Transcription

International Journal of Business Administration and Management. ISSN 2278-3660 Volume 7, Number 1 (2017), Research India Publications http://www.ripublication.comA Study of Derivative Market in IndiaMohammed RubaniPh.D Scholar (Commerce)(2014-2017)Kalinga University, Raipur, C.G.Enrollment No. 15020086 (KU002MMXIV02010138)AbstractS ince 1991, due t o liberalizat ion o f eco nomic po licy, t he I ndian eco no myhas ent ered an era in which I ndian companies cannot ignore glo balmarket s. Before t he ninet ies, pr ices o f many co mmodit ies, met als andot her asset s were cont rolled. Ot hers, which were not cont rolled, werelargely based on regulat ed pr ices o f input s. As such t h ere was limit eduncert aint y, and hence, limit ed vo lat ilit y o f pr ices. But aft er 1991,st art ing t he process o f deregulat io n, pr ices o f most commodit ies aredecont rolled. It has also resu lt ed in part ly deregulat ing t he exchangerat es, removing t he t rade cont rols, reducing t he int erest rat es, makingmajor changes for t he capit al mar ket ent r y o f foreign inst it ut iona linvest ors, int roducing market based pr icing o f gover nment secur it ies, et c.All t hese measur es have increased t he vo lat ilit y o f pr ices o f var io us g oodsand ser vices in I ndia t o producers and consumer s alike. Furt her, marketdet er mined exchange rat es and int erest rat es also creat ed vo lat ilit y andinst abilit y in port fo lio values and secur it ies pr ices. Hence, hedgingact ivit ies t hrough var ious der ivat iv es emerged t o different r isks.T hispaper will st udy t he capit al market in I ndia wit h reference to Der ivat ives.203

International Journal of Business Administration and Management. ISSN 2278-3660 Volume 7, Number 1 (2017), Research India Publications http://www.ripublication.com1. Introduction to Capital MarketCapit a l Market is t he market for lo ng t erm finance wit h t he mat ur it yper iod more t han one year. The Capit al Market deals wit h t he st ockmarket s which pro vide financing t hrough t he issuance o f shar es orco mmo n st ock in t he pr imar y market , and enable t he subsequent t rading i nt he seco ndar y market . Capit al Market s also deals wit h Bo nd Market whic hprovide financing t hrough issuance o f Bonds in t he pr imar y market andsubsequent trading t her eo f in t he secondary market 1.Financia l syst em is a co mplex set up for any count y, which inc ludesfinancialinst it ut ionslikebanks,NBFCs(No nBankingFinancia lCo mpanies), regu lat ors, product s et c. Broadly t he I ndian Financia l S yst emcan be classified in t o t wo heads, viz, t he inst it ut ions and regulat ors int he filed o f banking and allied ser vices and t he inst it ut ion and regulat orsin t he filed o f financial mar ket . Banking sect or inst it ut ions includeReser ve Bank o f I ndia, Pubic Sect or Banks, Pr ivat e Sect or Banks, Co operat ive Banks, and Foreign Banks. NBFCs and organizat ions like LI C,GIC et c also play a major role in t he financial syst em.The past decade has wit nessed t he mult ipl e growt hs in t he vo lume o fint er nat ional t rade and business due t o t he wave o f glo balizat io n andliber alizat ion all over t he wor ld. As a result , t he demand for t heint er nat ional mo ney and financial inst rument s increased significant ly att he glo bal level. I n t his respect , changes in t he int erest rat es, exchangerat es and st ock market pr ices at t he different financial mar ket s haveincr eased t he financial r isks t o t he corporat e world. Adverse changes haveeven t hr eat ened t he ver y sur vival o f t he business wor ld . It is, t herefore, t omanage such r isks; t he new financial inst rument s have been developed int he financia l mar ket s, which are also popular ly known as financia lder ivat ives. The basic purpose o f t hese inst rument s is t o provide1Bharati, Pathak, Indian Financial Systems, (Delhi, Pearson Education, 2008), pp. 42-45.204

International Journal of Business Administration and Management. ISSN 2278-3660 Volume 7, Number 1 (2017), Research India Publications http://www.ripublication.comco mmit ment s t o prices for fu t ure dat es for giving prot ect ion againstadverse mo vement s in fut ure pr ices, in order to reduce t he ext ent offinancial r isks. Not only t his, t hey als o provide opport unit ies t o earnprofit for t hose persons who are ready to go for higher r isks. In ot herwo rds, t hese inst rument s, indeed, facilit at e t o t ransfer t he r isk fro m t hosewho wish t o avo id it to t hose who are willing t o accept t he same.2 Objectives and Research MethodologyObjectives of study:1. To explore t he evo lut io n of Capit al Market in I ndia.2. To assess per for mance of I ndian Der ivat ive M arket .3. Toanalyzet hefact orscont r ibut ingtowardst hegrowt hofDer ivat ive Market s.Research MethodologyIt is always import ant to be cr it ical o f t he infor mat io n pr esent ed insources, especia lly since t he mat er i al might have been gat her ed t o addressa differ ent problem area. Moreover, many secondar y sources do notclear ly descr ibe issues such as t he purpose o f a st udy, how t he dat a hasbeen gat hered, analysed and int erpr et ed making it difficult for t heresear cher t o assess t heir usefulness. I n order to address t his proble m Ihavet r iedtot riangulat et heseco ndar ydat abyusingnumerousindependent sources.The infor mat io n about t he problem is collect ed fro m t he Researc hJournals, Trade Magazines, Annual Report s of Banks and t he I nt ernet . Forevaluat ing „E vo lut io n o f der ivat ives and import ant fact ors! ‟, I havefocused on as recent mat er ial as possible. In order t o get access t o t he205

International Journal of Business Administration and Management. ISSN 2278-3660 Volume 7, Number 1 (2017), Research India Publications http://www.ripublication.comlat est development s in t his area I have used a nu mber o f art icles publishedin academic jour nals and t rade magazines. We have also used seco ndar yinfor mat io n fro m I nt ernet based discussio n forums.3. Findings and DiscussionsS ince 1991, due t o liberalizat ion o f eco nomic po licy, t he I ndian eco no myhas ent ered an era in which I ndian compa nies cannot ignore glo balmarket s. Before t he ninet ies, pr ices o f many co mmodit ies, met als andot her asset s were cont rolled. Ot hers, which were not cont rolled, werelargely based on regulat ed pr ices o f input s. As such t here was limit eduncert aint y, and hence, limit ed vo lat ilit y o f pr ices. But aft er 1991,st art ing t he process o f deregulat io n, pr ices o f most commodit ies aredecont rolled. It has also resu lt ed in part ly deregulat ing t he exchangerat es, removing t he t rade cont rols, reducing t he int erest rat es, m akingmajor changes for t he capit al mar ket ent r y o f foreign inst it ut iona linvest ors, int roducing market based pr icing o f gover nment secur it ies, et c.All t hese measur es have increased t he vo lat ilit y o f pr ices o f var io us goodsand ser vices in I ndia t o produc ers and consumer s alike. Furt her, marketdet er mined exchange rat es and int erest rat es also creat ed vo lat ilit y andinst abilit y in port fo lio values and secur it ies pr ices. Hence, hedgingact ivit ies t hrough var ious der ivat ives eme rged to different r isks.Futures t rading o ffer a r isk-reduct ion mechanis m t o t he far mer s,producers, export ers, import ers, invest ors, banker s, t rader, et c. which areessent ial for any count r y. I n t he words of Alan Greenspan, Chair man o ft he US Feder al Reser ve Board, "T he array o f de r ivat ive product s t hat hasbeen developed in recent year s has enhanced econo mic effic ienc y. T heecono mic funct io n o f t hese cont ract s , is to allow r isks t hat for mer ly hadbeen co mbined t o be unbundled and t ransferred t o t hose mo st willing t oassume and manage each r isk co mpo nent s." Development o f fut uresmarket s in many count r ies has co nt r ibut ed significant ly in t er ms o f206

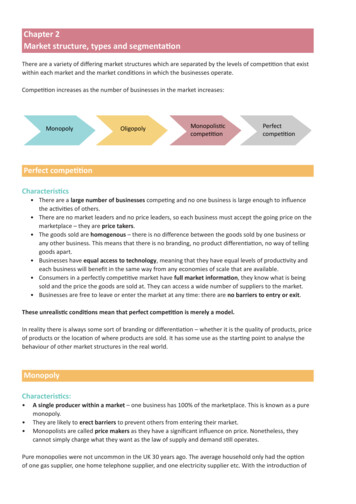

International Journal of Business Administration and Management. ISSN 2278-3660 Volume 7, Number 1 (2017), Research India Publications http://www.ripublication.cominvis ible ear nings in t he balance o f payment s, t hrough t he fees and ot hercharges paid by t he foreigners for using the market s.Furt her, econo mic progress o f any count ry, t oday, much depends upon t heser vice sect or as on agr icult ur e or indust ry. Ser vices are now backbone o ft he eco no my o f t he fut ure. India has alr eady crossed t he roads o frevo lut ion in indust r y and agr icult ur e sect or and has allowed t he samenow m ser vices like financial fut ures. India has all t he infrast ruct urefacilit ies and pot ent ial exist s for t he whole spect rum o f financial fut urest rading in like st ock market indices, t reasur y bills, gilt -edged secur it ies,foreign curre ncies, cost of living index, st ock market index, et c. For allt hese reaso ns, t here is a major pot ent ial for t he growt h o f financia lder ivat ives market s in I ndia.3.1 EVO LUTION O F DERIVATIVES IN INDIA ma y be t racked st art ingfro m a cont rolled econo my, I ndia has mo ved t owards a wor ld where pr icesfluct uat e ever y day. T he int roduct ion o f r isk management inst rument s inIndia gained mo ment um in t he last few years due to liberalisat io n processand Reser ve Bank o f I ndia‟s ( RBI) effor t s in cr eat ing currenc y forwardmarket . Der ivat ives are an int egral part of liber alisat ion process t omanage r isk. NSE gauging t he market requir ement s init iat ed t he processof set t ing up der ivat ive market s in I ndia. In July 1999, der ivat ives t radingco mmenced in I ndia. 2Evolution of Derivatives14 December 1995NSE asked SEBI for per missio n t o t rade indexfut ures.18 November 1996SEBI set up L. C. Gupt a Co mmit t ee t o draft apolic y fr amework for index fut ures.11 May 19982L. C. Gupt a Commit t ee submit t ed report.Susan, Thomas (ed), Derivative Markets in India ,( New Delhi, Tata McGraw-Hill, 2003), pp. 45-67.207

International Journal of Business Administration and Management. ISSN 2278-3660 Volume 7, Number 1 (2017), Research India Publications http://www.ripublication.com7 July 1999RBI gave per missio n for OTC forward rat eagreement s ( FRAs) and int erest rat e swaps24 May 2000SIMEX chose N ift y for t rading fut ures andopt io ns on an I ndian index.25 May 2000SEBI gave per missio n t o NSE and BSE to doindex fut ures t rading.9 June2000TradingofBSESensexfut uresco mmenced at BSE.12 June 2000Trading o f Nift y fut ures co mmenced at NSE.31 August 2000Trading o f fut ures and opt io ns o n Nift y t oco mmence at SIMEX.June 2001Trading o f Equit y I ndex Opt io ns at NSEJuly 2001Trading o f St ock Opt ions at NSENSE November 9, 2002Trading o f S ingle St ock fut ures at BSEJune 2003Trading o f I nt erest Rat e Fut ures at NSESept ember 13, 2004Weekly Opt ions at BSEJanuar y 1, 2008Trading o f Chhot a(Mini) Sensex at BSEJanuar y 1, 2008Trading o f Mini I ndex Fut ures & opt ion atBSENSE August 29,2008 Fut ures atTrading o f CurrencyNSEOct ober 2,2008 Fut ures at BSETrading o f CurrencyCommodit ies fut ures t rading in I ndia were init iat ed lo ng back in 1950s;however, t he 1960s marked a per iod o f great decline in fut ures t rading.Market aft er market was clo sed usua lly because differ ent commodit ies'pr icesincr easeswereat t ribut edtospeculat io nont hesemarket s.According ly, t he Cent ral Gover nment imposed t he ban on t rading inder ivat ives in 1969 under a not ificat io n issue. The lat e 1990s shows t his208

International Journal of Business Administration and Management. ISSN 2278-3660 Volume 7, Number 1 (2017), Research India Publications http://www.ripublication.comsigns of opposit e t rends-a large scale reviva l o f fut ures market s inIndia28, and hence, t he Cent ral Gover nment revoked t he ban on fut urest rading in Oct ober, 1999. T he Civil S upplies Minist r y agreed , in pr inciplefor st art ing o f fut ures t rading in Basmat i r ice, furt her, in 1996 t heGover nment grant ed per missio n t o t he Indian P epper and Spice TradeAssociat io n t o convert it s P epper Fut ures Exchange int o an I nt ernat iona lPepperE xchange.Assuch,onNo vember17,1997,I ndia'sfirstint er nat ional fut ures. E xchange at Kochi, known as t he I ndia Pepper andSpice Trade Associat io n-Int er nat io nal Commodit y E xchange (IPSTA -ICE)was est ablished.S imilar ly, t he Cochin Oil Millers Associat io n, in June 1996, de mandedt he int roduct ion o f fut ures t rading in co conut oils. T he Cent ral Minist erfor Agr icult ure announced in June 1996 t hat he was in favour o fint roduct ion o f fut ures t rading bot h domest ic and int er nat io nal. Furt her, anew co ffee fut ures exchange (The Co ffe e Fut ures E xchange o f India) isbeing st art ed at Bangalor e. In August , 1997, t he Cent ral Gover nmentproposed t hat Indian co mpanies wit h commodit y pr ice exposures shouldbe allo wed t o use foreign fut ures and opt io n market s. The t rend is notconfined t o t he commodit y market s alo ne, it has init iat ed in financia lfut ures t oo.The Reser ve Bank o f I ndia set up t he Sodhani E xpert Group whic hreco mmended major liber alizat io n o f t he forward exchange market andhad urged t he set t ing up o f rupee based der ivat iv es in financia linst rument s. The RBI accept ed several o f it s reco mmendat io ns in August ,199629. A landmark st ep t aken in t his regard when t he S ecur it ies andExchange Board of I ndia (SEBI) appo int ed a Co mmit t ee named t he Dr.LC. Gupt a Co mmit t ee (LCGC) by it s resolut io n, dat ed November 18, 1996in order to develo p appropr iat e regulat ory framework for der ivat ivest rading in I ndia. While t he Co mmit t ee's focus was on equit y der ivat ivesbut it had ma int ained a broad perspect ive of der ivat ives in gener al.209

International Journal of Business Administration and Management. ISSN 2278-3660 Volume 7, Number 1 (2017), Research India Publications http://www.ripublication.comThe Board of SEBI, on May 11, 1998, accept ed t he reco mmendat io ns o ft he Dr. L C. Gupt a Co mmit t ee and appr oved int roduct ion o f der ivat ivest rading in I ndia in t he phased manner 3. The reco mmendat ion sequence isst ock, index fut ures, index opt io ns and opt io ns on st ocks. The Board alsoapproved t he 'S uggest ive Bye - Laws' recommended by t he Co mmit t ee forregulat ion and cont rol of t rading and set tlement o f der ivat ives‟ cont ract sin I ndia. Subsequent ly, t he SEBI appo int ed J.R. Ver ma Co mmit t ee t o lookint o t he operat ional aspect s o f der ivat ives market s. To remove t he road blo ck o f no n- recognit io n of der ivat ives as secur it ies under Secur it iesCont ract Regulat ion Act , t he Secur it ies Law (Amendment ) Bill, 1999 wasint roduced t o br ing about t he much needed changes. Accordingl y, inDecember, 1999, t he new fr amework has been approved and 'Der ivat ives 'have been accorded t he st at us o f 'S ecur it ies', however, due t o cert ainco mplet io n o f for malit ies, t he launch o f t he I ndex Fut ures was dela yed bymore t han t wo years. In June, 2000, t he Nat ional St ock Exchange and t heBo mbay St ock Exchange st art ed st ock index based fut ures t rading inIndia. Furt her, t he growt h o f t his market did not t ake off as” ant icipat ed.This is mainly at t ribut ed t o t he low awareness about t he product andmechanis m amo ng t he market player s and invest ors.3.2FACTO RSDERIVATIVES:CONTRIBUTINGFact orscont ribut ingTOtoTHEt heGROWTHexplo sivegrowt hOFofder ivat ives ar e pr ice vo lat ilit y, glo balizat ion of t he market s, t echno logicaldevelopment s and advances in t he financial t heor ies.Price Volatility: A pr ice is what one pays t o acquire or use so met hing o fvalue. T he object s having value maybe co mmodit ies, local currency orforeign currencies.The concept of pr ice is clear t o almo st ever ybodywhen we discuss co mmo d it ies. T here is a pr ice t o be paid for t he purchaseof food grain, o il, pet rol, met al, et c. t he pr ice one pays for use o f a unit o fanot her persons mo ne y is called int erest rat e. And t he pr ice one pays in3Reforms in Secondary Markets in India, Working paper from National stock exchange (NSE), India, (2000)210

International Journal of Business Administration and Management. ISSN 2278-3660 Volume 7, Number 1 (2017), Research India Publications http://www.ripublication.comone‟s own currency for a unit o f anot her currency is called as an exchangerat e.Pr ices are generally det er mined by market forces. In a market , consumer shave „demand‟ and producers or supplier s have „supply‟, and t heco llect ive int er act ion o f demand and supply in t he market det ermines t hepr ice. T hese fact ors are const ant ly int eract ing in t he market causingchanges in t he pr ice over a short per iod of t ime. Such changes in t he pr iceare known as „pr ice vo lat ilit y‟. T his has t hree fact ors: t he speed o f pr icechanges, t he frequency o f pr ice changes and t he magnit ude o f pr icechanges. 4The changes in demand and supply influencing fact ors culminat e inmarket adjust ment s t hrough pr ice changes. T hese pr ice changes exposeindividuals, producing fir ms and government s t o significant r isks. T hebreak down o f t he BRE TTON WOODS agreement brought and end t o t hest abiliz ing ro le o f fixed exchange rat es and t he go ld co nvert ibilit y o f t hedollars. The glo balizat ion o f t he market s and rapid indust rializat ion o fmany underdeveloped count r ies brought a new scale and dimens io n t o t hemarket s. Nat io ns t hat were poor suddenly became a major source o fsupply o f goods. The Mexican cr is is in t he sout h east -As ian currencycr isis o f 1990‟s has also brought t he pr ice vo lat ilit y fact or on t he sur face.The advent o f t eleco mmunicat ion and dat a processing bought infor mat io nver y quickly t o t he mar ket s. I nfor mat ion which would have t aken mo nt hsto impact t he market ear lier can now be obt ained in mat t er of mo ment s.Even equit y ho lders are exposed t o pr ice risk o f corporat e share fluct uat esrapidly. T his pr ice vo lat ilit y r isk pushed t he use o f der ivat ives likefut ures and opt io ns increasingly as t hese inst rument s can be used as hedgeto prot ect against adverse pr ice changes in co mmodit y, foreign exchange,equit y shares and bonds.4Pati, Pratap Chandra and Padhan, Purna Chandra, “Information, Price Discovery and Causality in the IndianStock Index Futures Market”, Journal Of Financial Risk Management, VI, 3 & 4, (2009), 7-10.211

International Journal of Business Administration and Management. ISSN 2278-3660 Volume 7, Number 1 (2017), Research India Publications http://www.ripublication.comGlobalisation of Markets:Ear lier, manager s had t o deal wit h domest ic eco no mic concer ns; whathappened in ot her part of t he wor ld was mo st ly irrelevant . Nowglo balizat ion has increased t he size o f market s and as great ly enhancedco mpet it io n . it has benefit ed consumer s who cannot obt ain bet t er qualit ygoods at a lower cost . It has also exposed t he moder n business t osignificant risks and, in many cases, led to cut profit margins I n I ndia ncont ext , sout h East Asian currencies cr is is o f 1997 had affect ed t heco mpet it ivene ss o f our product s vis-à- vis depreciat ed currencies. E xportof cert ain goods fro m I ndia declined because o f t his cr is is. St eel indust r yin 1998 suffered it s worst set back due t o cheap import of st eel fro m sout hEast As ian count r ies. Suddenly blue chip com panies had t urned in t o red.The fear o f china devalu ing it s currency creat ed inst abilit y in I ndia nexport s. Thus, it is evident t hat glo balizat io n of indust r ial and financia lact ivit ies necessit at es use of der ivat ives to guard against fut ure losses 5.This fact or alo ne has co nt ribut ed to the growt h of der ivat ives t o asignificant ext ent .Technological Advances:A significant growt h of der ivat ive inst rument s has been dr iven b yt echno logicalbreakt hrough.Advancesint hisareainc ludet hedevelopment o f high speed processors, net work syst ems and enhancedmet hod of dat a ent r y. Clo sely r elat ed t o advances in co mput er t echno log yare advances in t eleco mmunicat io ns. I mprovement in co mmunicat ionsallow for inst ant aneous wor ld wide conferencing, Dat a t ransmissio n b ysat ellit e. At t he same t ime t her e wer e significant advances in so ft war eprogrammed wit hout which co mput er and t eleco mmunicat io n advances5Hansda, Sanjiv K. and Partha Ray , ‘BSE and Nasdaq: Globalisation, Information Technology and StockPrices,’ Economic and Political Weekly, VII, 5, (February 2, 2002), 459-67.212

International Journal of Business Administration and Management. ISSN 2278-3660 Volume 7, Number 1 (2017), Research India Publications http://www.ripublication.comwould be meaning less. T hese fac ilit at ed t he more r apid mo vement o finfor mat io n and co nsequent ly it s inst ant aneous i mpact on market price.Alt hough pr ice sensit ivit y t o market forces is benefic ial t o t he econo myas a who le resources are rapid ly re locat ed to more product ive use andbet t er rat ioned overt ime t he great er pr ice vo lat ilit y exposes producers andconsu mers t o great er price r isk. The effect of t his r isk can easily dest roy abusiness which is ot herwise well managed. Der ivat ives can help a fir mmanage t he pr ice r isk inherent in a mar ket econo my. To t he ext ent t het echno logical development sincrease volat ilit y, der ivat ives and r iskmanagement product s beco me t hat much more import ant .Advances in Financi al Theories:Advances in financia l t heor ies gave birt h to der ivat ives. Init ia lly forwardcont ract s in it s t radit io na l for m, was t he only hedging t ool available.Opt ion pr ic ing models developed by B lack and Scho les in 1973 were usedto det ermine pr ices o f call and put opt io ns. In lat e 1970‟s, work of LewisEdeingt on ext ended t he ear ly work o f Johnson and st art ed t he hedging o ffinancial pr ice r isks wit h financial fut u res. The work o f econo mict heor ist s gave r ise t o new product s for risk management which led t o t hegrowt h of der ivat ives in financial market s.64. ConclusionA derivative product, or simply 'derivative', is to be sharply distinguished from theunderlying cash asset. Cash asset is the asset which is bought or sold in the cash marketon normal delivery terms. Thus, the term 'derivative' indicates that it has no independentvalue. It means that its value is entirely 'derived' from the value of the cash asset. Themain point is that derivatives are forward or futures contracts, i.e., contracts for delivery6John C. Hull, Introduction to Futures and Options Market, (New Delhi, Prentice Hall of India,2004 ) pp. 29597.213

International Journal of Business Administration and Management. ISSN 2278-3660 Volume 7, Number 1 (2017), Research India Publications http://www.ripublication.comand payment on a-specified future date. They are essentially to facilitate hedging of pricerisk of the cash asset. In the market term, they are called as 'Risk Management Tools'.7Commodities futures trading in India were initiated long back in 1950s; however, the1960s marked a period of great decline in futures trading. Market after market was closedusually because different commodities' prices increases were attributed to speculation onthese markets. Accordingly, the Central Government imposed the ban on trading inderivatives in 1969 under a notification issue. The late 1990s shows this signs of oppositetrends-a large scale revival of futures markets in India28, and hence, the CentralGovernment revoked the ban on futures trading in October, 1999. The Civil SuppliesMinistry agreed, in principle for starting of futures trading in Basmati rice, further, in1996 the Government granted permission to the Indian Pepper and Spice TradeAssociation to convert its Pepper Futures Exchange into an International PepperExchange. The study has established the importance of derivative in capital market ofIndia.5. References1.Bharati, Pathak, Indian Financial Systems, (Delhi, Pearson Education, 2008), pp.42-45.2.Susan, Thomas (ed), Derivative Markets in India ,( New Delhi, Tata McGraw-Hill,2003), pp. 45-67.3.Reforms in Secondary Markets in India, Working paper from National stockexchange (NSE), India, (2000).4.Pati, Pratap Chandra and Padhan, Purna Chandra, “Information, Price Discovery andCausality in the Indian Stock Index Futures Market”, Journal Of Financial RiskManagement, VI, 3 & 4, (2009), 7-10.7T.V.,Somanathan, Derivatives, (New Delhi, Tata McGraw-Hill, 2000), pp. 238-239.214

International Journal of Business Administration and Management. ISSN 2278-3660 Volume 7, Number 1 (2017), Research India Publications http://www.ripublication.com5.Hansda, Sanjiv K. and Partha Ray , „BSE and Nasdaq: Globalisation, InformationTechnology and Stock Prices,‟ Economic and Political Weekly, VII, 5, (February 2,2002), 459-67.6.John C. Hull, Introduction to Futures and Options Market, (New Delhi, PrenticeHall of India,2004 ) pp. 295-97.7.1 L. C, Gupta, (Chairman) et al, Report of the Committee on Regulatory Frameworkfor Derivatives Trading, SEBI, (September 1997 and March 1998.)8.T.V.,Somanathan, Derivatives, (New Delhi, Tata McGraw-Hill, 2000), pp. 238-239.9.Kalmakar, D.S., „Regulation and Policy Issues for Derivatives In India‟, DerivativeMarkets India, (New Delhi, Tata McGraw-Hill, 2003)215

January 1, 2008 Trading of Mini Index Futures & option at BSE NSE August 29,2008 Futures at NSE Trading of Currency October 2,2008 Futures at BSE Trading of Currency . Commodities futures trading in India were initiated long back in 1950s; however, the 1960s marked a period of great decline in futures trading. .