Transcription

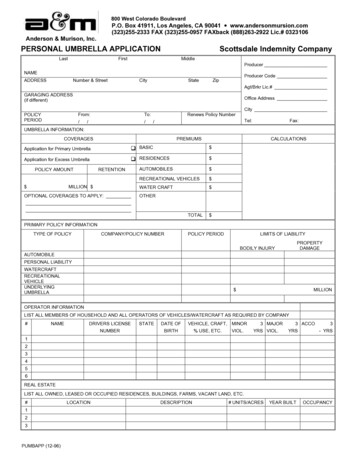

800 West Colorado BoulevardP.O. Box 41911, Los Angeles, CA 90041 www.andersonmursion.com(323)255-2333 FAX (323)255-0957 FAXback (888)263-2922 Lic.# 0323106Anderson & Murison, Inc.PERSONAL UMBRELLA APPLICATIONLastScottsdale Indemnity CompanyFirstMiddleProducerNAMEADDRESSNumber & StreetCityStateProducer CodeZipAgt/Brkr Lic.#GARAGING ADDRESS(if different)Office AddressCityPOLICYPERIODFrom:To:///Renews Policy NumberTel:/Fax:UMBRELLA on for Primary UmbrellaqBASICApplication for Excess UmbrellaqRESIDENCES AUTOMOBILES RECREATIONAL VEHICLES WATER CRAFT POLICY AMOUNT RETENTIONMILLION OPTIONAL COVERAGES TO APPLY: OTHERTOTAL PRIMARY POLICY INFORMATIONTYPE OF POLICYCOMPANY/POLICY NUMBERPOLICY PERIODLIMITS OF LIABILITYPROPERTYDAMAGEBODILY INJURYAUTOMOBILEPERSONAL BRELLA MILLIONOPERATOR INFORMATIONLIST ALL MEMBERS OF HOUSEHOLD AND ALL OPERATORS OF VEHICLES/WATERCRAFT AS REQUIRED BY COMPANY#NAMEDRIVERS LICENSENUMBERSTATEDATE OFVEHICLE, CRAFT, MINORBIRTH% USE, ETC.VIOL.3 MAJORYRS VIOL.3 ACCOYRS3- YRS123456REAL ESTATELIST ALL OWNED, LEASED OR OCCUPIED RESIDENCES, BUILDINGS, FARMS, VACANT LAND, ETC.#123PUMBAPP (12-96)LOCATIONDESCRIPTION# UNITS/ACRESYEAR BUILTOCCUPANCY

AUTOMOBILESRECREATIONAL VEHICLESLIST ALL AUTOS OWNED, LEASEDLIST MOTORCYCLES, SNOWMOBILES, DUNE BUGGIES, MINIBIKES, ETC.##YEARMAKE & MODEL112233YEARMAKE & MODELWATERCRAFTLIST ALL WATERCRAFT OWNED, LEASED, CHARTERED OR FURNISHED FOR REGULAR USE.#YEARTYPE, MANUFACTURER, TERSNAVIGATEDEMPLOYMENTOCCUPATIONEMPLOYER’S NAME & ADDRESSSPOUSE’S OCCUPATIONEMPLOYER’S NAME & ADDRESS (If not employed, so indicate)Other Operator’s OccupationsEMPLOYER’S NAME & ADDRESS (If not employed, so indicate)PRIOR EXPERIENCEHAS ANY LOSS OCCURRED ON ANY PRIMARY OR EXCESS POLICY, EXCEEDING 5,000,DURING THE LAST 5 YEARS?q NOq YES (EXPLAIN)GENERAL INFORMATION# EXPLAIN ALL “YES” RESPONSES IN REMARKS1 Any aircraft owned, leased, chartered or furnished for regular use?YES NOq qPRIOR CARRIER & POLICY NO.?#8EXPLAIN ALL “YES” RESPONSES IN REMARKSDo you employ any residence employees?Any non-owned property exceeding 1,000 in value,in your care, custody or control?Any non-owned business and/or professional activitiesincluded in the primary policies?Does any primary policy have reduced limits of liabilityor eliminate coverage for specific exposures?Was any coverage declined, cancelled, nonrenewed?(Last 5 years)YES NOq q2Any driver convicted for any traffic violations? (Last 3 years)q q93Any driver with mental/physical impairments?q q104Any premises, vehicles, watercraft, aircraft used for business?q q115Any premises, vehicles, watercraft, aircraft, owned, hired, leased orregularly used, not covered by primary policies?q q126Do you engage in any type of farming operation?q q13Any motorcycles, mopeds or all terrain vehiclesowned by insured (may be excluded)?q q7Do you hold any non-remunerative positions?q q14Any other underwriting information of whichCompany should be aware?q q15Are any business activities conducted from yourresidence or premises (excluded in policy jacket)?q qREMARKS:q qq qq qq qNotice to Applicant: In compliance with Public Law 91-508, this notice is to inform you that in connection with your application for insurance (1) aninvestigation may be made as to your insurability, including information as to character, general reputation, personal characteristics and mode of living;and (2) additional information as to the nature and scope of any investigation requested will be furnished to you, upon your written request made withina reasonable time after you receive this notice.I have read the foregoing and agree that it is true and complete to the best of my knowledge and that this policy, if issued, and all renewals thereof, areto be issued in reliance upon this information, unless a change in information is supplied by me. I understand that signing this application does not bindme to accept this insurance nor does it bind the company to issue a policy to me.APPLICABLE IN THE STATE OF NEW YORK: Any person who knowingly and with intent to defraud any insurance company or other person files anapplication for insurance or statement of claim containing any materially false information, or conceals for the purpose of misleading, informationconcerning any fact material thereto, commits a fraudulent insurance act, which is a crime, and shall also be subject to a civil penalty not to exceed fivethousand dollars and the stated value of the claim for each such violation.FRAUD WARNING: Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance orstatement of claim containing any materially false information or conceals for the purpose of misleading, information concerning any fact materialthereto commits a fraudulent insurance act, which is a crime and subjects such person to criminal and civil penalties.INSURANCE CANNOT BE CONSIDERED FOR BINDING UNLESS THIS APPLICATION IS SIGNED BY THE APPLICANT:X Time:Agent/Broker Signature XApplicant SignaturePUMBAPP (12-96)Date:Date:

Home Office Address:16 North Carroll Street, Suite 209 Madison, Wisconsin 53703-2783Property/Casualty Division:8877 North Gainey Center Drive Scottsdale, Arizona 85258A STOCK COMPANYPERSONAL EXCESS LIABILITYYOUR PERSONAL UMBRELLA POLICYPOL 006 (5-96)

POL 006 (5-96)

A STOCK INSURANCE COMPANY, HEREIN CALLED THE COMPANYPERSONAL EXCESS LIABILITY POLICYPART ONEThis is not a complete and valid contract without an accompanying DECLARATIONS PAGE, “Part Two,” signed by anauthorized representative of the company.NATIONAL CASUALTY COMPANY, hereinafter called the Company, in consideration of the payment of the premium, inreliance upon the statements in the Declarations made a part hereof, and subject to all of the terms of this policy, agreeswith the named insured as follows:(d) vehicles covered under this policy;INSURING AGREEMENTSI.(e) vehicles involved in an accident; orCOVERAGES(f) coverages under this policy;Coverage A – Excess Bodily Injury, Personal Injuryand Property Damage Liability.the Company’s liability is limited as follows:The Company will pay on behalf of the insured theamount of ultimate net loss, which the insuredbecomes legally obligated to pay:1. The “each occurrence” limit of liability set forth inItem 5(a) of the Declarations is the total liability ofthe Company for the sum of:1. in excess of the underlying limits (whethercollectible or not) because of bodily injury,personal injury, or property damage to which thispolicy applies, caused by an occurrence; or(i) all ultimate net loss under Coverage A; and(ii) all damages under Coverage B.2. Subject to 1. above, the “each accident” limit ofliability set forth in Item 5(b) of the Declarations isthe total liability of the Company for damagesunder Coverage B.2. in excess of the retained limit (self-insuredretention) because of bodily injury, personalinjury, or property damage to which this policyapplies, caused by an occurrence which is notcovered by or which is not required to be coveredby the underlying insurance.For the purpose of determining the limit of theCompany’s liability, all bodily injury, personal injury,and property damage arising out of the continuous orrepeated exposure to substantially the same generalconditions, shall be considered as arising out of oneoccurrence.Coverage B – Excess Uninsured Motorists InsuranceThe company will pay those sums which the insuredor his legal representative shall become legallyentitled to recover as damages because of bodilyinjury which is covered by the Uninsured MotoristsInsurance (including Underinsured Motorists) of theAutomobile Liability policy scheduled in Item 7(b) ofthe Declarations, less the applicable limits of liabilityof such Uninsured Motorists Insurance.III. DEFENSE AND SETTLEMENTII. LIMITS OF LIABILITYRegardless of the number of:(a) insureds under this policy;(b) persons or organizations that sustain injury ordamages;(c) claims made or suits brought;Page 1 of 9POL 006 (5-96)A. With respect to occurrences which are coveredunder Coverage A of this policy but which are notcovered or required to be covered by theunderlying insurance, the Company, if no otherinsurer has an obligation to do so, shall defendany suit against the insured seeking damages onaccount of bodily injury, personal injury, orproperty damage, even if any of the allegations ofthe suit are groundless, false, or fraudulent; andthe Company shall of the right to make suchinvestigation and settlement of any claims of suitas it deems expedient.

provided, however, the Company shall have noobligation to pay Supplementary Payments whichare payable under the underlying insurance.B. Except as specifically provided under A. above,the Company shall have no duty or obligation toassume the responsibility for the investigation,settlement, or defense of:C. In any country where the Company may beprevented by law or otherwise from carrying outthis agreement, the Company shall pay anyexpense incurred with its written consent inaccordance with this agreement.1. any claim made or suit brought against theinsured under Coverage A; or2. any claim made or suit brought by or onbehalf of the insured under Coverage B;but the Company shall have the right and shall begiven the opportunity to investigate and to beassociated in the control of any claim or suitwhich may, in the Company’s opinion, createliability on the part of the Company under theterms of this policy.V. POLICY PERIOD—TERRITORYA. This policy applies under Coverage A tooccurrences happening during the policy periodanywhere in the world.B. This policy applies under Coverage B to bodilyinjury which is sustained during the policy periodwithin the policy territory defined in the UninsuredMotorists Insurance of the Automobile LiabilityPolicy scheduled in Item 7(b) of the Declarations.C. The Company shall not be obligated to pay anyclaim or judgment or to defend any suit after theapplicable limit of the Company’s liability hasbeen exhausted by the payment of judgments orsettlements.VI. PERSONS INSUREDIV. SUPPLEMENTARY PAYMENTSA. The Company will pay, in addition to theapplicable limit of liability:1. All expenses incurred by the Company; and2. Reasonable expenses incurred by theinsured at the Company’s request, other thanloss of earnings.B. With respect to occurrences covered underCoverage A, the Company will pay, in addition tothe applicable limit of liability:1. All costs taxes against the insured in any suitdefended by the Company’s portion of anyjudgment thereon which accrues after entry ofthe judgment and before the Company haspaid or tendered or deposited in court thatpart of the judgment which does not exceedthe limit of the Company’s liability thereon;2. Premiums on appeal bonds required in anysuch suit, premiums on bonds to releaseattachments for an amount not in excess ofthe applicable limit of liability of this policy,and the cost of bail bonds required of theinsured because of accident or traffic lawviolation arising out of the use of any vehicleto which this policy applies, not to exceed 250 per bail bond, but the Company shallhave no obligation to apply for or furnish anysuch bonds;Page 2 of 9POL 006 (5-96)A. Each of the following is an insured underCoverage A to the extent set forth below:1. With respect to automobiles or watercraft towhich this policy applies:a. The named insured, while using anyautomobile or watercraft;b. Any relative, which using any automobileor watercraft not owned by or furnishedfor the regular use of the named insuredor any relative, provided such use is withthe owner’s permission and for thepurpose the owner intended;c.Any of the following, while using theautomobile or watercraft owned by or inthe care of the named insured;(i) Any person using an automobile orwatercraft with the permission of thenamed insured and for the purposeintended by the named insured;(ii) Any person or organization legallyresponsible for the use of suchautomobile or watercraft, but only ifno other insurance of any kind isavailabletothatpersonororganization for such liability.

None of the following is an insured underthis subsection (c):(i) Any person or organization that iseither employed or engaged in owing,transporting, leasing, parking, storingautomobiles or watercraft;(ii) The owner or lessee (including anyagent or employee thereof) of anautomobile or watercraft in the careof the named insured, but thisprovision does not apply to thenamed insured or any relative;2. With respect to animals to which this policyapplies:a. The named insured;b. Any relative;c.Any other person or organization (otherthan those providing professional animalcare services) legally responsible foranimals owned by the named insured orany relative, but only if no other insuranceof any kind is available to that person ororganization for such liability;3. Except as provided under (1) and (2) above:a. The named insured;b. Any relative;c.Any person under the age of 21, otherthan a relative, who is in the care of thenamed insured or a relative.B. Any person is an insured under Coverage B whoqualifies under the “Persons Insured”, “Who IsInsured”, or equivalent provisions of theUninsured Motorists Insurance of the AutomobileLiability Policy scheduled in Item 7(b) of theDeclarations.EXCLUSIONSA. This policy does not apply under Coverage A:1. To any obligation for which the insured or anycarrier as his insurer may be held liable under anyworkers’compensation,unemploymentcompensation or disability benefits law, or underany similar law;Page 3 of 9POL 006 (5-96)2. To bodily injury or property damage which isexpected or intended from the standpoint of theinsured, but this exclusion does not apply tobodily injury resulting from the use of reasonableforce to protect persons or property;3. To property damage to:a. Property owned by the insured;b. Aircraft rented to, used by, or in the care,custody, or control of the insured; orc.Any property rented to, utilized or occupiedby, or in the care, custody, or control of theinsured, to the extent that the insured hasotherwise provided insurance therefor;4. To bodily injury or property damage arising out ofthe ownership or use of any aircraft;5. To bodily injury or property damage occurringaway from the premises owned by, rented to, orcontrolled by the named insured and arising outof the ownership or use of any watercraft ownedby the insured, but this exclusion does not apply ifminimum primary limits for such watercraft arespecified in Item 7(c) of the Declarations andsuch coverage is in force on the date of theoccurrence for which claim is made hereunder;6. To bodily injury, personal injury, or propertydamage arising out of the rendering of or failureto render professional services by the insured orby any person for whose acts or omissions theinsured is legally responsible;7. To bodily injury, personal injury, or propertydamage arising out of:a. Business pursuits of the insured; orb. Property at or from which a business isconducted by the insured;8. To bodily injury or property damage arising out ofthe ownership or use of any automobile or othermotor vehicle in the conduct of the insured’sbusiness, but this exclusion does not apply to aprivate passenger automobile registered to thenamed insured and covered under an AutomobileLiability Policy scheduled in Item 7(b) of theDeclarations. As used in this exclusion, “PrivatePassenger Automobile” means:a. a motor home; or

b. any other land motor vehicle designed forcarrying not more than ten persons (includingthe driver) and used for the transportation ofpersons:but “Private Passenger Automobile” does notinclude:(i) a motorcycle; or(ii) a motortruck or truck tractor (other than anon-commercial pick-up truck of less thanone ton capacity);9. To bodily injury or property damage arising out ofthe ownership or use of any automobile or othermotor vehicle while being used as a public liveryconveyance, or while carrying persons for a fee orother consideration, expressed or implied;10. a. To contamination of any environment bypollutants that are introduced at any time,anywhere, in any way;b. To any injury, damage, or expense arising outof such contamination, including, but notlimited to cleaning up, remedying, ordetoxifying such contamination;c.To any injury, damage, or expense arising outof any request, demand, or order issued ormade pursuant to any environmentalprotection or environmental liability statute orregulation;d. To payment for the investigation or defense ofany loss, claim, or damage related to theabove.As used in this exclusion:(i) “Contamination” means any unclean, unsafe,damaging, injurious, or unhealthful conditionarising out of the presence of any pollutant orcombination of pollutants, whether permanentor transient, in any environment;(ii) “Environment” includes, but is not limited toany person, any man-made object or feature,animals, crops and vegetation, land, bodies ofwater, underground water or water tablesupplies, air, or any other feature of the Earthor its atmosphere, whether or not altered,developed, or cultivated, and whether or notowned, controlled, or occupied by theinsured;(iii) “Expense” includes anypenalty, or assessment;expense,fine,Page 4 of 9POL 006 (5-96)(iv) “Pollutant” means smoke, vapors, soot,fumes, acids, sounds, alkalis, chemicals,liquids, solids, gases, thermal pollutants,waste materials, and all other irritants orcontaminants;11. To any liability of the insured directly or indirectlyoccasioned by, happening through, or inconsequence of war, invasion, acts of foreignenemies, hostilities (whether war be declared ornot), civil war, rebellion, revolution, insurrection,military or usurped power, or confiscation ornationalization or requisition or destruction of ordamage to property by or under the order of anygovernment or public or local authority;12. To any liability to an employee or formeremployee arising out of a contract of employmentwith any insured, including, but not limited towrongful termination or discharge;13. To any liability arising from the insured’s activitiesas a director, officer, committee person, volunteerworker or other activities performed in any officialcapacity for any corporation, association, publicauthority, charitable institution or other legal entityregardless of whether such activities arepreformed with or without a fee or otherconsideration; but this exclusion does not apply tobodily injury or property damage arising out ofactivities performed by the named insured,without fee, for “not for profit” organizations,provided such bodily injury or property damage isalso covered under a policy scheduled in Item 7of the Declaration;14. To any claim made or suit brought against theinsured because of bodily injury or propertydamage arising out of, contributed to, or resultingfrom, directly or indirectly:a. a disease which is transmitted by an insuredthrough sexual contact; orb. the transmission by an insured of theAcquired Immune Deficiency Syndrome(A.I.D.S.) virus by any means;15. To personal injury, except to the extent thatinsurance therefore is provided by the underlyinginsurance;16. To any liability imposed on the insured or theinsured’s insurer under any uninsured motorists,underinsured motorists, or automobile no-fault orfirst party bodily injury or property damage law.

B. This policy does not apply under Coverage B:1. To bodily injury occurring at any time duringwhich the named insured does not maintainunderlying uninsured motorists insurance;2. To any injury which is not covered or collectiblefor any reason under the uninsured motoristsinsurance of the Automobile Liability Policyscheduled in Item 7(b) of the Declarations.C. This policy does not apply under Coverage A orCoverage B to fines, penalties, punitive or exemplarydamages of any kind.D. This policy does not apply under any liabilitycoverage:(c) the injury, sickness, disease, death ordestruction arises out of the furnishing by aninsured of services, materials, parts orequipment in connection with the planning,construction, maintenance, operation or useof any nuclear facility, but if such facility islocated within the United States of America,its territories or possessions or Canada, thisexclusion (c) applies only to injury to ordestruction of property at such nuclear facility.As used in this exclusion:1. to injury, sickness, disease, death or destruction(a) with respect to which an insured under thepolicy is also an insured under a nuclearenergy liability policy issued by NuclearEnergy Liability Insurance Association,Mutual Atomic Energy Liability Underwritersor Nuclear Insurance Association of Canada,or would be an insured under any such policybut for its termination upon exhaustion of itslimit of liability; or(b) resulting from the hazardous properties ofnuclear material and with respect to which (1)any person or organization is required tomaintain financial protection pursuant to theAtomic Energy Act of 1954, or any lawamendatory thereof, or (2) the insured is, orhad this policy not been issued would be,entitled to indemnity from the United Sates ofAmerica, or any agency thereof, under anyagreement entered into by the United Statesof America, or any agency thereof, with anyperson or organization.2. Under any Medical Expense Coverage, toexpenses incurred with respect to bodily injury,sickness, disease or death resulting from thehazardous properties of nuclear material andarising out of the operation of a nuclear facility byany person or organization.3. Under any Liability Coverage, to injury, sickness,disease, death or destruction resulting from thehazardous properties of nuclear material, if(a) the nuclear material (1) is at any nuclearfacility owned by, or operated by or on behalfof, an insured, or (2) has been discharged ordispersed therefrom;Page 5 of 9POL 006 (5-96)(b) the nuclear material is contained in spent fuelor waste at any time possessed, handled,used, processed, stored, transported ordisposed of by or on behalf of an insured; or“hazardous properties” includes radioactive,toxic or explosive properties;“nuclear material” means source material,special nuclear material or by-productmaterial;“source material”, “special nuclear material”and “by-product material” have the meaningsgiven them in the Atomic Energy Act of 1954or in any law amendatory thereof;“spent fuel” means any fuel element or fuelcomponent, solid or liquid, which as beenused or exposed to radiation in a nuclearreactor;“waste” means any waste material (1)containing by-product material and (2)resulting from the operation by any person ororganization of any nuclear facility includedwithin the definition of nuclear facility underparagraph (a) or (b) thereof;“nuclear facility” means(a) any nuclear reactor;(b) any equipment or device designed orused for (1) separating the Isotopes ofuranium or plutonium, (2) processing orutilizing spent fuel, or (3) handling,processing or packaging waste,(c) any equipment or device used for theprocessing, fabricating or alloying ofspecial nuclear material if at any time thetotal amount of such material in thecustody of the insured at the premiseswhere such equipment or device islocated consists of or contains more than25 grams of plutonium or uranium 233 or

3. The insured shall cooperate with the Companyand, upon the Company’s request, assist inmaking settlements, in the conduct of suits, and inenforcing any right of contribution or indemnityagainst any person or organization who may beliable to the insured because of injury or damagewith respect to which insurance is afforded underthis policy; and the insured shall attend hearingsand trails and assist in securing and givingevidence and obtaining the attendance ofwitnesses.any combination thereof, or more than250 grams of uranium 235,(d) anystructure,basin,excavation,premises or place prepared or used forthe storage or disposal of waste,and includes the site on which any of theforegoing is located, all operations conductedon such site and all premises used for suchoperations;“nuclear reactor” means any apparatusdesigned or used to sustain nuclear fission ina self-supporting chain reaction or to containa critical mass of fissionable material;With respect to injury to or destruction ofproperty, the word “Injury” or amination of property.4. The insured shall not, except at his own expense,voluntarily make any payment, assume anyobligation, or incur any expense.C. Maintenance of underlying insurance1. With respect to coverage A, the named insuredagrees to maintain insurance in full effect duringthe policy period for the coverages and minimumunderlying limits set forth in Item 7 of theDeclarations. Such insurance shall not affordsublimits of liability with respect to any coverageor driver.CONDITIONSA. PremiumFailure of the named insured to comply with thisagreement shall not invalidate this policy, but ifany portion of the underlying insuranceterminates during the policy period, isuncollectable for any reason, or has applicablelimits of liability lower than the minimum requiredamounts set forth in Item 7 of the Declarations,this policy shall apply in the same manner itwould have applied had the underlying insurancebeen in force, fully collectible, and with theminimum required limits of liability.The premium for this policy is as stated in theDeclarations.The named insured shall promptly notify the Companyin the event:1. There is a change in the coverage afforded by theunderlying insurance, or2. The named insured acquires or disposes of anypremises, automobiles, or watercraft.Any premium adjustment shall be made as of the dateof such change, acquisition, or disposal inaccordance with the Company’s rules, rates, andrating plans applicable to the insurance affordedherein.B. Insured’s duties in the event of occurrence, claim, orsuit1. Written notice of any injury or damage whichappears likely to result in a claim under this policyshall be given to the Company by or for theinsured as soon as practicable. Such notice shallcontain particulars sufficient to identify the insuredand the fullest information available at the time.2. With the respect to Coverage B, the namedinsured agrees to maintain uninsured motoristsinsurance in full effect during the policy period. Ifsuch insurance terminates during the policyperiod or is uncollectible for any reason, theExcess Uninsured Motorists insurance under thispolicy does not apply.D. Appeals2. If claim is made or suit is brought against theinsured for injury or damage with respect to whichinsurance is afforded under this policy, theinsured shall immediately forward to theCompany copies of every demand, notice,summons, or other process received by him or hisrepresentative.Page 6 of 9POL 006 (5-96)In the event the insured or any other interest electsnot to appeal a judgment in excess of the underlyinglimits, the Company may elect to do so and shall beliable, in addition to the applicable limit of liabilityhereunder, for the legal expenses at such appeal(including the taxable court costs and interestincidental thereto), but in no evident shall the totalliability of the Company exceed the applicable limit ofliability set forth in insuring agreement II plus theexpenses of such appeal.

3. Any claim against the Company by the insuredunder either Coverage A or Coverage B of thispolicy shall be made within twelve months afterthe insured:E. Action against the Company1. No action shall lie against the Company underCoverage A unless, as a condition precedenttheretoa) pays or becomes legally obligated to pay anamount of ultimate net loss within theCompany’s limit of liability under Coverage A;ora. There shall have been full compliance with allof the terms of this policy;b. The insured shall have paid or shall havebecome legally obligated to pay the fullamount of the underlying limits;c.Any applicable retained limit (self-insuredretention) shall have been paid by or onbehalf of the insured;b) becomes legally entitled to recover anamount of damages within the Company’slimit of liability under Coverage B.G. Other insuranceThe insurance afforded by this policy shall be excessover any other insurance collectible by the insured,irrespective of whether such other insurance is statedto be primary, contributing, excess, contingent, orotherwise; provided, however, this condition shall notapply to insurance purchased specifically to apply inexcess of the Company’s limit of liability under thispolicy.d. The amount of the insured’s obligation to payultimate net loss shall have been finallydetermined.2. No action shall lie against the Company underCoverage B unless, as a condition precedentthereto:a. There shall have been full compliance with allthe terms of this policy;H. SubrogationBecause this policy provides excess insurance, theinsured’s right of recovery cannot always beexclusively subrogated to the Company. It is,therefore, agreed that in case of any paymenthereunder, the Company will act in concert with allother interests concerned (including the insured), inthe enforcement of any subrogation rights or in therecovery of amounts by any other means. Theapportioning of any amounts so recovered shall followthe principle that any interest (including the insured)who shall have paid an amount over and above anypayment hereunder, shall first be reimbursed up tothe amount paid by them. The Company shall then bereimbursed out of any balance then remaining up tothe amounts paid under this policy. Lastly, theinterests (including the insured) of whom this policy isin excess are entitled to claim any residue remaining.Expenses necessary to the recovery of any suchamounts shall be apportioned between the int

PERSONAL UMBRELLA APPLICATION Scottsdale Indemnity Company Last First Middle NAME ADDRESS Number & Street City State Zip GARAGING ADDRESS (if different) POLICY PERIOD From: / / To: / / . TYPE OF POLICY COMPANY/POLICY NUMBER POLICY PERIOD LIMITS OF LIABILITY BODILY INJURY PROPERTY DAMAGE AUTOMOBILE PERSONAL LIABILITY WATERCRAFT RECREATIONAL .