Transcription

PropTech Market Update2020 Year-End Review

EXECUTIVE SUMMARY – 2020 PROPTECH» Despite a decline from 2019’s record capital raising levels, investment into the U.S. PropTech market remains incredibly activewith 7.3Bn of equity and debt raised across nearly 300 deals in the category in 2020» 58 deals of 20M in equity invested and 28 deals with 50M in equity investment scale leaders emerging across allsub-categories within PropTech and investors backing established category leaders» 100M investment rounds in 2020 into Vacasa, Sonder, Better, Hippo, Katerra, Procore and many others» M&A market remained highly active with 100 U.S. PropTech M&A deals in 2020 majority of M&A activity was driven bystrategic buyers, but private equity activity increasingSignificant Strategic & Private Equity M&A Transactions// 10,200MM/ 11,000MM/ 250MM/ 1,800MM/ 350MMUndisclosed» Valuation multiples in the market continue to remain strong, especially for software businesses, with the NASDAQ up 44% in2020(1) – Rise of SPACs (Special Purpose Acquisition Companies) with focus on PropTech‒ Opendoor, Porch, Open Lending, Vivint and United Wholesale Mortgage all announced SPAC mergers with multipleadditional PropTech-focused SPACs looking for targets‒ Successful and pending IPOs reflect continued significant public market demand for PropTech companiesSuccessful & Pending IPOsMarket Cap(2): 110BnMarket Cap(2): 9BnMarket Cap(2): 40BnFiled for IPO» GCA expects continued strong PropTech market activity in 2021 given the momentum and tailwinds in the sectorSource:(1) Reflects percent change from 1/2/2020 to 12/31/2020.(2) As of 1/22/2021.2

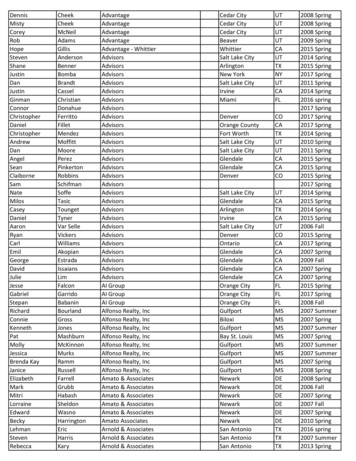

LEADING ADVISORY TEAM FOCUSED ON THE PROPTECH MARKETGCA U.S. PropTech TeamLeader in PropTech Advisory – 25 Global PropTech Deals Announced since 2017Chris GoughManaging DirectorHead of Real Estate TechnologyPhone: (415) 318-3658cgough@gcaglobal.comLizzie CooperstoneA Portfolio Company ofInvestment fromInvestment fromAcquiredMajority interestacquired byWe advised the sellerWe advised the sellerWe advised MobysoftWe advised the buyerWe advised the sellerAcquired byAcquired byAcquired byAcquired byMajority interestacquired byA Portfolio Company ofA Portfolio Company ofWe advised the sellerWe advised the sellerWe advised the sellerWe advised the sellerWe advised the sellerAcquired byAcquired byAcquiredAcquired byAcquired byWe advised the sellerWe advised the sellerWe advised the buyerWe advised the sellerWe advised the sellerAcquired byAcquired byInvestment fromInvestment fromAcquired byWe advised the sellerWe advised the sellerWe advised MobysoftWe advised CapsilonWe advised the sellerMajority investment fromlcooperstone@gcaglobal.comGCA European PropTech TeamAdrian ReedManaging DirectorPhone: 44 (161) 240-6422adrian.reed@gcaaltium.comDominic Orsini, Directordominic.orsini@gcaaltium.comKey Sub-Sector Coverage VerticalsResidential RE SoftwareCommercial RE SoftwareMortgage / LendingTitle / InsuranceHome ServicesFacilities ManagementConstruction TechIWMS3

GCA ADVISES LONE WOLF TECHNOLOGIES ON ITS STRATEGIC INVESTMENT F ROMSTONE POINT CAPITALTransaction OverviewEnd-to-End Real Estate Software PlatformGCA acted as financial advisor to Lone WolfTechnologies on its strategic investment fromStone Point Capital» On October 23rd, Lone WolfTechnologies announced that fundsmanaged by Stone Point Capital willbecome Lone Wolf’s lead nsaction management tools – MLS integration,forms, eSignatures, etc. – designed to enhanceagent productivity, drive compliance and managetransactions from contract to closeeSignatureCloud-based, electronic signature for real estatetransactions with over 22 million eSignatures filedannually» Lone Wolf Technologies is the NorthAmerican leader in residential realestate software» The Company provides agents, brokers,franchises, MLSs and associations thetools they need to build their businessand improve profitsCompany Highlights15M 1,000 8,000 Customers1.4M 99%22M AgentsNorth American FormsCoverageeSignaturesPer YearSource: Company websites and press releases.Creates, manages and auto-populates legallycompliant online forms and contracts byleveraging the industry’s most comprehensiveoffering of form coverage and typesBack-OfficeManagementPurpose-built back-office accounting softwarecombining traditional accounting with real estatetransaction functionality that results in stickyrelationships throughout any macroeconomic climateInsights &AnalyticsFirst-of-its-kind broker command center, deliveringAI-enabled predictive insights, built upon a data lakeleveraging 30 years of proprietary, industry-specificdata from Lone Wolf’s existing product suiteMarketplaceAll-in-one platform of over 30 partners, offeringcurated upstream and downstream services andtools to significantly improve the entire real estatetransaction experience and deliver unique agentdifferentiation4

GCA ADVISES LONE WOLF TECHNOLOGIES ON ITS STRATEGIC INVESTMENT F ROMSTONE POINT CAPITAL (CONT.)Select Transaction CommentarySelect Partners and CustomersMLSs & AORsWe’re excited to work with the team at Stone Point to continue our strategic“growth.Stone Point’s investment aligns with our vision to create a trulyconnected, fully digital real estate experience. We are thankful for thepartnership and leadership of Vista Equity Partners over the last five years,and we remain committed to serving the real estate industry going forward.”Brokerages & FranchisesJimmy Kelly,President and CEO,Lone Wolf Technologies“We are enthusiastic about the long-term opportunities within the real estateservices and technology industry. This industry is undergoing rapid digitaltransformation, and we are pleased to partner with Jimmy and hiscolleagues, who together have built a remarkable company and havedemonstrated the vision to continue to grow and better serve their clients.Marketplace Partners”Chuck Davis,CEO,Stone Point CapitalHistory of Strategic Acquisitions and Product DevelopmentInvestment byAcquisition ofLaunch of Lone Wolf LinkLaunch ofVista Equity Partners completed aminority investmentLone Wolf added cloud-based transactionmanagement products and extensive formscoverage (i.e., Canada)Seamless integration of Lone Wolf’stransaction management solutions withbrokerWOLF enables agents to communicatewith back-office processes in real-timeMarketplace hosts a variety of digitaltools, services and partner solutionsfor real estate agents and brokeragesJul 2016Apr 2015Apr 2019Oct 2017Jan 2020Apr 2019May 2020Investment byAcquisition ofLaunch ofVista Equity partners completed a majorityinvestment and focused on executing a coreorganic plan while simultaneously looking forinorganic pieceszipLogix brought breadth to existing formsbusiness, with complementary transactionmanagement solutions and unique customerrelationships (NAR, CAR)Insight’s AI-enabled system delivers on-demandsnapshots of sales forecasts, GCI and companydollarSource: Company websites and press releases.5

GCA ADVISES CONSTRUCTION TECH LEADER EQUE2 ON INVESTMENT FROM WESTBRIDGEGCA Altium acted as exclusive financial advisor to Eque2, a portfolio company of LDC, on the sale to WestBridgeBackground Eque2 are the UK market-leading supplier of business management software to the construction, contracting and housebuilding industries The Company targets businesses across a range of sizes from SMB (small and medium-sized businesses) to UMM (uppermid-market) within construction & related industries The investment from WestBridge will support Eque2’s management team to deliver its go to market strategy and SaaSplatform growthAbout the Transaction GCA Altium was appointed in early 2020 to assess exit options and prepare for a marketing process to both trade and PE Preparation and trade outreach commenced in early 2020, with financial, commercial and technology vendor duediligence commissionedLocationUKDateDecember 2020 The shareholders viewed WestBridge’s offer as the most compelling based on price, relationship, timetable and overallstrategy to pursue Eque2’s go to market strategy and SaaS growth opportunity The buyout was led by a five-strong senior management team and provided a full exit for LDC, which acquired a minoritystake in the company in November 2017, and other institutional shareholders within three weeks after receiving offersDeal TypeSell-side M&AConstructionTechnology6

GCA ADVISES MOBYSOFT ON ITS INVESTMENT FROM ECIGCA Altium advises multi-family software provider Mobysoft on investment from ECIBackground Based in Manchester, Mobysoft is a fast-growing, highly recurring provider of cloud-based rent arrears managementsoftware to the UK social housing sector Mobysoft’s flagship product, RentSense, processes payment patterns for more than 1.6m properties on a daily andweekly basis and uses predictive analytics software to provide recommendations and optimise workflows for over 140social housing providers RentSense has achieved significant penetration of the UK social housing market ( 30% on a properties basis) andMobysoft expects to generate annual recurring revenue of c. 11.5m by December 2020 Mobysoft was founded in 2003 by Derek SteeleAbout the TransactionLocationUK GCA Altium has advised Mobysoft since 2016, successfully facilitating minority investment from Livingbridge in 2017followed by a debt refinancing process in 2019, and was appointed in late 2019 to assess exit options The shareholders viewed ECI’s offer as the most compelling based on relationship, price and overall strategy to pursueMobysoft’s key growth opportunities ECI will take a significant stake alongside a minority reinvestment by Livingbridge and managementDateSeptember 2020Deal TypeMinority InvestmentMulti-FamilySoftware7

I.PROPTECH MARKET SUMMARYII.PUBLIC MARKETSIII. M&A AND MARKET COMPS BACK-UP8

2020 PROPTECH SECTOR SUMMARY – KEY SUBSEGMENT TRENDSResidential Real Estate TechnologyCommercial Real Estate Technology COVID-19 accelerating “digitization” of the transaction virtual showings, performance / data-driven customer capture,virtual notary, transaction management, broker managementtools, tech-driven escrow / title all will benefit from adoptiontailwinds in post-COVID market Commercial RE investment activity fell 44% through the firstthree quarters of 2020, but activity remains highly end-marketdependent – investors have favored multi-family and industrialassets relative to retail, office and hotels(3) Despite a challenging 2020, low interest rates, significant drypower and government stimulus should support the CRE marketin 2021 Record activity in the mortgage vertical driving significantmomentum in the market. Mortgage Bankers Associationexpects 3.6Tn in total originations in 2020 ( 2.2Tn refi / 1.4Tnpurchase) fueled continued interest in mortgage tech /mortgage originators(1) Brokerages have been the best performing public marketsegment in PropTech in 2020 continued verticalization of themarket with brokerages working to expand attach rates on title/ mortgage and adjacent transaction related productsUp 837% in LTM(2)Up 207% in LTM(2) CRE office solutions that deliver operational efficiency drivehigh ROI and are in high demand (energy efficiency, utilitiesbulling, predictive maintenance, visitor management, etc.) Tenant engagement, tenant experience and tenant safety toolsare also critical in post-COVID environment Continued activity and strong momentum in multifamilymanagement software, especially for firms that are using techto enhance tenant experienceUp 57% in LTM(2)Source:(1) Mortgage Bankers Association Mortgage Market Forecast.(2) Capital IQ as of 1/22/2021.(3) CBRE, Global Real Estate Market Outlook 2021 Review.9

ANOTHER RECORD YEAR – REFLECTED IN 2020 DEAL FLOWU.S. Real Estate Technology Venture Investment (2015 - 2020)( MM)Equity Raise ValueDebt Raise Value 9,015295 U.S. PropTech deals in2020, totaling 7.3Bn inequity and debt 2,060 7,284 1,345Q1 728 5,308 4,477 475 250 7,284 6,955 2,748Avg. DealValue:Q4 1,808 5,938Q2 3,933Q3 815 4,833 1,823 4,226201520162017201820192020 10.6 8.0 20.6 20.1 21.3 20.1Source: Capital IQ as of 12/31/2020, Pitchbook, press releases.Excludes Oyo Rooms and The We Company financing rounds.Represents data across CRE / Investment, Residential Real Estate and Mortgage Technology.10

ANOTHER RECORD YEAR – REFLECTED IN 2020 DEAL FLOWU.S. Growth Capital Raises Greater than 20MMTop 10 U.S. Equity Rounds of 2020( MM)Strong deal activity in 2020 in anunpredictable economic environmentAmt. InvestedFunding to DateLatestReportedValuation4/6 1,000(1) Equity/ 1,000 Debt 6,400(2)NA11/24 350 710 1,5005/19 200 1,491NA11/10 200 410 4,0006/24 170 560 1,3004/20 150 155NA4/30 150 400 5,0007/21 150 709 1,5005/21 123 230 6236/2 108 0162017201820192020Source: Capital IQ as of 12/31/2020, Pitchbook, press releases.Excludes Oyo Rooms and The We Company financing rounds.Represents data across CRE / Investment, Residential Real Estate and Mortgage Technology.(1) AirBnB raised 1Bn in debt and equity (mix not disclosed) and 1Bn of debt on 4/6/2020.(2) Debt and equity mix not disclosed.11

PROPTECH PRIVATE COMPANY FUNDING LEADERSEquity Raised to Date: 500MMMoversOther Mega Funding Leaders1( 614MM)( 468MM)( 3.0Bn)( 8.9Bn Equity / 6.1Bn Debt)2020 IPO / SPAC 200MM - 500MM(2021) 100MM - 200MM51 companiesraised 100MM 50MM - 100MM157 companiesraised 25MM 25MM - 50MMSource: PitchBook, CB Insights, company filings, company websites, press releases. Funding totals exclude secondary transactions. Equity raised to date as of 1/16/2021.12

HIPPO SECURED 350MM FROM MS&AD INSURANCE GROUPTransaction OverviewReceived StrategicInvestment from 350MM InvestedHippo Overview On November 24, Hippo Enterprises(“Hippo”) announced a capital investment of 350 million from Mitsui SumitomoInsurance Company, Limited, a subsidiary ofMS&AD Insurance Group Holdings, Inc. The investment solidifies the strategicpartnership between the two companies,which began with MS&AD Ventures’ initialinvestment in Hippo’s Series E funding roundABCDEE-II 3502015Description:Hippo Enterprises is a licensed national property and casualtyinsurer in the United States. The Company provides an onlineplatform that enables homeowners to obtain customized homeinsurance coverage, ongoing home-care services andmaintenance.Current Investors: 210 110 15 25 15 70 40Dec-16Jan-18Nov-18Previously Raised 150 320 100 110Jul-19 195Jul-20Modern Home InsurancePolicies provided by Hippo set a new standard ofhome insurance and offer protection for everythingfrom traditional property & liability coverage toindividual devices and appliancesHome Wellness 360 15Founded:Product Overview 710 40Mountain View, CA The investment will support Hippo’s productroll out in additional states and MitsuiSumitomo will take on a portion of risk tosupport Hippo through a reinsurance treatyHippo Fundraising TimelineSeries:Headquarters:Nov-20New FundingSource: PitchBook, CB Insights, Crunchbase, company website, press releases.Hippo helps care for your home and prevent smallissues from becoming expensive headaches withcomplimentary smart home monitoring systemsand virtual home maintenance services, DIY guidesand on-demand bookings60-seconds5 minutesUp to 25%To receive a quoteTo purchase a policySavings13

HIPPO SECURED 350MM FROM MS&AD INSURANCE GROUP (CONT’D)Geographic PresenceGeographic Presence Today The company currently offers insurance products to more than 70percent of homeowners in the countryGeographic Presence at Scale The money will be used to roll out in new states, helping Hippo get toits goal of reaching 95 percent of U.S. homeowners in the next yearSelect Deal CommentaryWe have been very thoughtful on the people that we’ve“boughtinto the capital structure and how can they help us buildthe biggest franchise. Mitsui Sumitomo is one of the best whenit comes to risk management and shares our desire to leveragedata and analytics to create better outcomes for homeowners.We’re excited to deepen our partnership and gain additionalcatastrophe modeling expertise from one of the world’s largestinsurers.”Assaf Wand, Co-Founder & CEO,Hippo InsuranceSource: PitchBook, CB Insights, Crunchbase, company website, press releases.We value the innovation that Hippo brought to the home“insurancespace through its advanced classification of risk. Welook forward to learning from one another through our strategicpartnership, providing high value-added products and servicesto customers of both companies in the U.S. and Japan, and tocontinue to support Hippo, which quickly became a topinsurtech in the U.S. home insurance space and is beloved by itscustomers.”Shinichiro Funabiki, Director, VPExecutive Officer, MS&AD Insurance14

ORCHARD RAISES 69MM IN SERIES C ROUNDTransaction OverviewSeries Cled by 69MM RaisedOrchard Overview On September 10, Orchard announced that ithad raised 69MM in equity led byRevolution Growth, with participation fromexisting investors FirstMark Capital, Navitas,Accomplice and Juxtapose This brings the company’s total attributedfunding to 155MM to date(1) Orchard plans to use its new funding tolaunch new product offerings and expandinto new markets throughout the countrySolution OverviewHeadquarters:New York, NYFounded:2017Description:Operator of home buying and selling marketplace, which digitizesthe experience of buying and selling homes. The company utilizestechnology to deliver valuation for homes and make contingencyfree offers on behalf of the buyer for a new home, enablingclients to buy before they sell, while also handling the showingand sale process of the old homeCurrent Investors:Orchard Fundraising Timeline1. Customized PlanSeries:AA-IIBCustomers start by answering a few questionsabout their current home and the companypairs them with an Orchard Home AdvisorC 1552. Buy 69Orchard Home Advisor assist customers infinding a new homeMake a contingency-free offer and reservethe home with Orchard’s cash 86 50 303. SellOrchard Home Advisor finds a buyer for the oldhomeOption to use Orchard Home Loans or a lenderto finalize the mortgageSource: PitchBook, CB Insights, Crunchbase, company website, press releases.(1) Additionally raised 200MM in debt to date. 36 86 20 30 30May-18Apr-19Previously Raised 50Jan-20Sep-20New Funding15

STATES TITLE RAISES 123MM IN SERIES C ROUNDTransaction OverviewSeries CLed By 123MM RaisedStates Title Overview On May 21, States Title announced that ithad raised 123MM in equity led byGreenspring Associates with participationfrom new investors Horizons Ventures,Eminence Capital, HSCM Bermuda as well asexisting investors Foundation Capital,Assurant, Fifth Wall Ventures, LennarVentures and SCOR Global P&C VenturesHeadquarters:San Francisco, CAFounded:2016Description:Offers patented machine intelligence-enabled tech solutions todigitize and automate residential real estate closings. States Titleand its family of brands – North American Title Company (NATC)and North American Title Insurance Company (NATIC) – offerssolutions for lenders, real estate agents, title agents andhomeowners that make closings more simple and efficientCurrent Investors: This brings the Company’s total attributedfunding to 230MM to date States Title plans to use its new funding totransform real estate closings at lower costsSelect Deal CommentaryStates Title Fundraising Timeline(1)States Title has developed an automated, patented technology“thatstreamlines the laborious title and escrow process, emergingas the market leader in an industry that historically lacksmeaningful innovation. We are thrilled to support States Title asthey advance the vision of an instant mortgage that closes withone tap. Especially in the current economic climate, themortgage industry needs to be re-imagined with transformativetechnological solutions to reduce costs and improve thecustomer experience. States Title is leading the vanguard of thistransformation.Jim Lim, Managing GeneralPartner, Greenspring Associates” 229.6 81.6 10.2Seed(11/25/2016)Source: Pitchbook, CB Insights, Crunchbase, Company website, press releases.(1) Per Crunchbase data. 23.2 13.0 58.4 23.2 106.6 123.0 25.0 81.6Series ASeries B-ISeries B-II(12/20/2017)(1/6/2019)(6/20/2019)Previously RaisedNew Funding 106.6Series C(5/21/2020)16

STATES TITLE RAISES 123MM IN SERIES C ROUND (CONT’D)Product OverviewCan reduce closing from 30 to 45 days to 20Instant Title Underwriting – Predictive analytics algorithm thatutilizes a forward-thinking risk-based insurance model to clear titlecommitments instantaneously2019A revenue of 200 million1 of the top 2 largest bank lenders & 2 of the top10 largest nonbank lenders as customersTransaction volume grew by 100 times in 2019compared to the year priorRemote Closings – To ensurebusiness continuity and acceleratetransactions, States Title offersmultifaceted state and lenderspecific eClosing solutionsBorrowers authorize closingagents to sign on their behalfRemote Online Notarizationpowered byComprehensive gap insurancefrom closing to recordationSolution OverviewFor LendersFor Real Estate ProfessionalsPredictively underwritten title insurance& escrow processesWhite-label digital closing experienceproductsResale of direct title services and directsettlement & escrow servicesFor Title AgentsQuick and straightforward underwritingservices, with a counsel that guarantees aresponse back to your questions within 1hourFast and transparent agency applicationprocess for qualified agentsSource: Pitchbook, CB Insights, Crunchbase, Company website, press releases.Experienced services and guidancethroughout the home purchase or saleprocessCustomer closing cost and mortgagequalification calculatorsFor HomeownersFast efficient title and escrow servicesMachine intelligence used to buy, sell orrefinance homes17

SPRUCE RAISES 29MM IN SERIES B ROUNDTransaction OverviewSeries BLed By 29MM RaisedSpruce Overview On May 21, Spruce announced that it hadraised 29MM in equity led by Scale VenturePartners with participation from Zigg Capitaland Bessemer Venture PartnersHeadquarters:New York, NYFounded:2016Description:Neutral third party that helps coordinate transactions betweenhomeowners and lenders / real estate institutions with a digitalfirst experience. Spruce takes handles title search, policy,settlement and escrow processes by pairing intuitive softwarewith high-touch human expertise This brings the Company’s total funding to 49MM to date Spruce plans to use its new funding toaccelerate development of its proprietarytechnology and deepen integrations withclient partnersSolution OverviewCurrent Investors:Spruce Fundraising TimelineLendersModern title & closing technologyDetailed audit trails of the entire transaction frombeginning to endIntegrate with current loan origination system orproprietary transaction softwareReal Estate TechPartner with industry experts to create optimalworkflowsDigital closing experience has an NPS of 60 andallows customers to view & sign documents, linktheir bank account, and schedule closing withease 49.1 29.0 20.1HomeownersSpruce provides a transaction coordinatorsupported by a team of in-house expertsAverage closing fee of 495(1)Safely receive funds and communicate abouttransactions via secure portalSource: Pitchbook, CB Insights, Crunchbase, Company website, press releases.(1) Excluding Colorado and Florida; Company website as of 7/10/2020. 4.5 4.5Series A(5/26/2017) 15.6 20.1 4.5Series A-IISeries B(7/18/2018)(5/21/2020)Previously RaisedNew Funding18

NOTARIZE RAISES 25.7MM IN SERIES C ROUNDTransaction OverviewNotarize Overview On April 15, Notarize filed that it had raised 25.7MM in equity led by Polaris Partnersand Hyperplane Venture CapitalSeries C This brings the Company’s total funding to 74MM to dateHeadquarters:Boston, MAFounded:2015CEO:Patrick KinselDescription:Provider of a document management platform oriented towardsthe real estate industry, allowing consumers and enterprises suchas lenders, insurers and title agents to sign and notarizedocuments onlineCurrent Investors: 26MM RaisedNotarize HighlightsLegally Sign &Notarize Documents100% OnlineNotarize Fundraising TimelineAvailable 24/7Subscription and PerNotarization PricingPlansNotarize Products( MM)DateSeed5/15/15Series A7/5/16Series B-I4/20/19Series B-II9/4/19Series C4/15/20Equity Raised 2.5 8.5 20.0 17.0 25.7Total Raised to Date 2.5 11.0 31.0 48.0 73.7Select Deal CommentaryeSignElectronically sign any documentFree serviceOnline NotarizationConnect with a commissioned notary public24x7 to sign & notarize documentsReal Estate ClosingsSigners can electronically review, sign andnotarize real estate documentsConnects the mortgage industry on 1 platformSource: Pitchbook, Company website, press releases.Notarize has been on a trajectory from day one, influencing“legislationand building the technology, relationships andinfrastructure to change business processes, while also creating asuperior customer experience for an antiquated process. Notarizesaw the potential to address the pain points of traditional notarywith a secure, streamlined solution that is already savinggovernment, businesses and consumers countless hours anddollars.Dave Barrett, Managing Partner,Polaris”19

ZUMPER RAISES 60MM IN SERIES D ROUNDTransaction OverviewZumper Overview On March 10, Zumper announced that it hadraised 60MM in equity led by e.ventureswith participation from a number of existinginvestors at a post-money valuation between 400MM and 600MM, bringing theCompany’s total funding to 150MM to dateSeries DHeadquarters:San Francisco, CAFounded:2012Description:Developer of a search-through-close rental platform where arenter can search, schedule a tour or apply through their phone.The platform also provides landlords with online tenant screeningand rent collection servicesCurrent Investors: Zumper noted that is experiencing 100% y/yrevenue growth and is on track to reach 80million users on its platform in 2020 60MM RaisedProduct Overview Zumper plans to use its new funding tostrengthen its engineering team and investfurther in its ability to process rentalpayments onlineFind Houses, Rooms or Apartments for RentReceive real-time alerts and instantly applyFilter by location, price range, bedroom count, pet-friendly oramenity and set an alert to get notifications when a new listing ispostedPost Rental Listings and Collect RentPost rental listings and screen tenantsCollect rent with online paymentsGenerate more leads with Zumper’s networkAcquisition TimelineSep2019Web-based software platform that automates the entire rentalprocess for landlords, leasing agents and tenantsJan2016Operates an online map-based apartment rentals searchwebsite and mobile application for consumers to search forrentals by geographic locationSource: Pitchbook, TechCrunch, Company website, press releases.(1) Post-money valuation estimates per Pitchbook and TechCrunch.Zumper Fundraising Timeline( MM)DateSeedSeries A Series A-I Series A-II Series B Series C Series D5/1/123/3/14 6/25/152/1/16 10/18/16 9/17/18 3/10/20Equity Raised 1.7 6.8 6.4 11.8 17.7 45.7 60.0Total Raised to Date 1.7 8.5 14.9 26.7 44.3 90.0 150.0(1)Select Deal Commentaryprogress so far is striking, and it has quickly become“theZumper’sleading independent company focused on the rental market.We believe that Zumper is well positioned because of its focus onproviding an exceptional product for renters and great value forlandlords and multifamily properties.”Mathias Schilling, Co-Founder &Managing Partner, e.ventures20

HOUSECANARY RAISES 65MM IN SERIES C ROUNDTransaction OverviewHouseCanary Overview On February 6, HouseCanary announced thatit had raised 65MM in equity led by AlphaEdison, Morpheus Ventures and PSP GrowthSeries C 65MM RaisedHeadquarters:San Francisco, CAFounded:2013Description:Developer of a real estate analytics platform designed to offerresidential real estate information for every block and propertyand help people make better real estate decisions. The company'sreal estate analytics platform aggregates millions of dataelements to accurately define and forecast values and marketinfluences, enabling individual buyers and real estateprofessionals to make better buying and selling decisions This brings the Company’s total funding to 130MM to date HouseCanary plans to use its new funding tocontinue to build the most accuratevaluations in the housing market, continue tobuild its world-class team to acceleratedevelopment and broad market adoption ofHouseCanary and invest in its leading-edgetechnologyProduct OverviewCurrent Investors:HouseCanary Fundraising Timeline( MM)DateData Explorer - Proprietary Property Explorer - Data &analytics for more than 100 details around individualmillion US homeshomes (e.g., historic pricegrowth)Agile Insights - Contextaround a home’s truevalue with individualhome reportsAgile Evaluation Condition-informedBPO alternativeMarket Explorer Interactive neighborhoodanalysis (rental return,affordability, etc.)Agile Certified - Securityof high-confidence AVMbacked by transferableinsurance policySource: Pitchbook, Company website, press releases.Early Stage VC3/8/17Series A4/7/17Series B5/1/17Series C2/6/20Equity Raised 0.6 33.0 31.0 65.0Total Raised to Date 0.6 33.6 64.6 129.6Select Deal CommentaryWe invest in disruptive companies that are innovative and“creativein how they tackle the changing landscape. Through theirproven software and data driven technology HouseCanary isstreamlining real estate transactions and changing the future ofthe industry.”Joseph Miller, Managing Partner,Morpheus Ventures21

CHERRE RAISES 16MM IN SERIES A ROUNDTransaction OverviewSeries ACherre Overview On February 5, Cherre announced that it hadraised 16MM in equity led by Intel Capitalwith participat

GCA ADVISES CONSTRUCTION TECH LEADER EQUE2 ON INVESTMENT FROM WESTBRIDGE Background Eque2 are the UK market-leading supplier of business management software to the construction, contracting and house building industries The Company targets businesses across a range of sizes from SMB (small and medium-sized businesses) to UMM (upper