Transcription

XXXXXXXX CHAPTER XX1

Sample

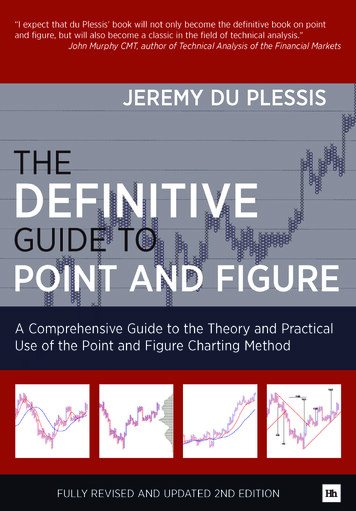

The Definitive Guide toPoint and FigureA Comprehensive Guide to the Theory and Practical Useof the Point and Figure Charting MethodJeremy du Plessis

HARRIMAN HOUSE LTD3A Penns RoadPetersfieldHampshireGU32 2EWGREAT BRITAINTel: 44 (0)1730 233870Fax: 44 (0)1730 233880Email: enquiries@harriman-house.comWebsite: www.harriman-house.comFirst edition published in Great Britain in 2005 by Harriman House.This second edition published 2012.Copyright Harriman House LtdThe right of Jeremy du Plessis to be identified as Author has been asserted in accordance withthe Copyright, Designs and Patents Act 1988.ISBN: 978-0857192-45-5British Library Cataloguing in Publication DataA CIP catalogue record for this book can be obtained from the British Library.All rights reserved; no part of this publication may be reproduced, stored in a retrieval system,or transmitted in any form or by any means, electronic, mechanical, photocopying, recording,or otherwise without the prior written permission of the Publisher. This book may not be lent,resold, hired out or otherwise disposed of by way of trade in any form of binding or cover otherthan that in which it is published without the prior written consent of the Publisher.Printed and bound by the CPI Group, Antony Rowe, Chippenham.No responsibility for loss occasioned to any person or corporate body acting or refraining toact as a result of reading material in this book can be accepted by the Publisher or by the Author.HhHarriman House

To Lynne

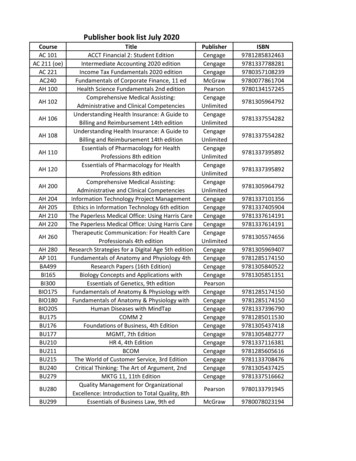

ContentsPraise for The Definitive Guide to Point and Figure ChartingAbout the AuthorPreface to the Second EditionPreface to the First EditionIntroductionIntroduction to Technical Analysisxvxviixixxxixxvxxxi1. Introduction to Point and Figure Charts1History and developmentWhere did Point and Figure charts get their name?The use of Point and Figure charts over the yearsThe voice of the market41618182. Characteristics and Construction23Characteristics of Point and Figure chartsConstructed with Xs and OsUp moves and down movesXs and Os called boxesBox sizeReversal sizeVariable sensitivityPrice gapsPrice on Y-axis but no time on X-axisTwo-dimensional chartsNo volumeDemand and supplyNaming Point and Figure chartsPoint and Figure construction1-box reversal chartsWhy change columns when price reverses?One-step-backUsing other box sizesConstruction example of a 1-box reversal chart25262626262627272728282828293030323435v

THE DEFINITIVE GUIDE TO POINT AND FIGURE JEREMY DU PLESSISImportant noteFilling and emptying glassesExample of building a 1-box reversal Point and Figure chart3-box reversal chartsConstructed from 1-box chartsUnique asymmetric filterConsider the value of the boxExample of a 10 X 3 Point and Figure chartConstructed from the 1-box chartCharacteristics of 3-box reversal charts5-box reversal charts2-box and other reversal charts2-box reversal chartsCharacteristics of 2-box reversal chartsOther box reversalsSummary so far1-box reversal charts3-box reversal charts5-box reversal charts2-box reversal chartsThe move from intra-day to end-of-day – the great controversyClose only methodPlotting a close only end-of-day Point and Figure chart when data is beingreceived in real-timeHigh/low methodExample of a 10 X 3 Point and Figure chart using high/low pricesPlotting high/low end-of-day Point and Figure charts when data isbeing received in real-timeProblems with the high/low methodOther construction methodsThe low/high methodThe open/high/low/close methodEnd-of-interval time frame Point and Figure chartsLog scale Point and Figure chartsNaming log scaled Point and Figure 595960616767686869707173

CONTENTSChoosing between log and arithmeticStops and log scale Point and Figure chartsSummary7477773. Understanding Patterns and Signals791-Box and 3-Box Reversal ChartsDo not ignore 1-box reversal chartsPoint and Figure signalsDouble-top and bottom patternsContinuation as well as reversalReversal patterns in 1-box chartsTriple-top and bottom patternsTriple-top and bottom patterns in 3-box chartsTriple-top and bottom patterns in 1-box chartsCompound patternsKnowing when to ignore signalsControl and reassertion of controlThe strength of the patternUpside and downside triangles – sloping bottom or sloping topSymmetrical triangles – sloping top and sloping bottomThe breakout and pullback3-box catapult patterns1-box catapult patternsTerminology clarification1-box and 3-box patternsTrapsBull trapBear trapTrading trapsShakeoutsBroadening patterns1-box broadening patternsBullish and bearish patterns that reverseBearish pattern reversedBullish pattern reversedComparing 3-box and 1-box 8108109109110111112114115115117118vii

THE DEFINITIVE GUIDE TO POINT AND FIGURE JEREMY DU PLESSISPolesTrading strategy with polesPoles in 1-box reversal chartsOpposing polesOther PatternsCongestion analysisThe fulcrumStrength and weakness in fulcrum patternsFinal word on patterns2-box reversal chartsSummary1201221241271271281291321381381404. Understanding and using Trend lines143Trend line breaks45 Bullish support and bearish resistance linesRationale for bullish and bearish 45 trend linesWhere to draw bullish support and bearish resistance lines45 trend line drawing rulesImplications of different box reversals on 45 trend lines45 lines and log scaled chartsInternal 45 trend linesMeasuring the strength of 45 linesParallel trend linesTrend lines and signal rulesExercise in drawing 45 trend lines on a log scale chart45 or subjective – which do you 91725. Projecting Price Targets175Counts on 1-box reversal chartsHow to establish a horizontal count on 1-box reversal chartsSummary of 1-box countsCounts on 3-box reversal chartsVertical counts on 3-box reversal chartsHow to establish upside targets using the verticalcount method on 3-box charts177178189189190viii191

CONTENTSHow to establish downside targets using the verticalcount method on 3-box chartsVertical count establishment and activationWhen should activation take place?The logic of the vertical countHorizontal counts on 3-box reversal chartsHow to establish upside targets using the horizontalcount method on 3-box chartsHow to establish downside targets using the horizontalcount method on 3-box chartsHorizontal count establishment and activationThe logic of the horizontal countThings you should know about Point and Figure countsTargets have no time-scaleNearest counts must be achieved firstClustering of countsNegating a countOpposing countsUsing counts to assess trend strengthUnfulfilled countsImprobable and impossible countsCounts on different time horizonsGood counter or bad counterCounts on close, high/low, low/high or ohlc chartsCounts on other box reversal chartsCounts on log scale chartsAccuracy of counts on log scale chartsDe Villiers and Taylor 3-box horizontal countsRisk and rewardRisk:reward ratio from vertical counts on 3-box chartsRisk:reward ratio from horizontal counts on 3-box chartsRisk:reward ratio from horizontal counts on 1-box chartsRisk:reward ratios on shortsFinal word on risk:rewardAnother way of projecting targets – Fibonacci 225228231232233236ix

THE DEFINITIVE GUIDE TO POINT AND FIGURE JEREMY DU PLESSIS6. Analysing Point and Figure Charts239Implications of changing the construction parametersChanging the reversal sizeChanging the box sizeChanging the data time frameChanging the construction methodChoosing your chart parametersKnowing your time horizonChoosing the reversal sizeChoosing the correct box sizeChoosing the construction methodChoosing the data time frameChoosing your scalingDrawing your first Point and Figure chartConsistencyShowing gapsOther ways of determining box sizeVolatility based box sizesAnalysis of 3-box reversal chartsFlipping chartsTaking a shorter-term viewChanging time framesAnalysis using 1-box reversal chartsTaking a shorter-term viewAnalysis of 2-box chartsStoplosses on Point and FigurePlacing a stop to limit a lossPlacing a stop to protect a profitTrailing stopsTrailing stops based on volatilityStoplosses based on column changesStoploss summaryLow-risk 6307308308309x

CONTENTS7. Point and Figure Charts of Indicators311Point and Figure of relative strengthUsing Point and Figure counts on relative strength chartsPoint and Figure of on-balance volumePoint and Figure of oscillatorsSummary3143203213233258. Optimisation of Point and Figure Charts327The case for and against optimisationApproaching Point and Figure optimisationTest parametersData consistency and adaptabilityAlternative exitsOptimisation of FTSE 100 constituents for longsOptimisation of S&P 100 constituents for longsOptimising for shortsOptimisation of FTSE 100 constituents for shortsOptimisation of S&P 100 constituents for shortsOptimising for specific patternsCatapult entry signalsOptimisation of FTSE 100 constituents for catapult entry for longsOptimisation of S&P 100 constituents for catapult entry for longsTriple-top entry signalsOptimisation of FTSE 100 constituents for triple-top entry for longsOptimisation of S&P 100 constituents for triple-top entry for 23423443453453463479. Point and Figure’s Contribution to Market Breadth349IntroductionA caveatBullish PercentAnalysing Bullish Percent as a line chartDivergenceAdjusting the sensitivity of Bullish PercentAnalysing Bullish Percent as a Point and Figure chartClose only, high/low, low/high or ohlc data351352353353357357360363xi

THE DEFINITIVE GUIDE TO POINT AND FIGURE JEREMY DU PLESSISBullish Trend PercentX-Column PercentOther Market Breadth Indicators based on Point and FigureMarket Breadth on other marketsSummary36737037137237310. Advanced Point and Figure Techniques375Moving averages on Point and FigureHow to use moving averages on Point and Figure chartsMoving averages on 3-box reversal chartsMoving averages on 1-box reversal chartsFine-tuning the guidelinesFinal word on moving averagesParabolic stop and reverse (SAR) on Point and FigureTaking earlier signalsParabolic on 1-box chartsParabolic acceleration factorCombining parabolics with trend linesBollinger Bands on Point and FigureOverbought or oversoldVolatility and the squeezeMore Bollinger Bands examplesActivity histogramsPrice Level Activity histogramVolume at Price Level histogramActivity at Price Level or Volume at Price LevelThe effect of gaps on Activity 40140140340640840841441741741911. Chart Examples421Spot Euro Dollar (daily) 0.01 X 1Spot Euro Dollar (60 minute) 0.01 X 1Gold PM Fix 5 X 1Gold PM Fix 5 X 3Brent Crude Index (IPE) 2% X 1Brent Crude Index (IPE) 1% X 3424425426427428429xii

CONTENTSMIB 30 Index 1% X 3Nikkei 225 Index 100 X 3Hang Seng Index 100 X 3DJ Euro Stoxx 50 1% X 3Infineon Technologies AG 2% X 3IBM 1% X 3Compuware Corporation 1% X 1Intel Corporation 0.25 X 3American Express Company 1.5% X 3Three month sterling interest rate future (June 2005) (60 minute) 0.025 X 1Gold 15 X 3US 10 year yield 0.025 X 3Brent Crude 1 x 12. Dividing your Stocks into Bullish and Bearish445Adding relative strength to the search451Conclusion453References and Further Reading459Appendix A – Construction of 2-Box Reversal ChartsExample of a 10 x 2 Point and Figure chartAppendix B – Construction of 1-Box Reversal High/Low ChartsExample of a 10 x 1 Point and Figure chart using high/low pricesAppendix C – Construction of Log Scaled Charts461463469471483Index487xiii

Praise for The Definitive Guide to Pointand Figure Charting“Rarely does a book live up to its claim of being the ‘definitive’ guide to something. Jeremy du Plessis’new book lives up to that claim and more. It’s almost impossible to imagine a more definitivetreatment of point and figure charting. The author pays homage to its early development and thepioneers who first wrote about it. He gives extensive coverage to the original 1-point reversal methodbefore moving on to the more modern methods. The subject is examined from every conceivableangle. I’m not aware of anyone who has even attempted to combine p&f charting with so manymodern technical indicators. I expect that du Plessis’ book will not only become the definitive bookon point and figure, but will also become a classic in the field of technical analysis.”– John Murphy CMT, author of Technical Analysis of the Financial Markets“Not only does Mr. du Plessis plumb the history and elucidate the present state of point and figureanalysis, he looks at a craft many regard as passé and sees a vibrant future. This eye-opener is awelcome addition to the literature of technical analysis.”– John Bollinger, CFA, CMT, President, Bollinger Capital Management“If you had to go to a desert island and were only allowed to take one investment tool with you, thenit should be the Point and Figure chart. If you were also allowed to take only one book, other thanthe Bible and the works of Shakespeare, then make it this Definitive Guide by Jeremy du Plessis.The whole subject is covered from its early historical beginnings as a way of noting the noise of theticker tape in the days of Charles Dow, then called the Book method, through its evolution to becomethe ‘Voice of the market’.How to construct and use the charts and their unequivocally clear buy and sell signals, revelation oftrend, reversal, support and resistance levels are all revealed and well illustrated. The subject isexplained as an evidence-gathering procedure, that leads to a successful trading method, with accurateentry, stop loss, and targets. It is also brought right up to date wi

Trading traps 110 Shakeouts 111 Broadening patterns 112 1-box broadening patterns 114 Bullish and bearish patterns that reverse 115 Bearish pattern reversed 115 Bullish pattern reversed 117 Comparing 3-box and 1-box charts 118 CONTENTS vii. Poles 120 Trading strategy with poles 122 Poles in 1-box reversal charts 124 Opposing poles 127 Other Patterns 127 Congestion analysis 128 The fulcrum 129 .