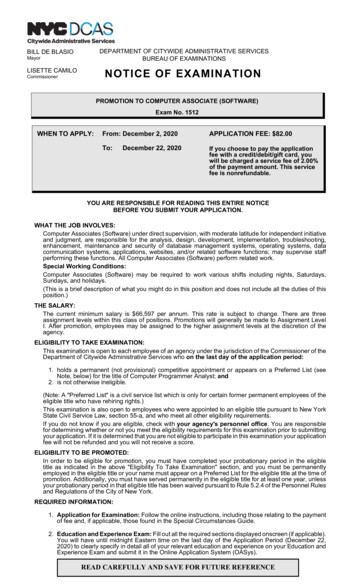

Transcription

Promotion of DevelopmentFinance in PakistanTuesday, 16th June, 2015Qazi Shoaib AhmadAdditional DirectorAC&MFD, SBP.

Outline of Presentation1. Landscape of Financial Inclusion2. Major Areasi.ii.iii.iv.v.vi.Agri. FinanceMicrofinanceBranchless BankingSME FinanceFinancial Inclusion ProgramHousing Finance2

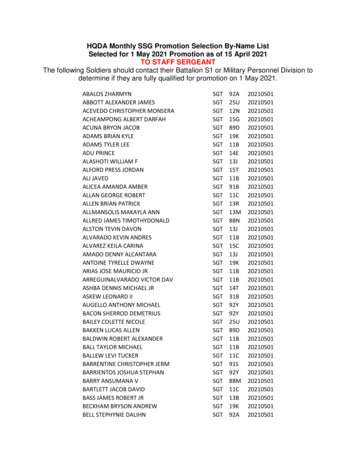

Financial Access and UsageNumber of Borrowers(Total 6 million)Financial AccessOthers Corporate SMEs2%Total No. . of POS35,29635%No. ofAgents2%HousingFinance204,07335% Adult Population (15 years ): CNIC Holders: Mobile phone subscription: Number of Deposit Accounts:ConsumerFinanceNo. of ATMs9,000120 M95 M14038 million3

SBP’s Strategic Direction Developing financial inclusion policy and programs, addressing issuesand market failures for broadening access to finance Strengthening regulatory environment for improving access to finance Promote innovation and alternative delivery channels Develop funding mechanism to improve flow of credit to under-servedsegments including SMEs, micro enterprises, agriculture, andinfrastructure, housing sector Developing and strengthening Islamic Finance as alternate andcompatible system To promote financial literacy and consumer awareness

Agri. Finance5

Agriculture Economy of PakistanSectoral shareContribution5.7% 1.3%21% of GDP37.6%45% of labor force55.4%60% to exportsCropsLivestockPoultryFisheries6

Agri. Commodity Sector OutlookContribution of Major Crops is 5.4% in GDPRankingProduction '000 66,469Maize4,2204,527* '000 bales7

Importance of Livestock 5th Largest milk producer-41 billion liters of milk 90% of the milk is supplied by small farmers having 1-6 animals 57 million animals (Cattle & Buffalo) Nili Ravi is considered best buffalo breed in world and known asBlack Gold of Pakistan. Other breeds are Kundi and Aza Kheli. Sahiwal, Cholistani, and Red Sindhi are our internationally wellknown dairy breeds. Other cattle breeds areAchai, Bhagnari, Dajal, Dhanni, Gibrali, Kankraj, Lohani, Rojhan, andThari.8

Agri. Financing banks increased from 20 to 339FY 2011FY 20157MicrofinanceBanks4 Islamic Banks0.5%6%(Rs 30 B)13 DomesticPrivate Banks19%(Rs 50 B)Top 5CommercialBanks53%15 DomesticPrivateBanksTop 5CommercialBanks23%51%(Rs 115 B)(Rs 140 B)(Rs 255 B)ZTBL & PPCBLZTBL &PPCBL28%20%(Rs 74 B)Rs 263 Billion(Rs 100 B)Rs 500 Billion9

Target Achieved 2014-15AnnualTargetRs 500 billion(28% higher thanRs 391 billion in FY16)BanksdisbursedRs 326.0 billionduring July-MarFY15(65% of the target)27.5%higher thansame periodlast year(Rs 256 billion)10

Financing to agri. sector accelerated inlast two years(Rs. In Billion)TargetDisbursement5009 monthProgressindicates thatthe target islikely to bemet380 3912502332008-09260 2482009-10270 2632010-11285 1

NPLs in (%) of Agri. Lending for Last 5 Years70.05 big Comm. Banks14 DPBs2 Specialized 13.811.40.02010201120122013201431-Dec-1412

SBP’s holistic approach to promote onof lendingportfolioRisk ssandCapacityBuilding13

Innovative Market DevelopmentInitiatives in Agri. Financebeing Introduced in Pakistan1.Value Chain Contract Farmer Financing2.Warehouse Receipt Financing3.Credit Guarantee Scheme for Small Farmers14

Microfinance15

Industry InfrastructureAs of Mar. 2015Industry Players and theirmarket shareMFBs56%RSPsClients20%3.32 MMFIs19%Infrastructure 10 Microfinance Banks (MFBs) 6 Rural Support Programs(RSPs) 16 Specialized MicrofinanceInstitutions (MFIs) 12 Others (NGOs)Outlets: 2,587Others5%16

Mainstreaming of MF into Banking(2001-todate)2008 Licensingof MFBs2000 FIP Pakistan PostFMFBPartnership BranchlessBankingRegulations2010 Easypaisa 3 largest MFIs havetransformed intoMFBs 3 largest MNOs havetheir own MFBs 8 of 10 MFBs OperateNationwide 200K Retail Agents Agents network in90% of total Districts UBL Omni2009By 2015SBP LEADERSHIPInnovation and GrowthInstitutional SustainabilityExpanding MF Outreach (2007-10)Strategic Framework (2011-15)17

Microfinance Sector Outreach (As of March, 2015)MFBsMFIs-NGOs/RSPs/OthersTotalNumber of MFPs103444Number of oss loan portfolio (Rs.In ‘000’)41,20832,55173,759Average Loan Balance(Rs)32,97015,72222,215Total No. of Depositors7,828,113-7,828,113Deposits (Rs. In ‘000’)42,487-42,487IndicatorsTotal No. of Borrowers18

Microfinance Banks-Key Indicators (As of Mar. 2015)(Amt. in Rs. irst ,621200,000Pak U 8-Total5071,249,857 41,208,557 42,487,939 7,828,113 71,457,476 15,706,2768,463,02919

Branchless Banking20

The evolution of BB Sector in PakistanYearProductProvidersTameer Microfinance Bank & Telenor2009Easy Paisa2010OmniUnited Bank Limited2012TimePeyAskari Bank & Zong2012MobicashWaseela Microfinance Bank & Mobilink2013HBL Express2013UPaisa2013MCB Lite2013Mobile PaisaHBLU-Microfinance Bank & UfoneMCB BankBank Alfalah & Warid21

The modes of financial inclusion through MFSTwo modes to address basic financial needs of the masses.1. Agent-Assisted Banking2. Self-Service Banking (through m-wallets)22

Number of Quarterly BB n'13Sep'13Dec'13Mar'14Jun'14Sep'14Dec'1423

Number of BB Accounts p'13Dec'13Mar'14Jun'14Sep'14Dec'1424

Number of BB 22,51217,588 19,40226,794 29,525 r'13Jun'13Sep'13Dec'13Mar'14Jun'14Sep'14Dec'1425

Average Size of 374,0613,8703,0002,0001,000Jun. 2013Sep'13Dec'13Mar.14Jun'14Sep'14Dec'1426

M-wallet projections for the next 3 2,61430,000,00025,000,00018,241,048Total No. of -1731-Dec-1827

Recent DevelopmentsA.Strategic partnerships between various entities/corporations/bodies with theBB players to facilitate :- Govt Youth Loans scheme- International Home remittances- Network penetration to the unserved areas- Financial inclusion for farmers- Disbursement of govt salary/pensions- Micro-insuranceB.Interoperability of MFS platform with Core Banking Account through InterBank Funds TransferC.Roll-out of Automated Customer Verification through NADRA’s Bio Verisys atreduced rate.D.Payment Systems integration with m-wallets (ATM, IBFT, and PoS)28

M-wallet uptake strategyOffer Tailor-made products for different market segmentsThe BB Channel can play a vital role in facilitating e-governanceInteroperabilityMerchant Payments & E-Commerce29

SME Finance30

SME Financing TrendsBorrowers is ‘000’Amount in Dec-11Dec-12 Dec-13 5272.5 287.9% Share inTotal .3%SMEBorrowers106161168185215212211168132137135% Share 7%4.0%4.2%NPLs - 1% Share inTotal MEOutstanding15.5% 15.4%Note: Dec-08 and onwards is the aggregate of Banks & DFIs31

SBP Role- SME FinancingEnabling Regulatory Framework for Increasing Finance to SMEs1. Legal & Regulatory FrameworkRevised PRs on SME Finance2. Financial InfrastructureCredit information BureauSecured Transaction RegistrySME Credit Rating3. Provide a facilitative role in Government InterventionsGovernment Subsidy Schemes32

SBP Role- Measures in PipelineNew Initiatives in PipelineLaunch of Funding Facility for banks/DFIs for availing advisory servicesfor diagnosis and revamping SME Banking portfolioFinancial Literacy of SMEsData Enrichment – New PRs, District-wiseWholesale Guarantee for NBFCs through FIP WindowSME Finance details from banks through a questionnaire/surveyNPL StudyLaunch of Financial Innovation Challenge Fund33

Financial InclusionProgram (FIP)34

Financial Inclusion ProgrammeFIP ngeFundSmall andRuralGuaranteeFacilityTechnical Assistance: Leverage technical assistance for surveys, assessmentsand market infrastructure and program management35

Microfinance Credit Guarantee FacilityObjective Develop commercial funding market for MF growthCoverage Option 1: 40% or 60% (for Tier II MFPs) Pari Passu Option 2: 25% First LossInterest Rate KIBOR of relevant tenor plus 200 bpsIncentives for Commercial Banks Risk Sharing and SLR & CRR deductibility for banks/DFIs36

MCGF - Leveraged Commercial Capital for MFPsMobilized around Rs. 15.45 billion through 44 deals including 2 TFCsEnabled 750,000 new microfinance loans to poor borrowersLeverage of around 3 timesExpected to raise additional Rs. 2.0 billion by offering higher riskcoverage for lending to weaker MFPs37

Institutional Strengthening FundObjective Transformation of grant assistence from operational subsidies to project basedfinancing for institutional development Level playing and open process Push and pull factors to enhance potential for growth and depth in outreach Preference for innovations in microfinanceEligibility Any institution with a clear strategic vision and strategy. Grants were approved onquality of plans for developing institutional capacity, systems and adoption ofinnovationsLimit Up to 1 million per year per recipient Subject to 25 percent matching contribution38

Credit Guarantee Scheme (CGS) forSmall and Rural EnterprisesEnhance Credit to micro, small and agricultural enterpriseParticipating Financial Institutions: 10 Commercial BanksSize of CGS: 13m Rs. 300 million by GoPRisk Coverage: up to 40%Maximum loan per party: 15 millionLoan Tenor: up to 5 year depending upon activityAnnual Limits FY15: Rs. 3.356 billion were assigned to banksCGS Exposure: Guarantee coverage of Rs. 2,554 million issued against MSEsloans of Rs. 6,328 millionLeverage: around 2.5timesMSEs Served: 10,000 Loans to Agri / MSEsAverage loan size: less than Rs. C2.htm39

Financial Innovation Challenge FundPromote innovations in a transparent and efficient manner Objectives:Support financial inclusion innovations through risk capitalLeverage funds to attract private investment Scope:Tested and proven products globally but new to Pakistan; andTested and proven innovation in Pakistan adopted by another organization or ina different geographic territory or segment– MechanismCompetitive Challenge round using a combination of Push & Pull FactorsSpecialized challenge rounds to catalyse innovations in high impact areas Challenge Round 1: Financially Inclusive G2P Payments Challenge Round 2: Innovative Rural & Agricultural Finance Challenge Round 3: Promoting Excellence in Islamic Finance40

Technical AssistanceInvestments to enhance market Information and Infrastructure and alsoprovision of technical assistance for FIP Implementation Technical Assistance for FIP implementationDevelopment of National Financial Inclusion StrategyBranchless Banking SurveysIslamic Finance KAP SurveyRepeat Access to Finance surveyAnti-Money Laundering - Strengthening of FMU’s Systemsand analytic abilityMicrofinance Credit Information BureauMF transparency initiative for MF industryStrengthening Consumer protection monitoring vis-à-visglobal benchmarksSBP Capacity Building41

FIP achievementsMarket TransformationTransformed donors operations in PakistanTransformation and demonstrated success inMicrofinance, Branchless BankingSome progress in Small enterprise and rural Finance and FinancialInnovationSupporting critical market infrastructureAnti-Money Laundering, Collateral registry and Credit informationbureau etc.Level playing access and leveraging capital from donors and privateinvestorsMicrofinance – Equity, Debt, DonorFinancial Innovation – Equity, DonorSmall enterprise Finance – Donor, Debt

Housing Finance43

Housing – An Overview Current State of Housing Sector in Pakistan– There is a large and widening gap in Housing market in Pakistan World Bank estimated a shortfall of 8 million housing units in Pakistan in 2009 According to estimates the annual incremental demand is 600,000 units, of which50% is met by the private/public investmentThe ever-widening housing demand and supply gap requires huge investment With 600,000 incremental demand and 500,000 units from the backlog, totalannual housing needs comes to 1.1 milli

Importance of Livestock 5th Largest milk producer-41 billion liters of milk 90% of the milk is supplied by small farmers having 1-6 animals 57 million animals (Cattle & Buffalo) NiliRaviis considered best buffalo breed in world and known as Black Gold of Pakistan. Other breeds are Kundiand AzaKheli. Sahiwal, Cholistani, and Red Sindhiare our internationally well-