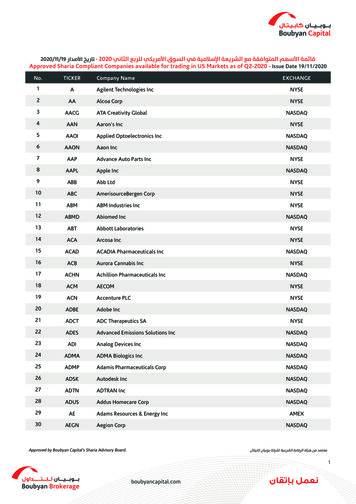

Transcription

NYSE Pillar GatewayBinaryProtocol SpecificationNYSE Arca OptionsNYSE American OptionsMay 12, 2022OPTIONS SPEC VERSION 3.6PROTOCOL VERSION 1.1

Copyright NYSE Group, Inc. 2022 All rights reserved.This document contains information of value to NYSE Group, Inc. It may be used only for the agreed purpose for which ithas been provided. All proprietary rights and interest in this document and the information contained herein shall bevested in NYSE Group, Inc. and all other rights including, but without limitation, patent, registered design, copyright,trademark, service mark, connected with this publication shall also be vested in NYSE Group, Inc. No part of thisdocument may be redistributed or reproduced in any form or by any means or used to make any derivative work (such astranslation, transformation, or adaptation) without written permission from NYSE Group, Inc.NYSE Group is a registered trademark of NYSE Group, Inc., a subsidiary of Intercontinental Exchange, Inc., registered inthe European Union, the United States, and Denmark. NYSE is a registered trademark and marques déposée of NYSEGroup, Inc., a subsidiary of Intercontinental Exchange, Inc., registered in the European Union, the United States,Argentina, Australia, Brazil, Canada, Chile, China P. Rep., Colombia, Czech Republic, Ecuador, European Union, Hungary,India, Indonesia, Israel, Japan, Kosovo, Liechtenstein, Malaysia, Mexico, ME, Nicaragua, Norway, Peru, Philippines,Poland, Russian Federation, Serbia, Singapore, South Africa, South Korea, Switzerland, Taiwan, Turkey, Uruguay,Venezuela and Viet Nam. For more information regarding registered trademarks owned by Intercontinental Exchange,Inc. and/or its affiliated companies see use.Other-third party product names used herein are used to identify such products and for descriptive purposes only. Suchnames may be marks and/or registered marks of their respective owners.Copyright 2022 NYSE Group, Inc. All Rights Reserved.OPTIONS SPEC VERSION 3.62

Contents1. Introduction . 51.11.21.31.4About the Pillar Binary Gateway.5Session Configuration by Market .5Failure Recovery .5Contact Us .72. Data Types . 73. Pillar Message Streams . 84. Data Structures . 84.14.24.34.44.54.64.74.8MsgHeader .8SeqMsgId.9SeqMsg .9BitfieldOrderInstructions - Single-leg Options . 10BitfieldOrderInstructions - Complex Options . 14BitfieldQuoteInst . 18BitfieldFlowIndicator . 19OptionalOrderAddOn – Order-sending Firms. 195. Reference Data . 205.15.25.3Start of Day . 20Intraday . 22Mapping Orders and Executions to NYSE XDP Market Data. 236. Trading Services . 246.16.26.36.46.56.6Self-Trade Prevention . 24Message Throttling . 24FIX Drop Copies. 25GTC Restatement Messages . 26Options Market Maker Sessions . 27Risk Controls . 277. Member Firm to Pillar - Application Layer Payload Messages . 287.17.27.37.47.57.6Session Configuration Request . 28Sequenced Filler Message . 30New Order Single/Complex and Cancel/Replace Request . 31Order Cancel Request . 34Order Modify Request . 35New Bulk Quote. 36Copyright 2022 NYSE Group, Inc. All Rights Reserved.OPTIONS SPEC VERSION 3.63

7.77.87.97.107.11New Order Cross . 38Bulk Cancel Request . 38Risk Limit Update Request . 42Risk Action Request . 46New Complex Series Request. 488. Pillar to Member Firm - Application Layer Payload Messages . .158.168.178.188.198.208.21Underlying Symbol Reference Data . 50Series Reference Data . 51Complex Series Reference Data . 52Minimum Price Variant Class Reference Data . 52Minimum Price Variant Level Reference Data . 53MPID Configuration . 54MMID Configuration*. 55Options Market Maker Symbol Appointment Reference Data . 56Session Configuration Acknowledgement . 56Order and Cancel/Replace Acknowledgement . 60Bulk Quote Acknowledgment . 63QuoteAck Repeating Group . 65Order Single/Complex Modify/Cancel Request Acknowledgment and UROUT . 66Order Cross Acknowledgement . 71Order Priority Update Acknowledgment . 71Execution Report . 73Trade Bust/Correct . 77Application Layer Reject . 79Risk Control Acknowledgement . 80Risk Control Alert. 86Complex Series Request Acknowledgement . 929. Appendix A: Liquidity Indicators . 9410. Appendix B: Pillar Reason Codes . 10111. Appendix C: Order Types . 10612. Document Version History . 107Copyright 2022 NYSE Group, Inc. All Rights Reserved.OPTIONS SPEC VERSION 3.64

1.IntroductionThis document describes the implementation of the Binary protocol used by the NYSE Group markets via the Pillar BinaryGateway. It includes information pertaining to application communication with the following venues.Current Market SupportFuture Market SupportNYSE Arca OptionsNYSE American Options1.1About the Pillar Binary GatewayPillar Binary Gateway is the application offering a single protocol for firms to transact business with one or more of theNYSE Group markets. It is a component of Pillar, an integrated trading technology platform that has been designed toreduce complexity, while enhancing consistency, performance and resiliency across the NYSE Group markets.While some of the binary message types contained in this document are specific to particular markets, participants willuse the same stream protocol messaging as defined in the NYSE Pillar Stream Protocol Specification. For moreinformation on the Pillar trading platform and gateway rollout, please visit https://www.nyse.com/pillar.1.2Session Configuration by MarketEach session on the Pillar Gateway will be configured to access a single NYSE Group market. The market configuration willdetermine which specific Application Layer Payload message types may be transacted over that session. For details onthe applicability of each message type to the various markets, please refer to the Application Layer Payload messageformats.1.3Failure RecoveryEach session on the Pillar Gateway is assigned two pairs of destination Pillar IP addresses, and one port number used byall four IPs. The IP/Port pairs correspond to the Pillar Primary and DR production environments. Primary Production Environment – Pillar Binary Gateway users may be simultaneously logged in to both theprimary and backup destination IP addresses, but the TG stream may only be open for writing on onedestination IP address at any given time.oIn the event that the primary destination becomes unavailable, the user should attempt to open the TGstream for writing on the secondary IP address. Cancel on Disconnect will be triggered if the outage wascaused by a gateway failure or when write permission is removed from the primary IP address,honoring the Cancel on Disconnect configuration for the session.oIn the event of an intraday session restart, both Primary and Secondary destination IP addresses will betemporarily unavailable. All open orders entered on the affected session will be cancelled, including GTC orders,regardless of the Cancel on Disconnect configuration for the session. Upon restart, additional streams may be available on the affected session:Copyright 2022 NYSE Group, Inc. All Rights Reserved.OPTIONS SPEC VERSION 3.65

Old GT stream(s) – if the session restart was not accompanied by a software releaserollback, the GT stream that was active prior to the outage will be available with theold StreamID and recoverable message data. In the event of multiple such intradaysession restarts, the number of old GT streams will be equal to the number of restartsthat occurred during the day. The old GT stream(s) will be advertised by StreamAvailmessages. New GT, TG, and REF Streams – will be available with new StreamIDs. Specifically, the“sess num” of the StreamID will increase, and this value will be equal for all three ofthese new streams. Compared to any old, recovered GT stream(s) described above, allnew streams will have the highest “sess num.”Additionally, sequence numbers on the new streams will start with 1. The new valueswill be advertised by StreamAvail messages. The specific sequence of StreamAvail publication is not guaranteed.EXAMPLE - two intraday session restarts in succession, without software release rollback.At start of day, there are three streams available: TGGTREF(Trader to Gateway)(Gateway to Trader)(Reference Data)Upon first restart, updated sess num will become available for all three stream types. At this point there will befour streams: TGGTREFGT(new - with sess num increased)(new - with sess num increased)(new - with sess num increased)(old - with original sess num at start of day. This may be opened for replay of oldmessages published by Pillar before the restart)Upon a second restart within the same day: TGGTREFGT GT(newest - with sess num increased again)(newest - with sess num increased again)(newest - with sess num increased again)(old - with sess num following the first restart. This may be opened for replay of oldmessages published by Pillar after the first restart, but before the second)(oldest - with original sess num at start of day. This may be opened for replay of oldmessages published by Pillar before the first restart.)DR Production Environment – In the event that the Pillar Primary Production environment becomes unavailable,Pillar Binary Gateway users may log in to the DR IP addresses configured for their sessions.oAll open orders will be cancelled automatically, regardless of whether the user attempts to log back inor not and regardless of the Cancel on Disconnect configuration for the session.Copyright 2022 NYSE Group, Inc. All Rights Reserved.OPTIONS SPEC VERSION 3.66

oStreamIDs will change for each session. The values assigned will have no correlation to the PrimaryProduction Environment StreamIDs, and sequence numbers on the streams will start with 1. The newvalues will be advertised by StreamAvail messages.oMessage data from the old streams that were active prior to the outage will not be recoverable.For more information, refer to the NYSE Pillar Stream Protocol Specification.NYSE Pillar Risk MitigationIn the event a matching engine enters an unexpected state, the Pillar Risk Mitigation process will be triggered. Gateway users will receive unsolicited cancels on all live orders on the impacted matching engine, including GTC,MOO, LOO, with a reason code ‘168 – Pillar Risk Mitigation’. The impacted matching engine will initiate an automatic recovery during which period new orders will berejected with a reason code ‘76 – System not available’. Once the resumption is complete, users will need to resubmit GTC, MOO, and LOO orders.1.4Contact UsThe NYSE Group Market Support teams have a centralized phone number. Through this number, clients are able to reachall support contacts for Trading, Technical, Market Data and Client Relationship Services. 1 212-896-2830Follow the prompts for menu options.2.Data TypesThe following data types are used in Pillar Binary Gateway xx)zchar(xx)PriceuPriceTimestamp32 bit signed Little Endian64 bit signed Little Endian8 bit Unsigned Little Endian16 bit Unsigned Little Endian32 bit Unsigned Little Endian64 bit Unsigned Little Endian1 ASCII characterFixed length string padded on the right with spacesFixed length string padded on the right with NUL (ASCII 0) charactersSigned Little Endian 64 Bit with Price Scale of 8. Example – 123000000 1.23Unsigned Little Endian 64 Bit with Price Scale of 8. Example – 123000000 1.23Unsigned Little Endian 64 bit since UNIX Epoch, in nanosecondsCopyright 2022 NYSE Group, Inc. All Rights Reserved.OPTIONS SPEC VERSION 3.67

Bits/bytes reserved for future use - firms should populate all units denoted in this specification as “reserved for futureuse” with 0.3.Pillar Message StreamsAll inbound and outbound messaging on the Pillar Binary Gateway is conducted over streams. A stream is an append-onlymessaging sequence.All messages transacted over Pillar message streams are classified as either Unsequenced or Sequenced. Pillar Stream Protocol – Unsequenced messages. They are used to manage and interact with Pillar messagestreams. For detailed information on stream functionality and the related unsequenced message types, pleaserefer to the NYSE Pillar Stream Protocol specification. Application Layer Payload – Sequenced messages; must carry a sequence number which is incremented witheach new message published to a given stream. The sequence number is contained in the data structure“SeqMsg,” which must be present on all Application Layer Payload message types.Both types of messages are transacted over the Pillar stream types shown below. Firms may read and/or write to thesestreams to the extent that those permissions are available. Availability is advertised via StreamAvail messages. Thespecific sequence of StreamAvail publication is not Read“Trader to Gateway” – individualized stream to which aparticular firm routes all their Sequenced and Unsequencedmessages destined for the Pillar trading platform.“Gateway to Trader” – individualized stream to which Pillarpublishes outbound Sequenced and Unsequenced messages to aparticular firm, including both transactional and Reference Datamessages.“Reference Data” – individualized stream to which Pillarpublishes Symbol, MPV Class, MPV Level, and SessionConfiguration Acknowledgment reference data.4.Data Structures4.1MsgHeaderUser Type: AllStream Type: AllMsgHeader is a basic structure required in all Pillar Binary Gateway messages. It declares the message type and messagelength.Copyright 2022 NYSE Group, Inc. All Rights Reserved.OPTIONS SPEC VERSION 3.68

e type. See Application Layer Payloadmessage formatsTotal message length, including this header allmessage payload/add-ons that follow thisheader.4.2SeqMsgIdUser Type: AllStream Type: AllSeqMsgId serves as the unique identifier of each SeqMsg message. It is made up of a stream identifier and sequencenumber, the combination of which is globally unique across all firms transacting with the Pillar trading platform, andindefinitely unique across time.FieldTypeOffsetLenValuesstream idStreamId08Target stream identifierSequ6488Message sequence number, starting from 14.3SeqMsgUser Type: AllStream Type: AllSeqMsg serves as the header for Application Layer Payload messages. As such, it is required at the beginning of eachApplication Layer Payload message type, and is immediately followed by the Application message itself (e.g., New Order,Execution Report, etc.). The main purpose of this header is to provide all Application messages with a unique sequencenumber and timestamp.For the NYSE Options Bulk Quote, which transports from 1 to 20 individual Quote messages, the sequence number willincrease by 1 for each Bulk Quote, regardless of the number of individual Quotes contained in the Bulk message. Forexample, if the sequence number is 10, and a user submits a Bulk Quote containing 10 individual Quote messages, thenext sequence number would be SeqMsgId416Type: 0x0905Minimum Length 32Globally unique message identifierReservedu32204Reserved fieldTimestampTimestamp248Time of message transmission.Copyright 2022 NYSE Group, Inc. All Rights Reserved.OPTIONS SPEC VERSION 3.69

FieldTypeOffsetLenValuesPayloadMsgHeader324Message payload. The Application Layer Payloadmessage (New Order, Execution Report, etc.)will begin here with its own MsgHeader4.4BitfieldOrderInstructions - Single-leg OptionsUser Type: Single-leg Options only - All usersStream Type: TG, GTOffsetWidth(Bits)ValuesReserved034Bits reserved for future useSecurityType3450 Not Applicable1 OPT2 MLEGIndicates sender’s capacity0 Not Applicable1 Customer2 Options Firm3 Options Broker4 Options Market Maker5 Options Away Market Maker6 Prof CustomerIndicates sender’s position0 Not Applicable1 Open2 CloseWhen using Pillar Pre-trade Risk Controls and specifying bothMPSubID and SelfTradeType on an order, allows the firm tospecify whether it should be used for both Risk and STP purposes,or for Risk purposes only. See “Self-Trade Prevention” section ofthis spec for more 65250 use MPSubID for both Pre-Trade Risk Controls and STP (withinan MPID)1 use MPSubID for Pre-Trade Risk Controls only; STP at MPIDlevel onlyCopyright 2022 NYSE Group, Inc. All Rights Reserved.American OptionsFieldArca OptionsBitfieldOrderInstructions is a data structure defining a number of order instructions, attributes, and modifiers.YesYes1112345612345612120011OPTIONS SPEC VERSION 3.610

FieldOffsetWidth(Bits)ValuesArca OptionsAmerican OptionsSpecialOrdType5150 No SpecialOrdType1 DMM Open/Re-open/Close with or without Auction (AOC)2 DMM Pre-auction3 DMM After-auction4 QCT5 Price Improvement CUBE6 Facilitation CUBE7 AON CUBE (Solicitation)8 Not currently used9 Cabinet10 QCC11 Customer to Customer edQuote6350 No LocateReqd1 LocateReq for SSH orders0 Not retail1 Retail order0 Not Attributed (equities) / Use current session configurationBOLD setting for the Username (options)1 Attributed for Market Data Feeds2 Include in Broker Volume3 Attributed for Market Data Feeds, and Include in BrokerVolume4 BOLD - Expose order info only5 BOLD - Expose order info and Capacity only6 BOLD - Expose order info and Participant ID only7 BOLD - Expose order info, Capacity and Participant ID8 Do not BOLD0 Not Applicable1 Agency2 Principal3 Riskless Principal4 Error Account (NYSE Floor Broker only)0 No InterestType1 Options MMQuote2 Reserved for future use3 Reserved for future use4 Q-Order5 Capital Commitment Order (CCO)6 Capital Commitment Order (CCO) – partial fill contra-side1 Early Trading Session2 Core Trading Session3 Late Trading Session4 Early & Core Trading 35TradingSessionID785Copyright 2022 NYSE Group, Inc. All Rights Reserved.OPTIONS SPEC VERSION 3.611

Width(Bits)ValuesAmerican OptionsOffsetArca OptionsField1231236701567010012341234003434005 Core & Late Trading Sessions6 Early, Core & Late Trading ote: for symbols trading on NYSE, all values that include Coredesignation (Core, Early/Core, Core/Late, and Early/Core/Late)will be allowed, if the order type supports the combination onother Pillar markets. However, for each of those values, Pillar willhonor the applicable trading sessions included in the instructionbased on Tape (B/C symbols - Early and Core; A symbols - Coreonly), and ignore the other trading sessions specified in theinstruction (Tape B/C symbols - Late; Tape A symbols - Early andLate)1 Day2 IOC3 At the Opening4 On Close5 GTX6 GTC7 FOK0 No ProactiveIfLocked1 Proactive route2 Proactive trade non display (Non-display remove liquidity fornon-displayed orders locked by contraside ALOs)0 Use current Session Configuration STP setting for theUsername*1 No Self Trade Prevention2 Cancel Newest3 Cancel Oldest4 Cancel Both5 Cancel Decrement*If 0 is specified, the explicit value (1-5) configured for the sessionwill be sent back on response messages.0 Not Applicable (follow default order behavior)1 Cancel order instead of repricing – for LULD only2 Cancel if doesn’t set NBBO on arrival or if needs to reprice forLULD3 Cancel order instead of repricing for any reason4 Once resting, allow to reprice once, then cancel instead ofrepricing5 Combination of value 2 and 36 Combination of value 2 and 40 No RoutingInst Minimum fill matches vs aggregate volumeboth upon arrival AND when resting (must be entered withCopyright 2022 NYSE Group, Inc. All Rights Reserved.OPTIONS SPEC VERSION 3.612

ExecInst108113Width(Bits)55ValuesMinQty tag populated with a non-zero value)1 Non-routable2 Routable3 Directed (Primary Only)4 Directed Routable (PO S)5 Primary Market until 9:456 Primary Market after 3:557 BOTH Primary Market until 9:45 AND Primary Market after3:558 Minimum Fill (must be entered with MinQty field populatedwith a non-zero value)9 Complex Book Only (non-legging Complex Order)0 No ExtendedExecInst1 Add Liquidity Only (ALO)2 No trade against MPL3 No route to IOI4 No trade against MPL and no route to IOI5 Retail Order Type 16 Retail Order Type 27 Retail Provider8 Imbalance Offset9 Discretionary Peg10 Dark (Non-Displayed) Primary Peg11 Reserved for future use12 Reserved for future use13 Add Liquidity Only (Non-taking ALO)14 Issuer Direct Offering (IDO)17 Complex Order Auction (COA)0 No ExecInst1 Reserved for future use2 Reserved for future use3 Tracking Order4 ISO5 Primary Peg6 Market Peg7 Midpoint Liquidity8 Non displayed (Retail Price Improvement and Limit-NonDisplayed orders)9 Trade-at ISO10 Last Sale Peg11 Reserved for future use12 Reserved for future use13 All-or-None (AON)Copyright 2022 NYSE Group, Inc. All Rights Reserved.American OptionsExtendedExecInstOffsetArca OptionsField121288008813130044881313OPTIONS SPEC VERSION 3.613

Width(Bits)ValuesOrdType11851 Market2 Limit3 Inside limit4 Pegged5 Stop6 Stop Limit9 AutoMatch Limit1 Buy2 Sell3 Sell short4 Sell short exempt5 Cross6 Cross short7 Cross short exemptSide4.51235American OptionsOffsetArca OptionsField1212565691212BitfieldOrderInstructions - Complex OptionsUser Type: Complex Options only - All usersStream Type: TG, GTBitfieldOrderInstructions is a data structure defining a number of order instructions, attributes, and modifiers.OffsetWidth(Bits)ValuesReserved034Bits reserved for future useSecurityType345CustomerOrFirm3950 Not Applicable1 OPT (Single-leg Option)2 MLEG (Complex/Multi-leg Option)Indicates sender’s capacity0 Not Applicable1 Customer2 Options Firm3 Options Broker4 Options Market Maker5 Options Away Market MakerCopyright 2022 NYSE Group, Inc. All Rights Reserved.American OptionsFieldArca OptionsThe below data structure is the same bit field defined above under the section ‘BitfieldOrderInstructions - Single-legOptions’ but listed below with valid values specific to Complex orders.YesYes221234512345OPTIONS SPEC VERSION 3.614

Width(Bits)Values6 Prof 635OrderCapacity685Indicates sender’s position0 Not Applicable1 Open2 CloseWhen using Pillar Pre-trade Risk Controls and specifying bothMPSubID and SelfTradeType on an order, allows the firm tospecify whether it should be used for both Risk and STPpurposes, or for Risk purposes only. See “Self-TradePrevention” section of this spec for more details.0 use MPSubID for both Pre-Trade Risk Controls and STP(within an MPID)1 use MPSubID for Pre-Trade Risk Controls only; STP at MPIDlevel only0 No SpecialOrdType1 DMM Open/Re-open/Close with or without Auction (AOC)2 DMM Pre-auction3 DMM After-auction4 QCT5 Price Improvement CUBE6 Facilitation CUBE7 AON CUBE (Solicitation)8 Not currently used9 Cabinet10 QCC11 Customer to Customer Cross0 No LocateReqd1 LocateReq for SSH orders0 Not retail1 Retail order0 Not Attributed (equities) / Use current session configurationBOLD setting for the Username (options)1 Attributed for Market Data Feeds2 Include in Broker Volume3 Attributed for Market Data Feed

NYSE Arca Options NYSE American Options 1.1 About the Pillar Binary Gateway Pillar Binary Gateway is the application offering a single protocol for firms to transact business with one or more of the NYSE Group markets. It is a component of Pillar, an integrated trading technology platform that has been designed to