Transcription

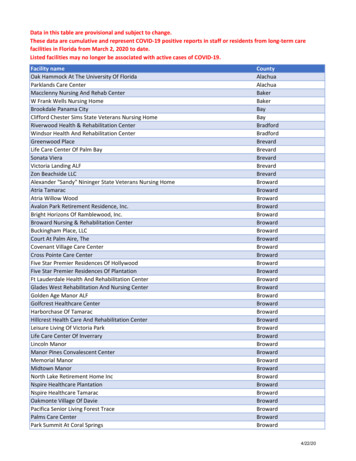

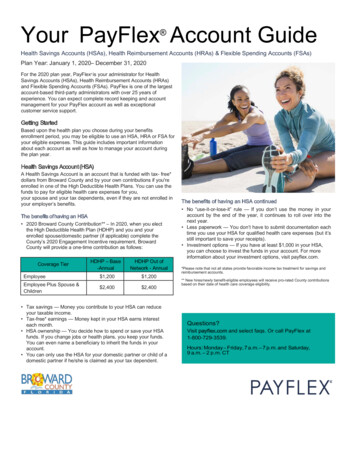

Your PayFlex Account Guide Health Savings Accounts (HSAs), Health Reimbursement Accounts (HRAs) & Flexible Spending Accounts (FSAs)Plan Year: January 1, 2020– December 31, 2020For the 2020 plan year, PayFlex is your administrator for HealthSavings Accounts (HSAs), Health Reimbursement Accounts (HRAs)and Flexible Spending Accounts (FSAs). PayFlex is one of the largestaccount-based third-party administrators with over 25 years ofexperience. You can expect complete record keeping and accountmanagement for your PayFlex account as well as exceptionalcustomer service support. Getting StartedBased upon the health plan you choose during your benefitsenrollment period, you may be eligible to use an HSA, HRA or FSA foryour eligible expenses. This guide includes important informationabout each account as well as how to manage your account duringthe plan year.Health Savings Account (HSA)A Health Savings Account is an account that is funded with tax- free*dollars from Broward County and by your own contributions if you'reenrolled in one of the High Deductible Health Plans. You can use thefunds to pay for eligible health care expenses for you,your spouse and your tax dependents, even if they are not enrolled inyour employer’s benefits.The benefits ofhaving an HSA 2020 Broward County Contribution** – In 2020, when you electthe High Deductible Health Plan (HDHP) and you and yourenrolled spouse/domestic partner (if applicable) complete theCounty’s 2020 Engagement Incentive requirement, BrowardCounty will provide a one-time contribution as follows:HDHP – Base-AnnualHDHP Out ofNetwork - AnnualEmployee 1,200 1,200Employee Plus Spouse &Children 2,400 2,400Coverage Tier Tax savings — Money you contribute to your HSA can reduceyour taxable income. Tax-free* earnings — Money kept in your HSA earns interesteach month. HSA ownership — You decide how to spend or save your HSAfunds. If you change jobs or health plans, you keep your funds.You can even name a beneficiary to inherit the funds in youraccount. You can only use the HSA for your domestic partner or child of adomestic partner if he/she is claimed as your tax dependent.The benefits of having an HSA continued No “use-it-or-lose-it” rule — If you don’t use the money in youraccount by the end of the year, it continues to roll over into thenext year. Less paperwork — You don’t have to submit documentation eachtime you use your HSA for qualified health care expenses (but it’sstill important to save your receipts). Investment options — If you have at least 1,000 in your HSA,you can choose to invest the funds in your account. For moreinformation about your investment options, visit payflex.com.*Please note that not all states provide favorable income tax treatment for savings andreimbursement accounts.** New hires/newly benefit-eligible employees will receive pro-rated County contributionsbased on their date of health care coverage eligibility.Questions?Visit payflex.com and select faqs. Or call PayFlex at1-800-729-3539.Hours: Monday – Friday, 7 a.m. – 7 p.m. and Saturday,9 a.m. – 2 p.m. CT

Health Reimbursement Account (HRA)Health Care FSAThe Health Reimbursement Account (HRA) funded by Broward Countyfor employees enrolled in the CDH plans has been phased out effective1/1/18. Employees enrolled in one of the CDH plans in 2019 whocontinue enrollment in one of the CDH plans in 2020 may continue touse the balance in their HRA.This account reimburses you for eligible health care expenses for you,your spouse and your eligible dependents. Eligible expenses includemedical, prescription, dental, vision, and hearing expenses. You canalso use the FSA funds to pay for copays, coinsurance and over-the counter (OTC) items.**Under certain circumstances, employees enrolled in one of the HDHPplans may be eligible to enroll in the HRA. The HDHP plans aretypically paired with a Health Savings Account, but in somecircumstances, employees are not eligible for the HSA so the Countyallow them stay, or enroll, in the HRA. The County also allowsemployees currently enrolled in the HRA with balances to elect toremain in the HRA under the HDHP plans.**OTC items include bandages, contact lens solution, first-aid kits, hotand cold packs, and thermometers. You can also use your health careFSA for OTC drugs and medicines like pain relievers, cold and fluremedies, or allergy and sinus products. But first you will need to get awritten prescription from your doctor.The HRA with a HDHP plan is only funded by Broward County if youand your enrolled spouse or domestic partner* complete the annualEngagement Incentive. No additional deposits can be made to thisaccount. You can use the funds to pay for eligible out-of-pockethealth care expenses for you, and your eligible dependents coveredunder your health plan. Eligible expenses include medical andpharmacy deductibles and coinsurance, dental and vision expenses.All expenses, with the exception of prescriptions, require supporting,detailed, documentation such as an Explanation of Benefits.*You can only use the HRA for your domestic partner or children of a domestic partner ifhe/she is claimed as your tax dependent.The benefits of having an HRA Tax-free** money — You get to use tax-free, employerprovided dollars to pay for your health care expenses. Works with an FSA — You can have both a health care FSA andan HRA at the same time. This means more ways to save money! Vested accounts — The balance in your HRA rolls over fromyear to year as long as you remain enrolled in the HRA forconsecutive years. The maximum account balance or rollovercap for the HRA is 20,000, regardless of tier of coverage. Savings for retirement – Your balances are transferred to aRetirement Health Savings Plan (RHS) at ICMA-RC approximately180 days following your retirement or leaving County employment.See We’ve Got You Covered ebook at broward.org/ benefits. RHSfunds can be accessed for health care expense reimbursementstarting at age 55. If you have an HRA and a health care FSA, your eligibleexpenses will be paid from your health care FSA first. Once youuse your health care FSA funds, your eligible expenses will bepaid from your HRA.*New hires/newly benefit-eligible employees will receive pro-rated County contributionsbased on their date of health care coverage eligibility.**Please note that not all states provide favorable income tax treatment for savings andreimbursement accounts.Flexible Spending Account (FSA)A flexible spending account (FSA) lets you set aside money from yourpaycheck (on a pre-tax basis) to use for eligible out-of-pocketexpenses. You can contribute to a health care FSA and/or adependent care FSA through Broward County biweekly payrolldeductions up to the annual maximums established by the IRS. Youcannot roll over your FSA balance from year to year. FSAs have a“use- it-or-lose-it” rule. Any funds left in your account at the end of theplan year are forfeited.2Dependent Care FSAThis account reimburses you for eligible child (under the age of 13) andadult care expenses. Such expenses include day care, before and afterschool care, nursery school, preschool and summer day camp, or carefor an aging parent to enable you to work.Contributions are paid biweekly through payroll deductions. Fundscannot be used until they have been accumulated and can only bereimbursement through completing a claim form and submitting itdirectly to PayFlex.QUICK TIP: View a list of common eligible expense items atpayflex.com.The benefits of having an FSAAn FSA can help reduce your income taxes and increase your takehome pay!FSA Savings ExampleLet’s say you have an annual salary of 40,000 and you decide tocontribute 1,500 to a health care account and 4,000 to adependent care account. With an FSA, you could saveapproximately 1,246.00. Here is how it works:

With an FSAWithout an FSAAnnual Salary 40,000 40,000Health Care FSA Contribution (pretax)( 1,500)( 0)Dependent Care FSA Contribution (pretax)( 4,000)( 0)Taxable income after contribution amount 34,500 40,000Estimated Taxes Withheld (22.65%)*( 7,814)( 9,060)Post-Tax Income 26,686 30,940( 0)( 5,500)Take-Home Pay 26,686 25,440Savings 1,246 0Money spent after-tax on health care and dependent care expenses*Based on 7.65% FICA and 15% tax bracketNote: Please be advised that this example is for illustrative purposes only. These projections are only estimates of tax information and should notbe assumed to be tax advice. Be sure to consult a tax advisor to determine the appropriate tax advice for your situation.Making sense of HSAs, HRAs and FSAsHow much can I contribute to my account? HSA - The IRS maximum contribution amount is 3,550 for individual coverage and 7,100 for family coverage. BecauseBroward County will make a contribution to your HSA, if your Engagement Incentive requirements are completed, the amountyou can contribute will be less than the limit. HRA – This account is funded only by Broward County, if the Engagement Incentive requirements are completed, for employeesenrolled in one of the HDHP plans who are not eligible for a HSA or have a current HRA balance. Health Care FSA – The annual maximum contribution amount is 2,700 per employee. If you and your spouse both participate in ahealth care FSA, you can each contribute up to 2,700 to your own FSA. Dependent Care FSA – The annual maximum contribution amount depends on your tax filing status. If you’re married and filing jointly, your contribution limit is 5,000. If you’re married and filing taxes separately, your contribution limit is 2,500. If you’re single and head of household, your contribution limit is 5,000. If either you or your spouse earn less than 5,000 a year, your contribution limit is equal to the lower of the two incomes. If your spouse is a full-time student or incapable of self-care, your contribution limit is 3,000 a year for one dependent and 5,000 a year for two or more dependents.3

HDHP Base Plan ORHDHP Out-of-NetworkPlan with an HSAEligibilityEmployees enrolled in a HDHPPlan.Employee OnlyEmployee DependentsIRS Contribution Limit 3,550 7,100County Contribution 1,200 2,400Your MaximumContribution 2,350 4,700HDHP Base Plan ORHDHP Out-of-NetworkPlan with an HRAEmployees not eligible for anHSA or Employee with HRAbalancesEmployee OnlyEmployee DependentsN/A 1,200 2,400N/AHealth CareFSADependentCare FSACDH Plan, HDHP All Benefit-eligiblew/HRA, or WaivedEmployeesCoverageN/AN/A 2,700 5,000N/AN/A 2,700 5,000NOTE: If you’ll be age 55 or older this year, you’ll be able to make an additional “catch-up” contribution of up to 1,000 to your HSA.NOTE: In 2020, employees switching from a CDH plan with a balance in their HRA, to a HDHP plan can elect to continue their HRA instead of enrolling in the HSA. The incentivizedfunding for the HDHP will be deposited into your HRA based on HDHP plan enrollment and tier of coverage.4

Frequently Asked Questions about HSAs, HRAs and FSAsWhat health plancan I have?What are theeligibilityrequirements?HSAHRAFSAHigh Deductible Health Plan(HDHP) Base or HDHP Out ofNetwork.High Deductible HealthPlan (HDHP) Base or HDHPOut of Network under certaincircumstances.High Deductible Health Plan (HDHP)under certain circumstances orConsumer Driven Health (CDH) HighPlan.You must be enrolled in one ofCounty’s HDHP plans to receiveCounty funding for an HRA andmeet one of the specialcircumstances:· If not eligible to participate inthe HSA under the HighDeductible Health Plan, or· You have a balance in your HRA,you may elect to enroll in theHRA with the High DeductibleHealth Plan. You cannot enroll in a health careFSA if you enroll in one of theCounty's High Deductible HealthPlans with an HSA. If you enroll in the dependent careFSA, your dependent care expensesmust be for a qualifying person.This includes: your children under age 13, or a spouse or other dependent(such as a parent or a disabledchild over age 13) who lives withyou and is incapable of self-care. You must be enrolled in one of theCounty's High Deductible HealthPlans (HDHP) to contribute to anHSA. You cannot have a generalpurpose health care FSA or anHRA in the same year. This isalso true for your spouse. You cannot have other healthcoverage except what is allowed bythe IRS. See IRS Publication 969for a list of allowable insurancecoverage. You cannot be enrolled in benefitsunder your spouse’s medical planor other plan that is not a highdeductible plan. You cannot be enrolled inMedicare, TRICARE, or havereceived Veterans Administration(VA) health benefits in the previous3 months. You cannot be claimed as adependent on another person’s taxreturn.Note: They do not need to be coveredunder your employer’s benefits.Broward County owns the account.If you leave County employment,you have two options for your HRA:1. Continue it at your own expenseunder COBRA;2. The County will transfer yourHRA balance to a RetirementHealth Savings Plan at ICMA-RCapprox. 180 days after you leavethe County.Who owns theaccount?You own the account.If you change employers or leavethe workforce, you can take theHSA with you.If you retire, balance will betransferred to a Retirement HealthSavings Account at ICMAapproximately180 days after retirement.Under all circumstances, the debitcard will be shut off on the last dayof the month in which you leaveCounty employment. All expensesmust then be submitted forreimbursement.5Broward County owns the account. If youleave the County employment you havetwo options for the FSA Medical ExpenseAccount:1. Continue at your own expense underCOBRA. This allows you to continueusing your FSA for the remainder ofthe year.2. If you do not elect to continue underCOBRA, you can only be reimbursedfor expenses incurred prior to yourtermination.FSA Dependent Day Care is not coveredunder COBRA and coverage ends onyour last day of employment.All claims must be submitted by March31 of the following year. You can onlysubmit eligible dependent care expensesyou incur through the end of the calendaryear.Under all circumstances, the debit cardwill be shut off effective with your last dayof the month in which you leave Countyemployment. All expenses must then besubmitted for reimbursement.

Who contributesto the account?Can I change mycontributionduring the year?HSAHRAFSAYou and Broward CountyBroward CountyYou You can change your HSA payrollcontributions throughout the yearby completing an HSA Affidavitand Payroll ContributionAuthorization Form and submittingit to Employee Benefit Services. You can also use the toolsavailable on the PayFlex site tomake a post-tax contribution, orto transfer funds from an IRA orfrom another HSA. Eligible health care expenses foryou, your spouse and your taxdependents. You can only use the HSA for yourdomestic partner if he/she isclaimed as your tax dependent.What can I payfor with myaccount?A list of common eligible andineligible expenses items isavailable onpayflex.com.Note: If you use HSA funds for ineligibleexpenses, you’ll have to pay income taxeson that amount and you may be subject to a20% penalty.Not applicable Eligible health care expenses foryou, and the eligible dependentscovered under your healthinsurance plan.You can only use the HRA for yourdomestic partner or children ofa domestic partner if he/she isclaimed as your tax dependent. You can only change your contributionduring the year if you have a qualifiedlife event.(marriage, birth, adoption,death, etc.) Specific to a dependent care FSA,you can change your contribution if: There is a change in yourprovider There is a change in the cost fora provider The requested change must beconsistent with the event You must apply for a change in yourcontribution by completing anEnrollment Change Form andsubmitting it with supportingdocumentation to Employee BenefitServices within 30 days after yourqualified life event. Health Care FSA - Eligible health careexpenses for you, your spouse andyour dependents. (including your childunder age 27, even if not your taxdependent) Dependent Care FSA - Expenses tocare for an eligible dependent so youcan work. If you're married, your spousemust either be working, lookingfor employment, be a full-timestudent or be incapable of selfcare. You can only use the FSA for yourdomestic partner if he/she isclaimed as your tax dependent. A list of common eligible andineligible expenses items isavailable on payflex.com.6

HSAHow do I accessthe funds?(See page 10 forhow to use theonline features.) Use the PayFlex Card, youraccount debit card. Pay out of pocket and requestreimbursement (this is known as awithdrawal). You can do thisonline or through the mobile app. Use online bill payment to payyour provider directly from yourHSA.HRAFSA Use the PayFlex Card, youraccount debit card. Pay out of pocket and submit aclaim for reimbursement. You cando this online, through the mobileapp or fill out a paper claim andfax or mail it to PayFlex. Useonline bill payment (“Pay Them”)to pay your provider directly fromyour HRA. Use the PayFlex Card, your accountdebit card (For health care FSA only). Pay out of pocket and submit a claimfor reimbursement. You can do thisonline, through the mobile app or fillout a paper claim and fax or mail it toPayFlex. Use online bill payment (“Pay Them”)to pay your provider directly fromyour FSA.Note: If you have a health care FSA and anHRA, the funds will come out of your FSANote: If you have a health care FSA and anfirst. Once you use all the funds in yourHRA, the funds will come out of your FSA first.FSA, any other eligible health care, dentalOnce you use the funds in your FSA, any otherand vision expenses for the plan year willeligible health care, dental and vision expensescome out of your HRA. Under allincurred during the plan year will come out ofcircumstances, the debit card will be shutyour HRA. Under all circumstances, the debitoff on the last day of the month in which youcard will be shut off on the last day of the monthleave County employment. All expensesin which you leave County employment. Allmust then be submitted for reimbursement.expenses must then be submitted forreimbursement.When can Iaccess thefunds? You can access the funds assoon as they are deposited in toyour account. County contributions will typicallybe made in the pay periodfollowing verification ofcompletion of the EngagementIncentive. Employee contributions areavailable after the funds arededucted from your paycheckand deposited into the accountor when you make a post-taxcontribution. New hires/newly benefit-eligibleemployees will receive pro-ratedCounty Contributions in the payperiod following benefits startdate. New hires/newly benefit-eligibleemployees are not requiredto complete the EngagementIncentive during the year theybecome benefit-eligible. Mustcomplete for the following year.When must eligibleexpenses beincurred*?Eligible expenses must be incurredafter the account has beenservice or purchase the established.*When you receive theproduct.7 You can access the funds assoon as they are deposited in toyour account. County contributions will typicallybe made in the pay periodfollowing verification ofcompletion of the Engagement Incentive. 100% of your health care FSANew hires/newly benefit-eligiblecontribution is available January 1,employees will receive pro-ratedor as soon as administrativelyCounty Contributions in the paypossible following your eligibilityperiod following benefits start date.date. New hires/newly benefit-eligible Dependent care FSA funds areemployees are not required toavailable after funds are deductedcompletetheEngagementfrom your paycheck and deposited.Incentive during the year theybecome benefit-eligible. Mustcomplete for the following year. If you're an active employee, theeligible expense must be incurredafter the account is establishedand while you're covered underthe plan and have funds in yourHRA. Eligible expenses incurred in theprior calendar year can bereimbursed if enrolled in the HRAduring the prior year. If you retire or separate from theCounty, the eligible expensemust be incurred prior to the endof month in which you leaveCounty employment. Eligible expenses must be incurredwhile you're covered under the planand before the plan year ends. If you retire or separate from theCounty during the year, health careFSA expenses must be incurred onor prior to the end of the month inwhich you leave County employmentunless you participate throughCOBRA for the rest of the year. FSA Dependent Day Care expensesmust be incurred prior to December31 of the plan year and submitted forreimbursement by March 31 of thefollowing year.

HSAIs documentationneeded forreimbursement?No. Documentation is not neededfor reimbursement from an HSA.However, the IRS may requestdocumentation at a later date;therefore, you should keep allreceipts, statements andExplanations of Benefits (EOBs).HRA You must submit an itemizedstatement, detailed receipt orExplanation of Benefits (EOB)when you submit a claim. You may also be asked to providedocumentation to verify that yourPayFlex Card* purchases are eligible.PayFlex will notify you if thedocumentation submitted does notmeet IRS requirements. Failure tosubmit IRS approveddocumentation will result in anoffset from a future claim, orbecoming taxable income in afuture year (2019 unsubstantiatedexpense will become taxableincome in 2021).*If you use the card to pay for copays orprescriptions, documentation is not generallyrequested by PayFlex.Does the balancecarry over?Yes. Any unused funds will carryover to the next year.Yes. Any unused funds will carryover to the next year.FSA You must submit an itemizedstatement, detailed receipt orExplanation of Benefits (EOB) whenyou submit a claim. You may also beasked to provide documentation toverify that your PayFlex Cardpurchases are eligible under thehealth care FSA. Failure to submit IRS approveddocumentation will result in an offsetfrom a future claim, or becomingtaxable income in a future year (2019unsubstantiated expenses willbecome taxable income in 2021). For dependent care FSAs, you’llneed to include a statement fromyour provider. If you don’t havedocumentation to support your daycare expense, you can have yourprovider sign a PayFlex claim form.No. Any amount left in the accountafter the end of the plan year will beforfeited. The last day to use your FSA dollarsis December 31. This means youmust incur eligible expenses by thisdate. You can submit claims forreimbursement up until March 31 ofthe following year.Can I earninterest or investthe funds in myaccount?Yes. The funds in your HSA earninterest. Once you have more than 1,000 in your HSA, you can investin a variety of mutual funds. Thereare no transfer or trading fees andno minimum investment amount.NoNo8

Additional ResourcesIn this section, you'll find FSA planning worksheets, important information on the PayFlex debit card, and a quick reference guide to help youmanage your account(s) online and through the PayFlex Mobile app. Planning WorksheetsUse the FSA worksheets below or our savings calculator at payflex.com to plan your contribution. Be conservative with your estimates. Anyfunds left in your account at the end of the plan year will be forfeited.Health Care FSADependent Care FSAAnnualEstimateMedical expenses not covered by insuranceDeductibles, copays, coinsurance Physician visits/routine exams Prescription drugs Insulin/syringes Annual physicals Chiropractic treatments Over-the-counter items Other: Subtotal Medical Expenses: AnnualEstimateDental expenses not covered by insuranceCheckups/cleanings Fillings Root canals Crowns/bridges/dentures Oral surgery Orthodontia Other: AnnualEstimateExams Eyeglasses Prescription sunglasses Contact lenses & cleaning solutions Corrective eye surgery (LASIK, cataract, etc.) Hearing exams/hearing aids & batteries Other: Subtotal Vision/Hearing Expenses: TOTAL MEDICAL EXPENSES 2020 Contribution Amount (max 2,700) Number of paychecks you will have in 2020 Per pay period deduction 9MonthAmountJanuary February March April May June July August September October November December TOTAL DEPENDENT CAREEXPENSESSubtotal Dental Expenses: Vision/Hearing expenses not covered byinsuranceEligible dependent care expenses include day care, before and afterschool care, preschool, summer day camps, and adult/elder care. 2020 Contribution Amount(max 5,000) Number of paychecks you willhave in 2020 Per pay period deduction

Using the Pay FlexCard , your account debit card The PayFlex debit card makes it easy for you to spend the money in yourPayFlex account. The card is available for the following accounts: Health Savings Account (HSA) Health Reimbursement Account (HRA) Health Care Flexible Spending Account (FSA) - MEDICAL ONLYNote: If you have an HRA and a health care FSA, you'll use the samecard for both accounts. Eligible expenses will be paid from your FSAfirst. Once you use the funds in your FSA, any future health careexpenses will come out of your HRA.Where can I use my card?You can use your card to pay for eligible health care expenses atqualified merchants where MasterCard is accepted. This includesdoctor and dental offices, hospitals, pharmacies (including mail- orderprescriptions), and hearing and vision care centers. You may also useyour card at some discount and grocery stores. These stores musthave a system that can process health care spending cards. For a listof common eligible and ineligible expense items, visit payflex.com. Can I order a card for my spouse or dependent? Yes. You canorder an additional card for your spouse or dependent at no costthrough payflex.com. See page 10 for directions.IMPORTANT INFORMATION ABOUT YOUR PAYFLEX CARDIt’s important to save your detailed receipts, itemized statements andExplanations of Benefits (EOBs). If you have a health care FSA orHRA, PayFlex may ask you to provide documentation to verify thatyou used your card for an eligible expense. The IRS requires us to dothis. If you have an HSA, you won’t be asked to providedocumentation for your card transactions. However, we recommendthat you still keep your documentation for tax records.How will I know if PayFlex needs documentation for my cardpurchases?If we do need documentation, we will post an alert message online orsend you a Request for Documentation letter. We do this when weneed to verify that you used your card to pay for an eligible item orservice. If you do not respond to the request within 45 days, yourcard will be suspended. To stay up to date on your card transactions,we encourage you to sign up to receive debit card notificationsthrough e-mail, web alert or both. Log in to payflex.com and clickAccount Settings from the top navigation. Then select Accountnotifications.How to respond to a Request for Documentation alertor letterIf we need more information on a debit card purchase, send usthe Explanation of Benefits (EOB) statement for the cardpurchase. You can upload your documentation to the PayFlexsite, send it through the PayFlex app, or fax or mail it to us.If you don’t have an EOB, you have three other options:1. Send us the itemized receipt for the card purchase.2. Substitute another expense for the one in question.3. Pay back your account for the amount in question. Send apersonal check or money order directly to PayFlex.Note: If you do not respond to the request within 45 days, your card willbe suspended until you either send in the requested documentation orpay back the account. If your card is suspended, you can still pay foreligible expenses with another form of payment. Then submit a claimfor reimbursement. Once we receive and process your documentationor repayment, your card will be active again.*If you choose to fax or mail documentation, include a copy of your Request forDocumentation letter.What should I do if my card is lost or stolen?Call us right away at 1-800-729-3539 to report a lost or stolen card. Donot order another card online.10

Managing your PayFlex account onlineWhen you have a PayFlex account, you can use the PayFlex memberwebsite (payflex.com) and the PayFlex Mobile app to manage youraccount and stay up to date on your account activity. It’s time to starttaking advantage of all the online features and tools available to you.Get started Go to payflex.com, your PayFlex member website. Click Sign In, located at the top right corner. Then, enter your username and password. If you’re a new user,click Create Your Profile and complete the required fields.For Broward County HSA Members: Set up your HSAYou’ll be prompted to follow a few simple steps:1. Review your fees and agreements. Check the box toacknowledge the terms of use. Then, enter your initials.2. Review and update your personal information.3. Add a primary beneficiary. You can also add a contingentbeneficiary.Take action on your accountOnce you log in, you’ll see your HSA listed. Within the Account Actionssection, you have the following options to choose from: View account details View HSA statements Link a bank account Manage my beneficiaries Set up account notificationsManage your fundsAt the top of the page, select your HSA from the Your Accounts dropdown menu. Within the Manage Funds section, you have thefollowing options to choose from: Deposit funds Request fundsOrder an additional PayFlex Card You can order an additional PayFlex debit card for your spouse ordependent at no cost. After you log in, click Account Settings from the topnavigation. Then select PayFlex Card. Select Order A Dependent Debit Card. Enter the first andlast name of your spouse or dependent. Click Submit. Yourcard should arrive within 15 business days. If your card is lost or stolen, call us immediately at1-800-729-3539. Do not order another card online.11

Sign up for electronic account updatesTo pay your provider directly, select Pay Them. Select your payee from the drop-down menu and clickNext. To add a new payee, click on

**OTC items include bandages, contact lens solution, first-aid kits, hot and cold packs, and thermometers. You can also use your health care FSA for OTC drugs and medicines like pain relievers, cold and flu written prescription from your doctor. Dependent Care FSA This account reimburses you for eligible child (under the age of 13) and