Transcription

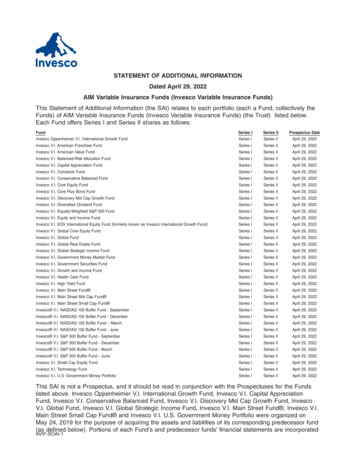

STATEMENT OF ADDITIONAL INFORMATIONDated April 29, 2022AIM Variable Insurance Funds (Invesco Variable Insurance Funds)This Statement of Additional Information (the SAI) relates to each portfolio (each a Fund, collectively theFunds) of AIM Variable Insurance Funds (Invesco Variable Insurance Funds) (the Trust) listed below.Each Fund offers Series I and Series II shares as follows:FundInvesco Oppenheimer V.I. International Growth FundSeries ISeries ISeries IISeries IIProspectus DateApril 29, 2022Invesco V.I. American Franchise FundSeries ISeries IIApril 29, 2022Invesco V.I. American Value FundSeries ISeries IIApril 29, 2022Invesco V.I. Balanced-Risk Allocation FundSeries ISeries IIApril 29, 2022Invesco V.I. Capital Appreciation FundSeries ISeries IIApril 29, 2022Invesco V.I. Comstock FundSeries ISeries IIApril 29, 2022Invesco V.I. Conservative Balanced FundSeries ISeries IIApril 29, 2022Invesco V.I. Core Equity FundSeries ISeries IIApril 29, 2022Invesco V.I. Core Plus Bond FundSeries ISeries IIApril 29, 2022Invesco V.I. Discovery Mid Cap Growth FundSeries ISeries IIApril 29, 2022Invesco V.I. Diversified Dividend FundSeries ISeries IIApril 29, 2022Invesco V.I. Equally-Weighted S&P 500 FundSeries ISeries IIApril 29, 2022Invesco V.I. Equity and Income FundSeries ISeries IIApril 29, 2022Invesco V.I. EQV International Equity Fund (formerly known as Invesco International Growth Fund)Series ISeries IIApril 29, 2022Invesco V.I. Global Core Equity FundSeries ISeries IIApril 29, 2022Invesco V.I. Global FundSeries ISeries IIApril 29, 2022Invesco V.I. Global Real Estate FundSeries ISeries IIApril 29, 2022Invesco V.I. Global Strategic Income FundSeries ISeries IIApril 29, 2022Invesco V.I. Government Money Market FundSeries ISeries IIApril 29, 2022Invesco V.I. Government Securities FundSeries ISeries IIApril 29, 2022Invesco V.I. Growth and Income FundSeries ISeries IIApril 29, 2022Invesco V.I. Health Care FundSeries ISeries IIApril 29, 2022Invesco V.I. High Yield FundSeries ISeries IIApril 29, 2022Invesco V.I. Main Street Fund Series ISeries IIApril 29, 2022Invesco V.I. Main Street Mid Cap Fund Series ISeries IIApril 29, 2022Invesco V.I. Main Street Small Cap Fund Series ISeries IIApril 29, 2022Invesco V.I. NASDAQ 100 Buffer Fund - SeptemberSeries ISeries IIApril 29, 2022Invesco V.I. NASDAQ 100 Buffer Fund - DecemberSeries ISeries IIApril 29, 2022Invesco V.I. NASDAQ 100 Buffer Fund – MarchSeries ISeries IIApril 29, 2022Invesco V.I. NASDAQ 100 Buffer Fund - JuneSeries ISeries IIApril 29, 2022Invesco V.I. S&P 500 Buffer Fund - SeptemberSeries ISeries IIApril 29, 2022Invesco V.I. S&P 500 Buffer Fund - DecemberSeries ISeries IIApril 29, 2022Invesco V.I. S&P 500 Buffer Fund - MarchSeries ISeries IIApril 29, 2022Invesco V.I. S&P 500 Buffer Fund - JuneSeries ISeries IIApril 29, 2022Invesco V.I. Small Cap Equity FundSeries ISeries IIApril 29, 2022Invesco V.I. Technology FundSeries ISeries IIApril 29, 2022Invesco V.I. U.S. Government Money PortfolioSeries ISeries IIApril 29, 2022This SAI is not a Prospectus, and it should be read in conjunction with the Prospectuses for the Fundslisted above. Invesco Oppenheimer V.I. International Growth Fund, Invesco V.I. Capital AppreciationFund, Invesco V.I. Conservative Balanced Fund, Invesco V.I. Discovery Mid Cap Growth Fund, InvescoV.I. Global Fund, Invesco V.I. Global Strategic Income Fund, Invesco V.I. Main Street Fund , Invesco V.I.Main Street Small Cap Fund and Invesco V.I. U.S. Government Money Portfolio were organized onMay 24, 2019 for the purpose of acquiring the assets and liabilities of its corresponding predecessor fund(as defined below). Portions of each Fund’s and predecessor funds’ financial statements are incorporatedAVIF-SOAI-1

into this SAI by reference to each Fund’s most recent shareholder report for its fiscal year endedDecember 31, 2021.You may obtain, without charge, a copy of any Prospectus and/or shareholder report for any Fund listedabove from an authorized dealer or by writing to:Invesco Distributors, Inc.P.O. Box 219078Kansas City, MO 64121-9078or by calling (800) 959-4246or on the Internet: http://www.invesco.com/usThe Trust has established other funds which are offered by one or more separate prospectuses andSAIs. Certain Funds in this SAI are not offered for sale or available for purchase. Any reference to theterm “Fund” or “Funds” throughout this SAI refers to each Fund named above unless otherwise indicated.AVIF-SOAI-1

STATEMENT OF ADDITIONAL INFORMATIONTABLE OF CONTENTSPageGENERAL INFORMATION ABOUT THE TRUST . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Fund History . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Shares of Beneficial Interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Share Certificates. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .DESCRIPTION OF THE FUNDS AND THEIR INVESTMENTS AND RISKS . . . . . . . . . . . . . . . . . . . . . . . . . .Classification . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Investment Strategies and Risks . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Equity Investments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Foreign Investments. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Exchange-Traded Funds . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Exchange-Traded Notes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Debt Investments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Rule 2a-7 Requirements. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Other Investments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Investment Techniques . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Derivatives . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .LIBOR Transition Risk . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Environmental, Social and Governance (ESG) Considerations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Receipt of Issuer’s Nonpublic Information . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Business Continuity and Operational Risk . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Cybersecurity Risk . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Natural Disaster/Epidemic Risk . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Fund Policies . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Portfolio Turnover . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Policies and Procedures for Disclosure of Fund Holdings . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Selective Disclosures. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .MANAGEMENT OF THE TRUST . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Board of Trustees. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Management Information . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Committee Structure . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Trustee Ownership of Fund Shares. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Compensation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Retirement Policy . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Pre-Amendment Retirement Plan For Trustees . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Amendment of Retirement Plan and Conversion to Defined Contribution Plan . . . . . . . . . . . . . . . . . . . .Deferred Compensation Agreements . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Code of Ethics . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Proxy Voting Policies . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .CONTROL PERSONS AND PRINCIPAL HOLDERS OF SECURITIES . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .INVESTMENT ADVISORY AND OTHER SERVICES . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Investment Adviser. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Investment Sub-Advisers . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Services to the Subsidiary . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Service Agreements. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 969799999999100100101101102102102112113113

PageOther Service Providers . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Custodian. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Securities Lending Arrangements . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Portfolio Managers . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .BROKERAGE ALLOCATION AND OTHER PRACTICES . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Brokerage Transactions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Commissions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Broker Selection . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Directed Brokerage (Research Services). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Affiliated Transactions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Regular Brokers . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Allocation of Portfolio Transactions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Allocation of Initial Public Offering (IPO) Transactions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .PURCHASE, REDEMPTION AND PRICING OF SHARES . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .DIVIDENDS, DISTRIBUTIONS AND TAX MATTERS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Dividends and Distributions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Tax Matters . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .DISTRIBUTION OF SECURITIES . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Distributor . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Distribution Plan . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .FINANCIAL STATEMENTS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .APPENDIX A - RATINGS OF DEBT SECURITIES . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .APPENDIX B - PERSONS TO WHOM INVESCO PROVIDES NON-PUBLIC PORTFOLIO HOLDINGSON AN ONGOING BASIS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .APPENDIX C - TRUSTEES AND OFFICERS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .APPENDIX D - TRUSTEE COMPENSATION TABLE. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .APPENDIX E - PROXY POLICY AND PROCEDURES . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .APPENDIX F - CONTROL PERSONS AND PRINCIPAL HOLDERS OF SECURITIES. . . . . . . . . . . . . . . . .APPENDIX G - MANAGEMENT FEES . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .APPENDIX H - PORTFOLIO MANAGER(S) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .APPENDIX I - ADMINISTRATIVE SERVICES FEES . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .APPENDIX J - BROKERAGE COMMISSIONS AND COMMISSIONS ON AFFILIATEDTRANSACTIONS. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .APPENDIX K - DIRECTED BROKERAGE (RESEARCH SERVICES) AND PURCHASES OFSECURITIES OF REGULAR BROKERS OR DEALERS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .APPENDIX L - CERTAIN FINANCIAL INTERMEDIARIES THAT RECEIVE ONE OR MORE TYPES OFPAYMENTS. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .APPENDIX M - AMOUNTS PAID TO INVESCO DISTRIBUTORS, INC. PURSUANT TO DISTRIBUTIONPLANS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .APPENDIX N - ALLOCATION OF ACTUAL FEES PAID PURSUANT TO DISTRIBUTION PLANS. . . . . . -1M-1N-1

GENERAL INFORMATION ABOUT THE TRUSTFund HistoryAIM Variable Insurance Funds (Invesco Variable Insurance Funds) (the Trust) is a Delaware statutorytrust registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-endseries management investment company. The Trust was originally organized as a Maryland corporation onJanuary 22, 1993 and re-organized as a Delaware statutory trust on May 1, 2000. Under the Trust’sAgreement and Declaration of Trust, as amended (the Trust Agreement), the Board of Trustees of the Trust(the Board) is authorized to create new series of shares without the necessity of a vote of shareholders of theTrust.Prior to April 30, 2010, the Trust was known as AIM Variable Insurance Funds.The following table shows each Fund’s current name and Fund history.FundFund HistoryInvesco Oppenheimer V.I. InternationalGrowth Fund*On May 24, 2019, the Fund assumed the assets and liabilities of its predecessor fundOppenheimer International Growth Fund/VA.Invesco V.I. American Franchise FundOn June 1, 2010, the Fund assumed the assets and liabilities of its predecessor fundVan Kampen LIT Capital Growth Portfolio.Invesco V.I. American Value FundOn June 1, 2010, the Fund assumed the assets and liabilities of its predecessor fundVan Kampen UIF U.S. Mid Cap Value Portfolio.Invesco V.I. Balanced-Risk Allocation FundNo prior history.Invesco V.I. Capital Appreciation Fund*Prior to April 30, 2021, the Fund was known as Invesco Oppenheimer V.I. CapitalAppreciation Fund. On May 24, 2019, the Fund assumed the assets and liabilities ofits predecessor fund Oppenheimer Capital Appreciation Fund/VA.Invesco V.I. Comstock FundOn June 1, 2010, the Fund assumed the assets and liabilities of its predecessor fundVan Kampen LIT Comstock Portfolio.Invesco V.I. Conservative Balanced Fund*Prior to April 30, 2021, the Fund was known as Invesco Oppenheimer V.I.Conservative Balanced Fund. On May 24, 2019, the Fund assumed the assets andliabilities of its predecessor fund Oppenheimer Conservative Balanced Fund/VA.Invesco V.I. Core Equity FundPrior to April 30, 2010, the Fund was known as AIM V.I. Core Equity Fund.Invesco V.I. Core Plus Bond FundPrior to April 30, 2015, the Fund was known as Invesco V.I. Diversified Income Fund.Prior to April 30, 2010, the Fund was known as AIM V.I. Diversified Income Fund. OnApril 29, 2022, the Fund assumed the assets and liabilities of Invesco V.I. Core BondFund.Invesco V.I. Discovery Mid Cap GrowthFund*Prior to April 30, 2021, the Fund was known as Invesco Oppenheimer V.I. DiscoveryMid Cap Growth Fund. On May 24, 2019, the Fund assumed the assets and liabilitiesof its predecessor fund Oppenheimer Discovery Mid Cap Growth Fund/VA.Invesco V.I. Diversified Dividend FundOn June 1, 2010, the Fund assumed the assets and liabilities of its predecessor fundMorgan Stanley Variable Investment Series Dividend Growth Portfolio.Invesco V.I. Equally-Weighted S&P 500FundOn June 1, 2010, the Fund assumed the assets and liabilities of its predecessor fundMorgan Stanley Select Dimensions Investment Series Equally-Weighted S&P 500Portfolio. On April 29, 2022, the Fund assumed the assets and liabilities of InvescoV.I. S&P 500 Index Fund.1

FundFund HistoryInvesco V.I. Equity and Income FundOn June 1, 2010, the Fund assumed the assets and liabilities of its predecessor fundVan Kampen UIF Equity and Income Portfolio.Invesco V.I. EQV International Equity FundPrior to April 29, 2022, the Fund was known as Invesco V.I. International GrowthFund.Prior to April 30, 2010, the Fund was known as AIM V.I. International Growth Fund.Invesco V.I. Global Core Equity FundOn June 1, 2010, the Fund assumed the assets and liabilities of its predecessor fundVan Kampen UIF Global Value Equity Portfolio.Invesco V.I. Global Fund*Prior to April 30, 2021, the Fund was known as Invesco Oppenheimer V.I. GlobalFund. On May 24, 2019, the Fund assumed the assets and liabilities of itspredecessor fund Oppenheimer Global Fund/VA.Invesco V.I. Global Real Estate FundPrior to April 30, 2010, the Fund was known as AIM V.I. Global Real Estate Fund.Invesco V.I. Global Strategic Income Fund*Prior to April 30, 2021, the Fund was known as Invesco Oppenheimer V.I. GlobalStrategic Income Fund. On May 24, 2019, the Fund assumed the assets and liabilitiesof its predecessor fund Oppenheimer Global Strategic Income Fund/VA.Invesco V.I. Government Money MarketFundPrior to April 29, 2016, the Fund was known as Invesco V.I. Money Market Fund. Priorto April 30, 2010, the Fund was known as AIM V.I. Money Market Fund.Invesco V.I. Government Securities FundPrior to April 30, 2010, the Fund was known as AIM V.I. Government Securities Fund.Invesco V.I. Growth and Income FundOn June 1, 2010, the Fund assumed the assets and liabilities of its predecessor fundVan Kampen LIT Growth and Income Portfolio.Invesco V.I. Health Care FundPrior to April 30, 2018, the Fund was known as Invesco V.I. Global Health Care Fund.Prior to April 30, 2010, the Fund was known as AIM V.I. Global Health Care Fund.Invesco V.I. High Yield FundPrior to April 30, 2010, the Fund was known as AIM V.I. High Yield Fund.Invesco V.I. Main Street Fund *Prior to April 30, 2021, the Fund was known as Invesco Oppenheimer V.I. Main StreetFund . On May 24, 2019, the Fund assumed the assets and liabilities of itspredecessor fund Oppenheimer Main Street Fund /VA.Invesco V.I. Main Street Mid Cap Fund Prior to April 30, 2021, the Fund was known as Invesco V.I. Mid Cap Core EquityFund. Prior to April 30, 2010, the Fund was known as AIM V.I. Mid Cap Core EquityFund.Invesco V.I. Main Street Small Cap Fund *Prior to April 30, 2021, the Fund was known as Invesco Oppenheimer V.I. Main StreetSmall Cap Fund . On May 24, 2019, the Fund assumed the assets and liabilities ofits predecessor fund Oppenheimer Main Street Small Cap Fund /VA.Invesco V.I. NASDAQ 100 Buffer Fund SeptemberNo prior history.Invesco V.I. NASDAQ 100 Buffer Fund DecemberNo prior history.Invesco V.I. NASDAQ 100 Buffer Fund MarchNo prior history.Invesco V.I. NASDAQ 100 Buffer Fund JuneNo prior history.2

FundFund HistoryInvesco V.I. S&P 500 Buffer Fund SeptemberNo prior history.Invesco V.I. S&P 500 Buffer Fund DecemberNo prior history.Invesco V.I. S&P 500 Buffer Fund MarchNo prior history.Invesco V.I. S&P 500 Buffer Fund - JuneNo prior history.Invesco V.I. Small Cap Equity FundPrior to April 30, 2010, the Fund was known as AIM V.I. Small Cap Equity Fund.Invesco V.I. Technology FundPrior to April 30, 2010, the Fund was known as AIM V.I. Technology Fund.Invesco V.I. U.S. Government MoneyPortfolio*Prior to April 30, 2021, the Fund was known as Invesco Oppenheimer V.I.Government Money Fund. On May 24, 2019, the Fund assumed the assets andliabilities of its predecessor fund Oppenheimer Government Money Fund/VA.*All historical financial information and other information contained in this SAI relating to the Fund (or any classes thereof) forperiods ending on or prior to May 24, 2019 is that of its predecessor fund (or the corresponding classes thereof).Shares of Beneficial InterestShares of beneficial interest of the Trust are redeemable at their net asset value at the option of theshareholder or at the option of the Trust, in accordance with any applicable provisions of the Trust Agreementand applicable law, subject in certain circumstances to a contingent deferred sales charge, if applicable.The Trust allocates cash and property it receives from the issue or sale of shares, together with all assetsin which such consideration is invested or reinvested, all income, earnings, profits and proceeds thereof, tothe appropriate Fund, as applicable, subject only to the rights of creditors of that Fund. These assetsconstitute the assets belonging to each Fund, are segregated on the Trust’s books, and are charged with theliabilities and expenses of such Fund and its respective classes. The Trust allocates any general liabilities andexpenses of the Trust not readily identifiable as belonging to a particular Fund primarily on the basis ofrelative net assets or other relevant factors, subject to oversight by the Board.Each share of each Fund represents an equal pro rata interest in that Fund with each other share and isentitled to dividends and other distributions with respect to the Fund, which may be from income, capital gainsor capital, as declared by the Board.Each class of shares of a Fund represents a proportionate undivided interest in the net assets belongingto that Fund. Differing sales charges and expenses will result in differing net asset values and dividends anddistributions. Upon any liquidation of the Trust, shareholders of each class are entitled to share pro rata in thenet assets belonging to the applicable Fund allocable to such class available for distribution after satisfactionof, or reasonable provision for, the outstanding liabilities of the Fund allocable to such class.The Trust Agreement provides that each shareholder, by virtue of having become a shareholder of theTrust, is bound by terms of the Trust Agreement and the Trust’s Bylaws. Ownership of shares does not makeshareholders third party beneficiaries of any contract entered into by the Trust.The Trust is not required to hold annual or regular meetings of shareholders. Meetings of shareholders ofa Fund or class will be held for any purpose determined by the Board, including from time to time to considermatters requiring a vote of such shareholders in accordance with the requirements of the 1940 Act, state lawor the provisions of the Trust Agreement. It is not expected that shareholder meetings will be held annually.3

The Trust Agreement provides that the Board may authorize (i) a merger, consolidation or sale of assets(including, but not limited to, mergers, consolidations or sales of assets between two Funds, or between aFund and a series of any other registered investment company), and (ii) the combination of two or moreclasses of shares of a Fund into a single class, each without shareholder approval but subject to applicablerequirements under the 1940 Act and state law.The Trust understands that insurance company separate accounts owning shares of the Funds will votetheir shares in accordance with the instructions received from owners of variable annuity contracts andvariable life insurance policies (Contract Owners), annuitants and beneficiaries. Fund shares held by aseparate account as to which no instructions have been received will be voted for or against any proposition,or in abstention, in the same proportion as the shares of that separate account as to which instructions havebeen received. Fund shares held by a separate account that are not attributable to Contract Owners will alsobe voted for or against any proposition in the same proportion as the shares for which voting instructions arereceived by that separate account. If an insurance company determines, however, that it is permitted to voteany such shares of the Funds in its own right, it may elect to do so, subject to the then current interpretation ofthe 1940 Act and the rules thereunder.Each share of a Fund generally has the same voting, dividend, liquidation and other rights; however, eachclass of shares of a Fund is subject to different sales loads, conversion features, exchange privileges andclass-specific expenses, as applicable. Only shareholders of a specific class may vote on matters relating tothat class’s distribution plan.Except as specifically noted above, shareholders of each Fund are entitled to one vote per share (withproportionate voting for fractional shares), irrespective of the relative net asset value of the shares of theFund. However, on matters affecting an individual Fund or class of shares, a separate vote of shareholders ofthat Fund or class is required. Shareholders of a Fund or class are not entitled to vote on any matter whichdoes not affect that Fund or class but that requires a separate vote of another Fund or class. An example of amatter that would be voted on separately by shareholders of each Fund is the approval of the advisoryagreement with Invesco Advisers, Inc. (the Adviser or Invesco).When issued, shares of each Fund are fully paid and nonassessable, have no preemptive or subscriptionrights, and are freely transferable. There are no automatic conversion rights but each Fund may offervoluntary rights to convert between certain share classes, as described in each Fund’s prospectus. Shares donot have cumulative voting rights in connection with the election of Trustees or on any other matter.Under Delaware law, shareholders of a Delaware statutory trust shall be entitled to the same limitation ofpersonal liability extended to shareholders of private for-profit corporations organized under Delaware law.There is a remote possibility, however, that shareholders could, under certain circumstances, be held liable forthe obligations of the Trust to

of its predecessor fund Oppenheimer Global Strategic Income Fund/VA. Invesco V.I. Government Money Market Fund Prior to April 29, 2016, the Fund was known as Invesco V.I. Money Market Fund. Prior to April 30, 2010, the Fund was known as AIM V.I. Money Market Fund.