Transcription

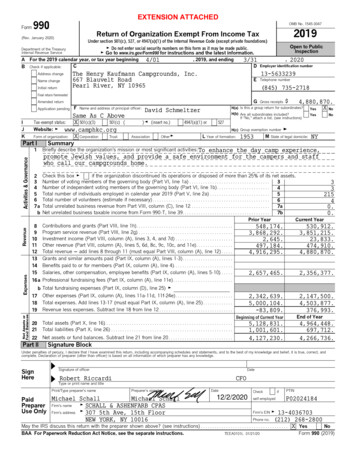

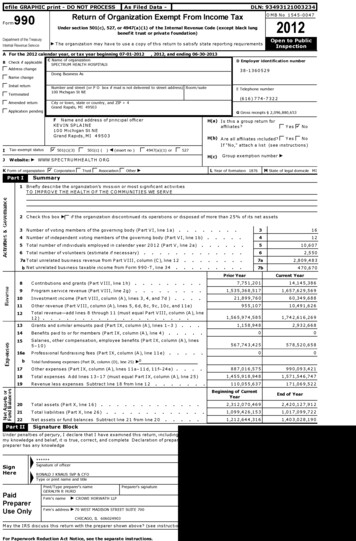

l efile GRAPHICFormprint - DO NOT PROCESSAs Filed Data -DLN: 93490134016569OMB NoReturn of Organization Exempt From Income Tax990Under section 501 (c), 527, or 4947( a)(1) of the Internal Revenue Code ( except black lungbenefit trust or private foundation)Department of the-The organization may have to use a copy of this return to satisfy state reporting requirementsTreasuryInternal RevenueServiceAFor the 2007calendar year, or tax year beginning 07 - 01-2007B Check if applicable1 Address changeF Name change1 Initial returnF Final returnPleaseuse IRSlabel orprint ortype . SeeSpecificInstruc tions .21545-0047007OpenInspectionand ending 06 - 30-2008D Employer identification numberC Name of organizationBAYLOR REGIONAL MEDICAL CENTER AT PLANO82-0551704E Telephone numberNumber and street (or P 0 box if mail is not delivered to street address ) Room/ suite2001 BRYAN STREET(214 ) 820-4135City or town, state or country, and ZIP 4DALLAS, TX 752013005FAccounting method (- Cash(- Other ( specify)F Accrual0-(- Amended returnF Application pendingH and I are not applicable to section 527 organizations* Section 501(c)(3) organizations and 4947(a)(1) nonexempt charitabletrusts must attach a completed Schedule A (Form 990 or 990-EZ).GWeb site :Organization type (check only one) 1- F9!! 501(c) (3) -4 (insert no )KCheck here 1- 1 if the organization is not a 509(a)(3) supporting organization and its gross receipts arenormally not more than 25,000 A return is not required, but if the organization chooses to file a return,be sure to file a complete returnGross receipts i1Is this a group return for affiliates?H(b)If "Yes" enter number of affiliates 0-H(c)Are all affiliates included?F YesF NoF YesF No- WWW BHCS COMILH(a)Add lines 6b, 8b, 9b, and lOb to line 12-(- 4947(a)(1) or(If "No," attach a list See instructions )F 527H(d)Is this a separate return filed by an organizationcovered by a group ruling?(- Yes F NoIGroup Exemption Number 0-MCheck - 1 if the organization is not required toattach Sch B (Form 990, 990-EZ, or 990-PF)155,908,781Revenue . Expenses . and Chances in Net Assets or Fund Balances (See the instructions.)Contributions, gifts, grants, and similar amounts receivedaContributions to donor advised fundsbDirect public support (not included on line 1a)lacIndirect public support (not included on line 1a)dGovernment contributions (grants) (not included on line 1a)eTotal (add lines la through 1d) (cash 31,206.lb.1c31,206ld)noncash le2Program service revenue including government fees and contracts (from Part VII, line 93)23Membership dues and assessments34Interest on savings and temporary cash investments45Dividends and interest from securities56aGross rents6abLess6bcNet rental income or (loss) subtract line 6b from line 6arental expenses7Other investment income (describe8aGross amount from sales of assetsaS)154,845,7781446c.7.(A) Securities1,031,653(B) Otherother than inventory8abLess cost or other basis and sales expenses8bcGain or (loss) (attach schedule)dNet gain or (loss) Combine line 8c, columns (A) and ( B)931,206.Sc.8dSpecial events and activities (attach schedule) If any amount is from gaming , check here 0-Fabc10aGross revenue (not including contributions reported on line 1b )Lessof.9adirect expenses other than fundraising expenses.9bNet income or (loss) from special events Subtract line 9b from line 9aGross sales of inventory, less returns and allowances.c10abLesscGross profit or (loss) from sales of inventory (attach schedule) Subtract line 10b from line 10acost of goods sold10b10c11Other revenue (from Part VII, line 103)1112Total revenue Add lines le, 2, 3, 4, 5, 6c, 7, 8d, 9c, 10c, and 1112155,908,78113Program services (from line 44, column (B))13121,218,8231418,608,548.14Management and general (from line 44, column (C))FUCL15Fundraising (from line 44, column (D)).w16Payments to affiliates (attach schedule)17Total expensesAdd lines 16 and 44, column (A)18Excess or (deficit) for the year Subtract line 17 from line 1219Net assets or fund balances at beginning of year (from line 73, column (A))20Other changes in net assets or fund balances (attach explanation) .21Net assets or fund balances at end of year Combine lines 18, 19, and 20.1516.For Privacy Act and Paperwork Reduction Act Notice, see the separate instructions 21Cat No11282Y5,473,787Form 990 (2007)

Form 990 (2007)Page 2All organizations must complete column (A) Columns (B), (C), and (D) are required for section501(c)(3) and (4) organizations and section 4947(a)(1) nonexempt charitable trusts but optionalStatement ofFunctional Expensesfor others (See the instructions.)Do not include amounts reported on line6b, 8b, 9b, 1Ob, or 16 of Part I.22a( A) Total(C) Managementand generalF22aOther grants and allocations (attach schedule)(cash 0noncash 0If this amount includes foreign grants, check here- fl22b23Specific assistance to individuals (attach schedule)2324Benefits paid to or for members (attach schedule)2425aCompensation of current officers, directors, key employeesetc Listed in Part V-A (attach schedule)25a609,201609,201bCompensation of former officers, directors, key employeesetc listed in Part V-B (attach schedule)25b68,28268,282cCompensation and other distributions not icluded above todisqualified persons (as defined under section 4958(f)(1)) andpersons described in section 4958(c)(3)(B) (attach schedule)25cSalaries and wages of employees not includedon lines 25a, b and c2633,858,67633,206,999651,67727Pension plan contributions not included onlines 25a, b and c271,049,6031,005,61443,98928Employee benefits not included on lines25a - 27284,792,7314,792,73129Payroll taxes292,485,0842,395,23230Professional fundraising fees3031Accounting fees3132Legal 735Postage and 4,37137Equipment rental and maintenance37798,867770,92027,94738Printing and 67,05116,89540Conferences, conventions, and 42Depreciation, depletion, etc43Other expenses not covered above (itemize)a44(D) FundraisingGrants paid from donor advised funds (attach Schedule)(cash 0noncash 0If this amount includes foreign grants, check here22b(B) Programservices(attach schedule)See Additional Data Table43ab43bc43cd43de43ef43fg43gTotal functional expenses . Add lines 22a through 43g(Organizations completing columns (B)-(D), carry these totalsto lines 13-15)4418,608,5480Joint Costs . Check - fl if you are following SOP 98-2Are any joint costs from a combined educational campaign and fundraising solicitation reported in (B) Program services 'If "Yes," enter ( i) the aggregate amount of these joint costs 0(iii) the amount allocated to Management and general 0fl YesF No, (ii) the amount allocated to Program services 0, and ( iv) the amount allocated to Fundraising 0Form 990 (2007)

Form 990 (2007)fiiiPage 3Statement of Program Service Accomplishments (See the instructions.)Form 990 is available for public inspection and, for some people, serves as the primary or sole source of information about a particularorganization How the public perceives an organization in such cases may be determined by the information presented on its returnTherefore, please make sure the return is complete and accurate and fully describes, in Part III, the organization's programs andaccomplishmentsWhat is the organization's primary exempt purpose'sACUTE CARE HOSPITALAll organizations must describe their exempt purpose achievements in a clear and concise manner State the number of clients served,publications issued, etc Discuss achievements that are not measurable (Section 501(c)(3) and (4) organizations and 4947(a)(1) nonexemptcharitable trusts must also enter the amount of grants and allocations to othersaProgram ServiceExpenses(Required for 501(c)(3) and(4) orgs , and 4947(a)(1)trusts, but optional forothersOVERVIEW Baylor Regional Medical Center at Plano ("Baylor Plano") brings residents of Collin County andNorth Texas the benefits of a 128 bed acute care medical and surgical facility that meets adult health careneeds Collin County residents can find comprehensive diagnosis, treatment, rehabilitation and follow-up care onthis smoke-free campus Highly specialized clinical services include internal medicine, gastroenterology,neurology, dermatology, pulmonology, orthopaedics, medical and radiation oncology, and cardiovascularservicesAs part of Baylor Health Care System, Baylor Plano offers patients access to innovative treatmentsand clinical trials performed through Baylor Research Institute in areas such as oncology and cardiovascularservices In addition, the Baylor Plano campus is the home to THE HEART HOSPITAL Baylor Plano, the firstdedicated heart hospital in Collin County HIGHLIGHTS Weight Loss Surgery Program For those who haveunsuccessfully battled a serious weight problem, the Weight Loss Surgery Center at Baylor Plano offers amultidisciplinary approach to this strugglePhysicians, nurses, dietitians, psychologists, and program andinsurance coordinators offer support and guidance for a variety of non-surgical weight loss options, and supportbefore, during and after for patients choosing a laparoscopic surgical procedure Baylor Plano offers two FDAapproved procedureslaparoscopic Roux-en-Y gastric bypass (RYGB) and laparoscopic adjustable gastric band(Lap-Band surgery), which reduce the size of the stomach and limit food intake Women's Center Baylor Women'sCenter at Plano treats nearly all the health conditions a woman could face, except pregnancy-related issuesHealth services offered include diagnosis and treatment for heart disease and stroke, diabetes, osteoporosis,skin conditions, cancer, senior care and breast care Women with questions about their health can accessappropriate medical resources whether its an internist, cardiologist, endocrinologist, rheumatologist, radiologistor other specialist, depending upon their need Sleep Center Snoring may be a sign of sleep apnea, a conditionthat affects 4 percent of men and 2 percent of women in the U nited States At Baylor Plano, sleep specialists canhelp diagnose and treat this serious medical condition Sleep apnea is a risk factor for cardiac disease, highblood pressure and stroke, as well as auto accidents and poor work performance because patients are frequentlyfatigued But treatment is available for this sleep disorder and other sleep conditions Scoliosis Center Scoliosisis a spinal condition that affects 12 million people worldwide The Baylor Scoliosis Center is the first center of itskind in the Dallas/Fort Worth Metroplex devoted to treatment, surgery and care of advanced spine curvature inadults Although scoliosis usually appears during adolescence, the condition can affect people well intoadulthood The center also is a national clinical trial site Back to Golf Program Nearly 80 percent of golfersoccasionally suffer from injury, and most injuries involve the back Research shows that during the golf swing, thespine can experience loads up to seven times the body weight The Back to Golf program, utilizing the expertiseof physical therapists, can help correct swings that produce incredible stress on the back, shoulders and elbowsRobotic Surgery The da Vinci SSurgical System treats a variety of gynecologic conditions - particularlyhysterectomies and uterine fibroids - with less scarring, less risk of infection and faster recovery Thisinnovative system also is used effectively in prostate surgery The da Vinci integrates 3D High-Definitionendoscopy and advanced robotic technology to improve the surgeon's views and surgical precision Baylor Planois among a handful of North Texas hospitals offering this new technology Digital Mammography The new digitalmammography technology computerizes the X-ray, enabling physicians to use a lower dose of radiation Digitalmammography is better than traditional film mammography for women who are under age 50, those who havedense breasts, and those who are pre- or pert-menopausal While reading the digital mammogram, physicians caneasily adjust the brightness, contrast and zoom into questionable areas for a more precise view STATISTICSThe following statistics are for the period between July 1, 2007 and June 30, 2008 Baylor Plano admitted 5,122patients, serviced 17,253 emergency room visits, and performed 5,507 operating room cases during the yearThe number of inpatient days was 25,177 and the average length of stay was 4 92 days The hospital occupancyrate at Baylor Plano was 64 9% Baylor Plano provided free care and/or subsidized care to indigent patients Thecharges related to the care of these patients during the fiscal year for financial statement purposes were 6,328,955 The unreimbursed cost of this care as reported to the State of Texas was 5,073,081 BaylorPlano provides care to persons covered by governmental programs at below cost Recognizing its mission to thecommunity, services are provided to both Medicare and Medicaid patients To the extent reimbursement is belowcost, Baylor Plano recognizes these amounts as a vital part of meeting its mission to the entire communityUnreimbursed charges related to the care of these patients were 86,167,699 COMMUNITY SERVICE AsBaylor Plano establishes itself in the community, it is important that the medical center supports its communitythrough its involvement Baylor Plano provides services such as health screenings, community educationseminars, support groups and school partnerships The medical center supports many organizations withdonations made from the BHCS Community Support Fund In fiscal year 2008, the following primary healthconcerns were the focus of the provision of community benefit diabetes, heart disease, injury prevention, andwellness Health Screenings Heart disease and diabetes are among the top health concerns identified in theCheckup and screenings to detect these conditions are detailed above Additional screening efforts that promotegeneral wellness and early detection of diseases, and increase chances for survival School District ActivitiesBaylor Plano worked with local school districts to provide health-professions education, and wellnessassessment These activities involved seminars, presentations health risk assessment for students acrossPlano Independent school district Health professions education sessions were provided in an effort to encouragestudents to select these professions in order to alleviate shortages Community Education and Support GroupsBaylor Plano supports the activities of local organizations through education and support groups in the primaryhealth concerns listed above Over 2,000 persons benefited from these programs In Kind Donations BaylorPlano supports activities of other not for profit agencies whose mission, vision and values correspond with thoseof Baylor Health Care System Through donations of equipment, Baylor Plano extends the reach of quality healthcare to countries and communities who could not otherwise provide it STATE REPORTING REQUIREMENTSFOR COMMUNITY BENEFITS The State of Texas requires non-profit hospitals to report community benefitsunder the strict definitions and requirements of Texas Health and Safety Code Chapter 311 Community benefitsinclude the unreimbursed cost of charity care, the unreimbursed cost ofgovernment- sponsored indigent healthcare (i e Medicaid), and the unreimbursed cost of government-sponsored health care (i e Medicare), education,donations, research, and other subsidized health services For the fiscal year ended June 30, 2008, Baylor Planoreported the following community benefits amount for State purposes * U nreimbursed cost of charity care 5,073,081 * Unreimbursed cost of government-sponsored indigent health care (i eMedicaid) 825,950Unreimbursed cost ofgovernment- sponsored health care (i e Medicare), education, donations, research, andother subsidized health services 22,535,603 Total Community Benefits(Grants and allocations 0) 28,434,634If this amount includes foreign grants, check hereF-121,218,823b(Grants and allocations )If this amount includes foreign grants, check hereF-(Grants and allocations )If this amount includes foreign grants, check hereF-(Grants and allocations )If this amount includes foreign grants, check here - F-)If this amount includes foreign grants, check herecde Other program services (attach schedule)(Grants and allocations fTotal of Program Service Expenses ( should equal line 44, column ( B), Program services )F121,218,823Form 990 (2007)

Form 990 (2007)Page 4Balance Sheets (See the instructions.)Note :Where required, attached schedules and amounts within the descriptioncolumn should be for end-of-year amounts only.Cash-non-interest-bearing46Savings and temporary cash investmentsallowance for doubtful accountsb Less49.455,3644647a Accounts receivable48a Pledges receivable(B)End of year5,34345b Less(A)Beginning of year.47a19 wance for doubtful accounts48b48cGrants receivable4950a Receivables from current and former officers, directors, trustees, andkey employees (attach schedule)50ab Receivables from other disqualified persons (as defined under section50b4958(c)(3)(B) (attach schedule)51a Other notes and loans receivable (attachschedule)b LessCD.allowance for doubtful accounts52Inventories for sale or use53Prepaid expenses and deferred charges51a372,17051b103,22054a Investments-publicly-traded securitiesF-Cost0-b Investments-other securities (attach schedule)F FMVF 60,0160F FMV054a54b55a Investments-land, buildings, andequipmentbasis.55ab Less accumulated depreciation (attachschedule).5655bInvestments-other (attach schedule)57a Land, buildings, and equipment basisb 179,191,98359180 ,626,24014,356,7806016,831,507accumulated depreciation (attachschedule)5855c.Other assets, including program-related investments(describe 0-59Total assets (must equal line 74) Add lines 45 through 5860Accounts payable and accrued expenses61Grants payable62Deferred revenue63.6162Loans from officers, directors, trustees, and key employees (attachschedule ).6364a Tax-exempt bond liabilities (attach schedule)64a173,320,946b Mortgages and other notes payable (attach schedule)6564b99158,320,946Other liablilities (describe 06566Total liabilities Add lines 60 through ,06768588,488Organizations that follow SFAS 117, check here 0- 7 and complete lines67 through 69 and lines 73 and 74j67Unrestricted68Temporarily restricted69Permanently restricted003'369Organizations that do not follow SFAS 117, check herecomplete lines 70 through 74LLZ5CDF- and70Capital stock, trust principal, or current funds71Paid-in or capital surplus, or land, building, and equipment fund70.72Retained earnings, endowment, accumulated income, or other funds73Total net assets or fund balances7172Add lines 67 through 69 or lines 70through 72 (Column ( A) must equal line 19 and column ( B) must equall i n e 21)74.Total liabilities and net assets / fund balances Add lines 66 and 73-8, 485, 74373179,191,983745,473,787180,626,240Form 990 (2007)

Form 990 (2007)Page 5Reconciliation of Revenue per Audited Financial Statements With Revenue per Return (Seethe instructions. )aTotal revenue, gains, and other support per audited financial statementsba155,900,716Amounts included on line a but not on Part I, line 121Net unrealized gains on investments2Donated services and use of facilities3Recoveries of prior year grants4Other (specify)bl.b2b3b4Add lines blthrough b4 .cSubtract line bfrom line ad.b.155,900,716CAmounts included on Part I, line 12, but not on line a12Investment expenses not included on Part I, line6b.Other (specify)dl9Nd2Add lines dl and d2e.8,065.dTotal revenue (Part I, line 12) Add lines c andd .155,908,781eReconciliation of Ex p enses p er Audited Financial Statements With Ex p enses p er ReturnaTotal expenses and losses per audited financial statementsba139,819,306b-8,065C139,827,371Amounts included on line a but not on Part I, line 171Donated services and use of facilities2Prior year adjustments reported on Part I, line20b2Losses reported on Part I, line20b334Other (specify).bl9Nb4Add lines blthrough b4.Subtract line bfrom line adAmounts included on Part I, line 17, but not on line a:2.c1.Investment expenses not included on Part I, line6b.-8,065.dlOther (specify)d2Add lines dl and d2 .e.Total expenses (Part I, line 17) Add lines c andd .d139,827,371eCurrent Officers , Directors , Trustees, and Key Employees (List each person who was an officer,director, trustee, or key employee at any time during the year even if they were not compensated.) (See theinttnictinnt )(A) Name and address(B) Title and average hoursper week devoted to positionJerri GarisonlN2001 Bryan Street Suite 2200Dallas,TX 75201President40 0Deanne Kindred2001 Bryan Street Suite 2200Dallas,TX 75201VP-Finance/HospOff40 0William Boyd IN2001 Bryan Street Suite 2200Dallas,TX 75201Ron CarterIN2001 Bryan Street Suite 2200Dallas,TX 75201(C) Compensation(If not paid, enter -0-.)(D) Contributions toemployee benefit plans &deferred compensationplans(E) Expenseaccount and cretary1 0000Trustee1 00001 0000Trustee1 0000Timothy Owens IN2001 Bryan Street Suite 2200Dallas,TX 75201Trustee1 0000Jim Turner2001 Bryan Street Suite 2200Dallas,TX 75201Trustee1 0000WalkerHarmanIN2001 Bryan Street Suite 2200Dallas,TX 75201Robert Mundlin2001 Bryan Street Suite 2200Dallas,TX 75201ChairFinForm 990 (2007)

Form 990 (2007)Page 6Current Officers , Directors , Trustees , and Key Employees (continued)Yes75aEnter the total number of officers, directors, and trustees permitted to vote on organization business at boardbAre any officers, directors, trustees, or key employees listed in Form 990, Part V -A, or highest compensatedmeetings.No.0- 5.employees listed in Schedule A, Part I, or highest compensated professional and other independentcontractors listed in Schedule A, Part II-A or II-B, related to each other through family or businessrelationships? If "Yes," attach a statement that identifies the individuals and explains the relationship(s)c75bNoDo any officers, directors, trustees, or key employees listed in Form 990, Part V -A, or highest compensatedemployees listed in Schedule A, Part I, or highest compensated professional and other independentcontractors listed in Schedule A, Part II-A or II-B, receive compensation from any other organizations, whethertax exempt or taxable, that are related to the organization? See the instructions for the definition of "relatedorganization" 95.75cYes75dYes.0-If "Yes," attach a statement that includes the information described in the instructionsdDoes the organization have a written conflict of interest policy?Former Officers , Directors , Trustees, and Key Employees That Received Compensation or OtherBenefits (If any former officer, director, trustee, or key employee received compensation or other benefits(described below) during the year, list that person below and enter the amount of compensation or otherbenefits in the appropriate column. See the Instructions.)(A) Name and address(D) Contributions toemployee benefit plansand deferred compensationplans(C) Compensation(If not paid enter -0- )(B) Loans and Advances(E) Expense account andother allowancesArthurAenchbache r2001 Bryan Street Suite 2200Dallas,TX 75201055,70100Jerry Carlisle2001 Bryan Street Suite 2200Dallas,TX 75201000221Jim Crupi2001 Bryan Street Suite 2200Dallas,TX 752010004,738Toni Jenkins2001 Bryan Street Suite 2200Dallas,TX 752010001,497Roy Lamkin2001 Bryan Street Suite 2200Dallas,TX 752010002,8390001,7890001,497Clarence Miller2001 Bryan Street Suite 2200Dallas,TX 75201Ron Parker2001 Bryan Street Suite 2200Dallas,TX 75201L&AW76Other Information (See the instructions.)YesNoDid the organization make a change in its activities or methods of conducting activities? If "Yes," attach a77detailed statement of each change76NoWere any changes made in the organizing or governing documents but not reported to the IRS?77NoIf "Yes," attach a conformed copy of the changes78aDid the organization have unrelated business gross income of 1,000 or more during the year covered by this return?.b If "Yes," has it filed a tax return on Form 990 -T for this year?7978aYes78bYesWas there a liquidation, dissolution, termination, or substantial contraction during the year? If "Yes," attacha statement80a79NoIs the organization related (other than by association with a statewide or nationwide organization) through common membership,governing bodies, trustees, officers, etc , to any other exempt or nonexempt organization?80aYesb If "Yes," enter the name of the organization p- See Additional Data Tableand check whether it is81aEnter direct or indirect political expenditures(See line 81 instructionsb Did the organization file Form 1120 -POL for this year?fl exempt or fl nonexempt81a081bNoForm 990 (2007)

Form 990 (2007)Page 7Other Information (continued)82aYesDid the organization receive donated services or the use of materials, equipment, or facilities at no charge orat substantially less than fair rental value?82aYes83aYes83bYesNob If "Yes," you may indicate the value of these items here Do not include this amount as revenuein Part I or as an expense in Part II (See instructions in Part III )83a82bDid the organization comply with the public inspection requirements for returns and exemption applications?b Did the organization comply with the disclosure requirements relating to quid pro quo contributions?84aDid the organization solicit any contributions or gifts that were not tax deductible ?.84ab If "Yes," did the organization include with every solicitation an express statement that such contributions orgifts were not tax deductible?8584b501(c)(4), (5), or(6) organizations, a Were substantially all dues nondeductible by members?b Did the organization make only in-house lobbying expenditures of 2,000 or less?.85a85bIf "Yes," was answered to either 85a or 85b, do not complete 85c through 85h below unless the organizationreceived a waiver for proxy tax owed the prior yearc Dues assessments, and similar amounts from members.85cd Section 162(e) lobbying and political expenditures85de Aggregate nondeductible amount of section 6033(e)(1)(A) dues notices85ef Taxable amount of lobbying and political expenditures (line 85d less 85e).85fg Does the organization elect to pay the section 6033(e) tax on the amount on line 85f7.85gh If section 6033(e)(1)(A) dues notices were sent, does the organization agree to add the amount on line 85fto itsreasonable estimate of dues allocable to nondeductible lobbying and political expenditures for the following taxyear?85h86501(c)(7) orgs. Enter a Initiation fees and capital contributions included on line 12b Gross receipts, included on line 12, for public use of club facilities870.86b0501(c)(12) orgs. Enter a Gross income from members or shareholders.87a087b0b Gross income from other sources (Do not net amounts due or paid to othersources against amounts due or received from them ) .88a86aAt any time during the year, did the organization own a 50% or greater interest in a taxable corporation orpartnership, or an entity disregarded as separate from the organization under Regulations sections 301 7701-2and 301 7701-3'' If "Yes," complete Part IX88aYes88bYesb At any time during the year, did the organization directly or indirectly own a controlled entity within the meaningof section 512(b)(13)'' If yes complete Part XI89a501(c)(3) organizationsEnter Amount of tax imposed on the organization during the year undersection 4911 0-0 , section 4912 0-0 , section 4955 0-0b 501(c)(3) and 501(c)(4) orgs. Did the organization engage in any section 4958 excess benefit transaction duringthe year or did it become aware of an excess benefit transaction from a prior year? If "Yes," attach a statementexplaining each transaction89bNo89eNo89fNoc Enter A mount of tax imposed on the organization managers or disqualified personsduring the year under sections 4912, 4955, and 4958.d Enter A mount of tax on line 89c, above, reimbursed by the organization.00-00-e All organizations. At any time during the tax year was the organization a party to a prohibited tax sheltertransaction?f All organizations. Did the organization acquire direct or indirect interest in any applicable insurance contract?g Forsupporting organizations and sponsoring organizations maintaining donor advised funds. Did the supportingorganization, or a fund maintained by a sponsoring organization, have excess business holdings at any timeduring the year?89g90aList the states with which a copy of this return is filed 0-b N umber of employees employed in the pay period that includes March 12, 2007 (Seeinstructions )91a.The books are in care of lim-Located at lob.DEANNE KINDRED4700 ALLIANCE BLVDPLANO, TX.90b.690.Telephone no 0-ZIP 4 lo-( 469) 814-2 13575093At any time during the calendar year , did the organization have an interest in or a signature or other authorityover a financial account in a foreign country (such as a bank account, securities account, or other financialaccount)?Yes91bNoNoIf "Yes," enter the name of the foreign country 0See the instructions for exceptions and filing requirements for Form TD F 90-22 .1,

BAYLOR REGIONAL MEDICALCENTER AT PLANO D Employeridentification number 82-0551704 label or print or Numberand street (or P 0 box if mail is not delivered to street address) Room/suite E Telephone number type. See 2001 BRYAN STREET Specific (214) 820-4135 Instruc- City or town, state or country, and ZIP 4 FAccounting method (- Cash FAccrual tions.