Transcription

Contactless Transit EMV FrameworkDecember 2017Contactless Transit EMV Framework 1

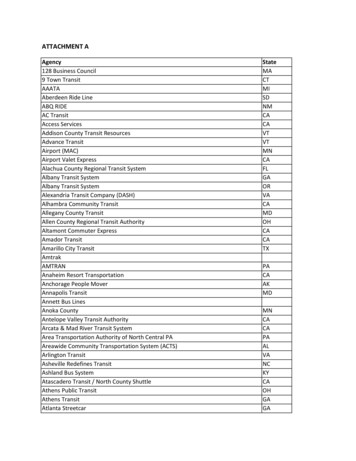

2 Contactless Transit EMV FrameworkUK Finance represents nearly 300 of the leading firms providing finance, banking, markets and paymentsrelated services in or from the UK. UK Finance has been created by combining most of the activities ofthe Asset Based Finance Association, the British Bankers’ Association, the Council of Mortgage Lenders,Financial Fraud Action UK, Payments UK and the UK Cards Association.Our members are large and small, national and regional, domestic and international, corporate andmutual, retail and wholesale, physical and virtual, banks and non-banks. Our members’ customers areindividuals, corporates, charities, clubs, associations and government bodies, served domestically andcross-border. These customers access a wide range of financial and advisory products and services,essential to their day-to-day activities. The interests of our members’ customers are at the heart of ourwork.Transit OperatorsUK Finance Card Industry MembersGovernment and agenciesCard Schemes

Contactless Transit EMV Framework 3Table of Contents1.0 Executive Summary 52.0 Background 62.1 Contactless Transit Project 62.2 Stakeholder engagement 73.0 Case for adopting contactless transit73.1 Customer Engagement & Views 73.2 Transit Industry 83.3 Card Payment Industry 83.4 Government and devolved administrations94.0 Contactless Transit Models 104.1 Customer Use Cases 104.2 Contactless Transit Models 105.0 Sharing the risk and liability125.1 Background 125.2 Transport for London 135.3 Model 1: Risk and liability agreement135.4 Model 2: Risk and liability agreement145.5 Cross-operator risk management 156.0 Contactless Transit EMV Implementation Guidelines157.0 Contactless Transit EMV Accreditation Guidelines168.0 Contactless Transit EMV Communication Toolkit179.0 Model 3, Pre-purchase EMV Business Requirements Definition18

4 Contactless Transit EMV Framework10.0 Contactless Transit EMV Framework Governance1910.1 Engagement Model for New Implementations1910.2 Business As Usual Framework Governance1910.3 Central Reporting 2110.4 Framework Review Process2111.0 Contactless Transit EMV Project Approach2211.1 Project approach 2211.2 Project success criteria 2311.3 Supporting project analysis2411.4 Ongoing work 24Annex A: Glossary of Terms25Annex B: Stakeholders and Governance26Stakeholders 26Contactless Transit Project Governance27Contactless Transit Executive Group28Contactless Transit Steering Group28Annex C: Contactless Transit Implementation Roadmap29Annex D: Contactless Transit Models30

Contactless Transit EMV Framework 51.0 Executive summaryThis document summarises the UK FinanceContactless Transit Framework that has beendeveloped by the card payment and transitindustries. This Framework describes how acustomer could travel on public transport using anEMV contactless card (or device such as a phoneor wearable) which has been issued by their bankor card company.The Contactless Transit Framework was developedto support transit operators’ own implementionplans to enable delivery of a consistent customerexperience and help achieve interoperability acrossregions and transport modes.The Framework includes three Contactless TransitModels:Building on the success of contactless paymentson the Transport for London network, andrecognition of customer demand outside ofLondon to pay using contactless.123Model 1, Single Pay-As-You-GoThe contactless card or device is used at the start of the journey with a knownfare; primarily for buses and trams.Model 2, Aggregated Pay-As-You-GoThe contactless card or device is used multiple times, and the fare is aggregatedat the end of the day or journey leg; for multi-mode operators.Model 3, Pre-PurchaseA contactless card or device is associated with a pre-purchased ticket and thenused to access the travel.The cards industry and transit industry developedthe detail underpinning Models 1 and 2 in 2015,refining them as transit operator implementationswent live in 2016/20171, and developed Model 3requirements in 2016.The Framework was initially published in January2016, at a parliamentary event co-sponsored bythe card payments and transit industries and theTransport Minister Andrew Jones MP.contactless as a ticketing option; an overviewof how the Models work; and the ongoinggovernance of the Framework. Contactless Transit EMV ImplementationGuidelines: this describes Models 1 and 2 indetail including minimum viable propositions,transaction processes and the underlying riskand liability agreements between the twoindustries to support them. Card Payment Accreditation Guide:description of the stages of accreditationthat the suppliers for the transit operatorswill need to go through to meet card schemerequirements. Contactless Transit EMV CommunicationsToolkit: this includes guidelines for customerand staff communication, and a current setof FAQs about the Models.The Framework documents have been updated inH1 2017 to take account of refinements and furtherdevelopments. The Framework now includes: 1Contactless Transit EMV Framework: thisdocument, which describes the Frameworkat a high level, including the case for transitoperators, the card payment industryand government bodies to support EMVBy the end of H1 2017, a number of bus operators had launched Model 1 and 2 implementations around the UK.

6 Contactless Transit EMV Framework Pre-Purchase EMV Business RequirementsDefinition (BRD): an amalgamation of theCustomer Proposition and the Statement ofUser Requirements for Model 3. It providesan outline of the proposed Pre-Purchasedsolution and requirements for participation,implementation and running of a contactlessservice.Contactless Transit EMV Project Analysis:this includes supporting analysis providingrationale behind the detail included withinthe framework documents.The Framework is jointly owned by thecard payments industry, transit industry andgovernment bodies and will be updated if requiredby mutual agreement of all the parties. Relateddocumentation is available on request from UKFinance.The Framework does not include technicalspecifications or infrastructure. The Frameworkis intended to help transit operators considerwhether to implement one or more of theModels, and it is the commercial decision of thetransit operators as to how they deploy their owncontactless solutions.2.0 Background2.1 ContactlessTransit ProjectCard payments have been used for many yearsin the transit industry to buy paper tickets, or totop up smart ticket cards or devices. In 2007, inorder to provide a fast and frictionless paymentexperience, the UK card industry introducedcontactless payments where up to a certain value(currently 302) the normal cardholder verificationmethod of entering a PIN is not required.Contactless card payments are ideal for certaintransit environments where speed and convenienceare key to a good customer experience.In 2013, Transport for London (TfL) introducedcontactless card payments on its bus network asa complementary alternative to its proprietaryOyster card. This was followed by the rollout ofcontactless payments on the TfL tube, DLR andrail network3 in 2014. TfL’s objective in introducingcontactless was to provide more convenienceto customers using pay-as-you-go (avoiding theneed to top up Oyster cards), and to cut theirown operating costs in producing and maintainingOyster cards. The initiative has been hugelysuccessful with steady growth, resulting in over 19mindividual cards being used by H1 2017 (over 650,000cards used on a typical day) and over 40% of allpay-as-you-go journeys completed on contactlesscards.The success of the TfL initiative led to interest fromother UK transit operators in implementingcontactless payments alongside smart ticketing andcash payments. Contactless use in transit is alsoseen as an important step on the journey towardsfuture payment and ticketing methods in the UK,specifically on mobile.A number of discussions took place between transitoperators and individual card companies and by theend of 2014 it became clear that it would be helpfulto have a central project to allow the two industriesto discuss the most suitable models for contactlesstransit. The UK Cards Association was integral tothe original collaborative discussions between itsmembers, the card schemes and TfL, and thereforewas the natural choice to run a project to buildon TfL’s success and expand contactless cards ontransit outside of London.From 2015 – 2017, the UK Cards Association ranthe Contactless Transit Project4 (as part of awider 2-year programme to increase the use ofcontactless cards across the UK). The purpose ofthis Project was to create a national ContactlessTransit Framework. This was designed to helptransit operators consider whether to implementcontactless, and support the delivery of aconsistent and good customer experience forjourneys made across the UK where a contactlesscard5 has been used during that journey. The projectwas jointly funded by the cards industry, transitindustry and government.²The cardholder verification limit has been increased over time to accommodate spending patterns on contactless cards, and wasraised from 20 to 30 from 1 September 2015.³ London overground and National Rail services within the TfL Travelcard zones4See also the Contactless Transit Programme Initiation Documents (Stage 1, Stage 2 (Phase 1 & 2))5An EMV contactless card is only one EMV contactless form factor that can be used. Others include mobile and wearable devices.

Contactless Transit EMV Framework 72.2 StakeholderengagementAs the Contactless Transit Project relied oncapturing business requirements from both thecard and transit industries, it required a high levelof engagement from operators in both areas.From the transit industry this included bus andtrain operators, and from the card industry, cardschemes, card acquirers (that hold the relationshipwith transit operators) and card issuers (thatissue credit and debit cards to customers). TheUK Cards Association also engaged with variouslevels of government that have an interest intransport, including the national and devolvedadministrations, and regional and city leveladministrations.A Contactless Transit Working Group wasset up. These monthly workshops across thetwo industries were designed to progress itsdeliverables. A Contactless Transit Steering Group,involving representatives from both industriesand government, met every 6 weeks and wasresponsible for making decisions and signingoff the deliverables. Overall sponsorship of theProject came from a Contactless Transit ExecutiveGroup which met three times annually. Moredetails on stakeholder engagement and the ProjectGovernance are included in Annex B.At a national level, the Department for Transport,Transport Scotland, Northern Ireland Departmentfor Regional Development, Transport for North,Transport for West Midlands and Transport Walesshowed their support for contactless use fortransit, and for providing an integrated customerjourney for those who want to travel across theUK on their EMV contactless card.3.0 Case for adoptingcontactless transit3.1 CustomerEngagement &viewsThe card payment industry is always looking at ways to make payments more convenient for consumers,retailers and transit operators alike. The case for adopting contactless transit for all of the stakeholderswas set out at the beginning of the cross industry Project6, and the benefits outlined then have broadlybeen confirmed during the course of the Project. These are outlined below.Engagement & viewsThe Project did not have the capacity to engagewith consumers directly, but relied on the transitoperators and card issuers reflecting the viewsof their customers, whether through customerfeedback or their own customer surveys.In addition, Transport Focus, the organisationrepresenting passenger and transport user views,was integral to the Project, with representatives onboth the Contactless Transit Working Group andSteering Group. Building on work conducted in2014 around using contactless cards for train travel,a survey conducted by Transport Focus in 2016asked how people were using contactless outsideof London. The survey also asked what peoplethought of being able to use contactless for publictransport. The survey found that 61% of customerswere very interested, or interested, in a contactlesstransit proposition7.Benefits Fast and easy payment for passengers,eliminating the need to queue for a paperticket or to ‘top-up’ smart tickets. Thesebenefits have been demonstrated throughthe TfL rollout. The Transport Focus surveyfound that of customers using contactlesspayments in general retail, 84% cited ‘speed’and 79% cited ‘ease’ as reasons for use8. Secure and transparent payments, which canbe seen on the customer’s bank statementor app.See the EMV Contactless Transit Programme Initiation Document.See Transport Focus survey results -contactless/8See above footnote67

8 Contactless Transit EMV Framework 3.2 TransitIndustryUsability on different form factors, includingcard, mobile and wearables. By end H1 2017,EMV mobile payments accounted for around10% of TfL contactless payments. Ability to travel on different operators usingthe same device, and without needing toregister. 45% of people (outside London) havecontactless and have used it, and 43%would be likely to use contactless on publictransport if it were introduced tomorrow9. 45% of passengers would feel morepositively towards public transport operatorsif contactless was introduced10.Engagement & viewsThe Project engaged both with transit operatorsdirectly and through the representative bodies ofthe Rail Delivery Group (RDG) and the Confederation of Passenger Transport (CPT), the latterrepresenting bus operators.CostsThere should be no costs for customers inadopting contactless. Over 60% of all paymentcards in issue are contactless with 16 card issuersproviding them, and contactless cards aregenerally provided on request by issuers. There isno transactional cost to the customer for usinga contactless card. (The one exception to this iswhere a customer from outside the UK may becharged a foreign transaction fee.) Permits interoperability between transitoperators, and is the most likely solution tobe able to interoperate with TfL, where 70%of rail journeys begin, take place or end. EMV contactless global security standardprovides assurance for transit operators. Operational cost savings for the transportoperator from reduction in cash handling,increased customer throughput andreduction in paper ticket printing orproducing and maintaining smartcards. 40%of TfL pay-as-you-go journeys now takeplace on contactless.There has been broad support for the Project fromtransit operators, both for the contactless transitproposition in general, and for creating a framework between the industries. The transit industryco-funded the second Phase of the Project.Benefits3.3 CardPaymentIndustry Increase number of journeys (as a result ofsimplified ticket purchasing) Increase speed of customer throughput Increase the range of payment options thatcan be offered to their customersCosts Infrastructure costs - investment is requiredto deliver a ‘card capable’ infrastructure Transactional costs Transit operators costs in sharing liabilityThe UK Cards Association began engaging its issuer and acquirer members, and card schemes, on extending the contactless transit proposal in 2014.Benefits Increased transactions for card schemes andissuers through cash replacement. In 2014,36% of bus and train payments were madeusing cards (27% debit, 9% credit), with theremainder made by cash11. By the end of2015, 11% of all contactless payments werebeing made on TfL. In a mature marketthere are few comparable opportunities fortransaction growth.See Transport Focus survey results h-contactless/10See above footnote11UK Payments Consumer Payments Survey data 2014.9

Contactless Transit EMV Framework 9 3.4Governmentand devolvedadministrationsThe halo effect of first-time users going onto use their contactless cards in other retailenvironments. Over 19m individual cardshave been used on the TfL system to date.By Q1 2017, around 6% of all contactlesspayments were being made on TfL, so eventhough TfL numbers have continued to grow,contactless use in other sectors has riseneven faster.Costs Card scheme costs in adjusting operatingregulations Card issuer costs in sharing liabilityChampioning the contactless experiencein the transit environment helps preparecustomers for contactless payments usingmobile devices.Engagement & viewsThe rollout of contactless-based ticketing solutions is the focus of increased political interest nationally and internationally. The solution providesa vehicle for fare simplification and integration ofregional transport, both of which are high priorityfor the Department for Transport (DfT) and otherdevolved administrations.The UK Cards Association engaged with the DfTfrom 2014 and during the Project engaged with thedevolved administrations in Northern Ireland, Scotland and Wales. The DfT and Transport Scotlandco-funded Phase 2 of the Project and sat on theContactless Transit Steering Group, and DfT wasrepresented on the Executive Group.In January 2016, the Transport Minister, AndrewJones hosted a parliamentary event at whichthe Framework was launched and commitmentsmade by the transit industry to deliver contactlessticketing.In 2015 the Government passed the Cities andLocal Devolution Act and in 2016 the Buses Act.The combination of these two pieces of legislationallows regional bodies to assume transport powersonce a mayor has been appointed, and suchdevolution agreements have already been agreedfor Manchester and the Midlands. In Phase 2 of theProject we worked closely with Transport for theNorth and Transport for West Midlands to helpthem apply the Models into their regional context,and to ensure that interoperability with otherregions is a key consideration in any development.Benefits UK model will be one of the leading globalmodels Delivers transport strategy and enables UKcommerce Supports the political agenda for integratedticketing Supports the international business andtourist visitor communities Provides interoperability between transitoperatorsCosts Investment into a back office hub, to ensureinteroperability Possible funding of pilots

10 Contactless Transit EMV Framework4.0 Contactless Transit Models4.1 CustomerUse CasesThe first deliverable for the Contactless TransitWorking Group to develop was identifying thekey customer use cases for which implementingcontactless as a payment option would deliver themost benefit.This involved a number of workshops, using thefollowing questions to identify the key use cases: What type of transit journeys will thecustomer make (e.g. commuter, intracity)? How will the customer make those transitjourneys (i.e. mode of travel, fare class)? Have the potential to lead to major costsavings Represent a large volume/% of journeystaken Represent a large % of revenues or margins Be perceived to be feasibleThe priority use cases that were agreed by bothindustries were: Journey type: intracity (mass market, mediumto low value); and town to city/commuter(medium to high value)What are the specific issues that needconsidering? Customer type: single adult and visitors/touristsWhat are the key components that makeup a transaction between the customer, thetransit operator and the cards industry (i.e.pre-authorisation, value)? Transit mode: trains, underground, bus andtram Fare type: full rate and reduced fare, seasontickets Operator model: cross-operator, multiownership model, single regulated and singleunregulatedThe judgment criteria used to identify the key usecases were that each should:4.2 ContactlessTransit Models Address a large customer segment Be strategically important Be politically importantThe Contactless Transit Working Group then took these agreed Customer Use Cases, which describethe customer journeys, and assessed how these could be delivered in different contactless transactionmodels. The agreed Contactless Transit Models are outlined below.Model 1, Single Pay-As-You-Go Model1Previously termed (Standard Retail Model); A pay-as-you-go model with a known fare, forsingle-mode operators (particularly bus and tram).Descriptioncards and make journeys that are morethan 30 in value on mobile devices whereoperator terminals are high value paymentenabled, and where the customer can selfauthenticate on their mobile.This is based on an existing pay-as-you-go modelthat was developed for the retail environment. In this model, the fare is known beforehand– it is either a flat fare, or inputted into thedevice by the driver or customer before thetransaction takes place. For contactless only terminals: the customershould be able to make journeys up to amaximum value of 30 with contactless The customer only touches in with their cardor device at the beginning of the journey (asthe fare is already known). The fare is charged to the customer’sissuer and will then be viewable on thecustomer’s issuer statement (depending on

Contactless Transit EMV Framework 11communications from the device this couldtake a couple of days). The customer must be able to obtain asuitable ticket, receipt and/or proof ofpurchase upon request. A receipt can bedelivered via a download from a website. The model offers transit operators an ‘entrylevel’ use of contactless cards as an alternativeto cash payments. This model is suited to low to medium valuesingle operator bus and tram services.The transit operators’ terminals will need tobe online capable, even if communicationcapability means they are not able to goonline at all times. Offline capability shouldbe limited to where online connection islost12.2Model 2, Aggregated Pay-As-You-Go ModelA pay-as-you-go model where an aggregated fare is charged at the end of the day or acompleted chargeable fare is charged, for single and multi-mode operators (including bus,tram, metro, train).Description ApplicabilityThis is based on the existing pay-as-you-gomodel that was developed for Transport forLondon. The model supports unknown andvariable fares on trains (using touch in andtouch out). Flat or known fares are supported on buses(uses touch in only). The fare is calculated at the end of a definedperiod (e.g. day) or after a completedchargeable fare by processing all the taps andcalculating the appropriate fare. Daily or weekly caps can be applied to thissystem. The charge will generally appear on thecustomer’s issuer statement the day aftertravel. The top end value for the use of a contactlesscard is 30 per aggregated or completedchargeable fare. 13 All devices should be able to be used withthis model (card, wearables, mobile). Thepotential exists to exceed the 30 contactlesslimit in the settlement process (although thisis not encouraged from a customer confusionperspective).ApplicabilityThis model is suited to low to medium value multimode operators, including train, underground, bus& tram services (e.g. mass transit and commuter).Transit Operators should authorise transactions that require an online authorisation as soon as possible. Authorisation canhowever be deferred to allow for instances where online data connectivity is not available or fast boarding speed is a requirement.In such instances, authorisation should not be delayed longer than 24 hours.1390% of all daily journeys are under 30 (percentage includes journeys within London).12

12 Contactless Transit EMV Framework3Model 3, Pre-Purchase ModelA pre-purchase model where contactless cards are associated with the ticket in advanceand then used to access travel (particularly train).Description This model is to support higher value tickets,where a contactless card / device is associatedwith a customer’s pre-purchased traveljourney. A process will be required for the customerto associate their contactless device with theproduct they have purchased / are entitled toreceive. The customer touches the associated card /device during their journey on a card reader,as specified by the transit operator. It willbe recognised during this journey as theirauthority to travel where challenged by aRevenue Inspector.All transit operators on which the customer istravelling to complete their journey will needto recognise that the nominated contactlesscard / device is authority to travel. It is suggested that a back office is requiredto record the traveller’s journey and recognisethe card that has been associated with thejourney. This back office(s) would need tobe interoperable between all the transitoperators that are supplying the customer’stravel.Applicability High value ticket e.g. Edinburgh to Londonreturn. Season tickets and carnets. Differentiated fares e.g. 20% off for acustomer segment. Concessions and free travel. Reservations (e.g. long distance coach travelwhere a seat is reserved on a specific coach).5.0 Sharing the risk and liability5.1 BackgroundA key part of the Framework is the Risk & LiabilityAgreement between the two industries that cansupport the Contactless Transit Models. In 2015 theProject developed Agreements to support Model1: Single Pay-As-You-Go and Model 2: AggregatedPay-As-You-Go set out below.There are a number of controls that the cardindustry uses to manage the risk of the fundsnot being available from the payer. For noncontactless card payments, generally this involvesrequiring an online issuer transaction authorisationfor particular transactions.Card payments have a unique characteristic incontrast to other forms of payment, in thatpayees (retailers or transit operators) often providegoods and services to payers (customers) prior toreceiving cleared funds. The payee does so onthe basis of the card payment guarantee, wherebythe card issuer guarantees the funds to the payeeeven if the customer does not have sufficientfunds to pay for the goods or services. In returnfor this guarantee, the retailer needs to adhere tospecific acceptance rules, and if they fail to do so,the payment guarantee is extinguished and liabilityresides with the retailer.For contactless cards the card industry needs tomanage two risks – of funds not being available,and of potential fraud if the card has been stolen.There are a number of controls that the cardindustry uses to manage these risks: Contactless card chip settings - a combinationof volume and value counters within thechip that force PIN entry where a number ofconsecutive contactless transactions haveoccurred without entry of the PIN. Card scheme floor limits – these will triggeran online authorisation request at certaintransaction values.

Contactless Transit EMV Framework 13 Online cards – some cards automatically arerequired to go online for issuer authorisationfor every transaction. These are generally forcardholders with low credit limits or specificcircumstances (such as under-18s). There is generally no scope for a PIN entryalongside the contactless card readers (unlikein a retail environment where most readershave PIN entry as standard). In Model 2, the fare is not known beforehand.This means that the customer could denythat they intended to make the payment andtherefore reclaim the amount from the issuer14. Moreover, legislation requires card issuersto make the cost of a transaction known tothe customer before they undertake a transaction15.There are additional challenges posed by theContactless Transit Models for the card industry inmanaging risk: 5.2 Transportfor LondonTo facilitate contactless payments on theTransport for London (TfL) network, the cardindustry developed a specific acceptance modelwhich is Model 2 Aggregated PAYG. Within thismodel, the following controls are in place tomitigate the risks: 5.3 Model 1:Risk and liabilityagreementCommunication capability varies greatly andtherefore there is no guarantee that cards willbe able to go online for authorisation.Trigger limits – in certain conditions the transitoperator’s back office require the operator toseek an online issuer authorisation i.e. if thecard has not been used on the system for apre-defined period, or if the cumulative valueof chargeable fares exceeds a threshold.To address the concern around the unknownfare, TfL provided posters in every stationwith common fare brackets. TfL also providedan automatic refund to all customers whoclaimed an unauthorised transaction for thefirst incident only, with the expectation thatthe customer would be aware of the likelyfare thereafter.The risk and liability agreement underpinningModel 1 is set out below.Overview The customer is not verified at the pointof payment (as this requires a Chip & PIN orsignature verification). The card is checked as being valid (and notcounterfeit) through the card- terminalinteraction. Transit Operators can manage cards associatedwith insufficient funds through Deny Lists.Despite these mitigating factors, it was consideredequitable for the transit operator and card issuerto share some of the financial risk between them.The risk of reduced fare revenues was of concernto TfL, while issuers were concerned with theprospect of less issuer protection than in thenormal retail environment.Negotiation between the parties resulted in acompromise solution, under which it was agreedthat TfL would assume liability for unauthorisedtransactions exceeding 6, while issuers hadliability for any transaction under that amount.From an operational perspective, this resultsin TfL submitting into clearing and settlementtransactions for under 6, even though theauthorisation request

specifically on mobile. A number of discussions took place between transit operators and individual card companies and by the end of 2014 it became clear that it would be helpful to have a central project to allow the two industries to discuss the most suitable models for contactless transit. The UK Cards Association was integral to