Transcription

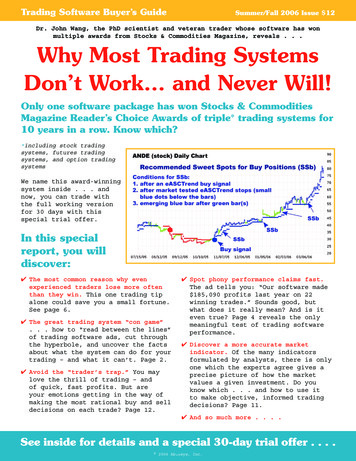

Trading Software Buyer’s GuideSummer/Fall 2006 Issue 12Dr. John Wang, the PhD scientist and veteran trader whose software has wonmultiple awards from Stocks & Commodities Magazine, reveals . . .Why Most Trading SystemsDon’t Work. and Never Will!Only one software package has won Stocks & CommoditiesMagazine Reader’s Choice Awards of triple* trading systems for10 years in a row. Know which?*including stock tradingsystems, futures tradingsystems, and option tradingsystemsWe name this award-winningsystem inside . . . andnow, you can trade withthe full working versionfor 30 days with thisspecial trial offer.In this specialreport, you willdiscover:4 The most common reason why evenexperienced traders lose more oftenthan they win. This one trading tipalone could save you a small fortune.See page 6.4 The great trading system “con game”. . . how to “read between the lines”of trading software ads, cut throughthe hyperbole, and uncover the factsabout what the system can do for yourtrading – and what it can’t. Page 2.4 Avoid the “trader’s trap.” You maylove the thrill of trading – andof quick, fast profits. But areyour emotions getting in the way ofmaking the most rational buy and selldecisions on each trade? Page 12.4 Spot phony performance claims fast.The ad tells you: “Our software made 185,090 profits last year on 22winning trades.” Sounds good, butwhat does it really mean? And is iteven true? Page 4 reveals the onlymeaningful test of trading softwareperformance.4 Discover a more accurate marketindicator. Of the many indicatorsformulated by analysts, there is onlyone which the experts agree gives aprecise picture of how the marketvalues a given investment. Do youknow which . . . and how to use itto make objective, informed tradingdecisions? Page 11.4 And so much more . . . .See inside for details and a special 30-day trial offer . . . . 2006 Ablesys, Inc.

m “Con Game”The Great Trading Systeuld bequick and easy profits coofsimclasiouurspkeo maw trading systemsSoftware marketers whyou don’t understand hogpinhoey’rtheeuscamisleading you – bereally work.Dear Trader:g a system that is bothh high hopes of finally owninwitre,twasofingtradonneyHave you ever spent a lot of mofor you?easy to use AND makes moneysertware was not what the advertin felt cheated because the sofeveord inteppodisanbeeAnd have you everclaimed?fits promised in the adly didn’t generate the huge protainceritdAn.usetoyeasbutgIn other words, it was anythincopy, right?SAY is:For instance, what theyg“Our system has a 90% winninrate.”is:What you should KNOWof goods. Why?g rate may be selling you a billninwintheonyonlusfocoPromoters whn a 99% winning rate won’trage losing trade is 100 eveavethebut 1isetradgWell, if the average winninmake you any money.haveof the most successful traderswin a few large gains. SometoseslosallsmnymaeptExperienced traders accthey make great profits.y win, they win big and sotheenwhButs.rategninwinonly modests — because they know that’sm outrageous high winning rateclaitoetinuconerslishpubYet many trading systemt to hear.what inexperienced traders wann to the “profit factor” — then, you should pay more attentionioopiourin,rategninwinInstead of focusing on thefit factor of 1.5 or higher.od trading systems have a proGo.lossssgrothebydeddivigross profitboth the winning rate andk-testing reports showing youbacdailedetyousgiveretwaassess systemAbleSys’s eASCTrend sof“AbleSys index” — to help youthe—exindtemsyssivehenpreprofit factor. There’s also a com4).epagonperformance (see articleWhat they SAY is:last year.”“Our system made 694,593is:What you should KNOWyou the size of the accountsystem promoter neglects to telltheeausbecul,ngfanimeiblyThis statement is not terrney.traded to make that much mocan’t use the system.93 profit, the average trader4,5 69kematotounaccIf you need a 5 millionaccumulated loss ofown was. If the system took anw-ddraumximmatheatwhyouThe promoter also hasn’t toldtem is not tradable.de the amount claimed, the sysmaitorehalf a million dollars beftrading systems that:years of disappointment usinghadIer,tradaaseausbecll,weI know these scams all too

4 Didn’t perform as promised.4 Lost me much moremoney than they made me.4 Didn’t tell me preciselywhen to buy but left itup to ME to figure it out!4 NEVER told me whenit was time to sell.4 Forced me to figure out on my own why it wasn’t working — with no helpprogrammers who designfrom the traders anded the software.To solve the problem, I didsomething you might expect of a trader who, likeprogrammer .me, is also a scientist andcomputerAnd it wasn’t easy.I designed and wrotemy own trading software!Despite my backgroundin mathematics, physics,and computer science, devreliable and precise tradinising the algorithms thatg instructions in all majorwould givemarkets was a bear of aproject.My team and I worked onit for years. Then, we exhaustively back-tested ourand a dozen other markesoftware on the Forex, Ruts favored by traders.ssell 2000,But the trading softwarewe produced, eASCTrend, was well worth the wait.Because only eASCTrend4Has delivered accurate buy:and sell trading signals —as verified by extensive back-testing.4Has accurately predictedmarket direction and performance.4Recommends precisely when to buy — and when tosell.4Generates recommendedoptimal stops for each trade.4Accommodates a wide variety of trading styles in allmajor markets.4Is intuitive and easy to use— with no calculations required.Today, traders in more than 54 countries and regions worldwide use my prograsoftware of choice.m, eASCTrend, as theirtradingOur traders are so delighted with eASCTrend that the software has won aCommodities — one of the“Readers’ Choice Awardmost reputable magazine” from Stocks &s in the industry — for 10straight years.In this issue of our trading software buyer’s guide,I’m going to take you thrprefer eASCTrend to anough the reasons why soy other system they havemany tradersever tried.I’ll show you why this simple, easy-to-use softwarecan help you trade morerationally than ever beforeAnd, I’ll even let you test-d.rive eASCTrend risk-freefora full 30 days. Just complepage 18 to get started.te and mail the form onYours for more profitabletrading,John Wang, CEOAbleSysP.S. If you decide to try eASCTrend, I don’t want youto commit to our systemthat this is the software youunless you are absolutelywant to trade with everyconvincedday.To activate your 30-day risk-free trial immediately, call us toll-free at 888-272Or visit: www.ablesys.co1688 today.m/b53

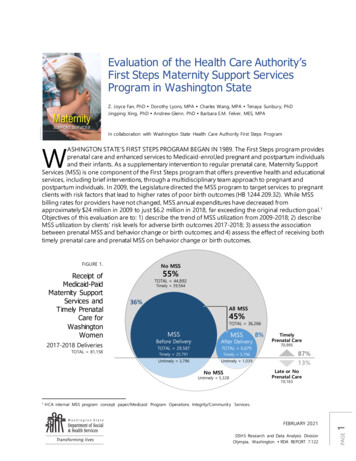

Measuringtrading systemperformancewith the“AbleSys Index”Your goal in trading shouldbe to maximize your totalnet profits. Three key factorsshow the potential for totalnet profits: Winning rate – thenumber of winning tradesdivided by the number oftotal trades. Win/loss ratio – theaverage winning tradedivided by the averagelosing trade. Profit factor – gross profitdivided by gross loss.Only eASCTrend’s tradingalgorithms are validated by a fulldecade of rigorous back-testing.Only eASCTrend’s trading algorithms are validated bya full decade of rigorous back-testing.No trading system can guarantee that you’ll makemoney. And past performance is not necessarily anindication of future results.If any trading software publisher tells youotherwise, you should run for the hills as fast asyou can!But eASCTrend has been rigorously back-tested - asfar back as 10 years. These test charts validatethat the signals generated by eASCTrend producedphenomenal performance.Has your trading software been proven throughback-testing?Some trading software publishers do little or noback-testing. But that’s a mistake . . . and a redflag that screams, “Buyer beware!”Here’s why . . . .Trading software programmers design algorithms thatwe think are the most accurate predictors of futureprices - for markets as well as individual equitiesand commodities - based on the best knowledgeavailable to us today.The AbleSys Index iscalculated by multiplyingthese three factors. Anysystem with an AbleSys Indexof 1.2 or greater is, in ouropinion, a tradable system.And there is no way to “test” whether our softwarewill accurately predict the future before we sell itto you - because the future hasn’t happened yet.Systems with an AbleSysIndex of less than 1.2 shouldnot be traded. If the index isless than 0.5, the system islosing money.So, in back-testing, we take historical data . andprocess it with the exact same algorithm we woulduse for analyzing today’s data.www.ablesys.com/b53But the past has happened. And complete pricehistories are readily available in databases we canaccess.The algorithm then generates buy and sell signals.However, since the buy and sell signals are for aprice movement that has already taken place, we cancheck whether the price subsequently rose or fell asthe algorithm predicted.

This in turn reveals whether we would have actually made a profit or loss on ourtrade by following the signals the system would have generated.And since our eASCTrend trading signals are precise and mechanical, recommendingexactly when to buy and when to sell - and not requiring interpretation by youthe trader - our results are more meaningful.Back testing is the only way to validatethe signal algorithm.An indicator software program is a trading system that uses colored lights orbars to tell you when to make a trade. A number of indicator software programs onthe market lack back-testing capability.How can you, as a trader, trust colored bars, lights, or any other indicatorsthat have not been validated through extensive back-testing? If you blindlyfollow unproved signals, you are just trading in the dark - and that can be verycostly.eASCTrend’s back-testing capability enables you to validate your signals andstrategies before you risk your hard-earned money.The chart below shows you an example of trade-by-trade back testing for QQQQ,which allows users to verify the trading strategy. The software can also showperformance summary reports which include total net profit, maximum draw-down,winning rate, number of consecutive winning trades, number of consecutive losingtrades, and profit factor. 1.888.272.1688

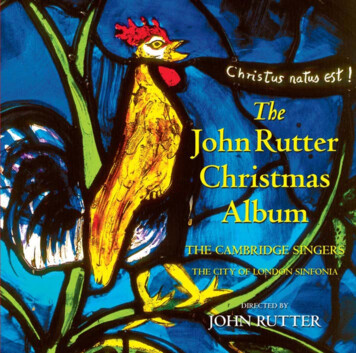

Seek to cut losses short . and let your profits run.The number one reason why traders fail is that they don’t know when to get outof a losing trade. The number two reason is that fear makes them abandon winningpositions too early - and not let their profits ride.Unfortunately, many trading systems are ambiguous about when to buy - and give noindication of when to sell. With eASCTrend, you get clear, precise, easy-to-read“sell” signals on every trade. Just log onto the system . . . and look at yourscreens.Any time you see a LARGE RED CIRCLE on any of your stock charts - stop! It’s timeto call your broker and tell him, “Sell now.”Seek to boostyour profitsby trading the“sweet spots”The eASCTrend softwaresignals “sweet spots” recommended optimum timesto get in on a trade with the first blue barto appear after a seriesof green bars, as in thechart to the right.If you missed the firstentry, the sweet spotgives you a second chanceto get on board thetrade.Already have a position? The sweet spots indicate that you should add more toyour position.That way, you can buy with confidence - and seek to expand your total gain onthe trade.An added margin of risk management: intelligent stopsA protective stop is used as a defense measure for gains or to limit losses. Howdoes it work?The trader typically places a “stop-loss order” at a predetermined dollar level.www.ablesys.com/b53

So if the market movesagainst the trader’sposition, it willautomatically liquidatethe position and limitfurther losses.The eASCTrend softwareuses principle-basedor “intelligent” stops- stops defined by themarket’s support andresistance levels. Thesoftware provides stopswith small blue dotsbelow the bars for buypositions, and small reddots above the bars forsell positions.These intelligentstops are dynamic andautomatically adjusted by the software as prices change. A built-in feedback loopretrieves the data for market direction, price range, and momentum.Because the stops are determined by actual market conditions, they are objective,back-testable, and can be used in real-world trading.Buy when you see blue. Sell when you see red.No mathematics required. What could be easier?Another problem traders put up with in many trading systems is that they arecomplex and difficult to use. They generate graphs and data, but leave it to youto puzzle out exactly what you should buy, and when. What good is that?By comparison, eASCTrend is one of the easiest systems to use. An indicatorsystem, eASCTrend is color-coded for intuitive, easy trading - telling you whento buy and sell. No mathematics required.You buy when you see a blue circle, and sell when you see a red circle. It’sa totally mechanical system, eliminating guesswork, emotion, and subjectivejudgment.Need more information so you can trade with confidence? Click on the blue to seesupport, the red to see resistance. No interpretation necessary on the part ofthe user. 1.888.272.1688

As you can see, ASCTrendprovides specific buysignals with blue dotsand blue bars - andspecific sell signalswith red dots and redbars.With these clear,specific signals, you cancontrol the influence ofemotion and impulse, bothof which are detrimentalto your trading. Knowingthat eASCTrend has beenrigorously back-testedenables you to trade oursignals with confidenceand discipline.Replacing emotionwith discipline cansave you a smallfortune!When trading software doesn’t tell you specifically when to buy - and when tosell - its value is extremely limited. And your risk of making losing tradesincreases geometrically.Here’s why: tradingsoftware that merelypresents charts andindicators forces thetrader to filter marketdata through his ownfears, greed, andprejudices.As Donald Cassidyexplains in his book It’sNot What Stocks You Buy,It’s When You Sell ThatCounts (Probus):“The disparity inmarket performancegenerally boils downwww.ablesys.com/b53

to how well each investor can invest againsthis emotions. So keeping a clear head means thedifference between profits and losses.”“When an investor gets emotionally involved in hisor her investments, it usually ends up as a losingproposition,” writes Zev Brachfeld in the TABSJournal. “People do not think rationally when theirmoney is involved.”William O’Neil, founder of Investor’s Business Daily,notes: “In my experience, the only way [to trade]is to establish buying and selling rules derivedfrom historical research - rules based on how themarket actually works, not on personal opinions orpreconceived ideas.”Beware of trading under the influence of marketimpulse. Market impulse is dangerous. There are alwaysgood set-ups for good trades. Never chase the marketmovement. Always follow your pre-defined and welltested entry rules and exit rules.eASCTrend’s real-time stops can help you manage yourtrades. The detail settings and signals are objective.If you have the discipline to follow the signals, youcan remove emotion and impulse from your trading,avoiding losses and increasing profits.The Great Americantrading software rip-off!And why eASCTrend can work in everymarket - with every style of trading!A favorite ploy of software marketers is to sell youmore of their products and services by convincing youthat you need a different, more specialized softwarepackage for each application - even though, inreality, you don’t. What a rip-off!Trading system publishers love convincing theircustomers that they need specialized, market-specificsoftware - because it enables them to extract manythousands of dollars from unsuspecting buyers. MeetDr. John Wang,creator ofeASCTrend . . .Dr. John Wang, CEO ofAbleSys, holds a Ph.D. inphysical chemistry and hasbeen trading commoditiessince 1990. He is aregistered CommodityTrading Advisor (CTA) withthe Commodity FuturesTrading Commission (CFTC)since 1995.Dr. Wang graduated fromthe University of Scienceand Technologies of China,one of the top universitiesin China, where he studiedmath and physics. Hereceived the University ofCalifornia (UC) RegencyFellowship for his Ph.D.studies at UC Santa Cruz.In 1992, Dr. Wang createdthe Spyglass trading system,gave Spyglass workshopwith George Angell.He co-founded AbleSysCorporation in 1994,created the ASCTrendindicators in 1995, anddeveloped the eASCTrendtrading system in 2000.1.888.272.1688

For instance, if their system is a thousand dollars, and they sell you onesystem, they make a thousand dollars.So they tell you: “THIS system only trades the Dow Jones. Oh, you want to tradethe Russell 2000? Then you need our Russell 2000 system!”And before you know it, you’ve bought two, three, or more systems - and spent asmall fortune.Curve fitting: buyer bewareThere’s another problem with software designed to trade just one specific market:curve-fitting.If a trading system is designed for a particular market - with a particular timeinterval - the programmer can easily “curve fit” the historical data . . . andcome up with an unrealistic, overly optimized program.Beware of programs designed to trade only one particular market with a particulartime interval - for instance, a system that only trades the e-Mini S&P 2-minutechart - because there is a very high likelihood that the program is curve-fittingthe historical data.In our opinion a program based on curve-fitting is worthless. That’s becausefinancial markets are dynamic and constantly changing.An algorithm based only on historical data ideally would work well only duringthat historical period. Only algorithms based on timeless and universal marketprinciples work in today’s markets - and in all markets, all the time.A “universal trading system”eASCTrend is a “principle-based” trading system because the algorithms arebased on the fundamental principles of the market. So it can work in any marketconditions - bull or bear.Because eASCTrend is a principle-based system, it is universal. It makes nodifference whether you are trading bonds, stocks, commodities, FOREX, or anyother freely traded markets.As a principle-based system, eASCTrend works with any time frame: weekly chart,daily chart, 60-minute chart, 10-minute chart, 2-minute chart, or any other timeinterval charts.www.ablesys.com/b5310

eASCTrend can work in every market - with every style of trading!The eASCTrend software is about helping you seek profits in any freely tradedmarkets anywhere in the world.You can use eASCTrend to trade any and all stock, e-mini, and futures markets including QQQQ, SPY, DIA, SMH, OIH, XLE, GLD, 1YR, S&P 500 index futures, NASDAQ100 index futures, Dow Jones index futures, and Russell 2000 index futures.Do you trade commoditymarkets like gold, crudeoil, natural gas, sugar,silver, and copper? OureASCTrend system can helpyou there, too. Samething with the majorForex markets includingEuro Dollar, BritishPound, Australian Dollar,Japanese Yen, CanadianDollar, and Swiss Franc.What’s more, eASCTrendfits any trading style:day trading, swing/position trading,portfolio/positiontrading, and auto orderexecution.That means you only have to buy one system to cover all your trading. No need toshell out big bucks for a different system for every market and style you trade.And no curve-fitting.Make rational trading decisions based on the truereality of the market: price!Price is reality. Everything the market knows about itself is reflected inits price. All fundamentals are contained in the price. Supply and demand arecontained in the price. Price is everything.A study from the Johnson Graduate School of Management at Cornell Universityfound that, as a rule, companies with positive price momentum earned highermarket-adjusted returns over the next 6 months than the broad markets.Using eASCTrend is one of the easiest and most accurate ways to make logical111.888.272.1688

trading decisions, based on the true reality of price movement.The eASCTrend software isn’t based on Elliott waves or Gann theory. Buy and sellsignals are calculated by a proprietary, back-tested algorithm based solely onreal-time or end-of-day price data - giving you timely, specific, and objectivesignals for every trade.Our proprietary indicators set optimal stops to seek maximum profits. eASCTrendtries to predict for the trader the most probable course the market will take inthe future.A breakthrough in trading softwareThe eASCTrend algorithm is based on an important discovery made about thefinancial markets:Early recognition of the market trend - coupled with the ability to set optimalstops - can result in greater profit for the trader.Our eASCTrend software reveals the fundamental principle of the market move,showing the support and resistance levels objectively. Equipped with thissophisticated technology, you can trade like a pro.Real-time pricing dataThe eASCTrend system works with real-time, delayed, EOD (End of Day), or eventext file data. Real-time data is provided by AbleFeed, eSignal, RealTick, orIQFeed.The EOD data could be either AbleFeed/eSignal EOD - for any market, and available30 minutes after the market close - or, get prices from AbleSys FREE EOD data,which gives you U.S. or international stocks and mutual funds only, and updatesafter 6:00 pm Pacific time.In addition to the AbleSys indicators and trading signals, the software alsoincludes some of the most commonly used indicators, such as: Moving Averages,Stochastic, MACD, Bollinger Band, and ADX.“Auto Scan” automatically keeps track of all your stocksand portfolios - applying eASCTrend’s unparalleledmarket logic to every position you own.The eASCTrend Auto Scan feature lets you keep track of every stock and ETF inevery portfolio you own - and monitor their price movement, trends, and signalsat a glance.www.ablesys.com/b5312

With the click ofa mouse, eASCTrendshows you each stock’sgraph, including itsbuy and sell signalsas well as support andresistance. So you canhold your positions withconfidence, and know whenit’s advisable to sell.For example, say you ownStarbucks. You mighthave an emotional reasonto hold the stock: forinstance, you love theircaramel lattes. Doesn’tmake sense, but that’show humans sometimesthink: “I like theproduct, so I like thestock.”But of course, trading decisions should be made with your intellect . . . notyour feelings. So, delicious as the latte you bought this morning is, theeASCTrend system will keep you on course with your position in Starbucks . . .and very clearly guide you on whether you should hold or sell.10 reasons why you should try the eASCTrend 6.0trading software full working version for 30 days at aspecial trial price . . . .1. Validated through exhaustive back-testing.The trading approach used in the eASCTrend algorithms is based onfundamental market principles, not curve-fitting of old data. It hasbeen validated with extensive back-testing in multiple markets going asfar back as 10 years.2. Dynamic stops help you to seek to cut losses short and let profits run.The software recommends intelligent stop loss orders to help you manageyour risk and keep losses small, based on the current price. As theprice moves, eASCTrend automatically adjusts the stop accordingly.3. One software package handles ALL your trading needs.Unlike many other trading software packages, which are limited totrading only a single market in a given chart time-frame, eASCTrendcan be used to trade virtually any market, in any time frame, with anytrading style - eliminating the need to buy separate trading systems foreach of the markets you trade.131.888.272.1688

4. Our customers rave about our system.Thousands of satisfied traders worldwide use eASCTrend to make moreintelligent and rational trading decisions. No wonder we’ve been ratedhighly by Stocks & Commodities magazine for 10 consecutive years!5. Proven indicators enable you to trade with confidence.The developers of eASCTrend have tested over 600 indicators, includingmore than 100 they developed themselves. Of all those 600-plusindicators, they believe that the four in eASCTrend are the mostpowerful, practical, and reliable.6. eASCTrend is simple and easy to use.When you see a blue circle, it’s time to buy. When you see a red circle,it’s time to sell. That’s all there is to it.7. An unparalleled reputation for excellence and honesty.AbleSys became a Commodity Trading Advisor (CTA) firm in 1995.Registered with the CFTC, AbleSys enjoys an excellent record in thetrading software industry. Our products have been on the market for morethan 11 years with an outstanding reputation.8. Principle-based software.The eASCTrend algorithms follow rules based on fundamental marketprinciples, derived from careful observation and analysis of actualmarket performance. We do not “cheat” or shortcut by slapping togetheralgorithms through curve-fitting of old data.9. Hands-free auto order execution (AOE).Electronic direct order-entry systems, Interactive Brokers, TWS, COESFXand more . are integrated into the Professional version of eASCTrend.AOE can help to significantly minimize slippage caused by human emotionsand order execution delays. Trading signals and order entries aresimultaneously sent out. Orders can be filled out instantaneously.10. No hard sell.While others make false claims with high-pressure sales, AbleSys doesn’twant to sell you software . . . at least, not yet.We’d much rather you accept our customer-friendly one-month trial. Youcan do back-testing or trade the market with our full working versionof eASCTrend for a month risk-free . . . then decide after the trialwhether you want to keep using our software.www.ablesys.com/b5314

Novice and Experienced TradersAlike Praise eASCTrend!“I have been using ASCTrend since the beginning of 2001, making moneyin trading mutual funds, stocks, options, and day-trading the EMinis. I have tried many software programs since the late 80’s andnothing has been as consistent as ASCTrend. While some software gives‘ratings’ on fundamentals, and others curve-fit the technicals, onlyASCTrend gives me clear entries and exits with consistent results.“I depend on ASCTrend for my entries and use the stops to manage mytrades after I open my trade. Both the entries and exits are veryspecific making risk management very easy. ASCTrend is the onlysoftware that has provided me with a practical way of making moneyin trading regardless of the market or timeframe.”-R.R., San Jose, CA“I’m a permanent license user of the AbleSys eASCTrend softwareand have used it over the past 10 years. I’ve tried Tradestationand Omnitrader, but they got too complex. I’ve always relied onAbleSys, because 15 years of options trading has taught me thatcomplexity results in confusion and losses, and simplicity resultsin clarity and winning trades. Not only does one click give me alist of great long and short trade prospects, but the compositionof the list reveals the overall mood of the market indices. I won’ttrade without it!”-B.R., Westlake Village, CA“Like many of my trader friends, I was skeptical. But I took theadvantages of the 30-day trial of eASCTrend. I was absolutelyastounded the first time I applied eASCTrend to my charts. I spentthe next 4 weeks testing, going back many years and many marketsin the history to see how it was real - and applied it to my realtrading, too. After all the research was completed, I found thateASCTrend had been just as accurate in history as in the present.“I have been amazed by the support and resistant levels thateASCTrend provides. By knowing where to place my stops, I can enterthe market with much better price and with much less stress . . .eACTrend is the best weapon there is on the market to do a superbjob of managing my accounts. Considering the results I am getting,eASCTrend is well worth the price.”-G.N. Rio de Janeiro, Brazil“As a sales representative for the industry’s leading quote service,I am frequently asked by new customers for a reputable and well-151.888.272.1688

performing technical analysis software program that is compatiblewith our quote service. My recommendations are based on the positivefeedback I get from my existing clients.“By far ASCTrend is rated as one of the best-performing technicalanalysis programs in today’s market. ASCTrend is time tested,outperforming competitors for more than four years. The software’sbuy and sell signal program, in conjunction with our quote service,can guide both novice and seasoned traders in obtaining theirfinancial goals.”-S.W., eSignal, Hayward, CA“I am confident in using ASCTrend2 indicator. This indicator keeps mein a good trending trade, and helps me to manage my risk. I have beenusing eASCTrend for 7 years with profit.”-J.B., Phoenix, AZ“eASCTrend signals take the uncertainty and stress out of my trading.Winning trades are allowed to run their course, while losing tradesare cut short every time! I am very, very happy with this software.The training seminars were especially helpful, clear, and easy tounderstand. I just wait for the confirmation of signals; then I cantake profits. It can’t get easier or better than that!”-E.S. Santa Barbara, CA“ASCTrend stops have saved me a bundle. The blue dots show me whereto place my stops even before I open my position. Since ASCTrendstops are dynamic, I was able to know my objective stops constantly.Consequently I’ve been able to trade more aggressively. I trade 30contracts of E-Mini S&P and I wouldn’t trade without ASCTrend.”-G.R., Austin,TX“I have been using ASCTrend since April 2003 trading e-mini S&P andmaking money. The eASCTrend training CD is especially helpful. Thetime I spent on studying the training CD is well worth the effort; itprovides excellent modeling to take emotion (fear and greed) out of atrade, improves discipline in adhering to trading rules, and allowsme to pick up the winning trades consistently.”-E.M., West Point, NY“I like eASCTrend because of its easy interpretation. It colo

Only one software package has won Stocks & Commodities Magazine Reader’s Choice Awards of triple* trading systems for 10 years in a row. Know which? *including stock trading systems, futures trading systems, and option tradi