Transcription

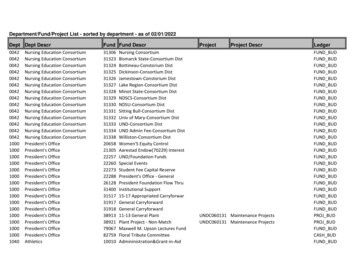

Doing Business 2020Costa RicaEconomy ProfileCosta RicaPage 1

Doing Business 2020Costa RicaEconomy Profile of Costa RicaDoing Business 2020 Indicators(in order of appearance in the document)Starting a businessProcedures, time, cost and paid-in minimum capital to start a limited liability companyDealing with construction permitsProcedures, time and cost to complete all formalities to build a warehouse and the quality control and safetymechanisms in the construction permitting systemGetting electricityProcedures, time and cost to get connected to the electrical grid, and the reliability of the electricity supply andthe transparency of tariffsRegistering propertyProcedures, time and cost to transfer a property and the quality of the land administration systemGetting creditMovable collateral laws and credit information systemsProtecting minority investorsMinority shareholders’ rights in related-party transactions and in corporate governancePaying taxesPayments, time, total tax and contribution rate for a firm to comply with all tax regulations as well as postfilingprocessesTrading across bordersTime and cost to export the product of comparative advantage and import auto partsEnforcing contractsTime and cost to resolve a commercial dispute and the quality of judicial processesResolving insolvencyTime, cost, outcome and recovery rate for a commercial insolvency and the strength of the legal framework forinsolvencyEmploying workersFlexibility in employment regulation and redundancy costPage 2

Doing Business 2020Costa RicaAbout Doing BusinessThe Doing Business project provides objective measures of business regulations and their enforcement across 190 economies and selected cities at the subnational andregional level.The Doing Business project, launched in 2002, looks at domestic small and medium-size companies and measures the regulations applying to them through their lifecycle.Doing Business captures several important dimensions of the regulatory environment as it applies to local firms. It provides quantitative indicators on regulation forstarting a business, dealing with construction permits, getting electricity, registering property, getting credit, protecting minority investors, paying taxes, trading acrossborders, enforcing contracts and resolving insolvency. Doing Business also measures features of employing workers. Although Doing Business does not present rankingsof economies on the employing workers indicators or include the topic in the aggregate ease of doing business score or ranking on the ease of doing business, it doespresent the data for these indicators.By gathering and analyzing comprehensive quantitative data to compare business regulation environments across economies and over time, Doing Business encourageseconomies to compete towards more efficient regulation; offers measurable benchmarks for reform; and serves as a resource for academics, journalists, private sectorresearchers and others interested in the business climate of each economy.In addition, Doing Business offers detailed subnational studies, which exhaustively cover business regulation and reform in different cities and regions within a nation.These studies provide data on the ease of doing business, rank each location, and recommend reforms to improve performance in each of the indicator areas. Selectedcities can compare their business regulations with other cities in the economy or region and with the 190 economies that Doing Business has ranked.The first Doing Business study, published in 2003, covered 5 indicator sets and 133 economies. This year’s study covers 11 indicator sets and 190 economies. Mostindicator sets refer to a case scenario in the largest business city of each economy, except for 11 economies that have a population of more than 100 million as of 2013(Bangladesh, Brazil, China, India, Indonesia, Japan, Mexico, Nigeria, Pakistan, the Russian Federation and the United States) where Doing Business also collected datafor the second largest business city. The data for these 11 economies are a population-weighted average for the 2 largest business cities. The project has benefited fromfeedback from governments, academics, practitioners and reviewers. The initial goal remains: to provide an objective basis for understanding and improving theregulatory environment for business around the world.To learn more about Doing Business please visit doingbusiness.orgPage 3

Doing Business 2020Costa RicaEase of Doing Business inCosta RicaRegionLatin America & CaribbeanIncome CategoryUpper middle incomePopulation4,999,441City CoveredSan JoséDB RANKDB SCORE7469.2Rankings on Doing Business topics - Costa sResolvingInsolvencyTopic Scores79.970.888.974.485.048.0Starting a Business (rank)144Getting Credit (rank)Score of starting a business (0-100)79.9Score of getting credit (0-100)78.077.61585.01055.2Trading across Borders (rank)Score of trading across borders (0-100)34.68077.6Procedures (number)10Strength of legal rights index (0-12)Time (days)23Depth of credit information index (0-8)7Documentary compliance (hours)24Cost (number)9.6Credit registry coverage (% of adults)36.4Border compliance (hours)20Paid-in min. capital (% of income per capita)0.0Credit bureau coverage (% of adults)86.0Cost to exportDealing with Construction Permits (rank)78Protecting Minority Investors (rank)110Time to exportDocumentary compliance (USD)Score of dealing with construction permits (0-100)Procedures (number)70.817Score of protecting minority investors (0-100)48.0Extent of disclosure index (0-10)5.0Border compliance (USD)80450Time to exportDocumentary compliance (hours)26Time (days)138Extent of director liability index (0-10)5.0Border compliance (hours)80Cost (% of warehouse value)2.0Ease of shareholder suits index (0-10)8.0Cost to export11.0Extent of shareholder rights index (0-6)2.0Documentary compliance (USD)Extent of ownership and control index (0-7)3.0Border compliance (USD)Extent of corporate transparency index (0-7)1.0Paying Taxes (rank)66Building quality control index (0-15)Getting Electricity (rank)Score of getting electricity (0-100)Procedures (number)Time (days)Cost (% of income per capita)Reliability of supply and transparency of tariff index (0-8)Registering Property (rank)Score of registering property (0-100)Procedures (number)Time (days)Cost (% of property value)Quality of the land administration index (0-30)2588.9539158.084974.45113.417.5Enforcing Contracts (rank)Score of paying taxes (0-100)Payments (number per year)78.010Time (hours per year)151Total tax and contribution rate (% of profit)58.3Postfiling index (0-100)87.2Score of enforcing contracts (0-100)7550011155.2Time (days)852Cost (% of claim value)24.3Quality of judicial processes index (0-18)9.5Resolving Insolvency (rank)137Score of resolving insolvency (0-100)34.6Recovery rate (cents on the dollar)29.5Time (years)Cost (% of estate)3.014.5Outcome (0 as piecemeal sale and 1 as goingconcern)0Strength of insolvency framework index (0-16)6.0Page 4

Doing Business 2020Costa RicaStarting a BusinessThis topic measures the number of procedures, time, cost and paid-in minimum capital requirement for a small- to medium-sized limited liability company to start up andformally operate in each economy’s largest business city.To make the data comparable across 190 economies, Doing Business uses a standardized business that is 100% domestically owned, has start-up capital equivalent to10 times the income per capita, engages in general industrial or commercial activities and employs between 10 and 50 people one month after the commencement ofoperations, all of whom are domestic nationals. Starting a Business considers two types of local limited liability companies that are identical in all aspects, except that onecompany is owned by 5 married women and the other by 5 married men. The ranking of economies on the ease of starting a business is determined by sorting theirscores for starting a business. These scores are the simple average of the scores for each of the component indicators.The most recent round of data collection for the project was completed in May 2019. See the methodology for more information.What the indicators measureProcedures to legally start and formally operate a company(number) Preregistration (for example, name verification or reservation,notarization) Registration in the economy’s largest business city Postregistration (for example, social security registration,company seal) Obtaining approval from spouse to start a business or to leavethe home to register the company Obtaining any gender specific document for companyregistration and operation or national identification cardTime required to complete each procedure (calendar days) Does not include time spent gathering information Each procedure starts on a separate day (2 procedures cannotstart on the same day) Procedures fully completed online are recorded as ½ day Procedure is considered completed once final document isreceived No prior contact with officialsCost required to complete each procedure (% of income percapita) Official costs only, no bribes No professional fees unless services required by law orcommonly used in practicePaid-in minimum capital (% of income per capita) Funds deposited in a bank or with third party before registrationor up to 3 months after incorporationCase study assumptionsTo make the data comparable across economies, several assumptions about the business and theprocedures are used. It is assumed that any required information is readily available and that theentrepreneur will pay no bribes.The business:-Is a limited liability company (or its legal equivalent). If there is more than one type of limitedliability company in the economy, the limited liability form most common among domestic firms ischosen. Information on the most common form is obtained from incorporation lawyers or thestatistical office.-Operates in the economy’s largest business city. For 11 economies the data are also collected forthe second largest business city.-Performs general industrial or commercial activities such as the production or sale to the public ofgoods or services. The business does not perform foreign trade activities and does not handleproducts subject to a special tax regime, for example, liquor or tobacco. It is not using heavilypolluting production processes.-Does not qualify for investment incentives or any special benefits.-Is 100% domestically owned.-Has five business owners, none of whom is a legal entity. One business owner holds 30% of thecompany shares, two owners have 20% of shares each, and two owners have 15% of shareseach.-Is managed by one local director.-Has between 10 and 50 employees one month after the commencement of operations, all of themdomestic nationals.-Has start-up capital of 10 times income per capita.-Has an estimated turnover of at least 100 times income per capita.-Leases the commercial plant or offices and is not a proprietor of real estate.-Has an annual lease for the office space equivalent to one income per capita.-Is in an office space of approximately 929 square meters (10,000 square feet).-Has a company deed that is 10 pages long.The owners:-Have reached the legal age of majority and are capable of making decisions as an adult. If thereis no legal age of majority, they are assumed to be 30 years old.-Are in good health and have no criminal record.-Are married, the marriage is monogamous and registered with the authorities.-Where the answer differs according to the legal system applicable to the woman or man inquestion (as may be the case in economies where there is legal plurality), the answer used will bethe one that applies to the majority of the population.Page 5

Doing Business 2020Costa RicaStarting a Business - Costa RicaStandardized CompanyLegal formSociedad Anónima (S.A.) - CorporationPaid-in minimum capital requirementNo minimumCity CoveredSan JoséIndicatorCosta RicaLatin America &CaribbeanOECD highincomeBest RegulatoryPerformanceProcedure – Men (number)108.14.91 (2 Economies)Time – Men (days)2328.89.20.5 (New Zealand)Cost – Men (% of income per capita)9.631.43.00.0 (2 Economies)Procedure – Women (number)108.14.91 (2 Economies)Time – Women (days)2328.89.20.5 (New Zealand)Cost – Women (% of income per capita)9.631.43.00.0 (2 Economies)Paid-in min. capital (% of income per capita)0.00.47.60.0 (120 Economies)Figure – Starting a Business in Costa Rica – Score47.177.495.2100.0ProceduresTimeCostPaid-in min. capitalFigure – Starting a Business in Costa Rica and comparator economies – Ranking and ScoreDB 2020 Starting a Business Score010091.4: Chile (Rank: 57)87.0: Colombia (Rank: 95)86.8: Guatemala (Rank: 99)79.9: Costa Rica (Rank: 144)79.6: Regional Average (Latin America & Caribbean)78.6: El Salvador (Rank: 148)Note: The ranking of economies on the ease of starting a business is determined by sorting their scores for starting a business. These scores are the simple average ofthe scores for each of the component indicators.Page 6

Doing Business 2020Costa RicaFigure – Starting a Business in Costa Rica – Procedure, Time and CostTime (days)Cost (% of income per capita)20Time (days)4153102510Cost (% of income per capita)50123456*7*8910Procedures (number)* This symbol is shown beside procedure numbers that take place simultaneously with the previous procedure.Note: Online procedures account for 0.5 days in the total time calculation. For economies that have a different procedure list for men and women, the graph shows thetime for women. For more information on methodology, see the Doing Business website (http://doingbusiness.org/en/methodology). For details on the proceduresreflected here, see the summary below.Page 7

Doing Business 2020Costa RicaDetails – Starting a Business in Costa Rica – Procedure, Time and CostNo.123ProceduresTime to CompleteAssociated CostsCheck the availability of the proposed company nameAgency : National Registry ( Registro de Personas Jurídicas)In order to register a company one must first verify the availability of the company name. Thecompany name can be verified online (https://www.rnpdigital.com) free of cost. Companies canalso be registered by number, in which case the name would not have to be verified.Less than one dayA notary public drafts and notarizes public deeds of the incorporation charter forregistration before the Public Registry onlineAgency : Public NotaryThe founding shareholders, as well as the members of the Board of Directors, must sign the publicdeed of incorporation drafted and authorized by the notary public, who will then submit it forregistration to the National Registry. A minimum of two founding shareholders is required, as wellas designation of a President, Secretary, Treasurer and Comptroller. The same person cannotoccupy two different positions. According to the fee schedule established by Executive Order No.41457-JP effective on February 1, 2019, the fee for notarizing the articles of association is CRC181,500 for any corporation.Less than one dayDeposit capital in the bank account, pay registration fees and stamp dutiesAgency : National Banking SystemAs a prerequisite for registering the company, 25% of the capital stock indicated in theincorporation charter (if paid in cash) must be deposited in a national bank. The amount depositedmay be withdrawn once the company has been duly recorded. If founders chose to sign apromissory note, there is no enforceable obligation to deposit capital in a bank account later. Infact, the business is not even required to operate a bank account at any point during its existence.1 daysee commentsRegister the incorporation charter in the National Registry and obtain authorization tolegalize the company books; send the notice of constitution of the company (edicto)Agency : Crear Empresa (National Registry)One must register the incorporation charter at the National Registry, obtain authorization tolegalize the company books and send a notice of constitution of the company. This can be doneonline since February 2012, when Costa Rica launched Crear Empresa. This online platform forbusiness registration allows all incorporation documents to be submitted electronically.2 daysCRC 8,000 (digitalFile Form D-140 with the before the Tax Department to register the firm as a taxpayerAgency : Tax Department (Registro Unico de Contribuyentes, Dirección General de TributaciónDirecta)Costa Rican citizens or corporations with a Costa Rican legal representative can registerelectronically as taxpayer ona.jsp)Less than one dayPay the Legal Entities TaxAgency : BankCompanies must pay the legal entities tax within the first thirty calendar days following registrationwith the National Registry. The tax is paid from the website of any Costa Rican bank.Less than one dayRegister for labor risk insurance with the National Insurance Institute (Instituto Nacional deSeguros)Agency : National Insurance Institute (Instituto Nacional de Seguros)The National Insurance Institute is the only insurance at the moment that only offers laborinsurance. The annual premium for this type of insurance is about 2.17% of reported payroll.1 day (simultaneous withRegister the company as an employer with Caja Costarricense de Seguro Social (CCSS,Social Security Institute)Agency : Social Security Institute (Caja Costarricense de Seguro Social)After submitting the documents required, the CCSS issues a registration form (inscripción anteCCSS de persona jurídica) that allows the company to start operations. Within 15 days afterregistration with the CCSS, the company will receive an ex-post inspection from an officer, whichconsists on a simple verification of the information provided by the company about the businessactivity and the employees.1 day (simultaneous withno charge(online procedure)CRC 181,500(online procedure)The registration fees, which include the notary public fees, are as follows:Stamp fees:National Archive (Archivo Nacional) CRC 20Coleg Contad. Priv (Libros legales) CRC 75Colegio de Abogados CRC 15,000Educación y Cultura CRC 750Fiscal CRC 625Municipal Fees CRC 0.2% of capitalNational Registry CRC 44,620Legal Books CRC 17,150.00Agrary Stamp (Agrario) CRC 0.15% of capital45678registration fees) CRC6,580 (publication fees)see comment(online procedure)15% of a base salary(online procedure)no chargeprevious procedure)no chargeprevious procedure)Page 8

Doing Business 2020Costa Rica9Apply for sanitary permitAgency : Health Department (Ministerio de Salud)The cost for applying for a sanitary permit depends on the degree of environmental risk of thecompany and varies from USD 30 to USD 100 (USD 30 for low environmental risk, USD 50 formoderate environmental risk, USD 100 for high environmental risk).1 dayUSD 3010Apply for the business license (patente municipal) from the municipalityAgency : Local municipalityAll new businesses must apply for the business license (patente municipal) from the municipality.15 daysCost varies between CRC10,000 and CRC 100,000depending on the type ofactivity, number ofemployees, location.Takes place simultaneously with previous procedure.Page 9

Doing Business 2020Costa RicaDealing with Construction PermitsThis topic tracks the procedures, time and cost to build a warehouse—including obtaining necessary the licenses and permits, submitting all required notifications,requesting and receiving all necessary inspections and obtaining utility connections. In addition, the Dealing with Construction Permits indicator measures the buildingquality control index, evaluating the quality of building regulations, the strength of quality control and safety mechanisms, liability and insurance regimes, and professionalcertification requirements. The most recent round of data collection was completed in May 2019. See the methodology for more informationWhat the indicators measureProcedures to legally build a warehouse (number) Submitting all relevant documents and obtaining all necessaryclearances, licenses, permits and certificates Submitting all required notifications and receiving all necessaryinspections Obtaining utility connections for water and sewerage Registering and selling the warehouse after its completionTime required to complete each procedure (calendar days) Does not include time spent gathering information Each procedure starts on a separate day—though proceduresthat can be fully completed online are an exception to this rule Procedure is considered completed once final document isreceived No prior contact with officialsCost required to complete each procedure (% of income percapita) Official costs only, no bribesBuilding quality control index (0-15) Quality of building regulations (0-2) Quality control before construction (0-1) Quality control during construction (0-3) Quality control after construction (0-3) Liability and insurance regimes (0-2) Professional certifications (0-4)Case study assumptionsTo make the data comparable across economies, several assumptions about the constructioncompany, the warehouse project and the utility connections are used.The construction company (BuildCo):- Is a limited liability company (or its legal equivalent) and operates in the economy’s largestbusiness city. For 11 economies the data are also collected for the second largest business city.- Is 100% domestically and privately owned; has five owners, none of whom is a legal entity. Has alicensed architect and a licensed engineer, both registered with the local association of architectsor engineers. BuildCo is not assumed to have any other employees who are technical or licensedexperts, such as geological or topographical experts.- Owns the land on which the warehouse will be built and will sell the warehouse upon itscompletion.The warehouse:- Will be used for general storage activities, such as storage of books or stationery.- Will have two stories, both above ground, with a total constructed area of approximately 1,300.6square meters (14,000 square feet). Each floor will be 3 meters (9 feet, 10 inches) high and will belocated on a land plot of approximately 929 square meters (10,000 square feet) that is 100%owned by BuildCo, and the warehouse is valued at 50 times income per capita.- Will have complete architectural and technical plans prepared by a licensed architect. Ifpreparation of the plans requires such steps as obtaining further documentation or getting priorapprovals from external agencies, these are counted as procedures.- Will take 30 weeks to construct (excluding all delays due to administrative and regulatoryrequirements).The water and sewerage connections:- Will be 150 meters (492 feet) from the existing water source and sewer tap. If there is no waterdelivery infrastructure in the economy, a borehole will be dug. If there is no sewerageinfrastructure, a septic tank in the smallest size available will be installed or built.- Will have an average water use of 662 liters (175 gallons) a day and an average wastewater flowof 568 liters (150 gallons) a day. Will have a peak water use of 1,325 liters (350 gallons) a day anda peak wastewater flow of 1,136 liters (300 gallons) a day.- Will have a constant level of water demand and wastewater flow throughout the year; will be 1inch in diameter for the water connection and 4 inches in diameter for the sewerage connection.Page 10

Doing Business 2020Costa RicaDealing with Construction Permits - Costa RicaStandardized WarehouseEstimated value of warehouseCRC 327,599,011.50City CoveredSan JoséIndicatorCosta RicaLatin America &CaribbeanOECD highincomeBest RegulatoryPerformanceProcedures (number)1715.512.7None in 2018/19Time (days)138191.2152.3None in 2018/19Cost (% of warehouse value)2.03.61.5None in 2018/19Building quality control index (0-15)11.09.011.615.0 (6 Economies)Figure – Dealing with Construction Permits in Costa Rica – Score52.067.790.173.3ProceduresTimeCostBuilding quality control indexFigure – Dealing with Construction Permits in Costa Rica and comparator economies – Ranking and ScoreDB 2020 Dealing with Construction Permits Score010075.9: Chile (Rank: 41)70.8: Costa Rica (Rank: 78)69.1: Colombia (Rank: 89)65.3: Guatemala (Rank: 118)63.2: Regional Average (Latin America & Caribbean)52.3: El Salvador (Rank: 168)Note: The ranking of economies on the ease of dealing with construction permits is determined by sorting their scores for dealing with construction permits. These scoresare the simple average of the scores for each of the component indicators.Page 11

Doing Business 2020Costa RicaFigure – Dealing with Construction Permits in Costa Rica – Procedure, Time and CostTime (days)Cost (% of warehouse value)1201Time (days)1000.8800.6600.440Cost (% of warehouse value)1.20.2200012*3*4*56*7891011* 121314* 15* 1617Procedures (number)* This symbol is shown beside procedure numbers that take place simultaneously with the previous procedure.Note: Online procedures account for 0.5 days in the total time calculation. For economies that have a different procedure list for men and women, the graph shows thetime for women. For more information on methodology, see the Doing Business website (http://doingbusiness.org/en/methodology). For details on the proceduresreflected here, see the summary below.Page 12

Doing Business 2020Costa RicaFigure – Dealing with Construction Permits in Costa Rica and comparator economies – Measure of Quality13.014Index ils – Dealing with Construction Permits in Costa Rica – Procedure, Time and CostNo.ProceduresTime to CompleteAssociated Costs1Request and obtain zoning authorization (uso de suelo) from the Municipal GovernmentAgency : Municipal GovernmentThe request must be made personally before the Local Government, the owner of the property orthird party with legal authorization of the owner, who must complete a form and provide therespective requirements. This request can also include a request for property line setbacks to beindicated by the Municipal Government. New land use policies were approved in April 2006. Thegreater San Jose metropolitan area includes 31 municipalities. The zoning authorization will bevalid for 6 months, or up to 12 months. Many municipal authorities, such as the Belen Municipality,do not respect their own land-use regulations when granting the final construction permit.10 daysno charge2Obtain results of geotechnical study / soil testAgency : Private licensed companyA soil study is not a requirement by law. In practice, contractors ask for a soil test to ensure thatthe foundation of the building is solid. The engineer must understand the suitability of the soil forthe proposed construction work. Soil test allows to build a solid foundation and avoid structures tobe damaged or collapsed or leaned.The zoning authorization must be obtained prior to requesting a soil test.17 daysCRC 628,9813Obtain topographic results of land plotAgency : Private licensed companyA topographic survey of the land plot is obtained prior to developing the architectural plans of thewarehouse.11 daysCRC 428,9824Request and obtain approval by the Water Department (Acueductos y Alcantarillados)Agency : Water DepartmentBuildCo must complete and submit an approval form to the Water Department. In turn, theDepartment must verify that the construction project site has a water source.10 daysno charge5Request and obtain workers compensation insurance proof from National InsuranceInstituteAgency : National Insurance InstituteThe National Insurance Institute requires proof that worker compensation insurance has been paidprior to issuing a building permit. This proof is required to start each new project. In the past,developers were allowed a blanket insurance policy that did not require purchase of insurance forevery new project. In 2007, the Institute’s policies were revised; it now allows a blanket insurancethat the developer adjusts, paying the differences annually. But the complexity of the processdiscourages its use. Most construction companies purchase individual insurance on a case-bycase basis for projects instead of globally for annual activities. This system is likely to be changedbecause of private sector complaints.1 dayno charge60 daysCRC 1,000,000Insurance premiums are based on the amount of coverage. The cost is 4.16% of the value of thelabor force which is in turn evaluated to amount for 35% of the total cost of the project. Thecompleted form must be presented with copies of the workers’ identification cards or (for underageemployees) working permits.6Request and obtain approval from National Environment Technical SecretaryAgency : National Environment Technical SecretaryBuildCo must obtain approval from the National Environment Technical Secretary (SecretaríaTécnica Nacional del Ambiente, SETENA), using two forms (in Spanish) available on SETENA’sWeb site (www.minae.go.cr /setena.html). BuildCo would use Form D-1 which costs anywherebetween CRC 1 million to CRC 1.5 million. The response generally takes 60 -- 90 days. Thisprocedure and the next can be completed simultaneously.Page 13

Doing Business 20207Costa RicaRequest and obtain approval of blue prints by College of Architects and EngineersAgency : College of Architects and EngineersBuildCo should submit the property survey map and a contract, signed by two members of theCollege of Architects and Engineers (Colegio Federado de Ingenieros y de Arquitectos de CostaRica), an electrical engineer and either a civil engineer or an architect. It is preferred that at leastfour blueprint copies be submitted. The college has implemented the new Administrador deProyectos d

-Has five business owners, none of whom is a legal entity. One business owner holds 30% of the company shares, two owners have 20% of shares each, and two owners have 15% of shares each.-Is managed by one local director.-Has between 10 and 50 employees one month after the commencement of operations, all of them domestic nationals.