Transcription

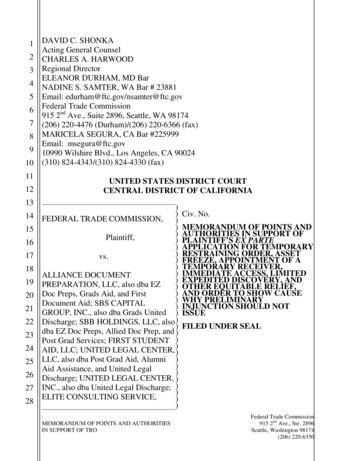

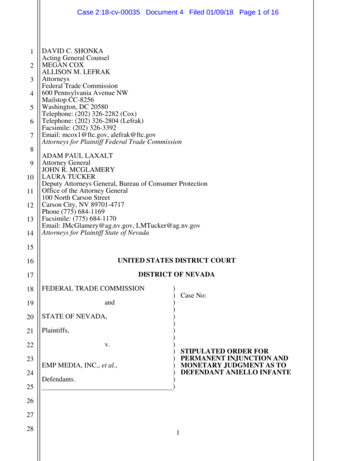

Case 4:18-cv-00806-SBA Document 34 Filed 03/02/18 Page 1 of 41234567DAVID C. SHONKAActing General CounselSARAH SCHROEDER, Cal. Bar No. 221528ROBERTA TONELLI, Cal. Bar No. 278738EVAN ROSE, Cal. Bar No. 253478Federal Trade Commission901 Market Street, Suite 570San Francisco, CA 94103sschroeder@ftc.gov, rtonelli@ftc.gov, erose@ftc.govTel: (415) 848-5100; Fax: (415) 848-51848UNITED STATES DISTRICT COURTNORTHERN DISTRICT OF CALIFORNIAOAKLAND DIVISION9101112FEDERAL TRADE COMMISSION,1314Plaintiff,vs.151617AMERICAN FINANCIAL BENEFITSCENTER, a corporation, also d/b/a AFB and AFSTUDENT SERVICES;18AMERITECH FINANCIAL, a corporation;19FINANCIAL EDUCATION BENEFITSCENTER, a corporation; andCase No. 4:18-cv-00806-SBADECLARATION OF DANIELHAMILTON IN SUPPORT OFFEDERAL TRADE COMMISSION’SMOTION FOR PRELIMINARYINJUNCTION2021222324BRANDON DEMOND FRERE, individuallyand as an officer of AMERICAN FINANCIALBENEFITS CENTER, AMERITECHFINANCIAL, and FINANCIAL EDUCATIONBENEFITS CENTER,Defendants.25262728DECLARATION OF DANIEL HAMILTON IN SUPPORT OF FEDERAL TRADECOMMISSION’S MOTION FOR PRELIMINARY INJUNCTION4:18-CV-00806-SBA

Case 4:18-cv-00806-SBA Document 34 Filed 03/02/18 Page 2 of 41DECLARATION OF DANIEL 27281.My name is Daniel Hamilton and I reside in California. The following statementsare within my personal knowledge and if called as a witness I could and would competentlytestify thereto.2.Attached as Composite Exhibit A are copies of miscellaneous AmeriTech relateddocuments I still have in my possession.3.I started working for AmeriTech Financial around February of 2016. Myemployment ended nearly two years later when I was terminated around November 13, 2017. Iwas told that I deviated from the script by adding the word “any” to some portion of the script,however, my suspicion was that I was fired for asking too many questions about how thebusiness operated.4.Throughout my tenure at the company, I was employed as an enrollmentspecialist in the sales department. I reported to the El Dorado Hills office located at 1101Investment Blvd STE 290, El Dorado Hills, CA.5.My training prior to starting lasted approximately 2 weeks and consisted of aseries of tests and mock phone calls. I was also given a script that I was to practice. This scriptchanged numerous times throughout the course of my employment.6.I worked in an office where we received inbound phone calls from people thatreceived our mailer. The mailer told consumers that AmeriTech Financial could reduce theirmonthly student loan payments and to call our phone number for more information.7.Once prospective clients called, my job was to encourage them to enroll in ourprogram and help them fill out our application over the phone. I would tell them that ourprogram was designed to eliminate or reduce their monthly student loan payments and that Icould qualify them over the phone.8.The criteria I used to qualify clients were occupation, income, family size, andstudent loan balance. These factors determined if a potential client would qualify, with the mostimportant factor being family size.Hamilton Declaration - Page 1

Case 4:18-cv-00806-SBA Document 34 Filed 03/02/18 Page 3 of 419.In the event that a potential client did not qualify, management would encourage2us to revisit the family size figure and get them to qualify. I recall being counseled by3management when not giving examples of what constituted a family member. I recall a floor4manager telling us that someone you gave gifts to meets the program’s definition of a family5member.610.Each week, I had to enroll a minimum of five clients. After six clients, I began to7earn a bonus. Some of my colleagues in the sales department enrolled up to 15-17 clients a week.8They accomplished this by aggressively inflating family size figures.911.Page A-6 to my declaration is a copy of the family size to income matrix that we10used to qualify clients. For example, if someone earned between 80,001.00 and 86,000.00 a11year, they would need to claim a family size of thirteen to qualify for our program.1212.The program fees were comprised of a document preparation fee and13membership fee. The document preparation fee ranged from 800- 1,200 and was used to14restructure a client’s loan by filing forbearance or deferment paperwork.1513.Once a client signed our contract, we would also sell them a packet of other16benefits. I am unsure of what these benefits were or whether clients actually used them. There17were different packages labeled “A” through “R.” The “A” package was the most expensive and18was sold to individuals that could afford more while the “R” package was sold to those that19could not afford as much.2014.To my recollection, these packages ranged from 69- 240 a month. The21membership would renew each year and the monthly fees were designed to be collected each22month until a client’s loan was paid off or forgiven. This could in many instances take between2310-25 years.2415.My understanding was that at least some of the fees clients paid us were going25towards paying down their loan balances and that we would pass along client’s payments to their26loan servicer. Due to how compartmentalized the business was, I was unsure of what the fees27were for or whether customers knew exactly what they were getting.28Hamilton Declaration - Page 2

Case 4:18-cv-00806-SBA Document 34 Filed 03/02/18 Page 4 of 416.1I recall management being dismissive when I asked them about how this process2worked and how we were helping our clients. My general impression upon leaving this company3was that they were running a scam.4s617.onI declare under penalty of perjury that the foregoing is true and correct. Executed I ?.§ /. 2018, in California.I789Daniel lton Declaration - Page 3

Case 4:18-cv-00806-SBA Document 34-1 Filed 03/02/18 Page 1 of 18Hamilton Composite Exhibit A

Case 4:18-cv-00806-SBA Document 34-1 Filed 03/02/18 Page 2 of 18DareI 01;r. / e111p/01mem sratus Witl, Am«itecl, Ffoaaeia/ has chaoged for the following reason,Re.,;1 led / VOhu,t, , quit efi'ecOvec ayofreduclion in force effective:D . . II00;,. . . -!scnarge tenninar,on e, ectrve:-f·Refusal to accept aiiabte work effective,. ve bseo e effective,1:.:{pecte date ot return to i;vo1-JcI cecoived a copy oftl is oorice on-l//2:;;, /, E01pleyee AcknowJedgmeatDa ----)BNJMUPO "UUBDINFOU "

Appendix ACase 4:18-cv-00806-SBA Document 34-1 Filed 03/02/18 Page 3 of 18Employee Statement1.Confidential Information. Except as set forth below, I acknowledge that at thecommencement of my employment with the Company I know nothing about the Confidential Information ofthe Company or its Clients, except information that has been disclosed to me by the Company:2.Conflicting Relationships. Except as set forth below, I acknowledge that I have no othercurrent or prior agreements. relationships, or commitments that conflict with my relationship with theCompany under this Agreement (if none, so state):Dated:./ism Il-123 IC) W(Typed or Printed Name of Employee)Appendix BTermination CertificationThis is to certify that I do not have in my possession, nor have I failed to return. any ConfidentialInformation or copies of such information, or other documents or materials, equipment, or other propertybelonging to the Company. I further certify that I have complied with and will continue to comply with allthe terms of the Confidentiality, Non-Disclosure And Non-Compete Agreement which I signed as acondition of employment.I further agree that, in compliance with the Confidentiality, Non-Disclosure And Non-CompeteAgreement, I will preserve as confidential and not use any Confidential Information or other informationthat has or could have commercial value or other utility in the business in which the Company is engaged.I will not participate in the unauthorized disclosure of information that could be detrimental to the interestsof the Company, whether or not such information is identified as Confidential Information by theCompany.On termination of my employment. I will be employed byr-- ------(name of new employer)(if not applicable, so state)Dated:Y?w/l Employee Signaturet)JhLJtiA-m V:f)dEmployee Name Typed or Printed-----)BNJMUPO "UUBDINFOU "

Case 4:18-cv-00806-SBA Document 34-1 Filed 03/02/18 Page 4 of 18Disciplinary Action Notice Verbal Written Final WrittenEmploy ee Name: ,D an -.,Hs::am:.:.:.:.il:.:.to.,n.,Termi nationDate: Novemb er 13, 2017Department: -'S a Je s - - - - - - - - - - - - - - - -- -- Job Title: Account SpecialistDescription of EventsA1/ach additional pages ifnecessaryOn August 18, 2017, you received a Verbal Warning for not meeting the acceptable standards for Call Compliance. On Septemb er S,2017, you received a Written Warning for not meeting the acceptable standardsfor Call Compliance. On Septembe r 18. 2017, youreceived a Final Written Warning for not meeting the acceptable standards forCall Compliance.A recent audit ofSalesfo rce record https://na72.salesforce.com/00I IH0000I NpZEphas shown a Compliance score of80%.A recent audit of Salesforce record https://na72.salesforce.com/003 l H0000 I nStayhas shown a Compliance score of 80%. At 7:27,you say FS includes "any gifts, any loans" etc. At I :30:00 you tell the clientthat there is no negative effect on their credit.Descrip tion of Policy Violatio nAttach additional pages ifnecessaryThe Account Specialist role is required to maintain full compliance per the established Call Compliance matrix.BAD #16 - Family Size definition not read to consume r word for word.BAD #7 - Providing false / untrue legal. tax or credit advice.Correct ive ActionAttach add/Ilona/ pages ,fneceMOryDischar e.IIEmploy ee Comme ntsA11ach addilionol pages ifnecessaryf2--4,,, "'-"-. ,,.,. ,. ,, Date:Employee signature: Q).,. -"'-.,.ClM- - -.Manage r signature:Date:Witness signature:Date:original to Human Resources; copy to employeeDirc,pfuwy Act,on FormCrated 11/16Rovaewod 11116Rovisod 11116)BNJMUPO "UUBDINFOU "

Case 4:18-cv-00806-SBA Document 34-1 Filed 03/02/18 Page 5 of 18Performance Improvement Plan/ Employee Name: Dan HamiltonSupervisor: Taylor ParrottDate: July 24, 2017Subject:Performance Improvement PlanDuring the past 2 weeks, it has become evident to me that you have not been performing your assigned work inaccordance with what is expected of an Account Specialist.You are being placed on a written improvement plan. For the next 14 days, July 24, 2017 - August 6, 12017your work will be closely monitored by your leadership team. You must demonstrate immediate improvementin the following areas:Closing % equal to or greater than 16%We will review your progress on each of the above items requiring improvement regularly. We trust that in sodoing, we can guide you in becoming a contributing employee of AmeriTech Financial.Improvement must occur immediately and must be maintained. If any portion of this improvement plan isviolated at any time during the specified timeframe, disciplinary action to include separation from the companymay occur. A decrease in performance after successfully completing the improvement plan may result in beingdismissed from AmeriTech Financial without the issuance of another warning or improvement plan.As always, the Open Door Policy is available for you to discuss any concerns.Your signature acknowledges this discussion. It does not indicate agreement or disagreement with this plan.Employee SignatureDatePerformance Improvement Plan TemplateCreated ll/16Reviewed 11/16Revised ll/16------- - --- - -)BNJMUPO "UUBDINFOU " .

Case 4:18-cv-00806-SBA Document 34-1 Filed 03/02/18 Page 6 of 18Agent Name:Date:Client Name:Read the introduction to the script- Inform the client that we are a document preparation company.We are NOT the government but this program is through the department of education.Explain the recertification process. Meaning we re-certify and maintain the file every year for thefull 10, 20 or 25 years.Read the FULL federal definition of family size.Have client write down the T-box and disclose the fees involved.If the client is PSLF- disclose that they must work a minimum of 30 hours per week for the full 10years to qualify.Inform to the client hat we collect the first months IBR/ICR payment but they are responsible forpaying the servicer starting on month two. They will receive correspondence from the servicerstating the dollar amount.Follow the proper steps for AGI. 1- studentloans.gov 2- picture of tax return or paystub 3- statedincomeRead the script while reviewing the agreement with the client.Explain to the client that we have a dedicated escrow account with "global client solutions". Nomoney is collected out of the account until the services are performed.Fully explain what the FEBCP is.)BNJMUPO "UUBDINFOU "

Case 4:18-cv-00806-SBA Document 34-1 Filed 03/02/18 Page 7 of 18)BNJMUPO "UUBDINFOU "

States WeDocumentDo Not34-1Do BusinessIn Page 8 of 18Case 4:18-cv-00806-SBAFiled 03/02/18NHCTCOMEGASCNCWIKSWVIDWAILORNew HampshireConnecticutColoradoMaineGeorgiaSouth CarolinaNorth CarolinaWisconsinKansasWest VirginaIdahoWashingtonIllinoisOregonVT VermontStates We Do Referral Business in ONLYIADEMNNDRIMSNJOHIowaDelawareMinnesotaNorth DakotaRhode IslandMissouriNew JerseyOhioPA c 1 x·0 h « r ·q L, ro Hamilton Attachment A - 7-j

Rev.9/11/17Compliance Enrollment Call AuditCase 4:18-cv-00806-SBA Document 34-1 Filed 03/02/18 Page 9 of 18Agent name: Dan HamiltonDate of Call:10/23/2017Manager:Call 2Call 3Call4Consumer name:Compliance officer:IWren NicholsonTlmestamp:4010:39amTime of call:Date/Time of Audit: 10/24/17 8:10a mProcessCompliance (Score out of 5)1. Introduction Script5Reads script7:272. Family Size0Not on script18:093. T-Box5Reads script28:05/1:25:234. PSLF5Reads script1:24:515. Renewal5Reads script2:20:226. Servicer Business Practices5Reads script5Reads script8 . Customer Service5Reads script9 . AGI (If Stated)5Read off paystu b0Does not break downenrollment1:16:35/2:21:07 7. Terms & Conditions1:24:134:58/1:09:311:29:45/1:59:18/10. Payment Breakdown2:09:22l nllh.lmcTimestamp7:27Process #Notes0S.!1t;.50Bad 16 Says FS includes 'any gifts, any loans' etcetcaama Sc2t.c:c.f 80%-Agent Signature:Hamilton Attachment A - 8J

Case 4:18-cv-00806-SBA Document 34-1 Filed 03/02/18 Page 10 of 1810/25/2017Agent name:Dan HamiltonDate of Call:Manager: Dan HenryDate/Time of Audit : 10/ 25/ 2017 @ 17:35Consumer name:Time of Call:TimestampCall 3Call4Compliance (Score out of S)Process1:001. Introduction Script57:452. Family Size521:553 . T-Box51:35:154 . PSLF51:34:055. Renewal51:36:206 . Servicer Business Practices57 . Terms & Conditions08 . Customer Service59 . AG I (If Stated)510. Payment Breakdown01 :33:255:40, 1:32:401 :42:40"T ,, ,.,,.TimestampProcess#Notes10/ 25/20179:22Call 2Compliance officer: Matt StoneCall Recording location: Call Uploaded to Google DriveIRev. 9/11/17Compliance Enrollment Call AuditOuts,/;,50Rep did not read t he Terms &Conditions.Rep did not disclose the onetime enrollment fee.-,,, ., Smr«:80%Hamilton Attachment A - 9Agent Signature:

Account Specialist Bonus Related Data: September 25th- 30th 2017Case 4:18-cv-00806-SBA Document 34-1 Filed 03/02/18 Page 11 of 18Rep Name: Dao HamiltonManager: Timothy ArquillaBranch: EDHHours Worked: 39.7Hours Scheduled: 40Hours/Work Qualifier %: 99%Tardys: 0Tardy Bonus %: 100%Litmos Completed: YesCompliance Audit (# 100%): 0Compliance Bonus %: 100%Utilization Time (Ready Call & VM, OnCall): 31.23Utilization %: 79%Rolled Calls: 1Rolled Call%: 4.2%% COO I Inbound Calls: 75%Ready VM Time: 0.00%Ready VM: 0.0%# Calls: 22# Contracts: 3**Closing %: 13.6%Closing % Bonus: 90%Total Unit Values: 3.5Utilization Override: No# Cancels: 1Cancel%: 33.3%Cancel Bonus %: 0%All Bonus Qualifications Met?: NoBase Bonus: 0.00Bonus Factor (Closing% x Cancel% x Tardy% x Compliance%):%Referral Bonus: 0.00Net Bonus: 0.00**2nd Voice Tier Candidate: No2nd Voice Prior-Results: 31.8181 81818Account Specialist signature:Sales Manager signature:8)04-'v /J/ Date:/D - y-- 17Date:.)BNJMUPO "UUBDINFOU "

Account Specialist Bonus Related Data: October 2nd - 7th 2017Case 4:18-cv-00806-SBA Document 34-1 Filed 03/02/18 Page 12 of 18Rep Name: Dan HamiltonManager: Timothy ArquillaBranch: EDHHours WQrked: 40.0Hours Scheduled: 40Hours/Work Qualifier%: 100%\ Litmos Completed: YesTardys: 0Tardy Bonus %: 100%Compliance Audit(# 100%): 1Compliance Bonus %: 90%.,.,.Utilization Time (Ready Call & VM, OnCall): 32.46Utilization%: 81%Rolled Calls: 0Rolled Call %: 0.0%% COO I Inbound Calls: 74%Ready VM Time: 0.00%Ready VM: 0.0%# Calls: 21# Contracts: 3Total Unit Values: 3.25UtiHzation Override: No# Cancels: 0Cancel %: 0.0%Cancel Bonus %: 100%**Closing%: 14.3%Closing % Bonus: 90%All Bonus Qualifications Met?: NoBase Bonus: 0.00Bonus Factor (Closing% x Cancel% x Tardy% x Compliance%): %Referral Bonus: 0.00Net Bonus: 0.00**2nd Voice Tier Candidate: Yes2nd Voice Prior - Results: Account Specialist signature: \f;}!;,-J (l,iSales Manager signature:r31,,,/ Date:/D /G - /1Date:)BNJMUPO "UUBDINFOU "

Case 4:18-cv-00806-SBA Document 34-1 Filed 03/02/18 Page 13 of 18A. Attendance Qualifier: The AS must-work a minimum of 80% of the time scheduled per pay periodto qualify for a bonus. You're "normally" scheduled for 80 hours every 2 weeks, 80% is 64 hours. The10% you can miss is equal to 2 days. Out of 10 days, you can miss 2 days.B. Timekeepin& Policies Qualifier:1 Tardy 10% deduction2 Tardies 35% deduction3 Tardies 50% deductionYou have a 6 minute window to clock in/out. IE; if you're scheduled at 8am and you clock in at8:06am, you're on time, at 8:07am you're tardy. Same qualifications go for breaks. Set alarms on y ourcell phone to stay on schedule. Know how long it takes you to get to work and plan appropriately.C. Utilization Qualifier - 75 % :FIVE9 DISPOSITIONS:- To be used the majority of the day- To be used the majority of the day-NEVER USE-NEVER USE-NEVER USE-NEVER USE- NEVER USEIn Verification - SM will watch deal, AS goes GREENTraining - Used for meetings - keep to a minimum.Break - Used for 20 mins per dayLunch - Used for 1 hour per dayD. Rolled Call Qualifier- 5%:NEVER ROLL CALLS, PERIOD. THERE IS NO EXCUSE FOR THIS.E. Compliance Qualifier - 80% movine toward 100%:80% -100%- No deduction70.00%- 79.99% - 10% deduction60.00% - 69.99% - 50% deductionF. Minimum Performance Qualifier; 10 points for the 2 week pay period.G. Continuin& Education Qualifier; Do your Litmos tests when you get them.H. Closin& Percentaee (%) Multiplier:00.00% - 19.99% Closing Percentage 90%20.00% - 24.99% Closing Percentage 100%25.00%- 29.99% Closing Percentage 110%30.00%- 34.99% Closing Percentage 115%35.00% Closing Percentage 120%I. Cancellation Percentaae Factor(%)0 - 20% cancels 100% Bonus20.01% - 25.00% cancels 50% Bonus)BNJMUPO "UUBDINFOU "

Enrollment Compliance Audit Score MatrixCase 4:18-cv-00806-SBA Document 34-1 Filed 03/02/18 Page 14 of 18 ffi t ri ·; -- .Read Intro ScriptRead Family Size Definition,Followed FS ProcessT-8ox: Had client writedown figuresFollowed AGIDetermination process-::- · - - , ·.-- t rit11.filo :Effective 10/3/2016- -- · --:, - c,i"jiJ p iffi :·:;J":-s. ,m;Read intro script exactly as provided. Didnot answer client's questions withcompliant/provided responses.Read intro script exactly a.s provided. Answeredclient's questions with compliant/providedresponses.Read Family Size as scripted. Gave apersonal example, but not approved. Gotthe client's FS number. 'Helped' clientincrease FS number.Read Family Size as scripted. Gave an approvedpersonal example. Got the client's FS number. Didnot coach client to increase family size.Has client write down all T-box figures, and followsHas client write down T-Box and figures, butscript for explanation. In full control of the T-Boxdoesn't follow saipt for explanation.portion of the conversation.Did not try and get AGI from FSA/IRS.Skipped to 'Statement of Income' stepsinstead.Got AGI through FSA/IRS. If not, got client toprovide tax returns (image attached to file). If not,got info from paystubs. If not, got statedinformation. Correctly selected Income Proof typein SF.XDisclosed must work 3o hours, and Job changecould affect program.Disclosed that client will need to recertifyfor their program each year. Did not getclient's acknowledgement that theyunderstand.Disclosed that client will need to recertify for theirprogram each year. Got client's acknowledgementthat they understand.(If PSlF) Disclosed mustwork 30 hours, and jobchallge could affectprogramExplained Annual Re newalProcessComplete Contract ReviewFollowed provided script and explained eactFollowed provided script and explained each pagepage of the contract. Did notof the contract. Correctly, and compliantly,correctly/compliantly, responsed to clientresponsed to any client questions.questions.Disclosed that in pr01ram,Ensures that client understands that theyEnsures that client understands that they need toclient needs to makeneed to make payments directly to servicer.make payments directly to servicer. Got client'spayments directly toDid not get client's acknowledgement thatServicerthey understand.acknowledgement that they understand.Referral ProgramFollowed Referral Script . Sent Confirmation Followed Referral Script. Sent Confirmation Email.Email. Got T&C Box Checked.Got T&C Box Checked. Client Logged in and Shared.Servicer Buslenss PracticesRebuttal -ExplanationFollowed Servicer Business PracticesFollowed Servicer Business Practices Explaination Explaination - Supplimental Script. Did not·supplimental Script. Got client's acknowledgementget client's acknowledgement that theythat they understand.understand.)BNJMUPO "UUBDINFOU "

tification Exam Questions (25)Case 4:18-cv-00806-SBA Document 34-1 Filed 03/02/18 Page 15 of 181.Student Loan ConsolidationsrJ"1have no restictions on eligibiltyallows borrowers to combine all of their federal student loans into one new loan with one lenderneed state approvalC,1can only accept 3 existing loans2. With the "Standard Repayment Plan"·- The borrower needs a full time job A Visa or Mastercardthe payment is calculated based on the size of the loan and the term of the loan-A Spouse3. With the "Standard Repayment Plan" the borrower. , must be still in schoolCJcannot owe money to more than 2 lending institutions'"J is required to not ever change marital information before repayment1 will pay less interest than they will under the graduated payment plan4. Student Loan Repayment Options include Standard RepaymentGraduated Repaymen- Income Contingent Repayment- Income Based Repayment. fJ All of the above5. With a "Graduated Repayment Plan"-t .J. 1·,payments start lower and then increase later in repaymentinterest is doubledresults in repossession of bookscauses bad debt. placed for collection6. Eligibility is determined by the Department of Education.JTrueCFalse7. "Income Sensitive Repayment" Plans must at least cover the interest that accrues each month.\JiuTrueFalse8. With a "Pay As You Earn" Plan- - - - - - - - - -- ----- - - )BNJMUPO "UUBDINFOU "

-1you will , '- eaure the client reports only estimated income informationCase 4:18-cv-00806-SBA Document 34-1 Filed 03/02/18 Page 16 of 18you will calculate your client's reduced monthly payments by using their gross income and familysize "., forgiveness is granted after 30 years of qualifying paymentsThe lender must report information to the state government ,9. With an "Income Based Repayment" PlanPayment is based on your client's adjusted gross incomeC Payment may be less than the interest that accrues each monthPayments are recalculated annuallyfAll of the Above10. With an "Income Contingent Repayme nr Plan4 It requires your client to provide documentation annuallyRules are there to protect the previous lendersGuidelines are established for Collection Agencies' Guidelines set out the rules for applying for credit by a borrower11 . The "Income Sensitive Repayment Plan . The payment must at least cover the interest that accrues each month. , Only applies to married borrowersOnly applies to single borrowersInterest is not considered.J-1"""12. A benefit of Student Loan Consolidation is.Y(Loans will have a fixed interest rateNew payment will be lowerClient will have one convenient payment per month to one lender All of the above13. Eligible "FFEL" Loans included in the "Income Sensitive Repayment" Plan include.Stafford Subsidized,Stafford Un-subsidizedStudent PLUSParent PLUS All of the above14. The "Income Contingent Repayment" Plan calculates the borrowers payment two differentways, and then givesthem the lower of the two payments.True False--. 15. Some disadvantages of Student Loan Consolidation are.Borrowers may be making payments for a longer timeJ For older loans, they may lose some deferment optiont l May increase the amount of interest they pay over the long term)BNJMUPO "UUBDINFOU "

u-fAll Qf the-above-,.::.----Case 4:18-cv-00806-SBA Document 34-1 Filed 03/02/18 Page 17 of 1816. Eligible loans under the "Standard Repayment Plan" include.Stafford SubsidizedStafford UnsubsidizedStudent PLUSf'All of the above17. FFEL loans are Federal Family Education Loans!1 1TrueC False18.With the "Pay As You Earn" Plan.Your client must not have a partial financial hardship' If they're married must not file a joint tax return, Repayment period is up to 30 yearsNone of the above 19. The Student Loan Consolidation Process includes.0Determining your client's current financial situationC.iIdentifying which program maximizes your client's savingsCJ Submition to the Department of Educationi!All of the above20. The Consumer Financial Protection Bureau estimates that one-fourth of the American workforce may be eligible forStudent Loan repayment or loan-forgiveness programs.· TrueFalse21 . With "Pay As You Earn" Repayment Plans.(./ Payments are usually 10% of their discretionary incomel.; It is only available for recent borrowers. If your client took out their first federal loan on or after October 1, 2007C They make payments for 20 years, then any remaining balance is forgiven All of the above22. "Income Sensitive Repayment Plans" are an alternative to "Income Contingent Repaymenr PlansITrue' False23. With "Loan Rehabilitation".(J The payments must be "rea.sonable and affordable" based on total financial circumstances00i1Payments must be voluntaryA borrower cannot rehabilitate a loan that has been reduced to a judgmentAll of the above)BNJMUPO "UUBDINFOU "

24. A guaranty agr.----:y.Case 4:18-cv-00806-SBA Document 34-1 Filed 03/02/18 Page 18 of 18Is a consumer collection agency---.Guarantees that a consolidation loan is approved Submits the application to the Department of EducationIs a state agency or a private, nonprofit organization that administers FFEL Program loans25. A lender may grant a "forbearance" if a borrower is willing but unable to make loan payments.-f TrueFalseImportant: I certify that I am the person whose name is included on this examination------,Submit For Scoring)BNJMUPO "UUBDINFOU "

FINANCIAL EDUCATION BENEFITS CENTER, a corporation; and BRANDON DEMOND FRERE, individually and as an officer of AMERICAN FINANCIAL BENEFITS CENTER, AMERITECH FINANCIAL, and FINANCIAL EDUCATION BENEFITS CENTER, Defendants. Case No. 4:18-cv-00806-SBA DECLARATION OF DANIEL HAMILTON IN SUPPORT OF FEDERAL TRADE COMMISSION'S MOTION FOR PRELIMINARY

![No, David! (David Books [Shannon]) E Book](/img/65/no-20david-20david-20books-20shannon-20e-20book.jpg)