Transcription

Quarterly UpdateQ2 2022 UPDATEAugust 3, 2022INTEGRITY ISNANF EOTVYA T I O NP E O P L SE A F E T Y I N N O VP AEOT I POLNE EXCELLENCE

FORWARD-LOOKING STATEMENTS This presentation contains forward-looking statements within the meaning of the federal securities laws. Although these statements reflect the current views, assumptions andexpectations of our management, the matters addressed herein involve certain assumptions, risks and uncertainties that could cause actual activities, performance, outcomesand results to differ materially from those indicated herein. Therefore, you should not rely on any of these forward-looking statements. All statements, other than statements ofhistorical fact, included in this press release constitute forward-looking statements, including but not limited to statements identified by the words “forecast,” “may,” “believe,”“will,” “should,” “plan,” “predict,” “anticipate,” “intend,” “estimate,” “expect,” "continue," and similar expressions. Such forward-looking statements include, but are not limited to,statements about guidance, projected or forecasted financial and operating results, expected financial and operations results associated with certain projects, acquisitions, orgrowth capital expenditures, future operational results of our customers, results in certain basins, future results or growth of our CCS business, future cost savings or operationalinitiatives, profitability, financial or leverage metrics, the impact of weather-related events on us and our financial results and operations, the impact of any customer billingdisputes and litigation arising out of weather-related events, future expectations regarding sustainability initiatives, our future capital structure and credit ratings, the impact of theCOVID-19 pandemic or variants thereof on us and our financial results and operations, objectives, strategies, expectations, and intentions, and other statements that are nothistorical facts. Factors that could result in such differences or otherwise materially affect our financial condition, results of operations, or cash flows include, without limitation (a)the impact of the ongoing coronavirus (COVID-19) pandemic, including the impact of the emergence of any new variants of the virus on our business, financial condition, andresults of operations, (b) potential conflicts of interest of Global Infrastructure Partners (“GIP”) with us and the potential for GIP to compete with us or favor GIP’s own interests tothe detriment of our other unitholders, (c) adverse developments in the midstream business that may reduce our ability to make distributions, (d) competition for crude oil,condensate, natural gas, and NGL supplies and any decrease in the availability of such commodities, (e) decreases in the volumes that we gather, process, fractionate, ortransport, (i) our ability or our customers’ ability to receive or renew required government or third party permits and other approvals, (j) increased federal, state, and locallegislation, and regulatory initiatives, as well as government reviews relating to hydraulic fracturing resulting in increased costs and reductions or delays in natural gas productionby our customers, (k) climate change legislation and regulatory initiatives resulting in increased operating costs and reduced demand for the natural gas and NGL services weprovide, (l) changes in the availability and cost of capital, including as a result of a change in our credit rating, (m) volatile prices and market demand for crude oil, condensate,natural gas, and NGLs that are beyond our control, (n) our debt levels could limit our flexibility and adversely affect our financial health or limit our flexibility to obtain financingand to pursue other business opportunities, (o) operating hazards, natural disasters, weather-related issues or delays, casualty losses, and other matters beyond our control, (p)reductions in demand for NGL products by the petrochemical, refining, or other industries or by the fuel markets, (q) our dependence on significant customers for a substantialportion of the natural gas and crude that we gather, process, and transport, (r) construction risks in our major development projects, (s) challenges we may face in connectionwith our strategy to enter into new lines of business related to the energy transition, (t) impairments to goodwill, long-lived assets and equity method investments, and (u) theeffects of existing and future laws and governmental regulations, and other uncertainties. These and other applicable uncertainties, factors, and risks are described more fully inEnLink Midstream, LLC’s and EnLink Midstream Partners, LP’s filings with the Securities and Exchange Commission, including EnLink Midstream, LLC’s and EnLink Midstream Partners,LP’s Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K. Neither EnLink Midstream, LLC nor EnLink Midstream Partners, LP assumes anyobligation to update any forward-looking statements. The EnLink management team based the forecasted financial information included herein on certain information and assumptions, including, among others, the producerbudgets / forecasts to, which EnLink has access as of the date of this presentation and the projects / opportunities expected to require growth capital expenditures as of the dateof this presentation. The assumptions, information, and estimates underlying the forecasted financial information included in the guidance information in this presentation areinherently uncertain and, though considered reasonable by the EnLink management team as of the date of its preparation, are subject to a wide variety of significant business,economic, and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the forecasted financial information. Accordingly,there can be no assurance that the forecasted results are indicative of EnLink's future performance or that actual results will not differ materially from those presented in theforecasted financial information. Inclusion of the forecasted financial information in this presentation should not be regarded as a representation by any person that the resultscontained in the forecasted financial information will be achieved.EnLink Midstream 2Q22 Quarterly Report2

INDEX2Q22 FINANCIAL RESULTS . . 52022 UPDATED GUIDANCE . . 9EXECUTION PLAN PRIORITIES . . 13APPENDIX . . 18EnLink Midstream 2Q22 Quarterly Report3

ENLINK MIDSTREAMIntegrated Business ModelFocused OnEnvironmentallyResponsible OperationsLarge-Scale, Cash-FlowGenerating PlatformCREATINGSUSTAINABLEVALUEDelivering EnergySolutions for the FuturePowered byOperational Excellence

2Q22 FINANCIALRESULTS

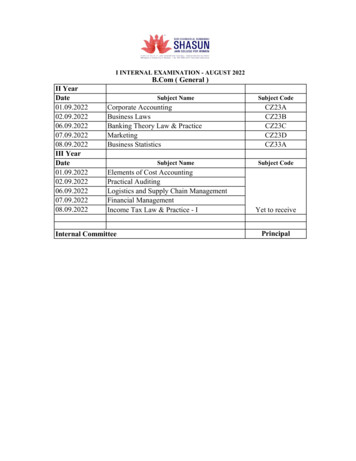

2Q22 FINANCIAL RESULTSADJUSTED EBITDA YEAR-OVER-YEAR GROWTH OF 16% MM, unless noted2Q22Net Income (Loss) 123.9Adjusted EBITDA, net to EnLink1 299.7Capex, net to EnLink, Plant Relocation Costs2, & Investment Contributions3Net Cash Provided by Operating ActivitiesFree Cash Flow After Distributions1Declared Distribution per Common Unit 98.7 174.9 67.5 0.1125As of June 30, 2022Debt-to-Adjusted EBITDA4Amount Outstanding on 1.4BN Revolving Credit FacilityCash, net to EnLink3.5x 0 11Record Quarterly Results 2nd consecutive quarter generating 300MM of Adjusted EBITDA Permian volumes and segmentprofit grew 11% and 24% sequentiallyand 46% and 76% YoY5, respectivelyRobust Free Cash Flow Generation Strong execution, cost control, andtiming of capex resulted in strong FCFAD Executed 75MM6 of common unitrepurchases in 1H22Strong Producer Activity & Outlook Robust commodity prices are drivingincreased producer activity across allsegments Expect significant growth to continue in thePermian and now in Oklahoma in 20231Non-GAAPmeasures are defined in the appendix. 2Includes 9.4MM and 1.7MM for 2Q22 in Permian and Oklahoma, respectively, for relocation costs related to plantrelocation classified as operating expenses in accordance with GAAP. 3Contributions of 26.6MM to the equity method investments for 2Q22, principally for Matterhorn JV.4Calculated according to revolving credit facility agreement leverage covenant, which may include up to 50MM of cash on the balance sheet. 5Excluding plantrelocation costs and unrealized derivatives. 6Includes 24MM of common units repurchased from GIP pursuant to the previously disclosed Unit Repurchase Agreementdated February 15, 2022 and which settled on August 2, 2022.EnLink Midstream 2Q22 Quarterly Report6

SEGMENT RESULTS OVERVIEWPOSITIVE VOLUME MOMENTUM DRIVES IMPROVED SEGMENT RESULTS2Q213Q214Q211Q222Q22Permian Gas Segment Profit28.158.460.150.4102.6Permian Crude Segment Profit15.910.713.722.69.5Segment Results ( MM)Total Segment ProfitQuarterly HighlightsPermian Sustained, robust producer activity in Midland Significant volume growth led to a greatercontribution from Delaware gas assets Excluding plant relocation costs and unrealizedderivative activity, segment profit increased 76%vs. 2Q2144.069.173.873.0112.1Plant Relocation OPEX110.08.80.18.99.4Unrealized Derivatives Loss/(Gain)7.9(10.2)4.75.9(12.5)Louisiana Gas Segment Profit10.65.918.314.117.8LouisianaLouisiana NGL Segment Profit47.850.185.869.464.3 ORV Crude Segment Profit8.97.77.67.06.9Benefited from robust pricing and purity productdemand from refineries and other downstreamcustomersTotal Segment Profit67.363.7111.790.589.0 9.48.8(19.3)5.6(11.8)Excluding unrealized derivative activity, segmentprofit declined by 18.9MM vs. 1Q22, mainly drivenby normal seasonal activity in the NGL segmentOklahoma Gas Segment Profit78.484.296.481.595.5Oklahoma Crude Segment Profit7.22.93.04.33.1Total Segment nrealized Derivatives Loss/(Gain)Plant RelocationOPEX1Unrealized Derivatives Loss/(Gain)North Texas Gas Segment ProfitUnrealized Derivatives Loss/(Gain)Note: Includes segment results associated with non-controlling interests. Segment results include realized and unrealizedderivatives and Plant Relocation OPEX. 1Project War Horse and Project Phantom.Oklahoma Favorable commodity pricing drove sustainedoperator rig activity Gathering volumes were flat compared to the prioryear and increased 2% sequentiallyNorth Texas BKV initiated new drilling program in March 2022 andcontinues with re-frac program commenced in 2021EnLink Midstream 2Q22 Quarterly Report7

STRONG PERFORMANCE & POSITIVE OULOOK ACROSS PORTFOLIOMOMENTUM BUILDING IN 2022 SUPPORTING SIGNIFICANTLY HIGHER VOLUME OUTLOOK FOR 2023Strong Growth in Permianand Louisiana: Permian gathering volumes increased11% sequentially in 2Q22 & 46% YoY Tiger plant came on line in the Delaware Basinat the end of 4Q21 Continuation of capital efficient approachwith Project Phantom, which adds 200 MMcf/dof capacity Downstream demand in Louisiana remainsstrong from petrochem and industrialconsumers; business supported by attractiveeconomics and growing NGL supply from G&PsegmentsSignificant Increase in Activity inOklahoma and North Texas: Expecting meaningful volume growth inOklahoma in 2023 driven by currentproducer activity and plans Existing assets can accommodate 25%more processing volume (post Phantommove) to support growth Drilling and refrac activity by BKV and otherscontinues to improve the volume outlook forNorth Texas Executed on low-risk M&A strategy, acquiringassets for an attractive valuation of 4xEBITDA, driven by significant operational andcapital synergiesEnLink Midstream 2Q22 Quarterly Report8

2022 UPDATEDGUIDANCE

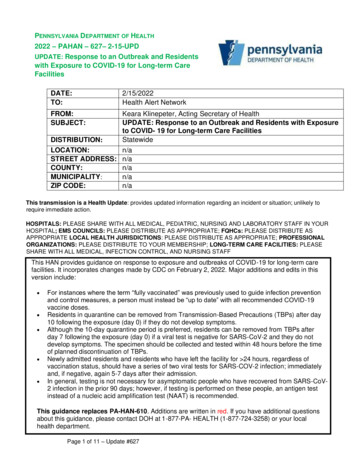

RAISING 2022 FINANCIAL GUIDANCEGROWING ALONGSIDE OUR CUSTOMERS DRIVES IMPROVED OUTLOOK FOR 2022 AND 2023 MM, unless notedInitialUpdated1 230 - 310 390 - 430Adjusted EBITDA, net to EnLink2,3 1,110 - 1,190 1,250 - 1,290Capex, net to EnLink, PlantRelocation Costs4 & InvestmentContributions 285 - 325 405 - 455Net Income (GAAP)Growth Capex, net to EnLink, & PlantRelocation Costs 230 - 260 300 - 330 55 - 65 40 - 50- 65 - 75Free Cash Flow After Distributions2 285 - 345 285 - 315Annualized 2Q22 Distribution perCommon Unit 0.45/unit 0.45/unitMaintenance Capex, net to EnLinkInvestment Contributions5Updated Commodity Price Assumptions (2H22 average): 1ReflectsNGL basket 1.07/gallon and Henry Hub 6.50/MMBtuAdjusted EBITDA Growth Midpoint now implies 21% growth over 2021 Significantly hedged 2022 commodityexposureRobust Free Cash Flow Generating 300MM or more in FCFAD for 3rdconsecutive year, while increasinginvestments in attractive high-return projectsCapital Discipline Incremental 2022 investment supports volumegrowth in 2023 Investing in downstream opportunities withattractive returnsBalance Sheet Strength Strong financial position provides ample flexibility Increasing return of capital to commonunitholders, while investing in the businessupdated 2022 Guidance issued August 3, 2022. 2Non-GAAP measures are defined in the appendix. 3Adjusted EBITDA does not reflect the one-time 45MMexpense related to Project Phantom. 4Includes 45MM classified as operating expense for GAAP purposes. 5Consists principally of Matterhorn JV contributions.EnLink Midstream 2Q22 Quarterly Report10

ROBUST CASH FLOW CREATES SIGNIFICANT FINANCIAL FLEXIBILITY1,270( MM)Delivering significant adjusted EBITDA1 growth1,039 7%Growth inUnderlyingBusiness2MVC2020Significant leverage reduction over last 2years puts balance sheet in a strong position1,050 21%2021Updated 2022GuidanceMidpoint2020Debt Paydown( MM)2021(136)(235)Leverage3Pivoting to a more balanced use of FCFAD1o Investing in growing the business, while increasingreturns to unitholdersmeasure defined in the appendix. 2Referenced growth in the underlying business is adjusted EBITDA. 3Calculated accordingto revolving credit facility agreement leverage covenant, which may include up to 50MM of cash on the balance uction175( MM)100UnitBuybackExecution402021Initial 2022TargetUpdated 2022GuidanceMidpointEnLink Midstream 2Q22 Quarterly Report11

2022 CAPITAL ALLOCATIONBALANCED CAPITAL ALLOCATION APPROACH2022E Distributable Cash Flow 300Uses of DCF20% distributionincrease in 4Q21Maintain significantFCFAD and financialflexibilityFCFADGrowth Capex &Plant Relocations 905MMInvesting in high-returngrowth projects 315 220MatterhornInvestmentCommonDistributions 702022E FCFADFinancial FlexibilityRepurchasedincremental 50MM ofPfd B in 1Q221IncludesRepurchased 75MM ofcommon units1 in1H22Expect to increase return ofcapital by 75% through 150MM - 200MM ofcommon unit buybacks 24MM of common units repurchased from GIP pursuant to the previously disclosed Unit Repurchase Agreement dated February 15, 2022 and which settled onAugust 2, 2022. 75 50 300MM 1751Q22 Pfd BRepurchaseReturn of Capital toCommon UnitholdersGrowthProjects/LeverageReductionEnLink Midstream 2Q22 Quarterly Report12

EXECUTION PLANPRIORITIES

2022 EXECUTION PLAN PRIORITIESFOCUSED ON DRIVING SUSTAINABLE VALUEFinancialDiscipline &FlexibilityOperationalExcellenceRigorous program centered oninnovation and continuousimprovementDelivering significantdeleveraging, while investingin the business Closed 25 operationalexcellence initiatives in 2021,delivering process efficienciesand savings Robust FCFAD generation drivesfinancial flexibility Increased 2022 financialguidance, which implies 21%growth over 2021 Put in place attractive ARfacility and have grown andimproved pricing twice Pivoting to more balancedcapital allocation that includeshigher returns to equity holders;instituted unit repurchaseprogram Implement remote operations atprocessing plants Utilize technology to automateprocesses Mobile operator applicationrolled out across EnLink Technology and innovationdrive next level of efficiencyStrategicGrowthSustainability& SafetyDeliberate and DisciplinedGrowth 90% of EnLink’s currentbusiness is natural gas andnatural gas liquids focusedStrong producer activitystrengthening the growthoutlook for 2022 and 2023volumes and cash flow 15% equity interest inMatterhorn Express PipelineSustainability and safety areintegrated into all aspects ofour business Acquired North Texas G&Psystem with attractive 4xeconomics driven byknown synergies andredeployment of assets2nd carbon capture projectat Bridgeport plant advancesemission reduction goals,while generating modestprofit First quarter of 2022 markedthe first time in 1Q with norecordable injuries On track to meet near-termemissions goal of a 30%reduction in scope 1 methaneemissions intensity1 by 2024 Validation of CCS strategyand opportunity withadditionalcommercialization with OxyLow Carbon VenturesInnovation & continuous improvement reducing costs, reducing carbon footprint & enhancing profitability companywide1Ascompared to 2020 scope 1 emissions levelEnLink Midstream 2Q22 Quarterly Report14

LINKING CO2 EMITTERS TO SEQUESTRATION SITESEXECUTING GOAL TO BECOME CO2 TRANSPORTATION PROVIDER OF CHOICEBaton Rouge AreaTotal Emissions (mtpa): 19.2Total Emitter Count: 33 Majority of industrial emitters are current customers, manywith multiple pipeline connections to their facilitiesGeismar Area 80 mtpa of emissions are largely located in four hubsTotal Emissions (mtpa): 7.9Total Emitter Count: 25 Utilizing repurposed pipeline and existing right-of-way,EnLink provides a cost-effective CO2 gathering system Working with sequestration providers near our existingpipeline network TalosSt. Charles AreaTotal Emissions (mtpa): 28.0Total Emitter Count: 27Donaldsonville AreaTotal Emissions (mtpa): 14.2Total Emitter Count: 13 Oxy Low Carbon VenturesNote: Sequestration sites are for illustrative purposes and exact location may vary.Future sequestration locationsEnLink Midstream 2Q22 Quarterly Report15

MATTERHORN EXPRESS PIPELINEEXPANDING DOWNSTREAM EXPOSURE THROUGH PERMIAN TAKEAWAY TRANSPORTATION INVESTMENTMatterhorn Express PipelinePermian Basin Transportation capacity of up to 2.5 Bcf/d fromWaha Hub to Katy, TX through 490 miles of 42” pipe Direct connections to processing facilities in theMidland Basin through approximately 75-mile lateral Final investment decision reached May 2022 basedon long-term contracts with high quality shippers Expected in-service date 3Q24 Equity partners include WhiteWater Midstream(operator), EnLink (15% interest), Devon and MPLX Project financing to be put in place at thepartnership level Attractive returns on FID case have potential toimprove with additional volume commitments EnLink’s total expected 15% equity investment: 100MM of which 70MM is expected to be spentin 2022 with the balance in 2023The Waha HubEnLink Midstream 2Q22 Quarterly Report16

CRESTWOOD NORTH TEXAS ACQUISITIONSIGNIFICANT SYNERGIES AND REDEPLOYMENT OF ASSETS RESULT IN ATTRACTIVE ECONOMICSDeployment of “The EnLink Way” Creates Significant Value Significant synergies, minimal integration capital, and significant capital avoidance – Plan tointegrate with EnLink’s footprint and redeploy assets to EnLink’s other segments, including thePermian segment in the near-term and the Carbon Solutions business in the future Significant reduction to EnLink’s 2023 capital expenditures as a result of redeployment ofacquired assets, mostly compression Improves emission intensity profile in North Texas segment with high mix of electric compression Potential additional CCUS opportunities aimed at meeting carbon intensity reductionobjectivesAsset Overview Expands position in prolific producing basin with proximity to incremental LNG exports alongGulf Coast 500 miles of lean and rich gas gathering pipeline Includes three processing plants with 425 MMcf/d of capacity (available for future relocation)Attractive Economics 275 million cash consideration 4x EBITDA and high teens unlevered return, driven by operational synergies and 50 million inidentified redeployment of assetso Upside from potential incremental drilling and additional asset redeployments High 2023E DCF and FCFAD accretion and leverage neutral No change to EnLink’s balanced capital allocation approachEnLink Midstream 2Q22 Quarterly Report17

APPENDIX

2Q22 CAPITAL EXPENDITURES, RELOCATION COSTS & INVESTMENT CONTRIBUTIONSCAPITAL EFFICIENT FOCUS AND INCREMENTAL DRILLING ACTIVITY DRIVE HIGH-RETURN PROJECTSCapex, net to EnLink, Plant RelocationCosts1 & Investment Contributions2( MM)Capital Spending by Project Type1Net to EnLink( MM)2Capital Spending by Segment1Net to EnLink (2Q22)43% Continued to connect highlyaccretive wells in Permian andSTACKSegment2Q22Permian 44.1Louisiana 6.3Oklahoma 13.2North Texas 8.1Corporate 28.5 20Total 100.2 7 11Crude ConnectsJV Contributions( 1.5) 30Natural GasWell ConnectsNet to EnLink 98.7Permian Project Phantom is underway8% 27InvestmentContributions oma29%Corp2Q221Includes 9.4MM and 1.7MM for Permian and Oklahoma, respectively, for relocation costs related to plant relocations classified asoperating expenses in accordance with GAAP. 2Contributions of 26.6MM to equity method investments for 2Q22 . 2Totals may not sum dueto rounding.EnLink Midstream 2Q22 Quarterly Report19

QUARTERLY VOLUMES (PERMIAN, LOUISIANA)PermianGAS GATHERING(1,000 MMBtu/d)GAS PROCESSING(1,000 ianaGAS TRANSPORTATION(1,000 MMBtu/d)2,1392Q212,0143Q212,3382,498CRUDE - ORV(Mbbls/d)182,697154Q211Q222Q22Note: Includes volumes associated with non-controlling interests.NGL 22Q211683Q211891911884Q211Q222Q22EnLink Midstream 2Q22 Quarterly Report20

QUARTERLY VOLUMES (OKLAHOMA, NORTH TEXAS)OklahomaGAS GATHERING(1,000 MMBtu/d)1,0162Q219971,0183Q214Q21GAS PROCESSING(1,000 Q21241Q22212Q22North TexasGAS GATHERING GAS PROCESSING(1,000 22EnLink Midstream 2Q22 Quarterly Report21

QUARTERLY SEGMENT PROFIT & VOLUMES3 Months Ended amounts in millions unless otherwise notedJun. 30, 2021Sep. 30, 2021Dec. 31, 2021Mar. 31, 2022Jun. 30, 2022PermianSegment Profit 44.0 69.1 73.8 73.0Adjusted Gross Margin 71.4 106.4 102.4 118.3 Processing 00Crude Oil Handling (Bbls/d)121,900157,500150,100150,700175,000Segment Profit 67.3 63.7 111.7 90.5 89.0Adjusted Gross Margin 99.0 94.2 144.0 123.5 123.8Gathering and Transportation (MMBtu/d) 112.1LouisianaGathering and Transportation ,500NGL Fractionation (Bbls/d)184,000167,900188,900191,300188,000Crude Oil Handling 2003,0003,200Brine Disposal (Bbls/d)OklahomaSegment ProfitAdjusted Gross Margin 85.6 87.1 99.4 85.8 98.6 103.4 106.9 122.1 106.8 121.7Gathering and Transportation 00Processing ,60023,80020,00019,30023,80021,400Segment Profit 57.9 60.0 56.1 63.0 66.9Adjusted Gross Margin 77.8 79.3 75.4 84.6 27,600627,900645,700614,300661,900Crude Oil Handling (Bbls/d)North TexasGathering and Transportation (MMBtu/d)Processing (MMBtu/d)Note: Includes segment profit and volumes associated with non-controlling interests.EnLink Midstream 2Q22 Quarterly Report22

AMPLE FINANCIAL FLEXIBILITYSUBSTANTIAL LIQUIDITY AND LONG-TERM DEBT MATURITY PROFILE PROVIDES FINANCIAL FLEXIBILITYFinancial Flexibility( MM) Ba1 / BB / BB Leverage ratio of 3.5x No near-term senior note maturitiesRevolvingCredit Facility 175MMundrawn 32% of long-term senior notes mature in 20 years 1.125Bnundrawn1755003251,12545015 2026Senior Notes2027A/R Facility20302031Undrawn CapacityNote: As of June 30, 2022. Pro forma for Crestwood acquisition, which closed on July 1, 2022, and upsized A/R facility to 500MM, which closed on August 1, 20222032203320342044 Revolving Credit FacilityEnLink Midstream 2Q22 Quarterly Report23

CAPITALIZATION( in MM)Cash and cash equivalents, net to EnLink 1.4Bn Unsecured Revolving Credit Facility due June 202710.60.0 350MM A/R Securitization due September 2024325.0ENLK 4.400% Senior unsecured notes due 2024519.8ENLK 4.150% Senior unsecured notes due 2025720.8ENLK 4.850% Senior unsecured notes due 2026491.0ENLC 5.625% Senior unsecured notes due 2028500.0ENLC 5.375% Senior unsecured notes due 2029498.7ENLK 5.600% Senior unsecured notes due 2044350.0ENLK 5.050% Senior unsecured notes due 2045450.0ENLK 5.450% Senior unsecured notes due 2047500.0Net Debt4,344.7Series B Preferred Units812.5Series C Preferred Units400.0MembersEquity1Total Capitalization1Based6/30/224,152.19,709.3on market value as of June 30, 2022. Unit price: 8.50, Units outstanding: 488,488,051; Common units: 479,825,804; outstanding restricted units: 8,662,247.EnLink Midstream 2Q22 Quarterly Report24

ENLINK ORGANIZATIONAL STRUCTUREPublic ENLCHoldersGlobal InfrastructurePartners (GIP)Non-economicmanaging interest 48% 42%EnLink MidstreamManager, LLCClass C Unitholders1 10% noneconomic interestSeries C Pref.UnitholdersEnLink Midstream, LLCNYSE: ENLCEnLink MidstreamPartners, LPSeries B. Pref.Unitholders1Operating AssetsNote: The ownership percentages are based upon June 30, 2022 data. 1Series B Preferred Units are convertible into ENLC units. ENLC ownershipinterests are shown for voting purposes and include the ENLC Class C units that the Series B Preferred unitholders received for voting purposes only.EnLink Midstream 2Q22 Quarterly Report25

UPDATED 2022 GUIDANCE RECONCILIATION OF NET INCOME TO ADJUSTEDEBITDA, DISTRIBUTABLE CASH FLOW AND FREE CASH FLOW AFTER DISTRIBUTIONSNet income of EnLink (2)Interest expense, net of interest incomeDepreciation and amortizationIncome from unconsolidated affiliate investmentsDistribution from unconsolidated affiliate investmentsUnit-based compensationIncome taxesPlant relocation costs (3)Other (4)Adjusted EBITDA before non-controlling interestNon-controlling interest share of adjusted EBITDA (5)Adjusted EBITDA, net to EnLinkInterest expense, net of interest incomeMaintenance capital expenditures, net to EnLink (6)Preferred unit accrued cash distributions (7)Other (8)Distributable cash flowCommon distributions declaredGrowth capital expenditures, net to EnLink & plant relocation costs (3)(6)Contribution to investment in unconsolidated affiliatesFree cash flow after distributionsUpdated 2022 Outlook (1)As of Aug 3, 2022 12)905(220)(315)(70) 3001) Represents the forward-looking net income guidance of EnLink Midstream, LLC for the year ended December 31, 2022. The forward-looking net income guidance excludes the potential impact of gains or losses on derivative activity, gains or losses on disposition of assets,impairment expense, gains or losses as a result of legal settlements, gains or losses on extinguishment of debt, the financial effects of future acquisitions, proceeds from the sale of equipment, and repurchases of common units or ENLK Series B Preferred Units. The exclusionof these items is due to the uncertainty regarding the occurrence, timing and/or amount of these events.2) Net income includes estimated net income attributable to (i) NGP Natural Resources XI, L.P.'s ("NGP") 49.9% share of net income from the Delaware Basin JV, (ii) Marathon Petroleum Corp.'s ("Marathon") 50% share of net income from the Ascension JV.3) Includes operating expenses that are not part of our ongoing operations incurred related to the relocation of equipment and facilities from the Thunderbird processing plant in the Oklahoma segment to the Permian segment.4) Includes (i) estimated accretion expense associated with asset retirement obligations and (ii) estimated non-cash rent, which relates to lease incentives pro-rated over the lease term.5) Non-controlling interest share of adjusted EBITDA includes estimates for (i) NGP’s 49.9% share of adjusted EBITDA from the Delaware Basin JV, (ii) Marathon's 50% share of adjusted EBITDA from the Ascension JV.6) Excludes capital expenditures that are contributed by other entities and relate to the non-controlling interest share of our consolidated entities.7) Represents the cash distributions earned by the ENLK Series B Preferred Units and ENLK Series C Preferred Units. Cash distributions to be paid to holders of the ENLK Series B Preferred Units and ENLK Series C Preferred Units are not available to common unitholders.8) Includes non-cash interest (income)/expense and current income tax (income)/expense.EnLink Midstream 2Q22 Quarterly Report26

PREVIOUSLY ISSUED 2022 GUIDANCE RECONCILIATION OF NET INCOME TO ADJUSTEDEBITDA, DISTRIBUTABLE CASH FLOW AND FREE CASH FLOW AFTER DISTRIBUTIONSNet income of EnLink (2)Interest expense, net of interest incomeDepreciation and amortizationIncome from unconsolidated affiliate investmentsDistribution from unconsolidated affiliate investmentsUnit-based compensationIncome taxesPlant relocation costs (3)Other (4)Adjusted EBITDA before non-controlling interestNon-controlling interest share of adjusted EBITDA (5)Adjusted EBITDA, net to EnLinkInterest expense, net of interest incomeMaintenance capital expenditures, net to EnLink (6)Preferred unit accrued cash distributions (7)Distributable cash flowCommon distributions declaredGrowth capital expenditures, net to EnLink & plant relocation costs (3)(6)Free cash flow after distributions2022 Outlook (1)As of Feb 15, 2022 270216604(2)1215445(2)1,207(57)1,150(2

2022 EXECUTION PLAN PRIORITIES Sustainability & Safety Financial Discipline & Flexibility Operational Excellence 90% of EnLink's current business is natural gas and natural gas liquids focused Sustainability and safety are integrated into all aspects of our business 2nd carbon capture project at Bridgeport plant advances