Transcription

Cardiovascular Systems, Inc.23rd Annual Needham Virtual Growth ConferenceJanuary 13, 2021 2020 Cardiovascular Systems, Inc. All Rights Reserved.

Safe HarborFORWARD LOOKING STATEMENTSThis presentation contains forward-looking statements and information within the meaning of Section 27A of the Securities Act of 1933, as amended, or the “Securities Act”, andSection 21E of the Securities Exchange Act of 1934, as amended, or the “Exchange Act”, which are subject to the safe harbor created by those sections. These forward-lookingstatements include, but are not limited to, statements in this presentation regarding CSI’s strategy and goals; growth; future financial measurements and investments;shareholder value; product development plans, milestones and introductions; geographic expansion; clinical trials and evidence; professional education efforts; marketestimates and opportunities; and developments, goals and expectations relating to the COVID-19 pandemic and the recovery therefrom. Forward-looking statements are onlypredictions and are not guarantees of performance. These statements are based on CSI management’s beliefs and assumptions, which in turn are based on their interpretationof currently available information.These statements involve known and unknown risks, uncertainties and other factors that may cause CSI’s results or CSI’s industry’s actual results, levels of activity,performance or achievements to be materially different from the information expressed or implied by these forward-looking statements. CSI may not actually achieve the plans,intentions or expectations disclosed in these forward-looking statements and you should not place undue reliance on our forward-looking statements. These forward-lookingstatements involve known and unknown risks and uncertainties that could cause CSI’s actual results, performance or achievements to differ materially from those expressed orimplied by the forward-looking statements, including, without limitation, the risks set forth in our filings with the Securities and Exchange Commission.CSI’s actual future results may be materially different from what CSI expects. You should not place undue reliance on these forward-looking statements. You should assumethat the information contained in this presentation is accurate only as of the date of this presentation. Except as required by law, CSI assumes no obligation to update theseforward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if newinformation becomes available in the future. CSI qualifies all of the information presented in this presentation, and particularly the forward-looking statements, by thesecautionary statements.FINANCIAL INFORMATIONThis presentation includes calculations or figures that have been prepared internally and have not been reviewed or audited by CSI’s independent registered accounting firm.Use of different methods for preparing, calculating or presenting information may lead to differences, which may be material.2

Our MissionSaving Limbs, Saving Lives Every DayFocused on Complex Peripheral and Coronary Artery Disease2 Million 160,000Patients with CriticalLimb Ischemia (CLI)1Annual Amputationsin the U.S.2370,000525,000Deaths Annually FromCoronary ArteryDisease in the U.S.3High Risk or ComplexHigh Risk ProceduresAnnually in the U.S.41. Yost ML, CLI U.S. Supplement, Beaufort, SC. 2016 as presented at NCVH 20172. Allie DE, Hebert CJ, Ingraldi A, Patlola RR, Walker CM. 24-Carat Gold, 14-Carat Gold, or Platinum Standards in the Treatment of Critical Limb Ischemia: Bypass Surgery or Endovascular Intervention? J Endovsc Ther. 2009;16(Suppl I):I134–I146.3. American Heart Association - Heart Disease and Stroke Statistics- 2018 Update4. CSI estimates3

Company ProfileDeveloping innovative solutions for treating peripheral & coronary arterial disease80,000 Patients treated annually#1U.S. market leader in calcifiedperipheral and coronary atherectomy200 Patents5,700 Real-world patients studied throughclinical studies as of FY20800 Employees and a highlyexperienced leadership team200125U.S. direct sales representativesU.S. clinical specialists1,700 U.S. customers; hospital andoffice-based labs4

CSII: A Growth CompanyBroadening Our Value StreamsFinancial Goal: Accelerate Profitable Revenue GrowthGrow and Protectthe Core BusinessSustain Market LeadershipAttractive and Consistent Growthin Core BusinessInnovation DrivesIncremental GrowthGlobal Expansion AcceleratesGrowth of Core BusinessExpand Product Portfolio andAddressable MarketsDrive higher revenue per orbitalatherectomy procedureSteady Cadence of CommercialLaunchesCapturing Market Share andDriving Market DevelopmentStrategy is supported by a strong balance sheetOver 200 million in cash and no long-term debt5

Grow and Protectthe Core BusinessDual-Action Mechanism of ActionUniquely designed for calcium:Enables simultaneous modification of both intimal and medial calciumPULSATILE FORCESFACILITATES FRACTURE OFMEDIAL CALCIUM1,2DIFFERENTIAL SANDINGMODIFIES INTIMALCALCIUM1VESSELWALLMEDIALCrown’s diamond surfacesands intimal ALCIUMGenerated particulates areaverage 2 microns in size,smaller than red blood cells 2,4Facilitates fracture to affect medialcalcium.26

Grow and Protectthe Core BusinessProduct PortfolioA Strong Cadence of Innovation350,000PeripheralRadial OASViperCathTM XCZilient Peripheral Guide WireExchangeable Serieswith GlideAssist Next Gen Diamondback with GlideAssistNext Gen Stealth withGlideAssistPTA balloons (inc. Radial) WIRION Embolic ProtectionSystem 0.035 ViperCath Fem Length 80,000ViperWire Advance withFlex TipSapphire OTW 1.0 mmballoon*Next Gen CoronaryDiamondback 360 Teleport Microcatheter*Large Vessel ATKMixed Plaque WIRION Radial EPD ARRIVAL GuidingSheath High-Risk PCI hemodynamicpump platform CoronaryNext gen OAS withGlideAssistSmall Vessel (BTA) Coronary ScoreFlex NC* CTO portfolio Sapphire II PRO 1.0OTW balloon* Next Gen PTCA Balloons Next Gen CoronaryDiamondback 360 Sapphire NC 4.5-5.0 mmballoons*PATIENTS TREATED ANNUALLY (U.S.)FY19FY20FY21Fiscal Year: July - June These products are not approved for sale in the United States. Safety and effectiveness have not been established. Features and performance offuture approved product may vary. All future product launch dates are current estimates and subject to change.* Product is manufactured by OrbusNeich Medical.FY22

Grow and Protectthe Core BusinessLeadership in Medical Evidence5,700 8,000600 PatientsLesionsPhysiciansTrialLIBERTY 360 (3-year Data)PADOPTIMIZE (Enrollment Complete)OASIS, CONFIRM series, TRUTH,CALCIUM 360, and COMPLIANCE 360Sizen 1,204n 66 “All-comers” trial, any treatment optionNearly 700 Rutherford Class 4-6 patients enrolledOAS DCB vs. DCB aloneCalcified below-the-knee lesionsn 3,359 High rates of procedural success and durability Low adverse events/bail-out stentingn 2,000 Largest randomized trial to study coronary atherectomy for calcifiedcoronary lesions OAS DES vs. angioplasty (including cutting/scoring balloons) DES Currently paused due to Covid 19ORBIT II (3-year Data)n 443 High freedom from revascularization resulting in economic benefits1,2COAST (1-year Data)n 100 Supported approvals of Coronary OAS in U.S. and Japan Japan commercialization began in FY18ECLIPSE (Enrollment Began March 2017)CAD1.2.ImportanceLee M, et al, Orbital atherectomy for treating de novo, severely calcified coronary lesions: 3-year results of the pivotal ORBIT II trial, Cardiovasc Revasc Med (2017), http://dx.doi.org/10.1016/j.carrev.2017.01.011L.P. Garrison Jr. et al., Cardiovascular Revascularization Medicine 18 (2017) 86–908

Stable ReimbursementCPT LER Code Review to Reflect Advances in TechnologiesAMA Action Plan: January 2019Specialty Societies: SVS, SIR, ACC and ACRScreen: In October 2018, code 37229 was identified by the High-VolumeGrowth screen, for services with 2017e Medicare utilization of 10,000 or more thathas increased by at least 100% from 2012-2017CPT descriptor: Revascularization, endovascular, open or percutaneous, tibial,peroneal artery, unilateral, initial vessel; with atherectomy, includes angioplastywithin the same vessel when performed.The specialties will recommend referring this set of codes to CPT to updatethe code descriptors and to accommodate new technologies.Grow and Protectthe Core BusinessAMA reasoning for review:“We believe the growth in CPTCode 37229 (BTK Atherectomy) isappropriate and in line with thebest practices for limb sparing.However, there have been manyadvances in lower extremityendovascular treatment since thecreation of the family of codes.”Code set update to reflect advances in technologies since 2011 creation of current codes.Changes will take effect in CY 2023 at earliest and could be 2024-25.See appendix for historical reimbursement by site of service9

Excellence in Quality and ManufacturingGrow and Protectthe Core BusinessScalable and Continuous COGS ManagementManufacturingInitiativesVolume driven overhead leverageLabor productivityLEAN continuous improvementSourcing andSupply ChainMaterial cost reductionsScalable andcontinuous reductionsto protect strong grossmarginsVertical Integration10

Innovation DrivesIncremental GrowthProduct PortfolioA Strong Cadence of Innovation350,000PeripheralRadial OASExchangeable Series withGlideAssist PTA balloons (includingRadial) ViperCathTM XCNext Gen Diamondback withGlideAssistWIRION EmbolicProtection System Zilient PeripheralGuide WireNext Gen Stealth withGlideAssistCoronary80,000Next gen OAS withGlideAssistViperWire Advancewith Flex Tip0.035 ViperCath FemLength Sapphire OTW 1.0 mmballoon*Next Gen CoronaryDiamondback 360 Teleport Microcatheter*Sapphire NC 4.5-5.0 mmballoons*Coronary ScoreFlex NC* Sapphire II PRO1.0 OTW balloon* Small Vessel (BTA) Large Vessel ATKMixed Plaque WIRION Radial EPD ARRIVAL GuidingSheath High-Risk PCIhemodynamic pumpplatform CTO portfolio Next Gen PTCABalloons Next Gen CoronaryDiamondback 360 PATIENTS TREATED ANNUALLY (U.S.)FY19FY20FY21Fiscal Year: July - June These products are not approved for sale in the United States. Safety and effectiveness have not been established. Features and performance offuture approved product may vary. All future product launch dates are current estimates and subject to change.* Product is manufactured by OrbusNeich Medical.FY22

Innovation DrivesIncremental GrowthComplex Coronary Product PortfolioComprehensive portfolio to treat the most complex coronary patientsLaunched FY18Prep. Place. Perform.Severe coronary calcium ispresent in 6-20% of patientsundergoing PCI.1,2Sapphire II PRO 1.0-4.0 mmSapphire NC Plus 2.0-4.0 mmCalcium considered mild ormoderate by angiography mayactually be severe in advancedimaging (IVUS or OCT).3,4Product portfolio in collaboration with OrbusNeichLaunched FY19 Sapphire SC II PRO 1.0 mm OTW Sapphire NC Plus 4.5-5.0 mmSapphire BalloonsNext GenerationCoronary Diamondback 360 Sapphire ExpansionLaunched FY19Launched FY20Expected Launch H2 FY21(Spring CY21) 3. Lee, M. S. & Shah, N. The Impact and Pathophysiologic Consequences of Coronary ArteryCalcium Deposition in Percutaneous Coronary Interventions. J Invasive Cardiol 28, 160-167(2016).4. Mintz, G. S. Intravascular imaging of coronary calcification and its clinical implications.JACC Cardiovasc Imaging 8, 461-471, doi:10.1016/j.jcmg.2015.02.003 (2015).Launched FY20Teleport MicrocatheterViperWire Advance with Flex TipScoreFlex NC*12

Innovation DrivesIncremental GrowthPeripheral Product PortfolioRobust portfolio of options to treat multi-level peripheral diseaseLaunch FY21Launched FY20(Spring CY21)Increased flexibility totreat different sizevessels above andbelow the knee in asingle procedure.Over 50% of patientsundergoing a PVI havemulti-level disease.1Launch FY21(Spring/Summer CY21)WIRION EmbolicProtection SystemExchangeable Series withGlideAssist Launched FY19Launched FY19Femoral lengthViperCath XC*Launch FY21(Spring CY21) 50% of the time ATK and BTK aretreated in separate procedures.1Product portfolio in collaboration with OrbusNeich *Zilient PeripheralGuidewire Teleport MicrocatheterJADE OTW andSapphire 1.0 mmBalloons13

Innovation DrivesIncremental GrowthRadial Product PortfolioEnabling a complete peripheral intervention from the radial arteryOptimize the patientexperience. CSI offers thefirst and only atherectomydevices enabling radialaccess to deliversignificant patient, clinical,and economic benefits.Launched FY19Launched FY19Launch FY22ViperCath XCExtended lengthOrbital Atherectomy SystemARRIVAL Guiding Sheath*Launch FY21FY21Expected Launch H2 FY22(Spring CY21)(1H CY22)Extended length PTABalloons*Extended lengthWIRION EmbolicProtection System*Femoral access is not possiblewith some patients.Lack of longer-length productslimits the ability to performperipheral interventions froma radial access site.14

Percutaneous Ventricular Assist Device (pVAD) SystemInnovation DrivesIncremental GrowthProviding temporary hemodynamic support for use in high risk PCI proceduresDeliver hemodynamic support to aide incomplete revascularization during high riskPCI proceduresMarker bandProvide optimal Profile-to-Output (PTO) to supporthigh risk interventions Flow: 3-5 LPMCrossing Profile: 10-14 Fr AccessCatheter Profile: 6-8 FrPhysician control and flow monitoring within thesterile fieldImproving ease of use, simplified user interface,hospital mobility, and increased runtime (12 hours),Compact console design ( 15 lbs)15

Global Expansion AcceleratesGrowth of Core BusinessGlobal Distribution NetworkPartnerships to Expand Orbital Atherectomy Across the GlobeSt. PaulCorporate Headquarters 800 employees United States direct sales force includes 200 sales reps and 125 clinical specialistsHong KongCorporate Headquarters 600 employees Develops, manufactures and distributes vascularintervention devices in more than 60 countries Exclusive distributor for OAS outside U.S. and JapanTokyoCorporate Headquarters 1,000 employeesCSI Direct SalesOrbusNeichMedikit Exclusive distributor for OAS in Japan16

Cardiovascular Systems, Inc.Creating Shareholder ValueLeveraging aStrong Core BusinessA CompellingGrowth StrategyCreatingCompetitive AdvantageImproving outcomes forcomplex coronary andperipheral artery diseaseDriving market leadingperformance in orbitalatherectomyHigh qualityproducts, servicesand relationshipsProprietarycore technologyServing large andgrowing marketsExpanding intonew geographic marketsInnovation and robustmedical evidenceDeveloping an innovativeportfolio of new productsMedical educationand superior clinicalsupportFinancially Strongwith the Team andTalent to WinSustaining double digitgrowthwith strong gross marginsPositive cash flow, strongcash position and nolong-term debtPositioned to investin organic growthA Mission drivenorganizationwith the leadership andtalent to succeed17

Appendix 2020 Cardiovascular Systems, Inc. All Rights Reserved.

Q1 FY21 Revenues of 60.5 Million42% Sequential Quarterly IncreaseQ1 FY21 Revenue Breakdown( in millions) 1.7US Peripheral revenue increased 40.0% sequentially Units sold increased 39.9% sequentially as procedurevolumes reboundedUS Coronary revenue increased 62.5% sequentially Units sold increased 62.6% sequentially as procedurevolumes rebounded Support product revenue increased to 543 per coronaryOAS soldInternational declined 18.2% sequentially Ability to enroll new accounts and drive adoption outsidethe U.S. is hindered by international travel restrictions OAS launched in 13 countries OUS to-date19

Financial Results ( in millions): Q1 FY21Worldwide Peripheral Revenue 45.5 47.6Worldwide Coronary Revenue 42.9 42.6 30.6 19.0 18.56% YOYdeclineWW in Q1due toCovid-19Gross Margin80.4% 79.9% 80.0% 76.2% 20.8 17.6 11.97% YOYdeclineWW in Q4due toCovid-19Cash and Marketable Securities 232.2 222.979.2%300 basis pointsequentialimprovement 105.0 109.4 107.3

Quarterly Scorecard: Q1 FY21 in (000)Q1 FY21YOYSequentialTotal Revenue 60,544-6.1%42.3%Worldwide Peripheral Revenue 42,932-5.7%40.0%Worldwide Coronary Revenue 17,612-7.1%48.4% 58,831-4.4%45.4% 42,932-5.2%40.0%--2.7%39.9% 15,899-2.2%62.5%--5.9%62.6% 1,713-42.1%-18.2%US RevenueUS Peripheral RevenueUS Peripheral Unit GrowthUS Coronary RevenueUS Coronary Unit GrowthInternational Revenue

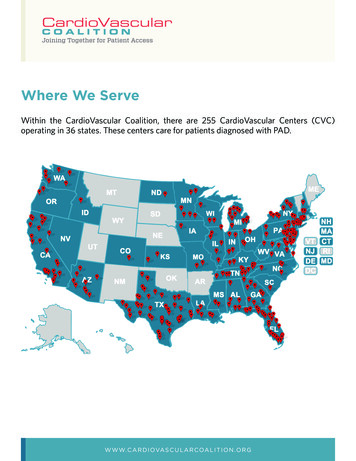

Highlights: Q1 FY21HighlightsFinancialRevenues -6.1% vs. LYOperational - Peripheral Gross Margin 79.2%SGA Expenses -13.8% to 40.3M R&D Expenses -15.9% to 9.1M Net Loss of (2.1)M Cash and marketable securitiesdecreased to 222.9MNo long-term debt Peripheral franchise performedbetter than expected, led by an8% year-over-year growth in theOBL segment.Peripheral units sold were 97%compared to last year.Exchangeable OAS nowrepresents nearly 20% ofperipheral volume.Targeting launch of WIRIONEPD in NovemberTargeting launch of peripheralsupport products in 2H FY217,900 patients clicked through toidentify physician l - Coronary Coronary OAS units increased63% compared to Q4 and were94% compared to Q1 last yearContinued adoption of coronarytoolkit featuring OAS withGlideAssist, 1.0mm Sapphireangioplasty balloons, TeleportMicrocatheter and nitinolViperWire with Flex Tip drove 543 of incremental revenuefor every coronary OAS sold inQ1Anticipate CE Mark in FY21ECLIPSE enrollment resumedOctober 1, 2020 Sold 20,000 OAS unitsNearly 1,000 medicalprofessionals attended CSIvirtual education programsTargeting FIH experience forpVAD device in FY21Review of lower extremityendovascular code set waswithdrawn from October 2020CPT Editorial Panel agendaAmputation Reduction andCompassion Act introduced inU.S. House ofRepresentatives to cover PADscreening, require diagnostictesting prior to amputationand increased PAD education

Investor Contact:Jack Nielsen651-202-4919j.nielsen@csi360.comCSI , Diamondback , Diamondback 360 ,GlideAssist , ViperWire , WIRION andViperWire Advance are trademarks ofCardiovascular Systems, Inc. 2020 Cardiovascular Systems, Inc.CSIIOrbusNeich , Teleport and Sapphire aretrademarks of OrbusNeich Medical, Inc.Cardiovascular Systems, Inc.For more information:www.csi360.com@csi36023

CSI’s actual future results may be materially different from what CSI expects. . CLI U.S. Supplement, Beaufort, SC. 2016 as presented at NCVH 2017 2. Allie DE, Hebert CJ, Ingraldi A, Patlola RR, Walker CM. 24-Carat Gold, 14-Carat Gold, or Platinum Standards in the Treatment of C