Transcription

2018ANNUALREPORTEMPOWEREDfor what’s ahead

To ourshareholdersKEVIN W. MONSON ChairmanCHARLES N. FUNK President and CEOTWENTY EIGHTEEN WAS A YEAR OF IMPROVEMENT AND PROGRESS. As you willread, our net income and earnings per share (EPS) were at all-time highs, and wemade tangible improvements in many areas of our operations. We announced astrategic acquisition of Dubuque, Iowa–based ATBancorp, which we are confident willadd long-term value to our shareholders. At the same time, we know that we havemuch to accomplish to achieve our intermediate and long-term goals.To summarize from 20,000 feet: our companyis clearly moving forward, and we aredetermined to speed up our rate of progress.Net income of 30.3 million and EPS of 2.48 in 2018 were well ahead of 21.9million and 1.82 in 2017, respectively, exclusive of deferred-tax adjustment.With the ATBancorp acquisition, we incurred transaction-related expenses of 0.8million. Thus, we believe the better comparison is 2018 operating net income of 31.1 million and EPS of 2.54. As stated in the opening paragraph, this is the bestyear in our company’s history on both counts.2 MidWestOne Financial Group, Inc. 2018 ANNUAL REPORT

Last year was the third consecutive year thatwe fell short of our own expectations in termsof asset (loan) quality. It was also the secondconsecutive year that provision for loanlosses was the singular barrier in reachingour financial goals. As we wrote in our 2017annual shareholders' letter, we have taken“a deep dive into the credit administrationprocess,” and what we found “was a processthat had served us very well for two decadesbut needed an upgrade due to the growthand increasing complexity of the company.”Our commitment to improvement continuedin 2018 and was bolstered at midyearwith the hire of Gary Sims as our SeniorVice President and Chief Credit Officer.Gary has more than twenty-five years ofcredit experience with companies largerthan MidWestOne, and after a period ofassessment, he has strengthened our creditadministration procedures even further. Ourprocess to identify and monitor weakeningloans is clearly trending in the right direction,as evidenced by internal and external loanreviews during the second half of 2018.NET CHARGE-OFFS TRENDED DOWNfrom 0.51 percent of total loans at year-end2017 to 0.26 percent of loans at yearend 2018. Non-performing loans to totalloans were 1.07 percent at year-end 2018compared to 1.08 percent at year-end 2017.Our loan-loss reserve maintained coveragefor troubled loans at 114.6 percent, a solidratio. It should be noted that our provisionfor loan losses did register a significantdecline, from 17.3 million in 2017 to 7.3million in 2018. This level of provisionremains too high for a company of our size,and we are confident there will again be apositive trend in the year ahead.Within the MidWestOne geographic footprint,the rural Iowa economy continues to sufferthe effects of low commodities prices forcorn and soybeans. While our agriculturalborrowers are experiencing generally weakoperating results, we continue to forecastrelatively low charge-offs for this portfolio.Elsewhere in our footprint, in Iowa City—where our headquarters is located—theeconomy is stable. The Twin Cities’ economycontinues to be strong, and the economiesin our two other major markets, Denver,and Southwest Florida, continue to berobust. Loan growth in these three marketsin 2018 reflected that economic strength.To recap, while we fell short of our goalsfor asset quality in 2018, we did registersignificant improvement from 2017. Webelieve we are well positioned to enjoyanother significant step forward in 2019, andwe see tangible reasons for our optimism.MidWestOne ended 2018 with assets of 3.29 billion, up slightly from 3.21 billionat year-end 2017. Total loans increasedby a healthy 4.9 percent to 2.40 billionby December 31, 2018. This increase wasprimarily driven by our Twin Cities, Denver,and Southwest Florida markets. Totaldeposits at 2.61 billion were flat comparedto year-end 2017. However, there was a largeamount of short-term deposits in the bankat year-end 2017, and importantly, averagedeposits for 2018 registered a 4.2 percentincrease over the prior year. Again, we notesignificant efforts from the Twin Cities andDenver, which provided the needed lift indeposits during the year.“ What wepreparefor iswhat weshall get.”THE BANKING INDUSTRY IS CURRENTLYIN A BATTLE for deposit dollars, and weregard funding loan demand with coredeposits as one of our great challenges of2019. Interestingly, technology has enabledour large U.S. bank and brokerage competitorsto increasingly compete with local communitybanks for deposit dollars—despite havingno physical presence in our communities.Banks without a sound deposit strategy willstruggle to grow in the coming years.MidWestOne Financial Group, Inc. 2018 ANNUAL REPORT 3

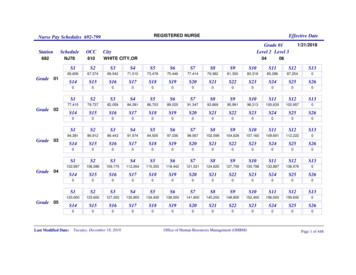

RETURN ON AVERAGE EQUITY 2014PeerFY2015All banksFY2016FY2017RegionalFY2018Asset sizeNET INTEREST MARGIN 015All banksFY2016FY2017RegionalFY2018Asset sizeNON-INTEREST EXPENSE/ AVERAGE ASSETS OFGFY2014PeerFY2015All banksFY2016RegionalFY2017FY2018Asset MOFGFY2014PeerWealth Management, comprising our TrustDepartment, Investment Services group,and MidWestOne Insurance Services, saw arelatively flat year in terms of fees collected.Given the nature of financial markets, this is notunusual. Of particular note is the MidWestOneTrust Department, which saw its revenues growby 5 percent over the prior year. InvestmentServices and Trust are well positioned to growtheir books of business in 2019.To summarize, we saw good loan growth in 2018and slightly improved operating metrics from thenon-interest income segments of the company,and we managed to achieve a stable “core” netinterest margin (“core” subtracts the discountaccretion income from the total). Asset quality,while slightly better than 2017, fell short ofexpectations and must improve throughout 2019for us to achieve our financial goals.THE MOST EXCITING NEWS for the company in2018 was the announcement of our acquisitionof ATBancorp, which operates two banks, oneheadquartered in Dubuque, Iowa, and one inCuba City, Wisconsin (just across the MississippiRiver from Dubuque).EFFICIENCY RATIO (%)56.00Our Home Mortgage Center was hampered bya weaker national housing market in 2018. Thiswas evidenced in a 19.9 percent drop in fees frommortgage originations. However, income fromour mortgage-servicing portfolio, increased by3.5 percent during the year. Several years ago,we made the decision to increase our real-estateloan-servicing portfolio, and that decision hasproved to be good. Our servicing portfolio atyear-end 2018 had risen to 299.6 million. Mostimpressive is the improvement we have madein delivering home mortgages to our customers.We are more efficient while delivering a betterproduct. Our progress over the past two years isnotable and positions us for better years whenthe mortgage market improves.FY2015All banks4 MidWestOne Financial Group, Inc. 2018 ANNUAL REPORTFY2016RegionalFY2017FY2018Asset size

ATBancorp has approximately 1.4 billion inassets and a history of community bankingprowess. The Dubuque-based American Trust &Savings Bank has been among the most admiredbanks in Iowa for many years and is the secondranked bank in the Dubuque market in terms ofmarket share.For many reasons, we believe that ATBancorpis a very good fit for MidWestOne and our culture.The company’s asset quality is excellent,as evidenced by its low loan charge-offs andpast-due loans in recent years. ATBancorp hasshown an ability to grow its franchise in bothmetro and rural Iowa and in rural Wisconsin.The cost-savings metrics on this transaction areexcellent and, we believe, readily achievable.The 1 billion-plus American Trust & Savings BankTrust Department will add scale and non-interestincome to our income statement.AS WE WRITE THIS LETTER, we have receivedall regulatory approvals, and we anticipatea May 1 transaction closing date. When weannounced the transaction in August, we spokeof earnings accretion—that is, increased EPS toour shareholders—from this transaction. As thisreport goes to press, we believe these projectionsremain accurate. When completed, we will havea 4.7 billion banking organization spanning fivestates with sixty banking offices. While biggerdoes not mean better, we will have added scale tocontinue to satisfy our customers’ preferences forproducts and technology, and we will have joinedefforts with a very talented group of bankers inour regional footprint. We believe this will begood for our employees, our communities, ourcustomers, and our shareholders.PRICE/LTM EPS 2013MOFGFY2014PeerFY2015FY2016All banksFY2017RegionalFY2018Asset sizeDIVIDEND PAYOUT RATIO eerFY2015FY2016All banksFY2017RegionalFY2018Asset sizeTOTAL RETURN 1/141/1/151/1/16NASDAQ Composite Index1/1/171/1/18SNL Midwest Bank IndexTECHNOLOGY IN BANKING IS ESSENTIALin 2019. It is also expensive. To survive as acompany, we have no choice but to strategicallyoffer our customers what they need to simplifyand enhance their financial lives. We are notbacking down from this challenge, and wecontinue to make record investments to remaintechnologically relevant.MidWestOne Financial Group, Inc. 2018 ANNUAL REPORT 5

In 2018 and 2019, our customerscan now:Navigate a much improved and userfriendly website that integrates morefunctions and apps than ever before.Enjoy real-time consumer “P2P”(person-to-person) payments viathe Zelle application, which waslaunched in February.Communication in our geographicallygrowing company has become morecomplex. We remain committed to winningthis challenge because we know that goodcommunication encourages and supportseach employee in their achievement for—and engagement in—our fine company.Each year, on Columbus Day, we cometogether as a company for our Rally Daycelebration. In 2018, five worthy bankersreceived our President’s Award:Receive real-time alerting to see balanceand transaction information.RYAN KLEINOpen deposit accounts and applyfor loans online.LISA WASSONNote: In the third quarter of 2018, only 18percent of customer transactions weremade in our branch offices. The others?They took place through our Service Centerand on smartphones, tablets, desktopcomputers, and ATMs. The world continuesto change. So must we.We continue to make worthwhileinvestments in the communities we serve.We feature one such project elsewherein these pages, led by our staff in CoonRapids, Minnesota. In 2018, our companyreturned more than 800,000 to ourcommunities in charitable contributions,and provided hundreds of hours ofvolunteerism from our communityminded employees. You read each yearin this letter that this is what exemplifiesexcellence in the industry that we proudlycall community banking.Our employees remain our greateststrength. This is not simply a triedand-true statement that gets dustedoff each year for the annual report.Our company continues to evolvefollowing our 2015 merger that broughtMinnesota, Wisconsin, and SouthwestFlorida into our footprint. For the sixthconsecutive year, MidWestOne’s Iowafranchise was recognized as a “bestworkplace” by the Des Moines Register.Only 150 Iowa businesses receive thisdesignation and the recognition isawarded after an anonymous surveyof our employees. What’s more, theDenver, Southwest Florida and TwinCities groups all scored above thenational averages on this survey.6 MidWestOne Financial Group, Inc. 2018 ANNUAL REPORTPersonal Banker, Burlington, IARetail Managing Officer, Forest Lake, MNKELLI BACKSTROMVice President, Regional Retail Manager,South St. Paul, MNJACK COURTNEYSecond Vice President, E-Commerce,Iowa City, IAMELISSA PAYNESecond Vice President, Service Centerand Virtual Banking, Iowa City, IAWith each year there is always change.In 2018, we said goodbye to Kent Jehle,who retired in September as our ChiefCredit Officer. Kent served the companyfor thirty years and made key contributionsto our growth over the past two decades.Kent was a team player in the bank and inthe Iowa City community. We thank himfor his service and wish Kent well.During 2018, we bid farewell to DirectorsJohn Morrison and Mike Hatch, who eachresigned late in the year. John is a legendin Minnesota banking circles and theformer owner of Central Bank, acquiredby our company in 2015. He served forone year as Chairman of our company.Mike is the former Minnesota AttorneyGeneral and served as a director after weacquired Central. Replacing John and Mikeare Larry Albert and Jennifer Hauschildt.Larry was the longtime Chief ExecutiveOfficer of Central Bank and has servedas a MidWestOne Bank director since2015. Jennifer is new to our company andbrings management experience as well asinformation technology knowledge fromher position as Chief Information Officer—North America for Uponor, an internationalmanufacturing company with U.S.headquarters in Apple Valley, Minnesota.We thank John Morrison and Mike Hatchfor their service to our company and lookforward to working with Larry and Jenniferin the years ahead.Directors Pat Heiden, Richard Schwab, andScott Zaiser will retire from our board atthe April annual meeting. Pat joined thebank board in 2014 and has been a bigsupporter of our company in the Iowa Citycommunity. She was recently elected to theBoard of Supervisors of Johnson County,Iowa. Dick Schwab joined the board in 2004and has been a stalwart on our board.He has chaired the Nominating andCorporate Governance Committee for thepast six years and has been a key memberof the Audit Committee. Dick will be leavingour region to retire in northern Wisconsin.Scott Zaiser joined our board with the2008 merger with MidWestOne and hasbeen with us every step of the way since.Scott owns a successful century-old familybusiness in Burlington, Iowa. His continualencouragement will not be easily replaced.We thank Pat, Dick, and Scott for theirloyalty to our company and hope for theircontinued success in their lives.Joining our company in 2018 was BarryRay, our Senior Vice President and ChiefFinancial Officer. Barry came to us aftertwelve years at a regional West Coastinstitution, and he hit the ground running atfull speed. Barry was a critical element in thecompletion of our ATBancorp transaction.He brings a new CFO perspective to ourcompany, and Barry’s prior experience isalready serving us very well.AS WE CLOSE, we acknowledge thatour shareholders are right to expectcontinued improvement in performancefrom this company. This letter outlines thedemonstrable progress that was madein 2018. With the close of the ATBancorpacquisition and continued improvementsin the legacy of MidWestOne, we believewe are on the right path. As the quote atthe opening of this letter notes, we achievewhat we prepare for. We are prepared foranother year of solid improvement in 2019.It is our great privilege to serve you, ourloyal shareholders. Thank you for yourfaithful support.Charles N. FunkPresident & CEOKevin W. MonsonChairman

Board OF DirectorsFIRST ROW, LEFT TO RIGHT:RICHARD R. DONOHUE MidWestOne Bank Director & MidWestOne Financial Group, Inc. DirectorRICHARD J. SCHWAB MidWestOne Bank Director & MidWestOne Financial Group, Inc. DirectorMICHAEL A. HATCH MidWestOne Financial Group, Inc. DirectorW. RICHARD SUMMERWILL MidWestOne Financial Group, Inc. Director EmeritusTRACY S. MCCORMICK MidWestOne Bank Director & MidWestOne Financial Group, Inc. DirectorSECOND ROW, LEFT TO RIGHT:R. SCOTT ZAISER MidWestOne Bank Director & MidWestOne Financial Group, Inc. DirectorPATRICIA A. HEIDEN MidWestOne Bank DirectorNATHANIEL J. KAEDING MidWestOne Bank Director & MidWestOne Financial Group, Inc. DirectorKURT R. WEISE MidWestOne Bank Director & MidWestOne Financial Group, Inc. DirectorCHARLES N. FUNK MidWestOne Financial Group, Inc. President & CEO, & MidWestOne BankPresident & CEOLARRY D. ALBERT MidWestOne Bank Director & MidWestOne Financial Group, Inc. DirectorDOUGLAS K. TRUE MidWestOne Bank Director & MidWestOne Financial Group, Inc. DirectorRUTH E. STANOCH MidWestOne Bank Director & MidWestOne Financial Group, Inc. DirectorKEVIN W. MONSON MidWestOne Bank Chairman & MidWestOne Financial Group, Inc. ChairmanMidWestOne Financial Group, Inc. 2018 ANNUAL REPORT 7

50,000 grantto Eagle’sHealing NestEMPOWERSVETERANSMelony Butler had to do something.The proud military wife and motherwatched as her son suffered frompost-traumatic stress disorder (PTSD).After he was turned away fromthe Veterans Affairs (VA) Hospitaldue to overcrowding, she decidedto open her own nonprofit facilityto help veterans and their families.Eagle’s Healing Nest in Sauk Centre,Minnesota, opened in 2012 as a home forveterans to heal in peace. State Senator JimAbeler, R-Anoka, a MidWestOne customer,wanted to bring Eagle’s Healing Nest to hishome of Anoka, Minnesota. He and Butlerset about restoring “cottages” on the historicState Hospital property. In December 2017,the first restored cottage opened formale veterans.“After learning about Eagle’s Healing Nestthrough Jim, we knew we had to help insome way,” Don McGuire, market president,said. “Those in our armed forces give somuch to our country, and we want to giveback to them—especially to those strugglingwith basic needs such as housing, food,and mental health.”McGuire, along with other bankers atMidWestOne’s Coon Rapids location, appliedfor a 50,000 Community Impact Grant fromMidWestOne. They knew the grant wouldbe instrumental in restoring another cottageat the Anoka-based Eagle’s Healing Nest.8 MidWestOne Financial Group, Inc. 2018 ANNUAL REPORT

Each year, the MidWestOne marketscompete for the coveted prize, and Eagle’sHealing Nest and the many veterans itserves were this year’s recipients.Thank you from the bottom of ourhearts to MidWestOne Bank for helpingus complete our home that will helpcountless veterans for decades to come.”“When we found out we won this year’sgrant, everyone in the location just stoodup and cheered,” said McGuire. “It’s suchan important cause, and it was verytouching to see everyone rally behindour effort.”The U.S. Department of Veterans Affairsestimates that roughly 11 percent of theadult homeless population are veterans.Most are single, live in urban areas, andsuffer from mental illness, alcohol and/or substance abuse, or co-occurringdisorders. Although the transient natureof homeless populations makes itchallenging to get accurate numbers, theU.S. Department of Housing and UrbanDevelopment (HUD) estimates that 40,056veterans are homeless on any given night.The 50,000 grant went to restoringCottage No. 4, called Lady Liberty, whichbecame the first-ever shelter for femaleveterans in the state of Minnesota. Thecottage had been in a state of deteriorationbefore the grant money helped completethe restoration.“There are currently no other homes inMinnesota that are specifically for veteranswho are women,” said McGuire. “We areso excited to be able to help Eagle’sHealing Nest create this safe haven forfemale veterans. They have served ourcountry, and it’s only right that we nowsupport them.”“ WHEN WE FOUND OUT WE WONTHIS YEAR’S GRANT, EVERYONEIN THE LOCATION JUST STOOD UPAND CHEERED.”—Don McGuireMany MidWestOne Coon Rapids employeeshave become involved in Eagle’s HealingNest. Beyond the grant money, theyhave given their time to help Eagle’sHealing Nest staff members makeconnections in the community. They havealso participated in the restoration byadopting a room and renovating it.With renovations to the women’s homewrapping up, Eagle’s Healing Nest willnow turn its attention to the third and finalbuilding on the historic property. CottageNo. 3 is slated to become a home formilitary families.MidWestOne team members, such as thoseat the Coon Rapids branch, play a vitalrole in giving back to their surroundingcommunities, and with the MidWestOneCommunity Impact Grant, employees cancontinue to help those in need soar.“ Those in our armed forcesgive so much to our country,and we want to give back tothem—especially to thosestruggling with basic needssuch as housing, food,and mental health.”—Don McGuireOPPOSITE PAGE:Laura Bartley, director, Eagle’s HealingNest Anoka BranchBELOW:Tom Wilkinson, a general contractor whorehabbed two older Anoka buildingsFor Butler, who worked against manyodds to make Eagle’s Healing Nest thehome it is, the community supportis overwhelming.“The Nest is so grateful to MidWestOneBank for this amazing gift,” said Butler.“The strong support of the communityin both the renovations and operationshas helped the Nest tremendously.This has enabled us to focus on ourmission of providing our veterans, militarymembers, and families a safe home,giving hope and offering resources to heal.MidWestOne Financial Group, Inc. 2018 ANNUAL REPORT 9

Investmentsin technologyand securityEMPOWERCUSTOMERS“Empowering customers is about providingpeople the ability to meet their own needswithout us getting in the way,” according toJohn Henk, Senior Vice President and ChiefInformation Officer.New technology and security features dojust that by enabling customers to bettermanage their money and make bankingwith MidWestOne a streamlined, convenient,and secure experience.“It’s all about making the customerexperience as frictionless as possible,” saidHenk. “If we can do this while improvingcustomer service and our own productivity,everyone wins.”In December, MidWestOne launched a newuser-friendly website. The reorganizedcontent makes information readilyaccessible and digestible.It also makes it easier for visitors to reachtheir bankers and find phone numbers andlocations. With more customers choosing toaccess the internet from their devices, thewebsite is also mobile responsive.As part of the new website, MidWestOne alsolaunched a new content-marketing strategythat features weekly blog articles designedto promote educational information.This content provides useful resources toenrich customers’ financial well-being.

FROM LEFT: Jack Courtney and John Henk of MidWestOne“Empowering customers is aboutproviding people the ability tomeet their own needs without usgetting in the way.”“We are investing in these technologiesto enhance the MidWestOne bankingexperience,” said Jack Courtney, SecondVice President, E-Commerce. “Most of ourinteractions with customers now take placethrough digital channels. So it’s criticalwe provide customers with simplified,intuitive, and secure banking options.”MidWestOne is also improving itspersonal mobile banking suite withZelle —a fast, safe, and easy way forcustomers to send money to familyand friends in minutes, all from theMidWestOne mobile app. Zelle operatessimilarly to other person-to-personpayment platforms. It also features thesame enhanced security that protectscustomers’ bank accounts and is availableto each person on an account.“ IT’S CRITICAL WE PROVIDECUSTOMERS WITH SIMPLIFIED,INTUITIVE, AND SECUREBANKING OPTIONS.”—Jack Courtney“When considering new solutions, likeZelle, we always adopt the perspectiveof the customer,” said Henk. “The latesttechnology has no value if it isn’t beneficialto the customer. This is a hard discipline,and we work hard to get this right.”Henk also pointed to a new onlineloan application making it easier andmore convenient for customers toapply for a loan.The reorganized internal loan processimproves employee productivity andresults in a faster, better experiencefor customers.A new, highly secure and customizableplatform called Business Online CashManager now enables customers to havea real-time view of accounts, transfers,and fund-management activities. It alsoprovides for quick and easy disbursements,tax and loan payments, automatedclearinghouse (ACH) transactions,internal transfers, and more.“ I THINK CUSTOMERS WILL GET A TON OF VALUEOUT OF OUR ENHANCED ALERTS SERVICE.THE NEW SERVICE WILL PROVIDE CUSTOMERSGREATER CONTROL OVER THEIR FINANCESAND A SUPERIOR EXPERIENCE. ”—John HenkDigital security has also been enhanced.SecureNow requires additionalauthentication steps when a customerattempts to access his or her account froman unknown device, and new real-timealerts notify the customer to take immediateaction if a suspicious transaction occurs.Customers can choose to receive theirreal-time alerts via e-mail, short messageservice (SMS), online secure inbox, and/orpush notifications.“I think customers will get a ton of valueout of our enhanced alerts service,”Courtney said. “The new service willprovide customers greater control overtheir finances and a superior experience.”MidWestOne Financial Group, Inc. 2018 ANNUAL REPORT 11

Growing home12 MidWestOne Financial Group, Inc. 2018 ANNUAL REPORT

MidWestOne empowers vibrant communitiesMidWestOne will soon make itself at home inDubuque, Dallas, and Polk Counties in Iowaand Grant County in Wisconsin.Seven American Trust offices are located inDubuque, one in Farley, two in Dyersville,and two in the Des Moines area.East across the Mississippi River, Grant County,Wisconsin, is an important portion of theTri-State Area. American Bank & Trust–Wisconsin has five offices, one in each ofthe communities of Cuba City, Hazel Green,Fennimore, Lancaster, and Platteville.“We’re thrilled to be joining these fine Iowacommunities,” said MidWestOne President andCEO Charlie Funk. “These cities are among thestrongest and fastest-growing in our state. Theymake Iowa a great place to live and work.”“ IT’S AN EXCITING TIME AND AN INCREDIBLEOPPORTUNITY FOR THE ENTIREORGANIZATION. WE CAN’T WAIT TO SEEWHERE THIS GROWTH TAKES US.”—Charlie FunkWith one of the lowest unemployment ratesin the state, Dubuque is a hub for the Tri-StateArea of Iowa, Wisconsin, and Illinois. In additionto being named an All-America City four times,Dubuque has been recognized as one of the100 Best Communities for Young People, one ofthe Best Small Places for Business and Careers,and one of the Smartest Cities on the Planet.1Composed primarily of agriculture, business,and industrial sectors, Grant County isbrimming with economic opportunity. Qualityschools, including the University of Wisconsin –Platteville and Southwest Wisconsin TechnicalCollege at Fennimore, yield highly qualified,knowledge-based, and skilled workers.Dubuque’s Lower Main Street and HistoricMillworks districts continue to expand with newloft apartments, breweries, restaurants, andentertainment venues. Along the U.S. Highway20 corridor west to Farley and Dyersville,new neighborhoods are being constructed,and manufacturing companies are hiring.The relationships American Trust and AmericanBank have forged with their customers overthe years are a testimony to the trust they haveearned in the communities they serve.As measured by annual research, the loyaltyof American Trust’s customers has remainedremarkably strong and consistent overthe years.To position the company for growth outside theTri-State Area, American Trust entered the DesMoines metro area in 2005. Today the bank hasan office in West Des Moines and in WindsorHeights. In 2018, U.S. News ranked Des Moinesfourth on the list of best places to live andfiftieth on the list of best places to retire.2“We’re really looking forward to welcomingthe American Trust and American Bank teammembers, and to integrating ourselves intotheir vibrant communities,” said Funk. “It’s anexciting time and an incredible opportunity forthe entire organization. We can’t wait to seewhere this growth takes om/places/rankings/best-places-to-live12

FROM LEFT: Michael Goedken and Chris Klitgaard of MediRevv, Inc.Expertise and serviceEMPOWER BUSINESSESUSING SOPHISTICATED TECHNOLOGY AND SOLID EXPERTISE, MidWestOne bankershelped one local company power its growth.MediRevv, Inc., a revenue-cycle-managementcompany, works with large physician groups,hospitals, and health systems to add efficiencyto the entire billing and payment cycle. Frompatient and insurance follow-ups to medicalrecords and coding, MediRevv helps patientsdecipher their bills and ensures doctors arereimbursed for their services.Chief Executive Officer Chris Klitgaard startedthe company in 2007 in Coralville, Iowa, withjust one colleague and one client. MediRevv’sgrowth has been on the fast track ever since.In 2008, the company made 1 million inrevenue. In 2018 it surpassed 50 million.For years, MediRevv employed fewerthan one hundred people. Today, thecompany employs 675 people, primarilyin Iowa City/Coralville, Iowa; Scottsbluff,Nebraska; and Anaheim, California.Before he founded MediRevv, Chris enjoyeda well-established personal bankingrelationship with MidWestOne. That’s why,with high expectations, Chris chose topartner with MidWestOne when he beganhis business.14 MidWestOne Financial Group, Inc. 2018 ANNUAL REPORT“We needed a community bank thatunderstood the importance of growing herein the Corridor,” said Michael Goedken, vicepresident of finance at MediRevv, Inc. “Chrishas strong roots in Iowa and wanted to growthe company in Iowa. It was important tohim to keep that connection and to leverageMidWestOne’s ability to understand thebusiness; what it needs and when.”“ WE COULDN’T HAVE GOTTEN TO WHEREWE ARE WITHOUT THE EXPERTISE ANDTHE LINE OF CREDIT WE WERE EXTENDED.IT WAS ABLE TO FUEL SOME GROWTH.”—Michael GoedkenMediRevv’s line of credit has been an importanttool in managing revenue ebbs and flows. Withfunds readily available, the company efficientlymanaged cash flow, made strategic financialdecisions, and planned a dynamic future as itcontinued to grow.“We

strategic acquisition of Dubuque, Iowa-based ATBancorp, which we are confident will add long-term value to our shareholders. At the same time, we know that we have . To summarize from 20,000 feet: our company is clearly moving forward, and we are determined to speed up our rate of progress. Net income of 30.3 million and EPS of 2.48 in .