Transcription

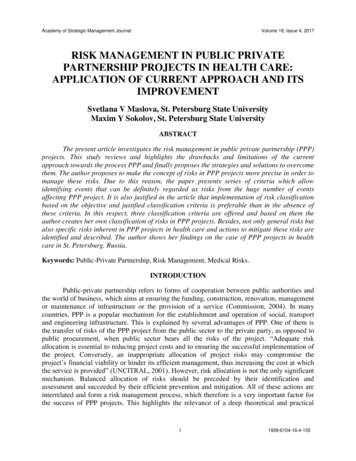

Academy of Strategic Management JournalVolume 16, Issue 4, 2017RISK MANAGEMENT IN PUBLIC PRIVATEPARTNERSHIP PROJECTS IN HEALTH CARE:APPLICATION OF CURRENT APPROACH AND ITSIMPROVEMENTSvetlana V Maslova, St. Petersburg State UniversityMaxim Y Sokolov, St. Petersburg State UniversityABSTRACTThe present article investigates the risk management in public private partnership (PPP)projects. This study reviews and highlights the drawbacks and limitations of the currentapproach towards the process PPP and finally proposes the strategies and solutions to overcomethem. The author proposes to make the concept of risks in PPP projects more precise in order tomanage these risks. Due to this reason, the paper presents series of criteria which allowidentifying events that can be definitely regarded as risks from the huge number of eventsaffecting PPP project. It is also justified in the article that implementation of risk classificationbased on the objective and justified classification criteria is preferable than in the absence ofthese criteria. In this respect, three classification criteria are offered and based on them theauthor creates her own classification of risks in PPP projects. Besides, not only general risks butalso specific risks inherent in PPP projects in health care and actions to mitigate these risks areidentified and described. The author shows her findings on the case of PPP projects in healthcare in St. Petersburg, Russia.Keywords: Public-Private Partnership, Risk Management, Medical Risks.INTRODUCTIONPublic-private partnership refers to forms of cooperation between public authorities andthe world of business, which aims at ensuring the funding, construction, renovation, managementor maintenance of infrastructure or the provision of a service (Commission, 2004). In manycountries, PPP is a popular mechanism for the establishment and operation of social, transportand engineering infrastructure. This is explained by several advantages of PPP. One of them isthe transfer of risks of the PPP project from the public sector to the private party, as opposed topublic procurement, when public sector bears all the risks of the project. “Adequate riskallocation is essential to reducing project costs and to ensuring the successful implementation ofthe project. Conversely, an inappropriate allocation of project risks may compromise theproject’s financial viability or hinder its efficient management, thus increasing the cost at whichthe service is provided” (UNCITRAL, 2001). However, risk allocation is not the only significantmechanism. Balanced allocation of risks should be preceded by their identification andassessment and succeeded by their efficient prevention and mitigation. All of these actions areinterrelated and form a risk management process, which therefore is a very important factor forthe success of PPP projects. This highlights the relevance of a deep theoretical and practical11939-6104-16-4-155

Academy of Strategic Management JournalVolume 16, Issue 4, 2017study of risk management process in PPP projects. In particular, the author believes that it isnecessary to resolve the following issues:1.2.3.Does the existing understanding of risks, their classification and description give a complete picture of risksin PPP Projects?Does the process of risk management cover all possible adverse events and does it protect the PPP projectand its participants from the unsuccessful outcome?How and what could be improved?These are quite difficult questions and search for the answers to them is the goal of thisarticle. This goal determines the structure of the article. First, we present the current approach torisk management in PPP projects and some of its flaws. Second, we provide literature review onthe concept and types of risks in PPP projects, which is the theoretical basis for our research. It isfollowed by the search and description of criteria in order to define the concept of risks andclassify them. It enables to distinguish a new type of risks-specific medical risks which becomethe subject of the further study. We continue the paper by giving a brief background of PPPdevelopment and PPP experience in Russia and St. Petersburg. Furthermore, we describe mainparameters of PPP projects in health care, which are planned to be implemented in St.Petersburg. Finally, third, we present the list of risks that are inherent in PPP projects in healthcare and their description using the author’s risk classification. Also we present several measuresfor mitigation and prevention of identified medical risks.RESEARCH METHODOLOGYCurrent Approach to Risk Management in PPP Projects: Overview and FlawsCurrently, the prevalent approach to risk management in PPP projects consists of thefollowing stages (Akintoye, Beck & Hardcastle, 2008):1.2.3.4.5.Risk identification: a process of identifying all the risks relevant to the project, either during itsconstruction or operation phase;Risk assessment: determining the likelihood of them at serialization of identified risks and the magnitude oftheir consequences if they do materialize;Risk allocation: allocating the responsibility for dealing with the consequences of each risk to one of theparties to the PPP agreement or agreeing to deal with the risk through a specified mechanism which mayinvolve the risk sharing;Risk mitigation: an attempt to reduce the likelihood of the risk occurrence and the degree of itsconsequences for the risk-taker; andRisk monitoring and reviewing: monitoring and reviewing the identified risks and managing new risks asthe PPP project develops and its environment changes. This process continues during the life cycle of thePPP contract (Guidance, 2011; Victoria, 2001).Some time ago, this approach was considered as being comprehensive. But the review ofthe research literature and expert discussions, guidelines, PPP databases and the analysis of riskmatrices have made evident series of shortcomings of this approach, including:1.2.3.4.Ambiguity of views on the concept of risks in PPP projects, their description and classification,Absence of the structured methodology of risk identification in PPP projects,Disregard to the specific risks,Insufficient description of measures aimed at preventing and minimizing negative effects of risks.21939-6104-16-4-155

Academy of Strategic Management JournalVolume 16, Issue 4, 2017Primarily, it is necessary to solve the problem of the definition of risk, which, as we seeit, has two aspects.First, not all of those researchers writing about risks explain what they include in thisconcept. As a result, without defining the subject of the conversation, many experts argue onrisks and their management, including not always the same, coinciding, meaning in this concept(Hodge, 2004; Loosemore, 2007).Second, there is a discrepancy in understanding the term “risk”. For instance, “risk isdefined as the chance of an event occurring which would cause actual project circumstances todiffer from those assumed when forecasting project benefit and costs” (Furnell, 2000). It followsthat the term “risk” is applied generally to all events, both negative and positive, that alter initialparameters of the PPP project.In our opinion, such a broad interpretation of the term risk causes confusion and does notcorrespond to the ultimate goal of risk management-to prevent risks and minimize theirconsequences. Therefore, we propose not to define risks of PPP projects as all the potentialevents that may occur in the implementation of PPP. We believe that risk management(identification, assessment, allocation, mitigation of risks) is needed for only those events thatnegatively affect the PPP project (for example, those that can lead to financial losses andadditional costs for participants of the PPP project, lost revenue, as well as delays in the PPPproject) which impede the achievement of the desired general results. Although successful eventsduring the PPP project (for example, unscheduled revenues for participants or reduction of theduration of construction) may influence the project, it will not be a problem for projectparticipants and should not be the subject of efforts to manage them. Such understanding of risksin PPP projects is generally consistent with the following statement: “a risk is defined as anyfactor, event or influence that threatens the successful completion of a project in terms of time,cost or quality” (Hodge & Greve, 2007). Agreeing with this, we think that it is necessary tocomplement this chain of objects (time, cost, quality) being under threat by the goals of the PPPproject.It is impossible to leave another fact without mentioning. The majority of studies containthe description of financial, legal, political, environmental, social, construction and commercialrisks only, that is, those that may arise in each PPP project (Delmon, 2017; Kabashkin, 2010;Vassallo & Gallego, 2005). That is true, but PPP projects have many other features, therefore,there are much more risks in PPP projects in real life. These risks also require special attentionand a thorough analysis using different research methods. The following example is veryillustrative. It is well known that one of the features of PPP projects is a complicated two-stageprocedure for selecting the private partner by conducting pre-qualification and settingrequirements for the experience of PPP projects’ financing, qualification of the private partner ina certain area, experience of similar projects implementation, etc. At the same time, eventsassociated with changes in the structure of the project company (private partner) may occurduring the implementation of the PPP project and as a result the private partner will not satisfythese requirements. It could negatively affect the PPP project. A similar case is described in theLegislative Guide on Privately Financed Infrastructure Projects prepared by the United NationsCommission on International Trade Law: “The contracting authority may be concerned that theoriginal members of the bidding consortium maintain their commitment to the project throughoutits duration and that effective control over the project company will not be transferred to entitiesunknown to the contracting authority Contracting authorities are therefore concerned that, ifthe concessionaire’s shareholders are entirely free to transfer their investment in a given project,31939-6104-16-4-155

Academy of Strategic Management JournalVolume 16, Issue 4, 2017there will be no assurance as to who will actually be delivering the relevant services”(UNCITRAL, 2001). In our opinion, this situation is a risk for the PPP project, which can besummarized in the risk matrix as follows (Table 1):Table 1RISK MATRIXRiskDescription of riskRisk ofchanges in thestructure ofthe privatepartnerPossible sale, transfer orother disposition of rightsfor the share of capital ofthe private partner (SPV)by its initial foundersNegativeconsequences ofriskDecrease of quality,failure to achievegoals of the PPPprojectRiskallocationMeasures of risk mitigationPrivatepartner1) Establishment oflimitations for such changes inthe structure of the privatepartner (SPV) in PPPagreement for a particularperiod of time;2) Execution of such changesonly with the consent of thepublic partner;3) Sale, pledging or otherdisposition of rights for theshare of capital is possibleonly to the qualified successor(an entity meeting therequirements for theparticipants of the contest forthe right to conclude a PPPagreement)Continuing to examine this question, we found that in several Russian regional laws onPPP it is possible to conclude a trilateral agreement on PPP with participation of the third party-alegal entity, which is owned by the public partner. Due to this situation, the following riskbecomes crucial (Table 2):Table 2RISK MATRIXRiskDescription of riskRisk of changesin the structureof the thirdparty to the PPPagreementPossible privatization,sale or other partial orcomplete loss of apublic partner’scontr

Current Approach to Risk Management in PPP Projects: Overview and Flaws Currently, the prevalent approach to risk management in PPP projects consists of the following stages (Akintoye, Beck & Hardcastle, 2008): 1. Risk identification: a process of identifying all the risks relevant to the project, either during its