Transcription

SPECIA L REPORTHow to Invest in Tesla’sSecret SupplierBy Jeff BrownA Brownstone Res ea rch Pub lica tion

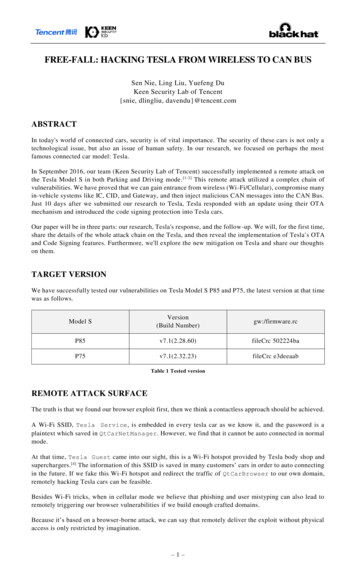

Special Report2022How to Invest in Tesla’s Secret SupplierBy Jeff Brown, Editor, The Near Future ReportIt’s a letter every management team hates to get power consumption, and less heat in phones.It was October 2013. And the board of directorsof TriQuint Semiconductors had just receiveda letter from Starboard Value – a renownedactivist investor.BAW filters were very important in the ongoing4G cellular rollout at the time. And they’re evenmore important now in the 5G rollout. Starboardpushed TriQuint to sell off or restructureunprofitable business segments and focus moreattention on BAWs.Activist investors are individuals or groups thatbuy a significant stake in a public companyto influence how that company is run. Theytypically demand large changes that areuncomfortable for both management and theemployees. And I know from personal experiencewhat this feels like from when I was working atJuniper Networks and NXP Semiconductors.At the time, TriQuint’s share price had beenmassively underperforming much of thesemiconductor industry, making it a prime targetfor Starboard Value. And when Starboard takesa position in your company, it demands change.TriQuint was no exception.In 2013, Starboard acquired 7.9% of TriQuintSemiconductors. And once the position wasmade public, it came with a list of “demands” toimprove business and boost the share price.Half of TriQuint’s business was not doing well,and this was covering up its crown jewel – theBulk Acoustic Wave (BAW) filter business.These BAWs can filter radio frequencies to enablebetter signal strength, fewer dropped calls, lowerThe Near Future ReportThese are the kinds of difficult, uncomfortabledecisions that result in large restructuring andemployee layoffs.Starboard also thought the company shouldfocus more attention on its new high-endsemiconductor technologies involving galliumnitride (GaN). At the time, these were only used inmilitary applications, but Starboard saw the futureand knew this tech would be used increasingly inautomobiles, servers, and wireless base stations.This wasn’t a revelation by Starboard. Industryinsiders knew this as well, but the revenueswere further out and TriQuint was too focusedon its existing business rather than investingheavily in the future.At the time of the letter, TriQuintSemiconductors’ shares were trading at 7.09.But Starboard had started accumulating sharesback in February of that year and had an averagecost basis of 4.82. Shares began trading higheralmost instantly. And just 22 months later,2

TriQuint merged with another company, RFMicrodevices. By then, TriQuint shares wereworth 27.55. All told, investors made 471% injust under two years with this stock.Careful readers may recognize the names ofthese two companies. After they merged, theybecame Qorvo (QRVO) – which is a Near Futureportfolio company.But TriQuint wasn’t the only success storyfor Starboard Value. This activist investorhas a track record of turning around troubledsemiconductor companies for a great return.In early 2016, Starboard invested in Marvell. At thetime, Marvell was scattered with no clear directionof product lines. But then Starboard came in, gotrid of the husband and wife team that founded thecompany, and helped focus operations.Three and a half years later, Starboard exited itsMarvell position for about a 200% gain.In late 2017, Starboard started purchasingshares of Mellanox – another beleagueredsemiconductor company at the time. Mellanoxfocused on interconnection technologies butstruggled to gain traction in the market. It justdidn’t have enough scale in its business.It was only a year and a half later whenStarboard exited its position because NVIDIApurchased the company. Starboard made 138%on its investment. And now, Near Future Reportsubscribers also have exposure to Mellanoxthrough shares in NVIDIA.Starboard knows how to create change in acompany and unleash shareholder value Whatit advocates may be uncomfortable and difficultfor the companies that it invests in, but ingeneral, its analysis is strong.And last year, Starboard took a position in asemiconductor company that I know very well.In fact, I used to compete against this companyThe Near Future Reportin some segments when I was an executive atNXP Semiconductors. That company is therecommendation we’re sharing in this report.Welcome to The Near Future ReportWelcome to The Near Future Report. I’m youreditor, Jeff Brown. I have nearly 30 years ofexperience working at high-tech companies likeQualcomm, NXP Semiconductors, and JuniperNetworks. With this research service, we lookfor stable, mid- to large-cap companies withproducts enabling the newest technologicaltrends. We can think of these as “sleep well atnight” stocks with great growth potential.These technology trends include 5G wirelessnetworks, artificial intelligence (AI), precisionmedicine, cloud-based software, and more.We profit by staying rational and investing ingreat technology companies whose products andservices are perfectly positioned for the highestgrowth trends coming around the corner.And that brings us to one of the biggest trendswe’ll see in the coming months: the future oftransportation.More specifically, the rise of electric vehicles (EVs).Electric Vehicles Have aSurprising HistoryBefore I share the company in this report – andshow you how we’ll profit from EVs in 2022 andbeyond – let’s take a step back. Understandingthe “bigger picture” is an important part of anyinvestment thesis here at The Near Future Report.We may be surprised to learn that electric vehiclesare nothing new. They’ve been around sincethe 1830s nearly 50 years before an internalcombustion engine (ICE) car was invented.It’s uncertain who invented the first electric car,but by the middle of the decade, inventors from3

Hungary, Scotland, Holland, and the state ofVermont had already built small electric cars.During the 1890s, EVs outnumbered othervehicles 10-to-1. New York City even had a fleetof EV taxis And some EVs had ranges between100 and 180 miles on a single battery charge.Pictures of the early EVs are tough to find, butthere are few designs from around 1900.Here is a picture of English inventor ThomasParker (seated in the middle), who was one ofthe first to make a “practical” electric car.One of Thomas Parker’s Early CarsBut eventually, gas-powered ICE vehiclesreplaced EVs due to the convenience. Energystorage has always been an issue with EVs. Andmuch like today, battery technology has been alimiting factor.Another issue was the infrastructure. It wasmuch easier to build out a nationwide systemof gas stations than to create electric chargingstations across the country.That’s why gas-powered cars won out over EVs forthe past century. But now, that trend is reversing.The Man Who Made ElectricCars DesirableOver the past century, EVs have been a hobbyistpursuit more than anything that is, until asmall company called Tesla, led by chairmanElon Musk, released its Roadster in 2008.In tests, the Roadster got about 245 miles on asingle charge. This range was unheard of for anelectric car in mass production. No longer wouldyou have significant range limitations with an EV.Source: Electric Vehicle NewsAnd below are a few “electric pleasure cars” fromthe 1907 MoToR Car Directory.MoToR’s 1907 Motor Car DirectoryThe Roadster was no slouch either. It couldaccelerate from 0 to 60 miles per hour in underfour seconds and had a top speed of 125 mph.Tesla estimated the Roadster’s efficiency ratingswere equivalent to gasoline mileage of 135 milesper gallon.Seeing these results forced other car manufacturersto take EVs seriously And it started a massiveworldwide competition to create the best EV.But while most car companies were merelyresearching or creating hybrid vehicles, Teslacontinued releasing more models. The companynow has four models for consumers to buy theModel S, 3, X, and Y.Source: Archive.orgThe Near Future ReportThis pursuit of future technologies has pushedTesla’s valuation to over a trillion dollars.4

My Tesla “Argument” With a Yale ProfessorMany readers know that I’m an alumnus of Yale University’s School of Management. In April2019, I got into something of an “argument” with one of the professors at Yale.He was applying the business models of the legacy car manufacturing industry to Tesla. Hissophomoric argument was that Tesla was still a car manufacturer that was losing money on everycar and would eventually go bankrupt. I told him he was wrong.I explained to him where the real value was in Tesla. It had the best EV battery technology on themarket it was one of the most advanced artificial intelligence companies in the world, which putits self-driving software technology years ahead of its competitors and the company was gearingup to launch a shared autonomous vehicle network that would be worth a fortune.He had no retort I suggested that he short the stock if he was convinced the company was overvalued. He said hewouldn’t. Later, a few of my classmates came up and told me they were investing in Tesla.Since then, Tesla’s stock is up more than 2,030%. Ouch It has to hurt to have been that wrong.I’m not sharing this to gloat but rather to make a point. Just because someone is standing in frontof a class doesn’t make them right – or even knowledgeable, for that matter. The same is true formany so-called experts. In this case, the professor’s position was myopic and demonstrated thathe did not understand the subject matter at all. It was the kind of generic, emotional, sweepingarguments that mean nothing.I treat myself in the same way. If I can’t demonstrate that I have critically analyzed a situationand clearly and logically presented an investment thesis, then you shouldn’t listen to me either.But I never recommend anything that I wouldn’t be willing to invest in myself. Even though I amnot allowed to invest in my recommendations, I treat each investment recommendation as if I wereinvesting my own money. This allows me to maintain complete objectivity with no conflicts of interest– my work is only for my subscribers – and also set the same bar that I use to allocate my own capital.And while I’m a huge fan of Elon Musk andTesla, this valuation is way too expensive for the“sleep well at night stocks” we look for here atThe Near Future Report.There’s no doubt Elon Musk pushed forward theworld on electric vehicle technology. And largelydue to the progress made by Tesla, the total costof owning an EV is now less than a traditionalICE car in many parts of the world Now thefree market can propel this industry forward.The Near Future ReportEVs Will Become CheaperThan Gas CarsAccording to the Kelley Blue Book, the averageprice of a new car in November 2020 was 39,259. That marks a 1.3% increase fromNovember 2019.But the average selling price of an electricvehicle was 43,703 Which is down 8.0% fromNovember 2019.5

So while ICE cars are going up in price, EVsare declining. While the 2021 chip shortage hastemporarily increased the cost of EVs, we canexpect to see this trend continue once supplychains return to normal. But the purchase priceisn’t the only factor in determining the total costof ownership.is on par with the cost of a typical gas-poweredcounterpart. And that is happening right now.We also must account for the difference in fuelcosts, insurance, and potential maintenance. Astudy done by fintech firm Self Financial foundthat on average an EV was around 600 cheapera year to run.But it may be undershooting the target.Remember, analysts and industry experts oftenunderestimate the impact of new technologies onthe market. And if EVs become a lot cheaper toown than ICE vehicles, consumers are going todemand EVs.If you plan to own a car for seven years or longer,an EV is already a better option. That’s becausethere are fewer moving parts in an EV, somaintenance costs are lower. And because fuel ischeaper, we can save a couple of hundred dollarsa year in fuel expenses And we can save evenmore if we can charge the car away from ourhouse – for example, at Tesla’s charging stations.And some EVs are already cheaper than orequivalent to traditional ICE vehicles. A TeslaModel 3 starts at 42,690 right now. That’s notthat different from the price of a gas-poweredcar Cost parity between ICE vehicles and EVs isalready here.Then, when we factor in tax credits, things geteven more interesting The U.S. federal government still has a 7,500tax incentive available for consumers whopurchase an EV from a company that has soldfewer than 200,000 EVs. Tesla and GM are nolonger eligible for that, but other companies are.And many states have their own credits as well.California has among the largest, with up to 6,000 in rebates.I raise these points not to try to convince readersto buy an electric vehicle – although perhapsyou’ll choose to. I want to illustrate a simplepoint: The EV market is about to explode. Thereal inflection point is when the cost of an EVThe Near Future ReportResearch firm Canalys estimates over 6.5 millionelectric vehicles were sold in 2021 And by2030, 27 million EVs will be sold every year.That’s massive growth over this decade.As impressive as 27 million vehicles sold in ayear is, that’s a small percentage of the market.In 2019, the International Organization of MotorVehicle Manufacturers reported that about 91million vehicles – gas and electric – were sold.Assuming that number stays steady for thisdecade, it means that EVs will only make up29.6% of the market by 2030. That’s way toosmall of a market share for the cheaper, moreenvironmentally friendly electric vehicles. Iwouldn’t be surprised to see the number of EVssold in 2030 to be well over 40 million andperhaps as high as 50 million.EV Competition Is StrongThis is why we’re seeing so many entrants intothe electric vehicle market. Companies see thesuccess of Tesla. They’ve seen the projectedgrowth of this market. And that’s why everyestablished automaker is working on buildingout its EV lineup.We have Ford making electric Mustangs andBroncos.GM is making an electric Hummer And it plansto make the Cadillac brand all electric by 2030.The BMW i4 looks sharp as well as the Audie-tron.6

Model 3s in 2019, tripling the sales of the secondbest-selling EV – the Chinese-made BJEV EUseries. But as I mentioned above, Tesla’s valuationis just too high for me to recommend it right now.Clockwise from top left: Ford Mustang Mach-E,Hummer EV, BMW i4, Audi e-tronSource: Ford, General Motors, BMW, AudiAnd then we have a proliferation of new entrantsto the car market, hoping to catch some of the EVmarket. Raising capital for these new upstartshasn’t been difficult at all.Here is a list of just a few. Fisker Faraday Bollinger Lordstown Motors Lucid Motors Rivian Workhorse Nio Hyliion CanooClockwise from top left: Rivian R1T, FiskerOcean, Lordstown Endurance, The Lucid Air,Nikola TRE, Bolinger B1, Nio EC6Source: Rivian, Fisker, Lordstown Motors,Lucid Motors, Bolinger Motors, NioThe best new EV companies will rise to thetop quickly, and I do not doubt that Tesla willcontinue to lead the race. Tesla sold over 300,000The Near Future ReportEstablished automotive companies aren’tgreat investments because they have too manylegacy costs. Many have dated factories, unioncontracts, and burdensome pension benefitsthey must pay out.And as for the new entrants I listed above?They’re all unproven. Most of these newcomersare still in the prototype stage – they haveno product for sale. It’s difficult to build outmanufacturing capabilities for something ascomplex as an automobile.But investors shouldn’t worry. Instead of tryingto pick which manufacturer will be the biggestwinner, we’re going to take a different approach The One Thing All EVs NeedWith the explosion in investment and innovativenew designs, the whole industry has begun, andwe are in for a decade-long period of growth.And every single EV will need hundreds ofdollars’ worth of semiconductors. And the largestarea of semiconductor spend in electric vehiclesis on power semiconductors.In 2020, I sent one of my research analysts –Nick Rokke – to the Consumer Electronics Show(CES) in Las Vegas. Longtime readers know I’ma big believer in “boots on the ground research.”And when I can’t attend a conference or event,I’ll often send one of my handpicked analysts toattend and report their findings.And at CES 2020, ON Semiconductors(ON) reported that it sells about 100 ofsemiconductor content into internal combustionengine (ICE) cars. But it sells about 500 ofcontent into EVs. That’s five times more revenuethat it can make per car.7

We already own one of the best automotivesemiconductor companies in the world. That’sInfineon – which has more than doubled sincewe bought it in May 2020.And now we can benefit from holding a smallercompetitor, ON Semiconductors (ON), in ourportfolio.Technological TransformationEven though ON may not have the market sharethat Infineon has in the automotive industry, ON isone of the leaders in a new kind of semiconductor.ON is cheap because the company is goingthrough a transformation right now It’sworking hard to get out of its lower-marginbusinesses and increase its investment in highergross margin semiconductors.ON has historically focused on powersemiconductors and what the industry refersto as “standard products.” These are highlycommoditized, very low-cost semiconductors.They are vital to the industry, but they also comewith much lower margins.For the better part of 60 years, the buildingblocks of power semiconductors like MOSFETs(metal–oxide–semiconductor field-effecttransistors) and IGBTs (insulated-gate bipolartransistors) remained relatively unchanged.These chips were built on a pure siliconfoundation. And this worked well for decades especially for low power applications.MOSFETs are typically used in lower voltageapplications like adapters, power supplies, andlow-voltage consumer products. It is normallyused in 10- to 500-volt applications.Super-junction MOSFETs are used in 500- to 900volt systems. And IGBTs are used in high-voltagesituations, like EVs and solar panels. They aretypically used for 1.2- to 6.6-kilovolt applications.The Near Future ReportAs the industry has moved toward higher-powerapplications, silicon-based MOSFETs and IGBTsare not the optimal solutions for high-powerapplications like electric vehicles and othernew technologies like 5G wireless networks.As a result, the industry has shifted toward newmaterial solutions that perform much better inhigh-power applications.One solution is a semiconductor material calledgallium nitride (GaN). GaN field-effect transistors(FETs), using practically the same design,provide anywhere from 5–50 times performanceimprovement over today’s silicon MOSFETs.As a semiconductor material, GaN is 10 timesfaster than silicon. It is capable of operating atmuch higher voltages and is a more efficientmaterial to manage power conversion. As if thatweren’t enough, GaN provides better thermalperformance – basically, it puts out less heat evenat higher power levels. And heat is one of the mostcritical things to manage in electronic equipment.GaN also allows electronic equipment to bedesigned with fewer components, which resultsin a smaller overall design. Fewer componentsand smaller design ultimately result in lessexpensive products.Another semiconductor material that isreplacing the IGBT modules is silicon carbide(SiC), which is typically used for higher voltagesituations – like controlling power in an EV ora solar panel. It has similar improvements overpure silicon as GaN does.The market size of SiC and GaN is still small It’sless than 10% of the total power semiconductormarket according to research firm YoleDéveloppement. But it is the fasting growingsegment, which is where we want to be as investors.And here’s the best part, On Semiconductor is aleader in GaN and SiC semiconductor technology.8

EVs Aren’t the Only MegatrendON Is PoweringWhile we’ll be investing in ON primarily for itsexposure to electric vehicles, it’s not the onlyreason to like the company.ON Semiconductors is also enabling thefollowing three tech trends:1. Solar power – ON is a leader in photovoltaic(PV) inverters, the component that convertssunlight into electric energy. This is the mostimportant part of the solar panel.I happen to know that Tesla uses ON’s PVinverters in its solar roof installations becauseI’ve been designing a new house, and I’m goingto install Tesla’s solar roof on it. I already havea detailed technical quote from Tesla aboutusing an inverter from a company called Delta– which gets its power semis from ON. This isas much a validation of On Semiconductor asit is of Delta’s finished product.2. Machine vision – ON has amazingcomplementary metal–oxide–semiconductor(CMOS) sensors. These sensors are mainlyused to help cars “see.” ON dominates theauto camera market with a 50% market sharein auto cameras and an 80% market share inADAS (advanced driver assistance) cameras.ON will be a major player in the autonomousdriving revolution.image sensor provider for its NVIDIA DRIVEConstellation simulation platform. NVIDIA’sgraphics processing units (GPUs) process thecomplex data to enable autonomous drivingin many leading car manufacturers. Andaccording to Navigant Research, NVIDIA isthe leader in the space. That leader uses ONchips in its systems.These chips are also used in factories to helpenable robot vision and automation. This willbecome a bigger market as the manufacturingrenaissance I’ve predicted comes to the U.S.3. 5G and wireless communication – ON’spower semis are used in 5G base stationsacross the world. It’s estimated ON placesabout 150 of content in each 5G basestation. And we’re still in the early stages ofthe Phase 1 infrastructure build-out for theworld’s 5G wireless networks.Also worth noting is that ON acquired one ofmy favorite wireless semiconductor companies,Quantenna Communications, in 2019. Quantennawas a former Exponential Tech Investorrecommendation known for its bleeding-edge WiFi chipsets. It had the best in the business. Andjust as the world is upgrading its cellular networksfrom 4G to 5G, the process has already begun toupgrade Wi-Fi networks to the latest and greatestWi-Fi standard, Wi-Fi 6 and Wi-Fi 6E.And there’s another reason we should positionourselves in this company Starboard Gets Involved With ONON has a major partnership with Tesla, whichis the closest to releasing fully autonomousvehicles. The Tesla Model 3 has a tripleforward-looking camera using three ON CMOSimage sensors. And the Model 3 has five morecameras that look out the back and sides of thevehicle using ON CMOS image sensors.In October 2020, Starboard Value announcedthat it had taken a stake in ON Semiconductors.As I showed above, Starboard does not investin a company unless it has ideas about how toimprove its overall financial position and put thecompany in a stronger competitive position.ON also works with NVIDIA and is theStarboard wants to see more consolidation ofThe Near Future Report9

ON’s manufacturing footprint. And it wants toincrease margins by exploring a fab-lite model which means outsourcing most semiconductorproduction to a company like TaiwanSemiconductors, another one of our portfoliocompanies. This is a more profitable model for asemiconductor company like ON. Factories areexpensive to operate and maintain, especiallywhen a company doesn’t have massive scale likeIntel, for example.I believe ON can close a few more factories toincrease operational efficiencies. And I’m sureStarboard will push it to do so. And it will alsomaintain some manufacturing capabilities,especially for strategic, high-value productswhere ON is better served by controlling itsmanufacturing in-house. This can be a criticalrequirement for some end customers, so thereis still value in ON maintaining some of itsmanufacturing footprint.The other dynamic at play is that Starboard’srecommended changes at ON will ultimatelymake it a more attractive acquisition target inthe semiconductor industry. This is exactly whathappened with Mellanox, which was acquiredby NVIDIA. Assuming that ON is successful injettisoning undesirable manufacturing facilitiesand lower margin product lines, its higher grossmargins and rapidly increasing free cash flow willmake it attractive to both larger semiconductorcompanies and private equity firms alike.In short, we want to build a position in ON beforethe transformation is completed. This is how wewill maximize our returns on this investment.What a great setup. Rather than trying topredict which automotive manufacturer will bethe biggest winner in the booming EV field oroverpaying for a company like Tesla, we’ll investin a key supplier with exposure to the entireThe Near Future Reportmarket. Let’s not pass up this opportunity.Action to Take: Please refer to our modelportfolio for the most current recommendedbuy-up-to price for ON Semiconductors(ON). Be sure to use a limit order whenplacing trades. For the time being, we willhold this stock with no stop loss. Alwaysremember to use rational position sizing.Risk Management: Because we will beholding this stock without a stop loss, Iencourage all readers to use rational positionsizing. We should remember to never go “allin” on any one investment. Our mission isto build a portfolio of our companies. That’show we’ll optimize our success.Note: My mission is to find the best technologycompanies trading at an attractive valuation. Ifthis stock is trading above our recommendedbuy-up-to price, it means it is slightly higherthan what I consider an excellent entry point.Technology stocks have natural volatility, and wealmost always have an opportunity to establish aposition at a great valuation.That said, ON Semiconductors has great longterm prospects. If it is trading above andsubscribers would like to begin building aposition today, we could consider establishinga 25% position now and wait to complete ourposition at a later date.As an example, if a reader would like to deploy 10,000 to this investment, we could invest 2,500 today and fill the rest of our position inthe event of a pullback or a raise in the buy-upto price.If this stock is trading at or below ourrecommended buy-up-to price, then it means I10

consider it a good entry for a full position.And remember, I’m constantly monitoring ourportfolio. If I feel it’s appropriate to raise ourrecommended buy-up-to price, I’ll always notifyreaders.Regards,Jeff BrownEditor, The Near Future ReportTo contact us, call toll free Domestic/International: 1-888-493-3156, Mon-Fri: 9am-5pm ET or email memberservices@brownstoneresearch.com. 2022 Brownstone Research, 55 NE 5th Avenue, Delray Beach, FL 33483. All rights reserved. Any reproduction, copying, or redistribution, in whole or in part, is prohibitedwithout written permission from the publisher.Information contained herein is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. It is not designed to meet your personal situation—weare not financial advisors nor do we give personalized advice. The opinions expressed herein are those of the publisher and are subject to change without notice. It maybecome outdated and there is no obligation to update any such information.Recommendations in Brownstone Research publications should be made only after consulting with your advisor and only after reviewing the prospectus or financialstatements of the company in question. You shouldn’t make any decision based solely on what you read here.Brownstone Research writers and publications do not take compensation in any form for covering those securities or commodities.Brownstone Research expressly forbids its writers from owning or having an interest in any security that they recommend to their readers. Furthermore, all other employeesand agents of Brownstone Research and its affiliate companies must wait 24 hours before following an initial recommendation published on the Internet, or 72 hours after aprinted publication is mailed.The Near Future Report11

e er re eor 5 And while I'm a huge fan of Elon Musk and Tesla, this valuation is way too expensive for the "sleep well at night stocks" we look for here at