or equivalentDesigned for the business student as areview of mathematical principles, techniques,computations, and their applications tobusiness problems. Topics include: checkingaccounts and bank reconciliations, percents,solving for the "unknown," discounts, markupsand markdowns, payroll, simple interest,discounting notes, present and future value,depreciation, inventory, taxes, insurance,stocks and bonds, annuities, sinking funds, andcalculator procedures. Lab access fee of 25 forcomputers applies. Canvas Course Mats 78/McGraw appliesACC 1750Applied Accounting4* Prerequisite(s): Appropriate placementscores or (ENGH 1005 or ENGL 1010 with agrade of C- or higher)Designed for non-accounting majors inExecutive Assistant and Paralegal. Providescomprehensive coverage of the accountingcycle for services and merchandisingorganizations. Topics include: ccounting systems, internal control, accountsreceivable, accounts payable, inventory control,and payroll. Taught in a computer environment.Lab access fee of 25 for computers applies.ACC 2010Financial Accounting3* Prerequisite(s): ENGL 1010 or ENGH 1005or higher with a minimum grade of C-, MAT1000 or higher with a minimum grade of C-, orappropriate test scores.* Corequisite(s): ACC 1150 recommended ifrequired for your degreeTeaches concepts and methods underlyingpreparation of financial statements utilizinggenerally accepted accounting principles(GAAP). Includes the accounting cycle; incomedetermination for service and merchandisingoperations; and the reporting of assets,liabilities, and owner's equity for soleproprietorships and corporations. May bedelivered online. Lab access fee of 25 forcomputers applies. Canvas Course Mats 78/McGraw applies.Utah Valley UniversityACC 2020Managerial Accounting3* Prerequisite(s): ACC 2010Focuses on the methods and tools usedto generate information for decision makingby managers within an organization andintegrates decision-making throughout thecourse. Addresses five primary topics:determining the cost of products, services,and segments of the organization; short-term/long-term role of planning in management;the control function of management. May bedelivered hybrid and/or online. Lab access feeof 25 for computers applies. Canvas CourseMats 78/McGraw applies.ACC 2110Principles of Accounting I3* Prerequisite(s): ENGL 1010 or ENGH 1005or higher with a minimum grade of C-, MAT1000 or higher with a minimum grade of C-, orappropriate test scores.Teaches basic accounting methods and toolsfor business decision making. Incorporatesfinancial and managerial accounting toprovide basic understanding of generallyaccepted accounting principles (GAAP).Applies analytical tools to assess profitability,relevant costs, and investment decisions.Canvas Course Mats of 111/McGraw applies.ACC 2120Principles of Accounting II3* Prerequisite(s): ACC 2110 with a B- or higherTeaches technical accounting concepts fromboth financial and managerial accounting.Includes generally accepted accountingprinciples (GAAP) to support understanding ofthe accounting cycle and financial statements.Includes managerial accounting topics suchas costing methods, budget preparation, andperformance evaluation tools. Canvas CourseMats of 111/McGraw applies.ACC 2125Introduction to the Accounting Profession1Teaches topics related to the accountingprofession, including career options inaccounting, certifications in accounting (CPA,CMA, CIA, CFE, etc.), ethics in theprofession, current issues in accounting,professional standards, and professionalismskills. Discusses the educational requirementsfor the accounting undergraduate and graduatedegrees.Course Catalog 2021-2022ACC 2250Accounting for Entrepreneurs3Addresses accounting issues from theperspective of an entrepreneur or smallbusiness owner. Includes choice of businessentity, payroll preparation, internal controlsystems, and the basic application of applicableincome and sales taxes. Teaches accountingsoftware to classify, record, summarize, andreport transactions and to generate financialstatements.ACC 2500Data Analytics in Accounting3* Prerequisite(s): ACC 2110 with a B- or higheror ACC 2010 with a B- or higher* Prerequisite(s) or Corequisite(s): ACC 2120or ACC 2020Introduces data analytics and data visualizationtools and techniques in accounting. Provideshands-on experience in analyzing accountingdata, creating visuals, and interpreting resultsusing various data analytics and visualizationsoftware.ACC 2600Business Law and Ethics3* Prerequisite(s): ENGL 1010* Prerequisite(s) or Corequisite(s): ACC 2110or ACC 2010Examines legal and ethical issues needed tomake sound business decisions. Provides anoverview of the legal system, constitutional law,ethical decision-making frameworks, businessentities, contract law, business crimes and torts,compliance and regulatory issues, agency law,and bankruptcy law.ACC 281RCooperative Work Experience2 to 8* Prerequisite(s): Approval of School ofBusiness Career and Corporate ManagerDesigned for accounting majors to provide onthe-job work experience that will utilize thestudent's skills and abilities in the field ofaccounting. Requires a portfolio of acquiredwork experience and enhanced skills. Includesstudent, employer, and coordinator evaluations;on-site coordinator visits; written assignments;and oral presentations. Provides experience informulating and completing individualized workexperience objectives. A maximum of 3 creditsmay apply toward graduation. May be gradedcredit/no credit.1

Course DescriptionsACC 3000Financial Managerial and Cost AccountingConcepts3* Prerequisite(s): ENGL 2010, MAT 1010 orhigher, and University Advanced StandingProvide students in computer science andthe technologies with knowledge of financial,managerial, and cost accounting conceptsand applications. Prepares students to utilizeaccounting information in making businessdecisions. May be delivered online. Lab accessfee of 25 for computers applies.ACC 3010Intermediate Accounting I3* Prerequisite(s): (ACC 2010 and ACC 2020)or (ACC 2110 and ACC 2120) each with a Bor higher, (MATH 1050, MATH 1055, or MATH1090) with a C- or higher, and UniversityAdvanced Standing* Prerequisite(s) or Corequisite(s): (MGMT2240 or MATH 1100), ACC 2125, and (ACC2500 or IM 2600)Reviews and expands on fundamentalaccounting material learned in beginningclasses. Covers an overview of the primaryfinancial statements, revenue recognition, andthe accounts on the asset portion of the balancesheet. Introduces the Conceptual Frameworkand current accounting standards to providea theoretical foundation upon which practicalapplications are based. Lab access fee of 25 applies. Canvas Course Mats 78/McGrawappliesACC 3020Intermediate Accounting II3* Prerequisite(s): ACC 3010, MKTG 220G, andUniversity Advanced Standing* Prerequisite(s) or Corequisite(s): ACC 3300Addresses debt and equity financing,investments in debt and equity securities,leases, deferred income taxes, employeecompensation (payroll and pensions), earningsper share, accounting changes, and errorcorrections. Lab access fee of 25 forcomputers applies. Canvas Course Mats 78/McGraw appliesACC 3030Intermediate Accounting for NonAccounting Majors3* Prerequisite(s): (ACC 2110 AND ACC 2120)or (ACC 2010 AND ACC 2020) and UniversityAdvanced StandingAn intermediate accounting course fornon-accounting majors with emphasis oninterpretation and use of closure notes. Addresses understandinginterrelationships among the various financialstatements and analyzing the effects oftransactions on the financial statements.Analyzes common and significant accounts/transactions, especially those relating to theliability and equity sections of the financialstatements. Canvas Course Mats 76/Wileyapplies.ACC 3120Internal Auditing3* Prerequisite(s): (ENGL 1010 or ENGH 1005),(MATH 1050 or MATH 1055 or MATH 1090 orhigher), junior standing, minimum cumulativeGPA of 3.0, and University Advanced StandingIntroduces students to the theories ofgovernance, risk, and control concepts;internal auditing standards; audit techniques;and reporting practices. Applicable acrossdisciplines.ACC 312GInternational Internal Auditing3* Prerequisite(s): (ACC 2110 and ACC 2120)or (ACC 2010 and ACC 2020), UniversityAdvanced StandingIntroduces students to the internationalinternal auditing standards; global auditingcase studies; theories of governance, risk,and control concepts; audit techniques;and reporting practices. Applicable acrossdisciplines.ACC 3300Cost Management3* Prerequisite(s): (ACC 2010 AND ACC2020) OR (ACC 2110 AND ACC 2120) eachwith a B- or higher and University AdvancedStandingProvides a strategic approach to costmanagement and the development and use ofrelevant information for management decisionmaking. Builds a foundation by discussingthe various concepts of cost, cost behavior,and cost estimation techniques. Addressescosting of products and other cost objectsusing job order and process costing, activitybased costing, and cost allocation. Introducesmanagement control topics of budgetingand performance evaluation through varianceanalysis. Concludes with current topics incost management. Lab access fee of 25 forcomputers applies.2Course Catalog 2021-2022ACC 3400Individual Income Tax3* Prerequisite(s): (ACC 2110 AND ACC2120) OR (ACC 2010 AND ACC 2020), andUniversity Advanced StandingStudies federal individual income taxes. Coversthe accounting theory and practices of federalindividual income taxation based on a study ofthe laws, regulations, and income tax decisions.Lab access fee of 25 for computers applies.Canvas Course Mats 116/Pearson applies.ACC 3510Accounting Information Systems3* Prerequisite(s): (ACC 3010 or ACC 3030)and (ACC 2500 or IM 2600) and UniversityAdvanced StandingTeaches analysis design and implementationof accounting information systems. Emphasizesaccounting cycles, internal controls, andcomputerized environments. Lab access fee of 25 applies. Canvas Course Mats 78/McGrawappliesACC 4030Governmental and Not For ProfitAccounting3* Prerequisite(s): ACC 3010 or ACC 3030,Matriculation into the Woodbury School ofBusiness, and University Advanced StandingCovers areas of governmental and notfor-profit accounting and reporting. Includesfund accounting, the budgetary process,governmental financial reporting, not-forprofit organizations, health care organizations,colleges and universities, and public sectorauditing. Lab access fee of 25 for computersapplies.ACC 4050Financial Statement Analysis3* Prerequisite(s): Matriculation into theWoodbury School of Business, and UniversityAdvanced Standing* Prerequisite(s) or Corequisite(s): ACC 3020Teachesfinancialstatementanalysistechniques and practices, such as financialmetrics, footnote disclosures, and businessprofitability. Informs decision making basedon practical analysis of financial statementinformation.Utah Valley University

Course DescriptionsACC 4110Auditing3* Prerequisite(s): ACC 312G, Matriculationinto the Woodbury School of Business, andUniversity Advanced Standing* Prerequisite(s) or Corequisite(s): ACC 3020Provides an introduction to independent auditsof financial statements in accordance withgenerally accepted auditing standards, theenvironment in which audits are performed,and professional ethics. Includes basic auditconcepts and procedures related to planning,testing internal controls, investigating reportedfinancial results of business process cycles,and required auditor communications. May bedelivered online. Lab access fee of 25 forcomputers applies. Canvas Course Mats 78/McGraw appliesACC 4140Advanced Internal Auditing3* Prerequisite(s): Matriculation into the BSAccounting degree program, and UniversityAdvanced Standing or Instructor Approval.Covers advanced topics in the theories ofgovernance, risk, and control concepts; internalauditing standards; and audit techniques.ACC 4310Advanced Management Accounting3* Prerequisite(s): ACC 3300, Matriculation intoany Woodbury School of Business bachelordegree program, and University AdvancedStandingStudies and applies advanced topics in CostManagement such as value chain analysis,activity-based management, and other currenttopics and issues in management accounting.Teaches the principles of managementcontrol including strategic planning, budgeting,performance measurement. Includes activeclass discussion, case analysis, and studentpresentations.ACC 4400Taxation of Business Entities3* Prerequisite(s): ACC 3400, Matriculationinto the Woodbury School of Business, andUniversity Advanced StandingFor accounting majors and other businessstudents. Provides an introduction andunderstanding of the construct and applicationof the federal tax laws. Studies the federaltaxation of corporations, partnerships/LLCs,estates and trusts, gifts, and exempt entitiesbased on the laws, regulations, and associatedtax decisions. Covers the professional rules,regulations, and ethical considerations imposedon tax professionals. Lab access fee of 25 forcomputers applies. Canvas Course Mats 78/Cengage applies.Utah Valley UniversityACC 4410Tax Research3* Prerequisite(s): ACC 3010, ACC 3400,Matriculation into the BS Accounting degreeprogram, and University Advanced StandingStudies theory and practice of tax research asit applies to federal income taxation laws, rulesand regulations. Applies ethical considerationsand standards to tax practice. Emphasizescomputerized tax research techniques whichwill be explored through cases dealing withadministrative aspects of the IRS, court cases,client communications and a wide variety of taxtopics.ACC 4510Information Systems Auditing3* Prerequisite(s): ACC 3510, ACC 312G,Matriculation into any Woodbury School ofBusiness program, and University AdvancedStandingProvides students a project course coveringIT audit and its impact on the financialstatement audit. Covers information security,social engineering, and fraud data mining arealso covered as they relate to accountinginformation systems and the associated data.May be delivered hybrid. Lab access fee of 25for computers applies.ACC 470RCurrent Topics in Accounting1 to 3* Prerequisite(s): ACC 3010, Matriculationinto the Woodbury School of Business, andUniversity Advanced StandingProvides opportunities for students to becomeexposed to emerging technology and topicsof current interest and demand in Accounting.Topics vary from semester to semester.Repeatable for a maximum of 3 credits towardgraduation.ACC 481RInternship2 to 8* Prerequisite(s): ACC 3010, Matriculation intothe Woodbury School of Business, Approval ofAccounting Department Internship Coordinatorand University Advanced StandingProvides accounting majors a transition fromschool to work where learned theory is appliedto actual practice through meaningful on-thejob paid experience commensurate with upperdivision classroom instruction. Includes student,employer, and coordinator evaluations, onsite work visits, written assignments, and oralpresentations. May be repeated for a maximumof 6 credits toward graduation. May be gradedcredit/no credit.Course Catalog 2021-2022ACC 490RAccounting Seminar1 to 3* Prerequisite(s): Matriculation into the BSAccounting degree program, DepartmentChair Approval, and University AdvancedStandingDesigned to provide short courses, workshops,and special programs on accounting-relatedtopics. May be repeated for a maximum of 3credits toward graduation.ACC 491RIndependent Study1 to 4* Prerequisite(s): Department Chair approvaland University Advanced StandingFor bachelor's degree students and otherinterested persons. Offers independent studyas directed in reading, individual projects, etc.,at the discretion and approval of the departmentchairperson. Repeatable for a maximum of 3credits toward graduation.ACC 5020Advanced Financial Accounting3* Prerequisite(s): ACC 3020, Matriculationinto the BS Accounting degree program, andUniversity Advanced StandingPresents accounting concepts and methodsfor business combinations, foreign currencytransactions, foreign statement translation,and partnerships. Canvas Course Mats 78/McGraw applies.ACC 5130Case Studies in Internal Auditing3* Prerequisite(s): ACC 312GTeaches student to design policies andprocedures for internal audit operations byusing risk based audit plans and developingaudit plans. May be delivered hybrid.ACC 5140Fraud Examination3* Prerequisite(s): ACC 3010 and UniversityAdvanced StandingExamines the seriousness of fraud and itsimpact on business and society. Includesforensic accounting and fraud prevention,detection, and resolution.ACC 6020Advanced Financial AccountingApplications3* Prerequisite(s): Admission to Master ofAccountancy programPresents accounting concepts, methods,and applications for business combinations,foreign currency transactions, foreign statementtranslation, and partnerships. Canvas CourseMats 78/McGraw applies.3

Course DescriptionsACC 6030Financial Accounting and Reporting3* Prerequisite(s): Acceptance into the Masterof Accountancy programFocuses on understanding the nature andfinancial reporting aspects of complex businesstransactions such as corporate acquisitions,mergers, and other strategic alliances. Includesaccounting for business combinations andthe various reporting requirements leading toconsolidated financial statements.ACC 6060Professionalism and Leadership3* Prerequisite(s): Admission to Master ofAccountancy programEnhances the ability to interact andcommunicate with others in the professionalworld. Builds skill development in oraland written communication, interviewing,networking, and leadership. Explores andenhances emotional intelligence.ACC 6130Case Studies in Auditing3* Prerequisite(s): Admission to Masterof Accountancy or Master of BusinessAdministration ProgramTeaches policies and procedures for internalaudit operations by creating risk basedaudit plans, developing audit objectives, andevaluating audit results.ACC 6140Fraud Examination and ForensicAccounting3* Prerequisite(s): Admission to Master ofAccountancy or the Master of BusinessAdministration ProgramEvaluates the seriousness of fraud and itsimpact on individuals, businesses and society.Formulates fraud prevention, detection, andresolution methods using cases.ACC 6150Information Systems Auditing3* Prerequisite(s): Admission to Masterof Accountancy or Master of BusinessAdministration Program.Provides projects covering information systemsaudit and its impact on the financial statementaudit. Covers information security, socialengineering, and fraud data mining as theyrelate to accounting information systems andthe associated data. Canvas Course Mats 78/McGraw applies.4ACC 6350Management Control Systems3* Prerequisite(s): Admission to Masterof Accountancy or Master of BusinessAdministration Program.ACC 6460Estate and Gift Tax3* Prerequisite(s): Admission to Masterof Accountancy or Master of BusinessAdministration Program.Evaluates the design of management controlsystems through case studies to enablethe successful implementation of accountingstrategies in a variety of for-profit entities.Emphasizes the development of the students'analytical and decision-making skills. CanvasCourse Mats 134/Pearson appliesExamines the law and theory of federal taxationof estates and gifts based on Federal code,I.R.S. regulations, and digest of official incometax decisions.ACC 6410Tax Research and Procedure3* Prerequisite(s): Admission to the Masterof Accountancy or Master of BusinessAdministration ProgramPractices the necessary skills to thoroughlyresearch and analyze a tax problem, as wellas to report research analysis and conclusionsaccurately. Explores computerized tax researchmethods, and the organization of the I.R.S.with some of the procedural aspects of taxcompliance and practice, tax related penalties,professional responsibility and tax ethics.ACC 6420Principles of Corporate Tax3* Prerequisite(s): Admission to Master ofAccountancy programCovers accounting theory and practices ofthe federal income taxation laws, rules andregulations relating to sales and exchangesof assets and the formation and operationof corporations and S corporations, and theireffects upon the corporation's shareholders.Canvas Course Mats 78/Cengage applies.ACC 6430Advanced Corporate Tax3* Prerequisite(s): Admission to Masterof Accountancy or Master of BusinessAdministration ProgramAssesses the appropriate federal income tax fora corporation based on relevant accounting andbusiness data. Analyzes the tax implicationsrelated to the form of entity and the location ofthe entity.ACC 6440Partnership Tax3* Prerequisite(s): Admission to Masterof Accountancy or Master of BusinessAdministration Program.Examines accounting theory and practicesof the federal income taxation laws, rulesand regulations relating to the formation andoperation of partnerships, and their effects uponpartners.Course Catalog 2021-2022ACC 6500Advanced Accounting Information Systems3* Prerequisite(s): Acceptance in the MBAprogramDevelops the background necessary toplan, design and implement an accountinginformation system.ACC 6510Financial Auditing3* Prerequisite(s): Admission to Masterof Accountancy or Master of BusinessAdministration Program.Examines current auditing standards forindependent audits of financial ant legislation, and selected contemporaryadvanced topics in auditing.ACC 6560Accounting Theory and Research3* Prerequisite(s): Acceptance into the Masterof Accountancy or Master of BusinessAdministration programEvaluates the financial reporting environment.Integrates accounting theory and practicalresearch methodology in the resolution offinancial reporting problems.ACC 6600Business Regulation3* Prerequisite(s): Admission to Masterof Accountancy or Master of BusinessAdministration Program.Examines contemporary issues in businesslaw, with an emphasis in accountancy. Studiessecured transactions, negotiable instruments,business associations, investor on in an increasingly global andinterconnected business environment.ACC 6610Financial Statement Research and Analysis3* Prerequisite(s): Admission to Masterof Accountancy or Master of BusinessAdministration program.Teaches financial statement research andanalysis, improving decision making based ontheoretical and practical research of financialstatement information.Utah Valley University

Course DescriptionsACC 679RSpecial Topics in Accounting3* Prerequisite(s): Admission to Master ofAccountancy programVaries from semester to semester. Providesopportunities for students to become exposedto emerging technology and topics of currentinterest and demand in accounting, taxation,auditing, and accounting information systems.May be repeated for a maximum of 6 creditstoward graduation.Aerospace Studies(AERO)AERO 1000Leadership Laboratory 1A.5Studies basic fundamentals of militaryleadership: drill, courtesy, planning, andorganizing at various levels of responsibility.AERO 1010Leadership Laboratory 1B.5Studies basic fundamentals of militaryleadership: drill, courtesy, planning, andorganizing at various levels of responsibility.AERO 1100The Air Force Today1* Corequisite(s): AERO 1000AERO 2000Leadership Laboratory 2A.5Teaches fundamentals of military leadership:drill, courtesy, planning, and organizing atvarious levels of responsibility. Increasedemphasis on performance level.AERO 2010Leadership Laboratory 2B.5Teaches fundamentals of military leadership:drill, courtesy, planning, and organizing atvarious levels of responsibility. Increasedemphasis on performance level.AERO 2100The Developmental Growth of Air Power A1* Corequisite(s): AERO 2000Studies development of various concepts ofair power employment, emphasizing factorsthat have prompted research and technologicalchange.AERO 2110The Development and Growth of Air PowerB1* Corequisite(s): AERO 2010Studies development of various concepts ofair power employment. Emphasizes factorsthat have prompted research and technologicalchange.Teaches development, organization, anddoctrine of the U.S. Air Force. EmphasizesStrategic Force requirements.AERO 3000Leadership Laboratory 3A.5* Prerequisite(s): University AdvancedStandingAERO 1110Aerospace Defense General Purpose andSupport Forces1* Corequisite(s): AERO 1010Teaches basic fundamentals of militaryleadership: drill, courtesy, planning, andorganizing at various levels of responsibility.Students perform as cadet officers. Emphasizesleadership development.Studies U.S. Air Force Defensive Forces,General Purpose Forces, and Tactical AirForces.AERO 3010Leadership Laboratory 3B.5* Prerequisite(s): University AdvancedStandingAERO 143RAir Force Physical Training.5* Corequisite(s): AERO 1000Prepares students for the physical demandsplaced upon them at Air Force Field Trainingencampment normally attended betweentheir sophomore and junior years. Providesleadership opportunities and tests a cadet'sphysical fitness. Repeats are allowed. Seeadvisor for details. May be repeated for amaximum of four credits.Teaches basic fundamentals of militaryleadership: drill, courtesy, planning, andorganizing at various levels of responsibility.Students perform as cadet officers. Emphasizesleadership development.AERO 305RLeadership Laboratory Honor Guard1* Prerequisite(s): University AdvancedStandingAERO 3100Management and Leadership A3* Prerequisite(s): University AdvancedStandingIntroduces students to the United StatesAir Force (USAF) and the ReserveOfficer Training Corps (ROTC). Includesconflict management, followership, rovement.AERO 3110Management and Leadership B3* Prerequisite(s): University AdvancedStandingIntroduces students to the United StatesAir Force (USAF) and the ReserveOfficer Training Corps (ROTC). Includesconflict management, followership, rovement.AERO 3200Jet Pilot Introduction2* Prerequisite(s): University AdvancedStandingStudies principles of flight and accompanyingissues. Introduces meteorology. Presents FARsas they apply to the private pilot. Providesorientation, understanding, and preparation ofthe US Air Force Undergraduate Pilot Training(UPT).AERO 399RAcademic Internship Leadership InternProgram4* Prerequisite(s): Instructor Approval for AirForce ROTC Cadets only and UniversityAdvanced StandingProvides advanced fundamentals of militaryleadership, planning, organizing, and teambuilding at various levels of responsibility. Maybe repeated for a maximum of 4 credits towardgraduation. May be graded credit/no credit.AERO 400RLeadership Laboratory 4A.5* Prerequisite(s): University AdvancedStandingPresents basic fundamentals of militaryleadership: drill, courtesy, planning, andorganizing at various levels of responsibility.Students perform as cadet officers. Emphasizesleadership development. May be repeated for amaximum of 2 credits.Teaches basic fundamentals of militaryleadership: drill, courtesy, planning, andorganizing at various levels of responsibility.Emphasizes leadership development. Studentsperform as cadet officers. Repeats are allowed.See advisor for details. May be repeated for amaximum of 8 credits.Utah Valley UniversityCourse Catalog 2021-20225

Course DescriptionsAERO 401RLeadership Laboratory 4B.5* Prerequisite(s): University AdvancedStandingPresents basic fundamentals of militaryleadership: drill, courtesy, planning, andorganizing at various levels of responsibility.Students perform as cadet officers. Emphasizesleadership development. May be repeated for amaximum of 2 credits.AERO 4100National Security Affairs A3* Prerequisite(s): University AdvancedStandingStudies the military profession, civil-militaryinteraction, and the forming of defense strategy.AERO 4110National Security Affairs B3* Prerequisite(s): University AdvancedStandingStudies the military profession, civil-militaryinteraction, and the forming of defense strategy.Automation andElectrical Tech (AET)AET 1050DC Electrical Math2* Prerequisite(s): MAT 1010 or DepartmentalApprovalUtilizes algebraic formulas and methods tosolve electrical problems related to DC electricalsystems. Covers the calculation of voltage,current, resistance, power, and efficiencyfor DC circuits. Teaches circuit analysistechniques such as superposition, sourcetransformations, Thevenin's theorem, meshand nodal analysis. Introduces wire sizingand resistance calculations pertaining to theNational Electrical Code. Software fee of 20applies.AET 1060AC Electrical Math2* Prerequisite(s): AET 1050Utilizes algebraic formulas and methods tosolve electrical problems related to ACelectrical systems. Covers the calculationof voltage, current, resistance, reactance,impedance, power, VARs, volt-amperes andefficiency for single phase and three phaseAC systems. Applies trigonometry, complexnumbers, and phasors to circuit analysistechniques. Analyzes sine waves, transformers,transformer connections and power factorfor single phase and three phase electricalsystems. Covers three phase balancedsystems.6AET 1130Applied DC Theory1* Prerequisite(s): MAT 1010* Corequisite(s): AET 1135, AET 1150, AET1155* Prerequisite(s) or Corequisite(s): AET 1050AET 1150Industrial Logic1* Prerequisite(s): MAT 1010* Corequisite(s): AET 1155, AET 1130, AET1135* Prerequisite(s) or Corequisite(s): AET 1050Reviews basic DC theory involving voltage,current, resistance, batteries, magnetism,power and the use of digital meters. Coverstroubleshooting techniques and applications ofDC circuits. Software fee of 20 applies. Labaccess fee of 45 for computers applies.Introduces digital logic and relay logic theoryand industrial applications of logic circuits.Discusses numbering systems, booleanalgebra, circuit simplification techniques, andlogic devices such as latches, one

accounting, certifications in accounting (CPA, CMA, CIA, CFE, etc.), ethics in the profession, current issues in accounting, professional standards, and professionalism skills. Discusses the educational requirements for the accounting undergraduate and graduate degrees. ACC 2250 Accounting for Entrepreneurs 3 Addresses accounting issues from the