Transcription

Market Intel:Medtech Giants ReadyTo Battle FrontrunnerIntuitive Surgical In ‘SoftSurgery Robotics’ARTICLE PACK

Market Intel: Medtech Giants Ready To Battle FrontrunnerIntuitive Surgical In ‘Soft Surgery Robotics’Executive SummaryThe global market for robotic surgery systems isexpected to reach 9.7bn by 2023. With medtechgiants Medtronic, Johnson & Johnson and ZimmerBiomet launching robotic platforms in 2020, thismarket is set for a major shakeup.The global market for robotic surgery systemsis expected to see double-digit, year-on-yeargrowth, reaching more than 9.7bn by 2023.Pioneering robotics surgery firm Intuitive SurgicalInc. continues to dominate the overall roboticssurgery market, accounting for more than 3.7bnin sales of its da Vinci systems, instruments andaccessories.This year, however, several major medtechplayers, Medtronic PLC, Zimmer Biomet HoldingsInc. and Johnson & Johnson Medical Inc., as wellas smaller companies like CMR Surgical Ltd., arevying to carve out market share by introducingcompeting platforms, according to “RoboticallyAssisted Surgical Devices,” an analysis by Informa’sMeddevicetracker.“It’s an interesting time in medical technology,”Ryan Zimmerman, a medical technology analystwith the global financial services company BTIGResearch in New York told Medtech Insight.“You’re seeing automation of procedures andthe introduction of more advanced enablingtechnologies that drive usage of moreconsumable-type implants [and] that cantake some variability out of the procedure byautomating certain components of it.”The market for robotic-assisted surgery systems2 / April 2020totaled about 4.6bn in 2018. Robotic proceduresworldwide made up only 2% of all surgeries whiletraditional minimally invasive surgery accountedfor about 30% to 35% of all surgeries, according toMeddevicetracker. The majority of surgeries arestill performed with traditional open approaches.However, as Robert White, Medtronic’s executiveVP for minimally invasive surgeries, noted duringan investor briefing last September, open andtraditional minimally invasive surgeries will “bedrawn into robotic-assisted surgery.”Zimmerman agreed that penetration of surgeryrobotics was low but said that Intuitive’s successin building soft tissue robotics is fostering interestfrom large companies like Medtronic and J&J.In the orthopedics sector, Stryker Corp.’s MAKOrobot is leading the pack with some 850 unitsplaced in the US alone, and given that thereare about 5,000 US hospitals with orthopedicprograms that could benefit from a robot, thereis ample room for growth, Zimmerman said.Similarly, in the robotics market in spine, whichZimmerman valued at about 400m to 450mglobally, there are only 300 to 400 surgical robotsin place today.“All of these areas have room for growth,” he said.Growth Drivers Versus BarriersSeveral factors are driving growth in roboticsurgery. One is patients’ demand for less invasiveprocedures. On the orthopedics side, steady-statepricing pressures have pushed prices down inrecent years. And surgical robot manufacturershave found that knee replacements, in particular,offer a good opportunity for revenue growth, Informa UK Ltd 2020 (Unauthorized photocopying prohibited.)

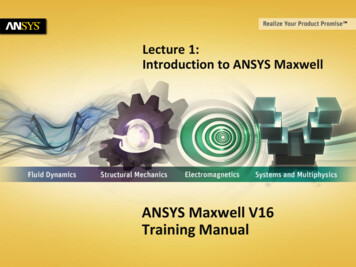

given that clinical outcomes have proven to bevery good with low mortality rates, he said.Brian Chapman, a principal with consulting firmZS Zurich, also believes that in orthopedics,surgery robots will create value, because whenrobots do the cutting, physicians can measureoutcomes much better. (Also see “MedtechCompanies Must Adjust To Growth Of OutpatientCenters, ZS Consultant Advises” - Medtech Insight,2 Mar, 2020.) “Where I think we’re going to getsome better answers in the short-term is inorthopedics,” Chapman told Medtech Insight.“They’re not doing the whole procedure. They’resimply doing the cutting. They have a specific rolethat the physician is working with and then, youcan actually measure the outcome much better ofan orthopedic procedure because of course, thegoal of an orthopedic procedure, in many cases, ismobility.”While there is only limited data on orthopedicsapplications to date, some studies have shownthat patients could benefit by recovering fasterand having shorter hospital stays. Meanwhile,hospitals and ambulatory centers tend to viewsurgical robots as marketing tools that can attractpatients to their facilities.“Surgeons [who] weren’t planning on becoming[users of robotic-assisted systems], but wereforced into it, because patients may go to aphysician who does robotic surgery, has drivenIntuitive’s growth for many years,” Zimmermansaid. More surgeons are also looking at theadvantages that robots can offer during surgery,such as greater visibility and precision, that couldlead to better outcomes.In a Meddevicetracker survey of selectedgynecologic surgeons in the UK and US, whoperformed robotic surgery, 75% of respondents3 / April 2020said procedure volumes had risen 1% to 25%since they bought a robotic system with 25% ofsurgeons saying that procedure volumes hadrisen by 26% to 50% since they brought in a robot.That said, barriers to entry are high.With the average cost of 1m for one roboticsystem, many facilities don’t have the capitalbudget to take on those costs, Zimmerman said.“That hasn’t stopped Stryker and others to findearly adopters and many physicians are making abrand out of being a robotic-based surgeon,” hesaid.But logistical challenges and interest by physiciansare also limiting factors. Zimmerman saidcompanies that introduce a “universal system”that can be used for different indications, andrule out some of the complexities in the operatingroom, will ultimately be winners. Chapman addedthat surgeons also can’t be expected to know howto operate multiple robots.“I just can’t imagine that any surgeon is goingto want to know how to do six different robots I think we have, again, one or two that willdominate in the longer-term, but the ways inwhich you can differentiate for the procedure,including the robot, are much more numerousthan just the implant itself,” he said.Market SizeIn the Meddevicetracker analysis, the marketfor robotically assisted devices is divided intothree segments – robotically assisted systems(RAS), instruments and accessories, and services/maintenance contracts. Instruments andaccessories ranked first in the overall market andare expected to see the largest growth of 18.3% by2023, reaching 5.1bn in revenues (see Figure 1). Informa UK Ltd 2020 (Unauthorized photocopying prohibited.)

Sales of robotic-assisted systems ranked secondin the market overall and are expected to reach 3.3bn by 2023, a compound annual growth rate(CAGR) of 14.6%. Service revenue is projected togrow at a 11.7% CAGR to reach 1.3bn by 2023.However, service revenue as a percentage of totalmarket revenue is projected to decline as a resultof lower-priced surgery systems that are expectedto be introduced by the newcomers.Figure 1. Robotically Assisted Surgical Devices, Global Market Forecast ( m), By Revenue Segment, 2018-23Meddevicetracker, RoboticallyAssisted Surgical Devices,Company Financials4 / April 2020 Informa UK Ltd 2020 (Unauthorized photocopying prohibited.)

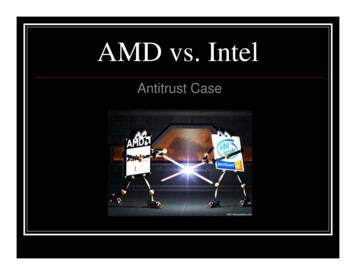

Intuitive SurgicalIn 2018, Intuitive Surgical dominated the globalmarket for robotic-assisted surgery systemswith an 80.6% market share and about 3.7bnin sales of its da Vinci systems, instruments andaccessories. (Also see “Rising Procedure VolumesPush Intuitive Surgical Third-Quarter EarningsAbove Forecast “ - Medtech Insight, 21 Oct, 2019.)The da Vinci system accounts by far for thegreatest share of robotic surgeries, led by generalsurgeries, as well as prostatectomy, hysterectomy,cardiothoracic surgery and transoral procedures.Calvin Darling, Intuitive’s spokesperson, toldinvestors during the fourth-quarter earningscall on 23 January that in 2019 1.2 million totalprocedures were performed using the da Vincisurgical system, an 18% rise from 2018.In the US, the da Vinci was used to performabout 421,000 general surgery procedures– representing about 48% of overall US daVinci procedures; 282,000 gynecologic surgeryprocedures; and 138,000 urologic procedures.Intuitive’s CEO Gary Guthart told investors thatin the fourth quarter, the company placed 336da Vinci surgical systems, up 290 from the fourthquarter of 2018. Total placements for the yearreached 1,119 systems, up 12% from 2018. For2020, he projects total procedures to grow in the13% to 16% range, driven by US general surgeryand procedures outside the US, where thecompany is at the earliest stage of adoption. 2019revenue reached 4.5bn, a 20% growth over 2018.Intuitive is in the first phase of rolling out its daVinci SP, or single-port platform and is pursuingadditional indications for this platform. Guthartnoted that Intuitive has been in discussions withthe US Food and Drug Administration about5 / April 2020data requirements for a colorectal indicationand expects this to require an investigationaldevice exemption (IDE) trial that includes followup analysis, making a third indication by 2020unlikely.The company is also launching its flexiblediagnostics Ion platform for lung biopsies for earlydiagnosis of suspicious lesions. Guthart noted that16 Ion systems have been placed thus far and thatuser feedback during the initial launch has beenstrong. He expects to see several presentationsby publications that are currently reviewing thesystem to be presented this year.When asked how Intuitive plans to respond tocompetitors that are marketing their efforts as“digital surgery” using new technologies such asartificial intelligence, technological advancementsand improved connectivity, Guthart’s short answerwas, “Welcome to the party,” noting that Intuitivehas been working on these issues for more thana decade. (Also see “Exec Chat: Intuitive SurgicalCEO Gary Guthart On Expansion, Innovation AndCompetition” - Medtech Insight, 8 Oct, 2019.)“We’ve been the Internet of Things in surgicalrobots for a decade, cloud-enabled for a decade.We are quite deep,” he said. (Also see “Exec Chat:XMed 2019: Intuitive Foundation’s PresidentCatherine Mohr’s Team Jackets Read ‘Plan For 100Years’” - Medtech Insight, 8 Nov, 2019.)He outlined four future opportunities: using bigdata to help customers establish benchmarks toimprove upon; using computing power in realtime to help surgeons improve outcomes –asexemplified by Ion – and educate surgeons toreduce surgical variations between patients; andusing computing technologies and networkingto help hospitals and Intuitive become moreproductive. Informa UK Ltd 2020 (Unauthorized photocopying prohibited.)

“The winner won’t be the tag line. I think thewinner will be those who deliver real value that’svalidated against those four categories,” Guthartsaid.On 10 February, Intuitive seized on one ofthese opportunities Guthart outlined duringthe earnings call when it announced that itacquired privately held New York-based OrpheusMedical, which offers information technologyand connectivity and expertise in processing andarchiving surgical video.MedtronicMeanwhile, Medtronic and J&J are also investingheavily in soft tissue robotic systems.Medtronic, which ranked in fourth place in theoverall robotics surgery market in 2018 with 88.4m in sales, announced on 13 February itacquired privately held Digital Surgery, whichdevelops digital surgical tools to strengthen itssurgery robotics platform. (Also see “MedtronicAdds UK-Based Digital Surgery To Support RoboticSurgery” - Medtech Insight, 13 Feb, 2020.)Omar Ishrak, Medtronic’s CEO, said during thecompany’s fiscal 2020 third-quarter earnings callon 18 February, “these products can be leveragedto provide insight into the procedure time, costand process to improve surgical care.” (Also see“More Than Mako: Stryker Delivers Strong GrowthIn All Three Businesses” - Medtech Insight, 30 Jan,2020.)This comes on the heels of Medtronic’sannouncement last year that it developed thesoft tissue Hugo RAS system, which will competedirectly with Intuitive’s da Vinci system for marketshare in general, urology, gynecology, thoracic,colorectal and bariatric robotic-assisted surgicalprocedures. (Also see “Medtronic IntroducesHugo To Rival Intuitive’s Robotic Surgery System” Medtech Insight, 25 Sep, 2019.)6 / April 2020The company hopes to earn a CE mark for thesystem in late 2020 or early 2021 and expectsthe FDA to clear Hugo RAS around September2021. Intuitive has been touting Hugo as moreflexible and mobile, which will make it easier forhospitals to use the robot more often, keepingthe per-procedure cost down. Zimmerman saidMedtronic’s plans to market Hugo in selectedmarkets outside of the US first is a relief forshareholders as Medtronic will not be in the USmarket so quickly.Medtronic already markets the Mazor X Stealthplatform for spinal surgeries, which it launchedafter acquiring Mazor Robotics for 1.64bn in late2018. Surgeons began using the system in Januaryof last year and Medtronic attributed the lowdouble digits growth in neurosurgery to “stronggrowth” in Mazor Robotics.J&JJ&J is a relative latecomer to the robotics marketbut has made a series of acquisitions in therobotic-assisted space to make inroads in severalindications. (Also see “J&J Has Big Plans ForRobotic Surgery In 2020” - Medtech Insight, 24 Jan,2020.)In February of last year, J&J bought Auris HealthInc. for 3.4bn to add the Monarch roboticsurgery platform, which was cleared by the FDAfor diagnostic and therapeutic bronchoscopyprocedures to treat lung cancer in 2018. Duringthe company’s fourth-quarter earnings call, AlexGorsky, J&J’s CEO, said physicians have performedmore than 2,000 bronchoscopy procedures usingthe platform.BTIG’s Zimmerman said that Auris is ahead ofIntuitive’s Ion platform in terms of systems placedand expects that J&J will explore other indicationsfor this system as well.In 2019, J&J bought out Verily Life Sciences LLC’s Informa UK Ltd 2020 (Unauthorized photocopying prohibited.)

share of Verb Surgical Inc. to develop roboticsand machine learning tools. This comes after asuccessful strategic collaboration with Verily, partof Google’s parent company Alphabet, to co-createVerb. (Also see “J&J Takes Full Ownership Of VerbSurgical, Verily Breaks Off Robotics Partnership” Medtech Insight, 23 Dec, 2019.)On the orthopedics side, J&J’s DePuy Synthes’division also gained an orthopedic roboticplatform resulting from the Orthotaxy SAS buyout in 2018.The Orthotaxy robot will be much smaller andless expensive than current robots on themarket and reportedly doesn’t require surgeonsto use disposable instruments, saving 1,500 2,500 per procedure. Gorsky said the companyplans a midyear regulatory submission for therobot. Longer-term, J&J plans to bring the nextgeneration of digital and robotics platform intoone robotics platform called VELYS.Zimmerman said for multi-billion generalsurgery companies such as Medtronic and J&J,investments in the robotics space remain tricky.Intuitive, by comparison, built its entire businessaround robotics.“What affect it will have on their core business,which comes at a higher margin than robotics,is something investors and these companies willwrestle with,” Zimmerman said.StrykerIn 2018, Stryker was the second-leadingcompetitor in robotics-assisted surgery with a9.6% market share and 422m in sales, driven, inlarge part, by the company’s Mako robotic systemfor hip and knee indications.The Mako system has seen steady growth sinceits introduction in the US in 2017 for total knee7 / April 2020replacements. Katherine Owen, Stryker’s VPfor strategy and investor relations, said duringthe company’s fourth-quarter earnings call on28 January that she expects robust orders forMako in 2020 and continued share gains inboth hips and knees. (Also see “Stryker’s MakoRobot Continues To Bite Orthopedic SurgeryCompetition “ - Medtech Insight, 1 Nov, 2019.)Globally, 860 Mako have been installed with 700being installed in the US, Owen said.Stryker’s Mako surgical robot“We now have nine Mako robots in Japan [where itis now approved for all indications] and continueto believe this represents a significant marketopportunity.”In the US, total procedures exceeded 114,000in 2019. Knee procedures rose 66% to 75,000in 2019 and hip procedures grew 40% last year.The fourth quarter represented Mako’s strongestperformance to date with Mako procedures risingnearly 50%, the company said.In the second quarter of 2020, Stryker plans tolaunch a “user-friendly” software upgrade forits hip application. Owen said Stryker will revealdetails about its new hip technology at the annualAmerican Academy of Orthopedics Association(AAOS) meeting, which will be held from 24-28March in Orlando.Kevin Lobo, Stryker’s CEO, told analysts during theearnings call that the company is also working ona robotics platform for spine.“We have two options, one with the Cardan,which came with the Mobius acquisition as wellas Mako,” Lobo said, adding that Stryker “isworking on those programs, but it’s too early togive a launch date.” (Also see “Stryker Closes GapWith Competitors In Strategic Spinal RoboticsAcquisition” - Medtech Insight, 6 Sep, 2019.) Informa UK Ltd 2020 (Unauthorized photocopying prohibited.)

Figure 2. Robotically Assisted Surgical Devices Market, Global Share By Supplier, 2018Meddevicetracker, RoboticallyAssisted Surgical Devices,Company Financials8 / April 2020 Informa UK Ltd 2020 (Unauthorized photocopying prohibited.)

Zimmer BiometIn 2018, Zimmer Biomet had a small share in theglobal robotics-assisted surgery market with 13min sales, well below Stryker, Medtronic and othercompetitors.The company received FDA clearance for itsROSA robotic system for spine applications but isfocusing its efforts on knee and hip applications,which represents a much larger marketopportunity, Zimmerman said.In the fourth quarter of 2019, Zimmer Biomet sawits knee business grow 7.8%, beating J&J’s 1.4%quarter knee volume growth. The growth waslargely driven by its ROSA knee robotic surgerysystem, which accounted for around 50% of thetotal, and by the Persona “personalized” kneereplacement system, the company said. (Alsosee “Knees Boost Zimmer Biomet; TurnaroundContinues, But FDA Woes Linger” - MedtechInsight, 6 Feb, 2020.)For 2020, it expects continued growth as thecompany will focus on sales expansion andsurgeon training, Zimmer Biomet’s presidentand CEO, Bryan Hanson, said during the fourthquarter earnings call on 4 February. The companyalso expects to launch a hip application during2020. (Also see “AAOS Exec Chat: An InsiderLook Into DePuy Synthes’ Anterior Approach “ Medtech Insight, 20 Mar, 2019.)Other CompetitorsNuVasive Inc., which developed a roboticapplication for spine, told investors it hasbeen working through “beta evaluations” ofits technology for the last quarters and plansto introduce its system in 2021. The San Diegocompany posted revenues of 310.4m for thethree months ended 31 December 2019. (Alsosee “NASS2019: Robotics Spotlight Is On New9 / April 2020Platforms By Globus Medical, NuVasive “ Medtech Insight, 1 Oct, 2019.)Smith & Nephew PLC’s new CEO, RolandDiggelmann, said during the company’s fourthquarter earnings call on 20 February that in2020, S&N will launch the next-generation of itshandheld CT-free design of NAVIO. He added, thisnext-gen robot will have an even smaller footprint,which is an advantage for ambulatory surgerycenters, and a “very distinct technology aroundthe burring,” which will be faster over time.“This platform should become the base for amulti-asset offering,” Diggelmann told analysts.He hinted at more announcements being made atAAOS next month.That said, Diggelmann told analysts that S&N willnot give out numbers on NAVIO’s installed base.Last year, Smith & Nephew acquired Brainlab AG’sorthopedic joint reconstruction business, which itfolded into its surgical robotics division.NAVIO differs from Stryker’s Mako in that it isdesigned to help augment the surgeon’s manualcapability while the Mako has integrated toolsand an articulating arm that takes the place ofa surgeon’s hand. The smaller footprint of theNAVIO makes it an “ideal solution for all surgicalcare settings, including ambulatory surgicalcenters,” the company said.UK-based CMR Surgical, which developed theVersius surgical robotic system, made greatstrides recently with the announcement that theWestern General Hospital and Milton KeynesUniversity Hospital NHS Trust became the firsthospitals in Europe to use the system to performminimal access surgery. Versius has initially beenused to perform a range of colorectal surgeries Informa UK Ltd 2020 (Unauthorized photocopying prohibited.)

for treating patients with serious bowel diseaseor bowel cancer. The Versius is currently underFDA review. (Also see “European Debut For CMRSurgical’s Versius Surgical Robot In Two UK NHSHospitals “ - Medtech Insight, 20 Feb, 2020.)10 / April 2020With the massive potential applications ofsurgery robots and continued innovations bymanufacturers, this field will continue to get morecrowded and draw increasing attention. Informa UK Ltd 2020 (Unauthorized photocopying prohibited.)

with an 80.6% market share and about 3.7bn in sales of its da Vinci systems, instruments and accessories. (Also see “Rising Procedure Volumes Push Intuitive Surgical Third-Quarter Earnings Above Forecast “ - Medtech Insight, 21 Oct, 2019.) The da Vinci system accounts by far fo