Transcription

Annual Report 2016BGFIBank Côte d’IvoireMarcory, Boulevard Valery Giscard d’EstaingAbidijan, Côte d’IvoireTel: 225 20 25 88 00Fax: 225 21 26 82 80www.groupebgfibank.com

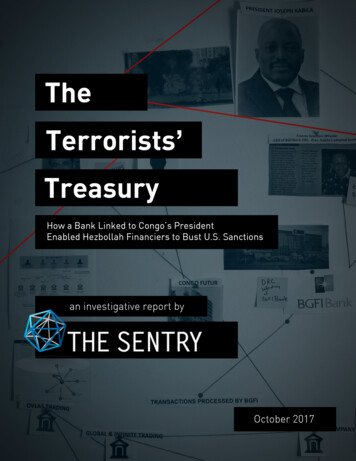

T H E K E Y FI G U R ES O FIN MILLIONSBALANCE SHEET versionUSD122 311177 213290 2404424668 8949 37212 5521920Equity (excluding income)Fixed capital21 22324 80034 2955255Customer deposits64 339110 915145 854222234Loans to customers80 062128 354183 2752792943 1932 0693 252557 38511 51214 8422324-4 512-6 214-7 895-12-13Fixed assetsNet banking incomeOverheadsof which amortisationGross operating profit-267-286-616-0,9-12 8805 3117 1471112Net provisions created-696-449-1 686-3-3NET PROFIT2 1072 6184 10267Net income ratio57%52%49%Gross cost61%54%53%Return on equity Net profit / Equity24%28%33%1,72%1,48%1,41%Rate of return Net profit / Balance sheet totalFixed EUR/XOFexchange rate: 655,957USD/XOF exchange rate: The balance sheet data isconverted at the closingrates on 31/12/2016 :USD/XOF 622,8522 The P&L data is convertedat average rates during themonth of 12/2016 :USD/XOF 613,4752Comments on the changes to the mainperformance indicators at the end of 2016At the end of 2016, budgetary forecasts concerning profitability and the size of the balance sheet were exceeded.The general expenses are controlled in order to coverrequirements efficiently.The evolution of the indicators is coherent with thedevelopment phase that began in 2015.The cost of client risk increased more slowly than thecost of credit risk, expressing the quality of portfoliomonitoring.The net banking income is boosted by the developmentof the loan portfolio in spite of the downward pressureon rates and the securities portfolio (support to theeconomy of the sub-region).

81 548122 311177 213290 24033 34464 339110 615145 854B G FI B ank Côte d ’ Ivoire2013201420152016201320142015201680 062128 354183 2754 5117 38511 51214 842C U S TO M ER D EP O S I T S49 679TOTA L B A L A N C E S H EE T201320142015201620132014201520162 8805 3117 1471292 1072 6184 102N E T B A N K I N G I N CO M E560C U S TO M ER LOA N S20132014201520162013201420152016G R O S S O PER AT I N G PR O FI TGraphs in XOF millionsN E T PR O FI T

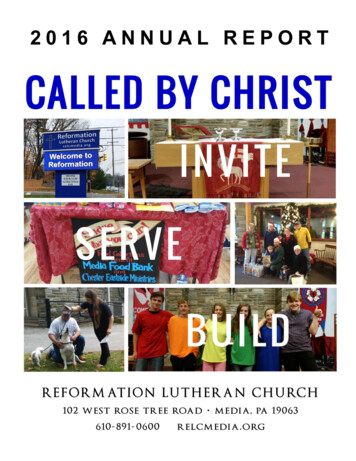

BGFIBank GROUPFINANCING AFRICANECONOMIESS U M M A RY O F T H E 2 016 A N N UA LREPORT FROM BGFIBankC ÔT E D ’ I VO I R EThe BGFIBank Group is positioning itself as a high-qualityAfrican financial portal and, in this respect, is developing awide range of high-performance financial services.3A N A LY S I S BY T H E G E N ER A LM A N AG EM E N T6Focus : Côte d’Ivoire as the group’s regional hub7T H E G OV ER N A N C EO F B G FI B a n k Côte d ’ Ivo i re10THE SOCIAL RESPONSIBILIT YR EP O RT11Focus : ISO 9001 version 2008 certification12T H E FI N A N C I A L R EP O RT12The asset side of the balance sheetLiability side of the balance sheetIncome statementGeneral report from the external auditors on theannual accounts of BGFIBank Côte d’IvoireThe group thus intends to put its expertise at the serviceof all client segments through an organisation and productrange specifically adapted to each of its targets: multinational groups and large companies, States and institutionalorganisations, small businesses / manufacturers andprofessionals, private clients, salaried employees and smallshopkeepers and independents.This product range breaks down into four innovativebusiness lines whose expertise has long been confirmed:1314ĥĥ The commercial bank BGFIBank and its four core15activities: The corporate bankThe retail bankThe private bankThe State and Institutional Organisations bank16T H E N E T WO R K O F B R A N C H E S Acting across these four activities, BGFIBank is innovating with a “Digital Bank” product range that is morecompetitive in Mobile banking and Mobile Payment.ĥĥ The Investment Bank BGFI Investment Banking andits three activities: Financial engineering Consulting Stockbrokingĥĥ The specialist financial services Finatra and Loxiawith, respectively, two activities: Consumer loans / Equipment loans / Financial leasing/ Leasing / Factoring Micro-financeĥĥ Insurance IARDT with ASSINCOTHE BGFIBANK GROUP IS PRESENT IN11 COUNTRIES:In Africa: Benin, Cameroon, Congo,Côte d’Ivoire, Gabon, Equatorial Guinea,Madagascar, Democratic Republic of Congo,São Tomé-et-Principe and Senegal.In Europe: BGFI International, Financeand investment bank, in Paris.

ANALYS I S BY TH E G EN ER ALMANAG EM EN T« B G FIB a n k Côte d ’ Ivo i reis ch a ra c te r ise d by t h e i m p e cc a b l eq u a l i t y of i t s se r v i ce s , s t ro n gre l at i o ns h i ps a n d re s p o nsive n e s st h at is a p p re ci ate d by t h e m a r ket. »After barely five years of actual presence in the Côted’Ivoire banking market, BGFIBank Côte d’Ivoire is nowin 9th place out of 27 banks (source APBEF 2016). Atthe end of 2016, the Côte d’Ivoire subsidiary had fivebranches and 96 employees.An economywhich is drivinggrowth upwardsThe very dynamic economy of Côte d’Ivoire, which isgrowing at nearly 10%, is inevitably attracting largeinternational groups and African bank competitors. This,combined with the increase in purchasing power, thewidespread adoption of new information and communication technologies and the high degree of digital literacyof the population of Côte d’Ivoire is obliging BGFIBankCôte d’Ivoire to identify new drivers of growth, such asdigital banking services.The Côte d’Ivoire market therefore still has strongpotential and is trending inexorably towards financialinclusion. Since the end of the crisis, the Côte d’Ivoireeconomy has been essentially driven by infrastructureprojects. It is now necessary to move to a more integratedstage, with growth that is more strategic.MALICK NDIAYE,CHIEF EXECUTIVEOFFICER BGFIBankCôte d’IvoireBGFIBank Côte d’Ivoire is positioning itself on all of theprofitable sectors of the Côte d’Ivoire economy and itsmain players. It is endeavouring to target the five leadersof each sector and is then working on its rollout to theirpartners (clients/suppliers). For example, it has been ableto penetrate the coffee and cocoa sector, as well as thevolume retailing and building and public works sectors.PA R T I E 1 ANALYSIS BY THEGENER AL MANAGEMENT3

2016 confirmsthe premiumpositioning of the offerfrom BGFIBankCôte d’Ivoire2016 was characterised by a consolidation of achievements and 2017 will see a clear expansion. The businessmodel of controlled growth is confirmed five years afterthe opening of the first branch in Abidjan.Branches will therefore continue to open, as will ATMs(cash machines) without forgetting the increase in therange of services and winning new clients and newmarkets.Digitisation will also be a means of capturing resources,enabling this expansion to be financed. BGFIBank Côted’Ivoire is targeting a position of excellence in all fields,the same as in physical reception, processing of transactions and attentiveness to clients. Digital services willbenefit from this same drive for excellence.The difference between BGFIBank Côte d’Ivoire andthe competition, five years after its entry into the Côted’Ivoire market, is the impeccable quality of its services,with strong relationships and responsiveness that isappreciated by the market. The bank is also capitalisingon its clients, who are strong opinion leaders in favourof the bank. However, BGFIBank Côte d’Ivoire also relieson its expertise as a pan-African bank as part of theBGFIBank Group, which has good knowledge of localways of thinking and functioning. This is what ChairmanOyima meant when he said: « Create an African groupfor the world ».« The impeccable qualit yof its ser vices, strongrelationships and responsivenessthat is appreciatedby the market dif ferentiateit from the competition. »4B G F I B a n k Côte d ’ Ivo i reANNUAL REPORT 2016201 7 W I L L B E T H E Y E A RW H E N T H E D I G I TA L O FFERC O M E S U P TO S P EEDThe digitisation project is the natural extension of theSIMAO (shared information system for West Africa)project, which is the real hub of the IT system, centralisedin Abidjan. Digitisation can optimise this resource, whichextends the scope of what is possible. BGFIBank Côted’Ivoire is in a highly competitive market and it musttherefore anticipate if it wants to keep its ranking andimprove it. After four years of presence, it must alreadyimprove its business model and identify other driversof growth. Digitisation clearly forms a part of this. Tomanage all of these innovations, BGFIBank Côte d’Ivoirehas set up a project team to identify requirements andprioritise them.Concerning anticipation, it monitors the market andholds discussions within the BGFIBank Group. Thiscorresponds to the will and vision of Chairman Oyimain creating a position of Chief Digital Officer. It enablessynergy, deployment and economies of scale.The BGFIBankCôte d’Ivoireheadquarters

After upgrading its range of digital products (SMSbanking and E-relevé [E-statement]), now is the timefor differentiation. So after having examined marketbenchmarks, BGFIBank Côte d’Ivoire identified therequirements and expectations of its clients, such asE-swift, which enables the automated monitoring ofbank transfers.At the beginning of 2017, BGFIBank Côte d’Ivoirewill focus on mobile banking and scanning cheques,which will give clients the perception of the bank asbeing always at the cutting edge of innovation. Mobilebanking, more reserved for retail clients, enables thebank to be carried on one’s person (in a smartphone),so that all of the conventional banking transactions canbe performed.In order to capture a high-potential clientele, afteropening within the Radisson Blu hotel in Abidjan, theCôte d’Ivoire subsidiary will open branches in Vallon« I n 201 7, B G FIB a n kCôte d ’ Ivo i re wi ll fo cu son mobile bankinga n d sc a n n i n g ch e q u e s .»and Plateau, as it did two years ago in the port town ofSan Pedro, which has strong economic activity. In thesame spirit, it will also develop the opening of ATMswithin shopping centres so that its clients can performnumerous transactions as well as merely withdrawingcash. They will therefore be able to directly pay for theirpurchases using prepaid cards.T H E C ED E AO ZO N ELike the CEEAC (Economic Community of CentralAfrican States), the CEDEAO (Economic Communityof West African States) is a coherent economic andgeographical zone from which BGFIBank cannot beabsent. Three geographical subsidiaries are establishedthere: BGFIBank Benin, BGFIBank Côte d’Ivoire andBGFIBank Senegal. A stable and prosperous region, itcan rely on the brand and expertise of BGFIBank forits enhancement and development. A regional director,Mr Malick Ndiaye, who is also Chief Executive Officerof the Côte d’Ivoire subsidiary, is in charge of coordinating the sub-region.PA R T I E 1 L’ANALYSE DEL A DIREC TION GÉNÉR ALE5

FOCUSCÔT E D ’ I VO I R EA S T H E G R O U P ’ S R EG I O N A L H U BBGFIBank Côte d’Ivoire’s IT ande-cash directorate is a supportfunction for everything involvingautomatic and computerisedprocessing. It provides itssupport to all directorates fortheir day-to-day activities andtheir decision-making andprovides tools to help withdecision-making, especially forproviding satisfaction to clients.For this, it needs tools that enablequick reaction. This forms partof the Excellence 2020 strategyvia the support function. Thisfunction is centralised in Côted’Ivoire for the sub-region in orderto harmonise the platforms andbest practices while diminishingcosts. The objective is to cover theentire sub-region with the sameefficiency. Since 2015, everythinghas been centralised in Abidjan;however some margin forautonomy is left to the subsidiariesof the sub-region. The objectiveis also to be able to exercise controlover the activities of the subsidiaries and thus be able to ensurecoherence at the group level.For the accounting,it is the Amplitude IT systemwhich manages commitments,accountancy, the managementof international transactions Applications for credit areinvestigated via the IT system withthe various configurations. A datarepository determines the bestpractices for each credit investigation: accounting and instalmentsare implemented automatically.6B G F I B a n k Côte d ’ Ivo i reANNUAL REPORT 2016« T h e su p p o r t f u n c t i o n is ce nt ra l ise di n Côte d ’ Ivo i re fo r t h e su b-re g i o n i n o rd e rto h a r m o n ise t h e p l at fo r m s a n d b e s tp ra c t i ce s wh i l e d i m i n is h i n g cos t s . »For the sub-region, the centralbank tries to harmonisethe classification of clients,companies and credits, whichgreatly facilitates collaborativework with Benin, Senegal andCôte d’Ivoire, thus establishingnumerous common points.In 2016, the IT departmentfocused on stabilisation afterintegrating three subsidiariesinto the system and providingsecurity. It is involvedin a process of PCIDSS certification, broadening it beyonde-cash and providing security.It is the configuration whichenables complete coordination of all the commitmentsin the sub-region. Of course,each country includes in itsconfiguration the specifics of itsmarket but it always applies theprinciples and standards specificto the group. It was the openingof the Senegal subsidiary whichled to the inauguration of SIMAO,the shared IT system for WestAfrica, with the telecommunication systems of each countrynow able to connect to eachother without difficulty. Thisshared support-function systemnow enables the group to veryquickly open a subsidiary in a newcountry, without difficulty.For 2017, a backup site willbe developed to avoid country risk.The system thus put in place mustbe able to facilitate the openingof new country subsidiaries.Concerning e-cash, after theMasterCard card, paymentby Visa card will be implementedat the beginning of 2017. Forlarge companies, the salarycard, which consists of directlyloading the salary onto thepayment card of each employee,is already proposed. For the bank,it is also a means of capturingresources and identifyingthe solvency of prospects.

TH E G OVER NAN C EO F B G FI B ank Côte d ’ IvoireThe executive committeeMALICK NDIAYEGISÈLE ASSEUMORY KOUYATEManaging director AdministratorHead of Administrativeand AccountingHead of Commercial andMarketingBORIS BILÉ COFFIRICHARD HATHRYKAFEHE SILUEHead of Commitments andLegal AffairsHead of Internal AuditHead of Operations andTreasuryROSIUS BAKPERODRIQUE AKREEUGÈNE ESSANHead of InformationSystem and e-moneyPermanent Control ManagerQuality andClient Service ManagerPA R T I E 2 THE GOVERNANCEOF BGFIBank Côte d’Ivoire7

The shareholdersIN FCFANATIONAL LEGAL ENTITIESSociété de Participations et de FinancementsAmountsBreakdown2 000 000 00020%10 00010 0000,0001%0,0001%2 000 030 00020,0003%6 999 950 000500 000 000500 000 00069,9995%5%5%10 00010 0000,0001%0,0001%7 999 970 00079,9997%10 000 000 000100%NATIONAL INDIVIDUAL PERSONSIbrahim Moriba KEITAIbrahim Jérôme KEINDESUB-TOTAL OF NATIONAL LEGAL ENTITIES/INDIVIDUAL PERSONS:FOREIGN LEGAL ENTITIESBGFI Holding CorporationYeshi GroupNahor Capital S.A.FOREIGN INDIVIDUAL PERSONSHenri-Claude OYIMARhinesse KATSOUSUB-TOTAL FOREIGN LEGAL ENTITIES/INDIVIDUAL PERSONS:TOTALSIN %The board of directorsThe representatives oflegal entitiesIbrahim Moriba KEITABGFI Holding CorporationHenri-Claude OYIMAYESHI Group LtdFrancis Gérard CAZEMalick NDIAYEAmadou KANEJanine DIAGOUNarcisse OBIANG ONDO8B G F I B a n k Côte d ’ Ivo i reANNUAL REPORT 2016Henri-Claude OYIMAAbdul Hussein BEYDOUNNationalityWhether or notshareholderDate ofassumptionof dutiesIvory CoastGabonGabonIvory CoastFrenchSenegalSenegalIvory CoastGabonShareholder 05/2016

The specialised committeesT H E C O M M I T T EE SO F T H E G E N ER A L M A N AG EM E N TT H E C O M M I T T EE SO F T H E B OA R D O F D I R EC TO R S the audit and risks committee the good governance, human resources and remuneration committeethe executive committeethe procedures validation committeethe commitments committeethe social consultation committeethe information systems security committeethe internal control committeethe health, safety and working conditions committeethe management reviewthe process reviewthe treasury committee / ALMThe charter of the committeeof good governanceThe good corporate governance committee supports theaction of the board of directors on a set of good governance principles, so as to organise and disseminate ahealthy culture of good governance within BGFIBank CI.It also assists the board of directors concerning theappointment and dismissal of directors, the compositionof the specialised committees of the board of directors,and the evaluation of the functioning of the board ofdirectors and of the directors who serve on it.It is composed of the three directors, including oneindependent, and meets once a year. oversee compliance with the instructions contained inthe director’s charter; verify the subsidiary’s governance regime; review the good governance charter at least once a year; develop a set of good governance principles applicableto BGFIBank CI, recommend them to the board ofdirectors and monitor their disclosure; monitor the links between the Board of Directors andthe general management and make sure that the latteracts within its prerogatives.Its responsibilities are to: propose measures for the good governance ofBGFIBank CI; recommend and make improvements to the governance of BGFIBank CI; as required, clarify and strengthen the guidelinesestablished by the various regulations of the BankingCommission in view of the good corporate governanceof BGFIBank CI; clarify and enhance the role of the board of directorsand the committees relative to the surveillance andmanagement of the main risks and internal control,through various charters;PA R T I E 2 THE GOVERNANCEOF BGFIBank Côte d’Ivoire9

The organisation of the generalmanagement carrying out its dutiesThe general management of BGFIBank Côte d’Ivoire iscomposed of an accountable manager appointed by theboard of directors and approved by the monetary authority of the country in accordance with the legislation andthe banking regulations in force in the country. examining the financial reports and internal control; supervising the performance of the subsidiary inrelation to the strategic plan; monitoring the state of progress of projects;The general management is responsible for: managing the strategic objectives of the subsidiary andensuring the coherence of its operational plan with theoverall strategy; providing a clear and relevant response to factorsrelated to the environment, regulations, politics,competition and any other similar question; defining the tasks and overall objectives of thesubsidiary; informing the general management of the group ofadaptations of the overall strategy to the specifics ofthe local environment; approving the main policies and the strategy of thedifferent departments; giving advice on local regulations and legislation havingan impact on the overall policy. taking the decisions concerning operational projectsand budgets;THE SOCIALRESPONSIBILIT Y REPORTBGFIBank Côte d’Ivoire had a workforce of 96 employeeson 31 December 2016, against 74 on 31 December 2015,mostly having executive status: 53% on 31 December2016, against 55% on 31 December 2015.We note an increase in the number of first-line supervisors, who represent 45% of the personnel, and clericalworkers who represent 2%, against respectively 40% and3% on 31 December 2015.On 31 December 2016, the subsidiary had 50 men (52%)for 46 women (48%) with a change in the number ofwomen compared to 31 December 2015 (58/32).10B G F I B a n k Côte d ’ Ivo i reANNUAL REPORT 2016BGFIBank Côte d’Ivoire has 4% of non-Côte d’Ivoirecitizens: four nationals of the WAMU including oneexpatriate.On 31 December 2016, there were 84 permanent contracts and 12 temporary contracts, against 66 permanentcontracts and 8 temporary contracts on 31 December2015. Eleven trainees joined the workforce during 2016.Concerning hires, BGFIBank Côte d’Ivoire had recruited25 staff as of 31 December 2016, of which there were16 women and 9 men.

* ISO 9001 version 2008 certification PIMENT BLEUFOCUSI S O 90 01 V ER S I O N 20 0 8 C ERT I FI C AT I O NIn December 2016, BGFIBankCôte d’Ivoire obtained AFAQ/AFNOR ISO 9001 version 2008certification for its managementsystem put in place for bankingactivities carried out in all of theBGFIBank Côte d’Ivoire branchesand its head office, including: ion, Measurement, Accountancy, Computerisation of all thebanking products for the retail,professional, institutionaland corporate markets, Human resources, Property and Persons Security, Control, Project management, Purchasing, Legal, Cash Management.This international recognitionrecognises the effort made by thesubsidiary to satisfy its clientson a daily basis. BGFIBank Groupthus becomes the 3rd subsidiaryof the BGFIBank Group to obtainthis certification, a guaranteeof the professionalism of its team.PA R T I E 3 THE SOCIALRESPONSIBILIT Y REPORT11

TH E FI NAN C IAL R EP O RTThe asset side of the balance sheetIN MILLIONSXOF31 décembre201531 décembre2016Var.%23 063128 35414 7528 9752 06938 772183 27560 3974 4793 31768%43%309%-50%60%177 213290 24064%Interbank debtsClient debtsInvestment securitiesOther assetsCapital assetsTOTAL BALANCE SHEET2016 was particularly marked by the very significantgrowth in the securities portfolio: 309%, representing about 46 billion XOF.Credit continued its evolution with an excellent increaseof 43%, representing 55 billion XOF.S T R U C T U R E O F T H E C R ED I TP O RT F O L I O I N M I L L I O N SS T R U C T U R E O F T H E P O RT F O L I OBY T Y P E O F C L I E N T I N M I L L I O N S60 000180 000outstanding balance-sheet credits50 000160 000asset deposits40 000140 00030 000120 00020 000100 0002 % D OUBTFULAND DISPUTEDDEBT: 3 50612B G F I B a n k Côte d ’ Ivo i reANNUAL REPORT 201620 000 The rate of downgrading of the portfolio wentfrom 1.1% on 31 December 2015 to 1.3% at theend of 2016. The cost of risk on stock stood at 0.9% against0.7% at the end of 2015.Rest of the worldWAMUStateState-owned company0CompaniesChemicalsTTM40 000RetailQ UA L I T Y O F T H E P O RT F O L I O98 % S OUND DEBT:181 928StateIndustryRetailOil & gasInsuranceAgro industryBank & FIReal-estate serviceworksCommerce60 000Commodities80 0000Building and public10 000

Liability side of the balance sheetIN MILLIONSXOFInterbank debtsClient depositsOther liabilitiesCapital and reservesCapitalLegal reserveRetained earningsEarningsReserve for general banking risksProvisions for R & CSubordinated loans31 December201531 December2016Var.%34 215110 9157 28311 99010 0000-1 9222 6181 29456012 250102 417145 8547 67516 65410 0001045924 1021 85639017 250199%32%5%39%0%-131%57%43%-30%41%177 213290 24064%TOTAL BALANCE SHEETThe balance-sheet total of BGFIBank Côte d’Ivoireincreased strongly by 64%, representing 113 billion XOFdue mainly to: The increase by 199%, representing 68 billion XOF ininterbank debt due to CBWAS refinancing. The increase in the growth of deposits from clients 32% representing 35 billion XOF. The strengthening of permanent capital thanks to thesubordinated loan of 5 billion XOF received from theholding company and a positive result generated overthe year.D I S T R I B U T I O N O F D EP O S I T S BY T Y P E48 % D EMAND ACCOUNTS : 69 9412 % SAVINGS : 3 2907 % S ECURIT YDEPOSITS : 10 45643 % T ERM ACCOUNTS : 62 166PA R T I E 4 THE FINANCIAL REPORT13

Income statementIN MILLIONSOF FCFAI N C O M E S TAT EM E N T31 December201531 December2016Var.16/15Var.%7 3854 12711 512-1 814-3 145-969-286-6 2145 311511-960-1 3209 3305 51314 842-2 374-3 859-1 046-616-7 8957 147-1 294-392-1541 9451 3863 330-560-714-77-330-1 6811 836-1 8055681 16626%34%29%31%23%8%115%27%35%-353%-59%-88%2 6184 1021 48457%Interest marginCommissionsNET BANKING INCOMEPersonnel expensesGeneral operating expensesTaxes and dutiesAllocations to depreciationGENERAL EXPENSESGROSS OPERATING RESULTNet CDL provisionsProvisions for net R&CExceptional earningsNET EARNINGSBGFIBank Côte d’Ivoire made net profit of 4,102 millionFCFA in 2016.NET BANKING INCOMEBGFIBank Côte d’Ivoire’s net banking income grew by30% compared to 2015, due mainly to: the strong growth in average outstanding loans andespecially investment securities; the increase in commissions thanks to the volumeeffect of transactions: transfers, foreign exchangetransactions, intermediation, etc.Average rates remained stable overall.INTEREST MARGIN :9.33 BILLIONrealised 2016/2015 : 33%realised/budget (2016) : 33%COMMISSIONS :5.51 BILLIONrealised 2016/2015 : 26%realised/budget (2016) : 12%TOTAL NET BANKING INCOME :14,84 BILLIONrealised 2016/2015 : 30%realised/budget (2016) : 19%14B G F I B a n k Côte d ’ Ivo i reANNUAL REPORT 2016G E N ER A L E X P E N S E SThe general expenses increased by 27% compared to2015 and include: Personnel charges (2,374 Mfcfa) which increased by31% compared to 2015 in line with the twenty-two(22) recruitments made over the year. The new recruitswere mainly assigned to branches. The general operating expenses and taxes (4,905 Mfcfa),which increased by 19% in line with the developmentof the activity.N E T A L LO C AT I O N STO P R OV I S I O N SThe provisions allocated in 2016 to cover the credit riskstand at 1,661 Mfcfa, representing 0.9% of balance-sheetcommitments. The cost of risk remains controlled inspite of the development of the activity.

General report fromthe external auditors on the annualaccounts of BGFIBank Côte d’IvoireDear Sirs,In execution of the mission assigned to us by yourgeneral meeting, we hereby present our report coveringthe financial year ending on 31 December 2016 on: the audit of the annual accounts of BGFIBank Côted’Ivoire as attached to the present report; the checks relative to the functioning of the corporatebodies and internal control; compliance with banking regulations; the specific checks and the information specified bythe law.The annual accounts were approved by the Board ofDirectors. It is our responsibility, based on our audit, toexpress an opinion on these annual accounts.OPINION ON THEA N N UA L AC C O U N T SWe have performed our audit according to the standardsof the profession; these standards require the implementation of checks to provide reasonable assurance that theannual accounts do not contain significant anomalies. Anaudit consists of checking, by sampling or using otherselection methods, the elements justifying the amountsand information shown in the annual accounts. It alsoconsists of assessing the accounting principles followed,the significant estimates adopted to close the annualaccounts and the overall presentation of the accounts.We consider that the elements that we collected are sufficient and appropriate to form the basis of our opinionexpressed hereafter.We certify that the annual accounts are regular andhonest and give a true image of the result of transactions during the financial year ending on 31 December2016, together with the financial situation and assets ofBGFIBank Côte d’Ivoire at the end of this financial year,in accordance with the accounting principles laid downby the banking chart of accounts for the West AfricanMonetary Union (WAMU) and the instructions of theCentral Bank of West African States (CBWAS) in mattersof the presentation of annual accounts.PRICEWATERHOUSECOOPERSSouleymane SoroCertified Public AccountantPartnerERNST & YOUNG SAJean-François AlbrechtCertified Public AccountantPartnerPA R T I E 4 THE FINANCIAL REPORT15

T H E N E T WO R K O F B R AN C H ESE TO I L E B R A N C HPlateau, Avenue Joseph Anoma, Im. AMCI, 15th and 16th floorsOpen from Monday to Friday, continuously from 8am to 4pm.Tel.: 225 20 25 88 00 Fax: 225 20 32 62 92Client Quality feedback: eqc@bgfigroupe.com 225 09 95 55 55AT H É N A B R A N C HYopougon, Zone industrielleOpen from Monday to Friday, continuously from 8am to 4pmand Saturdays from 9am to 12noon.Tel.: 225 20 25 88 11Client Quality feedback: eqc@bgfigroupe.com 225 09 95 55 555C A S S I O P ÉE B R A N C HMarcory, Boulevard Valery Giscard d’EstaingOpen from Monday to Friday, continuously from 8.30am to 4pmand Saturdays from 9am to 1pm.Tel.: 225 20 25 88 00 Fax: 225 20 32 62 92Client Quality feedback:eqc@bgfigroupe.com 225 09 95 55 55GA Ï A B R A N C HSan-Pedro, Avenue de l’Indépendance,Open from Monday to Friday, continuously from 8am to 4pmand Saturdays from 9am to 12noon.Tel.: 225 34 71 03 18 Fax: 225 34 71 03 24Client Quality feedback: eqc@bgfigroupe.com 225 09 95 55 55H ER M E S B R A N C HPort Bouet, Boulevard de l’Aéroport, next to the Radisson Blu HôtelOpen from Monday to Friday, from 9am to 1pm and from 2pm to 4pm,and Saturdays from 9am to 1pm.Tel.: 225 20 25 88 13 Fax: 225 20 32 62 92Client Quality feedback: eqc@bgfigroupe.com 225 09 95 55 55Responsible editor: general management of BGFIBank Côte d’IvoireDesign and formatting: De Visu Digital Document Design S.A. (www.devisu.com)Authorship: Philippe Fourny (p.fourny@devisu.com) with the participation of MarcEveraert and input from the executives and managers of BGFIBank Côte d’IvoirePhotos: BGFIBank Côte d’IvoirePrinting: Artoos Hayez, Belgium July 2017

BGFIBank CIThe partner of your successTel. : 225 20 25 88 00Tel. Ecoute Qualité Clients : 225 09 95 55 55Fax : 225 20 32 62 92E-mail Ecoute Qualité Clients : eqc@bgfigroupe.comwww.groupebgfibank.com

www.groupebgfibank.com

Marcory, Boulevard Valery Giscard d'Estaing Abidijan, Côte d'Ivoire Tel: 225 20 25 88 00 Fax: 225 21 26 82 80 www.groupebgfibank.com Annual Report 2016 BGFIBank Côte d'Ivoire