Transcription

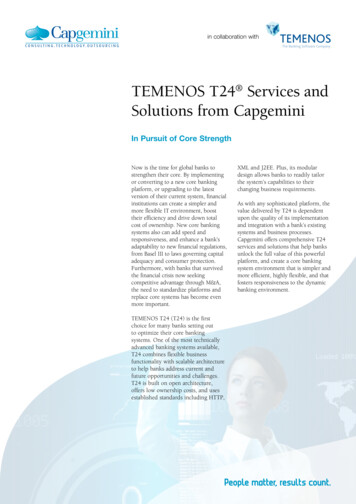

in collaboration withTEMENOS T24 Services andSolutions from CapgeminiIn Pursuit of Core StrengthNow is the time for global banks tostrengthen their core. By implementingor converting to a new core bankingplatform, or upgrading to the latestversion of their current system, financialinstitutions can create a simpler andmore flexible IT environment, boosttheir efficiency and drive down totalcost of ownership. New core bankingsystems also can add speed andresponsiveness, and enhance a bank’sadaptability to new financial regulations,from Basel III to laws governing capitaladequacy and consumer protection.Furthermore, with banks that survivedthe financial crisis now seekingcompetitive advantage through M&A,the need to standardize platforms andreplace core systems has become evenmore important.TEMENOS T24 (T24) is the firstchoice for many banks setting outto optimize their core bankingsystems. One of the most technicallyadvanced banking systems available,T24 combines flexible businessfunctionality with scalable architectureto help banks address current andfuture opportunities and challenges.T24 is built on open architecture,offers low ownership costs, and usesestablished standards including HTTP,XML and J2EE. Plus, its modulardesign allows banks to readily tailorthe system’s capabilities to theirchanging business requirements.As with any sophisticated platform, thevalue delivered by T24 is dependentupon the quality of its implementationand integration with a bank’s existingsystems and business processes.Capgemini offers comprehensive T24services and solutions that help banksunlock the full value of this powerfulplatform, and create a core bankingsystem environment that is simpler andmore efficient, highly flexible, and thatfosters responsiveness to the dynamicbanking environment.

Our Temenos ServicesNew Core BankingTransformationsCapgemini’s experience inimplementing T24 in both new andlegacy replacement scenarios makesus the provider of choice for newT24 implementations or conversionsfrom other core banking platforms.Our proven approach comprises threephases: Flash Audit, Conversion, andTransition & Support.The Flash Audit is a fast-paced yetin-depth assessment that ensuresalignment between the new systemand the bank’s strategy, and allowsCapgemini to tailor the implementationto each client’s business goalsand challenges, integration andfunctionality requirements, andin-house IT capabilities.Exhibit 1: T24 Migration ApproachConversion Project OutlinesBusiness AlignmentGap AnalysisArbitration T24 ImplementationData ConversionFunctional Testing Transition StrategyRehearsalsTransition CutoverStabilizationTransition &SupportFlash AuditChange Management & TrainingThe Flash Audit lays a solidfoundation for Conversion, whichincludes T24 implementation, dataconversion and functional testing.Conversion is an iterative approach,from specifying data and transcodingrules, to preparing automated toolsand performing static and dynamiccertification and functional testing.Capgemini’s comprehensive, modelbased testing ensures user acceptanceand a smooth transition to the newcore banking system.The final step in Capgemini’s approachto implementing T24 is Transition &Support, including the development ofa transition strategy, rehearsals acrossa range of transition scenarios and,finally, cutover to T24 in a productionenvironment. Capgemini clients enjoycomprehensive post-implementationservices, including start-up assistance,user support, and help with systemstabilization. In other words,Capgemini does much more thanimplement T24: We also ensure ourclients are fully able to derive lastingbusiness benefits from the platform foryears to come.UpgradesTemenos is committed to investing inthe continual improvement of the T24Core Banking Solution, and Capgeminihelps leading financial institutions tapinto the full value of these investments.As a Temenos Global Partner,we stay up-to-speed with all T24enhancements, and we invest in ourown processes, technology support andupgrade services.

BankingCapgemini takes a phased approachto upgrades that encompasses the fullscope of critical activities including:the way we do itExhibit 2: Upgrade MethodologyPhasesUpgrade planning and strategy,encompassing project scoping andupgrade analysis Business process optimization Pre-upgrade housekeeping Migration Testing, including user acceptancetesting Transition, from go-live toenvironment management, changemanagement and post-upgradesupport Comprehensive project management Reducing Risk and Ensuring aSmooth TransitionCapgemini professionals haveexperience with all of the challengesthat can arise during a T24 upgrade orimplementation (Exhibit 3). Capgeminihelps its clients overcome legal andregulatory challenges, including thoserelated to cross-border restrictionsand transactions, differing bankinglaws and practices across regions,and complex data privacy and laborlaws. Our experts also can help clientssurmount technology challenges suchas peripherals that vary from Project ScopingUpgrade AnalysisUpgrade/MigrationUser Acceptance TestingUpgrade Go-livePost Upgrade SupportEnvironment ManagementChange ManagementProject ManagementBanks have invested richly in theirTemenos systems over the years.With help from Capgemini, they canensure those investments continue topay dividends.to country, the need for roundthe-clock multilingual support andtraining, and diverse connectivityoptions and interface requirements. Ofcourse, cultural issues are important aswell, and Capgemini can help—withextensive experience in fulfilling multicountry requirements, managing globaland local reporting requirements, andstaying focused on value realizationdespite dynamic economic andpolitical environments.Exhibit 3: Core Banking Implementation and Upgrade ChallengesLegal and Regulatory Differing banking laws & practicesHosting and disaster recoveryenvironmentsTechnology and Support Availability of hardware supportSpecial peripherals may differ fromcountry to countryGeographical and Cultural Solution may not support all multi-countryrequirementsMergers & acquisitions duringimplementationCross-border restrictions & transactions Multi-lingual support (24x7)Data privacy Training on local language Global & local reporting on same data Labor laws Differing connectivity options Long timelines for implementation Physical & legal boundaries Local interfaces for clearing, payments Changing economic & political outlook Regulatory reporting & compliance

Exhibit 4: Integrated Data MigrationApproach for T24SourceDatabaseExtractionToolExtracteddata passedto the toolDataMigrationFactoryTargetDatabaseT24DM LoaderTransformedfiles basedon mappingrules loadedto databseIntegrated Data MigrationApproachWith more than 20 years of experiencein legacy migration, Capgemini deeplyunderstands the issues and challengesassociated with data migration. Ourapproach to this critical aspect of corebanking system implementation hasevolved in response to challenges ourclients have experienced, includingmergers and acquisitions, theintroduction of shared services, andincreased requirements for businessintelligence from legacy systems.Such experience bears fruit forCapgemini clients in the form ofproprietary tools and methodsthat speed T24 implementationswhile reducing risk. For instance,our controlled data migrationenvironment allows Capgeminiprofessionals to migrate client datato a new system with speed andaccuracy, while our factory-basedapproach to data migration usesoptimized processes, tools, andtemplates to configure, generate, andrun the conversion system.This factory-based approach ensuresseamless data extraction, cleansing,transformation and loading intothe T24 target environment, whilethe combination of analysis andtransformation rules allows Capgeminiteams to improve data quality. Indeed,both data cleansing and enrichment,including adding data from externalsources, can be integrated efficientlyinto our data migration process.Since data is at the heart of anybank, data migration is key tounlocking the full value of T24.Thanks to Capgemini’s extensiveexperience helping clients overcomethe challenges of data migration, ourprofessionals can help banks speedthis critical step while reducing riskand business disruption.TestingHow can banks ensure T24 willdeliver its full complement of corebanking capabilities from day one?Extensive system testing is critical,and Capgemini has the tools andexperience needed to make thisgoal a reality. The Capgemini T24Workbench uses a model-basedtesting approach that helps ourprofessionals generate efficient testscenarios and cases by modeling ourclients’ business requirements. Withover 16,000 test cases and more than700 use cases, Capgemini can provideits clients with complete coverage ofthe core banking system.As shown in Exhibit 5, this five-stepapproach encompasses capturingrequirements, creating businessprocesses, defining actors, developinguse and test cases, and managing userinterface mock-ups. Most importantly,our proven testing methodologyallows Capgemini clients to utilizeindustry best practices, generate costsavings, speed time-to-market, enhancetraceability and improve test qualityand coverage.

Bankingthe way we do itExhibit 5: T24 Model Based Testing Workbench Approach24Create BusinessProcess BusinessOperationalUser Businessprocess flowIdentify actorperformingthe flowUse CaseCreation MakerChecker 1Checker 2 RequirementCapturingUI Mock UpsIdentify modelsIdentify submodelsCreate usecasesPre conditionPost condition Interface Development/CustomizationCapgemini has an excellent partnerrelationship with Temenos, and workswith the company on many interfacedevelopments and regional and localdevelopment projects. This relationshiphas helped Capgemini to understandTemenos-defined programmingstandards, architectural changes, andfeatures of the latest releases of T24.Capgemini has delivered many projectsinvolving interfaces, central bankreporting, and the specific needs ofretail, corporate and private bankingcustomers. Capgemini leveragesthis extensive body of knowledge todevelop best-fit solutions that leverageproven development methodologies. Capture screenshotsManagerelationshipSimulateTest DataCreationActor Definition1Identify testdataInclude testdataManagerelationship35Exhibit 6: T24 Application DevelopmentT24 ntUpgradesCore T24Changes

“Capgemini goes one stepfurther: It offers a TEMENOST24-specific implementationmethodology as well as aconfiguration and changemanagement tool.1”Support and MaintenanceWell-defined support and maintenanceof a large system like T24 is vital tothe successful financial institution.Capgemini has the infrastructure, T24technical and domain knowledge and,above all, the processes required toprovide maintenance and support thatmeet strict service level agreements(SLAs). We also have years ofexperience in providing various kindsof preventative maintenance andproactive support to our T24 clients(see Exhibit 7).Training and ChangeManagementImproving operational performanceand deriving maximum benefits fromT24 is possible only with trained userswho can fully leverage the power ofthe system. To help banks achievethis goal, Capgemini has developed acomprehensive training and changemanagement approach that draws onour detailed analysis of what banksneed to use T24 effectively. Thisknowledge has resulted in programsthat are focused on the roles of usersand the business processes managedby them.An important aspect of Capgemini’sapproach is the UDIM (Understand,Design, Implement and Maintain)methodology, which, as appliedto the design of our training andchange management programs, helpsparticipants acquire and enhanceknowledge in a structured manner,and effectively apply it to their day-today work.Exhibit 7: T24 Application Maintenance ServicesT24 velopmentFirst LineSupportClose ofBusinessKnowledgeManagementHousekeepingNew Instance /ImplementationInterfaceswith T24UpgradesCore SupportCapgemini ServicesService Providers For Banking Platform Transformation,” Forrester Research, Inc.,20 December 20111

Bankingthe way we do itOur Temenos SolutionsCapgemini has created an exclusiveTemenos Solutions Center to developinnovative business solutions anddeliver specialized services thatenable banks to further leverage theirinvestments in T24. The businesssolutions have been developed basedon Capgemini’s extensive knowledgeof T24 and draw upon experienceimplementing, upgrading andsupporting a large number ofT24 clients.TARGET—Tool for Internal AuditTARGET is a tool that facilitates theinternal audit of banks using T24. Itenables auditors to perform the auditat reduced time, cost and effort, andat the same time, quickly identify anydeficiencies. TARGET extracts relevantinformation for the audit period, preprocesses and presents the information‘ready for audit’. The typical auditscenarios are mapped as queriescovering business rules, overrides,transaction analysis and customerhistoric activity.GLAssist—Tool for GLReconciliationGLAssist is a tool to identify, track andmanage general ledger mismatches forresolution. Identifying the root causeof a mismatch is a daunting task foraccountants and GLAssist helps themby making all relevant details available‘ready for analysis’. With the relevantdetails from the analysis, the bank canresolve general ledger issues in a fastermanner, achieve proper complianceand reduce risks.RePortal—Virtual Library ofT24 ReportsStatutory obligations, litigations, andother reviews of past financial affairsnecessitate access to past statementof accounts, advices, confirmations,reports, and more. The currentprocess in banks to provide suchlegacy information is cumbersomeand fraught with delay and increasedsupport cost.RePortal is a tool that enables settingup a portal for reports, convertingT24 reports to PDF files, catalogingand storing the reports and publishingusing a SharePoint server. RePortal, atool for today’s information worker,provides extensive catalog and searchfacilities and enables easy access andretrieval of reports.TAME—Tool for Configurationand Change ControlTAME is a comprehensive toolfor managing changes in T24environments and can easily adaptto the specific change managementprocess followed by the bank. The toolhas a repository, provides features foruser management, version control,environment and release managementand comes with queries and utilities.MOBRANCH—Last MileConnectivityMOBRANCH is a comprehensivesolution for banks, micro creditunions and micro finance institutionsto provide last mile connectivity totheir clients. MOBRANCH is real timebanking extended through handheld/mobile devices and has featuresfor transaction capture, biometricverification, smart card operations,real-time connectivity and printingof receipts. It enables the bank toautomate the point of transactionor field activities and to extend thebanking operations to a large numberof individuals in remote areas.

www.capgemini.com/bankingEnabling Transformation atReduced RiskArmed with expertise in supportinghundreds of large-scale financialservices technology initiativesand complex core bankingimplementations, Capgemini canhelp minimize implementation risksand make the T24 implementationpredictable for the bank.We also provide business informationmanagement, system integration,application lifecycle management, andinfrastructure management servicesto many leading financial servicescompanies. Furthermore, Capgeminiis developing a T24 software-as-aservice (SaaS) solution for those banksinterested in migrating away from anon-premise core banking solution.Capgemini has the skills andexperience banks need to unlock T24’sfull potential from the outset.Equally important is Capgemini’sglobal core banking network,including local expertise supportedby our Rightshore network. Thisnetwork gives Capgemini clientsscalable access to more than 500 corebanking consultants, 1,750 testers thatspecialize in banking, and more than1,700 experienced business analysts,technical architects, and projectmanagers. Capgemini has the expertsyou need where you need them, withmore than 75 centers in 24 countries.Yet Capgemini offers far more thanT24 services and solutions. Ourprofessionals are well-versed infinance transformations; IT strategy,governance and architecture; andprogram and project management.To find out more about Capgemini’sTemenos services and solutions visitwww.capgemini.com/temenos. Youcan also contact us by sending ane-mail to banking@capgemini.com.Another Capgemini strength: Ourlarge repository of business referencemodels, which both speeds theattainment of benefits and allowsbanks to design processes that fostercompetitive advantage. Our teams canAbout Capgemini and theCollaborative Business ExperienceCapgemini, one of theworld’s foremost providersof consulting, technology and outsourcingservices, enables its clients to transformand perform through technologies.Capgemini provides its clients withinsights and capabilities that boost theirfreedom to achieve superior resultsthrough a unique way of working, theCollaborative Business Experience .All products or company namesmentioned in this document aretrademarks or registered trademarksof their respective owners.In sum, Capgemini’s strongmethodologies, tools, andexperience allow banks to tapinto the transformative potential ofT24 more rapidly, cost-effectively,and predictably.The Group relies on its global deliverymodel called Rightshore , which aims toget the right balance of the best talentfrom multiple locations, working as oneteam to create and deliver the optimumsolution for clients.Present in 40 countries, Capgemini reported2011 global revenues of EUR 9.7 billion andemploys around 120,000 people worldwide.Capgemini’s Global Financial ServicesBusiness Unit brings deep industryexperience, innovative service offerings andnext generation global delivery to serve thefinancial services industry.With a network of 21,000 professionalsserving over 900 clients worldwide,Capgemini collaborates with leading banks,insurers and capital market companies todeliver business and IT solutions and thoughtleadership which create tangible value.For more information please visitwww.capgemini.com/financialservicesRightshore is a trademark belonging to CapgeminiCopyright 2012 Capgemini. All rights reserved.FS201207131009CSWith a Temenos team of more than350, Capgemini has completed12 model bank implementationsand more than 20 successful T24migrations. We have experiencesuccessfully managing and executingTemenos implementation projects.Our capabilities recently have beenput to use in T24 implementationsacross the globe, including largebanks in the Middle East, Vietnam,Bangladesh and at multiple locationsfor a large global bank. Furthermore,our T24 solutions and acceleratorscan shrink the T24 implementationtimeline by up to 20 percent.utilize more than 300 robust businessprocess reference models in areas suchas term deposits, branch operations,payments, loans and trade finance.These proven models allow clientsto build best-in-class core bankingsolutions more rapidly. In fact, usingthem accelerates target state design byup to 20 percent.

teams to improve data quality. Indeed, both data cleansing and enrichment, including adding data from external sources, can be integrated efficiently into our data migration process. Since data is at the heart of any bank, data migration is key to unlocking the full value of T24. Thanks to Capgemini's extensive experience helping clients overcome