Transcription

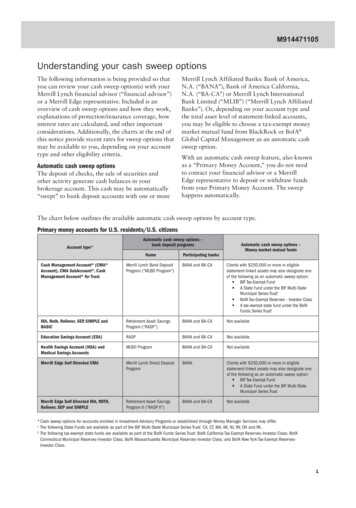

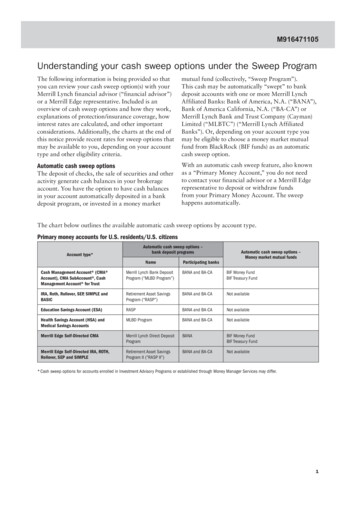

M916471105Understanding your cash sweep options under the Sweep ProgramThe following information is being provided so thatyou can review your cash sweep option(s) with yourMerrill Lynch financial advisor (“financial advisor”)or a Merrill Edge representative. Included is anoverview of cash sweep options and how they work,explanations of protection/insurance coverage, howinterest rates are calculated, and other importantconsiderations. Additionally, the charts at the end ofthis notice provide recent rates for sweep options thatmay be available to you, depending on your accounttype and other eligibility criteria.mutual fund (collectively, “Sweep Program”).This cash may be automatically “swept” to bankdeposit accounts with one or more Merrill LynchAffiliated Banks: Bank of America, N.A. (“BANA”),Bank of America California, N.A. (“BA-CA”) orMerrill Lynch Bank and Trust Company (Cayman)Limited (“MLBTC”) (“Merrill Lynch AffiliatedBanks”). Or, depending on your account type youmay be eligible to choose a money market mutualfund from BlackRock (BIF funds) as an automaticcash sweep option.Automatic cash sweep optionsWith an automatic cash sweep feature, also knownas a “Primary Money Account,” you do not needto contact your financial advisor or a Merrill Edgerepresentative to deposit or withdraw fundsfrom your Primary Money Account. The sweephappens automatically.The deposit of checks, the sale of securities and otheractivity generate cash balances in your brokerageaccount. You have the option to have cash balancesin your account automatically deposited in a bankdeposit program, or invested in a money marketThe chart below outlines the available automatic cash sweep options by account type.Primary money accounts for U.S. residents/U.S. citizensAutomatic cash sweep options –bank deposit programsAccount type*NameParticipating banksAutomatic cash sweep options –Money market mutual fundsCash Management Account (CMA Account), CMA SubAccount , CashManagement Account for TrustMerrill Lynch Bank DepositProgram (“MLBD Program”)BANA and BA-CABIF Money FundBIF Treasury FundIRA, Roth, Rollover, SEP, SIMPLE andBASICRetirement Asset SavingsProgram (“RASP”)BANA and BA-CANot availableEducation Savings Account (ESA)RASPBANA and BA-CANot availableHealth Savings Account (HSA) andMedical Savings AccountsMLBD ProgramBANA and BA-CANot availableMerrill Edge Self-Directed CMAMerrill Lynch Direct DepositProgramBANABIF Money FundBIF Treasury FundMerrill Edge Self-Directed IRA, ROTH,Rollover, SEP and SIMPLERetirement Asset SavingsProgram II (“RASP II”)BANA and BA-CANot available* Cash sweep options for accounts enrolled in Investment Advisory Programs or established through Money Manager Services may differ.1

Understanding your cash sweep optionsPrimary money accounts for non-residents/non-U.S. citizens*Account type†Automatic cash sweep options –Bank deposit programsNameCMA, CMA SubAccount and CashManagement Account for TrustParticipating BanksMLBD ProgramBANA and BA-CAInternational Bank VariableRate Deposit FacilityMLBTC‡Automatic cash sweep options –Money market mutual fundsDollar Assets Portfolio§* These automatic cash sweep options are not available to all clients. Jurisdictional restrictions apply. Please contact your financial advisor to determine if you areeligible to participate. For additional information on these automatic cash sweep options, please see your account agreement or contact your financial advisoror a Merrill Edge representative.† Cash sweep options for accounts enrolled in Investment Advisory Programs may differ.‡ Deposits are placed with MLBTC, a bank incorporated in the Cayman Islands. Deposits held at MLBTC are not deposits within the meaning of the FederalDeposit Insurance Act (12 U.S.C. 1813(I)), are not insured or guaranteed by the U.S. government, the FDIC or any other government agency or covered by anyother deposit protection program.§ Dollar Assets Portfolio (the Fund) is offered only to non-US citizens who are not residents of the United States. It is not offered for sale or sold in theUnited States, its territories or possessions. The Fund may only be offered in jurisdictions in which such offer or sale is permitted. The Fund is a no-load openended investment company incorporated as an exempted company under the laws of the Cayman Islands. The Fund is a money market mutual fund seekingcurrent income consistent with the preservation of capital and liquidity by investing in a diversified portfolio of United States dollar denominated short-termmoney market instruments of high quality issuers. There can be no assurance that the investment objective of the Fund will be realized. BlackRock InvestmentManagement, LLC acts as the investment adviser (the Investment Adviser) for the Fund, with full responsibility for the selection and management of the Fund’sportfolio investments. The Investment Adviser is registered with the U.S. Securities and Exchange Commission pursuant to the U.S. Investment Advisers Act of1940, as amended.Your Merrill Lynch account statement indicates where your cash balances are currently deposited or invested,as well as recent yield information.Additional money accounts/manual alternativesIn addition to your Primary Money Account, youmay be able to choose additional cash sweep optionsor “manual alternatives” that provide automaticwithdrawal/redemption only. Depending on youraccount type, manual alternatives may include bankdeposit programs, money market mutual fundsor the Insured Savings Account (ISA ),1 a limitedtransaction deposit program.If you choose a manual alternative, you mustcontact your financial advisor or a Merrill Edgerepresentative each time you want to invest ordeposit your cash. Otherwise, available cash willcontinue to automatically sweep to your PrimaryMoney Account.Manual alternatives provide an automatic withdrawal/redemption feature in order to satisfy purchases anddebits from your account, including check writing,Visa card activity and other cash managementactivity. Therefore, you do not need to contact yourfinancial advisor or a Merrill Edge representativewhen you need to withdraw funds. However, cashin a manual alternative will only be withdrawn orredeemed automatically when the Primary MoneyAccount is depleted or in the order in which you havedesignated for the account.A “No Sweep” option is available to CMA accounts.This provides the capability to choose NOT to haveyour free credit and cash balances automatically sweptto a bank deposit or money market mutual fund.This means that if you choose this option, your cashwill not be deposited into a bank deposit program orinvested into a money market mutual fund. Instead,it will remain as cash until it is needed to satisfy anydebits and will not earn interest or dividends. Freecredit balances and cash held in a brokerage accountat Merrill Lynch are “cash” and receive SIPC andexcess-SIPC protection. For additional information onthe SIPC, visit sipc.org.If your account is enrolled in a Merrill Lynchinvestment advisory program and you choose theNo Sweep option, you should understand thatMerrill Lynch may charge an asset-based advisory feeon the cash in the account even though you are notearning any interest or dividends on that cash.Please speak with your financial advisor or aMerrill Edge representative to find out more aboutthe manual alternatives that may be available to you.Continued on page 32

Understanding your cash sweep optionsConsiderations when choosing a cash sweep optionWhen choosing a cash sweep option, it is importantto consider the following: Your needs, goals, risk tolerance, investment timehorizon and liquidity requirements. Yields may differ between money market mutualfunds and bank deposit programs. Money market mutual funds and bankdeposit programs have different types ofprotection/insurance coverage. See sectionsbelow for additional details. Money market mutual funds have investmentrisk of various degrees and are not guaranteed orinsured as to principal.FDIC insurance and other bank deposit protectionYour sweep deposits in BANA and BA-CA areinsured by the Federal Deposit Insurance Corporation(“FDIC”) up to the applicable standard maximumdeposit insurance amount (“SMDIA”). The SMDIAis currently 250,000 per depositor, per ownershipcategory, per bank. Deposits maintained in differentcategories of legal ownership — such as individualaccounts, joint accounts or certain retirementaccounts — are separately insured by the FDIC, upto applicable insurance limits. FDIC insurance coversboth principal and credited interest. Any accountsor deposits maintained with BANA or BA-CA inthe same legal ownership category, whether directly,through other Merrill Lynch accounts or through anyother intermediary, would be aggregated for FDICinsurance limit purposes.Deposits placed with MLBTC are not depositswithin the meaning of the Federal Deposit InsuranceAct (12 U.S.C. 1813(I)). MLBTC deposits are notinsured or guaranteed by the U.S. government, theFDIC or any other government agency or covered byany other deposit protection program.Clients are responsible for monitoring the totalamount of deposits held at BANA and BA-CA inorder to determine the extent of FDIC insuranceavailable to such deposits. Merrill Lynch is notresponsible for any insured or uninsured portionof such deposits.For additional information on FDIC, refer to youraccount agreement or visit www.fdic.gov.SIPC and excess-SIPC coverageThe securities and cash that Merrill Lynch holdsin your brokerage account are protected by theSecurities Investor Protection Corporation (“SIPC”).If a U.S. broker-dealer fails, SIPC funds are availableto make up for any shortfall of client assets that thebroker-dealer was required to maintain — up toa maximum of 500,000 per client for securities,inclusive of up to 250,000 per client for cash.In addition, Merrill Lynch has obtained “excessSIPC” coverage from a Lloyd’s of London syndicatefor large client accounts. This policy provides furtherprotection (including up to 1.9 million for cash) forcustomers who would not be made whole by SIPC,subject to an aggregate loss limit of 1 billion for allcustomer claims.Please note that money market mutual funds anddeposits in BANA and BA-CA are not “cash” forpurposes of SIPC account protection. Rather, moneymarket mutual funds receive SIPC and excess-SIPCprotection as securities, and deposits in BANA andBA-CA are protected by FDIC insurance. SIPCand excess-SIPC coverage do not protect againstinvestment losses from market action.For additional information on SIPC, visitwww.sipc.org.Benefits to Merrill LynchDeposits held at the Merrill Lynch Affiliated Banksare financially beneficial to Merrill Lynch and itsaffiliates. For example, the Merrill Lynch AffiliatedBanks use bank deposits to fund current and newlending, investment and other business activities. Likeother depository institutions, the profitability of theMerrill Lynch Affiliated Banks is determined in largepart by the difference between the interest paid andother costs incurred by them on bank deposits, andthe interest or other income earned on their loans,investments and other assets. The deposits providea stable source of funding for the Merrill LynchAffiliated Banks, and borrowing costs incurred tofund the business activities of the Merrill LynchAffiliated Banks have been reduced by the use ofdeposits from Merrill Lynch clients.Merrill Lynch receives up to 100 per year fromBANA and BA-CA for each account that sweeps tothe Merrill Lynch Bank Deposit (“MLBD”) Programand Merrill Lynch Direct Deposit Program, andup to 85 per year for each account that sweepsto RASP or RASP II. Merrill Lynch receives up to 100 per year from MLBTC for each account thatsweeps to the International Bank Variable RateDeposit Facility and a fee of up to 2% per annum ofthe average daily balances from the ISA banks. Thiscompensation is subject to change from time to timeand Merrill Lynch may waive all or part of it.Continued on page 43

Understanding your cash sweep optionsMerrill Lynch financial advisors are compensatedbased on their clients’ total deposits held in theMerrill Lynch Affiliated Banks (excludes RASPand RASP II).Assets held in the BlackRock money market mutualfunds are also financially beneficial to Merrill Lynchand its Affiliates. Merrill Lynch provides theplatform infrastructure related to the use of thesemoney market mutual funds as the automaticcash sweep option in accounts at Merrill Lynchas well as distribution, marketing support andother services with respect to the money marketmutual funds. In consideration of the provision ofthe infrastructure, marketing support and/or otherservices, Merrill Lynch receives compensation of upto 0.44% annually of the value of money marketmutual fund shares held in Merrill Lynch accounts.Merrill Lynch also provides various sub-accountingand other related administrative services with respectto each money market mutual fund position held inan account at Merrill Lynch. As compensation forthese services, Merrill Lynch receives either up to 15annually for each position or up to 0.10% annuallyof the value of money market mutual fund sharesheld in a client’s account at Merrill Lynch. Certain ofthe money market mutual funds have also retainedFinancial Data Services, Inc. (“FDS”), an affiliate ofMerrill Lynch, as the transfer agent to such funds.Each money market mutual fund’s operating costsinclude its allocable share of the fees and expenses ofsuch outside service providers.Merrill Lynch financial advisors are compensatedbased on their clients’ total assets held in the cashsweep option money market mutual funds.Rates and yieldsInterest rates for the MLBD Program, Merrill LynchDirect Deposit Program, RASP, RASP II and theInternational Bank Variable Rate Deposit Facility: Are determined by the Merrill Lynch AffiliatedBanks in their sole discretion. Are variable and may change at any time afterthe account is opened, without notice or limit.Fees may reduce earnings. May be higher or lower than the interest ratesand Annual Percentage Yield (“APY”) availableto other depositors of the Merrill LynchAffiliated Banks for comparable accounts orthe rates of return payable on comparablearrangements offered to Merrill Lynch clients.For certain account types with the MLBD Programor RASP, interest rates are tiered based upon yourrelationship with Merrill Lynch, as described in“Linking accounts.” Clients with higher total eligibleassets may receive a higher yield on their bank deposits.Clients should compare the terms, interest rates,APY, rates of return, required minimum amounts,charges and other features with other accounts andalternative investments before deciding to maintainbalances in deposit accounts through the MLBDProgram, RASP, Merrill Lynch Direct DepositProgram, RASP II or the International Bank VariableRate Deposit Facility.Yield information on any deposits held at theMerrill Lynch Affiliated Banks is included onyour Merrill Lynch account statement. You canalso obtain current interest rate information onMyMerrill.com (see the “Deposit Account &Money Fund Rates” link at the bottom of eachpage) or by contacting your financial advisor or aMerrill Edge representative.Linking accountsYou may be able to “link” your accounts togetherfor statement delivery purposes and to establishhigher levels of eligible assets and a potentially higherinterest-rate tier for the MLBD Program and RASP.For regulatory or other reasons, certain types ofaccounts that can be linked for statement deliverypurposes cannot be linked for the purposeof determining your total eligible assets.Interest-rate tiering does not apply to deposits inthe Merrill Lynch Direct Deposit Program, RASP IIor the International Bank Variable Rate DepositFacility. MLBD Program and RASP deposits fromaccounts enrolled in certain Investment AdvisoryPrograms receive the Merrill Lynch Bank DepositProgram Tier 4 rate.2If you have any questions about linking youraccounts or linking eligibility, please contact yourfinancial advisor or Merrill Edge representative.Additional information on cash sweep optionsYour Merrill Lynch financial advisor or a Merrill Edgerepresentative is available to discuss your cash sweepoptions as the yields on respective cash sweep optionsmay change, depending on market conditions, atdifferent times throughout the year.Please refer to the MLBD Program, RASP, RASP II,Merrill Lynch Direct Deposit Program or theInternational Bank Variable Rate Deposit FacilityContinued on page 54

Understanding your cash sweep optionsdisclosures in your account agreement for additionaland more detailed information concerning sweepdeposits with the Merrill Lynch Affiliated Banks.For additional information on ISA, refer to yourISA Fact Sheet or contact your financial advisor orMerrill Edge representative.The charts below and on the following page displaycash sweep options that may be available to you,depending on your account type and other eligibilitycriteria. If you have any questions, please contact yourfinancial advisor or a Merrill Edge representative.1I SA is a series of electronically linked money market deposit accounts(“MMDAs”) into which funds are deposited on your behalf by Merrill Lynch.The MMDAs are held at one or more depository institutions, whose depositsare insured by the FDIC, including depository institutions affiliated withMerrill Lynch and its parent, Bank of America Corporation. The ISA programis not appropriate for clients who anticipate effecting frequent third-partypayments or transfers, including payments or transfers by check orthrough the Funds Transfer Service. ISA has a minimum opening depositof 1,000. Merrill Edge Self-Direct clients are not eligible to participate inthe ISA program.2P lease refer to the Recent Yields on bank deposits table for the Tier 4 rate(as of 9/2/2016).Recent yields on bank depositsBank deposits available through Merrill Lynch accounts*MLBD Program – Tier 1 ( 250,000)MLBD Program – Tier 2 ( 250,000 to 1M)MLBD Program – Tier 3 ( 1M to 10M)MLBD Program – Tier 4 ( 10M)MLBD Program – Tier 5†ISARASP – Tier 1 ( 250,000)RASP – Tier 2 ( 250,000 to 1M)RASP – Tier 3 ( 1M to 10M)RASP – Tier 4 ( 10M)Merrill Lynch Direct Deposit ProgramRASP IIInternational Bank Variable Rate Deposit FacilityAPY as of 01%0.02%0.01%0.01%0.02%* Please note: Availability is based on account type and may depend on other eligibility criteria.†Offered during previous promotions; currently new enrollments are not being accepted.Important informationThe availability of the bank deposits included in the Recent yields on bank deposits table is based on account type and may depend on other eligibilitycriteria. Yields shown are indicative of recent yields as of the date shown and are subject to change and availability.The Recent yields on bank deposits table does not constitute a recommendation or solicitation by Merrill Lynch for the purchase or sale of any particular product.Bank depositsAnnual Percentage Yield (“APY”) of a bank deposit account is a rate based on daily compounding of interest, and assumes interest is not withdrawn from thedeposit account and there is no change to the interest rate for one year. Note that the interest rate (and APY) may change at any time at the depository bank’sdiscretion, after the deposit account is opened. The depository bank uses the daily balance method to calculate interest on your deposit account, whichapplies a daily periodic rate to the principal in your deposit account each day. Fees may reduce earnings.Recent yields on money market mutual fundsMoney market mutual funds*BIF Money FundBIF Treasury FundReady Assets U.S.A. Government Money FundReady Assets U.S. Treasury Money FundReady Assets Prime Money FundRetirement Reserves Money Fund Class I (closed to new investors)Retirement Reserves Money Fund Class IIDollar Asset Portfolio

BANA BIF Money Fund BIF Treasury Fund Merrill Edge Self-Directed IRA, ROTH, Rollover, SEP and SIMPLE Retirement Asset Savings Program II (“RASP II”) BANA and BA-CA Not available * Cash sweep options for accounts enrolled in Investment Advisory Programs or established through Money Manager Services may differ. M916471105File Size: 315KB