Transcription

Payment Gateway OverviewGet familiar with credit card processing & our platform

What Do Merchants Need to Be Successful Online?Understanding all of the working parts involved in your merchant customers’ success onlineDomain RegistrarWeb/App DeveloperWeb HostingShopping CartAccepting Payments

The Common Merchant Struggle:Piecing together all of the working parts to get their ecommerce store up and runningTo do this, he knows he will need to:This is Joe the MerchantHe wants to sell blue widgets onlineRegister a domain forhis ecommerce websiteFind a good web developerand even after all of that, there isstill one missing piece Joe needs Accepting PaymentsDecide on a hosting companySelect a shopping cart provider3

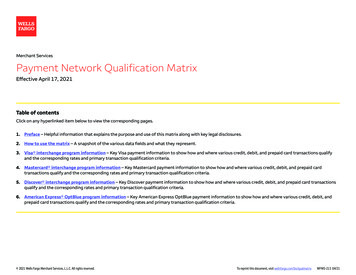

Great Question Joe.What Do Merchants Need to Accept Payments?Merchant Account A merchant account, also known as a MID(short for Merchant ID), is a type of bankaccount that enables merchants to accept andprocess payments through debit & credit cardtransactions and connects the merchant withthe processor.Merchants can obtain a merchant accountthrough a Merchant Service Provider, likeDharma Merchant Services.Merchant accounts are a necessity for manybusinesses, and are essential for merchantswith ecommerce businesses.Payment Gateway AccountPayment ProcessorA merchant account and paymentgateway account both connect tothe processor & both accounts areessential in order for merchants toaccept payments. If a merchant wants to get paid, they need apayment gateway account.A payment gateway account connects to theprocessor & securely transfers informationbetween the merchant’s website and theirmerchant account.A payment gateway is what authorizes creditcard payments and is the equivalent of aphysical point-of-sale terminal located in mostretail outlets.4

Let’s Walk Through the Steps with JoeNow that Joe knows what he needs, he is only a few steps away from accepting payments on his ecommerce storeNow Accepting Payments!Joe’s Merchant Account Joe applies for a merchant account throughDharma Merchant Services.Dharma Merchant Services has a list ofrequirements given to them by its acquiring bank(see slide 10 for definition).Joe’s application satisfies all the requirementsand he is granted a MID!Joe’s Payment Gateway Account Joe needs a payment gateway account so hecan connect his MID to his website.Joe opens a gateway account with DharmaMerchant Services which allows him to inputhis MID. 5

How Does Credit Card Processing Work?Understanding all of the working parts involved in processing a credit card transactionCardholderMerchantPayment GatewayPayment ProcessorIssuing BankCredit Card NetworkAcquiring Bank

Key Players in Processing a Credit Card TransactionCardholderMerchantIssuing BankA cardholder is someonewho has obtained a creditor debit card from a cardissuing bank. They are theone who begins the creditor debit card transaction byusing their card to make apayment to a merchant fortheir goods or services.A merchant is someone whowants to accept credit anddebit card payments from theircustomers (cardholders) for thegoods or services they sell.They must obtain a merchantaccount and set up a paymentgateway account before theycan start accepting paymentsand get paid.(Cardholder Bank)This is SuziLook it’s Joe!Payment GatewayJoe’s PaymentGateway AccountA payment gateway authorizescredit card payments and is whatsecurely transfers paymentinformation between themerchant’s website and theirmerchant account.Joe’s ProcessorSuzi’s BankThe issuing bank issues creditcards to consumers. They areresponsible for paying theacquiring bank for thepurchases their cardholdersmake.Credit CardNetworkThe credit card networkhelps to connect theissuing and acquiringbanks by routing theappropriate transactioninformation between thetwo banks.Payment ProcessorAcquiring BankThe payment processor works to actually processthe credit card transaction from start to finish. Itdoes this by connecting the merchant account withthe payment gateway so it can receive thetransaction details and it also connects theDharma/NMI Gateway to the Credit Card Networkfor authorization from the issuing bank.(Merchant Bank)Joe’s BankThe acquiring bank is also referred to asthe merchant bank because they createand maintain merchant accounts thatallow a merchant’s business to acceptcredit and debit cards.7

Credit Card Transaction Flow2. Suzi’s Transaction Details are Sent toDharma/NMI gatewayThe gateway references Joe’s MID and using a secureconnection to the payment processor, routes thetransaction details on to them.1. Suzi the Cardholder Purchases a Blue WidgetJoe’s Payment ProcessorSuzi has been searching for the perfect blue widget andafter finding Joe’s Blue Widget’s ecommerce site shedecides to buy one. So she enters in her payment infoand submits the transaction.Joe’s Payment Gateway Accountwith Dharma Merchant ServicesJoe’s Merchant Account8

3. Joe’s Payment Processor Receives the Transaction DetailsAfter Joe’s payment processor receives them, they send the request on to theCredit Card Network who identifies the issuing bank for the payment card andsends the request on to them.Step 3Step 3Step 4Step 4Joe’s Payment ProcessorIssuing Bank (Suzi’s Bank)Credit Card Network4. Suzi’s Issuing Bank Approves or Declines TransactionAfter the issuing bank checks Suzi’s account, they either approve or decline thetransaction and then the results back to the Credit Card Network who sends itback to Joe’s payment processor.9

5. Joe’s Payment Processor Relays the Results back to Dharma/NMI GatewayAfter Joe’s Payment Processor receives the results, they relay them back to the Dharma/NMIGateway where the Dharma/NMI Gateway stores the results and then sends them back to thewebsite where Suzi & Joe see the approval or decline.Joe’s Payment ProcessorJoe’s Payment Gateway Accountwith Dharma Merchant Services7. Joe Gets PaidThe issuing bank (Suzi’s bank) releases thefunds to the acquiring bank (Joe’s bank).After the settlement period Joe’s bankreleases to funds to his account where hecan access the money.Suzi’s Bank6. Suzi’s Transaction was Approved!Now that Suzi’s transaction has been approved,Joe can now send out the blue widget to Suzi.Joe’s Bank10

What Does The Dharma/NMI Gateway Offer?Understanding the payment gateway’s CapabilitiesProcessing EnvironmentsCore FeaturesData Security &Fraud DetectionPayment Types &Acceptance MethodsBack Office Tools

Merchant Payment Processing EnvironmentsOur omni-channel platform supports all types of merchant payment processing environments such asecommerce, retail, mobile, MOTO, restaurant & Apple PayVirtual TerminalSwIPeiProcess Mobile APIGateway APIsEnables merchants toprocess transactions bysubmitting credit cardand electronic checkpayments online.Enables merchants usingcard readers to acceptcard-present transactionsby installing a lightweightWindows based point-ofsale software application.Enables merchants toaccept mobile paymentsthrough a secureapplication for Apple &Android devices.Provides developers with atoolkit that makes addingcard readers to a paymentapplication seamless andstraightforward.Take advantage of ourflexible Integration Librarythat enables you to supportecommerce, mobile andretail payment processingenvironments for yourcustomers.Batch ProcessingFacilitates processing largequantities of paymentsefficiently by multithreading simultaneoustransaction requests.12

Payment Gateway Core FeaturesVirtual TerminalProduct ManagerSwipe credit & key-in cards, andchecks from your browserManage product SKUs & quickly recallproducts when creating new VirtualTerminal transactions.Currencies AcceptedRecurring BillingUSD, CAD, many internationalcurrencies based upon processorintegrationSetup payment plans & subscriptionswithout having to collect paymentinformation againCard Types AcceptedVisa, MasterCard, Discover,American Express, Diners Club, JCBReporting CapabilitiesSearch & get detailed insight intotransactions13

Payment Gateway Core FeaturesManage Multi-MIDsBoard multiple MIDs to a single gatewayaccount to consolidate reporting, managebranches, organize products, Etc.Advanced Transaction RoutingInterface (ATRI)Allows a merchant with multiple MIDs on asingle gateway account to automaticallydetermine which MIDs to route transactionsto based on advanced load balancingdirectivesQuickClickAllows merchants to quickly & easily link awebsite to the payment gateway by utilizing anative payment gateway shopping cartsolution.Customer SupportOur customer support team hasextensive gateway knowledge and ishere to answer any gateway relatedquestions you have.Three-Step Redirect APIReduces a merchant’s PCI footprintby eliminating transmission ofsensitive payment information.Gateway EmulatorEnables merchants to migrate fromother industry gateways to theDharma/NMI Gateway.14

Additional Processing FeaturesiSpy FraudElectronic InvoicingElectronic CheckReal-time fraud scrubbing utility thathelps to differentiate legitimate fromfraudulent transactions.Enables merchants to invoice customers viaemail. Customers can then submit payments byfollowing an embedded link. Invoices aregenerated with line detailed information andautomatically convert to PDFs that are attachedand emailed to customers.Enables online and traditional merchants toaccept and process electronic check paymentsdirectly from an ecommerce storefront orthrough Virtual Terminal.Customer VaultLevel III ProcessingPCI-compliant encrypted and tokenized customercredit card and ACH account data storage.Tokenization allows merchants to processtransactions without transmitting credit card orACH account data.Level III Processing is used by government and enterpriselevel corporations when handling large orders throughbusiness-to-business and business-to-governmenttransactions.15

Payment Gateway Account If a merchant wants to get paid, they need a payment gateway account. A payment gateway account connects to the processor & securely transfers information between the merchant’s website and their merchant account. A payment gateway is what a